When you’re thinking about buying your first home or moving up to your next home, it helps to get your head around the acronyms and jargon that lie ahead. If someone’s using these abbreviations without first explaining what they mean, be sure to ask. There are no silly questions when it comes to making good financial decisions. In the meantime, here’s a quick explanation of the main terms and acronyms to help you start talking like a mortgage pro.

It’s also important to get professional advice and support to help you choose the best mortgage structure for your situation and prepare a strong application. To make this easy, we have a free service that connects you with one of New Zealand’s best mortgage advisers from our handpicked panel. Their services are generally free, because they are paid by lenders.

What is LVR?

A loan-to-value ratio (LVR) describes the size of a mortgage compared to the total value of the property. It’s written as a percentage. Most standard mortgages for owner-occupiers (not investors) and existing properties (not new-builds) need to be no more than 80% of the property’s value. That means having a deposit that’s at least 20%.

It’s important to note that most lenders will use a registered valuation of the property, not the price you paid, when calculating your LVR and determining how much they’ll lend.

How to calculate your LVR

For a new purchase most lenders will refer to the price on the sale and purchase agreement when calculating the LVR. However if there’s something unique about the property or you’re borrowing over 80% of the value, they may request a registered valuation. The bank may also request a registered valuation if you are refinancing a property.

For example: If you want to buy a property that’s valued at $1 million and you have a deposit of $200,000, your mortgage will be $800,000.

Your LVR is ($800,000 ÷ $1,000,000) x 100 = 0.8 x 100 = 80%.

Why is LVR so important?

A lower LVR means less risk for a mortgage lender. If you are unable to keep up your regular mortgage repayments, as a last resort your lender might have to sell your home to recover the money owed. If your mortgage at the time is close to the property’s value, the lender might not be able to recover all of their money, particularly if house prices have fallen.

Through the Reserve Bank’s regulations, the government only allows a small percentage of each bank’s owner-occupier mortgages to have an LVR of more than 80%. If a lender approves a mortgage with a higher LVR, they will usually charge you a higher interest rate (known as LEP or low equity premium) and require you to have mortgage repayment protection insurance to cover their added risk (known as LMI or lenders’ mortgage insurance).

What is DTI?

The debt-to-income (DTI) ratio compares a borrower’s total debt with how much they earn. It’s usually reported as a simple number, not a percentage. The DTI ratio is used to measure a borrower’s ability to keep up with their regular repayments.

The Reserve Bank collects this information from New Zealand’s banks and uses it to help monitor things like risk in the banking system, housing affordability and how much general consumer spending might reduce in challenging economic times.

Other countries use loan-to-income (LTI) calculations to restrict mortgage lending. This measure looks only at the loan amount, not the person’s total debt. In Ireland, for example, a mortgage LTI cannot be more than 3.5, which means a mortgage can’t be more than 3.5 times your income. For first home buyers it’s 4.

The Reserve Bank sees DTI restrictions as a possible future addition to LVRs and other ways we control mortgage lending risk in New Zealand. Because DTI uses your entire debt, not just the new mortgage loan amount, the potential DTI limit in New Zealand might be around six, for example. If so, your total debt, including a new mortgage, might be limited to no more than six times your income. Your total debt could include other mortgages, personal and car loans, credit card limits, lay buy debt and overdraft facilities. The income value is whatever the bank uses when assessing your ability to afford a mortgage.

By October 2021, some banks had voluntarily started using a maximum DTI ratio of six, but said it would be continually monitored and reviewed. Since then the Reserve Bank has consulted on introducing DTI restrictions for all banks and has now given them until 1 April 2024 to prepare their systems and policies for DTI restrictions. The Reserve Bank has not indicated what the DTI ratio would be, nor confirmed when it might be introduced, if at all. They just want banks to be ready.

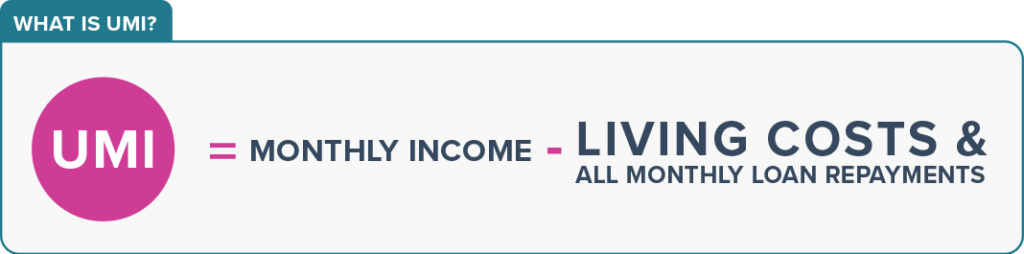

What is UMI?

Uncommitted monthly income (UMI) is a term used by mortgage lenders to describe how much income you have left over each month after paying for your living expenses and ‘fixed payments’. Fixed payments usually include the regular repayments you make for mortgages and other debts.

Your UMI provides some indication of how you might manage financially in the face of events like mortgage interest rate increases and a loss of income. It indicates the strength of your financial position.

If you’re applying for a mortgage that has a more substantial loan-to-value ratio, the lender will need to see a higher UMI before approving your loan.

What is AML?

Anti-money laundering (AML) requirements were introduced to help detect and discourage money laundering and terrorism financing. Money laundering is when money earned from illegal activity is made to look as though it came from legal sources, to help criminals cover their tracks.

The AML law means banks, lenders and other financial businesses have to take specific steps to accurately check a customer’s identity and sometimes their financial activity.

What do banks have to do for AML requirements?

All banks have to do the same checks, but they may have different ways of doing them. They all have to:

- Confirm the true identity of new customers

- Repeat this for existing customers, in some circumstances

- Keep an eye on customer transactions

- Report suspicious activity and certain transactions

What do the AML requirements mean for bank customers?

Whenever you…

- Open an account

- Apply for a loan

- Give someone else authority to operate your account

- Ask to have a large sum (from something like an investment) paid into a bank account

- Want to send or receive money from overseas

You are likely to be asked for…

- Photo ID (passport/driver licence)

- Proof of address, such as a utility bill with your name and address on it

- Confirmation of your Inland Revenue (IRD) number

- A bank statement for any account you want large sums paid into

From time to time, a bank may also want to check the AML information they have about you is still up to date.

What is a credit score?

Most people over 18 have a credit score and you’ll definitely have one if you’ve ever applied for credit. It basically indicates how good you are at managing debt and paying your bills on time. It’s a number between 0 and 1,000, and more than 500 is usually considered a good score. Most people have a score between 300 and 800.

The higher your score, the more likely you are to have loans or credit approved. A bad score can make it difficult to get a loan or you may be asked to pay a higher interest rate.

How to check your credit score

In New Zealand, three approved ‘credit reference agencies’ collect information about your credit history. It can only be seen by you and organisations that provide loans, credit, insurance or contracted services.

You can check your credit score for free, but there may be a fee if you need it urgently. Here’s a link to each agency.

- My Credit File, by Equifax, to get a free online report within 10 days

- ClearScore, a website and app providing free monthly credit reports from ilion

- Centrix for a free credit report the next working day if the ID you provide is a New Zealand driver licence or passport details, or 5 to 10 days for other types of ID

For more on credit scores and how you can improve then, see our helpful guide to buying a house with bad credit.