Going shopping for a home – either your first or your next – is always an exciting time. The secret to making it a positive experience is having a realistic picture of how much you can afford to pay, so that you can view properties that fall within your budget. To get the clearest view of your financial ballpark, you need to know how much you could borrow from a bank.

The amount you might be able to borrow to buy a house in New Zealand typically depends on three things:

- How much you have for a deposit

- How much you can afford for regular fortnightly or monthly mortgage repayments

- What the house you want to buy is worth

Get a look at the magic number right now

The easiest way to find out exactly how much a bank will lend you is to ask. In the meantime, our mortgage borrowing power calculator provides a quick way to get a reasonable idea of what you could afford. But first, here’s some more background on what’s involved and a preview of how our calculator can instantly help.

Getting a deposit together to buy a house

In New Zealand, most banks and home loan companies will want you to pay for at least 20% of a home’s value upfront. It’s called a deposit and it provides the lender with some protection in case house prices fall. It also shows the lender that you can manage money well enough to save a sizeable sum.

Does all of a house deposit have to come from your savings?

What can go into a deposit?

Lenders don’t normally expect you to have saved the entire amount yourself, so getting a helping hand from the ‘bank of mum and dad’ is usually OK. It’s also OK if you have received a lump sum, such as an inheritance.

If it’s your first home and you’ve been in KiwiSaver for at least three years, you may be able to withdraw all but $1,000 of your fund for a house deposit. You might also qualify for a first home grant of $5,000 for an existing property or $10,000 for a new build.

Getting a loan to increase your deposit is not normally acceptable. It would also reduce the regular repayments you could afford. And no matter how you put a deposit together, the lender will still want to be sure you can afford the regular mortgage repayments.

How much can you borrow based on your deposit?

If your deposit is 20% of the house’s value then the loan could be up to 80%, provided you can afford the regular mortgage repayments. That means your mortgage could be up to four times your deposit. So a deposit of $100,000 would mean you’re eligible for a mortgage of $400,000 to buy a home worth $500,000.

Borrowing more than 80% of a home’s value

If you’re going to live in the property, it’s sometimes possible to borrow up to 95% of a property’s value, which means you would only need a 5% deposit. Obviously there is more risk involved, particularly if house prices fall. The lender will usually charge you a higher interest rate to cover the added risk. This would typically continue until the amount you owe becomes less than 80% of the property’s value, because you have repaid some of what you owe and/or the property has increased in value.

Understanding your disposable income

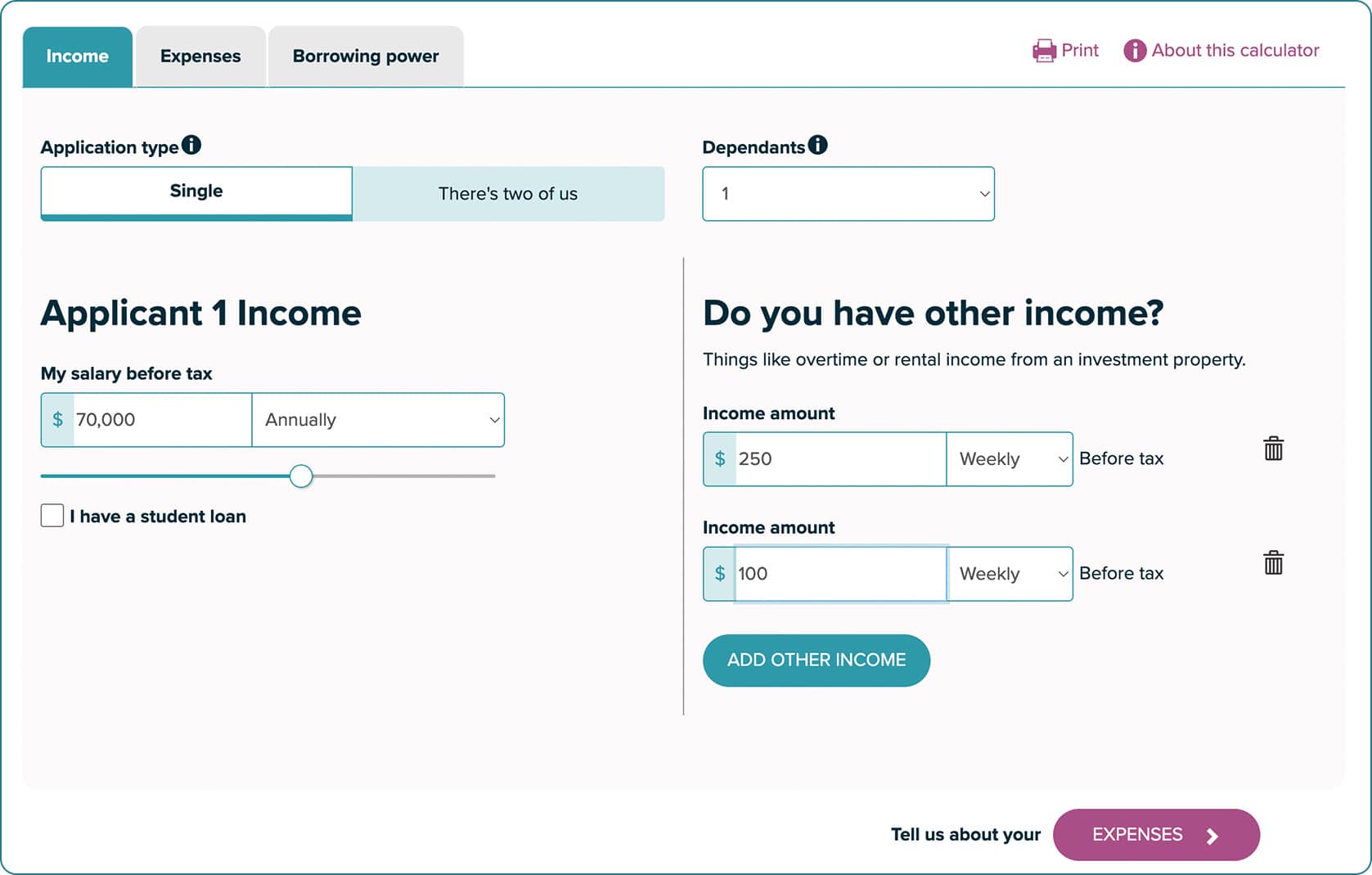

Entering your income

If two of you are applying together, click the tab that says ‘there’s two of us’. Otherwise leave it on ‘single’ applicant.

- Enter your salary. To make this easy you can choose an annual, monthly, fortnightly or weekly period.

- Select how many dependants you have – children under 18 years.

- Enter your total income from other sources. You can enter it in either the before tax or after tax row, or some in each if that’s easier. Again, you simply choose the most convenient period from annually to weekly.

- Click the expenses button for the next section.

The example below shows a person applying for a home loan on their own. Their annual salary is $70,000 before tax and they have one dependent child. They also earn $250 a week before tax working from home some evenings and $100 a week before tax looking after the child of a friend who works late some days.

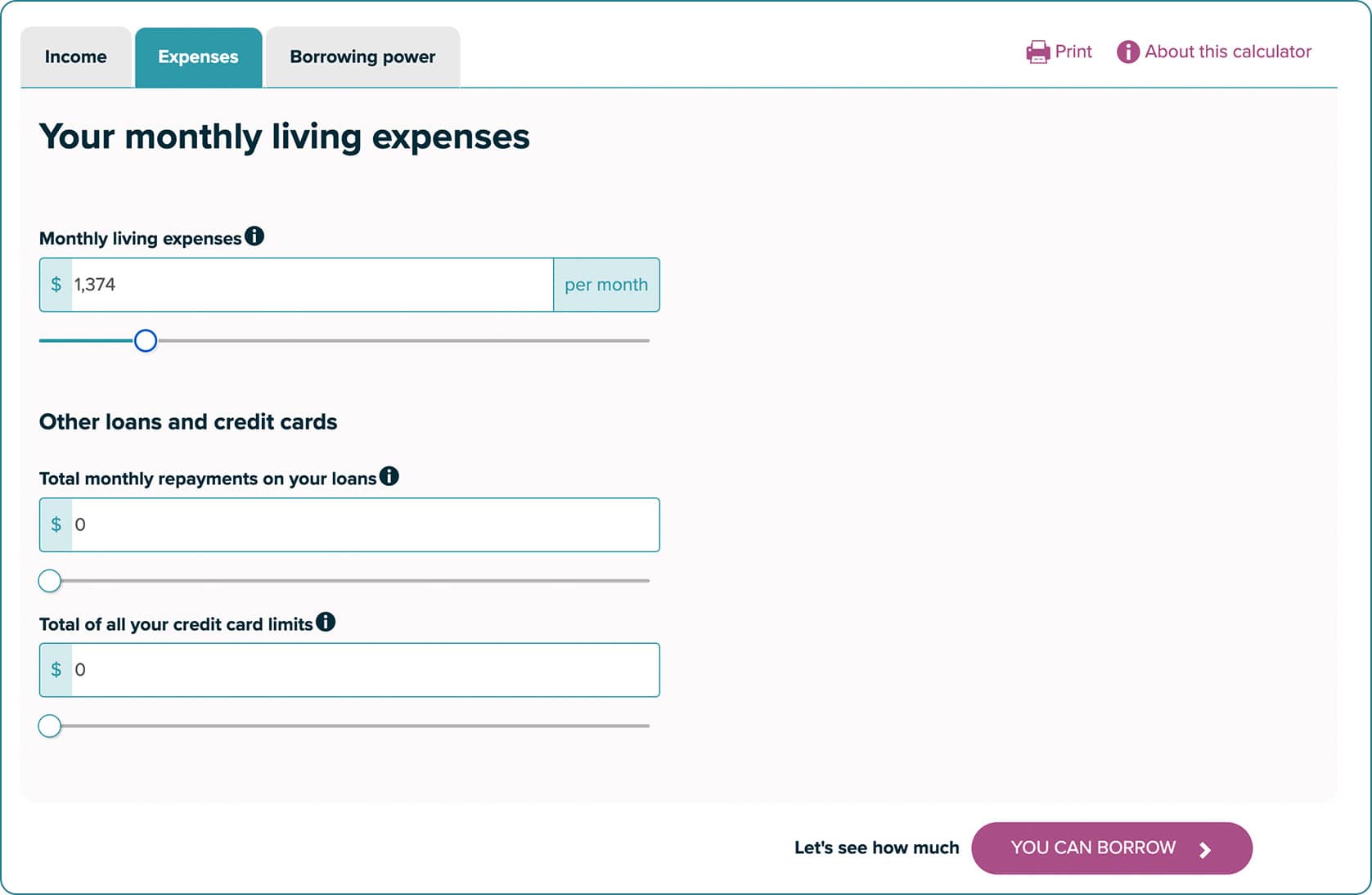

Entering your expenses

When working out your expenses, be careful to keep things real. There’s no point pretending you spend less than you do, or promising yourself you’ll cut back to what might be an unrealistic level. The last thing you want is the stress of surviving without essentials because you over-committed to your mortgage.

If more than one person is applying, be sure to enter your combined totals.

- Enter your total monthly living expenses. Include regular treats and entertainment that might not show in your bank statements because you pay with cash.

- Enter the total of all your credit card limits. Not the current balances, but the maximum you’re allowed to owe on them.

- Click the ‘you can borrow button’ for the next section.

Top Tip - working out your income and expenses

Our budget planner calculator makes it easy to enter your sources of income and regular expenses, each over a selectable period. It then shows them as a single total over a period you choose.

Example

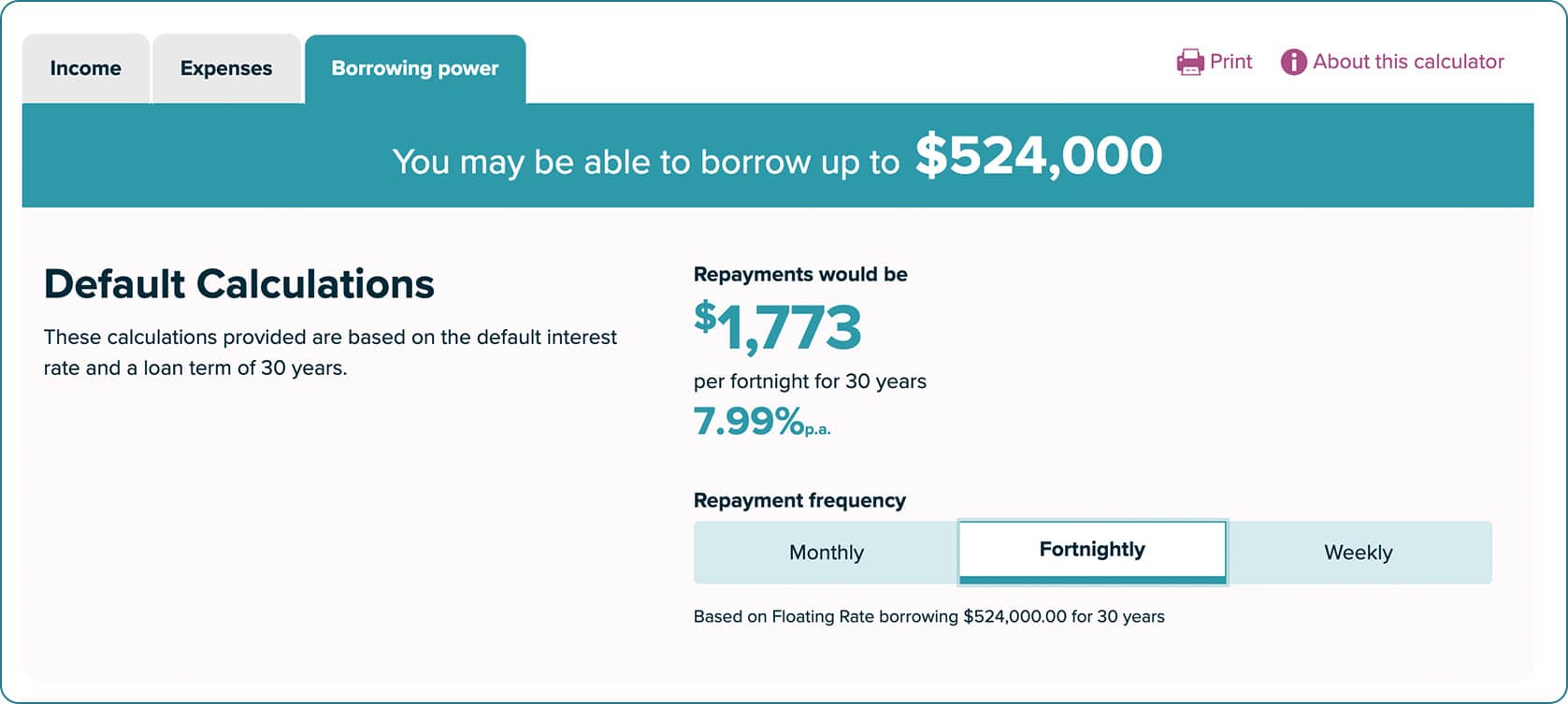

Abracadabra! See how much you could borrow

In an instant, the final section shows you how much you might be able to borrow for a mortgage.

It also shows what the regular mortgage repayments would be. This is based on an interest rate close to the current variable (floating) rates and a mortgage term of 30 years.

Our mortgage repayments calculator is also handy for seeing the effect of changing more than one of the above. For example, you could quickly check whether a longer term might mean you could afford the regular repayments on a larger mortgage.

Example

For our imaginary person above, the calculator immediately showed they may be able to borrow up to $524,000.

Selecting fortnightly repayments, to match their pay days, they also saw their regular mortgage repayments would be $1,773. The calculator based this on the variable (floating) interest rate at that time, which was 7.99%, and a mortgage term of 30 years.

Top Tip - to see what the repayments would be for different rates and terms

Our separate mortgage repayments calculator lets you enter the amount you want to borrow and quickly see how different interest rates and mortgage terms would alter the regular repayments.

Try our borrowing power calculator now

Whether you’re ready for an accurate estimate or just want to have a play to get a ball-park idea, using our borrowing power calculator is a great way to see how much you might be able to borrow for a mortgage right now. Have fun!

Borrowing Power Calculator

Size up your mortgage borrowing potential.

Borrowing Power Calculator

Size up your mortgage borrowing potential.