More buyers making enquiries

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken this week, attracted 51 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- Lenders are becoming more willing to advance funds with different operators easing different criteria bit by bit.

- Over the past two months the biggest change in buyer presence seems to be the arrival of more first home buyers rather than investors.

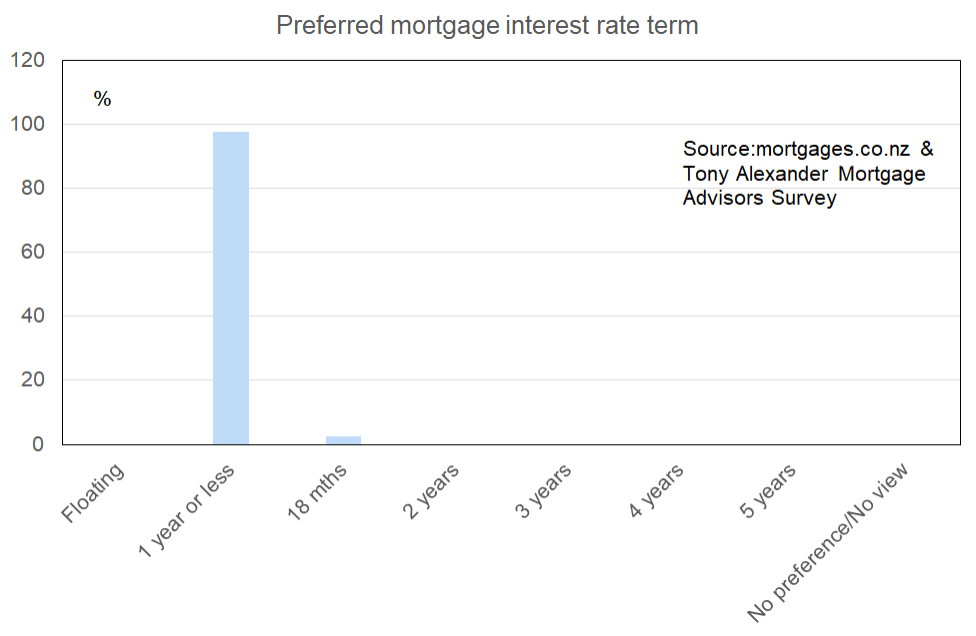

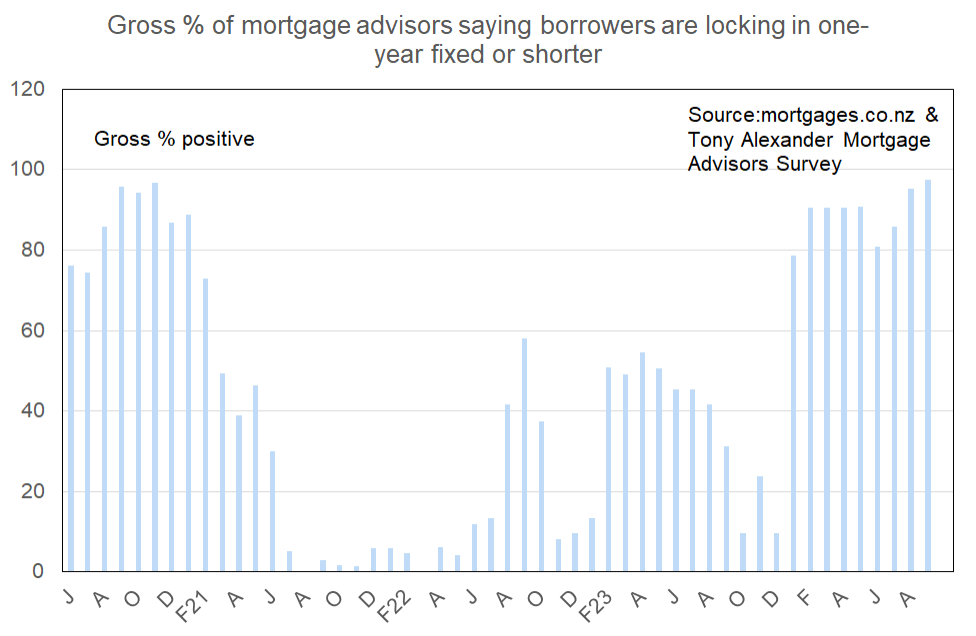

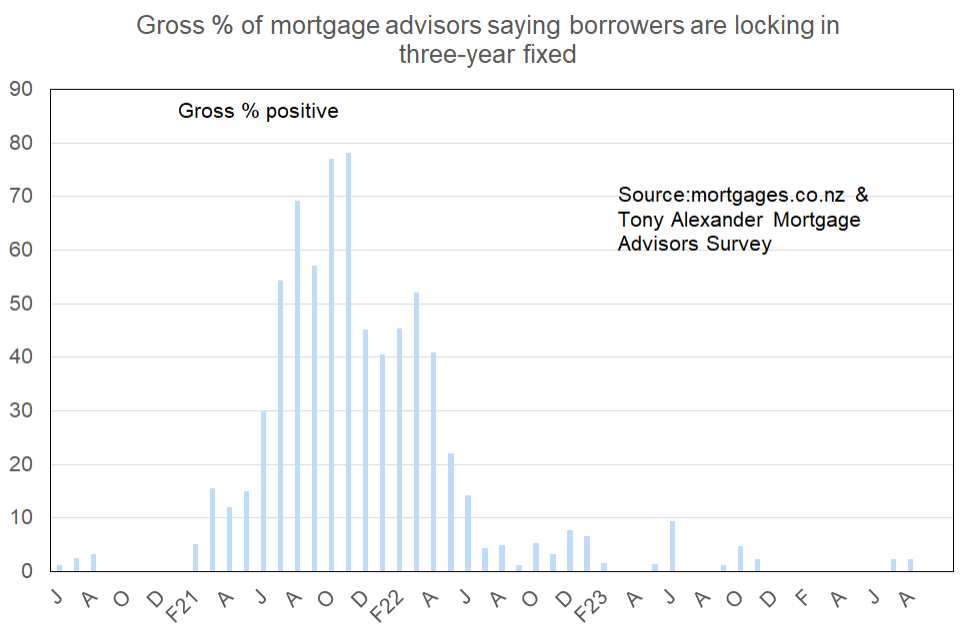

- Borrowers overwhelmingly are fixing their interest rates now for a term of one year or less.

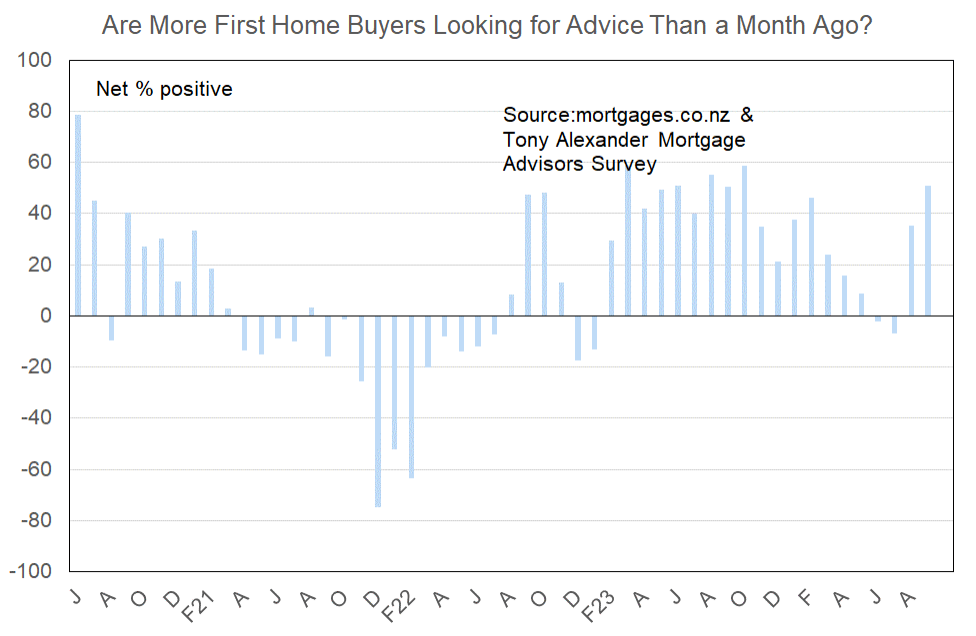

More or fewer first home buyers looking for mortgage advice

A high net 51% of mortgage advisors this month have reported that they are receiving more enquiries from first home purchasers. This is a strong turnaround from two months ago when a net 7% said that fewer enquiries from these generally young people were coming through.

Banks are slowly easing up on their criteria for lending to borrowers generally including first home buyers, and general sentiment in the country is improving now that a path towards less interest rates pain has become clear.

Comments on bank lending to first home buyers submitted by advisers include the following.

- Test rates have gone down for most of the major banks making it easier to get more money, UMI requirement for 10% deposit have been eased a little bit meaning more borrowing for first home buyers. Boarder incomes allowed at less than 20% deposit – has been for a while but test rates reduction, makes it easy to borrow.

- Serviceability becoming easier to obtain lending for high LVR clients.

- Some banks are allowing for easier servicing criteria for those without a 20% deposit.

- UMI (uncommitted monthly income) requirements for high LVR continue to ease.

- The changes in the CCCFA are slowly filtering through – watch this space. Banks are also starting to reduce their test rates which is encouraging.

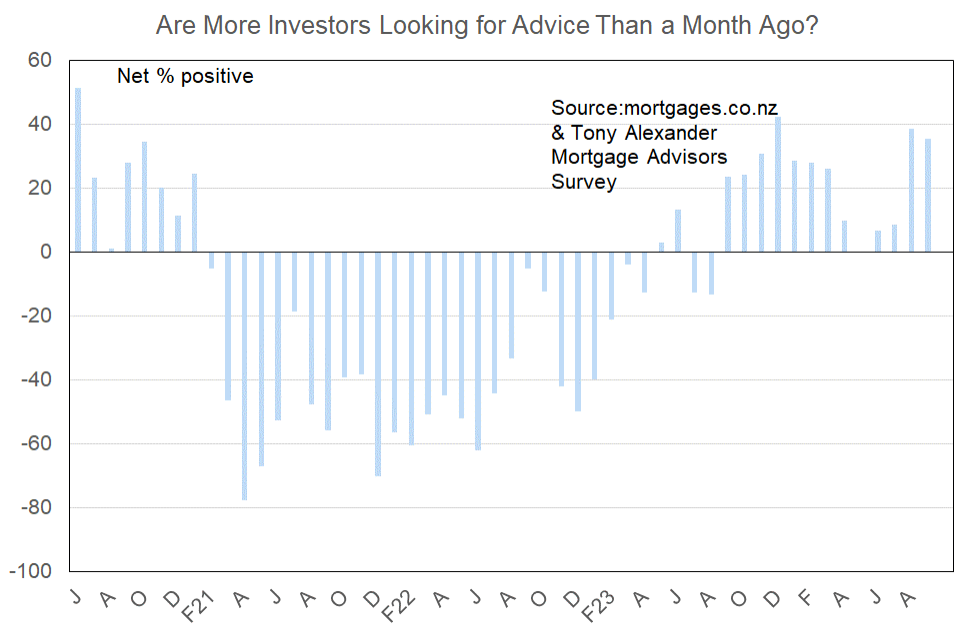

More or fewer investors looking for mortgage advice?

A net 35% of advisors have reported that they are seeing more enquiry from investors. This is well up from 9% two months ago but that two-month change is less than for first home buyers just discussed. Also, last month’s result was a net 38% of brokers seeing more investors.

Therefore while we can safely say that more investors are being attracted back into residential property, it is still the case as it has been since perhaps mid-2021 that it is first home buyers who are the prime movers in the marketplace.

Comments made by advisers regarding bank lending to investors include the following.

- Lower test rates are increasing affordability.

- LVR changes (70% for investors) has made it easier to use the equity to purchase the next property coupled with the test rates reductions. rental income shading linked to tax deductibility is almost gone.

- No major changes in this space with assessment, however debt to income will be a factor moving forward as investment enquiry increases.

- No longer required to include rates and insurance in assessment.

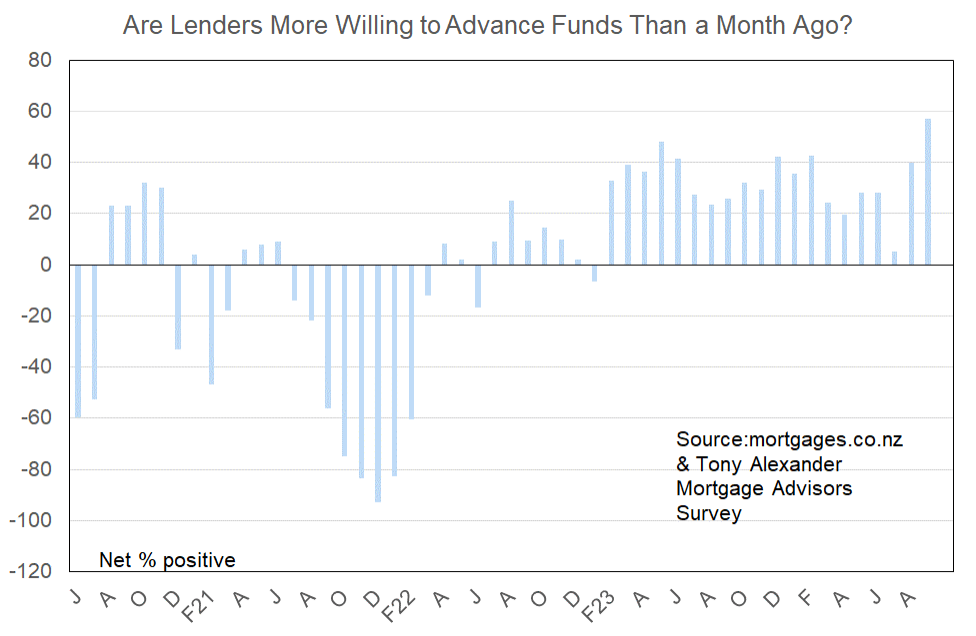

More or less lenders willing to advance funds?

A net 57% of brokers in this month’s survey have reported that they feel lenders are becoming more willing to advance funds. This is an important result because the severe tightening up of credit availability in New Zealand over 2021 sparked the sizeable fall in real estate activity and prices from late that year.

The net 57% is in fact the strongest such result in the four and a bit history of this survey.

What time period are most people looking at fixing their interest rate?

With universal expectations that easing monetary policy will bring much lower mortgage rates (that is the explicit intention of policy easing), borrowers are fixing short in order to secure presumably a “low” medium to long-term rate when it looks like rates may have bottomed out.

We cannot know when that point in the interest rates cycle will be reached and for now it seems reasonable to assume that most people will continue to fix short for a considerable period of time.

Note however that some brokers are finding some banks offering attractive 18 month rates.

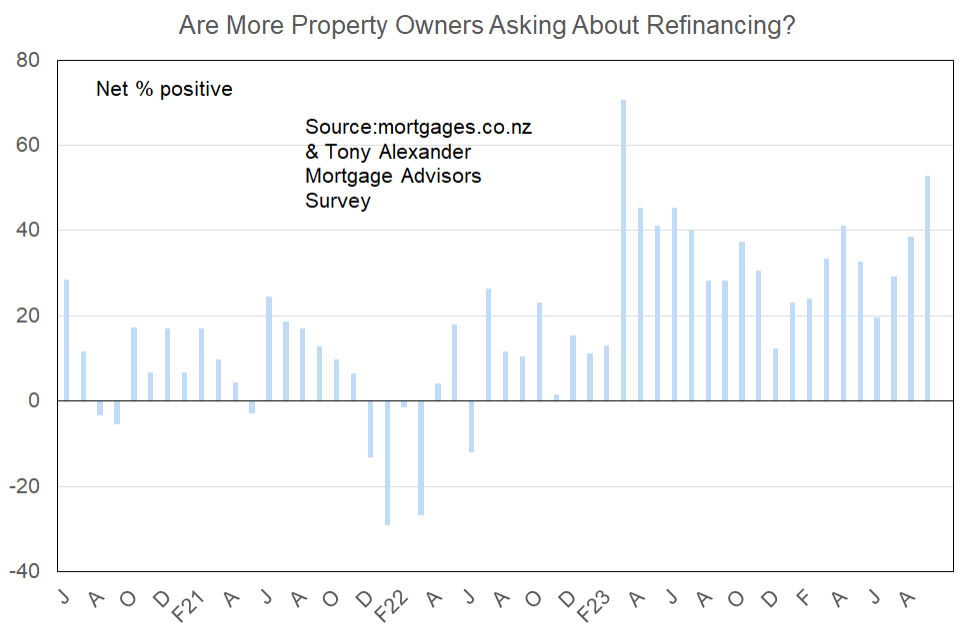

Are more property owners asking about refinancing?

A net 53% of respondents this month have reported that they are receiving more enquiries about refinancing. This is the second highest result on record and likely reflects the changing interest rates landscape making people think about more active management of their interest rate reset exposure.