Conditions tough

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted a lower than usual number of responses at 42. Perhaps the sense of despair among some respondents is to blame.

The survey shows continued withdrawal of interest by investors and first home buyers, a slight lift in favour of fixing for one year, and a decline in perceptions of bank willingness to lend amidst rising test interest rates and increasing requirements for surplus monthly income.

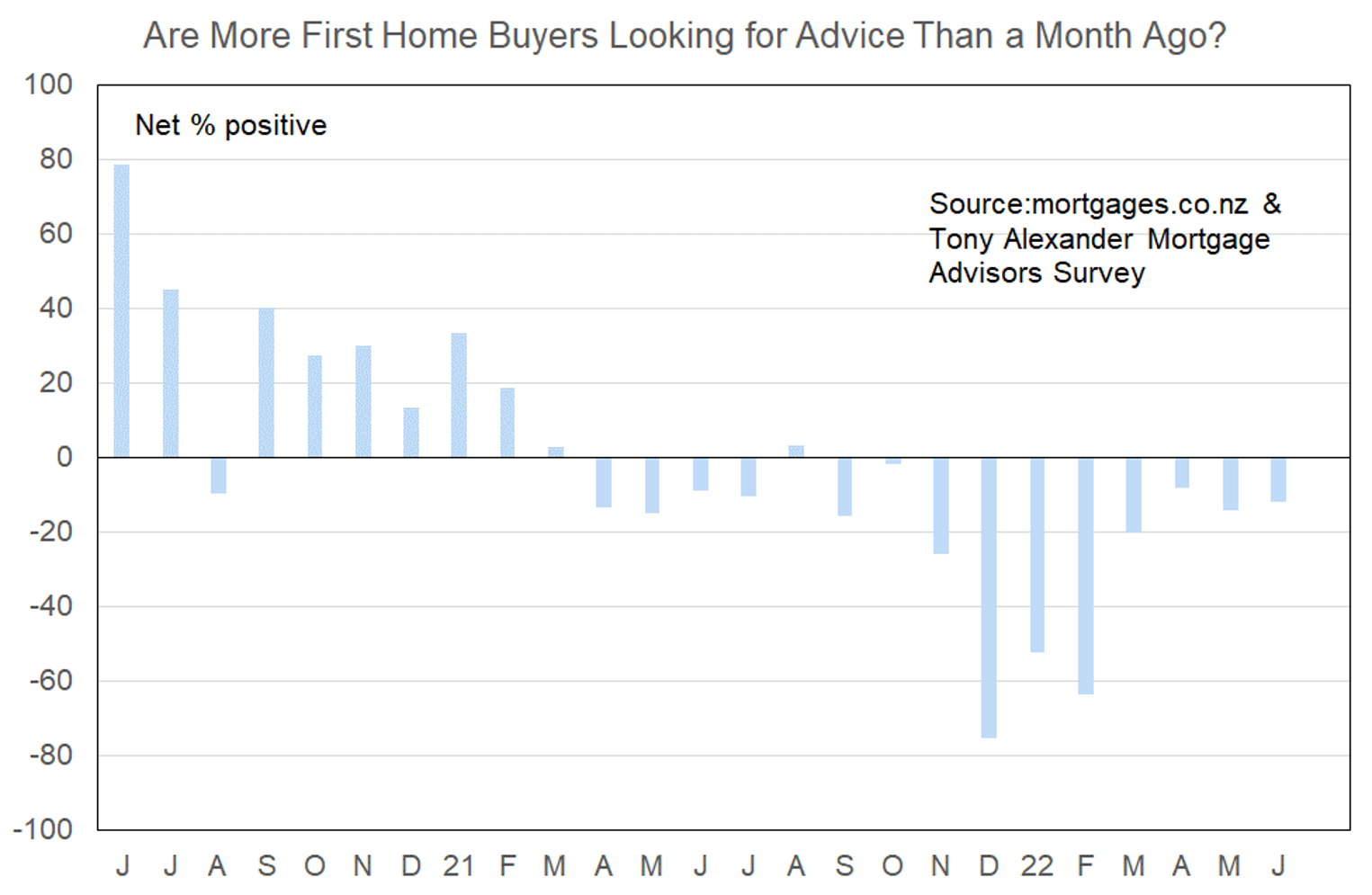

More or fewer first home buyers looking for mortgage advice

First home buyers are likely to be holding back from the market as they see a continuing string of reports about falling prices and difficulties being faced by those getting a house built.

Those stepping forward looking for finance are finding that they often cannot get it or obtain the volume of funding they are after. Banks have increased their test interest rates to around 7.6% as mortgage rates have gone up and the Reserve Bank has signalled extra monetary policy tightening is to come.

Banks have also increased their UMI – uncommitted monthly income – requirements. One major lender requires that borrowers have at least $2,000 a month not committed to any regular outgoing before they will agree to financing. This is a larger requirement than for a long time.

It is also very difficult for young buyers to now acquire a mortgage with less than a 20% deposit.

Banks want to lend, but like everyone else they are increasingly cautious about the NZ and world economic environment.

Comments on lending to first home buyers submitted by advisers include the following.

- Kainga Ora changes have helped – but buyers are hindered by income caps – its all very well to remove price caps, but the income slows most buyers down in Auckland – still near impossible for single people to buy.

- Still almost impossible for FHBs without 20% deposit to purchase an existing property.

- Increased UMI requirements and stricter review of become and expenses.

- Rules around CCCFA have had a slight easing, timing wise it makes no difference as Test rate increases have reduced borrowing capacity more than the rule changes have saved.

- Still difficult and as test rates increase, pre-approval amounts are reducing.

- Meeting debt servicing is getting harder as the test rates continue to increase. Will expect to see the living expense calculations increase as well due to cost of living increases.

- First home loan criteria/price cap increase is a huge win for first home buyers in Christchurch and Dunedin.

- Little sub-20% lending available.

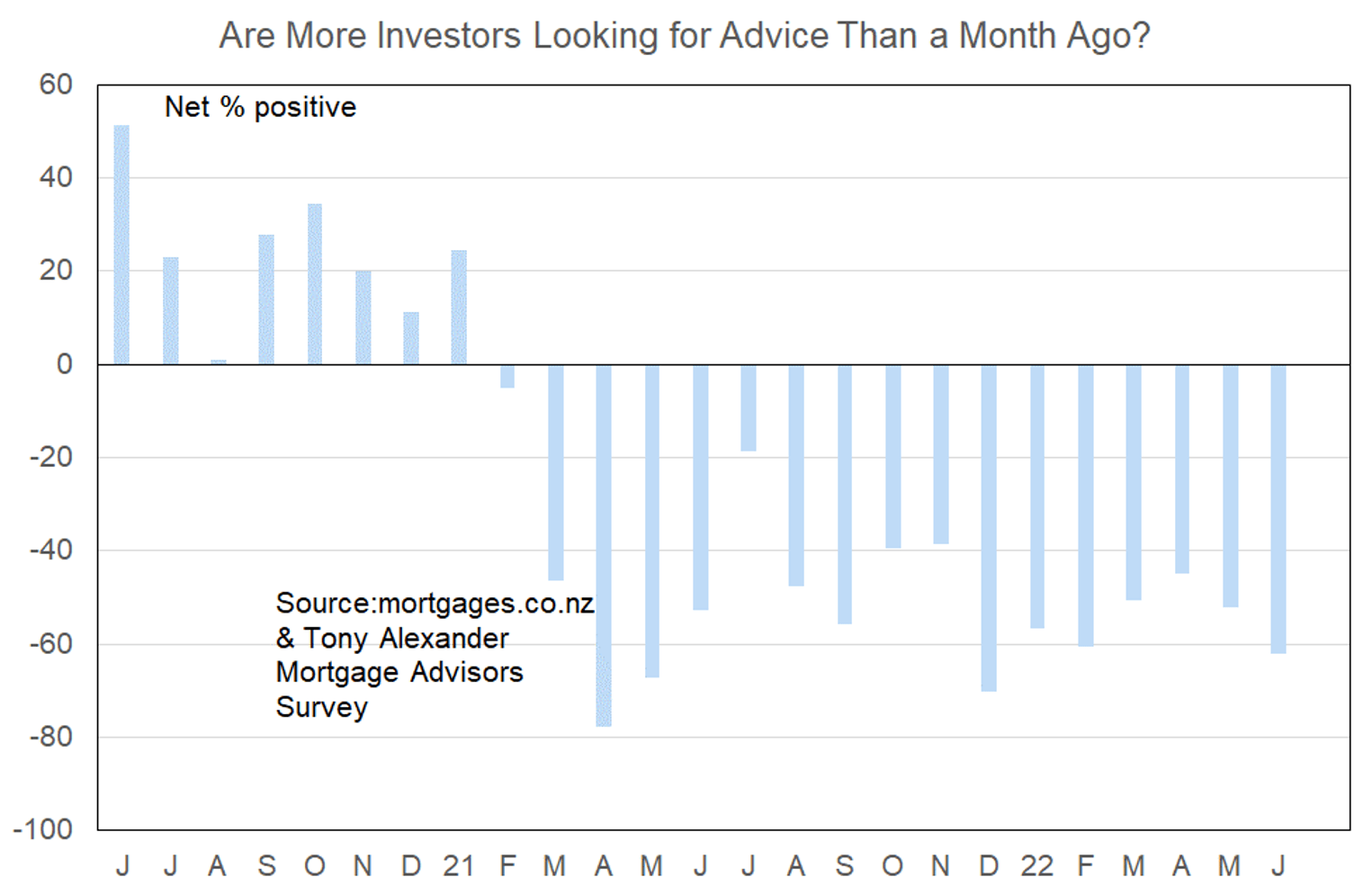

More or fewer investors looking for mortgage advice?

Comments made by advisers regarding bank lending to investors include the following.

- Significant variation in rent shading – some banks include rates and insurance as a separate cost. Others don’t.

- Getting more and more difficult to fund IP through the income that it generates with all the changes the govt has made.

- Scaling of the rental income depending on the year it was built! And now needing to add in rates and insurance.

- Loans servicing getting tighter with higher test rates.

- Investors are still limited by affordability due. To stricter rules/calculations

- With the increase in interest rates, and changes to tax rules re deductibility of interest expenses, I’ve had little new enquiry re investment property lending this year. And those that do enquire, usually don’t qualify or don’t proceed.

- The current mentality is completely different from the past 2 years, when, as property values soared, people couldn’t wait to use the newly created increased wealth in their own home, to buy more property as an investment.

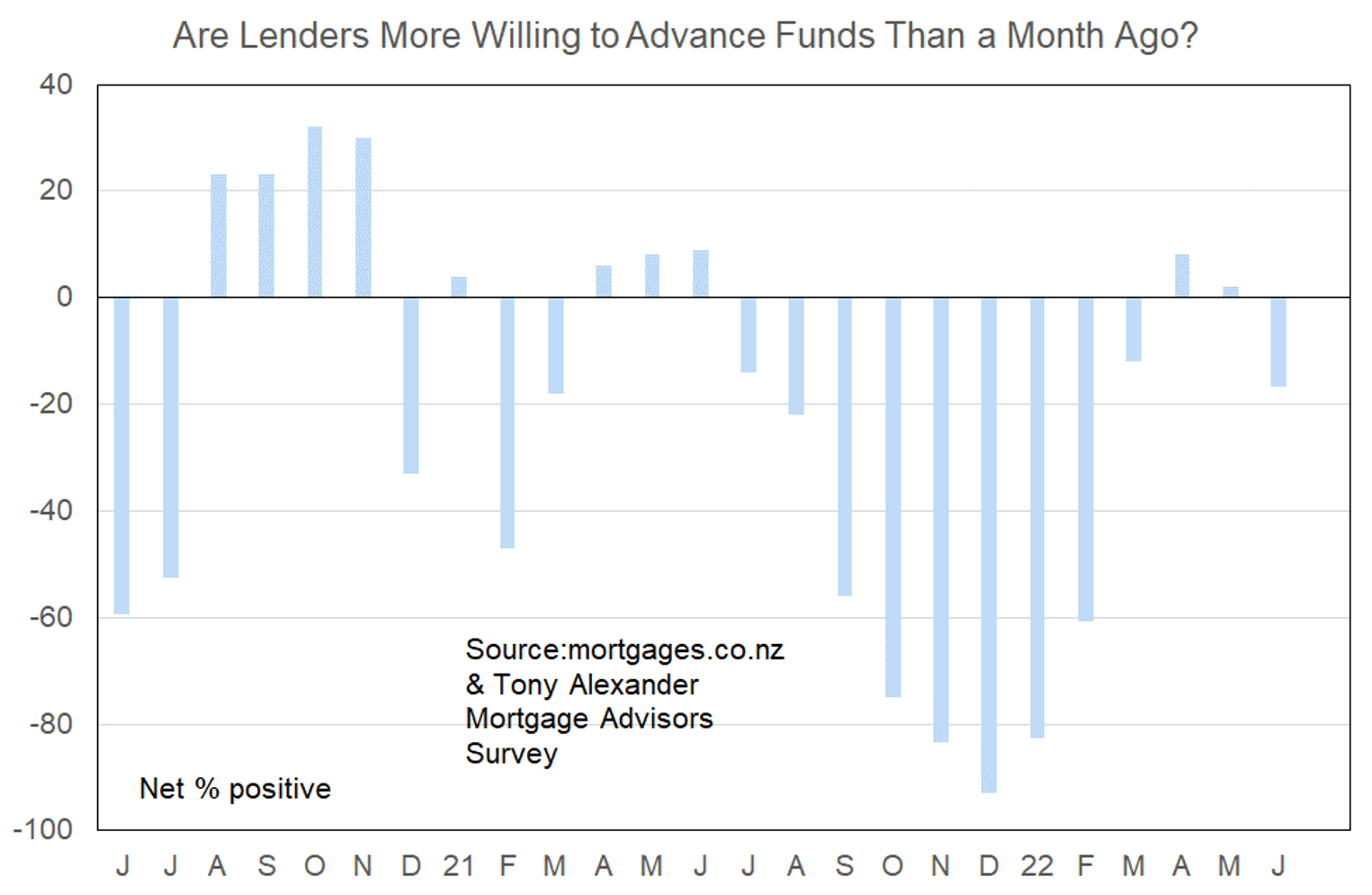

More or less lenders willing to advance funds?

In April and May net positive proportions of mortgage advisers said that banks were becoming more willing to advance funds. But this month we have reverted to a net 18% feeling that they have become less willing to lend.

Triggers for this view appear to include higher test interest rates, additional scaling back of rental income, and higher requirements for uncommitted monthly income.

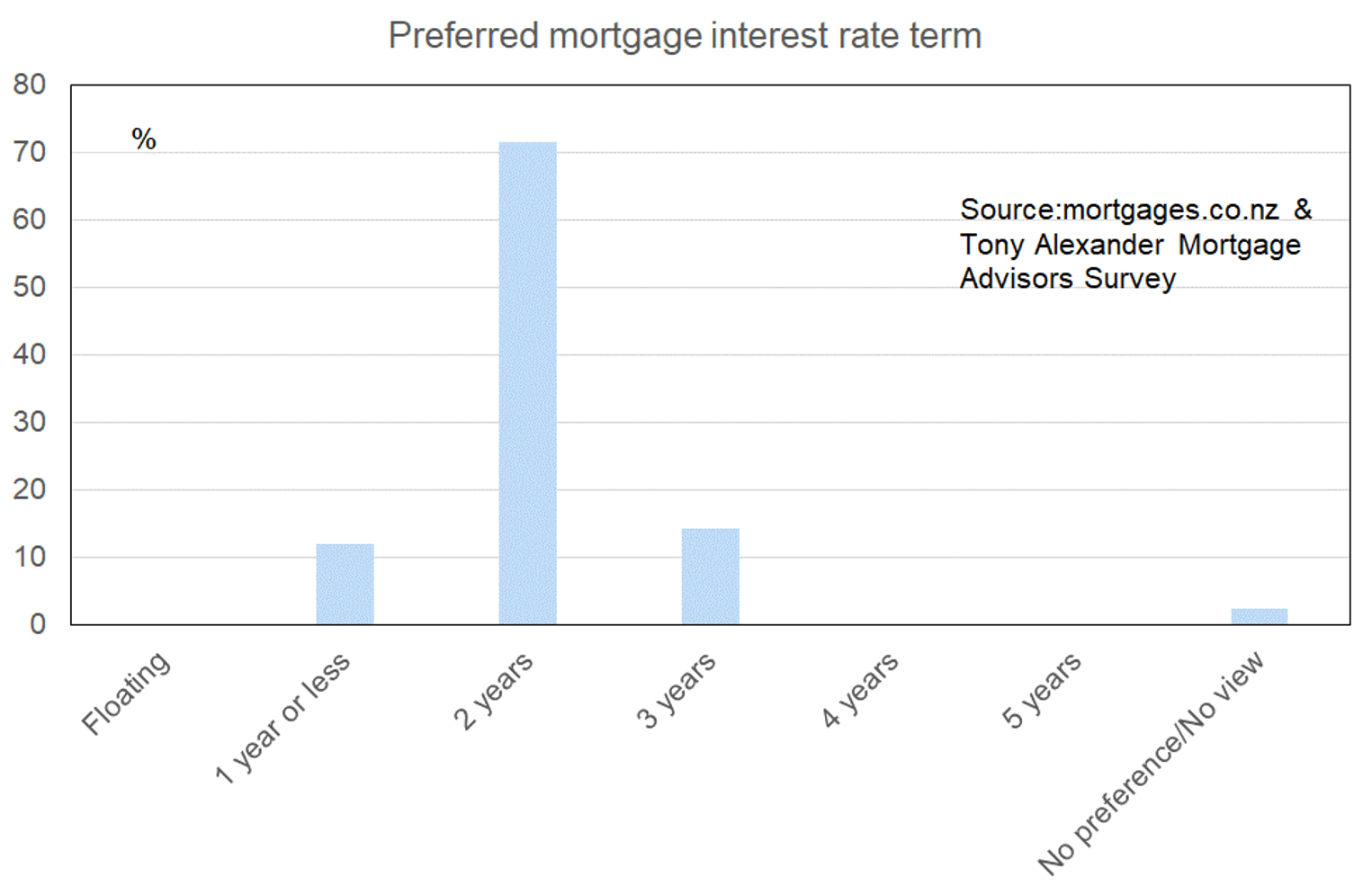

What time period are most people looking at fixing their interest rate?

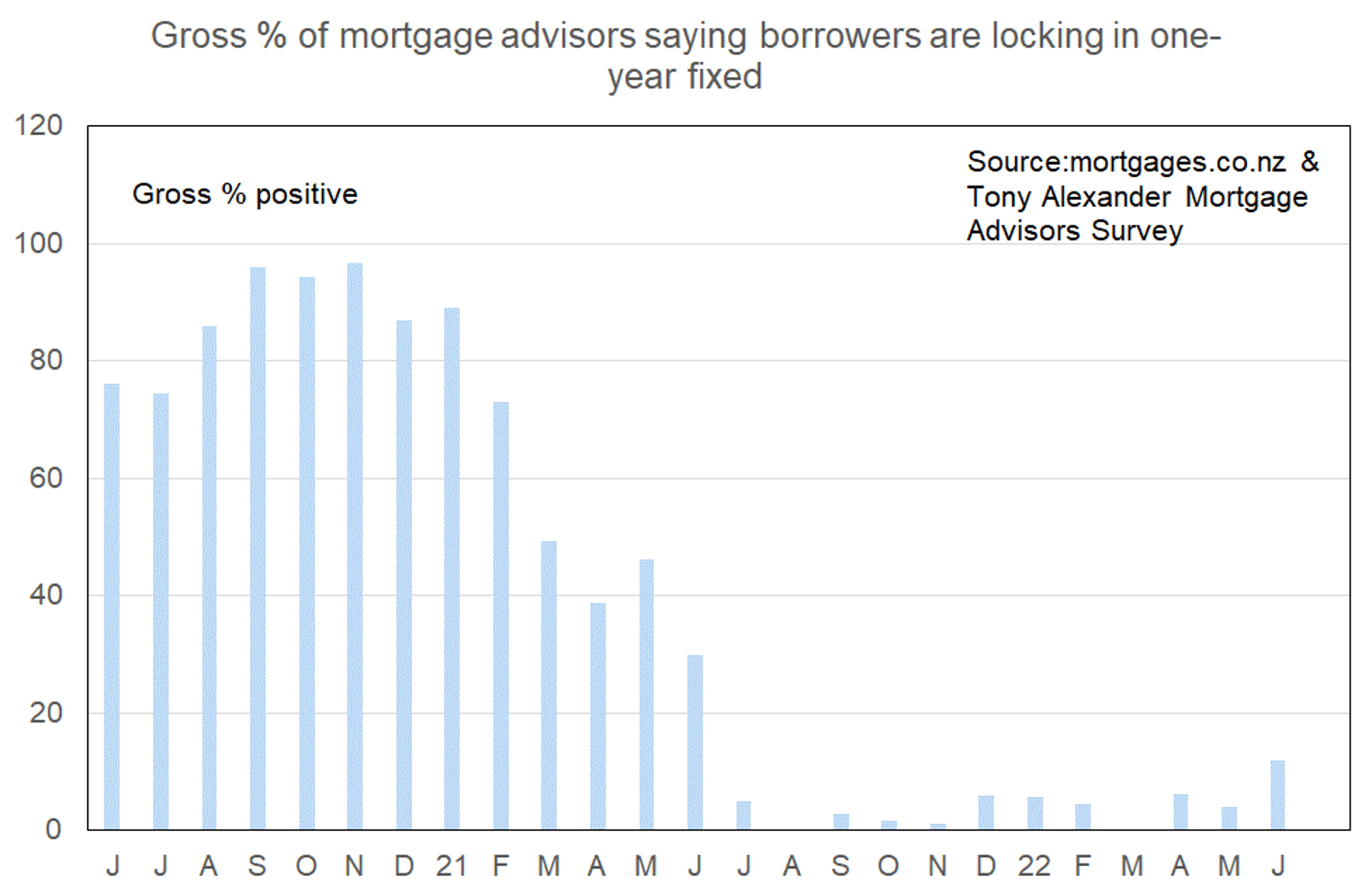

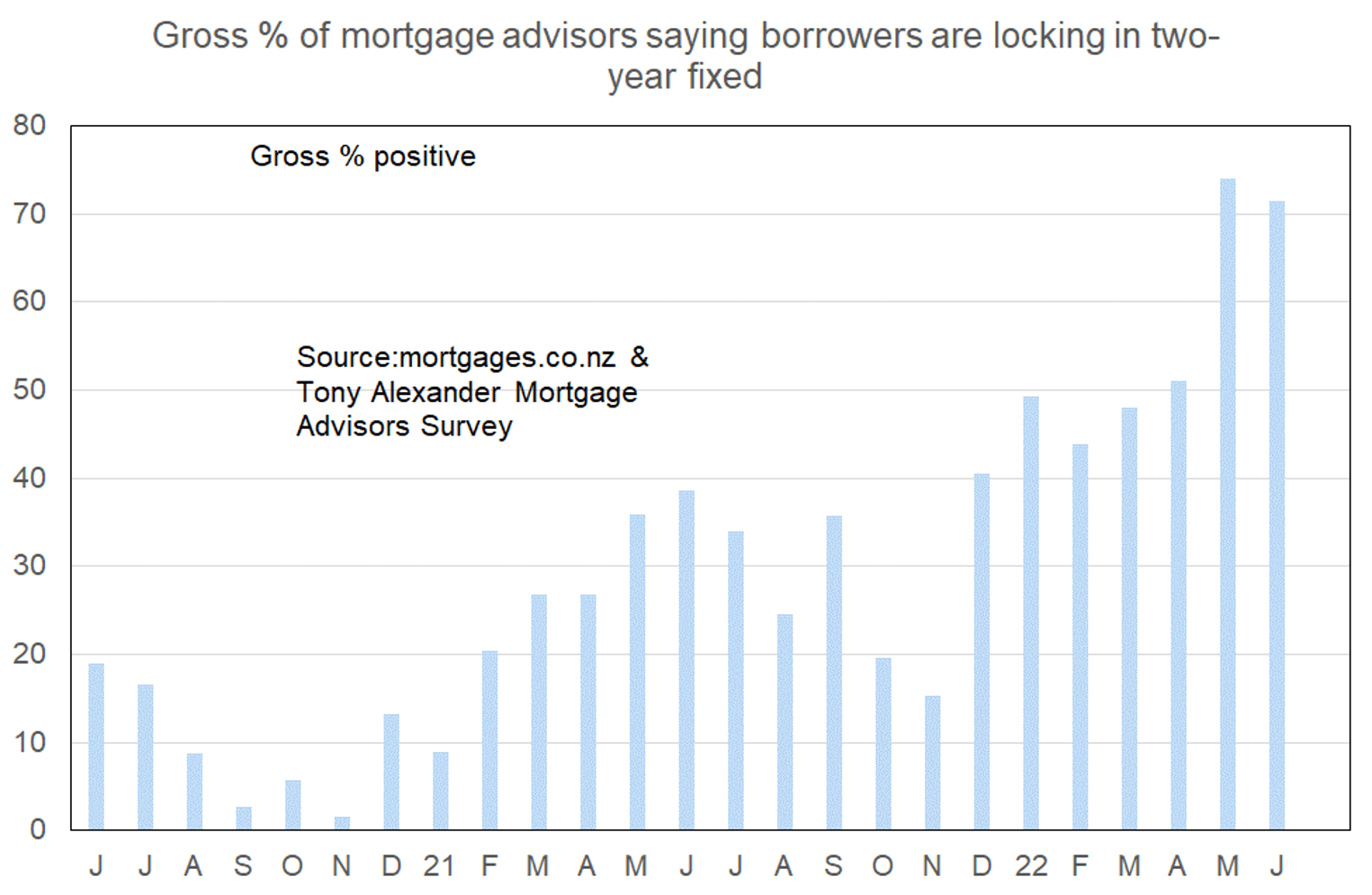

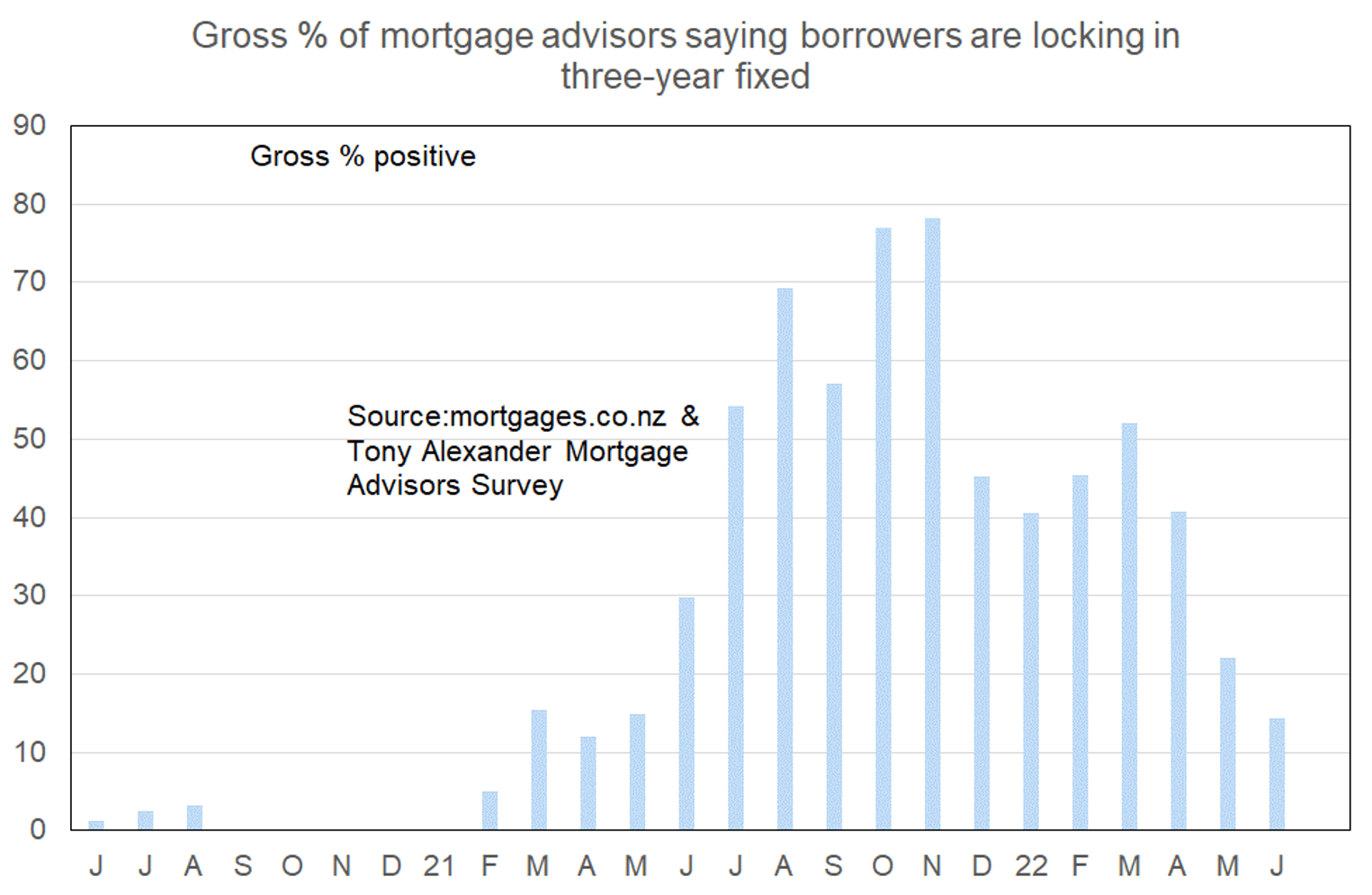

Last month we noted that having shifted from heavily preferring to fix one years out to three years, the preference had pulled back to two years. But we noted that as yet there was no sign of a shift to fixing just for one year. This month we can however see that this transition is now underway.

Whereas last month just 4% of respondents said that buyers were preferring to fix for one year, this month 12% say this is their preference.

This is still well below the 71% preferring to fix for two years and the change has mainly been in the proportion opting to fix for three years declining from 22% to 14%.

These next graphs show the shifts in term preference over the two years we have been running our mortgage adviser survey.

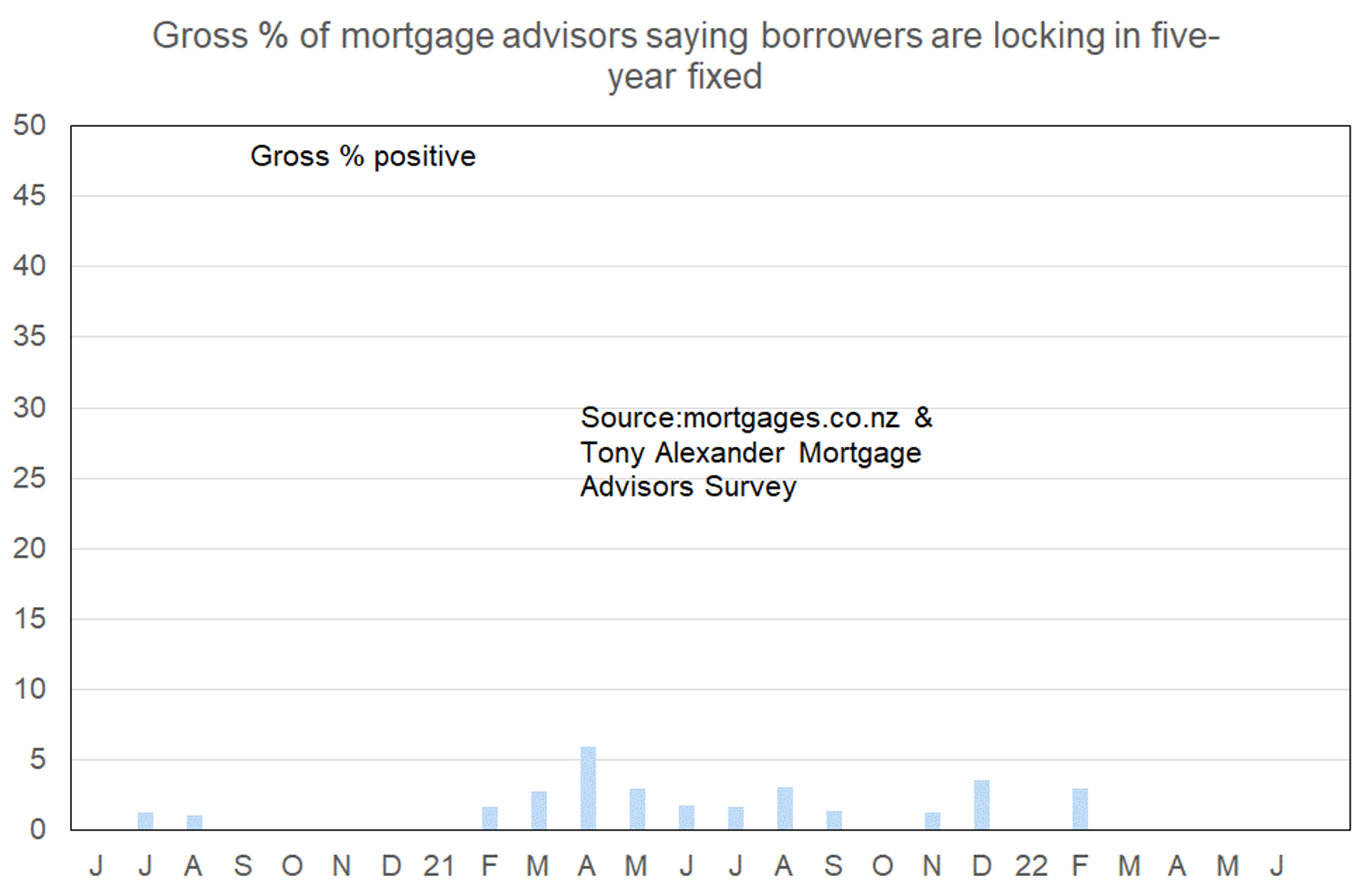

The following graph illustrates why banks in New Zealand not only do not offer 30-year fixed rate loans or 20, or 10, but rarely push even their five year rate with discounted deals. Kiwis hardly ever fix longer than three years.