One of the simplest ways to see what your regular mortgage repayments would be is to use our mortgage repayments calculator. You can also use it to check the effect of increasing or decreasing your regular repayments, or making a lump sum repayment at some point during the term of your mortgage. And if you’re thinking of refinancing (moving to another lender), this calculator can help you to work out whether it’s a good idea.

But before you dive in, here’s a quick guide to the information you need to enter and the various ways the calculator could help with important decisions.

1. Mortgage calculators don’t have a crystal ball

No mortgage calculator can see into the future. When it comes to interest rates, they have to assume the selected rates will continue unchanged over time. Obviously this won’t happen, but mortgage rates seldom change very quickly, so at least you’ll get a good idea of what your regular repayments might be in the short term.

2. Changing the information changes the result

Here are the different types of information you will need to enter into our online mortgage calculator. You can change one or more of them to test out different situations.

- Loan amount – how much will you borrow?

- Loan type – variable (floating) or fixed interest rate mortgage?

- Loan term – how long do you want to take to repay the mortgage completely?

- Interest rate – the calculator will suggest a typical current rate or you can enter one

- Payment type – will your regular repayments include principal and interest, or interest only?

- Payment frequency – will your regular repayments be monthly, fortnightly or weekly?

You also have the option to enter extra repayments and see the effect they’ll have. You can choose to enter:

- A regular extra repayment amount

- A lump sum repayment and the year it will be made

What our mortgage repayments calculator shows you

When you enter a set of information, the calculator will immediately display:

- How much your regular repayments would be

- The total interest you would pay over the life of the mortgage

If you choose a fixed interest rate term (say three years), the calculator automatically switches to the current variable (floating) rate for the remainder of the mortgage term. It then shows you both of the regular repayment amounts.

Example: mortgage repayment calculation

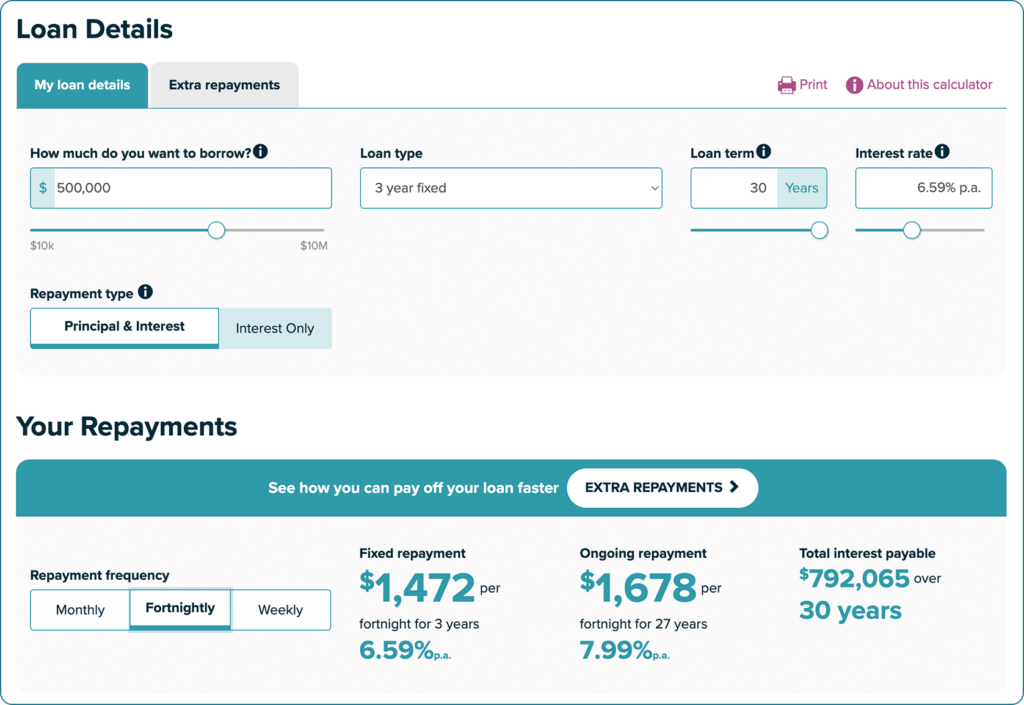

The example below shows a $500,000 mortgage with a 30-year term. An initial three-year fixed interest rate (6.59% p.a.) has been selected, as well as principal plus interest regular fortnightly repayments.

The calculator shows the regular fortnightly repayments would be $1,472 for the first three years. After that it switches to a floating rate of 7.99% for the remaining 27 years. In this example the total interest paid over the life of the 30-year mortgage would be $792,065.

Top Tip - a single interest rate for the entire mortgage term

If you want to use a particular interest rate for the life of your loan, select the variable (floating) rate then manually enter the interest rate.

3. Compare different mortgages

- Different mortgage amounts – If you want to see the effect of borrowing more or less, it’s easy. Just enter the new amount and you’ll immediately see your new regular repayment and total interest paid over the life of the loan.

- Different interest rates – The calculator lets you switch between the typical current interest rates or manually enter a rate. It immediately shows the resulting regular repayment amount and total interest paid over the life of the loan (assuming the rates stay the same, of course).

- Different mortgage terms – People often wonder what would happen if they tried to pay off their mortgage five years sooner. The calculator not only shows you the effect on your regular repayment (affordability), it also shows how much you would save on interest over the life of the mortgage.

Our mortgage repayments calculator is also handy for seeing the effect of changing more than one of the above. For example, you could quickly check whether a longer term might mean you could afford the regular repayments on a larger mortgage.

Top Tip - when you already have a mortgage

If you’re already part way through repaying a mortgage, simply enter the amount you still owe (principal owing) as the amount you want to borrow. You can also enter how many years your mortgage still has to go as the loan term. Now you can try out all sorts of scenarios and see how they might affect your regular repayments, as well as the total interest you’ll pay from now on.

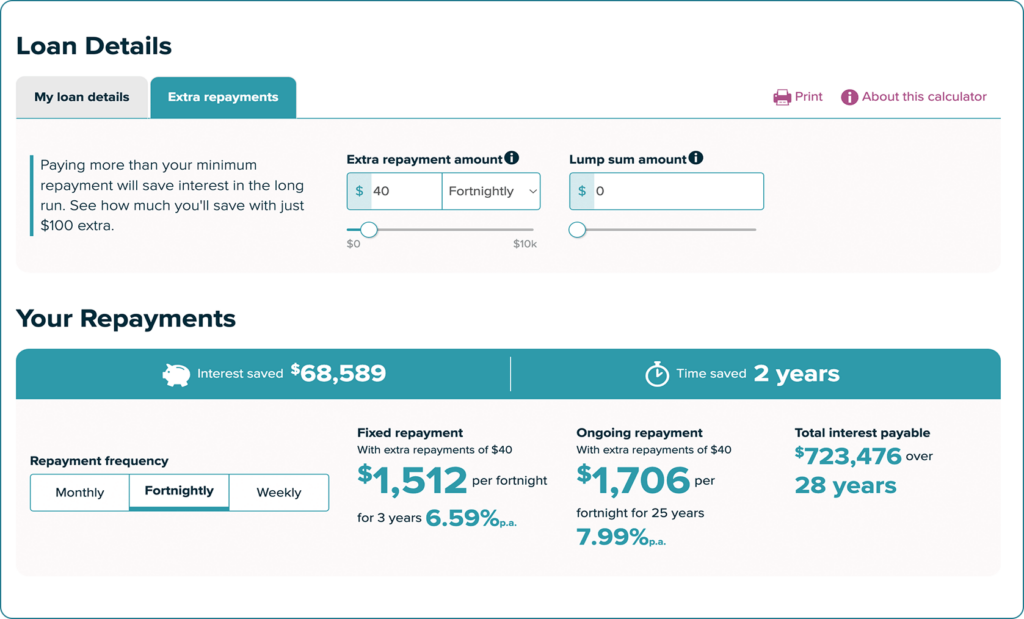

4. The benefit of increasing your regular repayment can be huge

Paying more than your minimum regular repayment not only helps you to be mortgage-free sooner, it can also save you mega-bucks in interest over the life of your mortgage. The calculator lets you see this effect straight away. It can be incredibly motivating.

Example: calculating the effect of extra repayments

Top Tip - avoiding early repayment penalties

Most fixed interest rate mortgages only let you increase your regular repayment by a small percentage or not at all. If you exceed this you may have to pay an early repayment penalty. This situation can be avoided by having some of your total borrowing in a variable interest rate mortgage. Another option is to have an offsetting mortgage and deposit the extra repayments into a linked savings account, at least until you’re comfortable you can afford to continue them. To learn more, view our guide below.

5. A lump sum repayment is a game-changer

If you have built up savings, sold an asset or inherited a significant amount, it almost always pays to use it to repay some of your mortgage rather than investing it in something like a term deposit. That’s because the interest you pay on the mortgage is almost always higher than what a term deposit earns. What’s more, investment interest is taxable.

Our mortgage calculator lets you immediately see the effect of making a lump sum repayment. You can even enter the year you expect to make it.

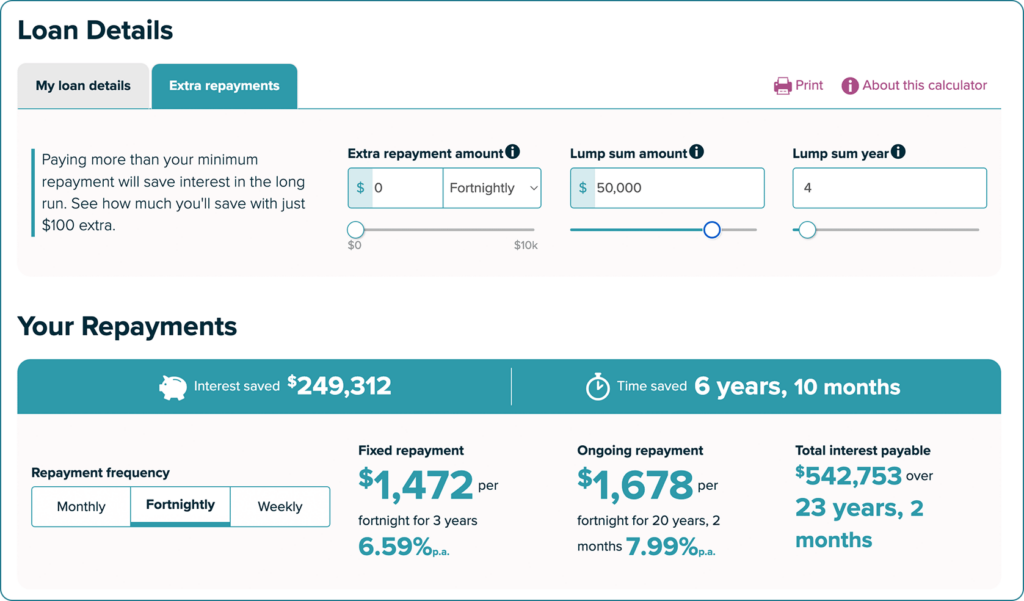

Example: calculating the effect of a lump sum repayment

This calculation uses the same loan details as the first example above. The original regular repayments have stayed the same, but this time a $50,000 lump sum repayment has been made in the fourth year, when the mortgage switched from the three-year fixed interest rate to a variable (floating) rate.

The calculator clearly shows this would save $249,312 in interest over the life of the mortgage and it would be fully repaid six years, ten months earlier.

Try the mortgage repayments calculator now

Whether you’re about to get a mortgage, keen to review an existing one or just want to learn more by having a play, now’s a great time to see what our mortgage repayments calculator can do for you.

Mortgage Repayments Calculator

The million dollar question: how much each month?

Mortgage Repayments Calculator

The million dollar question: how much each month?