Most NZ interest rates have peaked

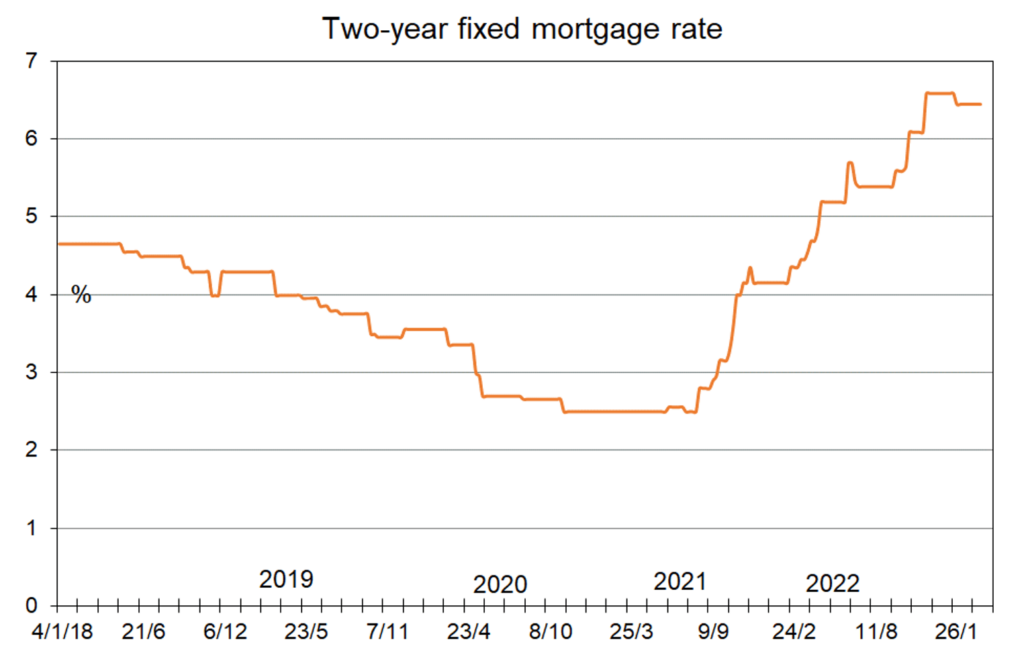

In my last column two months ago I noted that the factors affecting interest rates in New Zealand were starting to change and the potential for further increases in fixed mortgage rates was disappearing quite rapidly. I ventured the opinion that some buyers would start to return to the residential real estate market shortly. Both things have happened.

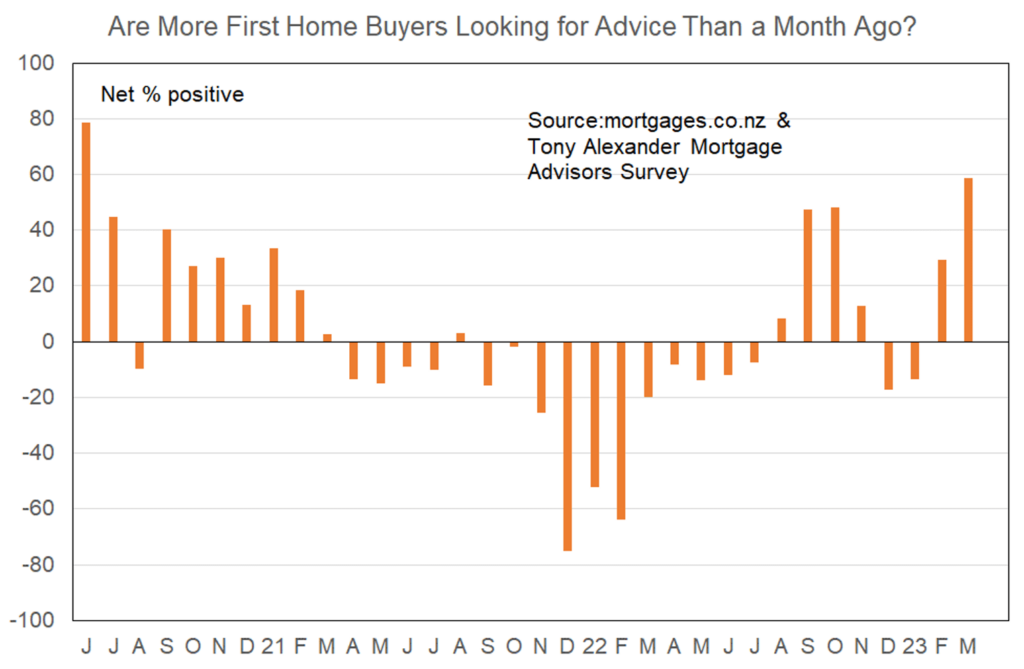

Firstly, from my monthly survey of mortgage advisors and also the survey I undertake each month of real estate agents around New Zealand we can see that both groups of people are seeing more first home buyers in the market. A record net 59% of mortgage advisors in the middle of March said that they are seeing more first time buyers and a net 22% of real estate agents at the very end of February also said they were seeing more first home buyers.

High availability of stock

Young people are being encouraged back into the housing market by the high availability of stock, average 16% fall in prices from the peak of November 2021, high job security, rising rents, and decreasing worries that interest rates are going to increase to further punishing levels.

Two months ago I noted that the December quarter inflation number was not a shock result as the September quarter data released on October 18 had been. That was a positive for interest rates. Since then, we have also received data showing wages growth to be less than expected and that the economy shrank by 0.6% during the December quarter.

The size of the economy is in fact roughly 2% smaller than the Reserve Bank had calculated when they undertook their most recent review of the economy and reviewed the official cash rate on February 22. On that date they increased the cash rate by 0.5% to 4.75%. Since that review something interesting has happened.

In theory the 0.5% cash rate rise is a tightening of monetary policy. In practise nothing has happened. That is, since then there has not only been no increase in bank fixed mortgage rates but they haven’t increased their floating mortgage rates either. This is quite surprising because the express intention of the Reserve Bank when it raises its official cash rate is that banks raise their mortgage rates and that is the way in which monetary policy changes have their greatest impact on the economy and therefore eventually the inflation rate.

Why have banks not increased their mortgage lending rates? Because real estate sales are exceedingly weak. In both January and February turnover in the residential real estate market around New Zealand was at record lows since the data started in 1992. Banks are not meeting their mortgage sale targets and that has encouraged them to effectively discount their interest rates.

Banks have been experimenting with interest rates

In fact just a month ago we saw the likes of one bank briefly offering a one year rate at 4.99% and another offering fixed rates for 18 to 24 months at 5.99%. Banks have been experimenting with interest rates to see what works in acquiring new customers and perhaps retaining their existing customer base. The problem they face is not just the low level of real estate turnover but the fact that $170 billion worth of fixed rate mortgages come up for renewal in the next 12 months. As people jump from an average interest rate perhaps near 3.5% to something much higher they will naturally look around beyond their existing lender to see who might be offering a better rate.

In light of the intense competition between banks for mortgage business and some better than expected inflation indicators in New Zealand we have seen bank wholesale borrowing costs decrease a bit in the financial markets. The biggest element of the decreases however has come about as a result of new disturbances in the banking sector in the United States.

The collapse of three banks in the United States, not due to bad lending but because of bad management of their deposits and liquidity policies, has sent some fresh jitters into the financial markets in the United States in particular but also the rest of the world. This hasn’t prevented the European Central Bank from last week increasing their cash rate by 0.5%, but it has encouraged the Federal Reserve in the United States to only increase their interest rate on March 22 by 0.25% rather than the 0.5% which had previously been expected.

In addition, the Fed have softened their language regarding future increases in interest rates. The markets now believe there is only one more 0.25% increase in interest rates to come and that before the end of this year and through 2024 and 2025 the Federal Reserve will in fact be cutting interest rates.

Underlying inflationary pressures in New Zealand still remain quite firm

Here in New Zealand the next review of the official cash rate will occur on April 5. It is now very unlikely that there will be another 0.5% rise and instead a 0.25% increase in the cash rate is most probable. There is a chance the Reserve Bank will slightly soften their language but not by all that much. Underlying inflationary pressures in New Zealand still remain quite firm and there is a boost to inflation coming from the effects of recent flooding in some parts of the North Island.

Taking all these factors into consideration and a few others not mentioned here, the interest rate dynamic in New Zealand is now this. Fixed mortgage rates reached their peaks about two months ago for this interest rate cycle and now will be declining. The speed of decline however is likely to be extremely slow and there will be shocks which at times will make people believe there might still be some increases left.

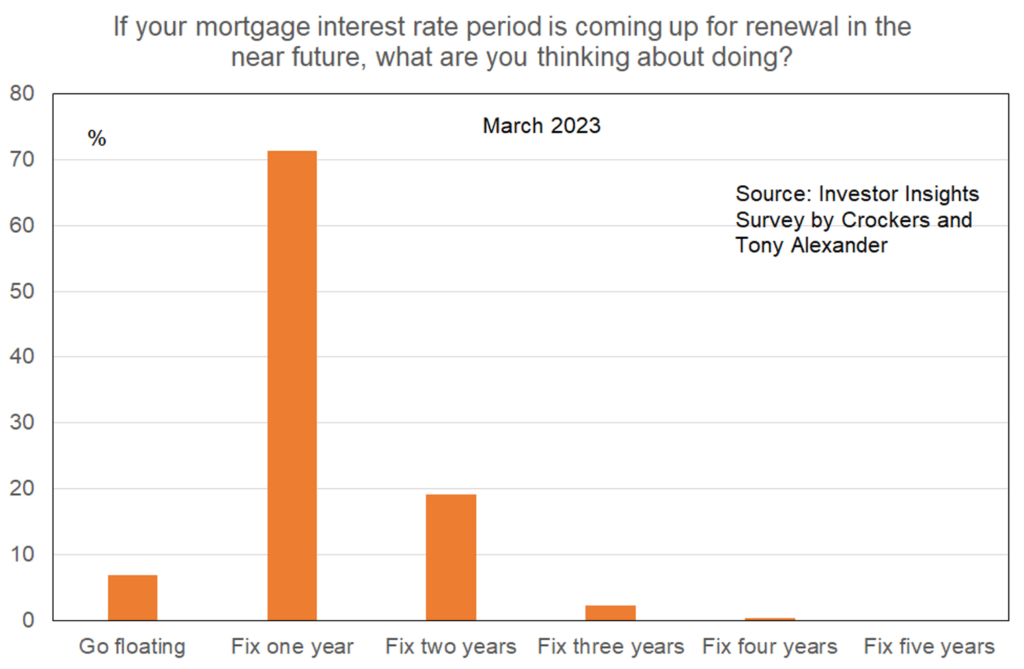

For most borrowers when it comes to choosing what terms to fix their interest rate for the one and two year periods are likely to remain as popular in the next few months if not the remainder of this year as they have been over the past couple of months.