Borrowers flock to three years

This month’s survey of mortgage brokers around New Zealand received 65 responses with half before the Tuesday lockdown announcement and half after. Because the survey asks advisors about what they are seeing we would not expect observations to shift – and broadly results are similar for the two groups.

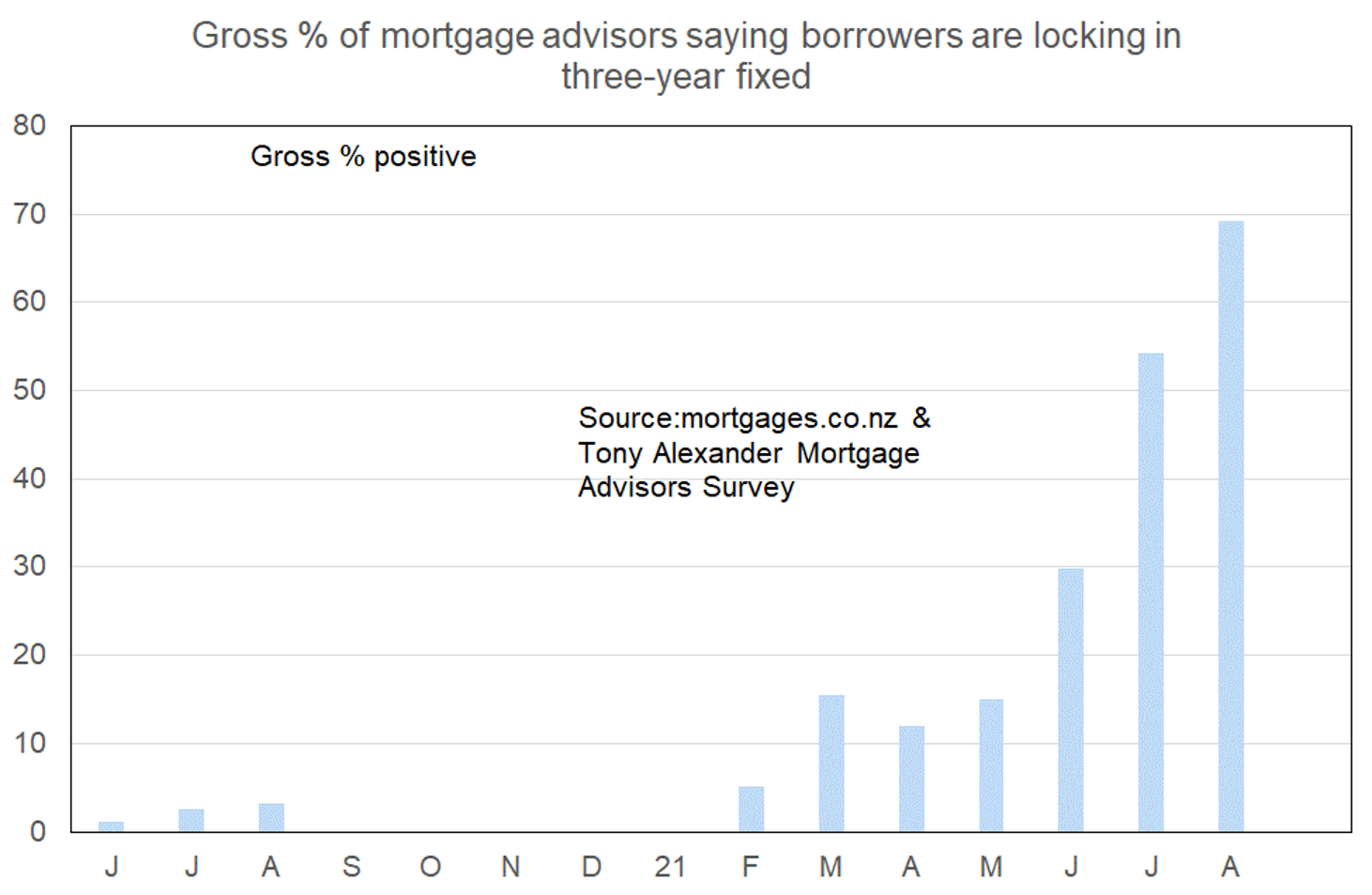

They show a fresh decline in the net proportion of advisors seeing business from investors, but a rise in first home buyer activity. There has been a noticeable jump in the proportion of brokers noting that buyers are preferring the three-year fixed rate term for their mortgage interest rates.

The Reserve Bank have held off raising the official cash rate for now in light of uncertainty surrounding the latest nationwide lockdown duration and impact. But they have made it clear that they see the economy as growing at a pace faster than resources can keep up. That means rising inflation from the already high 3.3% rate reported in mid-July.

It is highly likely that the cash rate will be raised at the next review on October 6, if not earlier, and the Reserve Bank have signalled their expectation that the cash rate will now have to rise by about 0.25% more than they were thinking in May.

With increasing talk of mortgage rates rising a lot more, our survey shows a clear shift by borrowers to protect themselves against the rate rises to come. The latest Covid-19 outbreak has actually provided them an increased length of time in which to get that protection before the official rate rise cycle commences.

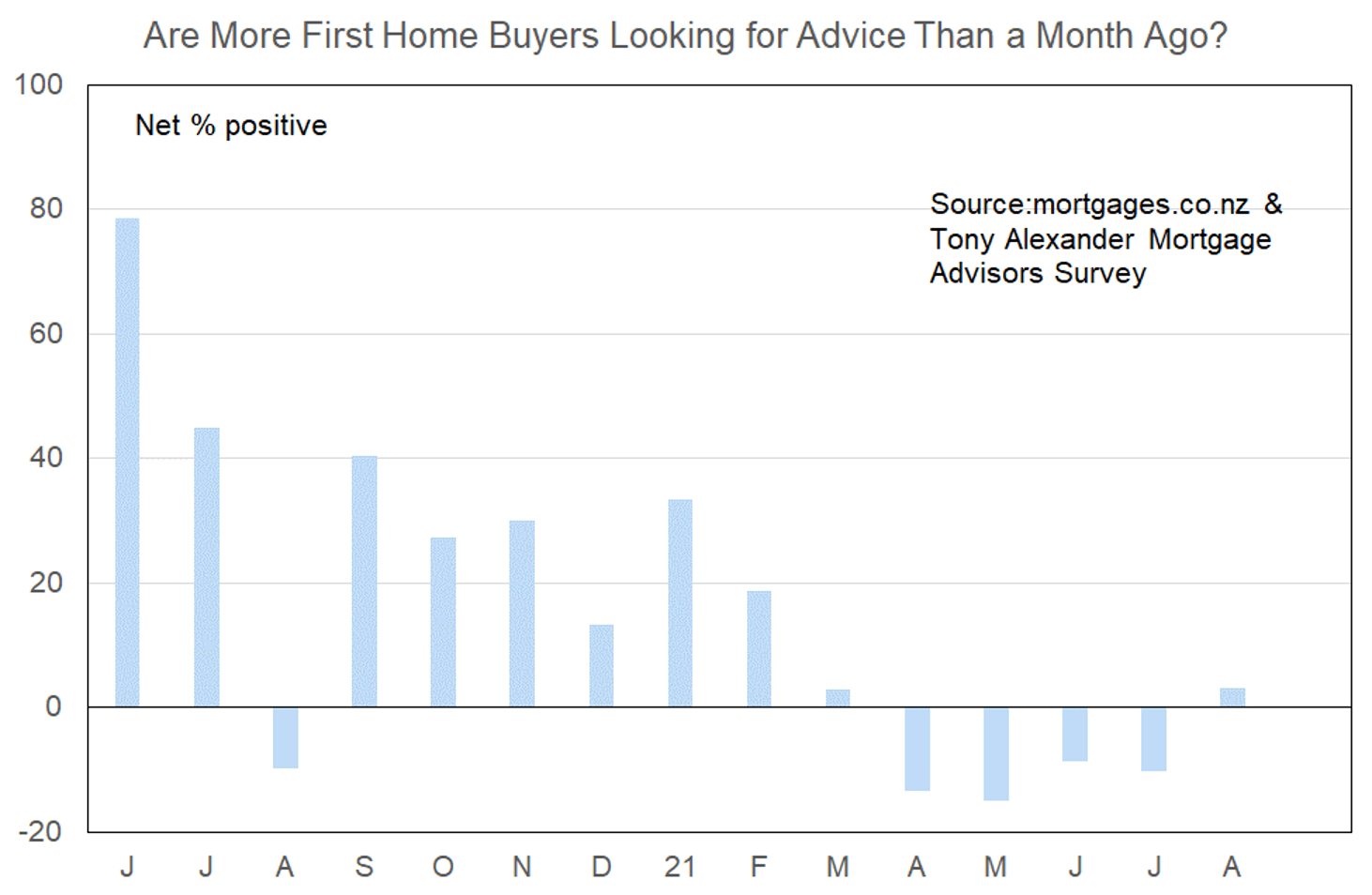

More or less first home buyers looking for mortgage advice

For the first time since just before the March 23 tax announcement, there are more mortgage advisors saying that they are seeing more first home buyers seeking advice than fewer. A net 3% have reported more compared with a net 10% reporting few first-time buyers last month and a net 15% in May.

This result is consistent with many other results from similar surveys of market activity in that there is recovery underway after the initial sentiment slump from late-March.

But at just 3% the outcome is considerably weaker than all bar one month in the period from June last year to February. The exception was August last year when Auckland was in lockdown. This suggests that the current lockdown may also cause a dent in first time buyer engagement with the residential real estate market in the very near future.

The recovery from September 2020 however suggests that this possible imminent withdrawal of buyers will be temporary.

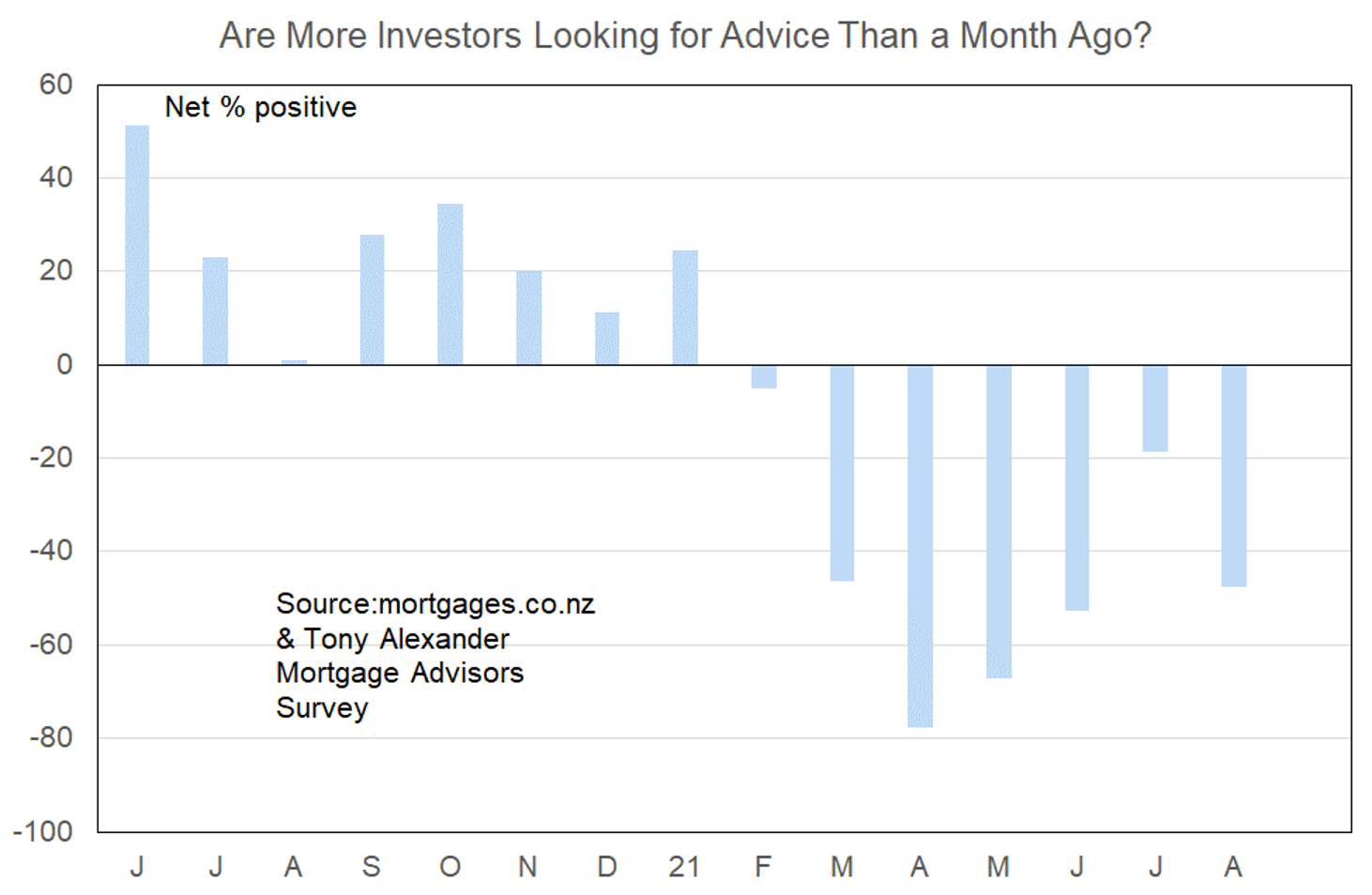

More or less investors looking for mortgage advice?

This is our first coalface examination of investor sentiment since the Reserve Bank’s recent announcement that low deposit lending by banks would be further curtailed. But given that almost no lending to investors occurs with a deposit less than 20% of the property’s value, this policy change may not much explain the easing back of investors.

Perhaps the edging up of interest rates is having an impact, or perhaps many investors are simply feeling high prices make purchasing less safe currently than has been the case for some time.

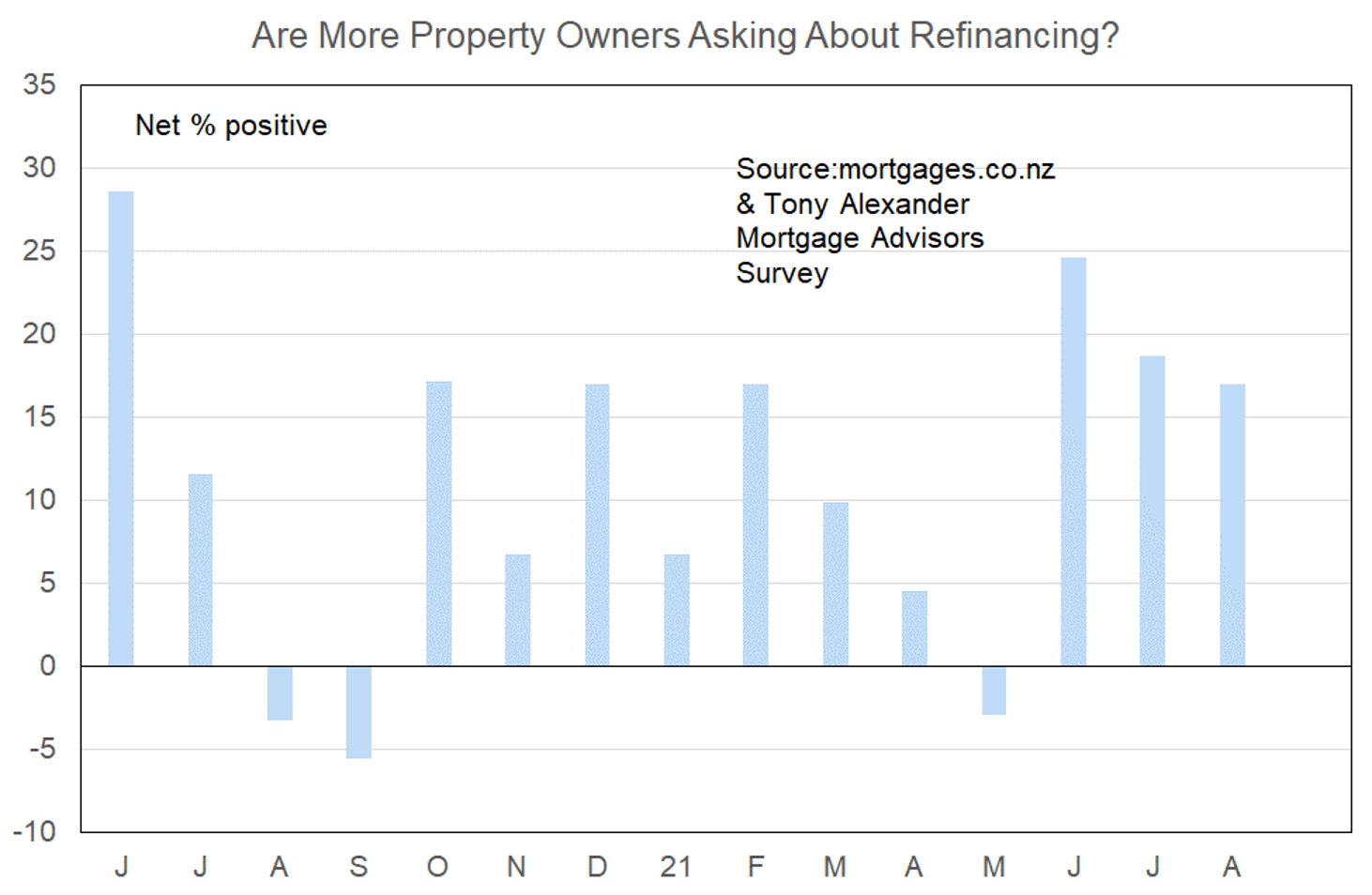

More or less property owners looking for refinancing?

This month there has been little change in the net proportion of mortgage advisors noting more people seeking discussions about refinancing. But compared with the past year the increase in discussion activity (a net positive 17%) is notable and understandable in light of the recent increases in mortgage rates and expectations of further rises over the coming 1-3 years.

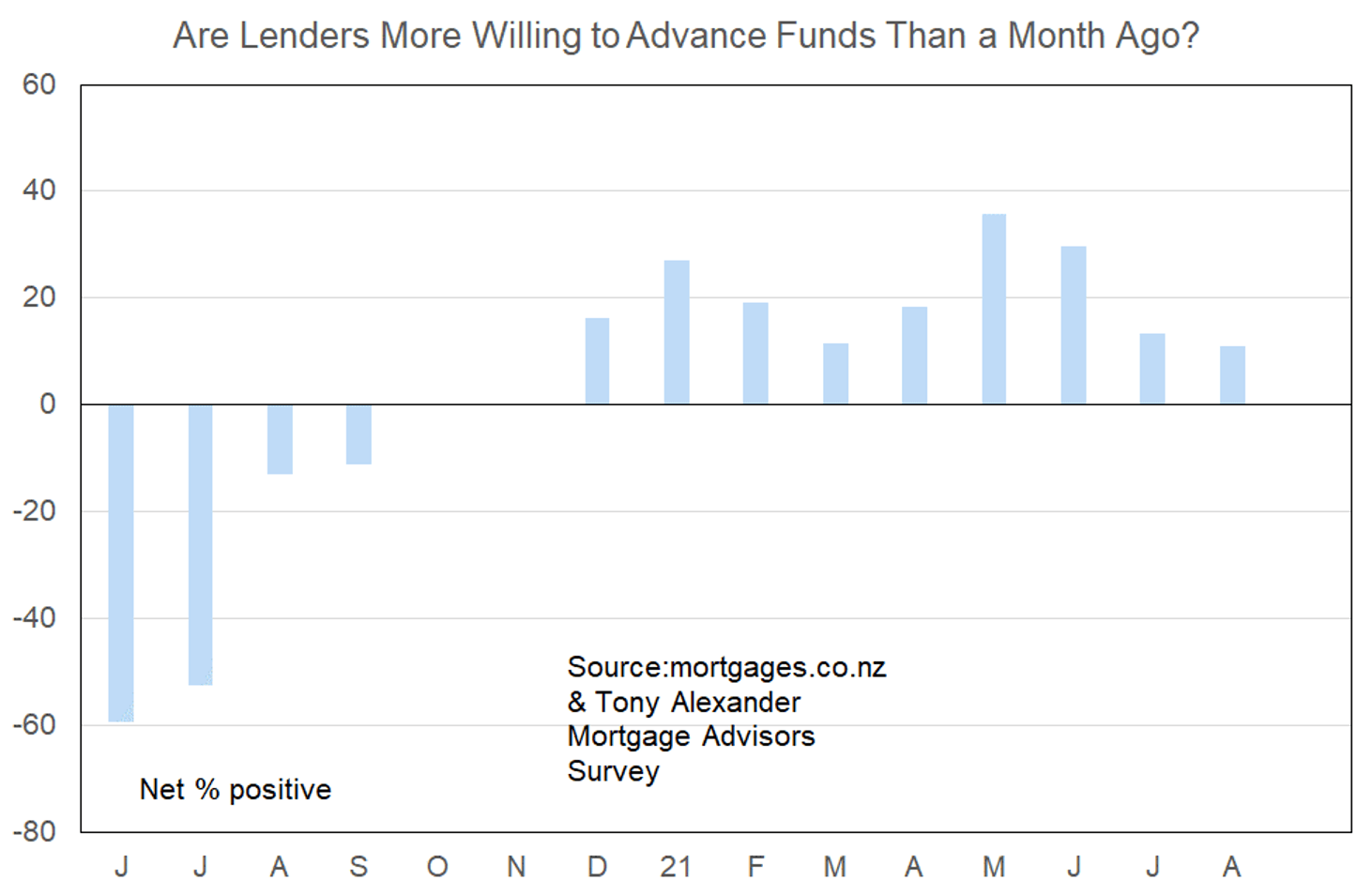

More or less lenders willing to advance funds?

Since the very end of last year there has been no firm trend in advisor perceptions of bank willingness to lend. But the decline in recent months could signal that much as desires for business and market share are keeping banks actively engaged in seeking customers, their lending momentum is easing.

It will be interesting to see if this measure turns negative as we approach a period when the Reserve Bank will talk more about implementation of new lending controls such as Det to Income ratios.

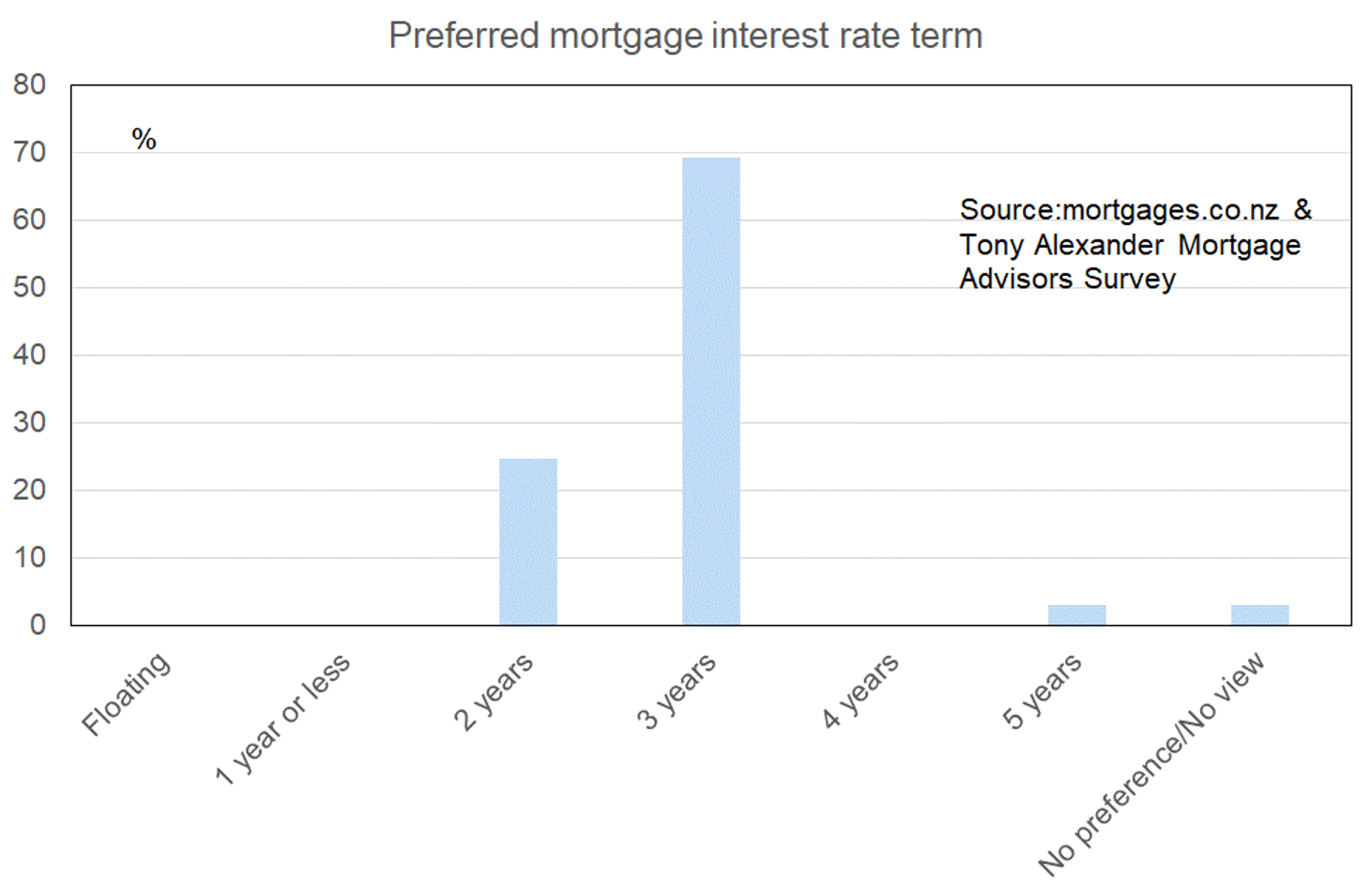

What time period are most people looking at fixing their interest rate?

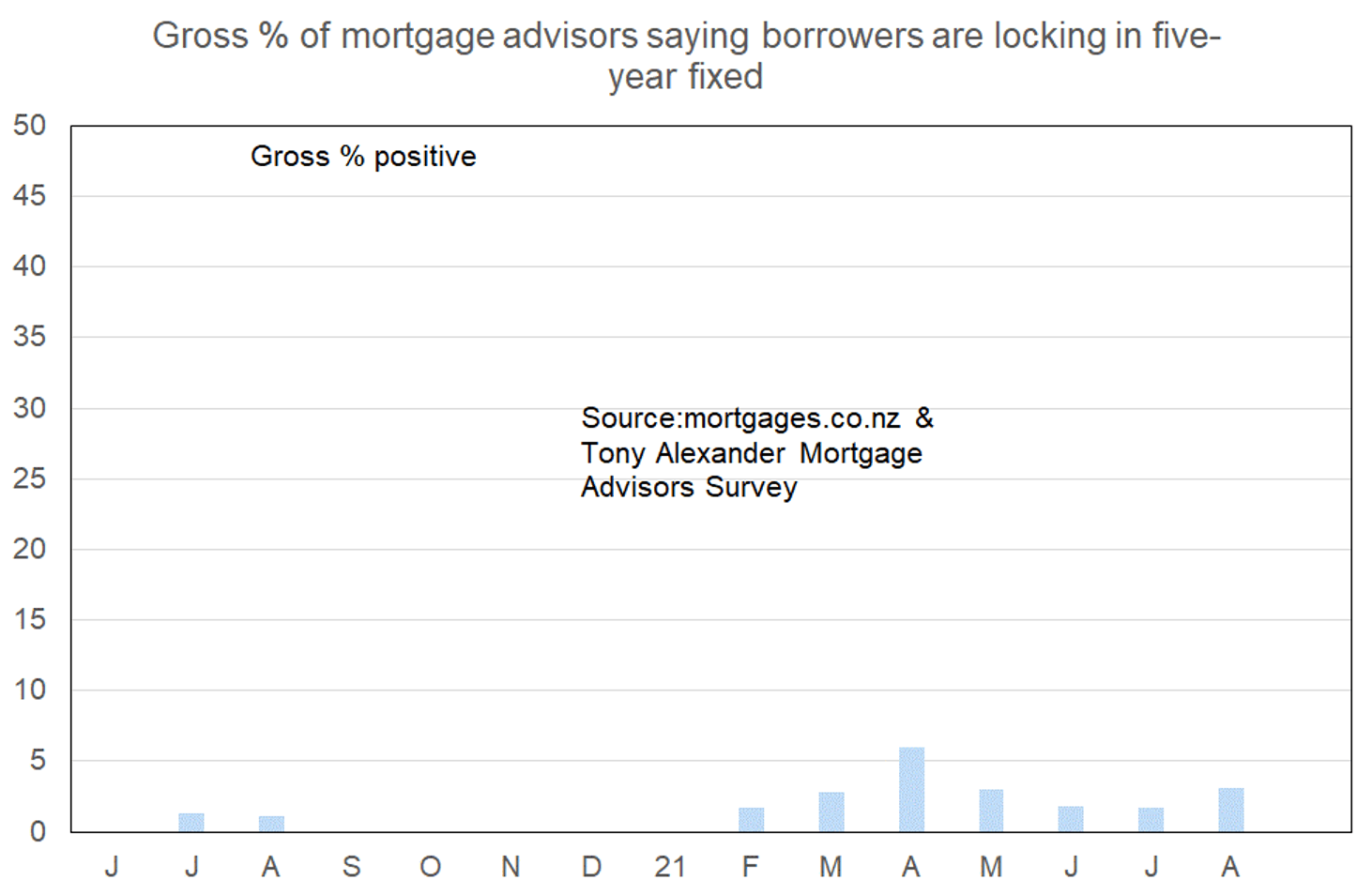

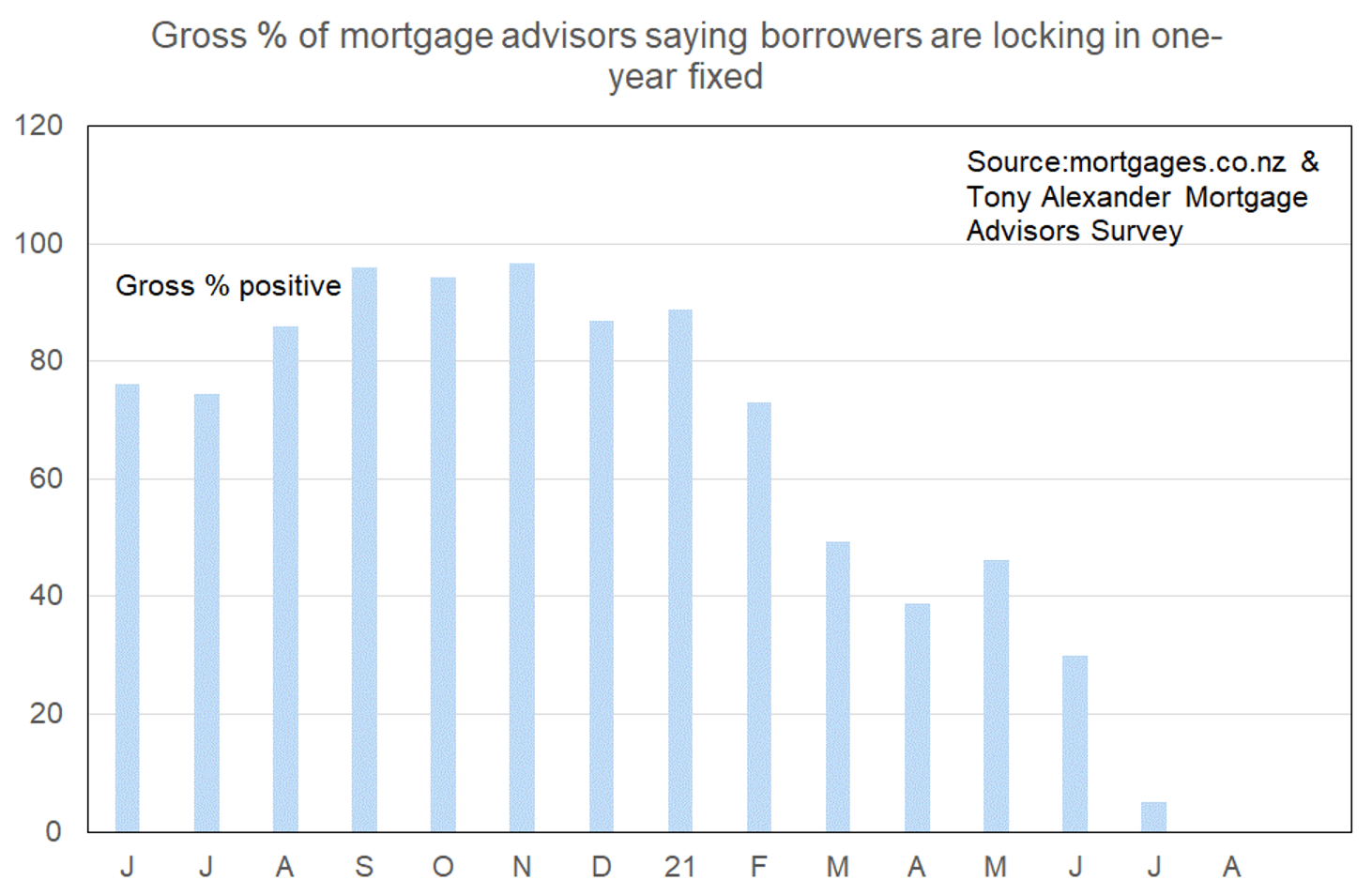

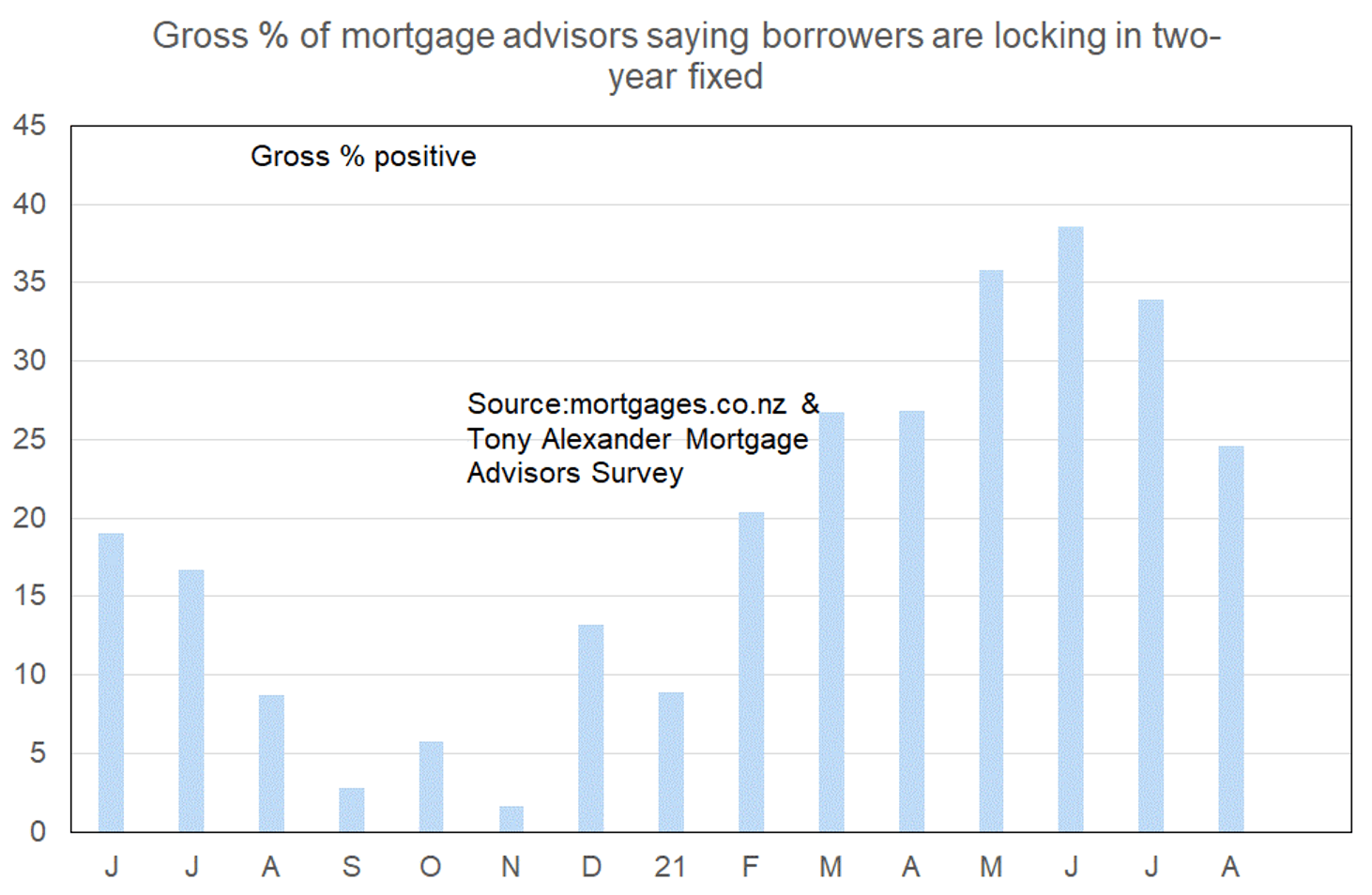

Mortgage interest rates are rising and there are widespread predictions of further rises to come – though delayed for now by the Covid outbreak staying the Reserve Bank’s hand. Unsurprisingly, mortgage advisors are noticing a sharp decrease in willingness of borrowers to continue with the previously successful strategy of fixing one-year. Preference has strongly shifted to three years.

The following graph shows the gross proportion of advisors noting customer preferences for each term in our August survey.

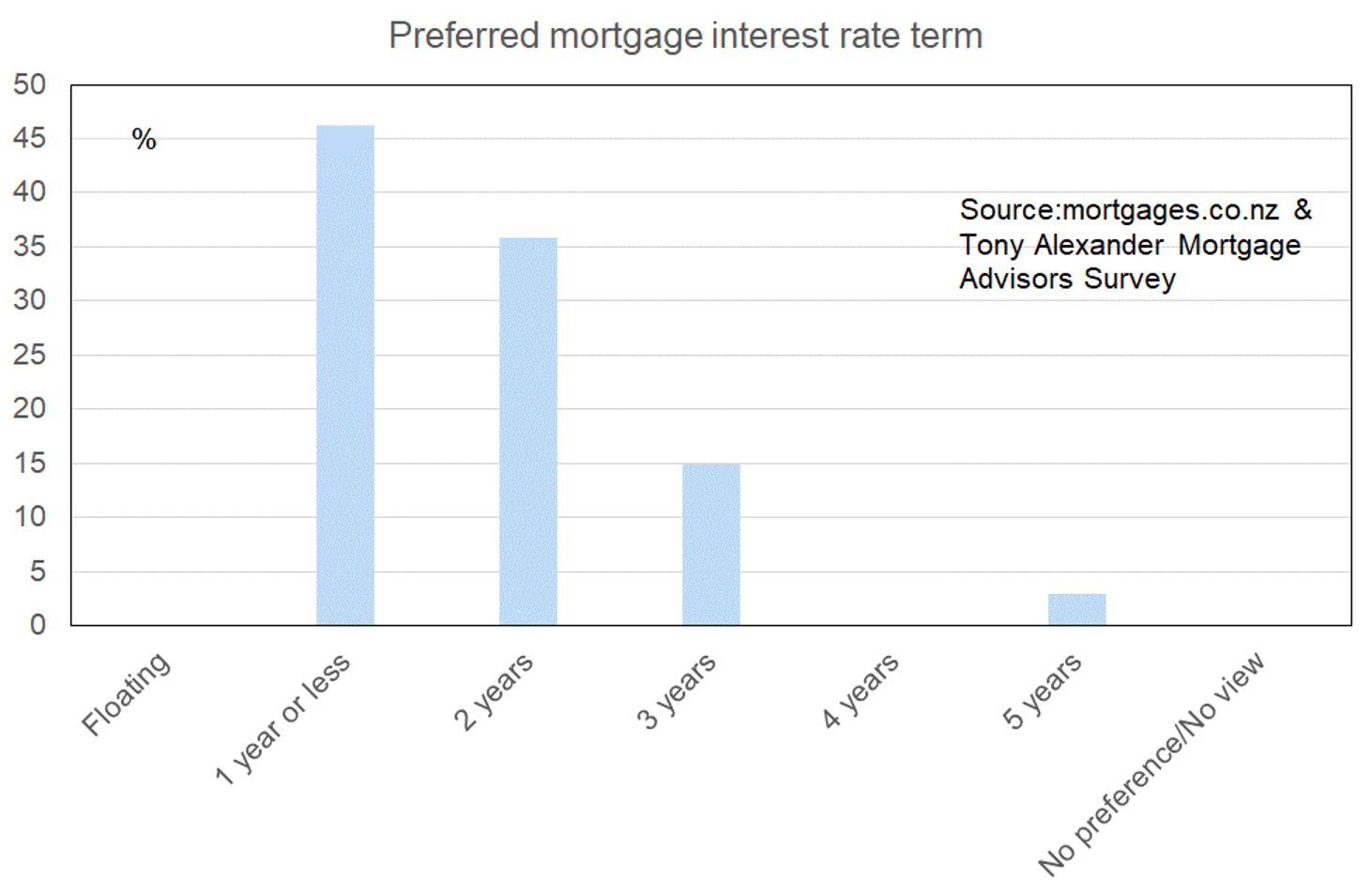

This next graph shows what the preference structure looked like just three months ago in May. The shift is clear to see.

The strong preference now is for fixing three years with a strong surge in this term over the past two months in particular.