Strong buyer demand evident

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken this week, attracted 59 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- Bank turnaround times for processing applications are increasing.

- First home buyers remain active in the market and investor presence has noticeably risen.

- Borrowers still strongly favour fixing their mortgage interest rate for less than one year.

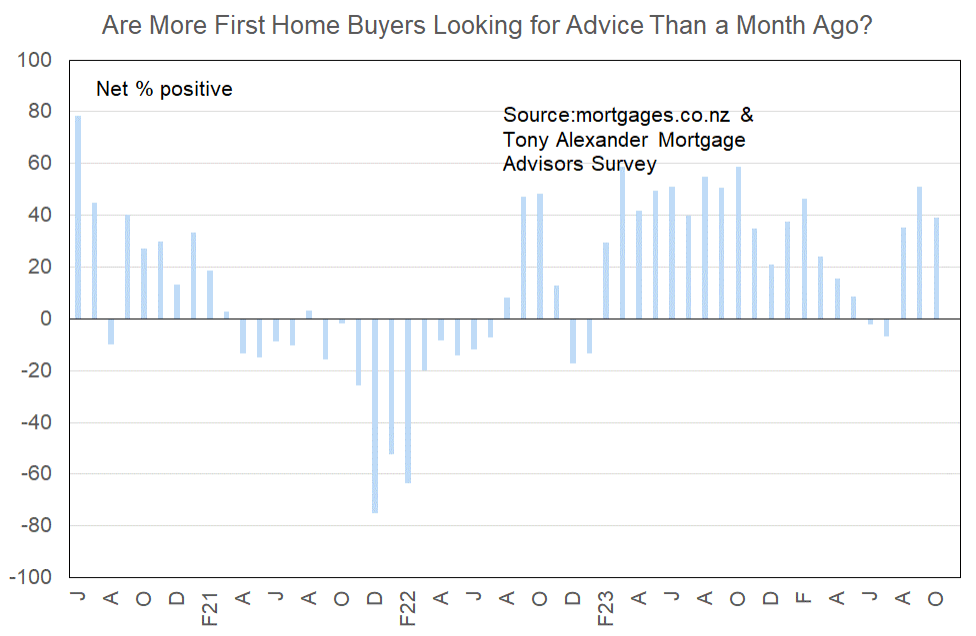

More or fewer first home buyers looking for mortgage advice

A net 39% of the mortgage advisors responding in this month’s survey have said that they are seeing more first home buyers in the market. This is down from a net 51% in September but still a level consistent with an argument that young buyers are active.

The turnaround in first buyer demand since the middle of the year has been quite large. This tells us that changes in interest rate levels and expectations are a driving factor because the employment situation has deteriorated and continues to do so.

Comments on bank lending to first home buyers submitted by advisers include the following.

- Big cash offers for new business

- In general the banks are more open to business than they were at the beginning of the year.

- Building report needed to confirm deferred maintenance

- Recognising Developer funds can be treated as first home loan deposit is a helpful and pragmatic change.

- If the clients have good incomes with little to no other debt and they have a 20% deposit, then the Banks already are looking to lend to the clients quite easily.

- There is definitely more activity, but over 80% lending is still tough. Esp with timeframes pushing back out again

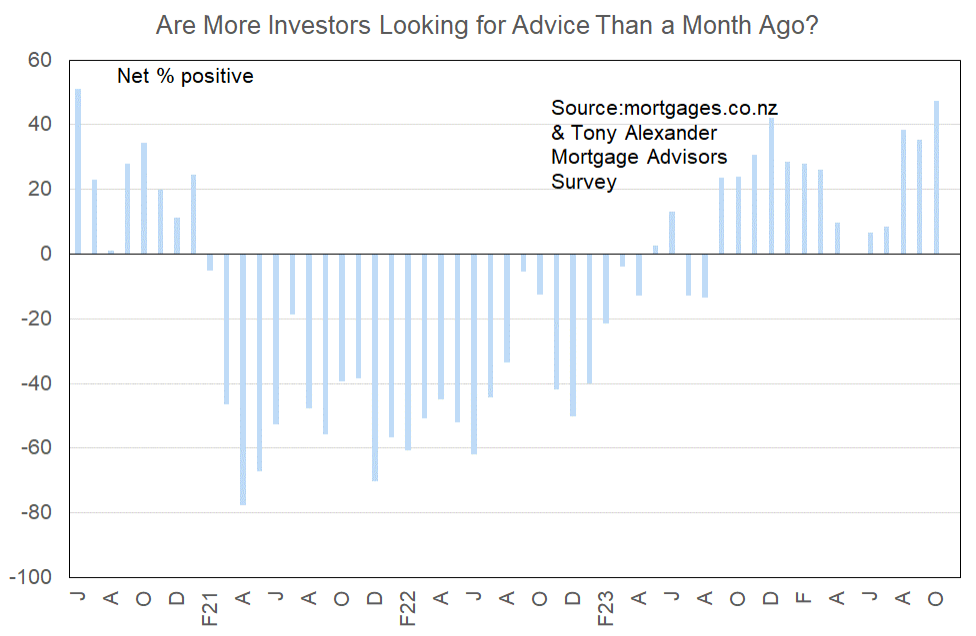

More or fewer investors looking for mortgage advice?

A net 47% of brokers have reported that they are seeing more investor buyers in the market. This is up from a net 35% last month and the strongest result since June 2020. Falling interest rates and feelings that the best time to buy is right now appear to be driving factors behind the rise in investor demand.

Comments made by advisers regarding bank lending to investors include the following.

- Mum and dad investors seems to be making moves, and banks happy to accommodate.

- More and more investors are buying new homes which are issued CCC and title recently

- Fewer checks on insurance premiums & body corp/rates which is a recent change by most banks due to CCCFA.

- Starting to see a softening in policy, but nothing too significant since the last survey

- One bank recently lowered the shading on rental income – another bank improved their assessment process around insurances on investment properties when applied for separately to any owner occupied lending.

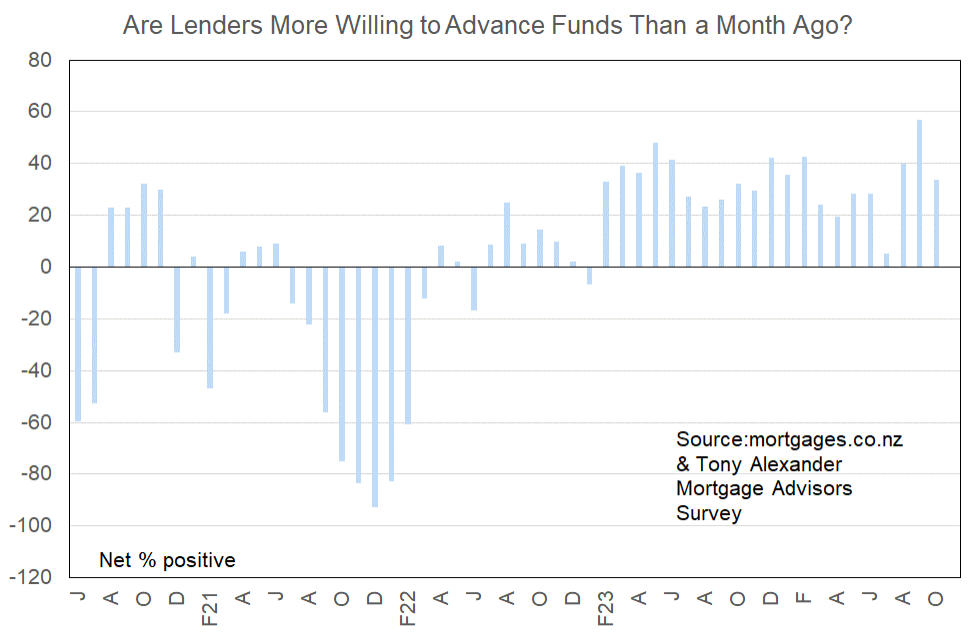

More or less lenders willing to advance funds?

Bit by bit since early in 2023 banks have been easing their lending criteria – sometimes encouraged by changes in the CCCFA legislation and perhaps at other times by silent nods from the central bank regarding acceptance of better credit access.

A net 34% of mortgage brokers have this month reported that banks are becoming more willing to lend. Although this is down from a net 57% last month the result is still on the high side and backed up by the comments brokers have made regarding some criteria being eased.

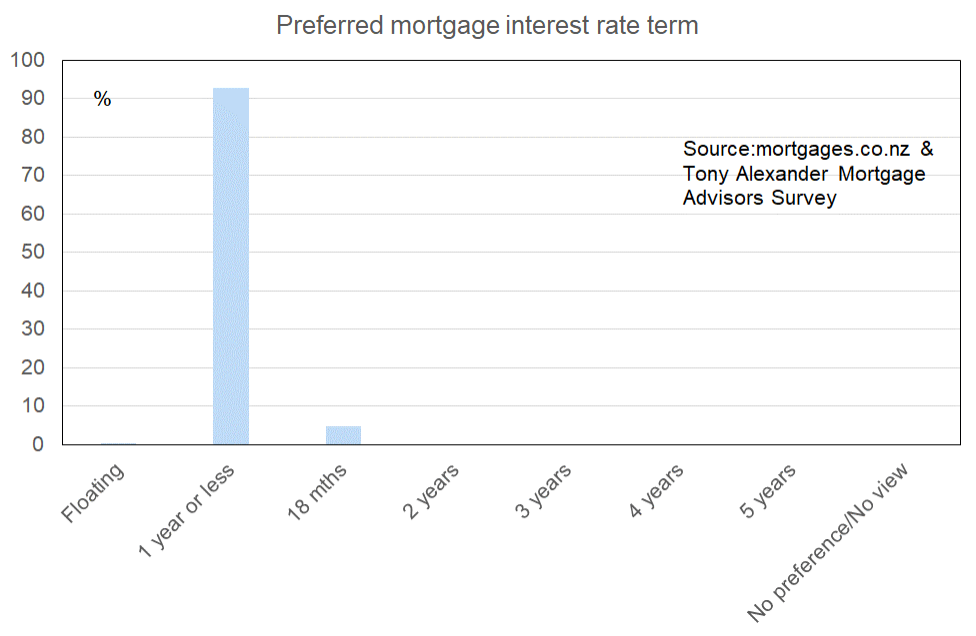

What time period are most people looking at fixing their interest rate?

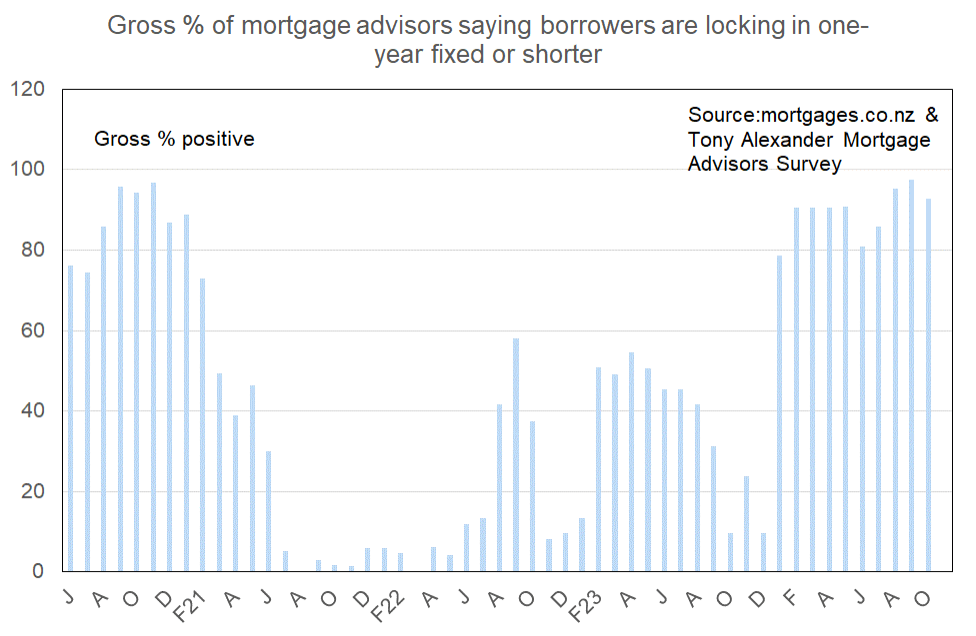

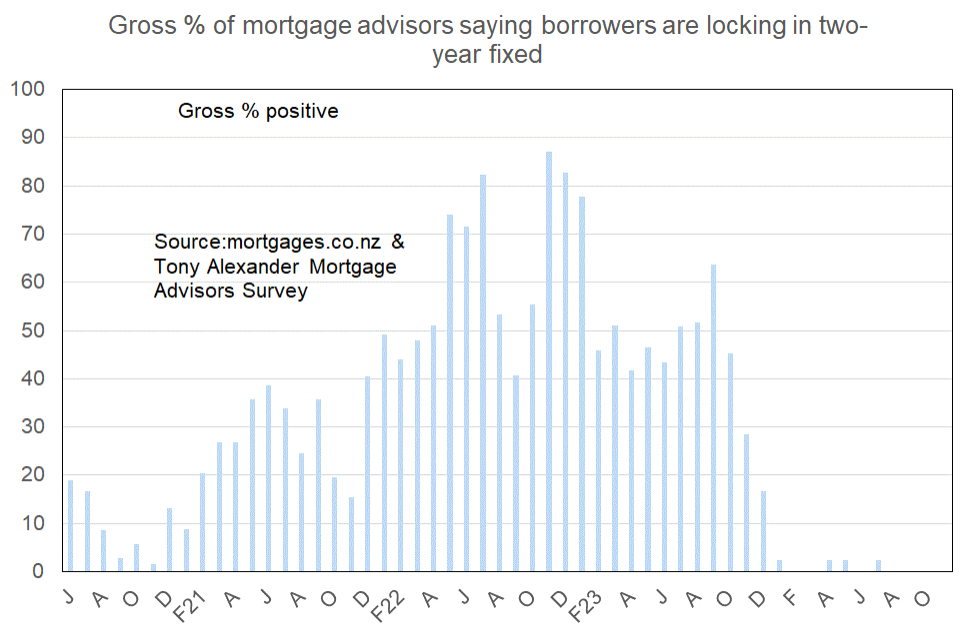

There has been extensive noting in the media of the way in which borrowers have been either floating or fixing their interest rate for a very short period of time in expectation of interest rates falling. Those expectations were met with the monetary policy easings on August 8 and October 9 and further reductions are expected in the coming year.

This tells us that in the near future people are likely to continue to preference the six month term even though banks are not much competing for business with that specific rate.

93% of brokers report that borrowers favour fixing one year or less (mainly six months).

This term preference has dominated since the very start of this year.

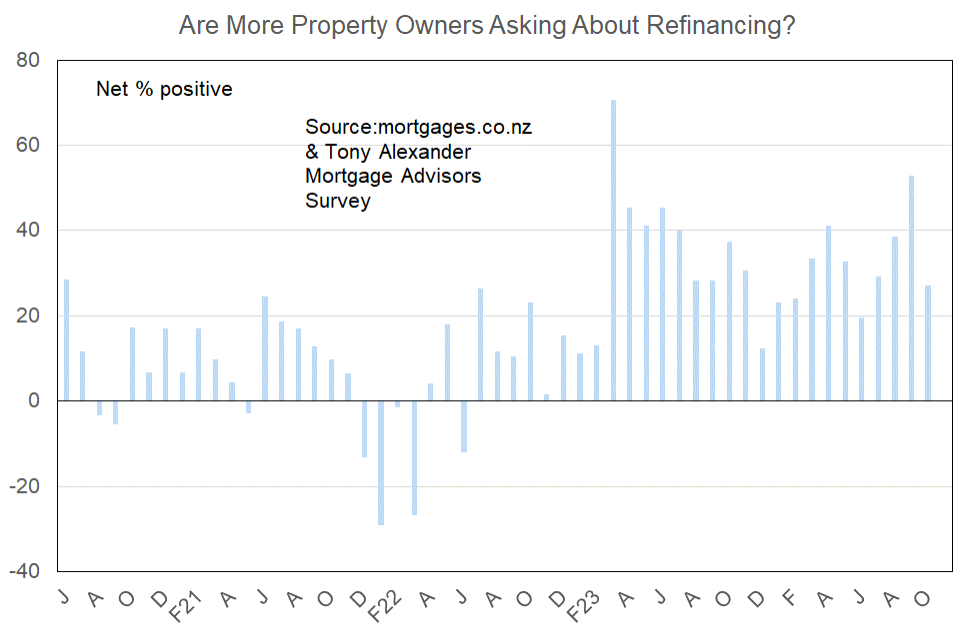

Are more property owners asking about refinancing?

A net 27% of mortgage advisors have said that more people are coming in looking for advice about refinancing. This is down from a net 53% last month but still on the strong side as people watch some large interest rate alterations occur and ponder how they should manage their exposure going forward.