Why do lenders charge interest on a mortgage?

The money you borrow with a mortgage basically comes from people and organisations who deposited it with your lender. It’s not your lender’s money, it’s someone else’s. Your lender pays them interest for the use of the money.

A lender, such as a bank, needs to pay wages, shareholders and other expenses. They also need to make a profit, just like any other business. To do this, your lender charges you interest on the money you borrow through your mortgage. But they only keep a small part of it. Most of the interest you pay covers the interest the lender pays to the people whose money you borrowed. To ensure the lender makes enough to stay in business, mortgage interest rates are always higher than savings and investment interest rates at any time.

How does the Reserve Bank control interest rates?

Most of the money a lender has available to lend comes from individuals, businesses and organisations with money to deposit into an account. But banks also borrow from wholesale lenders overseas and the Reserve Bank of New Zealand.

The lender has to keep the interest rates it offers to investors attractive enough to ensure investors deposit sufficient money with them. However, interest rates are mainly influenced by what the overseas lenders might be able to get somewhere else, as well as what the Reserve Bank is charging.

The Reserve Bank’s lending rate is just above the official cash rate, or OCR. They set the OCR seven times a year to influence the rates that lenders charge borrowers and pay depositors. This helps to influence things like consumer spending and inflation. So while the Reserve Bank can affect interest rates to some extent, its only part of the story. See a Reserve Bank video about how the OCR works.

How do lenders calculate your regular mortgage interest payments?

In most cases, your lender calculates the interest charge daily, based on how much you still owe each day. When it’s time for your weekly, fortnightly or monthly mortgage payment, they simply add up all the daily interest charges since your last payment – and that’s the interest you pay.

For example, let’s say you are on a fixed rate interest only loan (i.e. no principal payments are being deducted and your balance will remain the same at the end of your loan period) and your fixed mortgage interest rate is 6% p.a. (a year) and the amount you still owe today is $500,000. They will calculate 6% of $500,000 = 500,000 x 0.06 = $30,000.

But that interest rate is for a year, so they divide the answer by the number of days in the year, which is 365 (or 366 in a leap year). That means the daily interest charged for today will be $30,000 divided by 365 days = $82.19.

Daily interest charge = (amount owing x interest rate) / days in the year

Using our mortgage repayments calculator

As you can see, working out a daily interest charge for today is relatively straight forward. But as you repay some of what you owe with each regular repayment, your daily interest charge will gradually decrease. So how can you work out the total interest you’ll pay over the life of your loan?

Our online mortgage repayments calculator makes that really easy. You just enter a set of loan details and it immediately shows your regular repayments and the total interest you’ll pay over the life of the loan. It’s a really handy tool because you can try different scenarios and immediately see the effect on your regular repayments and the total interest you’d pay.

Our mortgage repayments calculator lets you enter:

- A loan amount

- A fixed or floating interest rate

- Typical current rates provided or one you choose

- How long you want to take to repay the loan (term)

- Whether your regular repayments will repay some of what you owe or only the interest owing

- Weekly, fortnightly or monthly repayments

It also lets you instantly see the effect of:

- Making a one-off lump sum repayment in a year of your choice

- Increasing your regular repayment by any amount

Top Tip - if you already have a mortgage

If you already have a mortgage, you can still use the calculator to explore the effects of different scenarios. Just enter the amount you still owe as the loan amount and the remaining time until it is fully repaid as the term.

What affects the amount of interest you pay?

The amount of interest you pay over the life of your mortgage is affected by:

- Interest rates

- The amount you borrow

- How long you’ll take to repay the loan (the term)

- The frequency of your regular repayments

- Whether your mortgage is a principal plus interest or interest-only type

- Whether you can use money in linked accounts to offset the daily balance of your mortgage

- Any lump sum repayments you make

- Increasing your regular repayments above the required minimum

Principal and interest vs interest-only

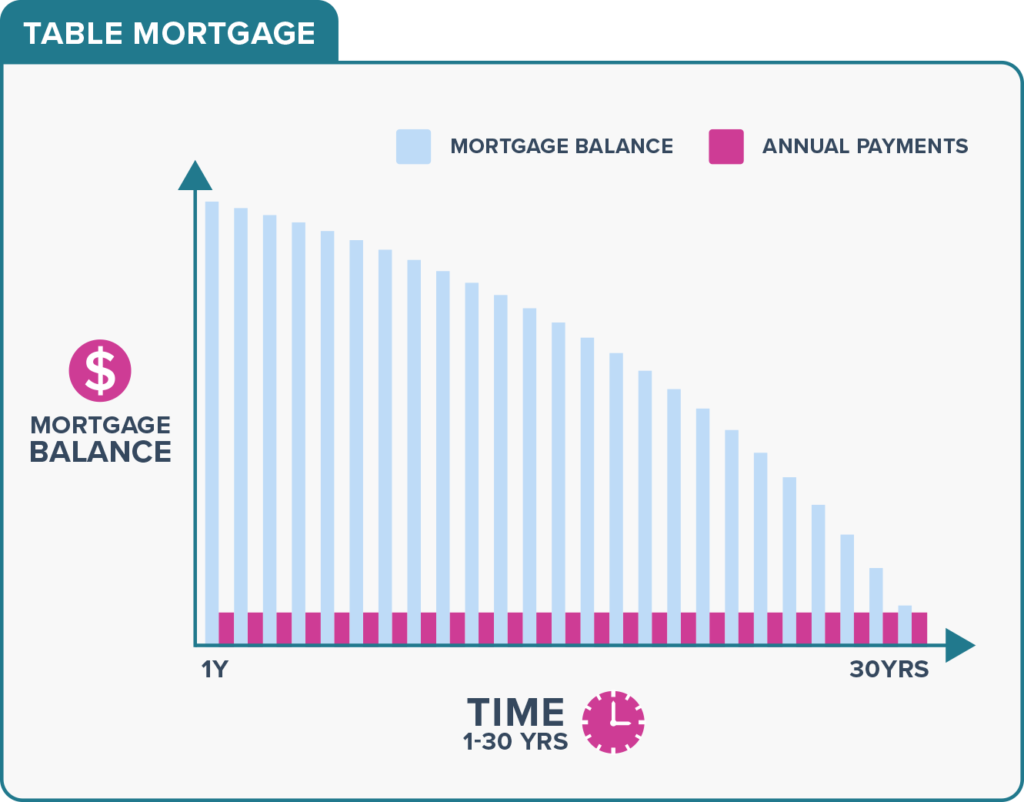

With most mortgages, your regular repayments include some of what you owe (principal) and the interest owing for that period. As you gradually repay what you owe, the interest charged each time will decrease (assuming your interest rate hasn’t changed). Usually your regular repayment remains the same (table mortgage), which means you’ll repay a little less interest and a little more principal every time. Towards the end of your term your mortgage balance decreases quite rapidly.

With an interest-only mortgage, you don’t repay any of what you owe until the end of the mortgage term, which is typically no more than five years. At that point you repay what you borrowed in full, often by taking out a principal-plus-interest mortgage. The advantage of an interest-only mortgage is lower regular repayments. The disadvantage is paying interest on the full amount every time and, at the end of the term, you start from the beginning again with a principal-plus-interest mortgage. Interest-only mortgages are mainly chosen by property developers who want to minimise their expenses while completing their project, then sell to repay what they owe.

How to save interest on your mortgage

Apart from shopping around for the lowest interest rates, the main way to save on interest is to repay your mortgage as fast as you can. For tips on the various ways to do this, see our helpful guide on how to pay off your mortgage faster.

To learn more:

- To check and compare the current interest rates, visit our mortgage rates page

- To explore different mortgage repayment options see our mortgage repayments calculator

- For tips on using our calculator see how do I calculate my mortgage repayments

- For a guide to different mortgages see types of mortgages – which one is right for you?