Official Cash Rate rising

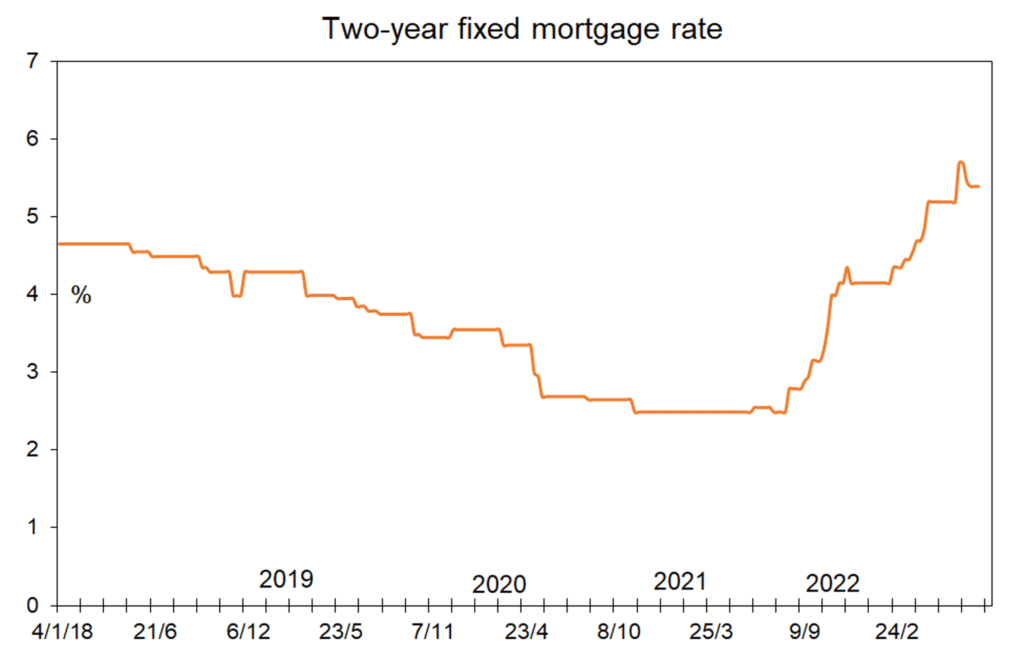

They eventually started raising the official cash rate in October last year and market anticipation of increases all this year has seen fixed mortgage rates rise by between 3% and 3.5% from where they were just over a year ago.

Currently the official cash rate is 2.5% and the Reserve Bank are likely to take it to 3.5%. Some believe they will go as high as 4.0%. That is unlikely, and the chances are high that for all bar floating and the one-year fixed mortgage rate we have seen the peaks this cycle.

As noted in this column two months ago we can clearly see weakness appearing in consumer spending plans. Back then I noted that a net 20% of respondents to my monthly Spending Plans Survey intended cutting back on their spending in the next 3-6 months. Now that is a net 26%.

Consumer confidence at a record low

We also have consumer confidence at a record low level by an alternative measure and business confidence also is sitting near record lows. The 7.3% hike in the cost of living in the past year is sapping consumer ability to spend and even though their costs are rising strongly businesses are slowly losing their ability to comfortably raise selling prices.

The upshot is that with help from a recent absence of fresh increases in international energy, food, and minerals prices, plus falls for some, we may be at peak inflation in New Zealand. Once the next inflation number comes out in the middle of October the discussion around inflation and interest rates is likely to shift from pain to the speed with which interest rates and cost of living relief will come along.

Will inflation fall?

None of us have good economic models which can tell us how quickly inflation will fall away. But in the United States the markets are anticipating inflation back below 3% come the end of 2023 and factoring in three cuts to the Federal Reserve’s funds rate before the end of that year. Note that before those cuts appear further rises are anticipated because of the need to make it clear that all efforts will be undertaken to ensure inflation does not become entrenched.

Soon, if not perhaps already, the financial markets in New Zealand will be pricing in cuts to our official cash rate from the latter part of 2023. Because the markets are forward looking that means the cost to banks of borrowing money at fixed rates in order to lend it to you and I at fixed rates will be falling well before those rate cuts come along. That is why I note the chances are high that fixed mortgage rates have already reached as high as most are likely to this cycle.

What does this mean for the housing market?

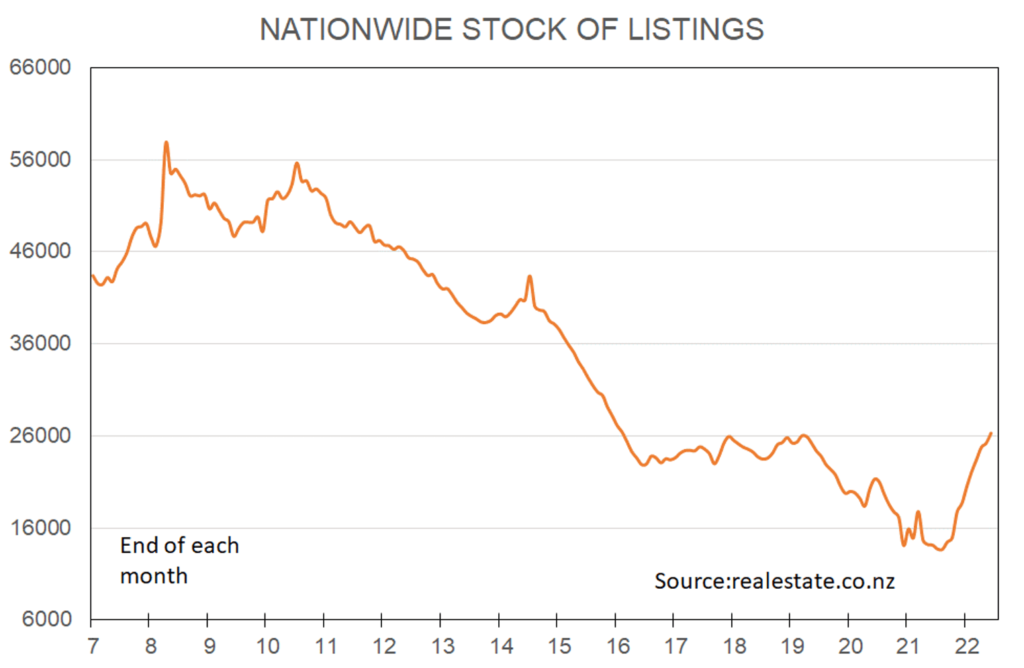

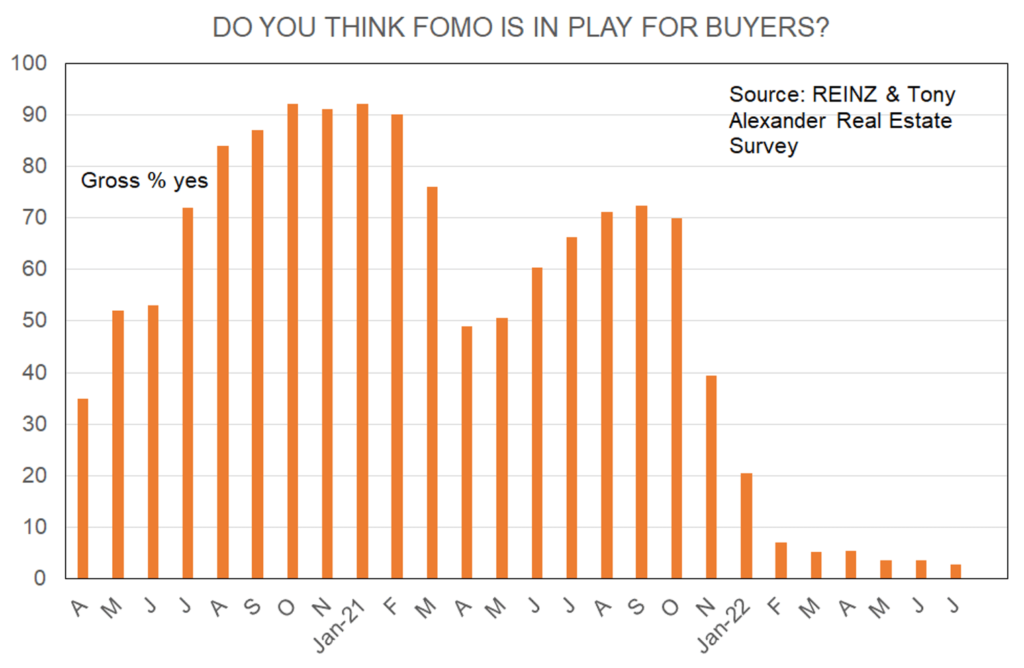

For the moment the economic fundamentals and sentiment are negative. Interest rates are firm, confidence is low, FOMO has gone to be replaced by FOOP (fear of over-paying), and net migration flows are negative and set to get worse. Stories are proliferating of people losing money as builders collapse or fail to deliver the quality of product ordered, and Kiwis are shifting away from ordering new houses towards perusing the stock of listings which now sit over 80% ahead of a year earlier.

Negativism prevails. But a queue of buyers sitting on their hands is building up. In this queue there are investors waiting for bargains, people simply waiting for prices to bottom out (good luck guessing when that will be – probably within 6-9 months), people taking their time to peruse the growing number of listings, and young buyers unable to get finance at current test interest rates and bank restrictions on low deposit lending.

But before the end of the year interest rate worries will be backing off as inflation is seen to be headed lower. There is also a good chance that the Reserve Bank will ease the LVR rule restricting banks to having a maximum of 10% of new lending at less than 20% deposit (40% for investors). Throw in investors saying they will return if it looks like National will win the late-2023 general election (because of their promise to restore interest expense deductibility and a two year brightline test) and things are likely to look very different in our housing market come the start of 2023.

Gains are likely

Average prices are likely to fall by another 5%+ after already declining just under 10%. But over 2023 some gains are likely because of the altered fundamentals and the catch-up on buying to come from those currently standing on the side-lines.

Things won’t boom, and perhaps there is just one useful message in all of this. If one is looking to buy and in a financial position to do so, then with listings rising strongly it seems like the best time in many years to be actively perusing what is on offer. A good strategy may be to find three suitable properties then get the real estate agent for each vendor to work on their client to convince them to take your low ball offer.