Mortgage rates have probably peaked

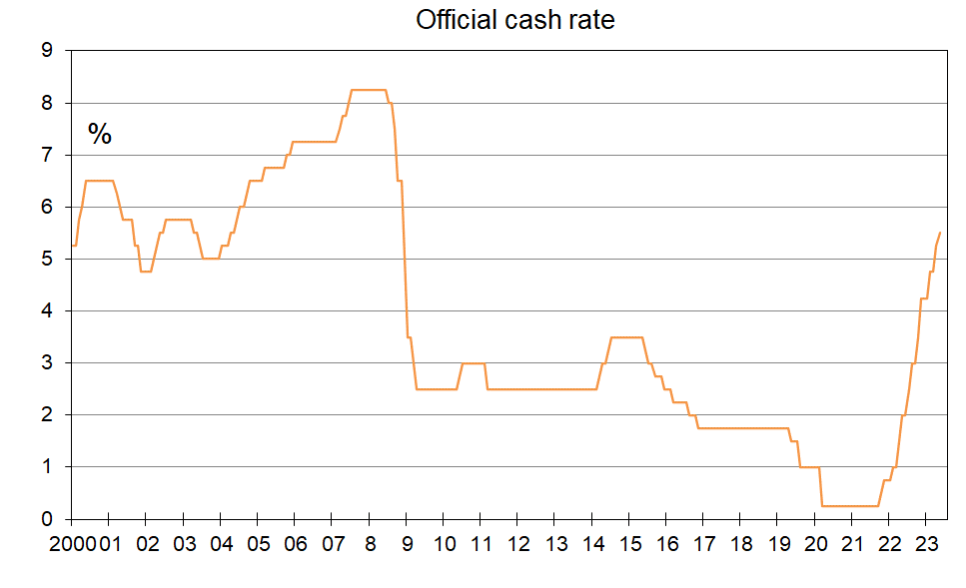

Back on April 5 when the Reserve Bank surprised the financial markets by increasing the official cash rate 0.5% rather than the expected 0.25%, a lot of optimism about the rate peaking at the 5.5% level predicted by the Reserve Bank started to disappear. This loss of optimism accelerated in response to much stronger than expected net migration numbers and some signs of the housing market starting to bottom out.

As a result, in recent weeks some analysts have been falling over themselves to predict a higher and higher peak for the official cash rate. In the financial markets wholesale interest rates had been increasing in expectation that the Reserve Bank would surely be seeing things the same way and they would lift their predicted peak for the cash rate from 5.5%.On May 24 they did not.

At their most recent review of monetary policy the Reserve Bank only raised the official cash rate by 0.25% and indicated that there was no discussion of increasing it 0.5%. In fact, two of the seven Monetary Policy Committee members voted to leave the cash rate unchanged.

Less inflationary than expected

The Reserve Bank left their predicted peak for the cash rate at 5.5% and made a point of emphasising the way in which many of the indicators they track have been coming in less inflationary than expected and that others are showing monetary policy to be working.

For instance, they noted that the economy shrank towards the end of last year whereas they expected it would keep growing. They noted that the latest inflation numbers were lower than they were predicting and that the price pressures they expected to result from recent flooding events have proved to be less than expected.

They noted the labour market is showing signs of easing up, global supply chains are starting to function better, residential construction in the country is falling and expected to continue to do so, and that it is not certain the boom in net immigration will be inflationary. They even went so far as to say that the Budget read by the Finance Minister last week was still contractionary, only slightly less so than they assumed in their previous set of economic forecasts released in February.

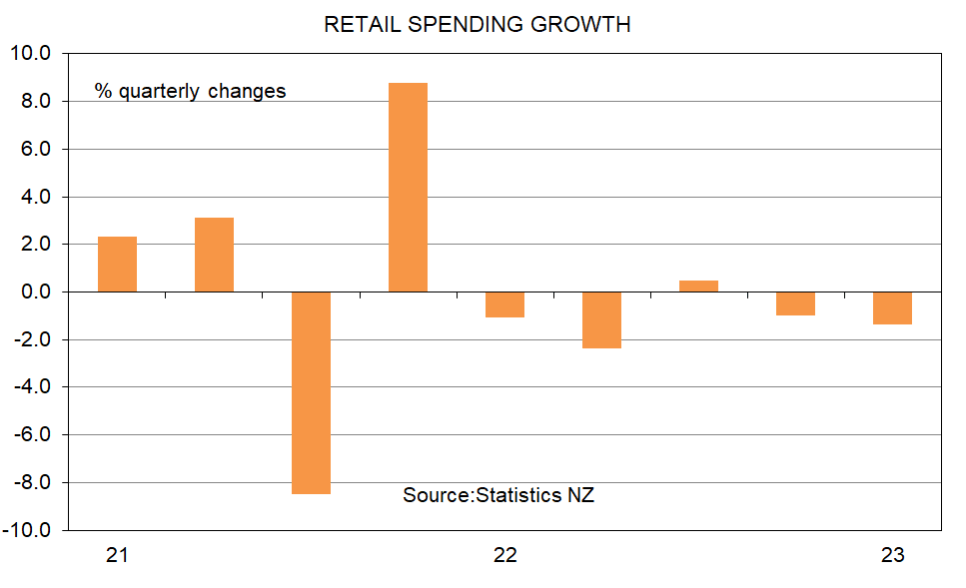

Given the downward trend in business pricing plans which I can see in my monthly survey, some slowing in wages growth underway, and deep weakness in consumer spending just revealed by statistics New Zealand for the March quarter, we can now strongly talk in terms of fixed mortgage rates having hit their cyclical peaks.

Banks know they're not going to win much business

The high levels for fixed mortgage rates of three, four, and five years were reached two or three months ago. Those rates now sit 0.7% down from their peaks. Are they going to be cut again in the near future? Probably not because banks know they’re not going to win much business as very few people are showing any interest in fixing for other than a one year or 18 month or two year time period.

I think we can talk about two year fixed mortgage rates having peaked and for the one year fixed rate maybe, maybe not. A lot of it will come down to the degree of competition between banks for relatively scarce new mortgage lending business.

The question now turns to how quickly interest rates are likely to decline and the Reserve Bank made clear their belief that they will need to keep interest rates at current levels for an extended period. In fact, they have not factored in a cut in their 5.5% official cash rate until just before the end of next year.

The chances are good that they will in fact ease the interest rate before then, but it could be a bit optimistic to expect this to happen before the end of this year. Still, who knows? None of us have lived through a post-pandemic environment before and just as none of us picked what would happen in the pandemic, it’s quite possible we’re not going to be able to pick with much accuracy what happens in this new uncertain period.

The economy is receiving some good support

But if I were borrowing at the moment, what might I do? The economy is receiving some good support from rising numbers of tourists and the return of foreign students. The boom in net immigration is adding to consumer spending and it’s going to be one factor causing the housing market to turn around. How quickly that turn around occurs is impossible to say because it all depends upon when people stop thinking about Kiwis going to Australia and realise that a great number of people are entering New Zealand from the rest of the world.

With house construction falling and over $150 billion worth of fixed rate mortgages rolling on to new rates which are around 3% higher than what they have recently been paying, there is still going to be weakness in our economy through the remainder of this year and into the first half of 2024.

If I were borrowing at the moment, I’d be looking to fix either one or maybe two years. The 18 month period seems to be favoured by a good number of people and it’s hard to argue against that given the uncertainties involved.

When might we be back again at cyclically low interest rates? That is impossible to say at this stage. But my best guess would be maybe a couple of years from now some good opportunities will open up to lengthen the time period that I would be happy to fix my mortgage interest rate for.