First home buyers disappear

Each month we invite mortgage brokers around the country to give insights into developments in the residential real estate market from their unique perspective. The first survey was undertaken in June 2020 just after the first nationwide lockdown ended and we could easily see from the responses the high level of interest from first home buyers and investors through last year’s winter into February this year.

Our latest survey undertaken this week has yielded 78 responses and they reveal two key things.

- A record level of perceptions that banks are cutting back on willingness to lend.

- A record stepping back of first home buyers.

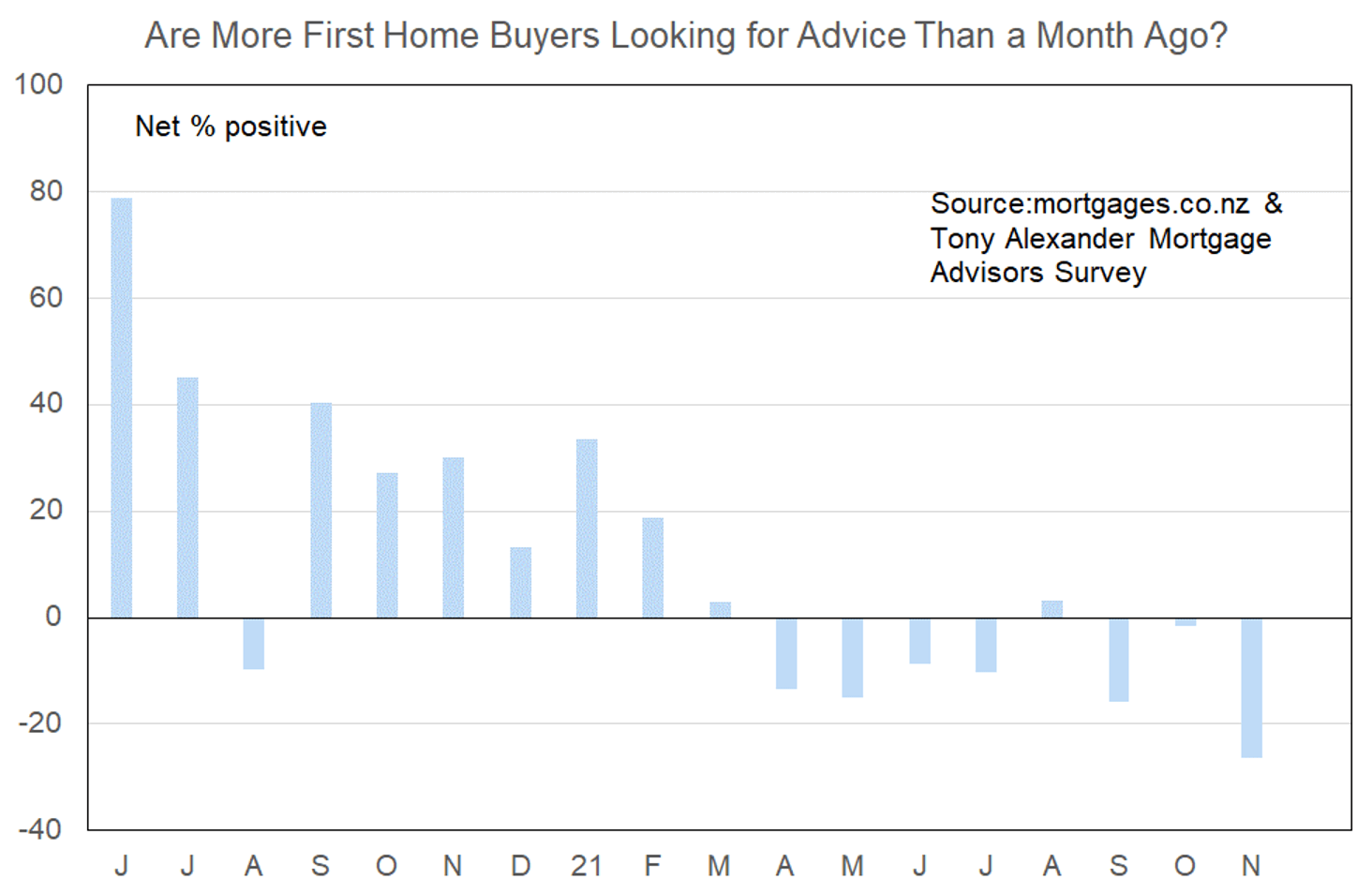

More or less first home buyers looking for mortgage advice

A net 26% of the 78 respondents this month have reported that they are seeing fewer first home buyers coming forward for advice on making a property purchase. This is a strong deterioration from the net 2% last month seeing an easing in first home buyer enquiry and the biggest pullback in such enquiry since our survey started last year.

Young property buyers are viewing a continuing flow of media stories about high prices being achieved by vendors. Their interest in making a purchase is likely to be high. However, they are also encountering a growing flow of information about banks tightening up their lending criteria.

This includes a sharp reduction in the availability of low deposit mortgages as banks have scrambled to get low deposit lending below 10% of new lending from November 1. One bank has even just withdrawn previously approved finance for such lending.

About 75% of low deposit loans have historically gone to first home buyers and it was expected that they would be disproportionately impacted by this rule change.

But they are also being affected by banks having to undertake the deepest examination of mortgage applicant expenses and income sources and stability on record. Banks are getting ready for the December 1 commencement of more stringent responsible lending criteria in the Credit Contracts and Consumer Finance Act. Fewer young people, self-employed, and people over 50 in particular are now qualifying for mortgages.

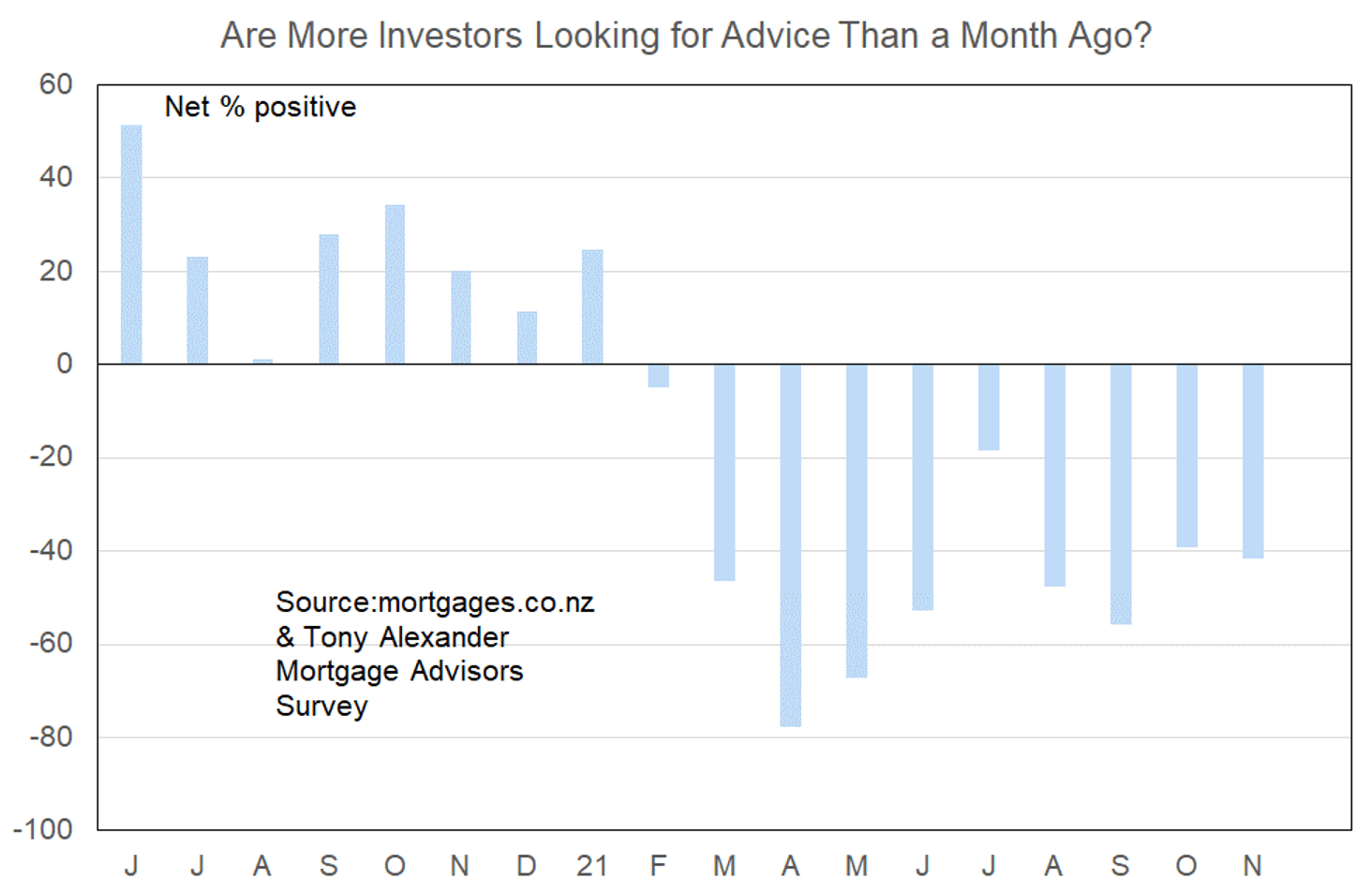

More or less investors looking for mortgage advice?

In contrast to the sharp decline in purchasing interest from first home buyersFirst home buyer’s guide and reinforcing perhaps the disproportionate impact of LVR changes, enquiry from property investors is little changed.

A net 42% of mortgage advisors report that they are seeing less enquiry from investors. As the graph shows, this is consistent with the retreat of investors underway since just before the March 23 tax announcement affecting investors.

Mortgage rates for new lending and refixing of maturing fixed rates are now 1.3% – 1.8% above the lows of less than six months ago. LVR rules have tightened, banks are counting extra expenses when assessing debt servicing ability, and new uncertainties have arisen regarding new builds and their final cost and completion dates.

Although a transition of investor buying from existing properties to new builds is underway, the rising level of interest rates in particular, along with construction sector issues, may stem the extent of that switch in focus in the coming year or so.

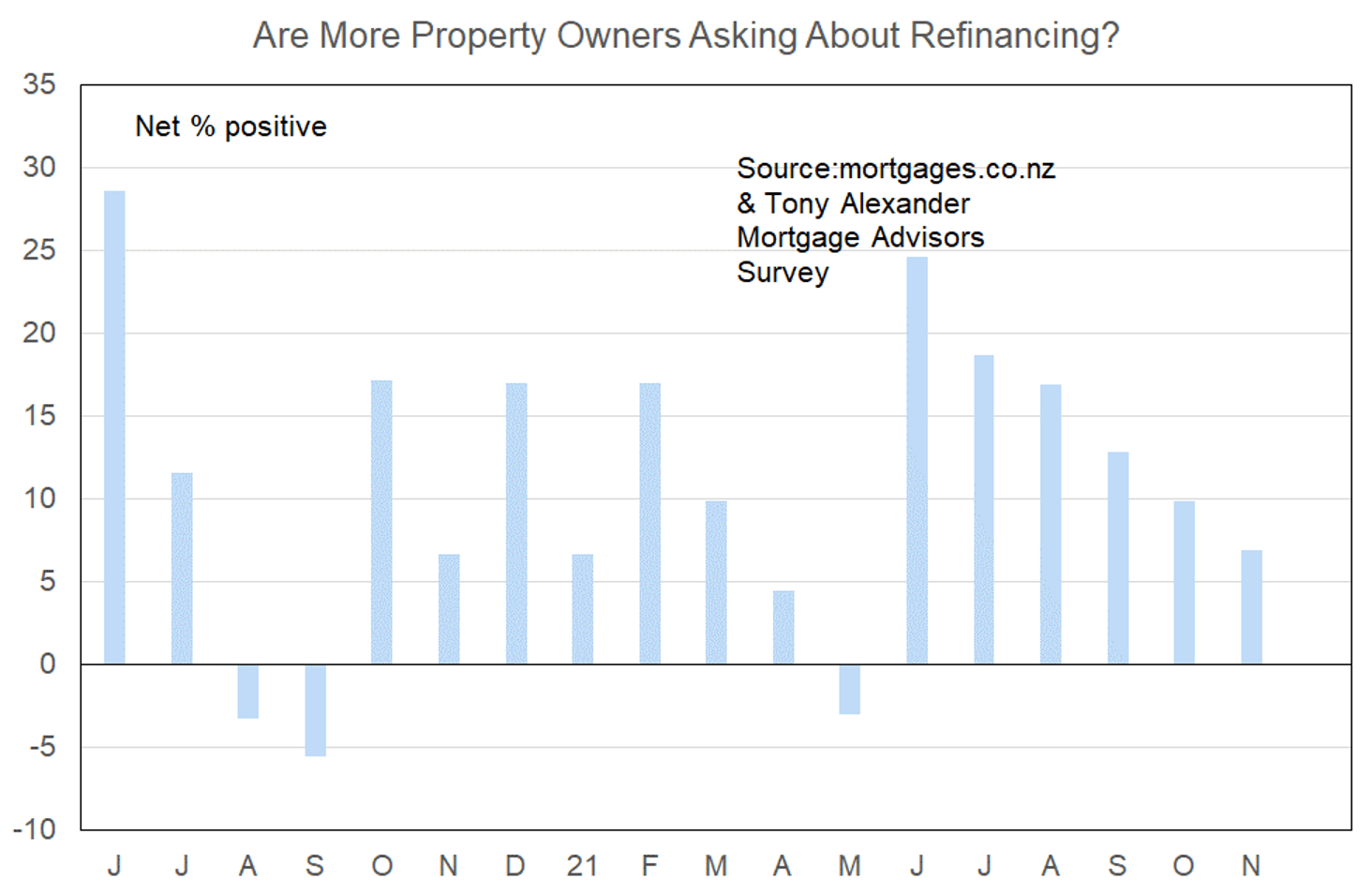

More or less property owners looking for refinancing?

The quite noticeable downward trend in the net proportion of mortgage advisors noting more enquiries about refinancing has continued this month. A net 7% of the 78 responding brokers have reported more enquiries, but this was down from a net 10% last month and is the lowest proportion since just after the March 23 tax announcement.

The downward trend despite the recent sharp jump in mortgage rates may reflect general commentary surrounding the low interest banks currently have in servicing other than their own existing customers. This is probably a temporary situation reflecting the speed with which banks are having to rein in lending to meet the new rules.

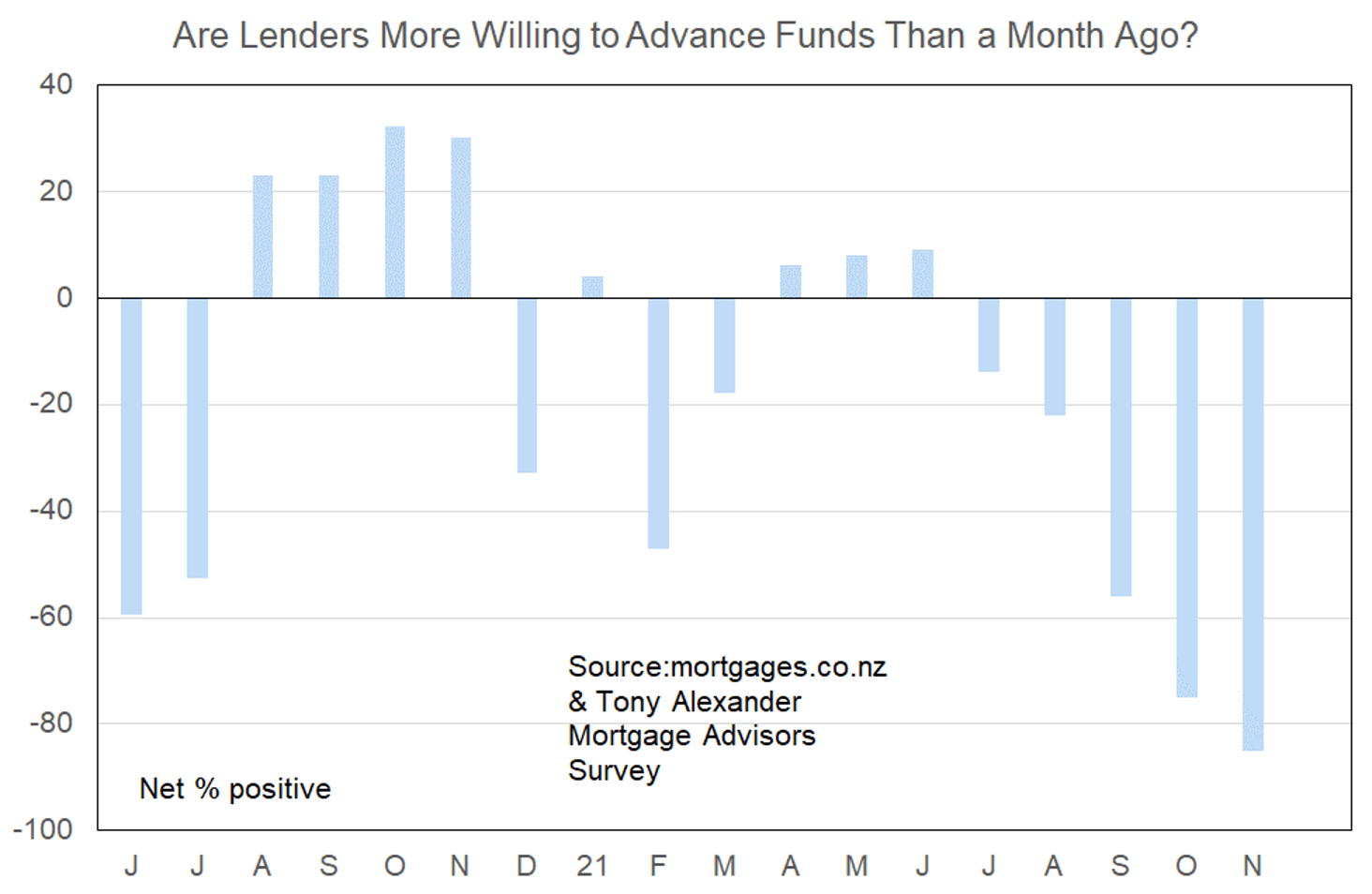

More or less lenders willing to advance funds?

The second substantial change registered in our survey this month is a decline in advisor perceptions of willingness to lend to the lowest on record. A net 85% say that lending willingness has declined as compared with 75% last month.

Only five months ago advisors were seeing lending willingness increase so the period since June represents a substantial turnaround in bank lending policies.

Factors contributing to the pullback include tougher LVR rules, getting ready for the anticipated introduction of debt-to-income restrictions, and meeting new requirements of the Credit Contracts and Consumer Finance Act.

The strong divergence of between the change in lender willingness and the recently accelerating pace of price rises calls into serious question the ability of prices to keep rising for much longer.

Note that results presented for this question differ from previous months (now more accurate) due to a coding change.

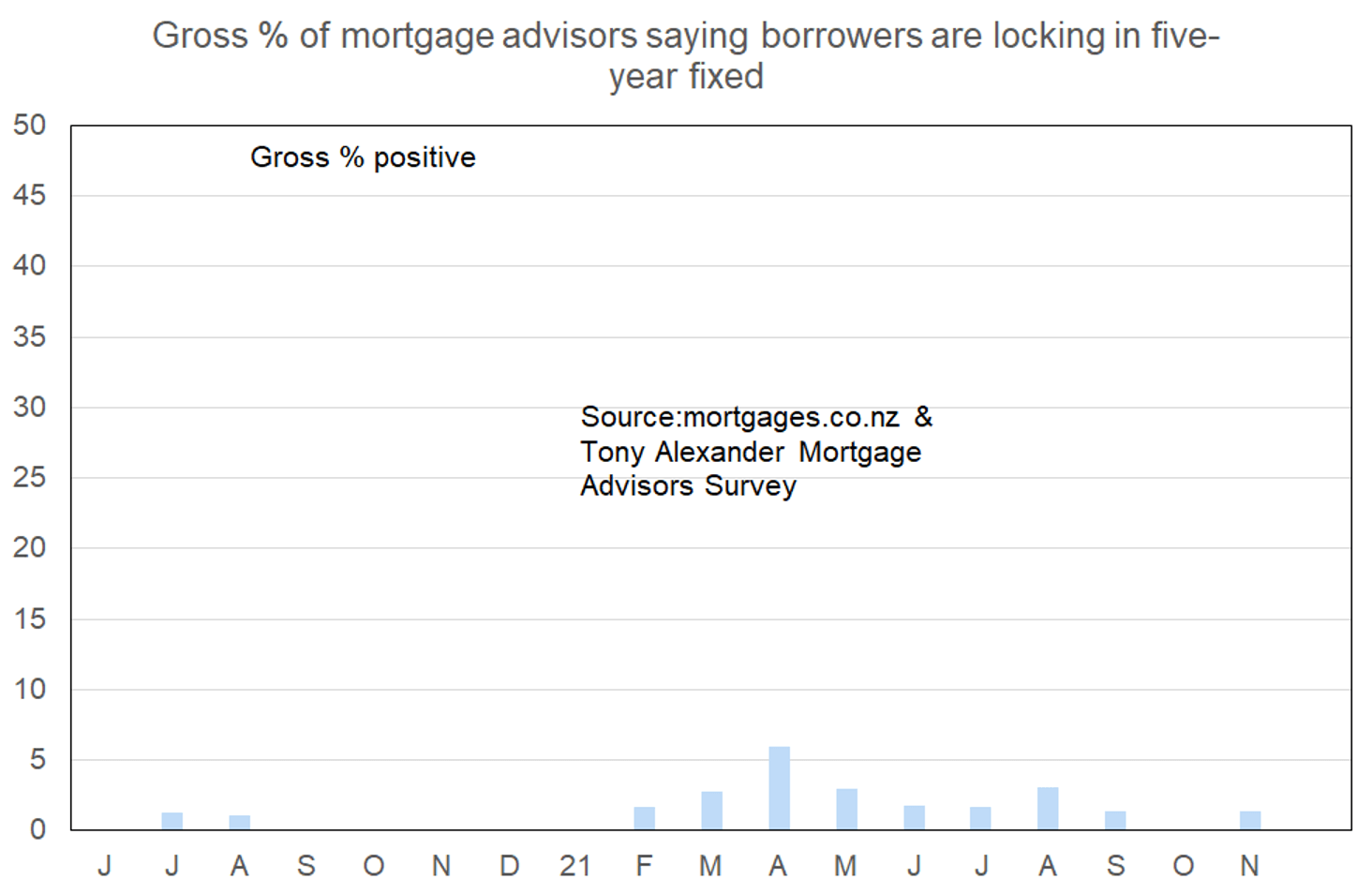

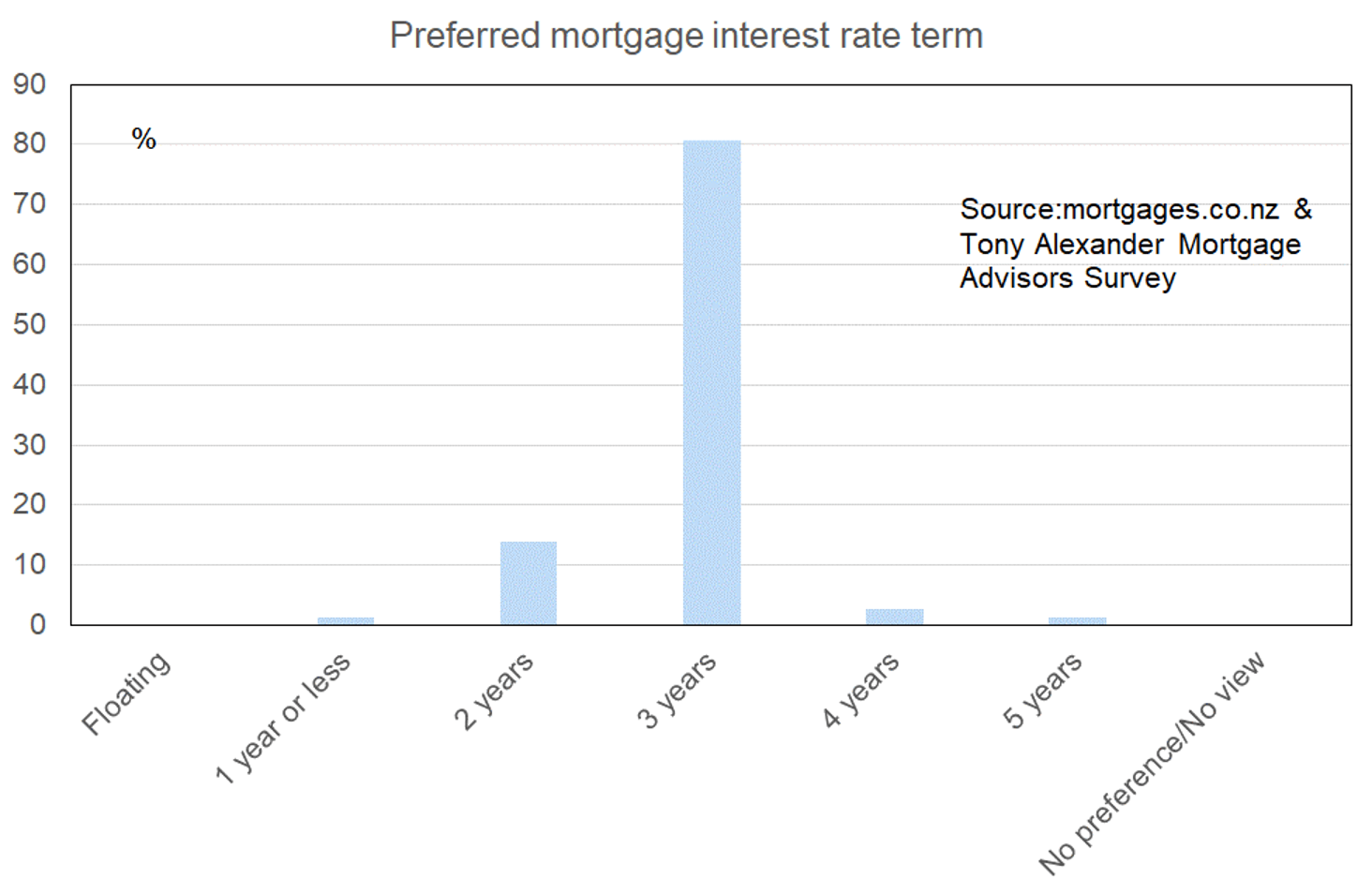

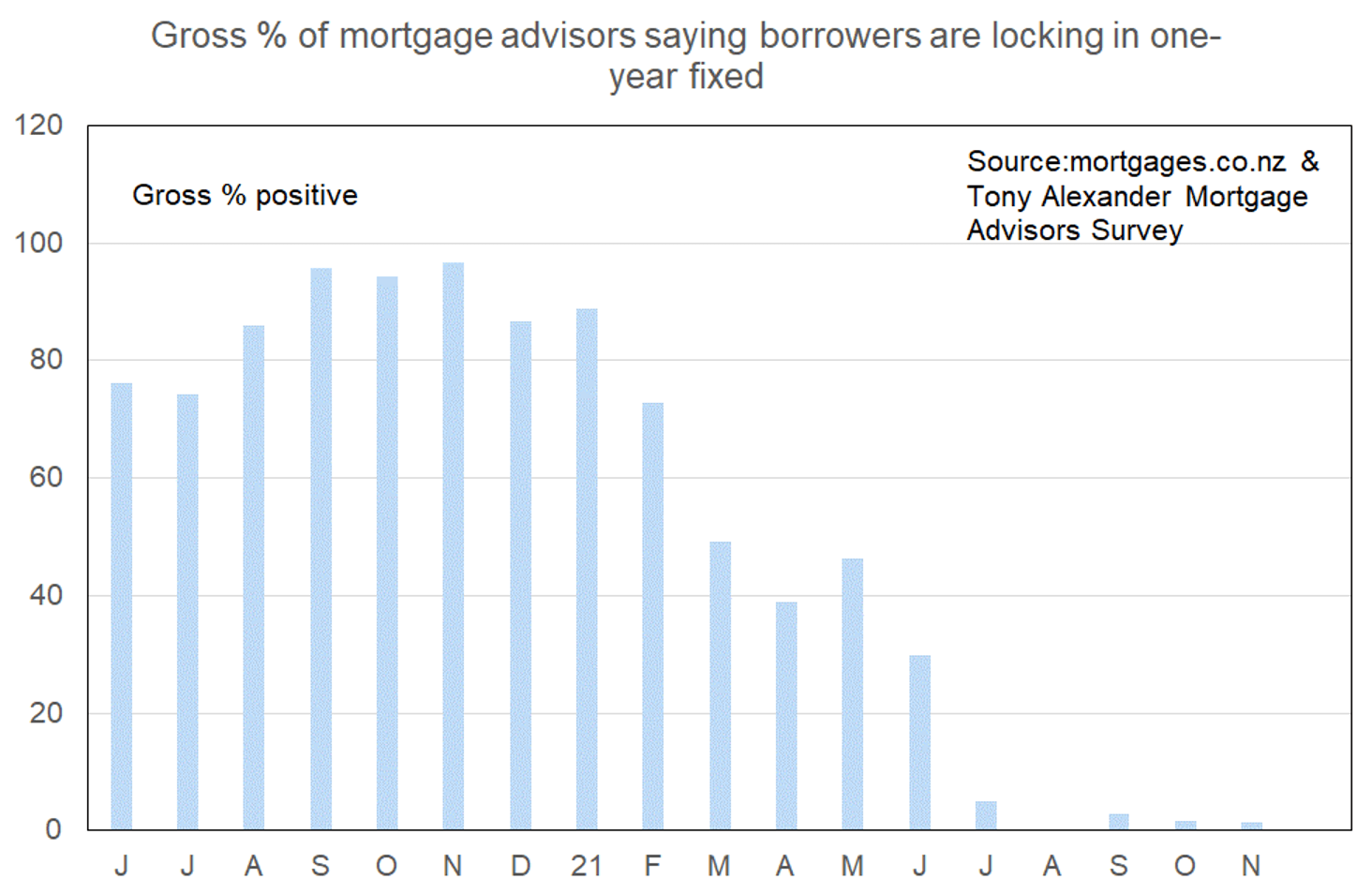

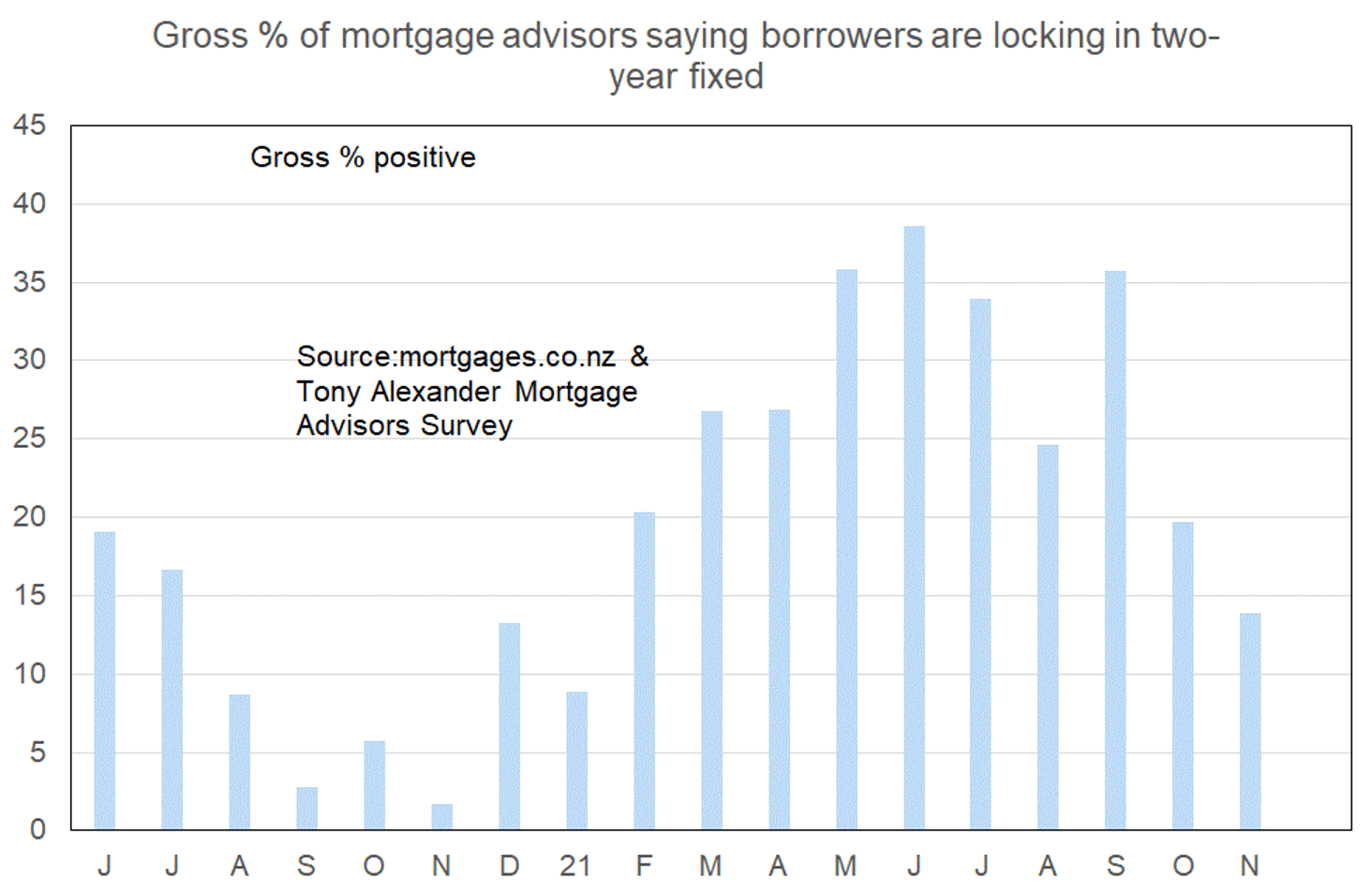

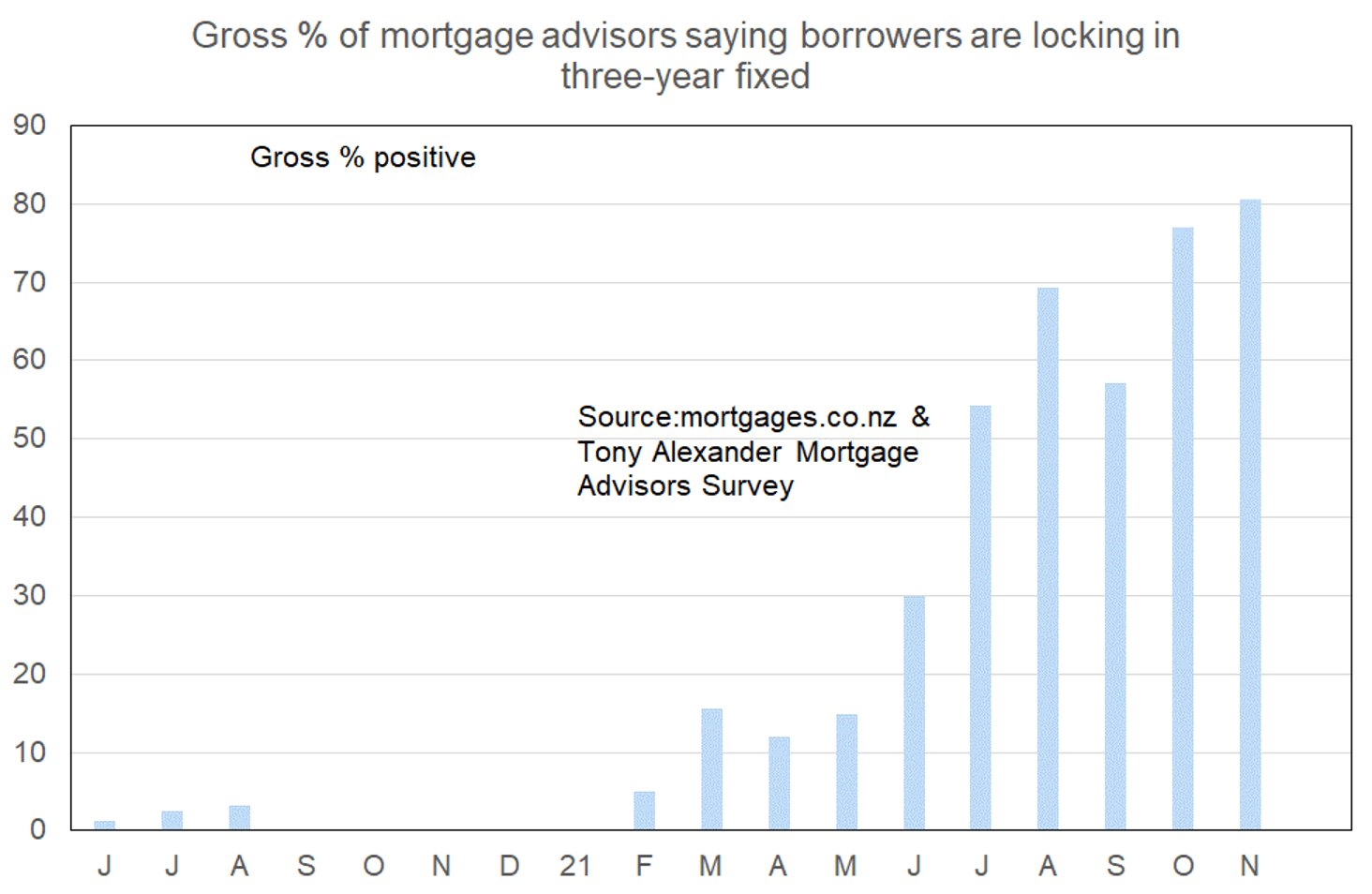

What time period are most people looking at fixing their interest rate?

This graph shows how the one-year term has fallen strongly in favour as interest rates have risen from 2.19% to near 3.5%.

The two-year term jumped in importance for a while, but that preference has been fading.

Support for fixing three years just grows and grows.

Support for fixing five years remains low. Most borrowers are likely to wish they had locked in for five years at the 2.99% rate commonly available for a year up until about five months ago