What are the extra costs involved when buying a house?

One way to reduce some of the stress of finding and owning your first home, or moving up to your next home, is to plan ahead for the extra costs involved. That way there’ll be less chance of nasty surprises that blow your budget and ruin the fun. Everyone has their eye on mortgage repayments, […]

How much income should go to my mortgage?

Whether you’re a first home buyer, looking for your next place or building a home, one of the most important rules is to know what you can realistically afford. And what you can afford isn’t the same as what you could pay if you really squeeze every last drop out of your income. It means […]

What is a mortgage cashback?

For some years now, New Zealand’s main banks and other mortgage lenders have been known to offer a cashback reward to eligible customers when they draw down (start) a new mortgage. It’s typically a lump sum cash payment of $1,000 to $3,000 – or even significantly more, depending on how much you’re borrowing. In this […]

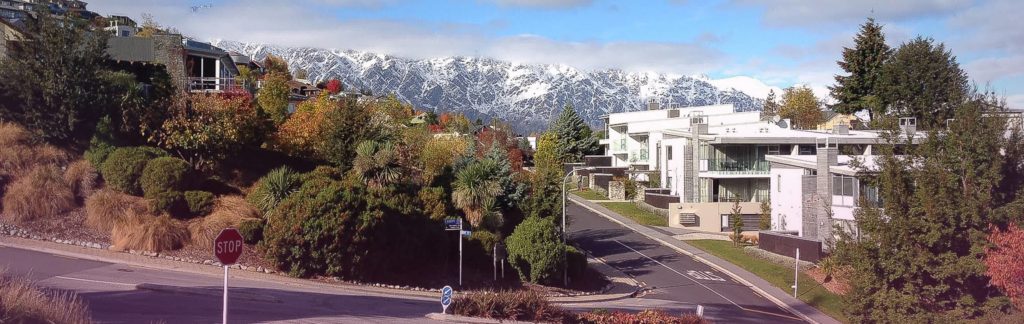

A guide to consider – is it better to rent or buy a home?

Owning your own home, or intending to, has been a New Zealand tradition for generations. But that doesn’t mean it’s still the best option for you today. People used to smoke on aircraft, we were once encouraged to save a tree by using plastic instead of paper and bars had to close at 6pm. Things […]

How much can you borrow for a mortgage in New Zealand?

Going shopping for a home – either your first or your next – is always an exciting time. The secret to making it a positive experience is having a realistic picture of how much you can afford to pay, so that you can view properties that fall within your budget. To get the clearest view […]

How do I calculate my mortgage repayments?

One of the simplest ways to see what your regular mortgage repayments would be is to use our mortgage repayments calculator. You can also use it to check the effect of increasing or decreasing your regular repayments, or making a lump sum repayment at some point during the term of your mortgage. And if you’re […]