First home buyers active

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 56 responses.

The main themes to come through from the statistical and anecdotal responses include these.

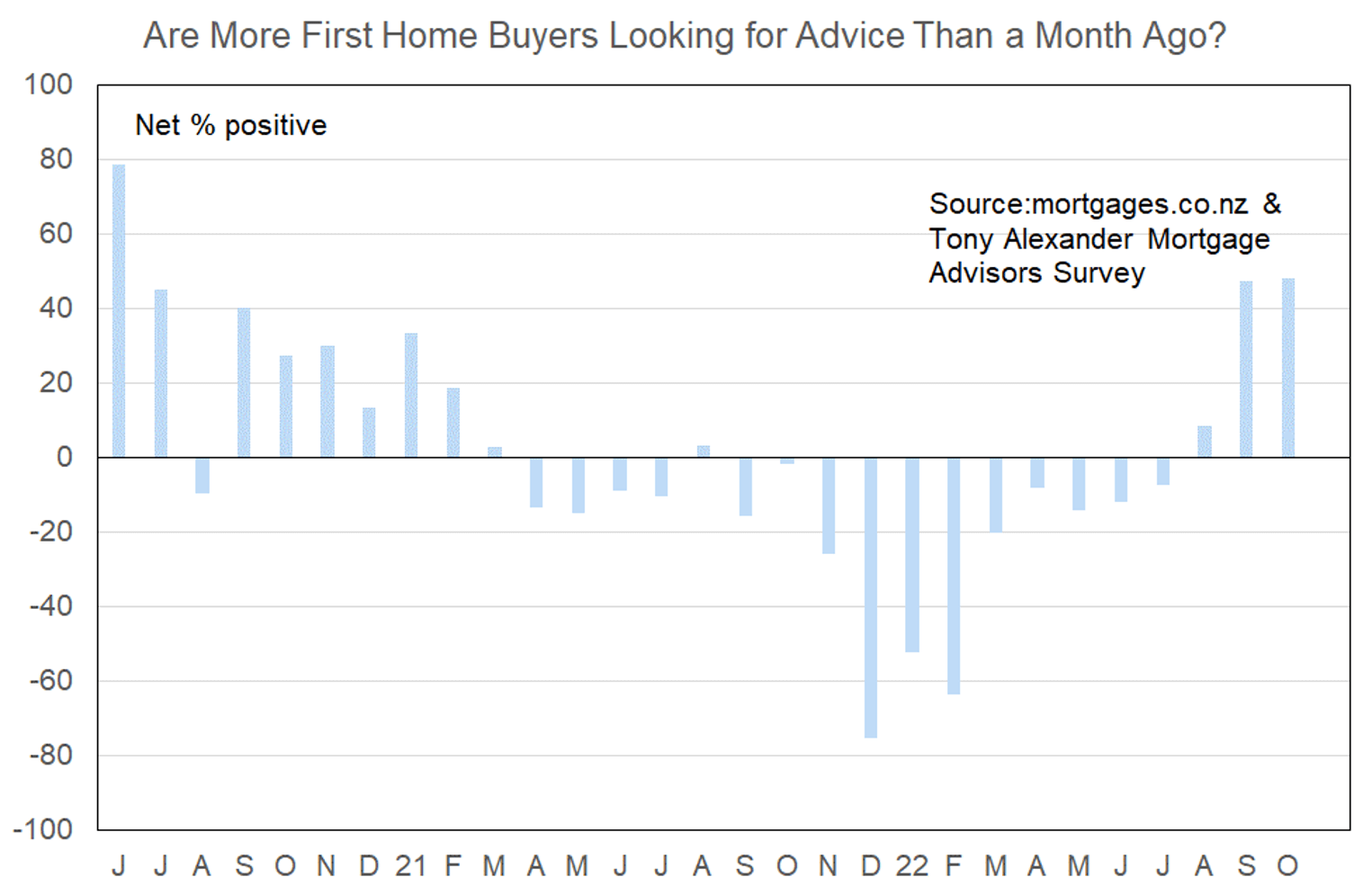

- First home buyers are confirmed as back in the market.

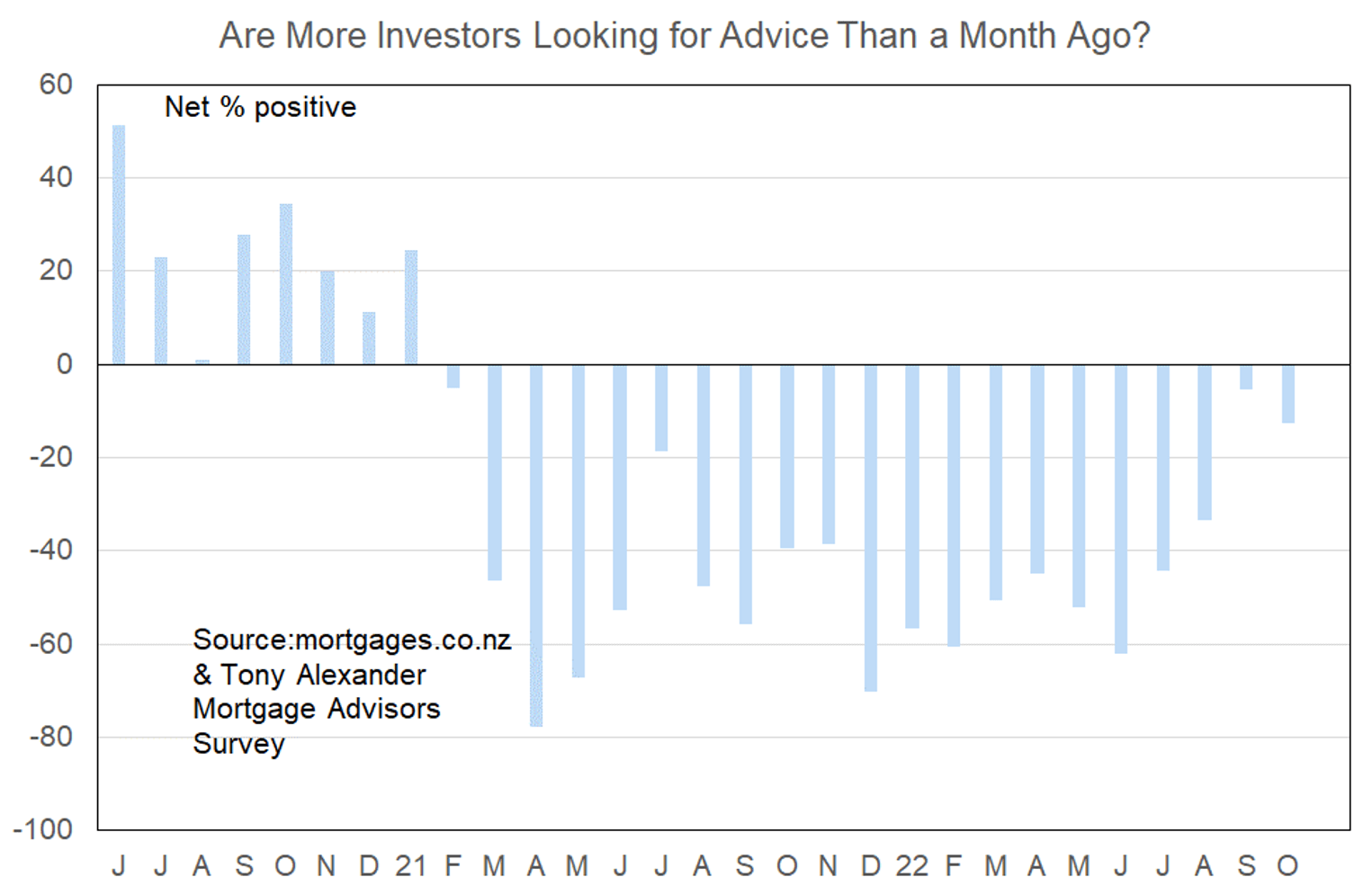

- Investors however continue to hold back.

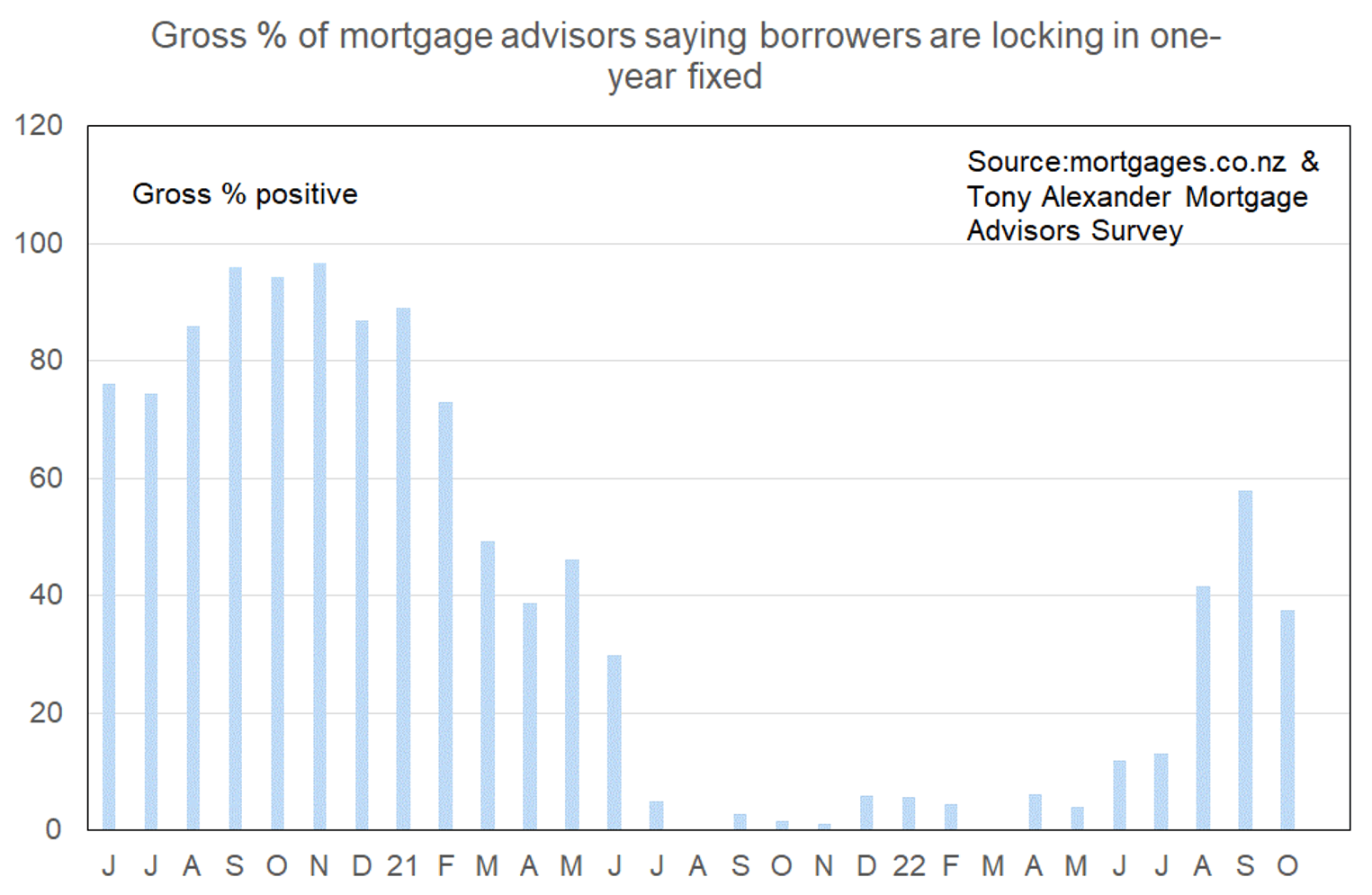

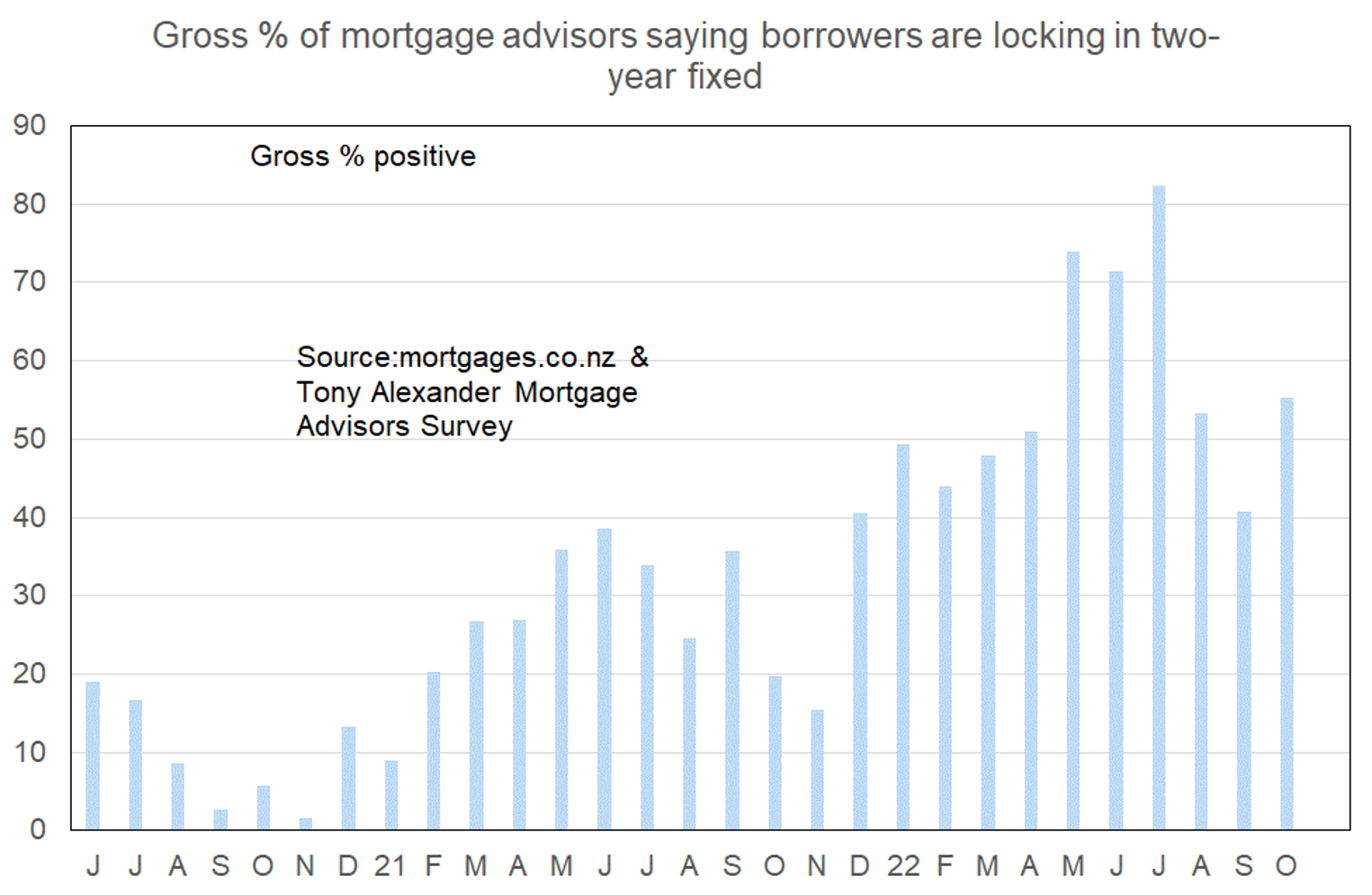

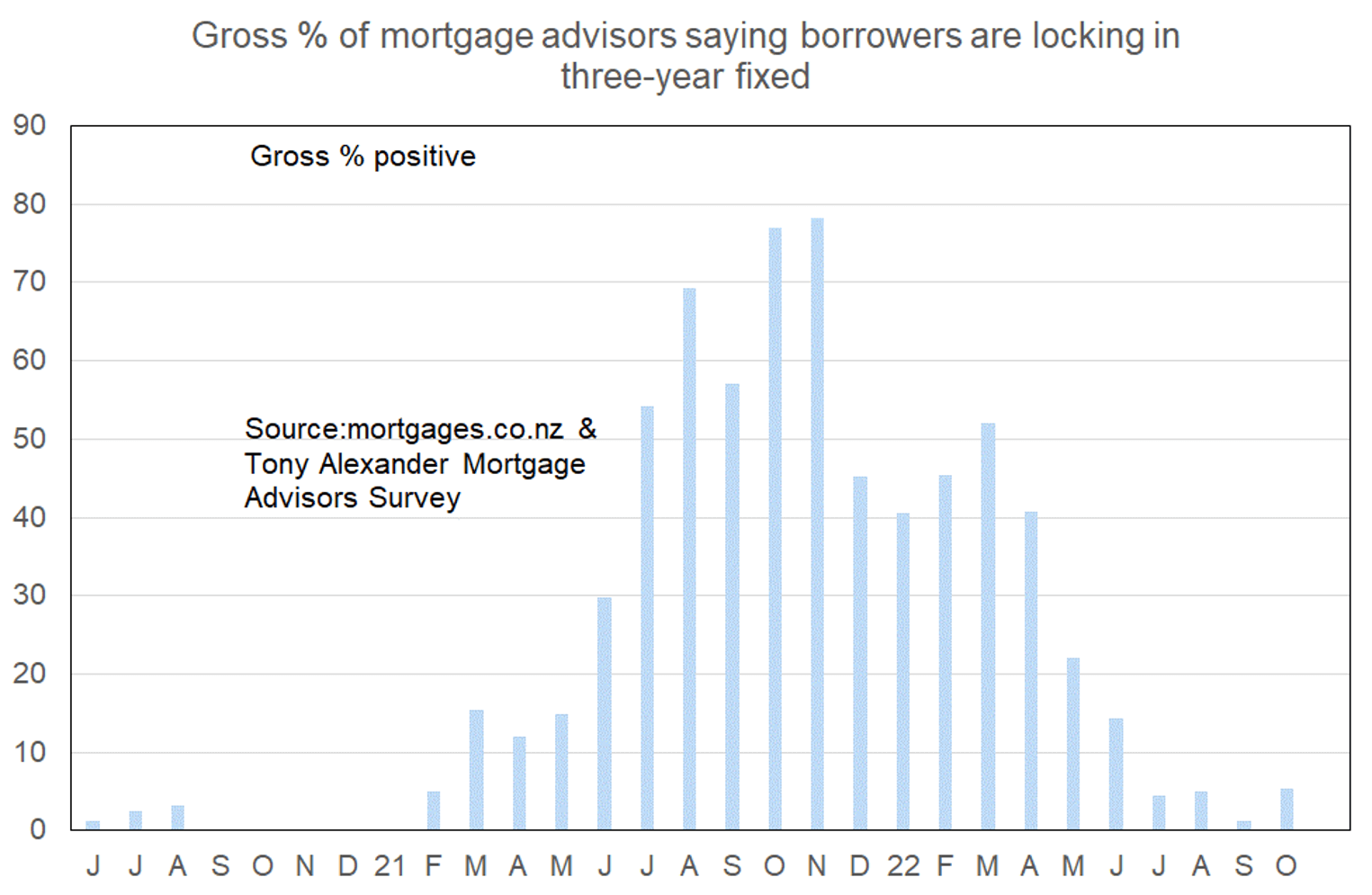

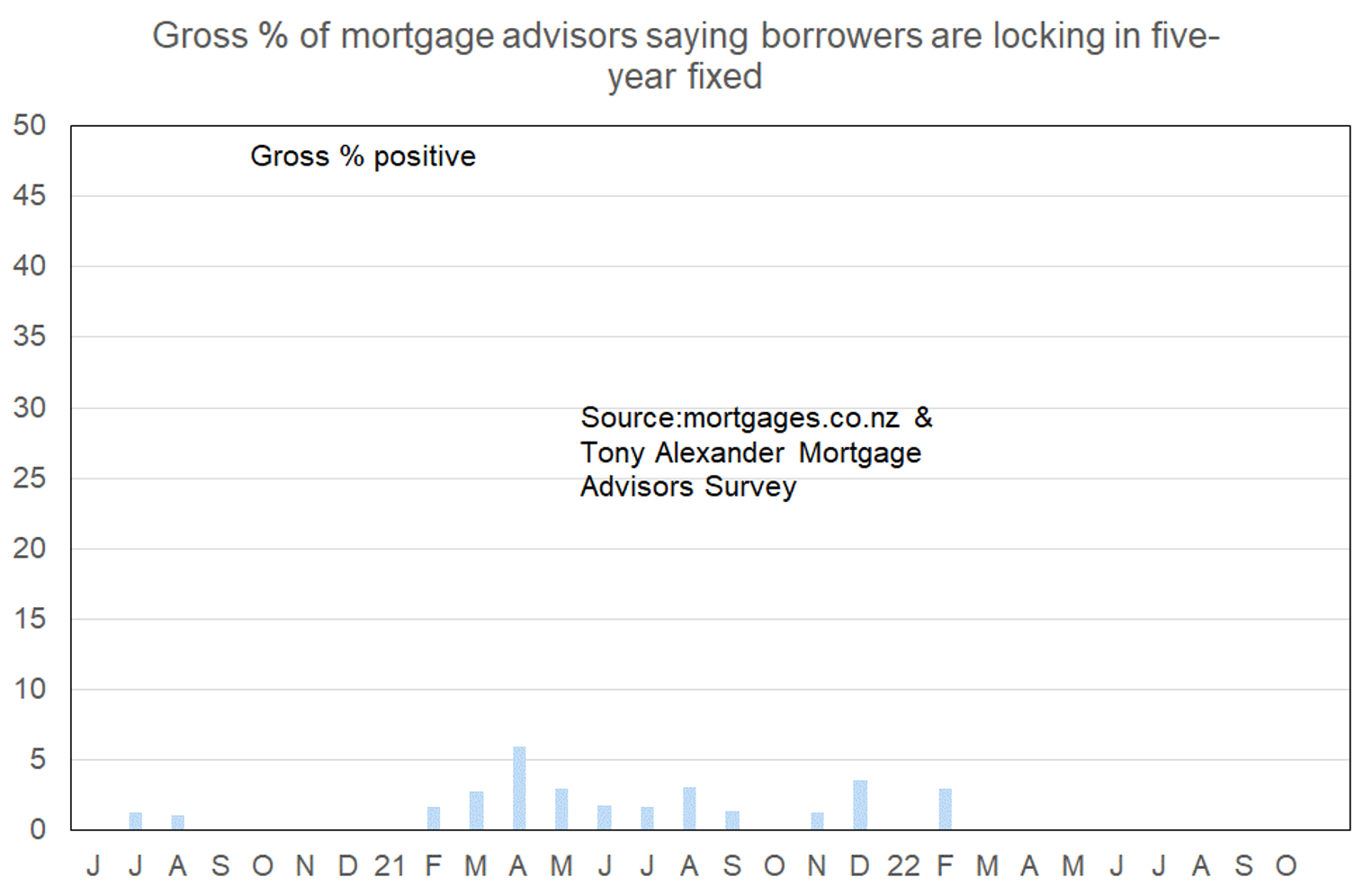

- Worries about interest rates have encouraged a small shift back towards fixing for two years and away from fixing one year.

More or fewer first home buyers looking for mortgage advice

Comments on lending to first home buyers submitted by advisers include the following.

- We are seeing banks saying they are willing to lend to first home buyers, but the actual criteria are so restrictive its near impossible.

- A bit easier getting low deposit finance with Kainga Ora changes.

- Still limited ability to lend to those with a deposit of less than 20%.

- Barely any lending over 80% except First Home Loan and the queues are horrendous.

More or fewer investors looking for mortgage advice?

Comments made by advisers regarding bank lending to investors include the following.

- Servicing is tight with increasing test rates, large scaling of rent and separating rates and insurance for each property.

- One lender at a smaller NZ bank explicitly said they didn’t really have much appetite for investor lending at the moment and would prefer to grow their owner occupied book more instead.

- Ok for new build, existing forget it.

- Still 60% LVR for existing properties. Higher discount of rental income for existing property rental income compared to new build properties.

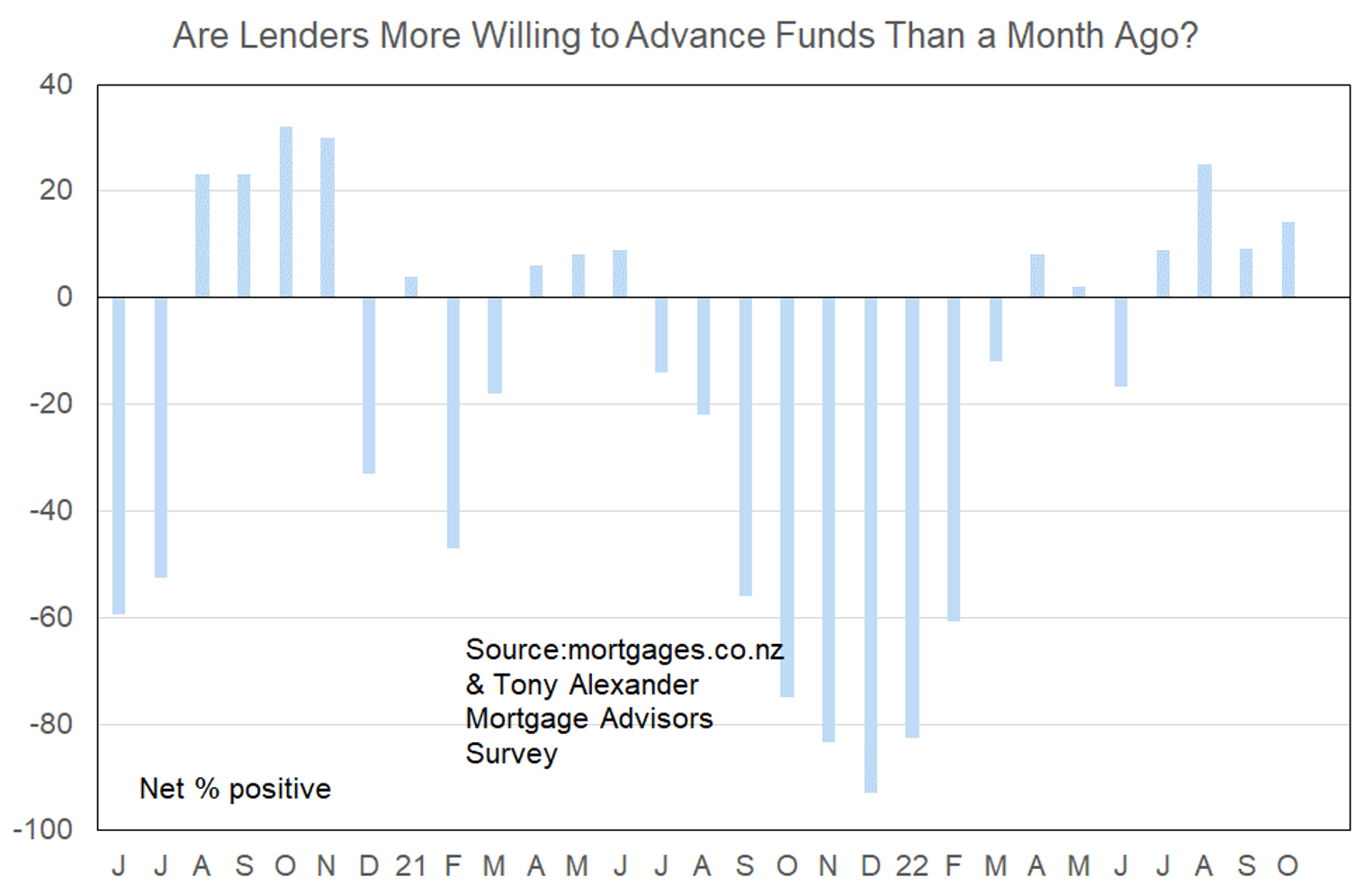

More or less lenders willing to advance funds?

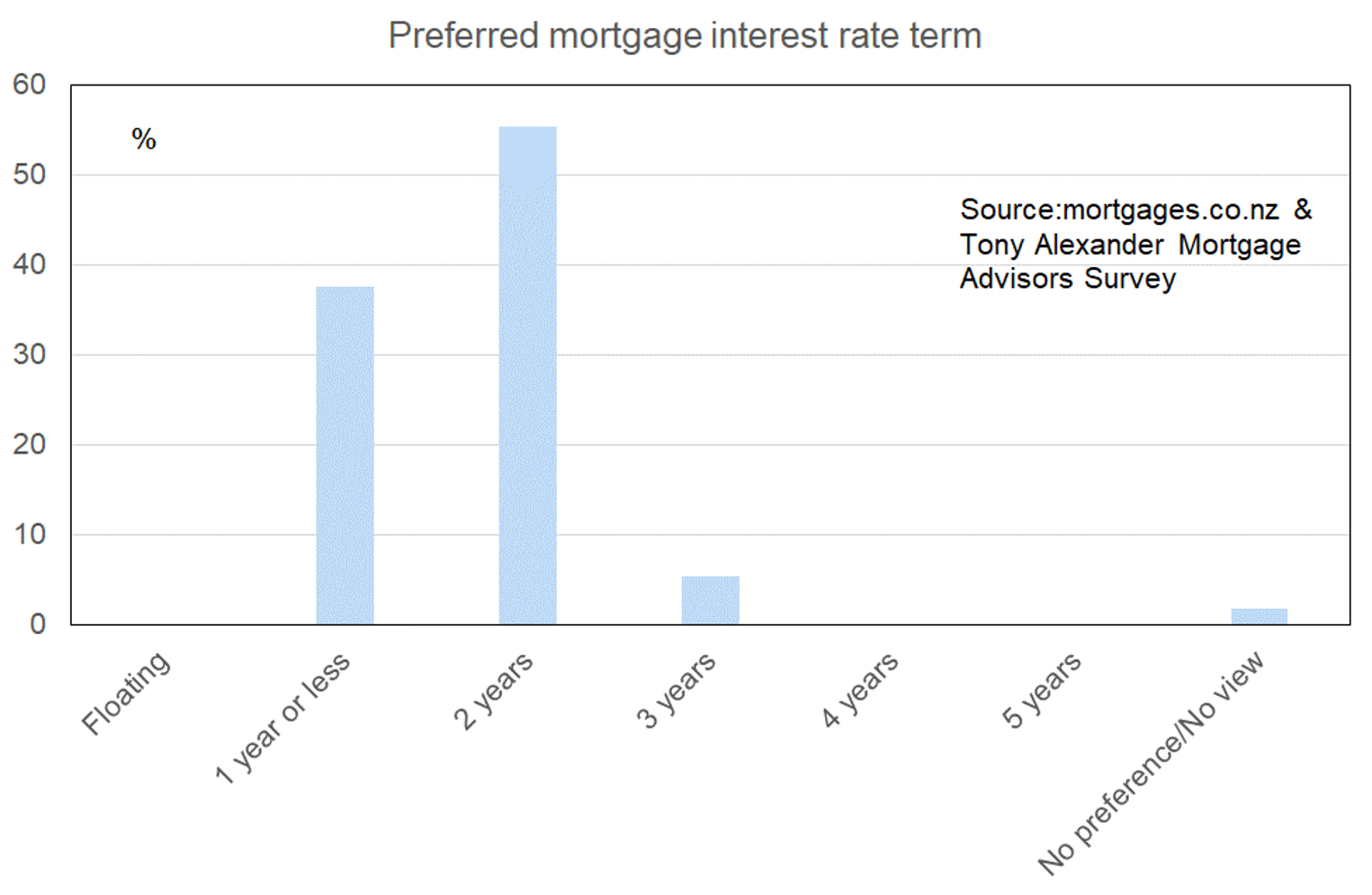

What time period are most people looking at fixing their interest rate?

Around the world concerns about rising interest rates have soared in the past month in response to a substantial easing of fiscal policy in the United Kingdom raising concerns about a debt blowout when the ratio of government debt to GDP is already 100%. In addition, inflation measures in the United States continue to print largely on the higher than expected side. Plus, there is some renewed upward pressure on oil prices and therefore inflation stemming from OPEC’s decision to cut oil output.

Hikes in wholesale borrowing costs facing banks have led to some fixed mortgage rates for shorter terms going up and unless things change very quickly in the wholesale markets further increases for all terms are likely as banks seek to rebuild currently very crunched margins.

As a result of the reduced optimism about interest rates borrowers have pulled back on their enthusiasm for fixing just one year. Last month 58% of advisers said that borrowers preferred the one year term. This month 38% have said that.