First home buyers back

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 68 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- First home buyers have returned to the market.

- The decline in investor requests for mortgage advice has almost ended – but not quite.

- Banks have increased their test interest rates and that constraint is offsetting some easing of expense calculations and assumptions

More or fewer first home buyers looking for mortgage advice

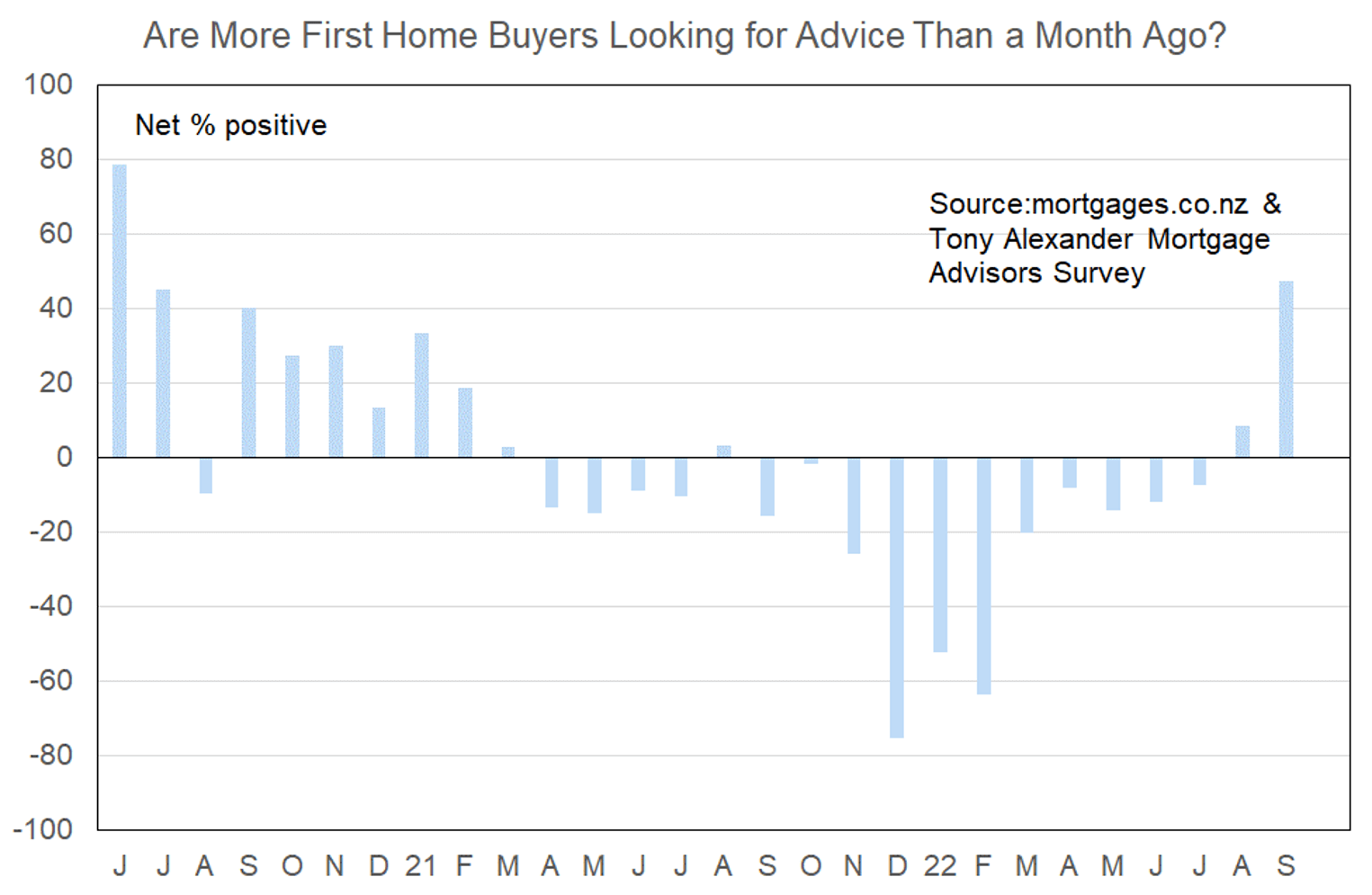

Last month we reported that for the first time since August last year more mortgage advisers reported seeing first home buyers looking for assistance than were seeing fewer. This month that net positive proportion has jumped from 8% to 47%. This is the highest reading since our very first survey in June 2020 and tells us clearly that first home buyers are back in the market.

Changes to house price limits relevant to accessing government grants and loans have brought a home purchase within reach of many people. Fears about high interest rates may also have eased slightly. At heart though it is entirely possible that with houses on average around the country now 12% cheaper than at their peak, and with increasing talk about picking the bottom in the market, many young people have decided not to take the risk of waiting too long and seeing listings potentially dry up again as they did last year.

Comments on lending to first home buyers submitted by advisers include the following.

- Still really hard with main banks. However, with the property caps removed for first home loan, I have multiple first home loan applications going on at the moment. Almost no main bank. Some main banks have opened up to their own clients, but the criteria are tough and only for live deals.

- If there is a strong income and plenty of surplus funds, some banks are relaxing a little on evidencing some of the monthly expenses.

- Options remain limited without a 20% deposit and lenders appear to be tweaking their UMI Surplus requirements to control flow. There seems to be less rigour around expenses now – questions are still being asked but they aren’t as silly as they were following the CCCFA changes.

- Test rate has gone pass 8% however some banks have relaxed servicing which is helping A lot of FHBs into the market especially with the 5% Kainga Ora new rules.

More or fewer investors looking for mortgage advice?

Comments made by advisers regarding bank lending to investors include the following.

- A lot more non-bank activity as too hard at main bank.

- With the large discount applied to rental income, and LVR caps we find investors who “pass” the banks affordability calculator are generally not overly scrutinised further – but passing at the outset is often the issue.

- Not many investors application these days because of the tax on rental income.

- Rental income continues to be scaled back heavily, mismatch of some lenders counting rates + insurance as an expense (on top of scaling back rental income) vs others who do not continues.

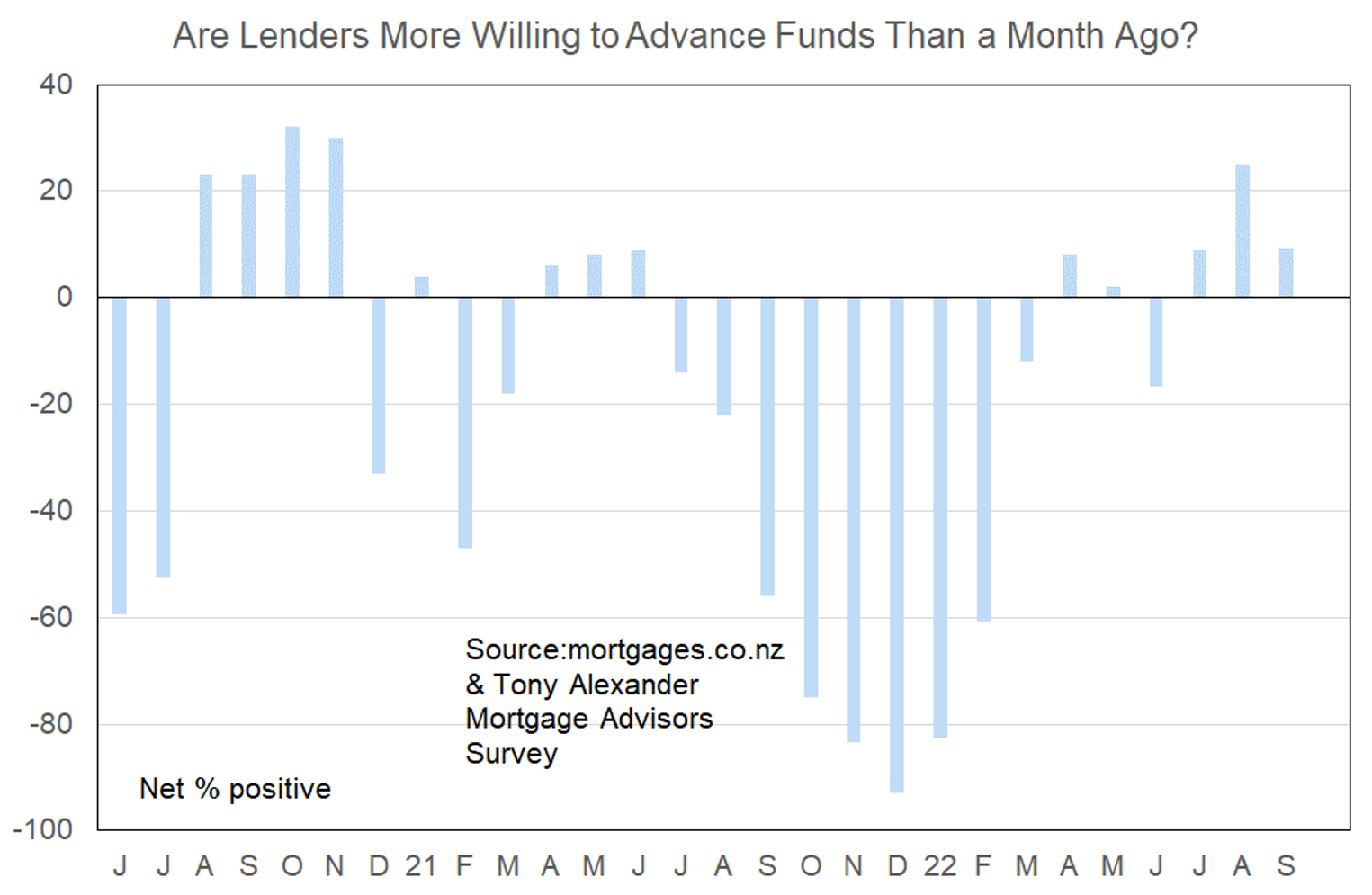

More or less lenders willing to advance funds?

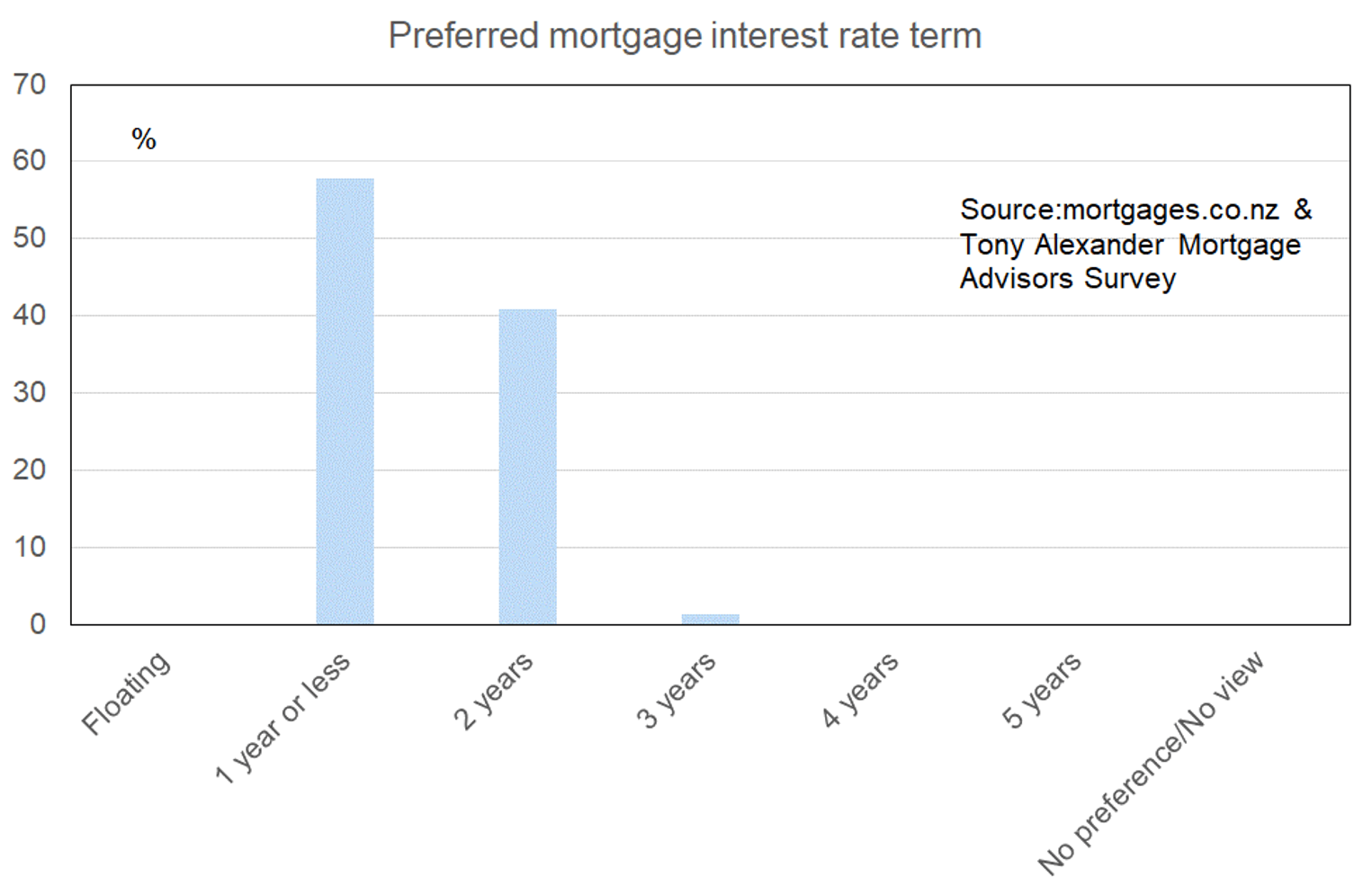

What time period are most people looking at fixing their interest rate?

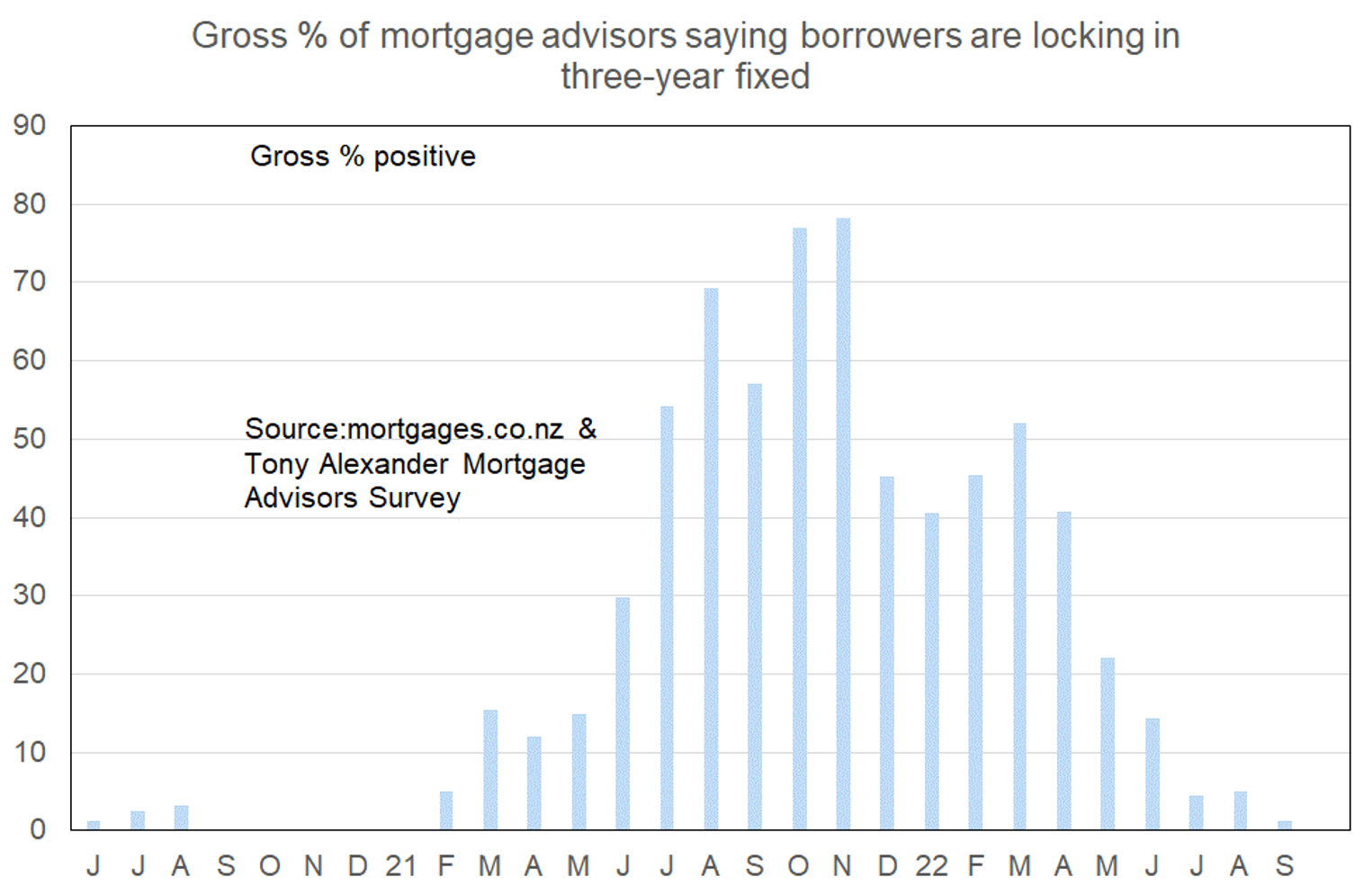

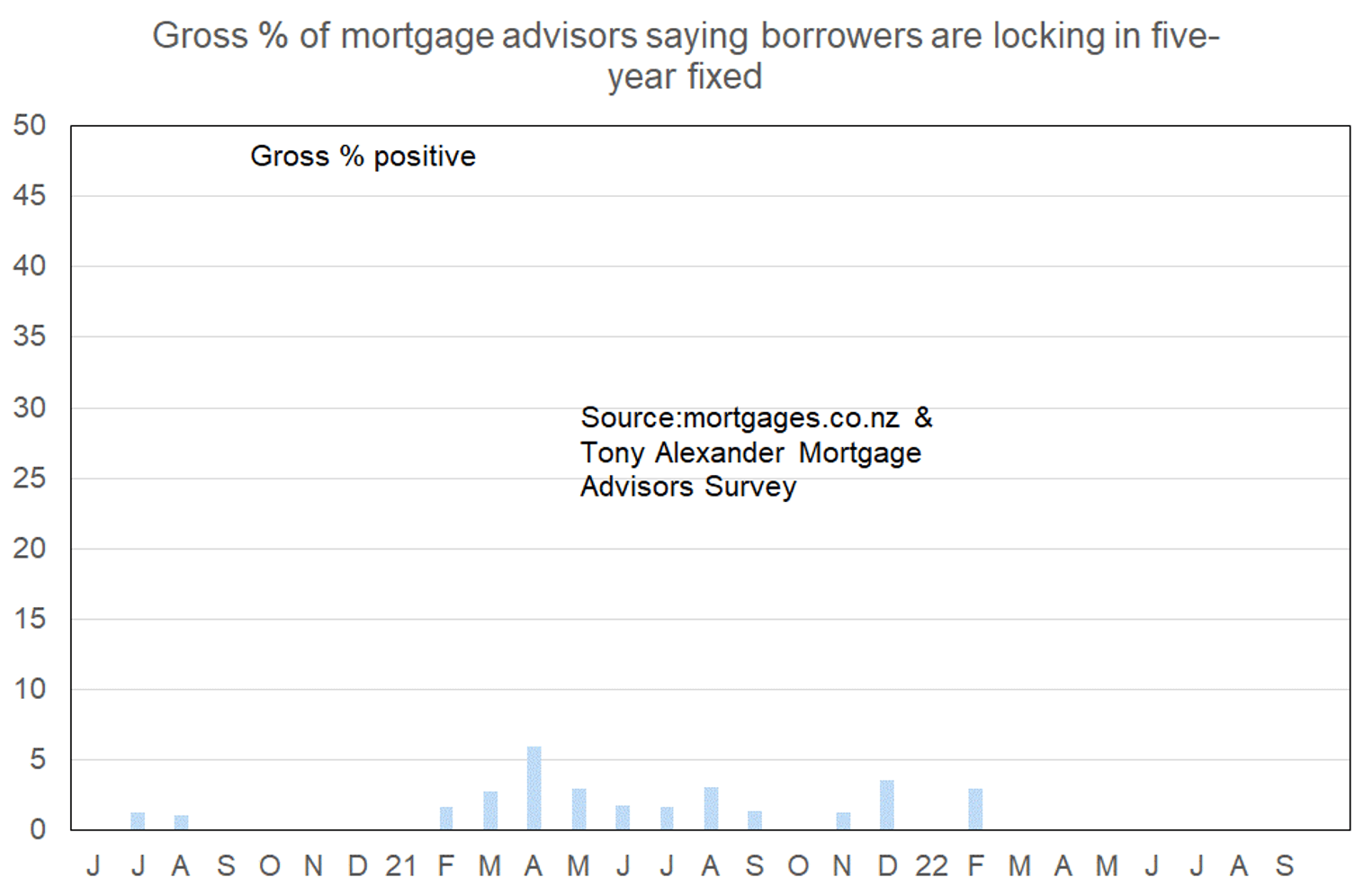

Since August the one year term preference has strongly returned, driven by banks discounting that rate to win business, and expectations that interest rates will be falling either from late-2023 or through 2024. Borrowers appear to wish to benefit from those expected declines.

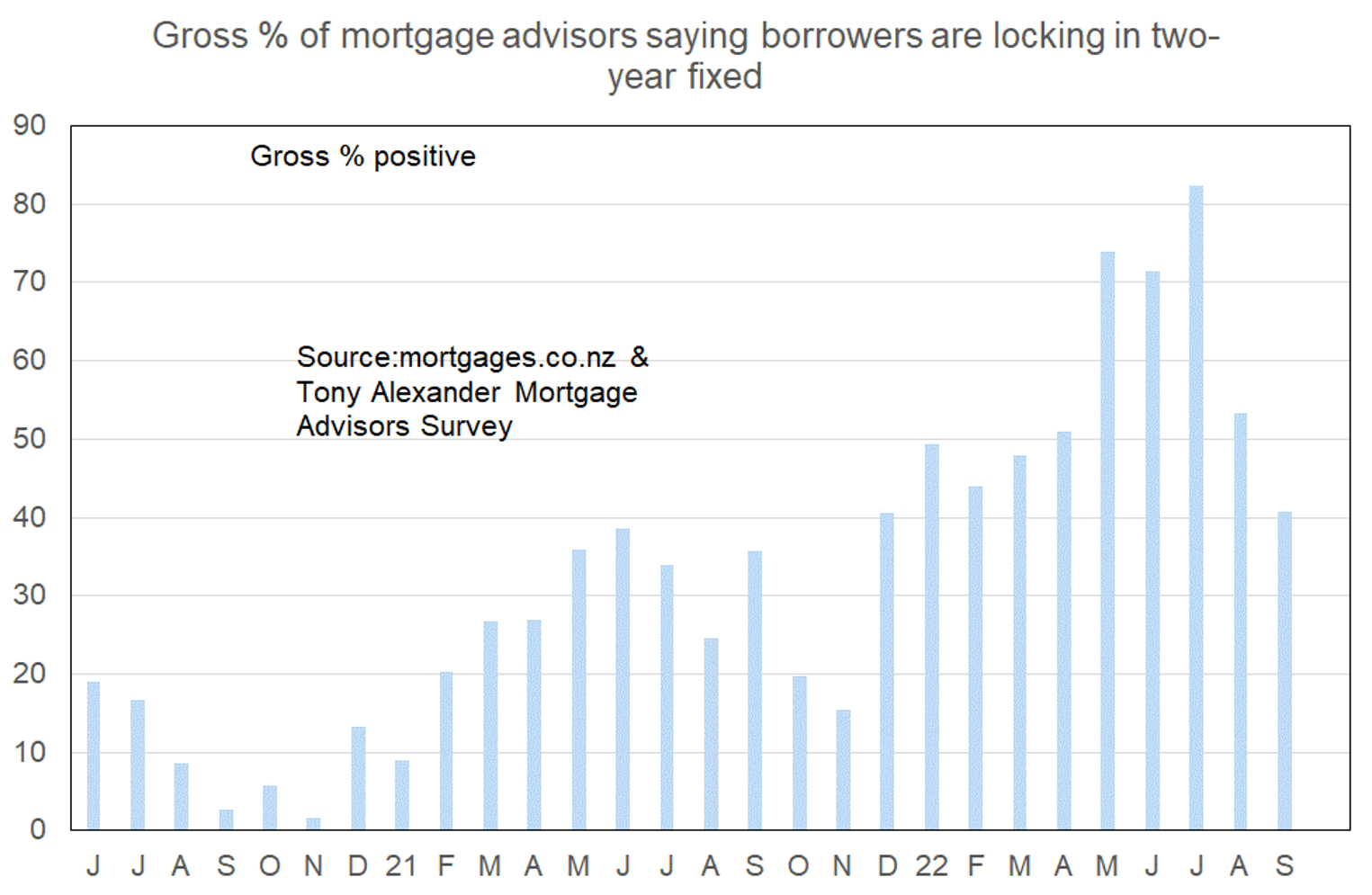

The preference for fixing two years peaked in June.