First home buyers present

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 52 responses.

The main themes to come through from the statistical and anecdotal responses include these.

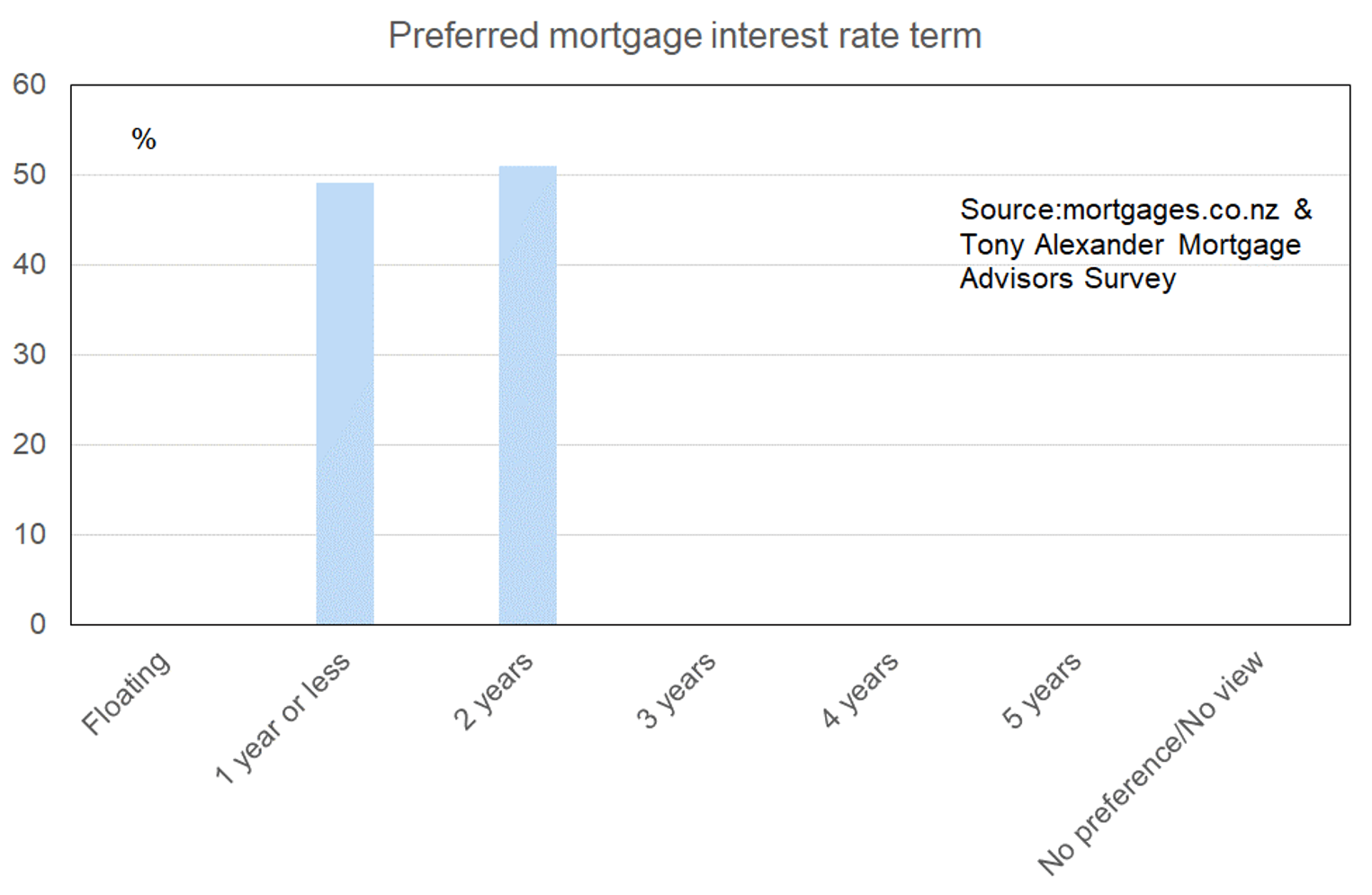

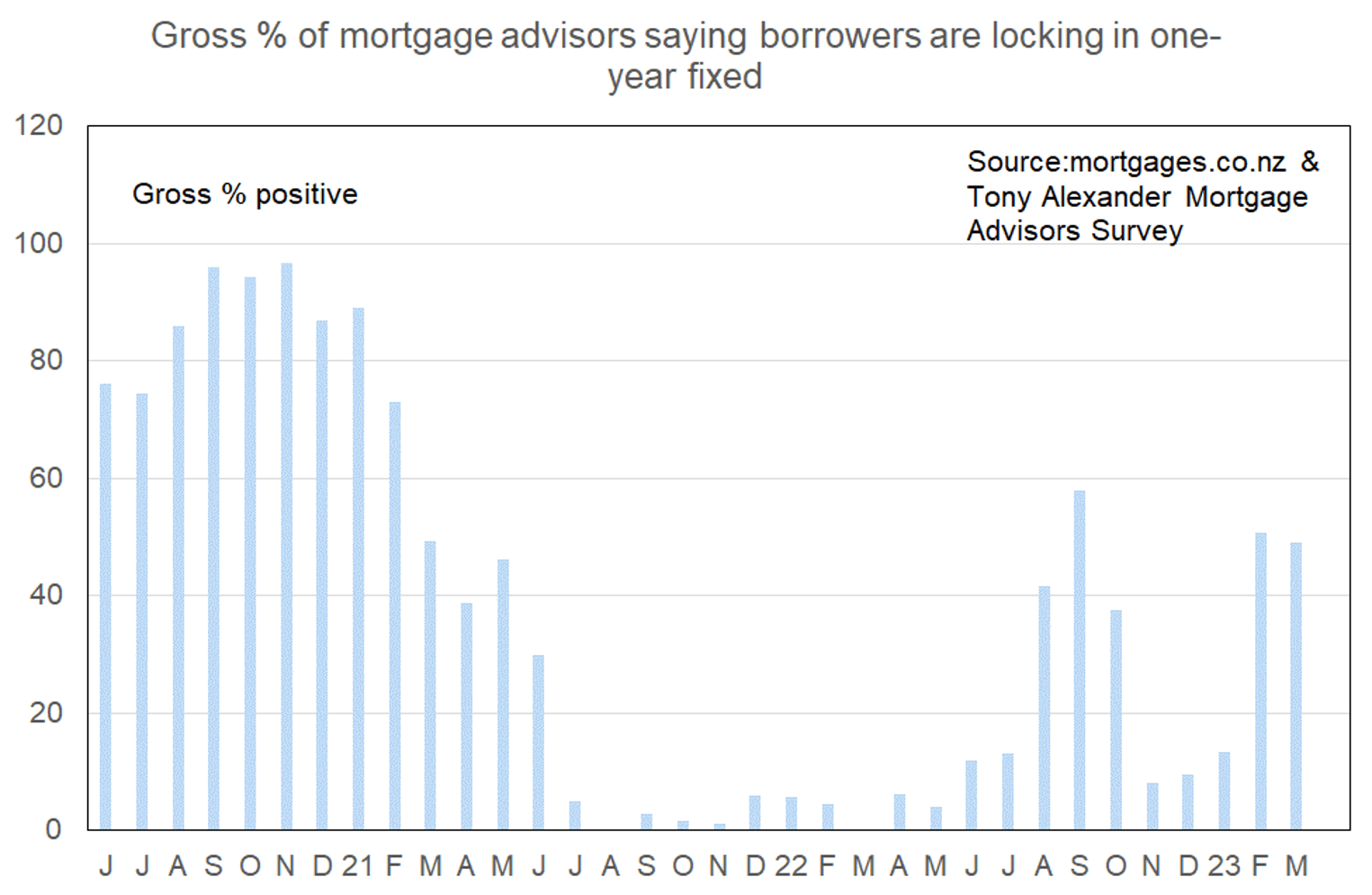

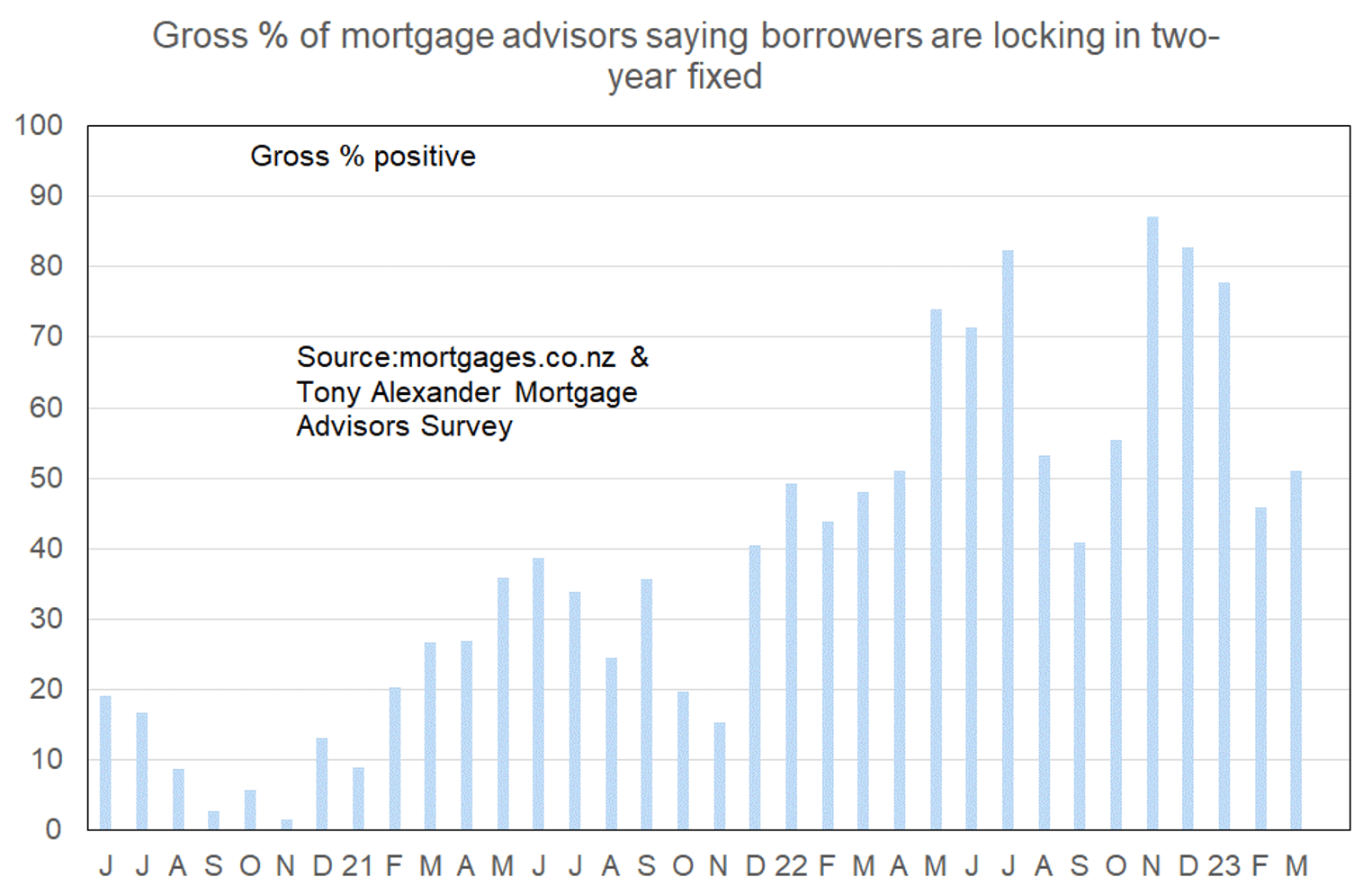

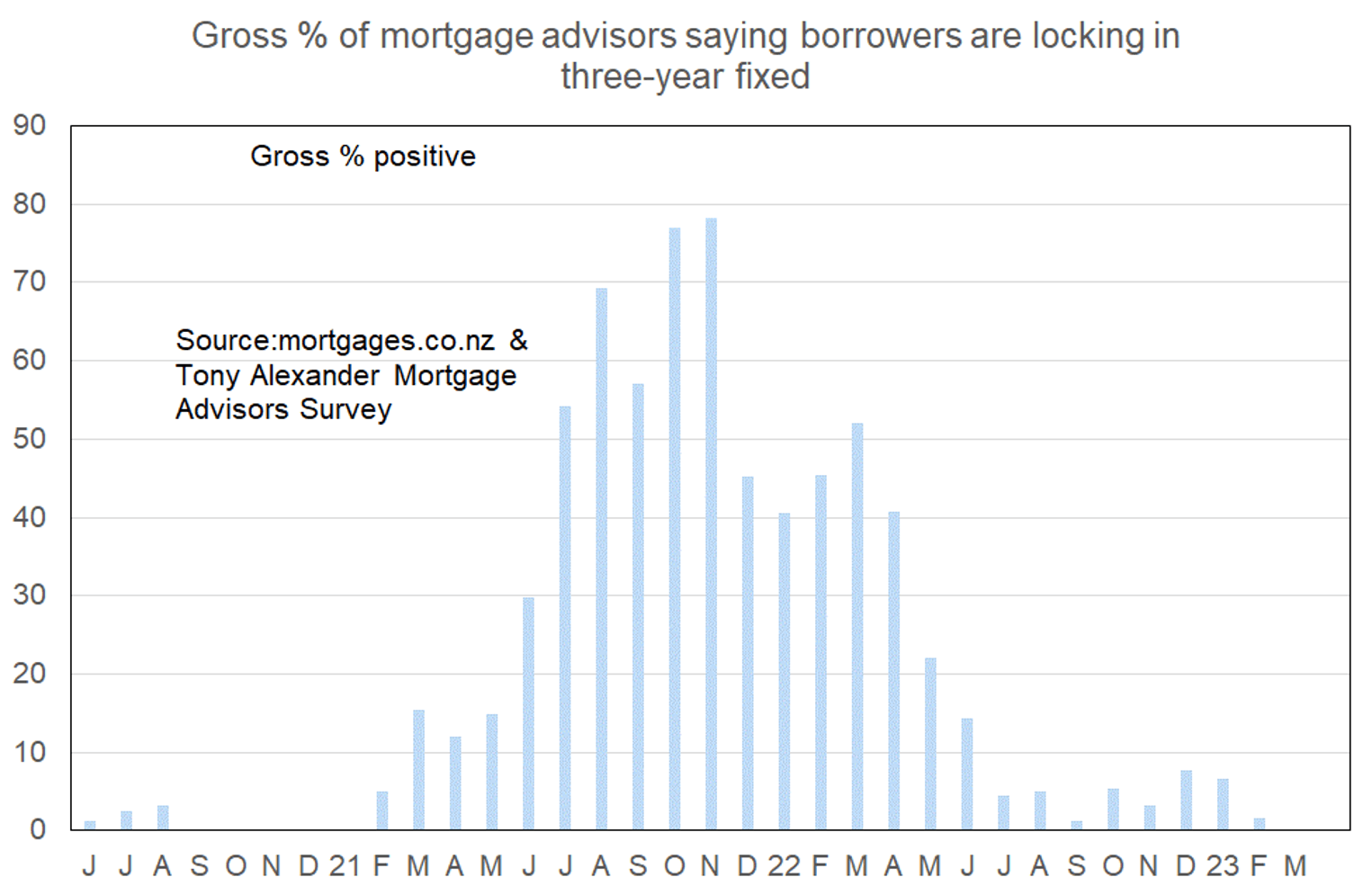

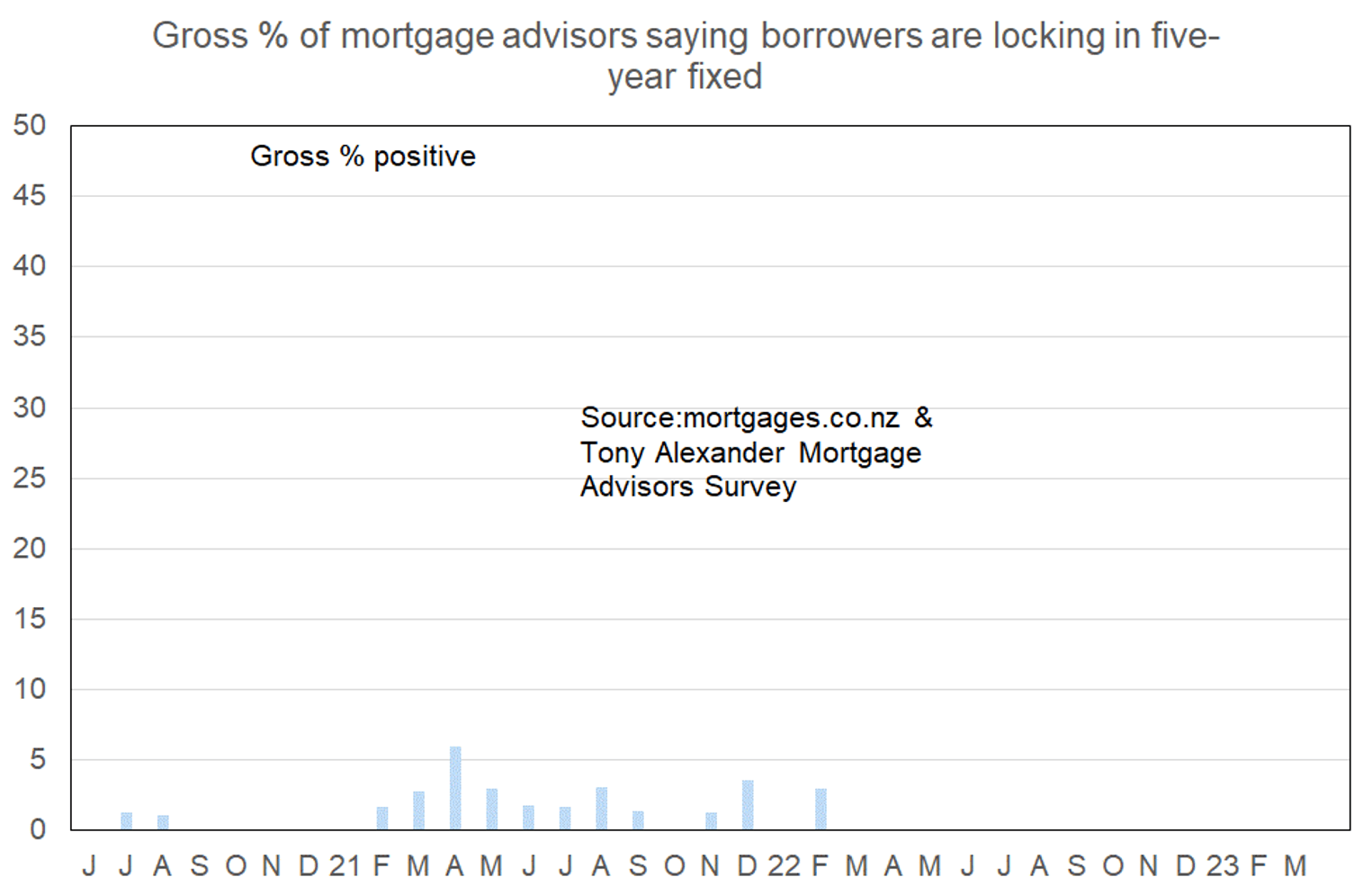

- Borrowers are evenly split between favouring the one and two year fixed rates.

- Brokers are discontented with the unadvertised and selective nature of recent specials offered by banks. Borrowers are also resentment if they have not been made aware of the specials.

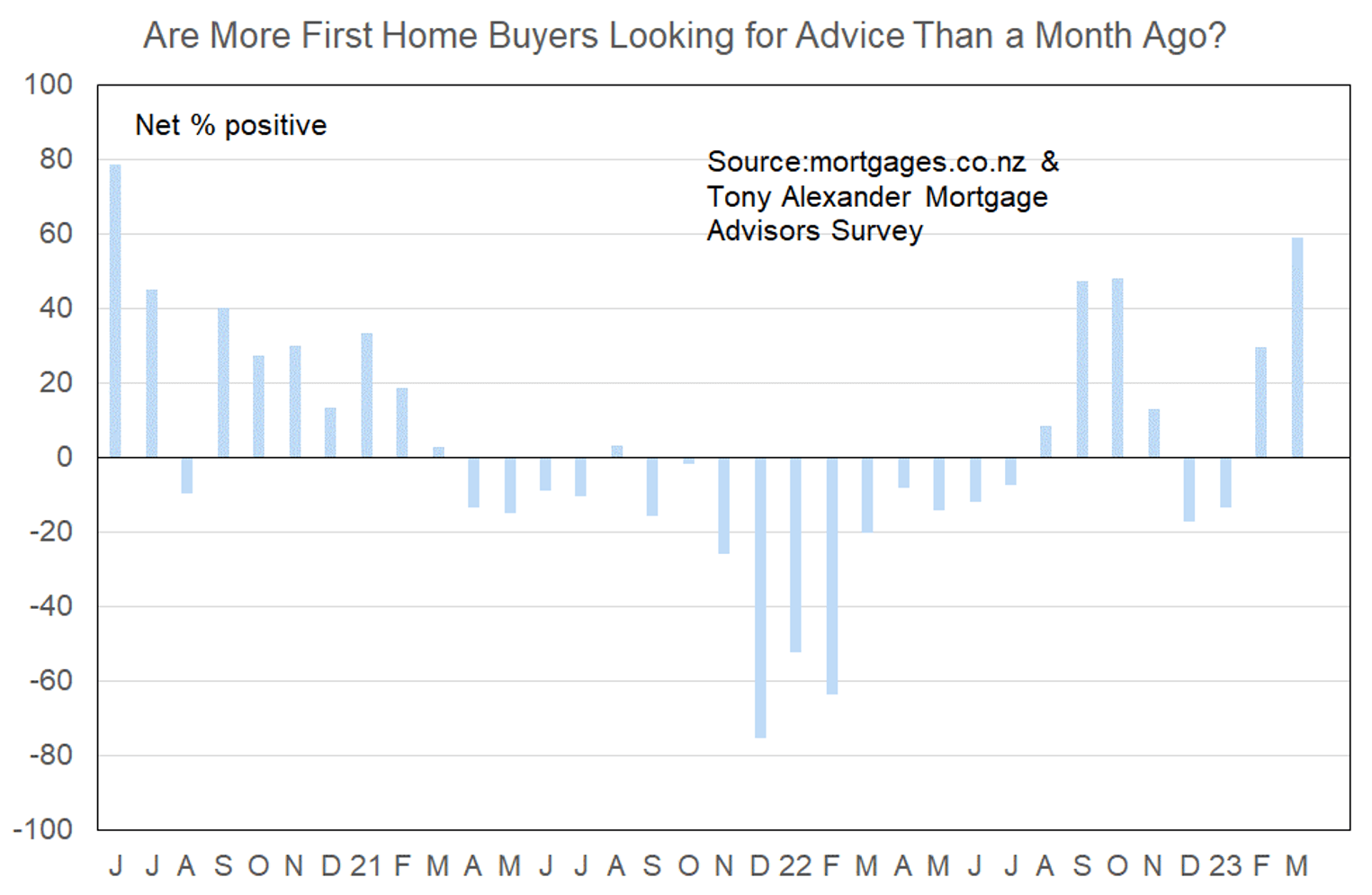

- First home buyers are in the market but investors remain absent

More or fewer first home buyers looking for mortgage advice

Average house prices around New Zealand are still well up from levels immediately preceding the pandemic. However a wages measure relevant to first home buyers has risen by almost the same amount. Feedback from advisers suggests that the biggest issue young buyers face currently is not raising a deposit but meeting bank servicing requirements. In that regard it seems unlikely that many of the first home buyers will necessarily be able to make a purchase in the near future until interest rates move slightly lower.

Yet that is what has been happening recently with a round of fixed mortgage rate cuts almost two months ago and some low-rate specials recently offered by banks protecting their market share.

Comments on bank lending to first home buyers submitted by advisers include the following.

- Affordability is the biggest issue still. No change really, other than one smaller bank increasing their assessment rate slightly.

- Competition is heating up, with lenders starting to use interest rates to gain the ‘large’ loans.

- House prices are lower which has contributed to lower LVR levels and affordability for first home buyers.

- One bank offered over 80% lending, but got swamped so had to pull the opportunity, after a few days.

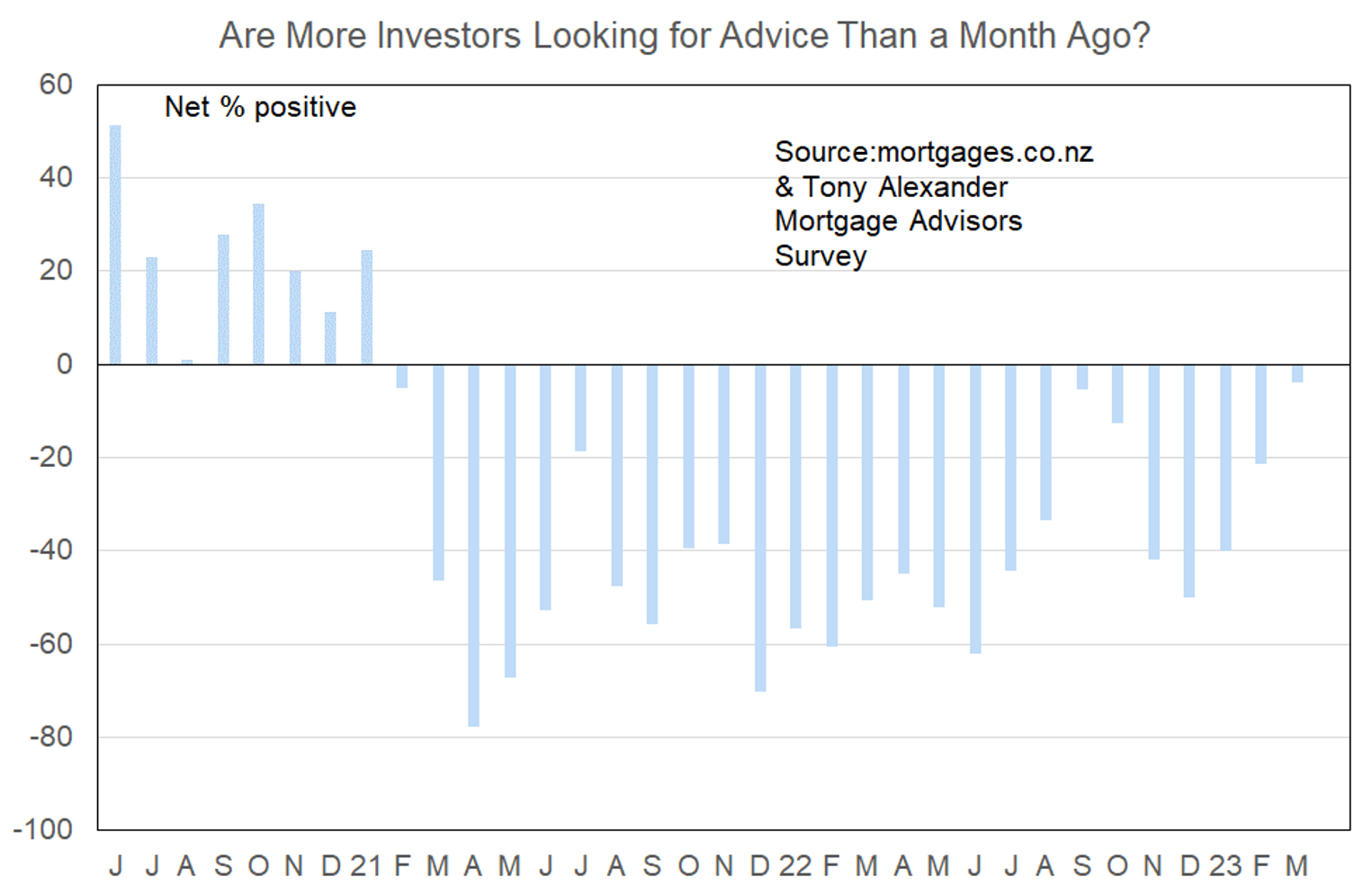

More or fewer investors looking for mortgage advice?

The net proportion of mortgage advisers saying that they are seeing fewer investors in the market has fallen to the lowest level since just before the tax changes in early-2021. At 4% the result shown in the following graph is still negative and one could not say that investors are returning. But their extended two-year period of market desertion could be reaching an end.

It is too soon to say this definitively however as one swallow does not a summer make. But I will be closely examining results for investors from my other monthly surveys to see if a similar change occurs.

Comments made by advisers regarding bank lending to investors include the following.

- We are seeing less of a tendency to question all expenses (not necessarily for investors alone), and so the response to the CCCFA seems to have softened.

- Investors aren’t interested.

- Scaling of rental income and servicing is the major issue.

- Very little change here… investors are largely waiting to see the result of the election

- Banks still 60%, nonbanks at 80%

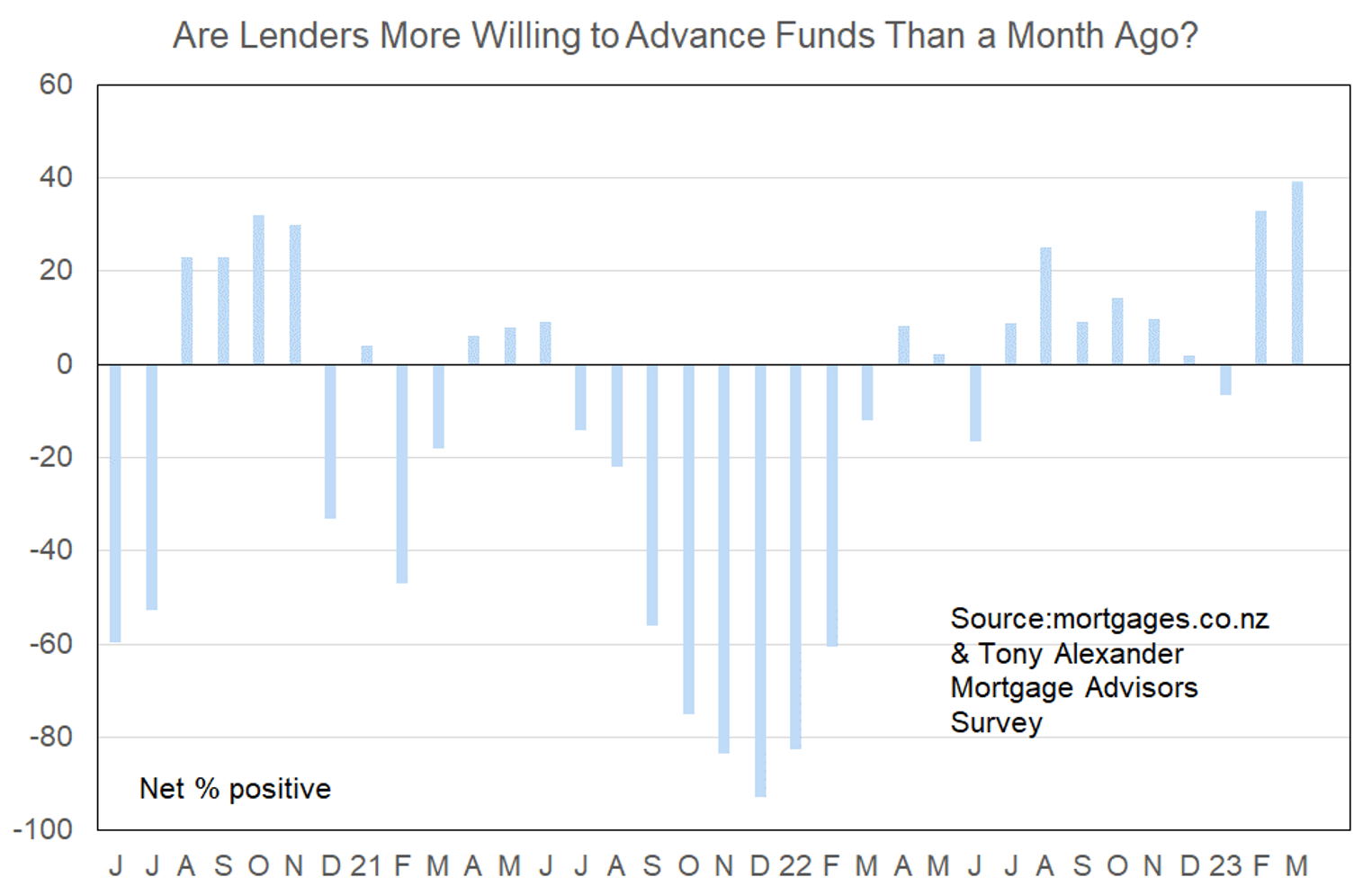

More or less lenders willing to advance funds?

What time period are most people looking at fixing their interest rate?