Interest rate falls still not imminent

In my last column two months ago I rather cheekily wrote at the start “Maybe we’ll be right this time.” I was referring to the way in which all of our expectations regarding inflation and the levels to which interest rates would go have been wrong for the past year in New Zealand and also in most other countries.

What we have learnt is that after a global pandemic when excessive stimulus was applied through loose monetary and fiscal policies, inflation is a problem. This stands in contrast to the experience after the 2008-09 Global Financial Crisis when loose policies including printing money overseas not only did not create extra inflation but might have created low inflation and then the deflation problem of 2019.

Wholesale interest rates up

Over the past two months it is not so much anything to do with the NZ economy which has pushed wholesale interest rates up by between 0.1% and 0.5%, but stronger than expected growth in the United States economy. In particular the US labour market has proved to be much stronger than expected and this has just encouraged the Federal Reserve to warn that monetary policy will need to stay tight for longer in 2024 than previously indicated.

For borrowers the news of some small extra rises in interest rates has been bad news. But there is something else underway which means it is not certain at all that our central bank will take its cash rate above the current 5.5%, or that the first rate cut won’t come until the very end of 2024.

More cutbacks in spending

In fact, even more cutbacks in spending look likely soon because the country’s weather pattern has shifted to an El Nino one which could be quite deep. This means extra wind from the West and drought conditions on the east coast of both main islands.

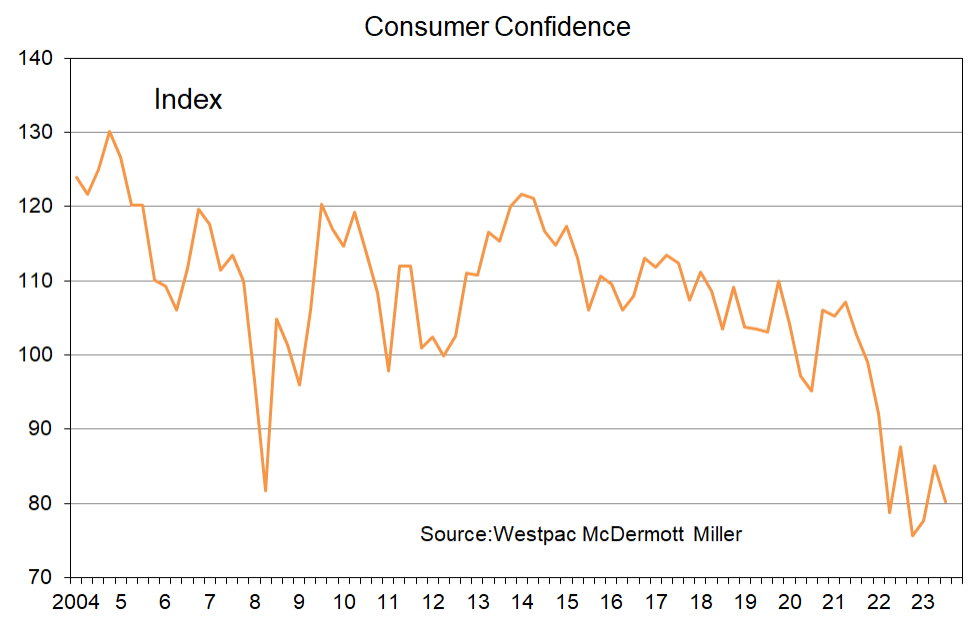

There is also weakness in our economy to come from many tens of thousands of people yet to see their fixed mortgage rates roll onto levels near 7% from 4% or lower. Also, consumer sentiment has just fallen again, and whichever party wins the general election, a tightening of fiscal policy looks highly likely.

The outlook for New Zealand’s economy is not guaranteed to be recession, not with booming immigration and tourism. But prospects for the next 12-18 months look weak and that means decreasing ability of businesses to pass cost increases easily through to their selling prices.

Will the Reserve Bank give a signal at the next cash rate review on October 4 that things are looking better or worse for inflation? Probably not. The level of uncertainty regarding how quickly inflation falls after a pandemic binge is as great now as it was two and 12 months ago.

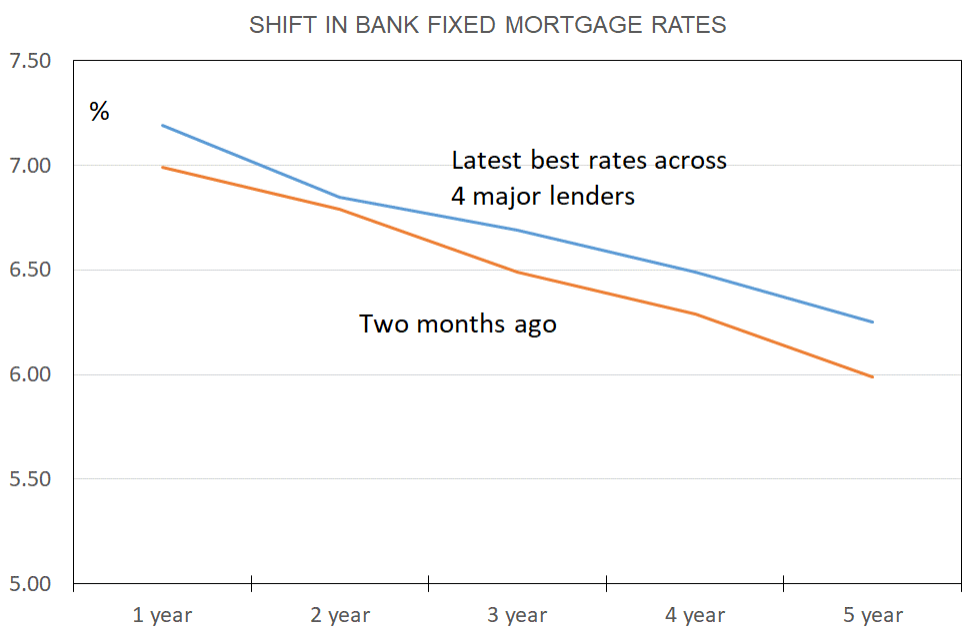

Therefore for borrowers the answer to the question of what term to fix one’s mortgage rate for remains quite difficult.

Have a mix of fixed rates

As a rule, where the likes of the five year fixed mortgage rate sits at the moment is not a position one would normally want to fix. We are at the wrong point of the cycle for that and possibly two more years away from where we were early in 2021 when I so strongly suggested that people fix for five years at 2.99%. Not that such a low rate is likely to return again until the next time we have a devastating event like the GFC or the Covid-19 pandemic.

For now, if I were borrowing, I would still feel inclined to have a mix of fixed rates running from 12 to 24 months. That way I would be able to benefit once the easing cycle starts, even if the first easing is just over a year from now as the Reserve Bank has for some months pencilled into their forecasts.

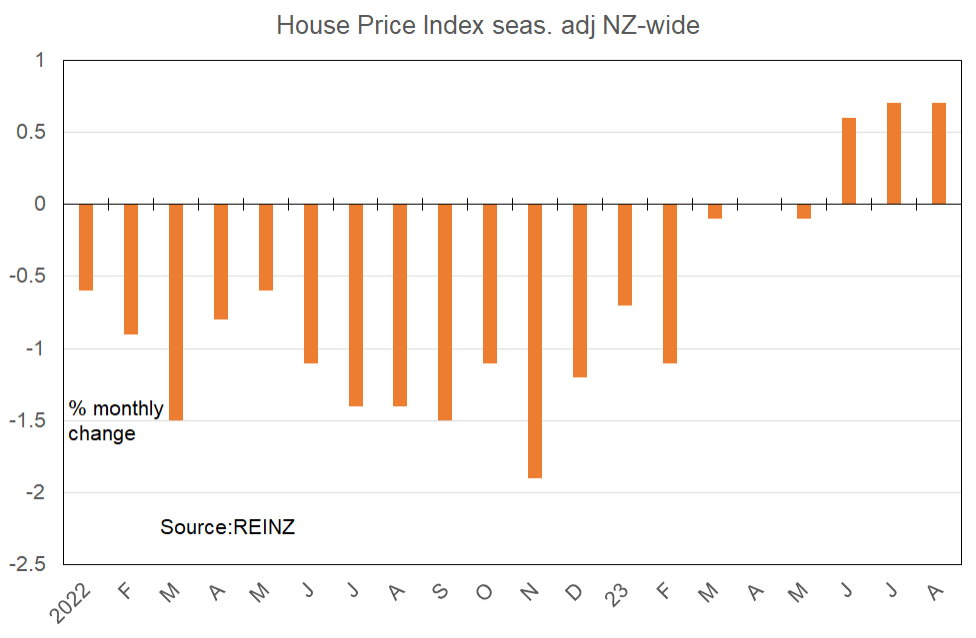

On another matter, demand for credit and discussions about interest rate fixing options for borrowers are now picking up between potential buyers, lenders, and mortgage advisers. That is because the property market is picking up and according to the nationwide House Price Index prepared by REINZ, we are now into the fourth month of the upward leg of the house price cycle. Seasonally adjusted prices have risen by near 0.7% in each of June, July, and August. Sales have risen a seasonally adjusted 8% in the past three months after rising near 20% in the three months before that ending in May. The number of days taken on average to sell a property is also about six down from a year ago.

With growing awareness of the population-boosting record level of net migration inflows, a record of price rises being established, and potential changes in tax rules after October 14, investors are starting to re-enter the property market. A boom is not in the offing by any means – not with interest rates at cyclically high levels, credit still not very easy to get for even established bank customers, and consumers still deeply wary of the economy.

But things are on the upward move and come the point in 2024 when mortgage rates do in fact start falling, some greater pace of increase in prices can reasonably be expected.