Lockdown impact eases

Each month we invite mortgage brokers around the country to give insights into developments in the residential real estate market from their unique perspective. The first survey was done in June 2020 just after the first nationwide lockdown ended and we could easily see from the responses the high level of interest from first home buyers and investors through last year’s winter into February this year.

From March we could see the immediate impact on sentiment of the tax changes announced by the Finance Minister on March 23. But we then saw the initial wave of pessimism ease off, only to return from late-August when the country went into the second nationwide lockdown.

Now, in our most recent survey we can see the initial shock to sentiment has eased. But overall there remains an air of caution as we head into summer and through a spring still heavily affected by Covid-related restrictions.

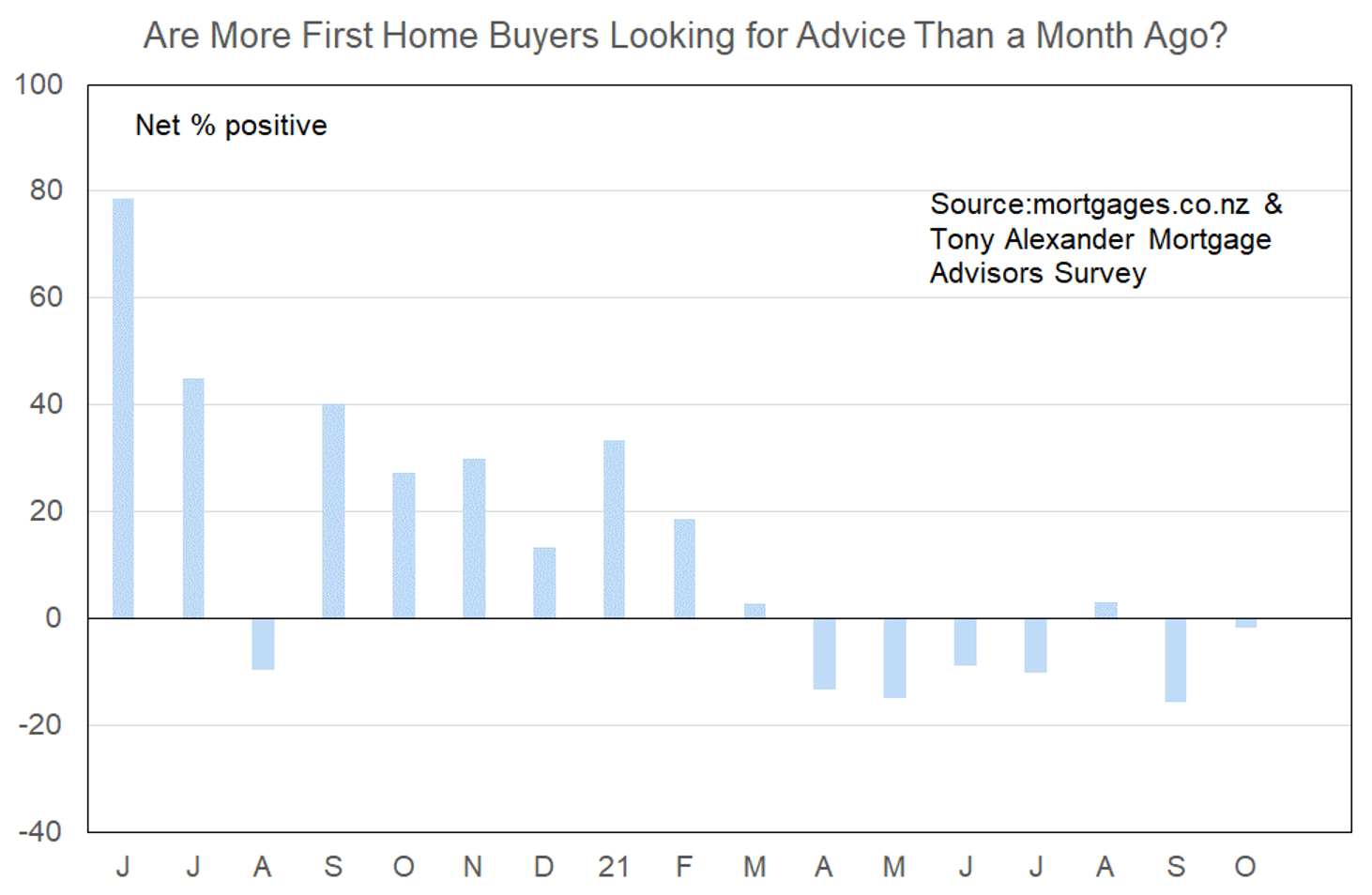

More or less first home buyers looking for mortgage advice

With Auckland still in lockdown it is not surprising that the overall result for first home buyer interest is negative. History tells us that when lockdown lifts, we should expect to see a lift also in young buyer activity. However, there will be restraint on this improvement for reasons which were not there in June last year.

These new factors include reduced ability of banks to lend to borrowers with low deposits, higher interest rates with more rises expected ability to travel overseas looking more possible, and banks applying tougher scrutiny of expenses and incomes to meet new rules being applied from December 1.

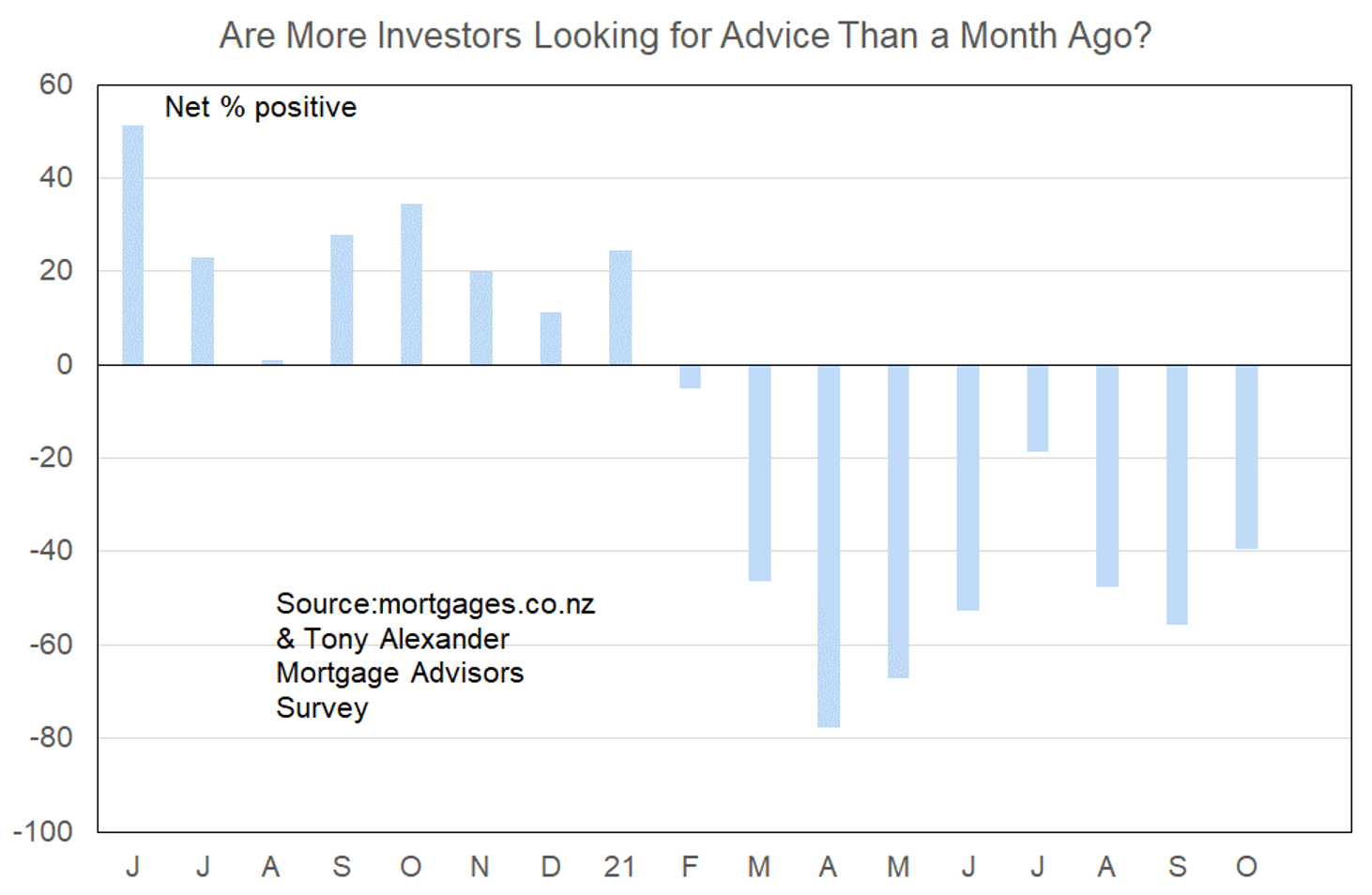

More or less investors looking for mortgage advice?

There has been an improvement in the net proportion of mortgage advisors who report that they are seeing more enquiries from investors. But the gain is only to a net 39% seeing a deterioration from 56% last month.

Therefore, although there has been a slight easing in investor pessimism, overall the strong impact on investor willingness to make additional purchases following the March 23 announcement remains.

Mortgage rates are now rising and expectations for the extent of rises are likely to increase as people digest the impact of inflation hitting 4.9% and being set to exceed 5% in three months. Record low interest rates for borrowers and on bank deposits have been key factors globally in driving a wave of investor demand for residential property. Rising rates are likely to offset the effect of lockdown ending, so it would not be surprising if this particular measure of market strength stays in negative territory for a long period of time going forward.

However, rising construction and improved development opportunities from removal of resource consent requirements for three storeys/three-unit complexes in our biggest cities means many investors are likely to remain actively engaged in the property market and seeking assistance from mortgage advisors.

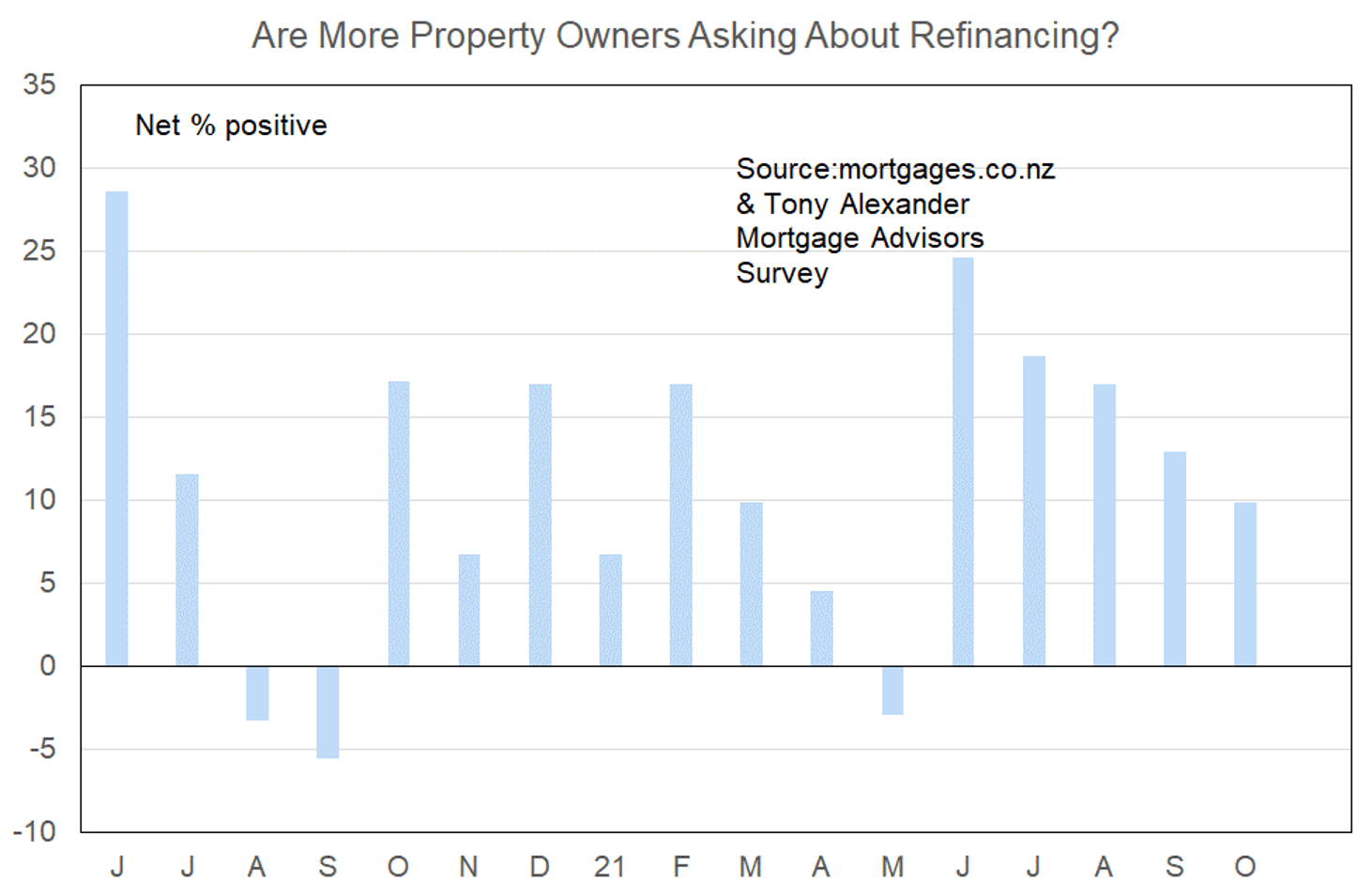

More or less property owners looking for refinancing?

In June there was a large jump in the net proportion of mortgage brokers reporting that they were seeing more requests for refinancing. The trigger for this surge seen in the following graph may have been heightened discussion regarding interest rates rising. However, with inflation just reported at 4.9% and even greater awareness of rising interest rates, this time around there has not been any extra firming in refinancing enquiries.

In fact there is a downward trend in the net proportion of advisors reporting more such enquiries. Nonetheless, such enquiries remain above average. With some investors selling one or two properties to retire debt, or perhaps switching their wealth into other assets following a stellar run, refinancing enquiries could easily regain strength.

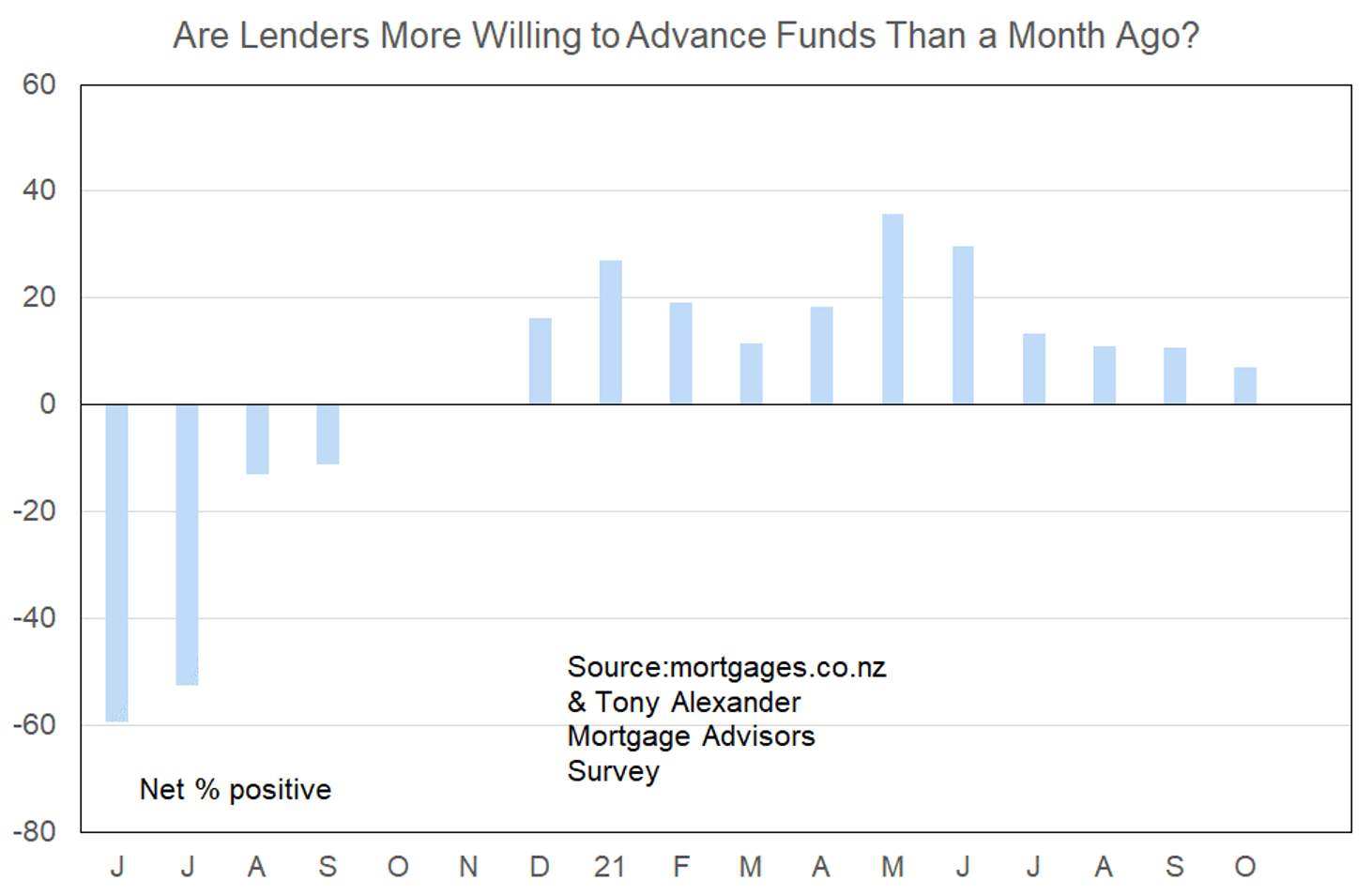

More or less lenders willing to advance funds?

This is reassuring in the context of the many changes underway relevant to where house prices will go over the long-term (rising supply, tax changes etc.)

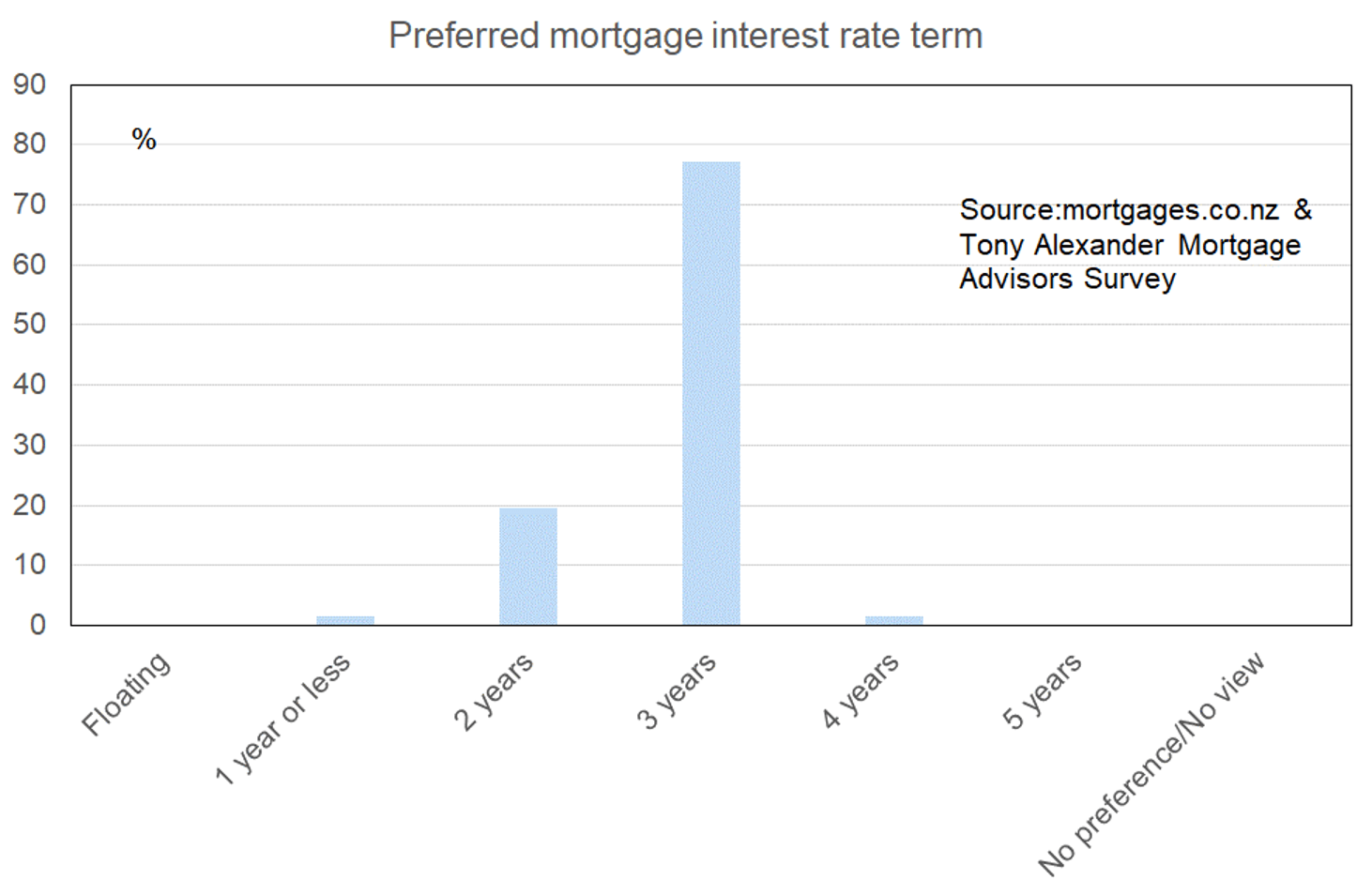

What time period are most people looking at fixing their interest rate?

Our most recent survey has revealed that 77% of mortgage advisors are seeing clients show greatest preference for fixing their mortgage interest rate over a three-year period. Last month this proportion was 57% and the rebound perhaps reflects a reduced focus on the short-term negative impacts of lockdown which stayed the Reserve Bank’s hand on August 18.

The official cash rate has now been raised 0.25% to 0.5% and the recently released much higher-than-expected inflation numbers suggest the potential for interest rates to rise is much greater than the Reserve Bank and most people have been anticipating this past year.

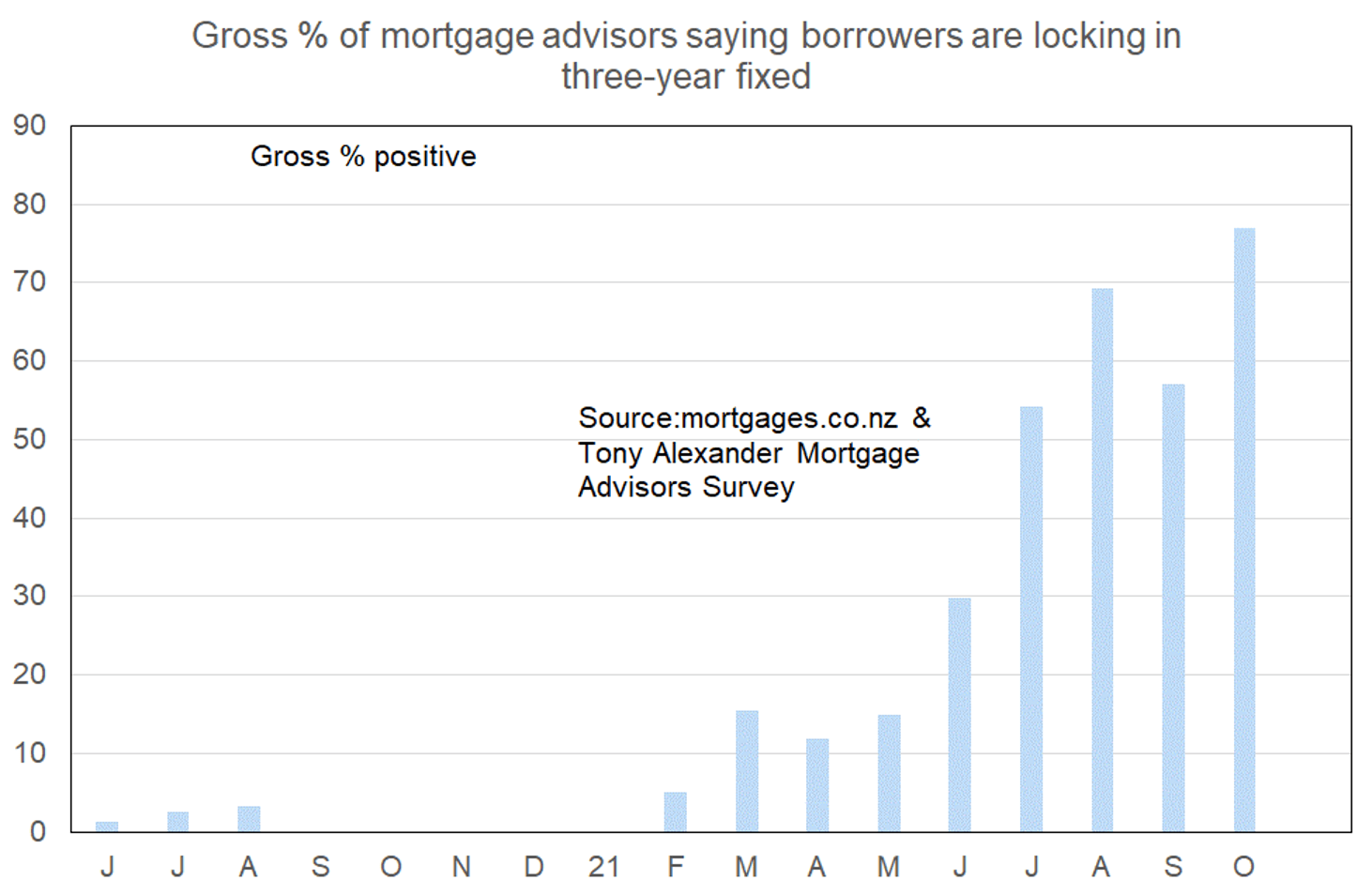

These next graphs show the change in borrower fixed term preferences, starting with the now popular three-year period.

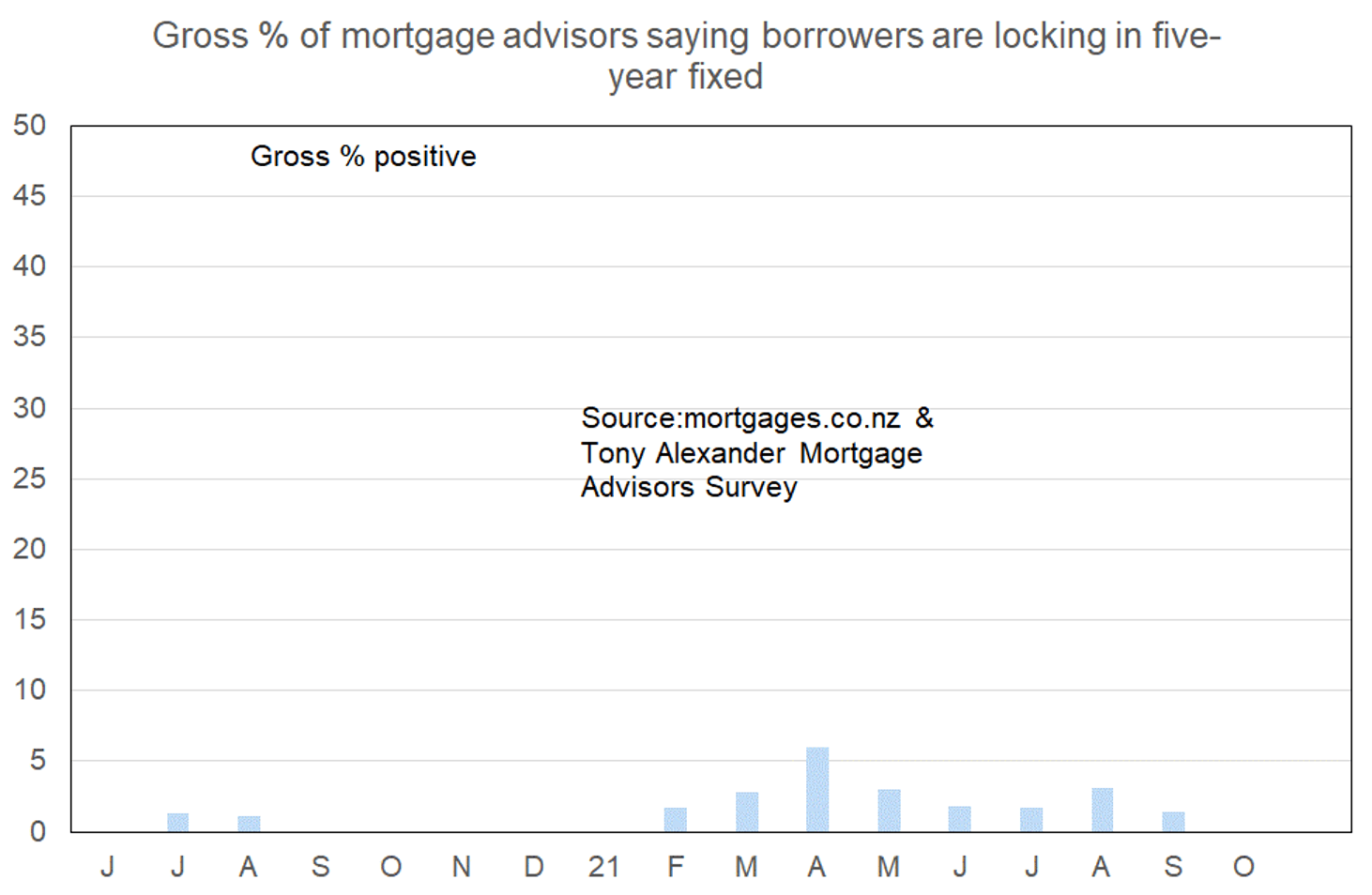

Historically, New Zealanders only rarely fix their interest rate for longer than three years. That helps explain the continuing low proportion of mortgage advisors reporting that people wish to fix five years. In fact, this month no advisor said five years is the preferred term.

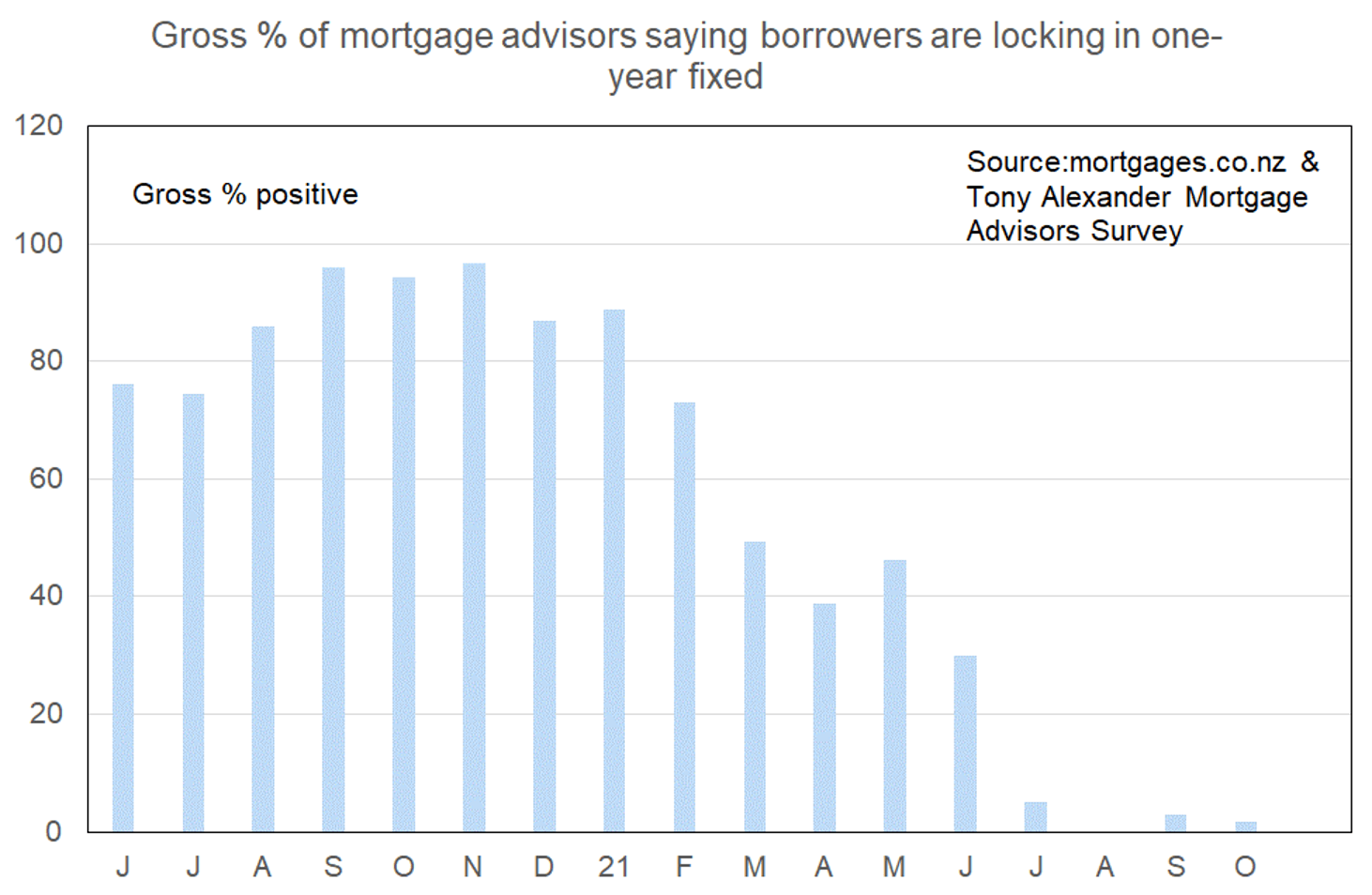

Very few borrowers are now opting for the previous most popular term of just one-year.

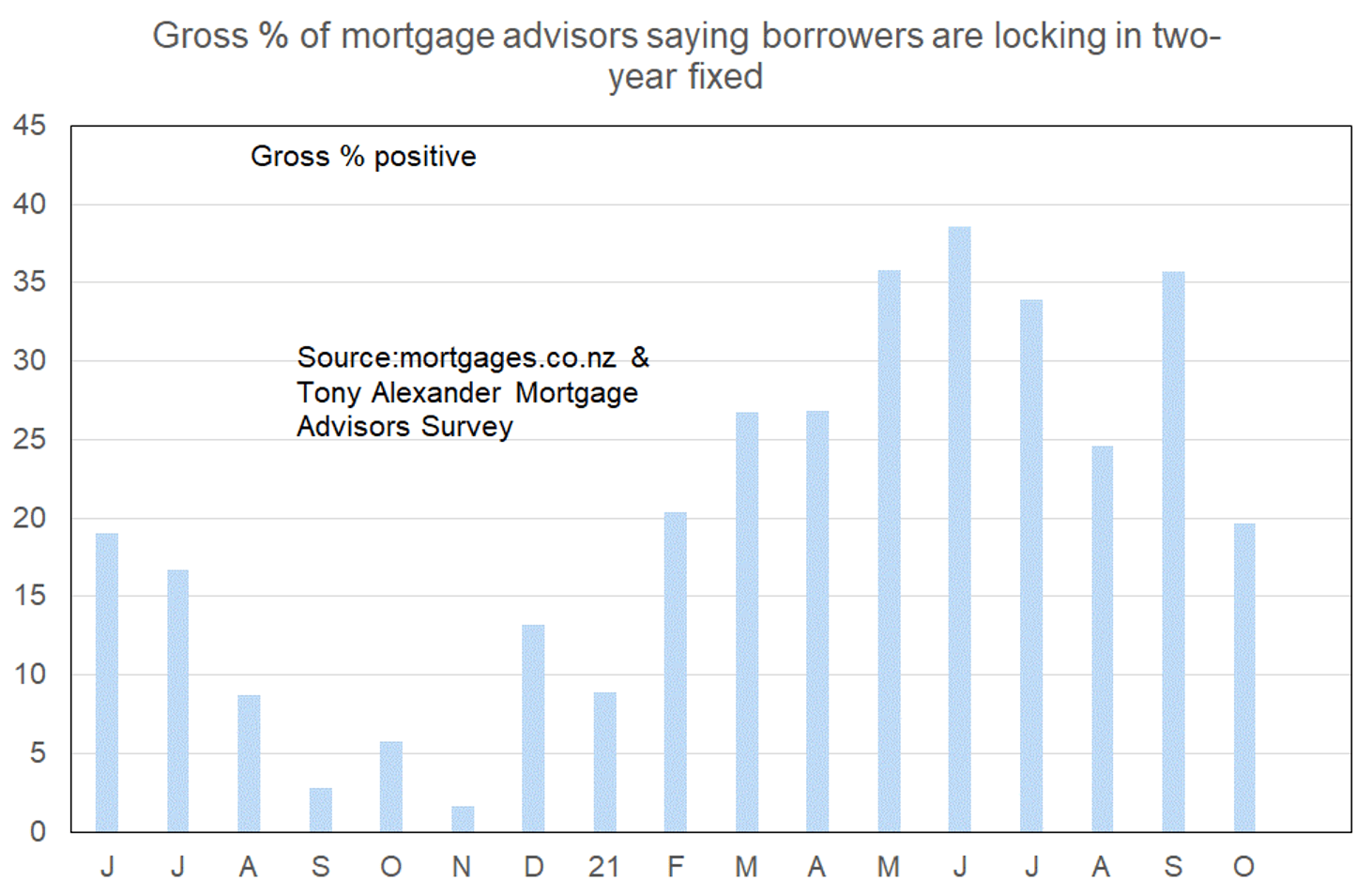

The two-year term in contrast has become more popular, but not to the same extent as the three-year term.