Buyers edge back

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken this week, attracted 54 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- Buyer interest in residential property remains but it has eased slightly recently.

- Bit by bit banks are slowly easing their lending criteria.

- Borrowers overwhelmingly only want to fix their interest rate for a period of one year or less.

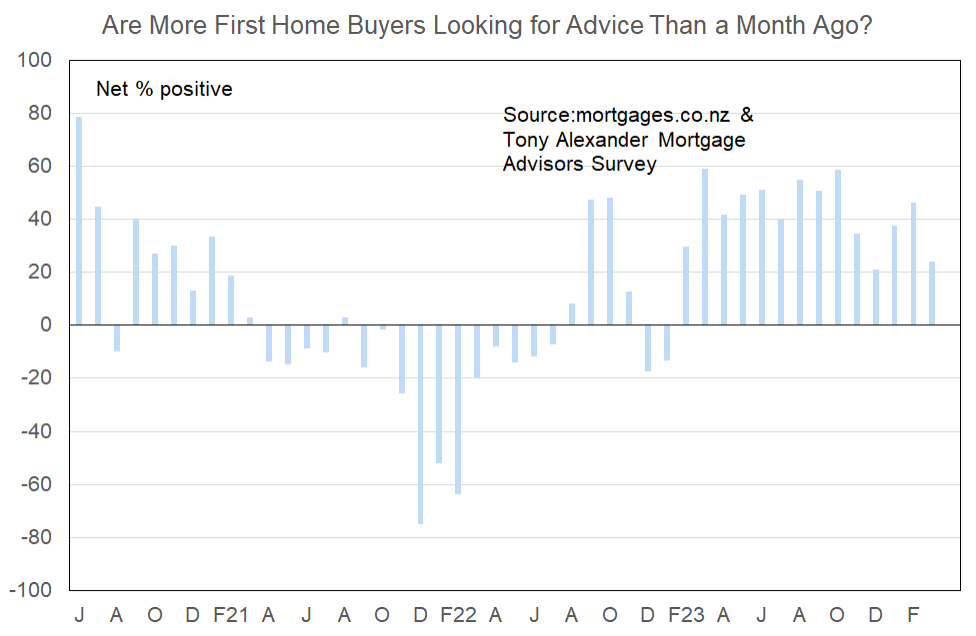

More or fewer first home buyers looking for mortgage advice

A net 24% of the 54 advisers responding in this month’s survey have reported that they are seeing more first home buyers in the market. However, this is a decline from a robust net 46% last month and about equal to the net 21% in our early-December survey.

Consistent with measures in my other surveys and indicators from other sources, there has been some cooling in the intensity of buyer demand in recent times.

Comments on bank lending to first home buyers submitted by advisers include the following.

- Higher UMI requirements remain but banks are showing more flexibility in this space e.g.: now open to including boarder income, may approve outside of the normal rules with strong mitigants.

- Slight relaxation of the rules for high LVR borrowers, still only preapprovals available for 20% purchasers or Kainga Ora applications, however all banks taking live deals for nonbank customers for low deposit home loans now.

- The Banks are definitely softening towards first home buyers – they are not as aggressive towards them and actually seem to want to assist FHB’s get into homes.

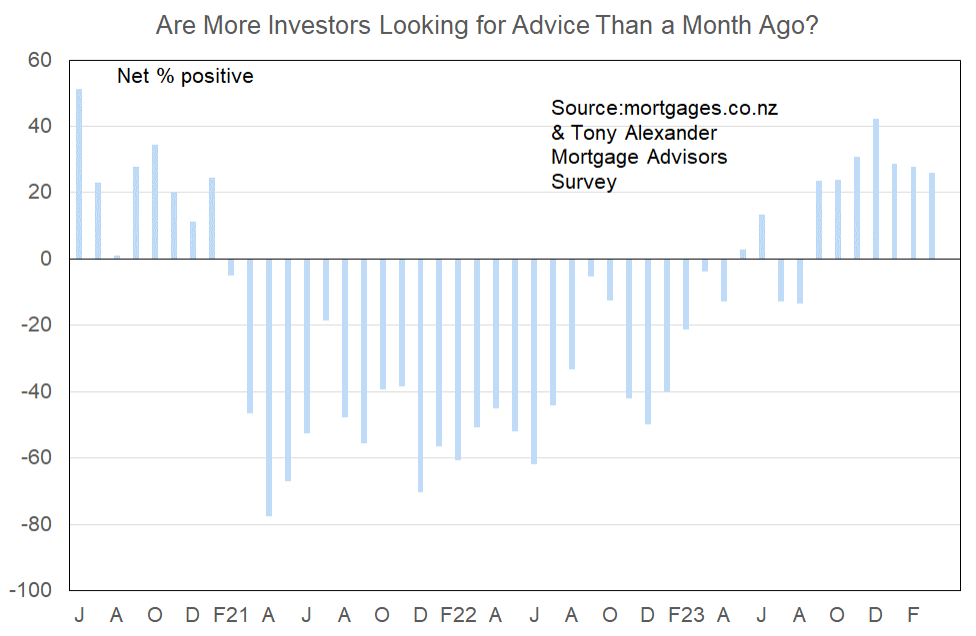

More or fewer investors looking for mortgage advice?

Comments made by advisers regarding bank lending to investors include the following.

- One bank has re-jigged their haircuts applied to investment income and starting to see DTI calcs included as part of banks servicing calculations.

- One bank updated its criteria recently, making affordability for investors a bit easier.

- No changes. More investors are enquiring and just started buying slowly.

- One lender has simplified the calculation of investment property expenses in the debt servicing calculation which is great. The same lender has also now included a calculation of the DTI in their debt servicing calculator in preparation of them being introduced.

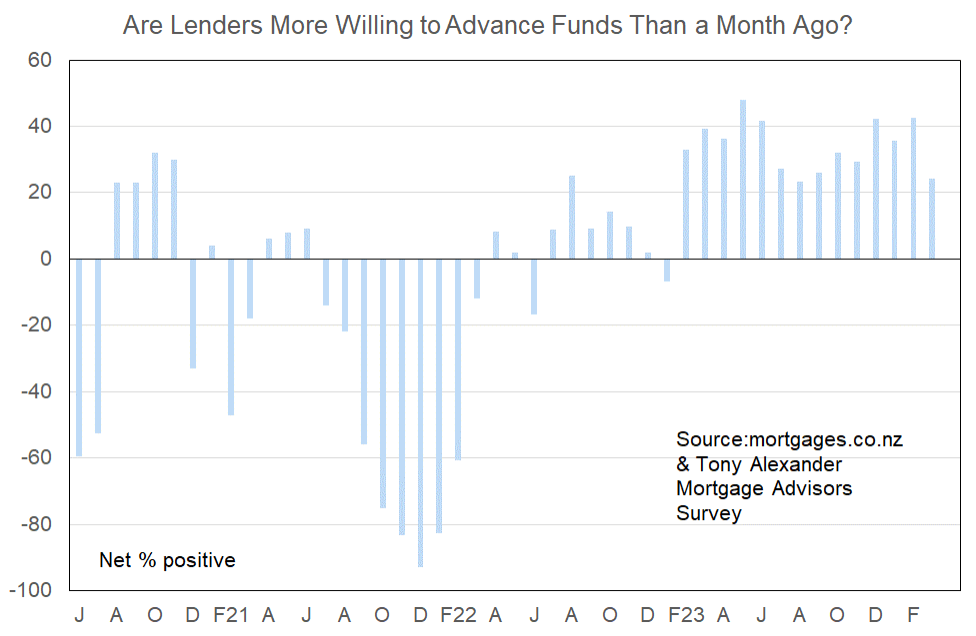

More or less lenders willing to advance funds?

Despite comments of brokers above indicating that banks are tweaking their eligibility criteria for the better, there has been a drop in the proportion saying that banks are more willing to lend. The decline has been to a net 24% from 43% last month.

In the context of the past year this is a small decline and we have seen similarly readings before but without the drop being sustained.

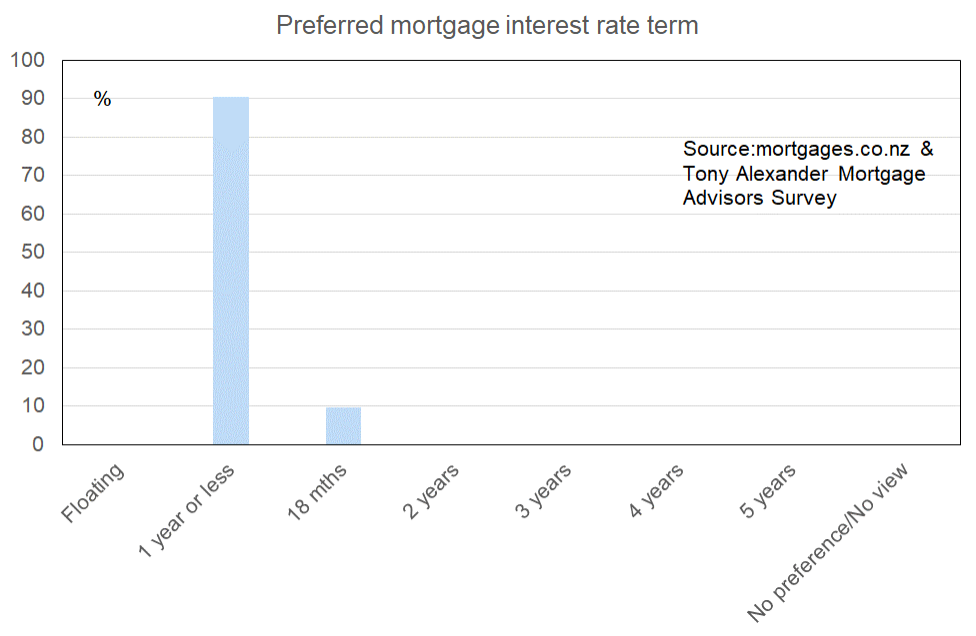

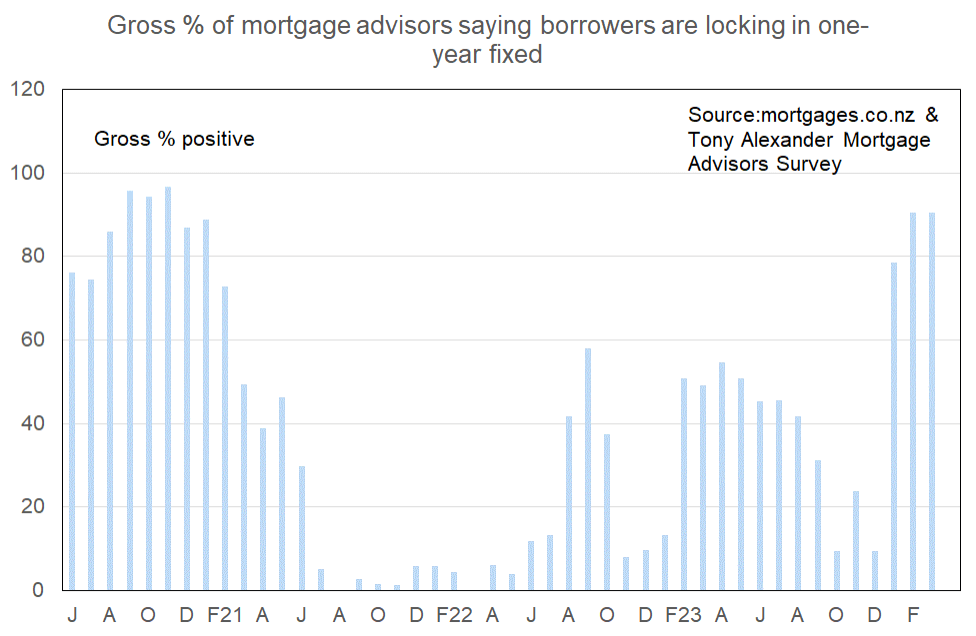

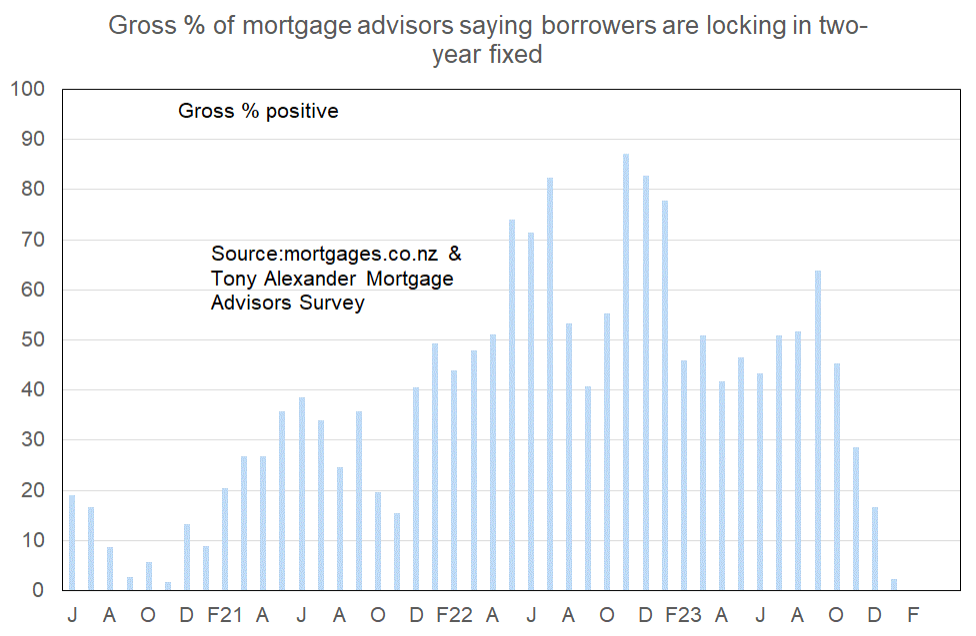

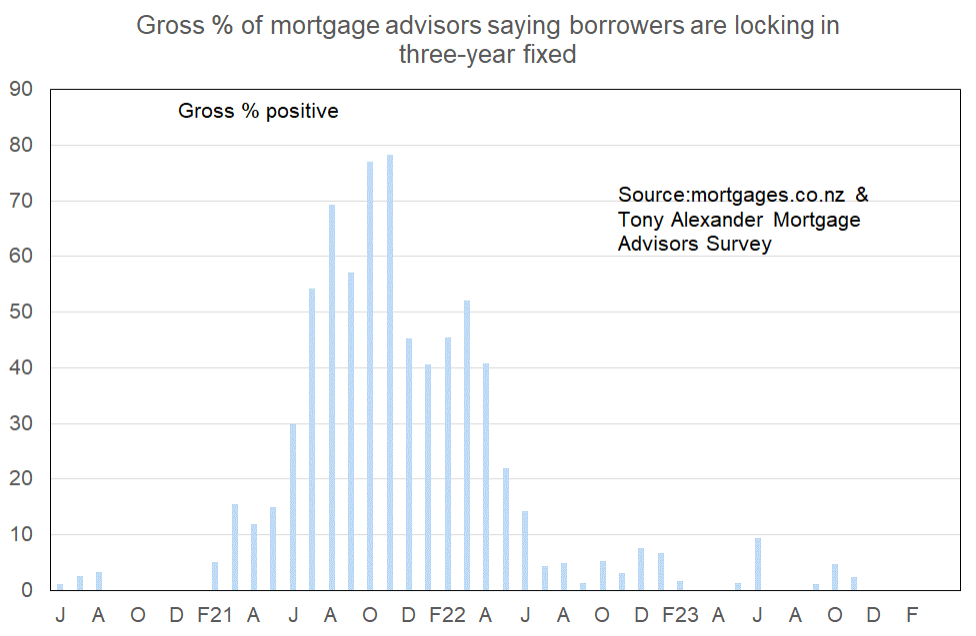

What time period are most people looking at fixing their interest rate?

Brokers stronger report that borrowers prefer to fix for one year or less. 90% say this is the preference with just 10% saying two years is the popular choice.

There is no interest in fixing for longer than two year period.

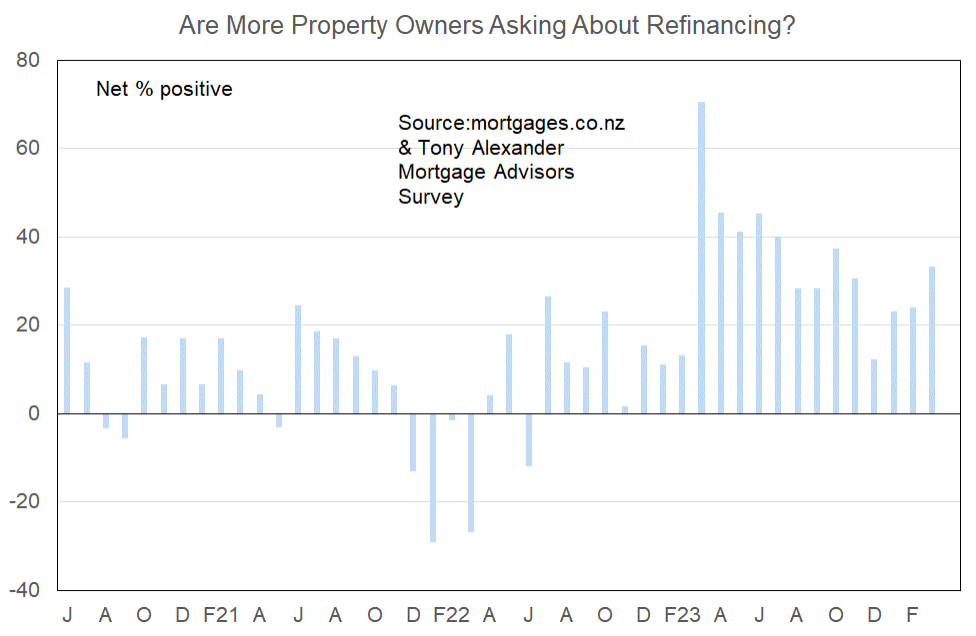

Are more property owners asking about refinancing?