Policy change to boost housing market

Rates are high and in conjunction with some rapid rises

The improvement in cash flows will come at a time of two things with regard to another big determinant of investor property demand – interest rates. Currently those rates are high and in conjunction with some rapid rises in costs for insurance, council rates, and maintenance mean that the numbers do not stack up for a lot of investors.

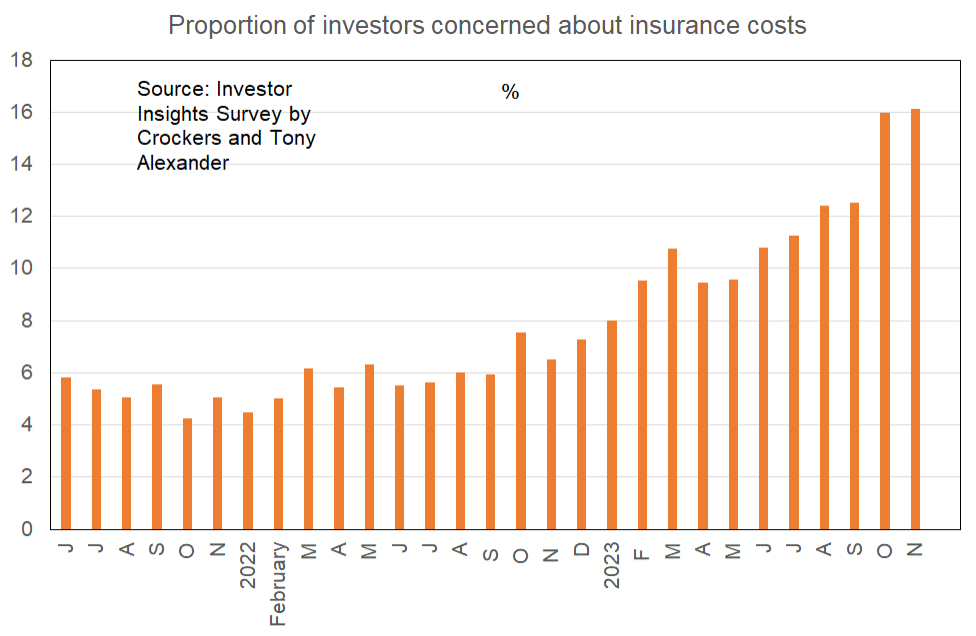

My monthly survey of residential property investors for instance shows that in recent months concerns have escalated about maintenance, insurance, and council rates.

Cuts are fairly meaningless

The result has been at least one major bank making some small reductions in its fixed interest rates. These cuts are fairly meaningless in the context of rises through all of this year. But they along with increasing general confidence about inflation falling will work towards building an expectation amongst borrowers that funding costs are headed lower through 2024 and 2025.

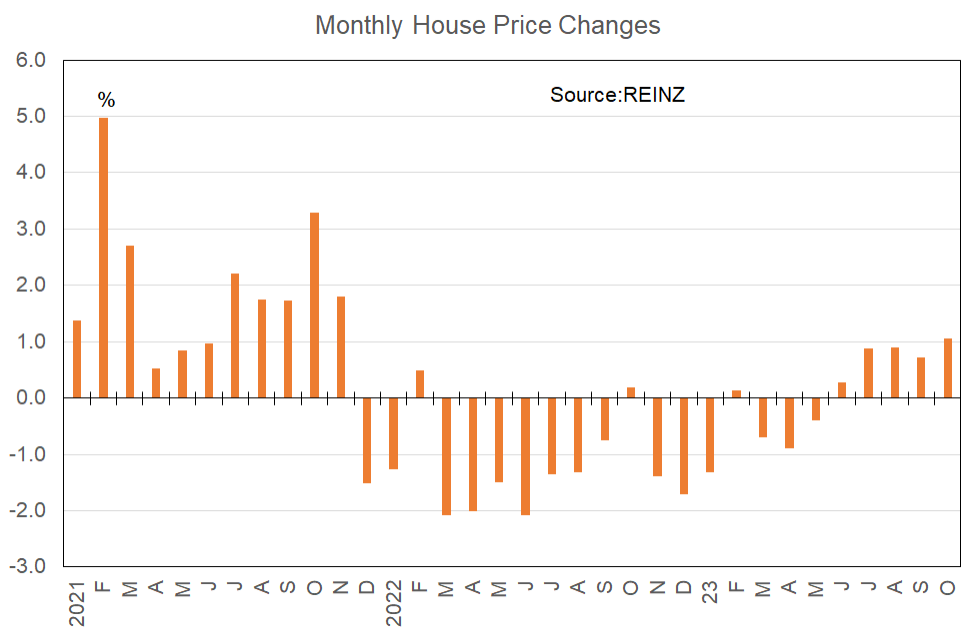

That change in interest rates expectation will act as an incentive to buy. So too will the record of price rises which is building up. Average NZ house prices bottomed out in May and since then have risen by almost 4%. Canterbury prices are ahead 4%, Wellington 4.5% and Auckland 5.4%. Momentum is developing and as participants in the financial markets will tell you “The trend is your friend.” My experience however tells me that though there may be a trend for something in place, the occasional bumps along the way can at times be large.

Will there be a rush of investors into the market?

Almost certainly not. Credit is hard to get and by the time some more momentum has developed in the first half of next year the Reserve Bank will have probably introduced its long-planned debt to income limits on lending. They expect that first home borrowers will be minimally impacted and instead the restraint will mainly fall on investors.

But overlying everything is the fact that the upward leg of the house price cycle in New Zealand tends to run for 5-6 years and November is month six of the upturn. There is a long way to go and the economic fundamentals of strong population growth, falling new house supply, falling interest rates, and less burdensome tax regime facing investors argue for prices rises at an accelerating pace through 2024 then again through 2025.

But it is not just investors we should think about when picking what may happen in the NZ housing market over the next few months. Imagine you are a first home buyer reading this and looking at the coalition agreements just signed. There are some things in the agreements which may work towards encouraging house construction over a long period of time – say a decade. But the greater impact will be encouragement of investors to return.

Competition from investors is closing

The chances are that young buyers will realise the window of opportunity for them to make a purchase with good selection on offer, low prices, and little competition from investors is closing and closing more rapidly than they may have been thinking.

The upshot is that through Summer while many investors run their numbers many young buyers will look to secure their first property purchase.

On a month to month basis the change in prices which these forces will produce is anyone’s guess. But as noted above, the bit to focus on is the trend and that trend is now upward.

Would I still feel inclined to fix for just a short period of time?

If I were buying or borrowing anew at the moment, would I still feel inclined to fix for just a short period of time of 12 to 18 months or maybe 24 months? Yes, personally speaking. The improving outlook for inflation including a tightening of fiscal policy by the new government means the Reserve Bank is likely to cut interest rates through 2024. We can’t know when the first cut will come. But falling rates mean locking in at one of the long time periods is generally not what one would want to do at this point in the rates cycle.

In fact very few people have been fixing their interest rate for longer than two years through at least the past year. There has been movement at the margin between preferring a mix of 12/18 months and 18/24 months. If I were borrowing at the moment my inclination would be a mix of 12 and 18 months. Having said that, with the best guess for most of us being interest rates bottoming out in maybe three years (a total guess really), even fixing two years is not something to ignore completely. Three years? Maybe, but I’d probably not.