Mixing the fixing.

These are the last words I wrote in my previous column two months ago.

“For most people fixing one year will be optimal. But it would pay to recognise the huge uncertain factors in play by considering fixing some portion of one’s debt also for two years – or even longer for those of highly conservative bent.”

Thanks goodness I did because since then we have seen a much higher than expected annual inflation number for New Zealand announced in the middle of October. We have also seen

- an unexpectedly large surge in inbound tourism,

- better than anticipated net migration data,

- a lift in people’s expectations for inflation over the next couple of years,

- some extra weakness in the NZ dollar,

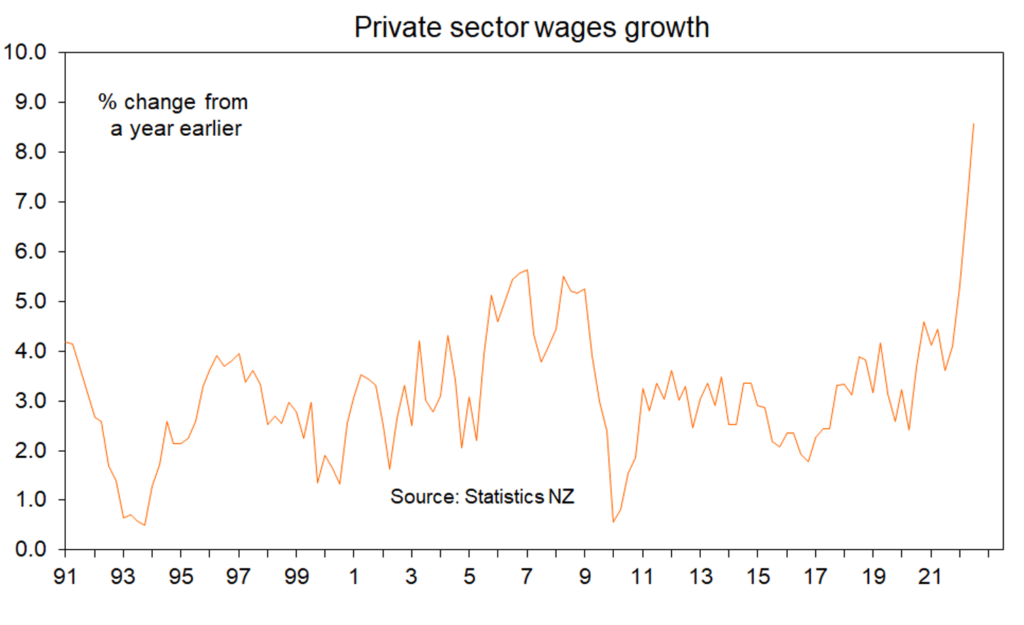

- faster than expected wages growth and stronger than expected jobs growth, and

- less weakness than expected in Kiwi household spending.

Inflationary pressures in NZ are running firmer

In other words, we have learnt that underlying inflationary pressures in New Zealand are running firmer than we were all thinking. As a result, wholesale borrowing costs which banks must pay in order to lend to you and I have increased.

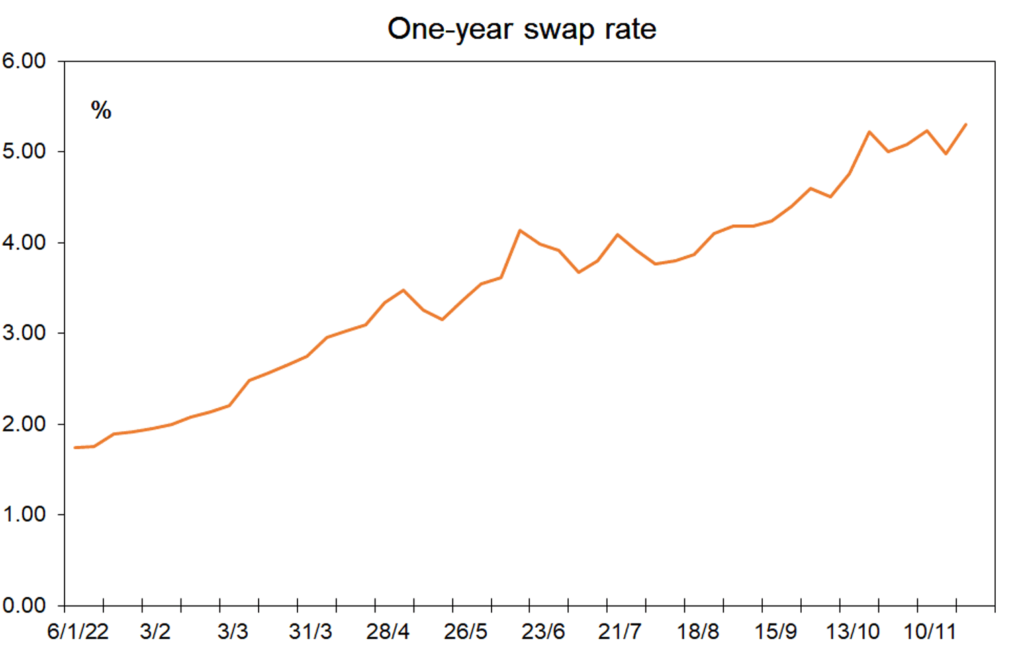

The one-year wholesale interest rate (swap rate for those of technical bent) has risen to near 5.3% from 4.6% at the end of September. The five year borrowing cost has risen to near 4.65% from 4.55%. That is obviously much less of an increase. Why?

These borrowing costs reflect market expectations for where the Reserve Bank will take monetary policy as represented by the official cash rate over the relevant 1 – 5 year periods. Expectations have grown that rates will be higher than earlier thought in the coming 1 – 2 years. But beyond that expectations are firm that inflation will be successfully lowered, and that monetary policy will be eased over 2024 if not in fact from late-2023.

The hikes in wholesale borrowing costs have fed through to fixed mortgage rates rising by about 0.5%. More rises may come, but they are likely to be relatively small. How can this be when the Reserve Bank only days ago indicated their great concern about inflation and raised the official cash rate by a record 0.75% to 4.25%? They also lifted their prediction for the peak in the rate from 4.1% in the middle of next year to 5.5%.

The last cab off the rank

The Reserve Bank in many regards was simply the last cab off the rank to officially make a statement about the worsened inflation outlook. Markets were primed for them to do so and that means when the rate change came, the actual movement in fixed borrowing costs has been quite small.

For instance, the one-year swap rate is now only slightly above where it jumped to right after the high inflation number of 7.2% was revealed in mid-October.

Having said that, just ahead of the Reserve Bank’s monetary policy change the markets were primed for a 5.1% cash rate peak, not 5.5%, therefore we have seen some extra upward pressure on interest rates with a tad more yet to come.

For borrowers the degree of uncertainty remains extreme and that is why all I can do is repeat what I wrote last month and reprinted at the start of this article. A mixture of 1-2 year fixed rates will probably be optimal for most people, but there will also be some value in fixing a portion of one’s interest rate exposure for three years for those of more conservative nature.

Scaring people into cutting their spending

Going back now to the November 24 review of monetary policy, the day wasn’t really about interest rates. Instead, the announcement finally brought us the outright threat and in fact promise from the Reserve Bank to put the NZ economy into recession in order to suppress inflationary pressures. The strong words and warnings delivered by the Reserve Bank are important and they represent the second monetary policy weapon which they have at their disposal – scaring people into cutting their spending and pricing plans.

In simple terms, the more people are scared and voluntarily curb their spending and wage/pricing plans, the less high interest rates will need to go in order to achieve the same thing. One might think that it doesn’t matter which outcome occurs because the inflation impact will be the same. However, high interest rates can hit our export sector hard by pushing up the NZ dollar. High rates also hit hardest into those who most recently have purchased a property and taken on a large mortgage.

High interest rates can also force many businesses to close down because of cash outflows needed to finance inventories.

At this stage it seems reasonable to expect that by the end of March fixed mortgage rates will have completed their increases for this cycle. But if we have already had one episode of inflationary pressures proving to be stronger than expected, we could easily have a second. And then, somewhere down the track, we will get the opposite and interest rates will fall away quite quickly.

But we should not expect a return to the ridiculously low borrowing costs of 2019 – 2021, unless that is we see the strange return of deflation worries and a new global pandemic.