The golden rule for the minimum deposit required to buy a first house is 20%. But there are opportunities to get a home loan with a deposit as low as 10% or even 5%, in special circumstances. In this guide, we look at major bank lenders’ approaches to lending money for first home buyers. We also look at how KiwiSaver and the government’s Kāinga Ora programme can help to get you into your first home.

Across all the deposit options available today, it’s important to remember that the bigger your deposit, the less you’ll pay in interest over the life of your loan.

Having a deposit of 10%, or ideally 20%, opens up more home loan options, so it’s important to get independent professional advice before making any final decisions.

That’s why we offer a free Find a Broker service that connects you with a mortgage adviser. They get paid by the mortgage lender you finally choose to sign up with, so there’s no charge to you for their advice and support.

What is a house deposit?

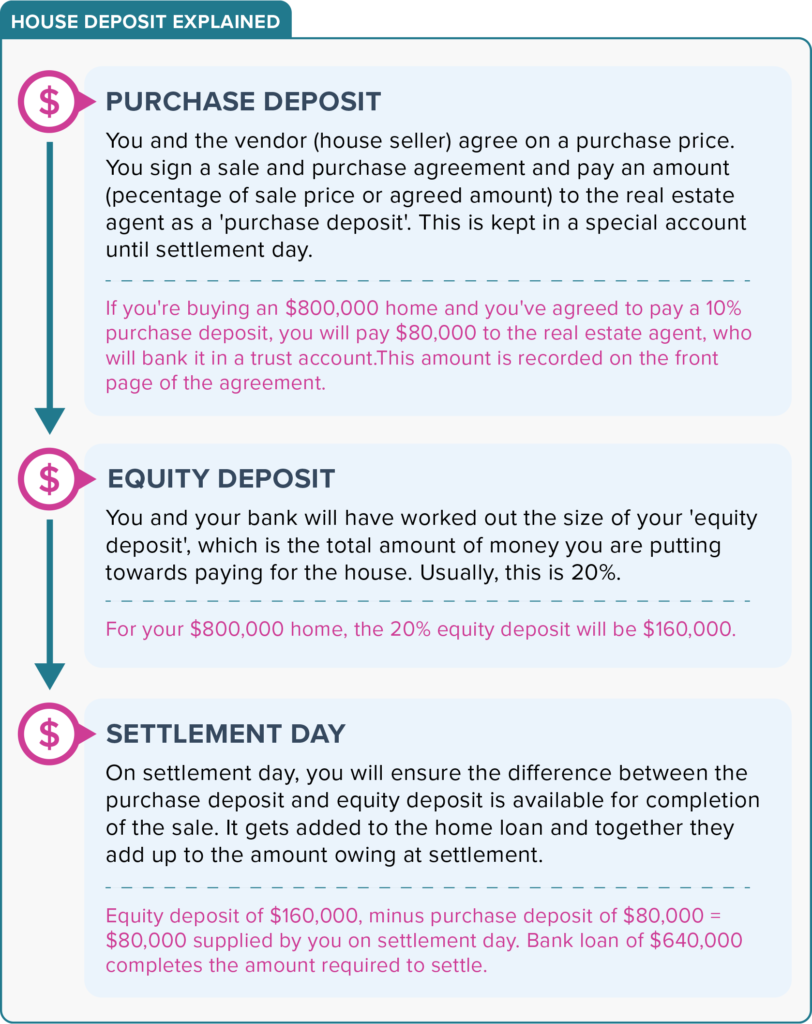

A house or home deposit (aka equity deposit) is the amount you will contribute to paying for your house. For example, if you want to buy a $800,000 house with a 20% equity deposit, you need to have $160,000 available. The home loan covers the other $640,000 of the purchase price.

It’s easy to get confused between the equity deposit and the purchase deposit, which is paid when you sign a sale and purchase agreement. This diagram shows the typical progress of a house sale and how the two deposits work together.

How much is a typical first house deposit?

New Zealand home lenders love it when you have a 20% deposit (or even more) to contribute to the house purchase process. It tells them you have a good savings record, so you’re probably going to be an excellent home loan customer.

From your point of view, having a deposit of 20% or more comes with three significant benefits.

- You’ll probably be offered the bank’s advertised home loan rates, rather than a higher rate to offset the risks attached to a lower deposit.

- You won’t have to pay a low equity fee and it’s unlikely your lender will insist on mortgage insurance.

- You’ll be paying less interest over the life of your loan, because you’ve contributed more to the purchase up front.

- Your fortnightly or monthly mortgage repayments will be more affordable, because you’ve borrowed less.

Yep, a 20% or more deposit is the ‘perfect world’ scenario. However, increasing New Zealand house prices are making it much harder to achieve this optimum deposit level. And that’s why government regulations are allowing lenders to help some first home buyers who can only get 10% or 5% together.

Can you buy a house with a 10% or 5% deposit?

A minimum deposit that’s less than 20% puts you into the ‘low deposit home loan’ category.

There are plenty of major lenders who will consider helping you to buy a house with a smaller-than-usual deposit. Some of them are in the government’s Kāinga Ora First Home Loan lenders list, including Westpac, TSB, Kiwibank, NZCU, Cooperative Bank, SBS, NBS, NZHL and First Credit Union.

Be aware that a low equity home loan could come with some strings. For example, some banks charge a higher interest rate to cover their increased risk; others charge a ‘low equity fee’ (aka low equity margin), which is added to the balance of the loan.

Low equity charges don’t apply to the First Home Loan product because Kāinga Ora removes the lender’s risk by underwriting the loan. However, lenders in the Kāinga Ora list will still consider your financial ability to repay the loan, financial circumstances, credit history and your banking record.

How does KiwiSaver help with a first home deposit?

KiwiSaver is much more than a retirement savings scheme. It can also help you to buy your first home by letting you withdraw most of your funds for an equity deposit.

Buying a house using KiwiSaver as part or all of the deposit:

How does the Kāinga Ora programme help first home buyers?

- be over 18

- have earned less than the income caps in the last 12 months ($95,000 or less before tax for an individual buyer; $150,00 or less before tax for and individual buyer with one or more dependents; $150,000 or less before tax for two or more buyers)

- not currently own any property (this excludes ownership of Māori land)

- purchase a property that is within the regional house price caps

- agree to live in your new house for at least six months

To apply for a First Home Grant, go to the application page on the Kāinga Ora website.

Building your first home with a turn-key home and land package

If you want your first home to be brand new, i.e. built just for you, then a turn-key home and land package could be the best way forward.

Group builders that offer house and land packages usually have a portfolio of house designs, which are customisable to some extent. As a rule you pay a deposit before the build starts, then part-payments at intervals.

House and land packages with prefabricated and kitset homes are also a possibility if you want a new home. A deposit of at least 10% is usually required for turn-key contracts, however the First Home Loan backed by Kāinga Ora can have a deposit as low as 5%.

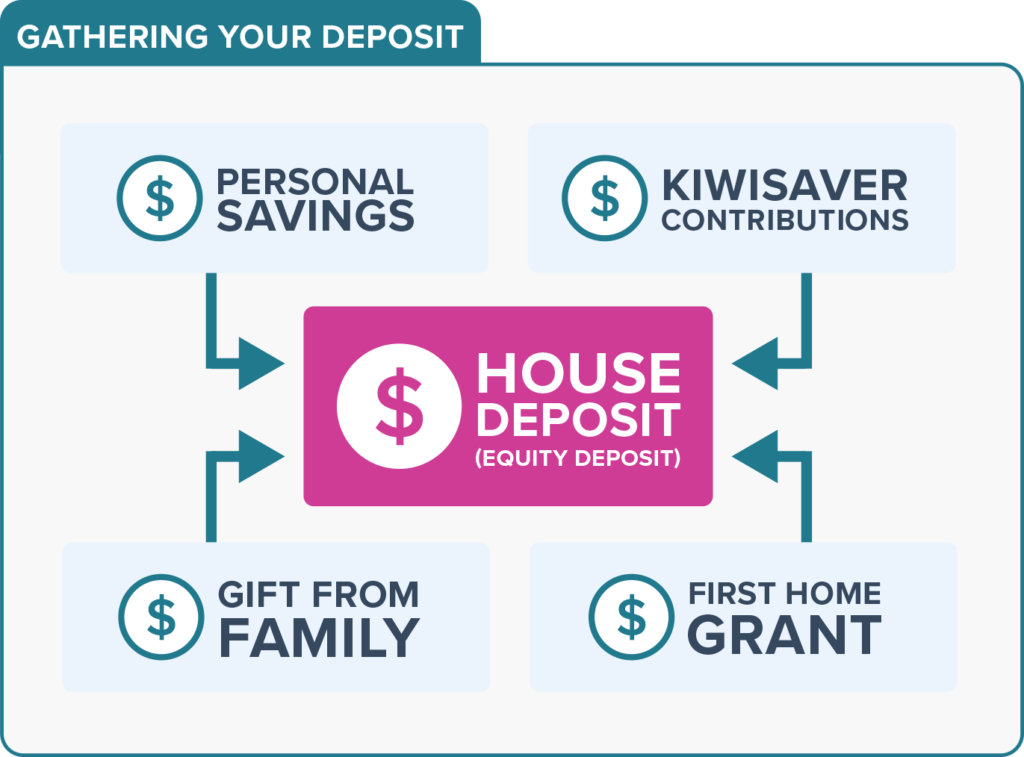

Where can the deposit money come from?

These days, deposits are usually made up of many parts. While gathering your deposit from a number of places is more complicated than simply saving until you reach your goal, it means you can get onto the property ladder faster.

How to get your deposit together faster

How to spend less:

- Begin by knowing where your money goes. Often, a spending audit will reveal some home truths that are limiting your ability to save. Find a notebook, open a spreadsheet or download an app, then record what you spend every day for a month.

- Analyse expenditure by category, such as rent, supermarket, utilities, vehicle expenses, public transport, cafés and restaurants, clothing, hair and makeup, hobbies and entertainment.

- Use a budgeting tool to create a realistic framework for monthly spending. Do some nipping and tucking to amplify the amount of money you can save each month.

- It’s smart to pay off outstanding credit card debt as quickly as possible, because it’s a costly way to do your spending and could adversely affect your loan application. Consider switching to a debit card instead.

- Monitor your spending for a few months, to ensure you’re living within your budget.

How to earn more:

- Check your employment contract (or ask your boss) to see if you’re allowed to do freelancing in your own time. If your side gig doesn’t interfere with your main gig, you could develop an extra income stream.

- If you’re creatively inclined, see if you can make useful products or artworks that can be sold online or at a local market. For example, upcycling old furniture is a sustainability trend that could provide you with a new hobby, as well as some extra cash.

Where to keep your deposit savings

While your deposit funds are building up, you’ll probably want them to earn some interest. There are various options available – from bank savings accounts and term deposits through to paying lump sums into KiwiSaver. However, it’s sensible to remember that the promise of higher returns is usually accompanied by a higher degree of risk or a longer-term investment. Depending on your timeframe, you might need your funds to be instantly available, so that you can move quickly on a property opportunity.

Before you commit to any type of investment beyond a standard savings account, talk to a qualified financial adviser who understands your situation.

Want to know more about buying a first home? Read our first home buyers guide. Want to know more about building a new home? Read our guide to how much it costs to build a new house in NZ.

Finally remember to seek advice from a trusted mortgage broker or financial planner.

IMPORTANT: 29/09/2023 – Due to recent unprecedented demand, the Kāinga Ora First Home Partner scheme is now fully subscribed and therefore they will not be accepting any new applications while they work through their commitments to those already in the scheme. Find out more here.