Lockdown impact apparent

This month’s survey of mortgage advisors throughout New Zealand has yielded 70 responses telling us the following.

Banks remain as willing to lend on average this month as last month, but there is far more scrutiny being applied to client expenses and income sources than ever before. Low deposit loans are harder to secure for clients and there is increasing bank wariness of funding some people into purchasing off the plan as costs escalate.

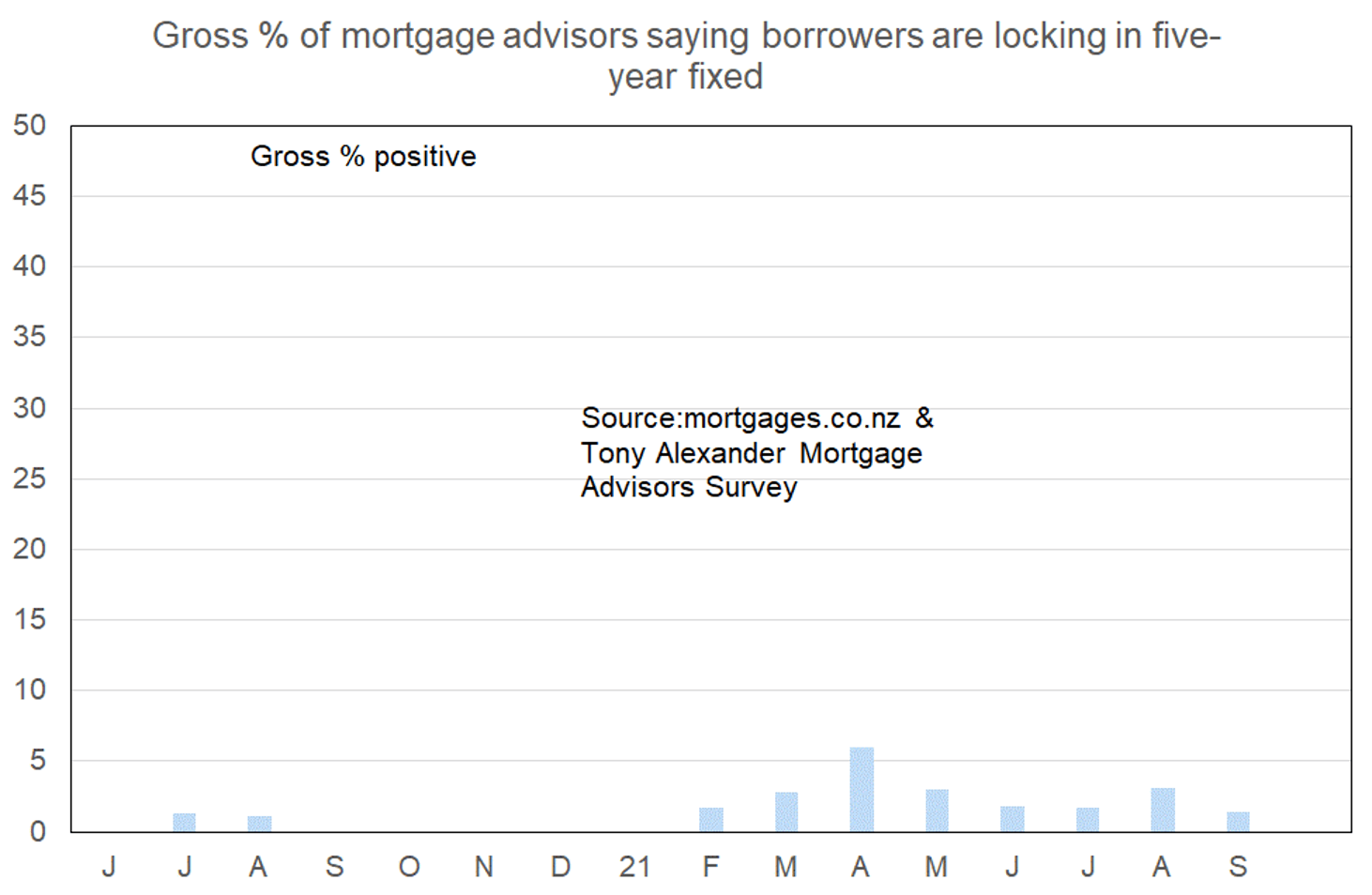

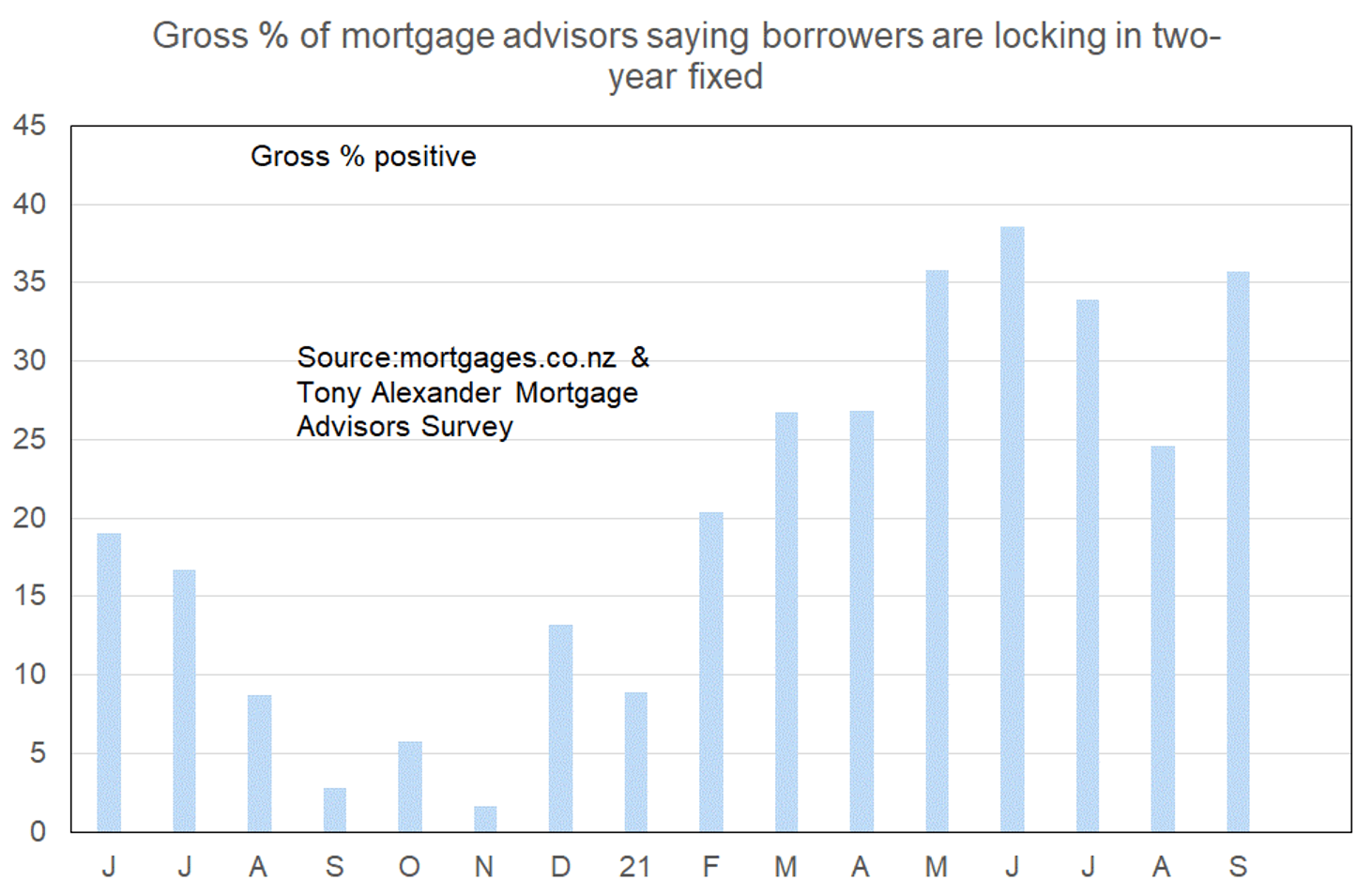

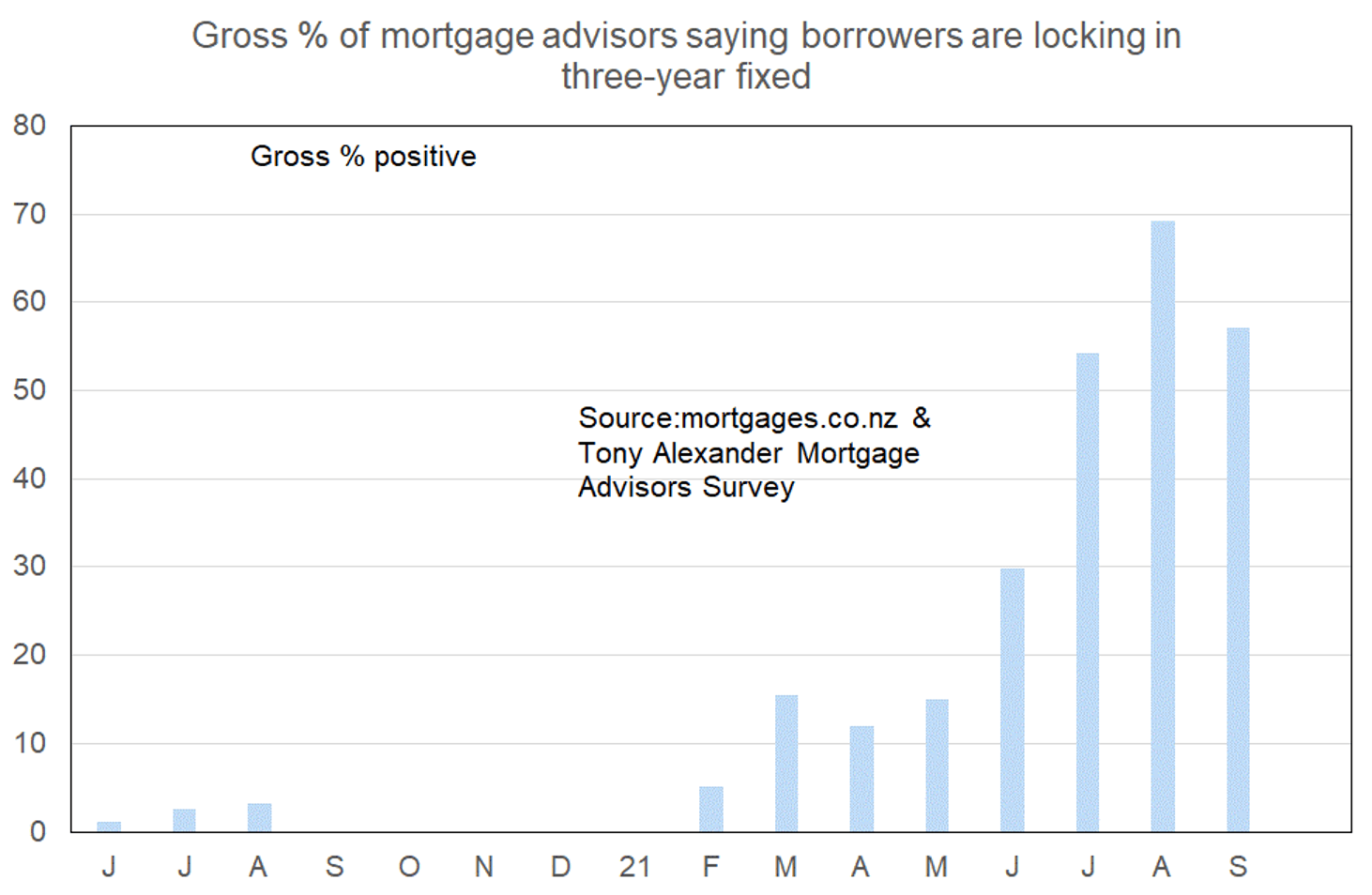

Lockdown has had an impact on the level of enquiry from both first home buyers and investors. The delay in interest rates going up may have contributed to a slight shift in fixed term preference back towards two years from three years.

But these remain the most favoured terms to fix and there is as much interest now in fixing one year as in fixing five years – virtually none for either term.

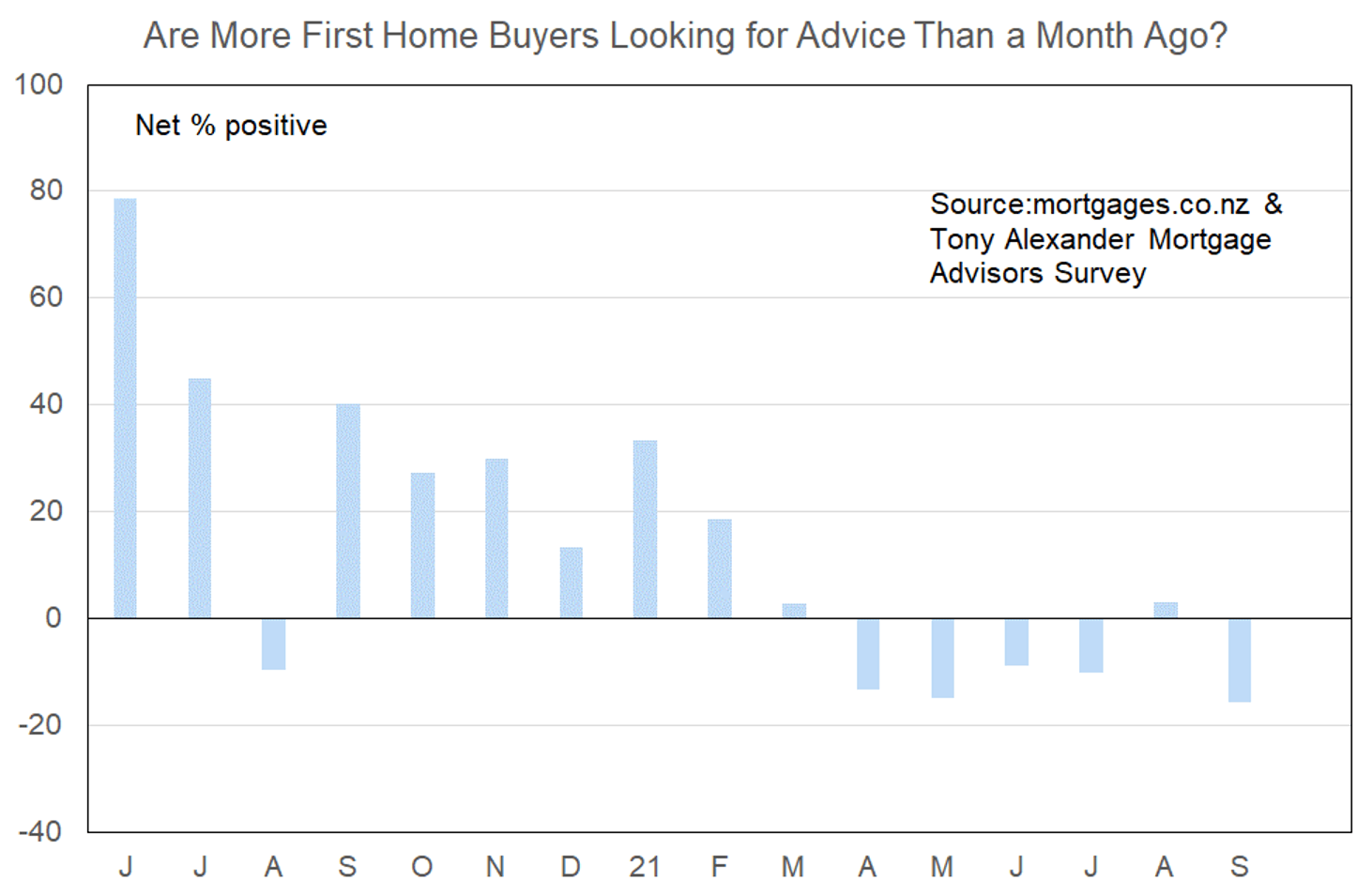

More or less first home buyers looking for mortgage advice

A net 16% of the mortgage advisors replying in this month’s survey have reported that they are seeing fewer first home buyers coming forward for advice. This is a deterioration from the net 3% last month who were seeing more first home buyers.

The change is not unexpected in light of the decline seen in August last year when Auckland went into lockdown from the 12th. Back then the change was from +45 to -10 which is a far greater slump than the 19% this time around.

This reduced decline provides some further evidence that this lockdown is being viewed in different terms than the other two significant events. Why? Probably because of the overwhelming evidence that when lockdowns end the hosing market surges anew.

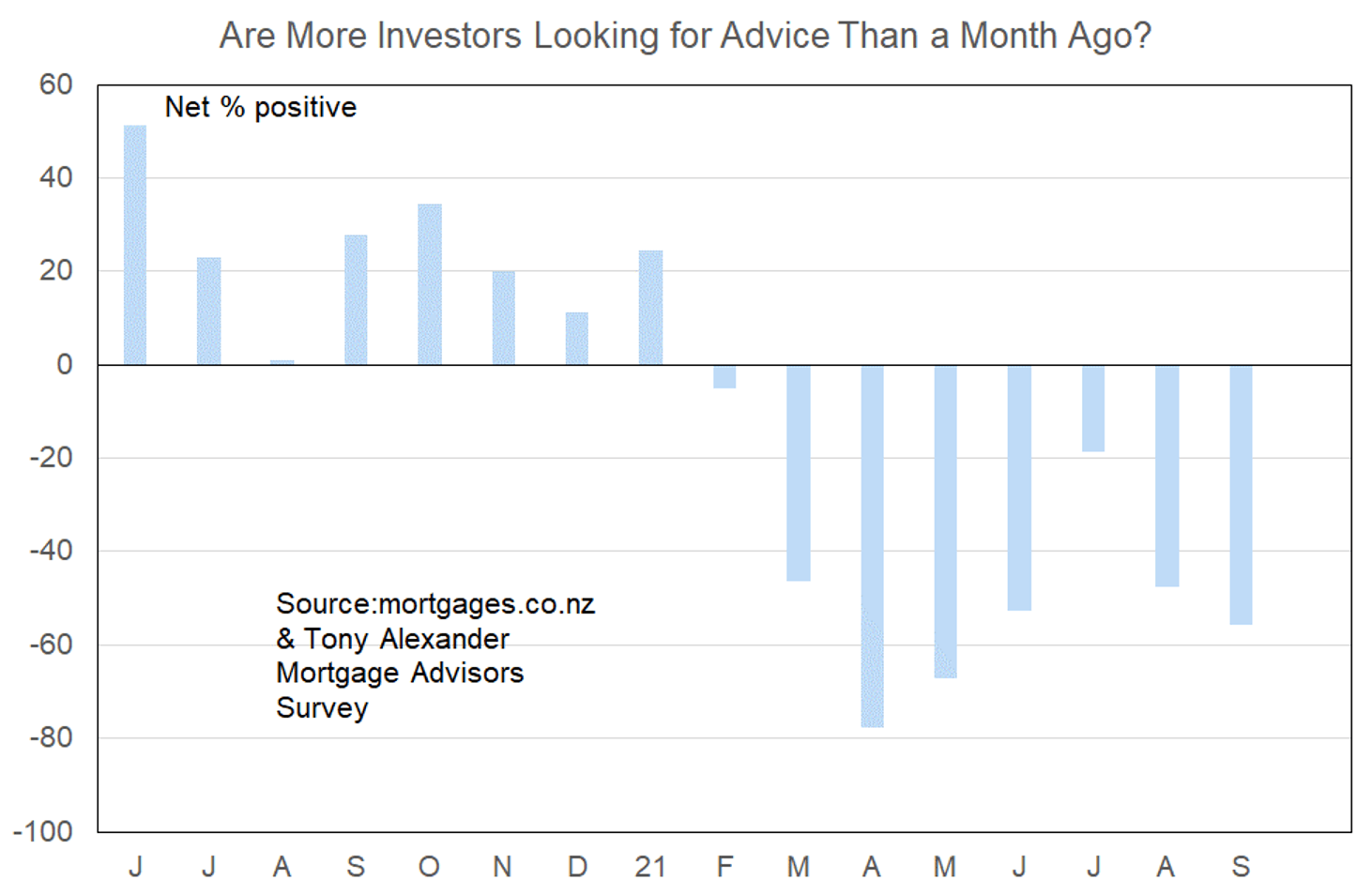

More or less investors looking for mortgage advice?

A net 56% of mortgage advisors have reported seeing fewer investors stepping forward for mortgage advice. This is a very weak result. However, it is in line with the situation from March to June this year and represents some giving back of the improvement seen from July, which was itself substantially unwound anyway in August where most replies to our survey came in before the country went into lockdown.

The result is consistent with those from other surveys showing that investor demand to purchase property has been curbed by the LVR and tax changes announced over February and March this year.

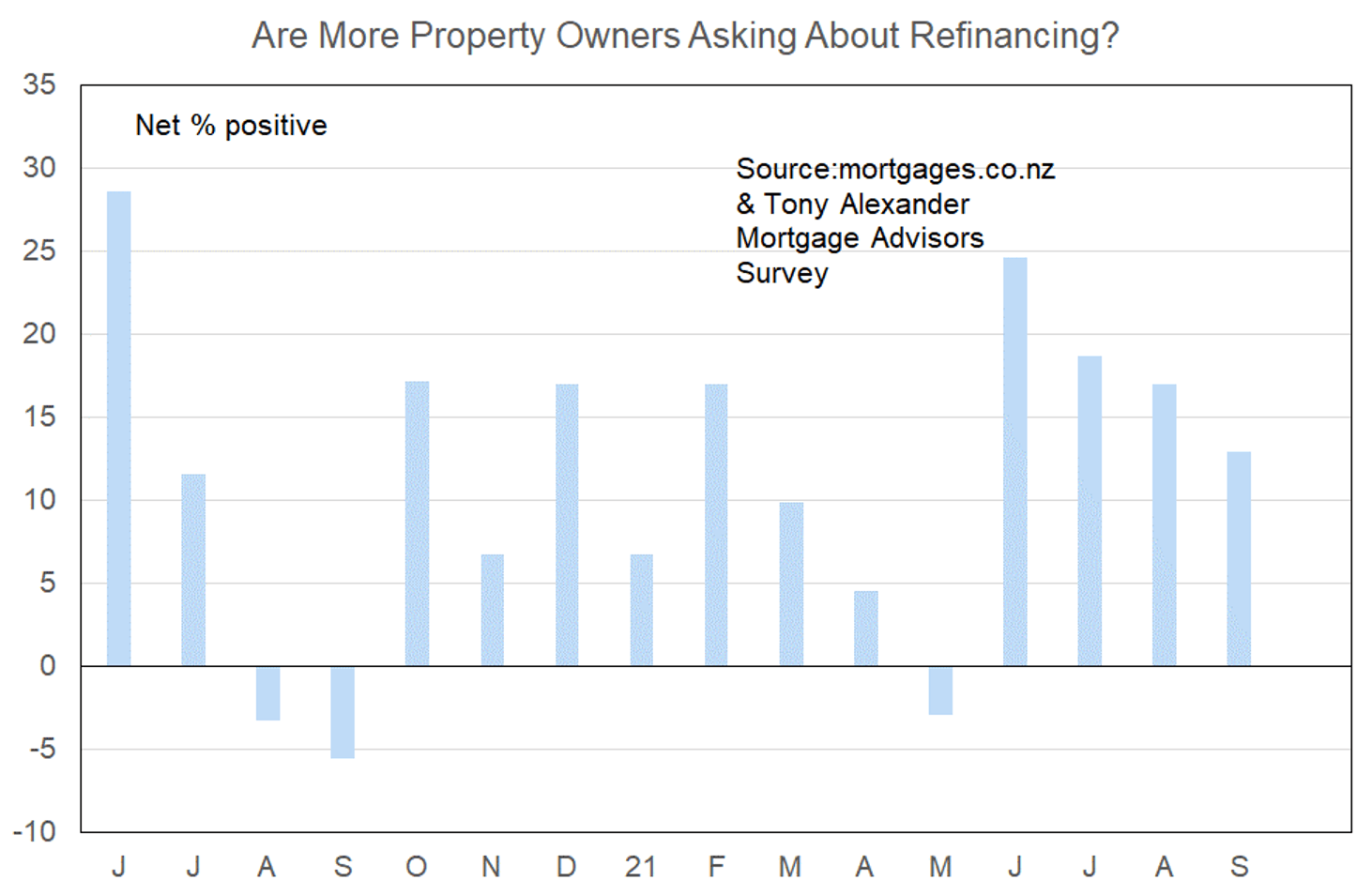

More or less property owners looking for refinancing?

In May the Reserve Bank stated their expectation that they would raise interest rates 1.5% starting in the second half of 2022. This comment along with general discussion regarding rate rises may account for the sharp jump over June in the net proportion of mortgage advisors seeing more people seeking assistance in refinancing their mortgage.

This refinancing may involve shifting lender or changing the interest rate fixed term, as discussed below.

This month, the Reserve Bank’s delaying of its first rate rise previously near universally expected for August 18, may have contributed to a slight easing of refinancing enquiries.

At a net 13% positive, refinancing enquiries are essentially equal to the average since June last year of 11%.

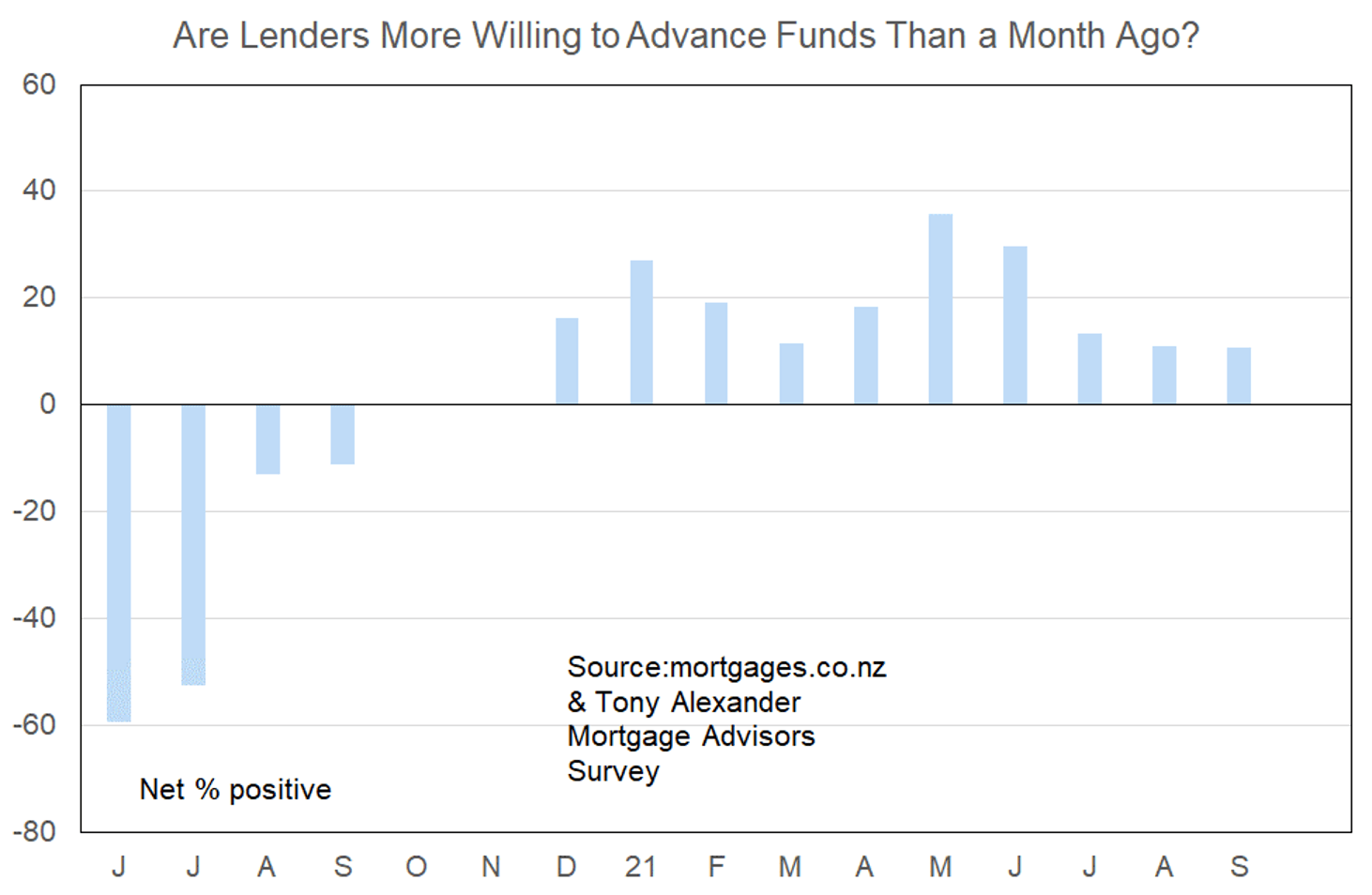

More or less lenders willing to advance funds?

The government has delayed new responsible lending and other tightened credit assessment criteria until December 1 from October 1 in light of the impact of lockdown on the ability of those involved to get ready. Nonetheless, the willingness of banks to advance finance still sits lower in September than in all other months since December last year bar August.

The ability of banks to lend to borrowers with low deposits is being reduced, and banks are already undertaking the far deeper scrutiny of borrower expenses and income sources which CCCFA changes will require.

Perhaps the important point to note with regard to this question is that there has not been a sudden new tightening up of lender willingness this past month as lockdown has been in place. Experience with previous lockdowns has shown that while particular sectors such as hospitality (and construction this time) are heavily affected by lockdown, the economy and housing market are now known to bounce up strongly when freedom returns.

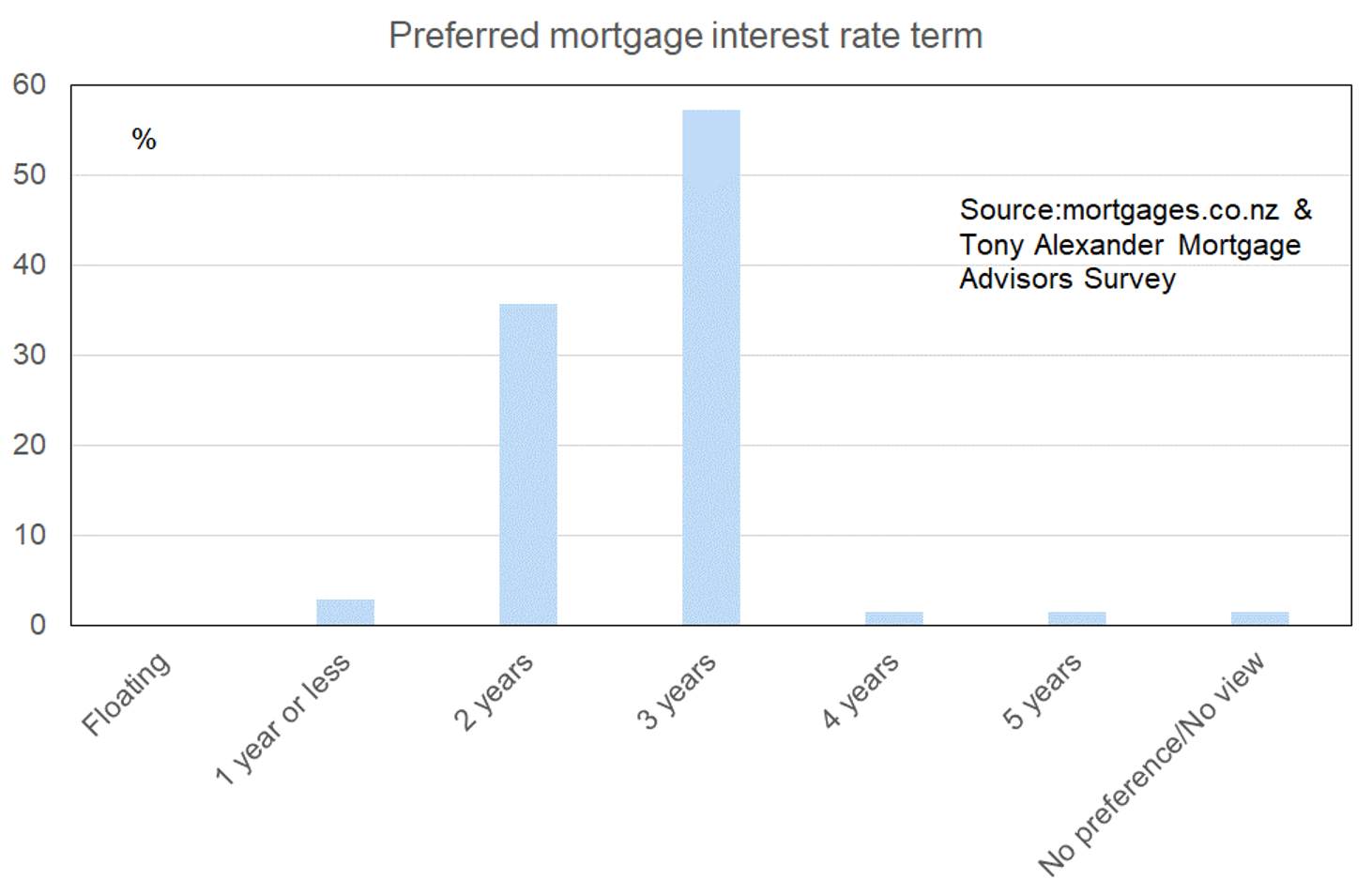

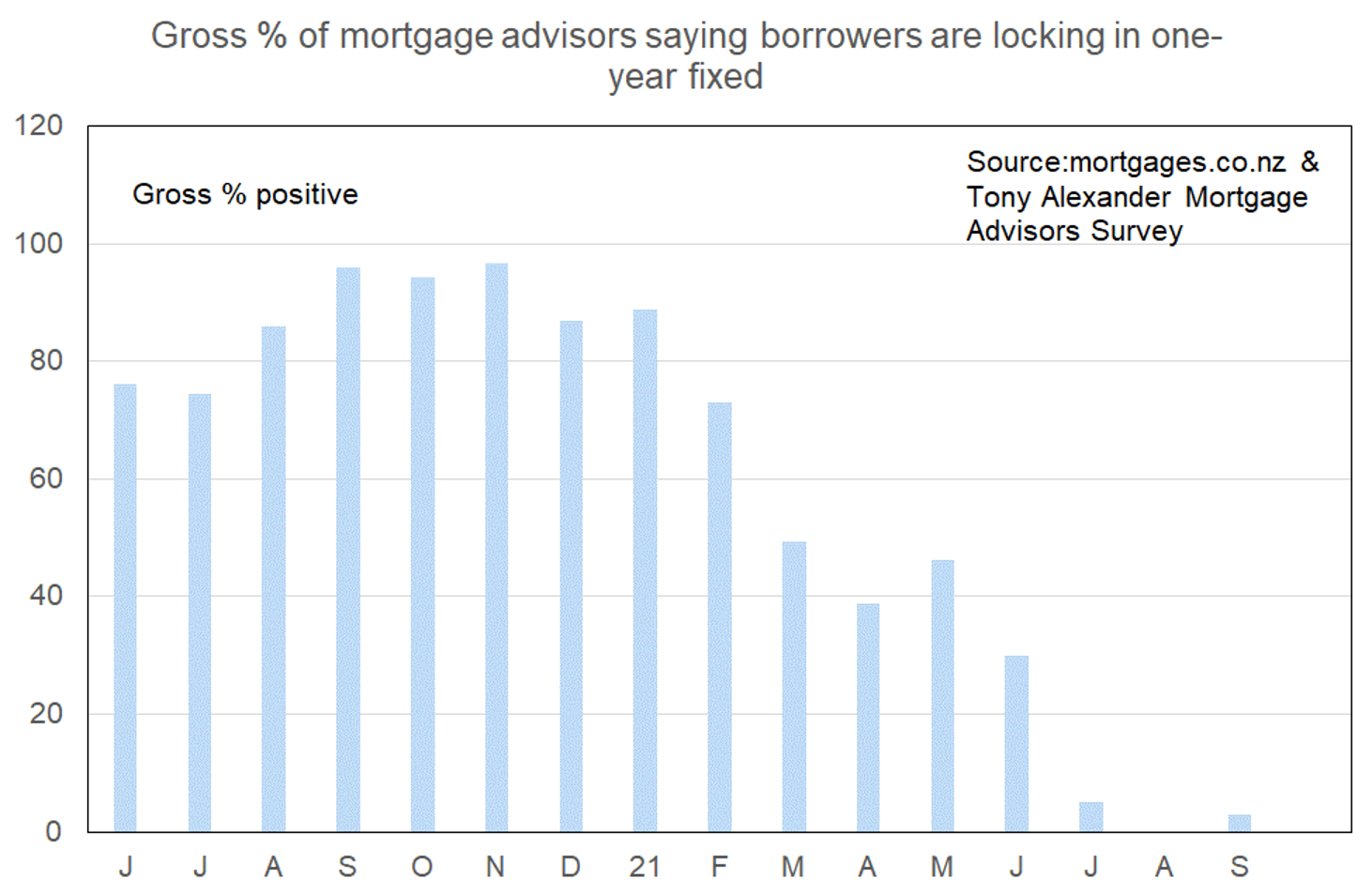

What time period are most people looking at fixing their interest rate?

For all of our surveys last year the overwhelming majority of mortgage brokers reported that their clients were most in favour of fixing their mortgage rate for one year. This has been the best strategy since the end of 2008 in New Zealand.

But last year we could see inflationary pressures starting to build, and I became a strong advocate of fixing five years at 2.99%. Few borrowers took up this option as banks discounted their one-year rates as low as a carded 2.19%.

But this year has seen things shifting. Whereas in January 89% of advisors said the one-year term was most favoured, that fell to 39% in April, 5% in July, and now only 3%.

Still, very few people favour locking in fixed for five years and this situation is likely to continue until the five-year rate is below mortgage rates for shorter terms – which will then be exactly the wrong time to fix long-term.