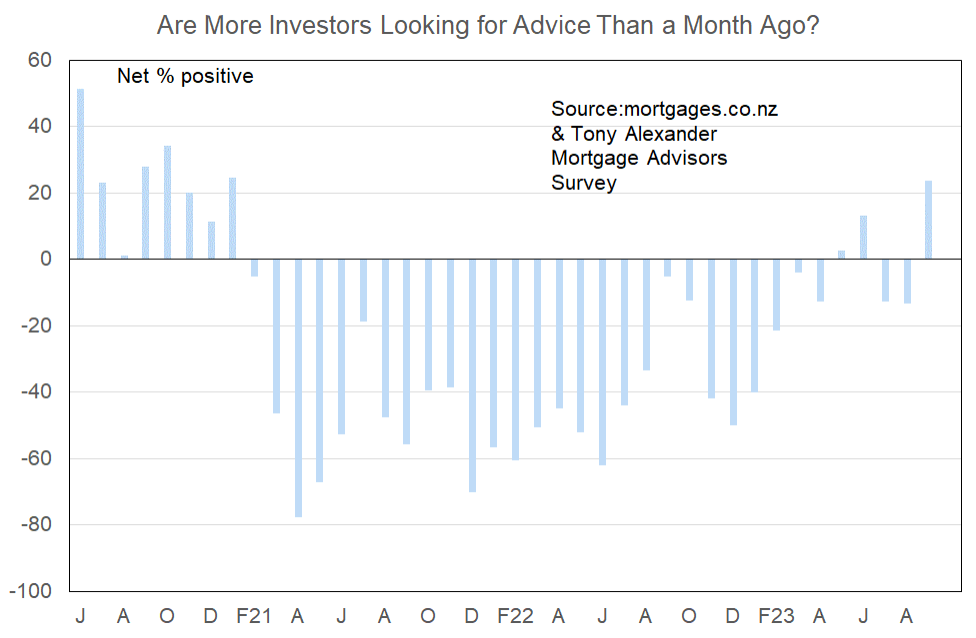

Investors return

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 85 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- The largest net proportion of brokers seeing investors in the market since January 2021 has been reported this month.

- First home buyers remain strongly active.

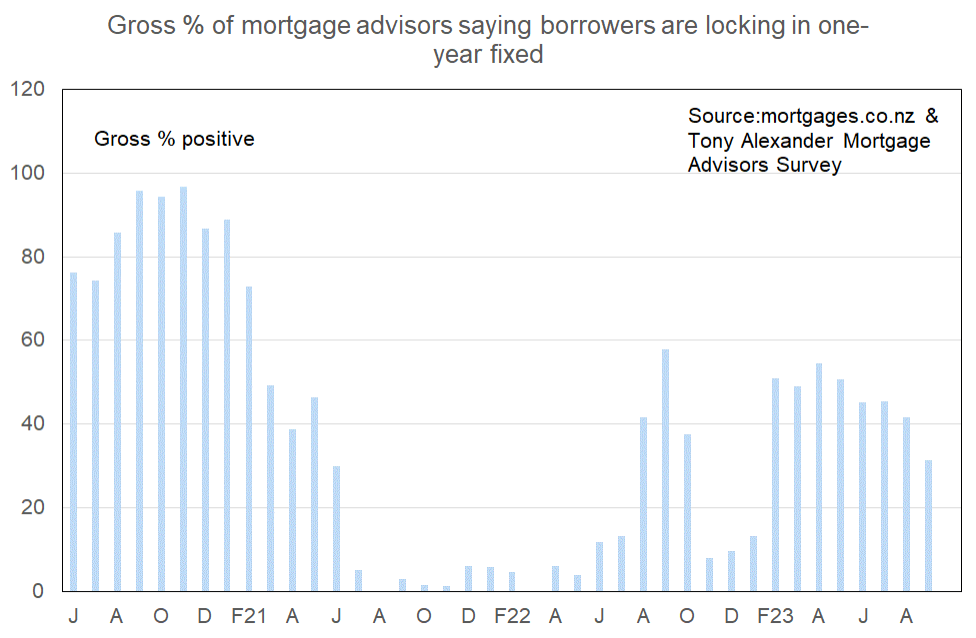

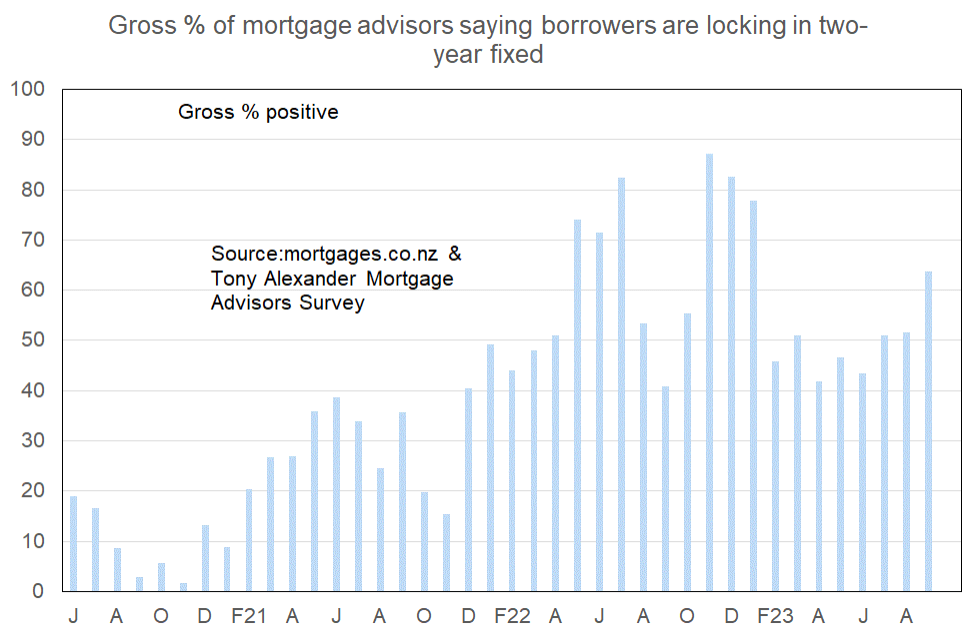

- Recent interest rate moves and worries have encouraged borrowers to more strongly favour fixing two years than one year.

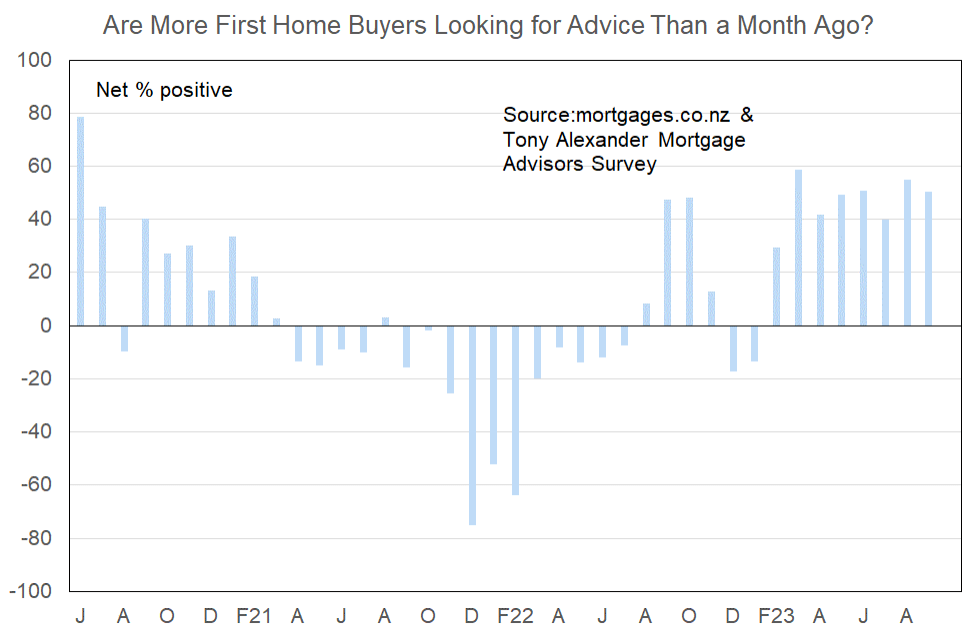

More or fewer first home buyers looking for mortgage advice

A net 51% of advisers in our monthly survey have reported that they are seeing more first home buyers making contact about financing advice. As the graph here shows, this result is consistent with the other high outcomes since February this year.

Young buyers have been returning to the market in high numbers despite still rising mortgage rates, a rise in the unemployment rate from 3.2% to 3.6%, and high levels of household pessimism. They have been attracted by lower house prices, higher listings, better access to credit and growth in deposits over the past two and a half years.

Comments on bank lending to first home buyers submitted by advisers include the following.

- Banks want to do more deals, but competition between banks is low. Not much movement on negotiating interest rates and cashback

- We are using the Kianga Ora Partnership scheme more & more.

- Banks are more relaxed on discretional expenditure items

- Activity is picking up – applications are taking longer to process to approval. Not quite so picky around expenses – increased reality.

- No real change although appears to be a little more availability in low equity space.

- No pre-approvals, only looking at existing clients, fussy with properties when only having 10% deposit – or lower valued properties

More or fewer investors looking for mortgage advice?

Comments made by advisers regarding bank lending to investors include the following.

- Servicing is key, at almost 9%, it is hard for a lot of people to borrow money to buy investment properties considering there are some lenders who are still using rates and insurances as a separate expense for rental properties.

- Still tough in this space, having to provide existing Rates and Insurance confirmations plus stress testing at 9% makes these deals really tough.

- Open for business, but not much business due to tax settings – except new builds.

- Affordability still proving to be the main issue for investors.

- Interest only term is harder for assessment and have to indicate you have spoken with the client around the implications of interest only.

- Bank dependent, but quite big shading on rental income happening

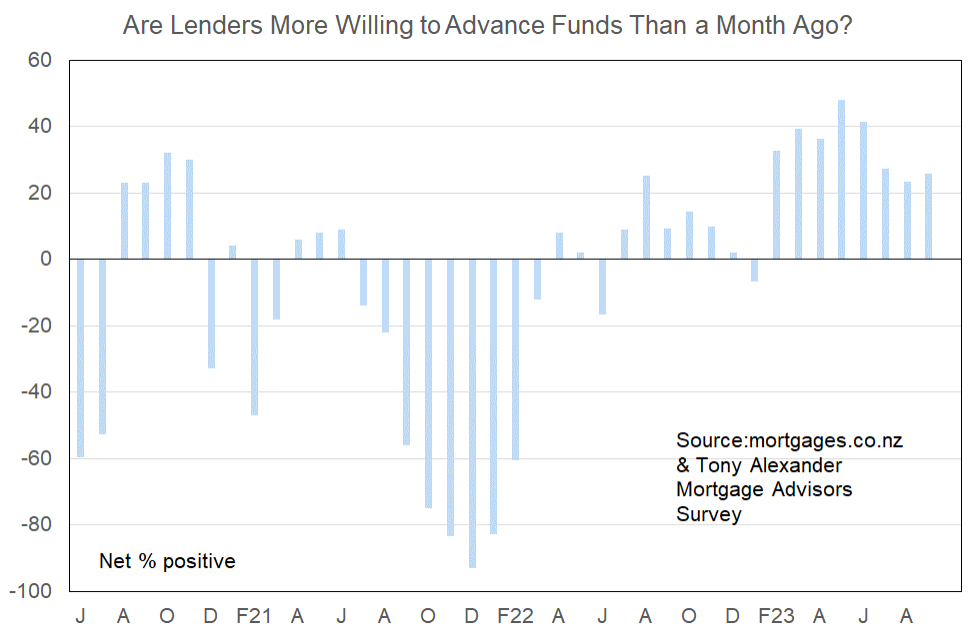

More or less lenders willing to advance funds?

Early this year mortgage advisers reported a strong improvement in the willingness of banks to advance funds. That willingness has generally been maintained with a net 26% of brokers this month reporting that banks are becoming more willing to lend.

The graph here shows clearly the credit crunch late in 2021 which precipitated 18% average house price falls through to May this year.

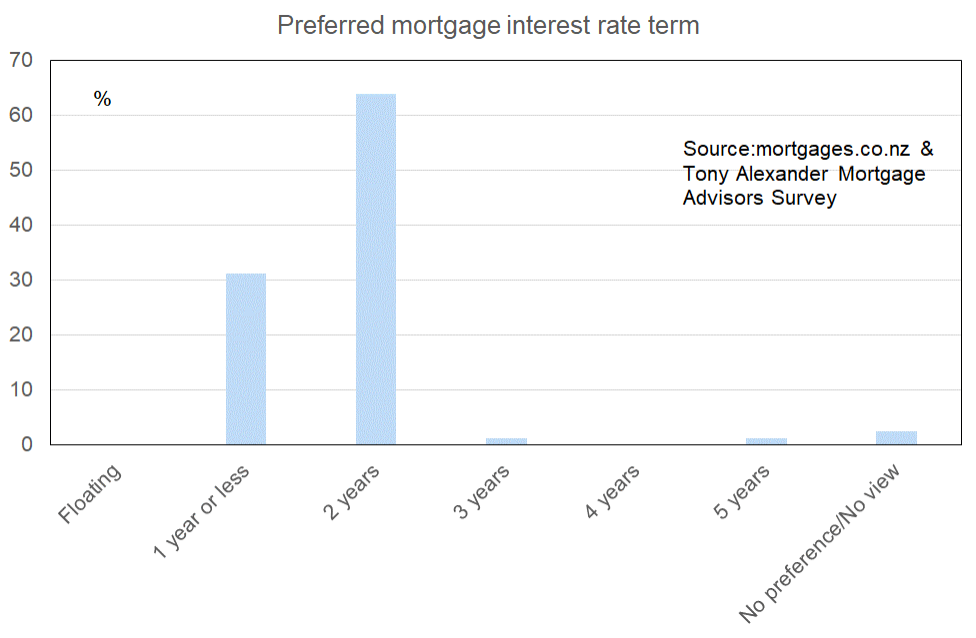

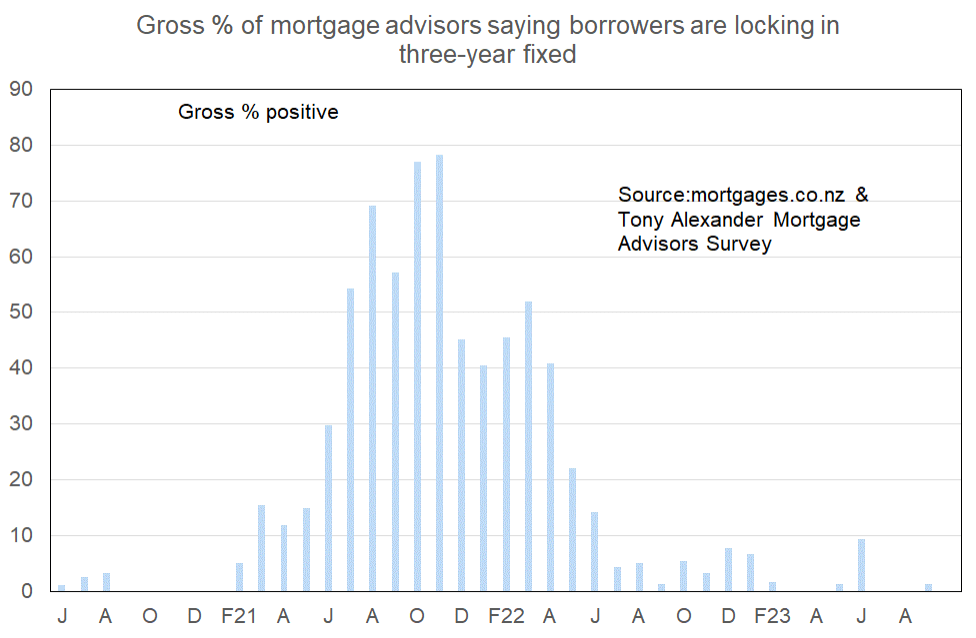

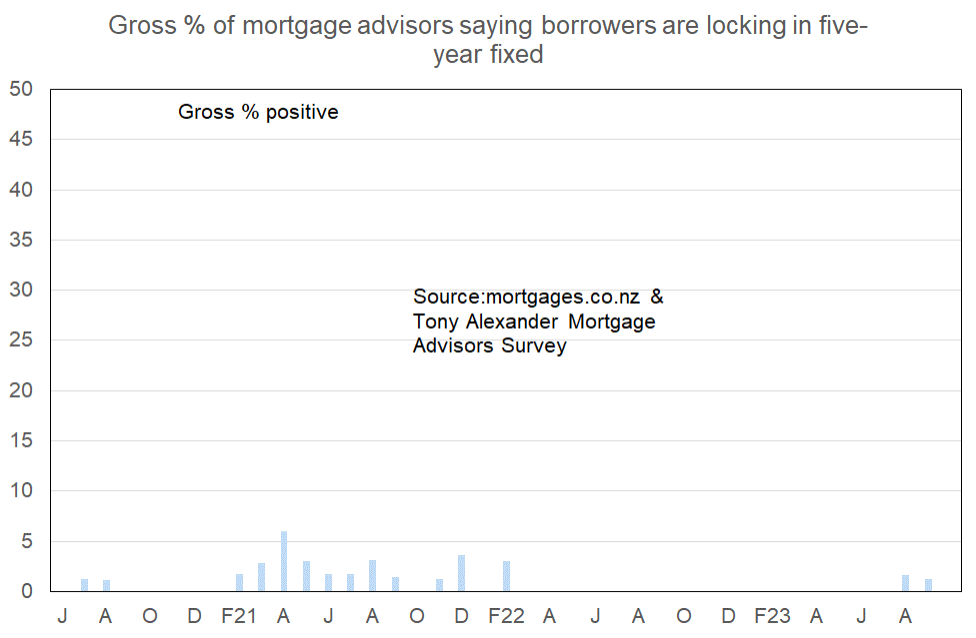

What time period are most people looking at fixing their interest rate?

Some have reported that 18 months is the preferred term and from next month’s survey that option will be included.

The preference for fixing one year has been declining this year, perhaps as continuing rises in bank lending rates despite no tightening of monetary policy have made people wary.

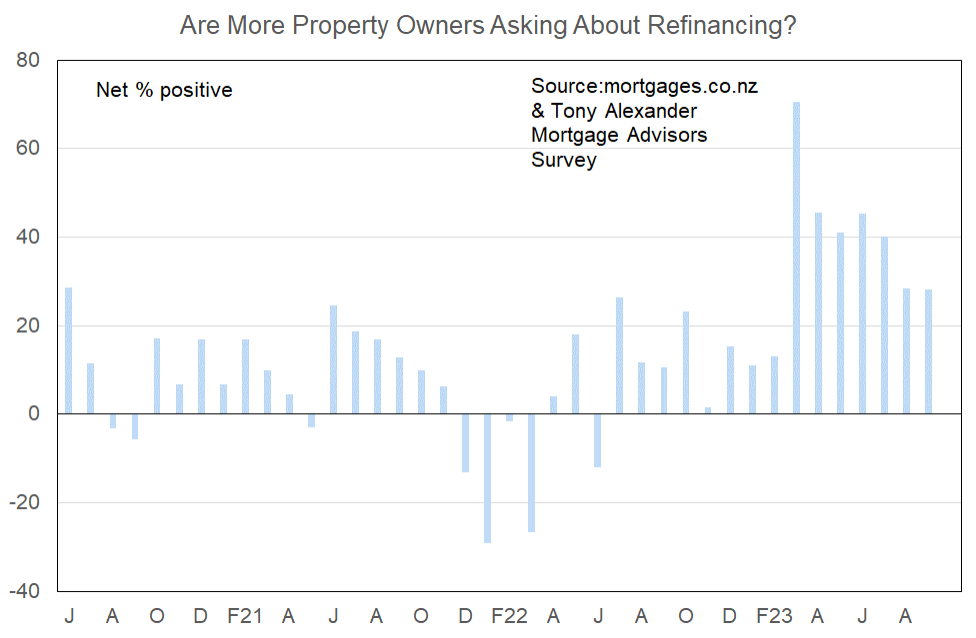

Are more property owners asking about refinancing?