Investors slowly returning.

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 75 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- First home buyers remain actively engaged with the housing market.

- Demand from investors is rising.

- Confirmation of a change in government alongside discussion of rising prices is bringing more people into the market.

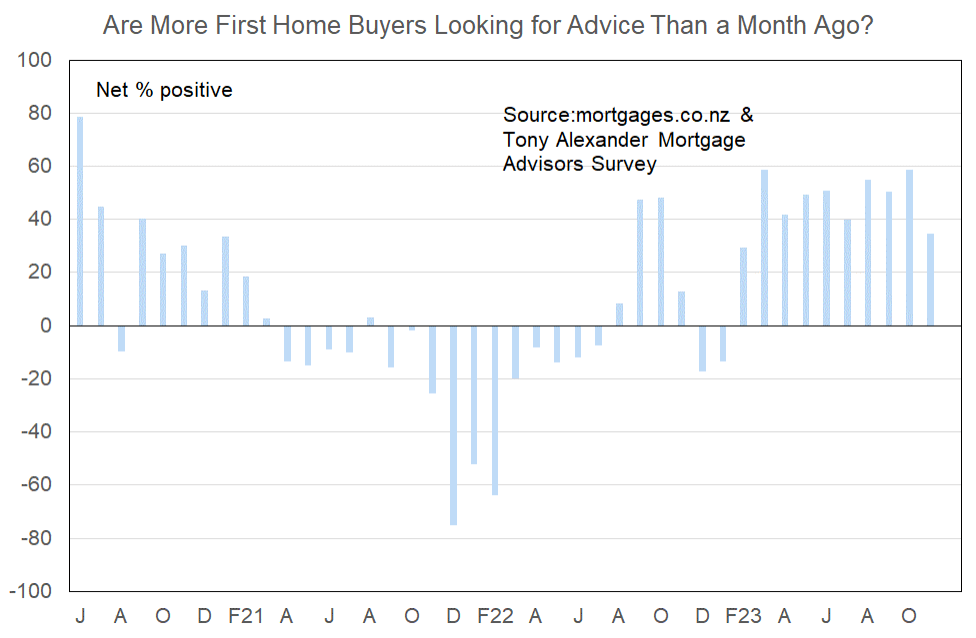

More or fewer first home buyers looking for mortgage advice

This month 75 mortgage brokers from around New Zealand have responded to our survey and the first result of note is that a net 35% report they are seeing increased numbers of first home buyers looking for advice. This is a decline from a net 59% in October but consistent with the strong results in place since February this year.

First home buyers have been the key drivers of the turning in New Zealand’s residential real estate market this year and our survey shows they remain well engaged with the market – despite extra rises in interest rates recently.

Comments on bank lending to first home buyers submitted by advisers include the following.

- Same criteria as always. Not so hard on discretionary spending.

- Over 80% is still limited if not eligible for the first home buyer’s mortgage. It is hard for buyers not being able to obtain a pre-approval. There has been a small softening in UMI’s required for over 80% but very little else.

- xxx new policy for those with less than 20 % deposit ,will accept 1 boarder up to $ 200 PW.

- Servicing requirements continue to be tight in relation to high LVR lending across all the main banks. When clients aren’t eligible under Kainga Ora first home loan scheme there remain limited options to proceed with other than mainly a ‘live’ deal which is then subject to low equity margins etc.

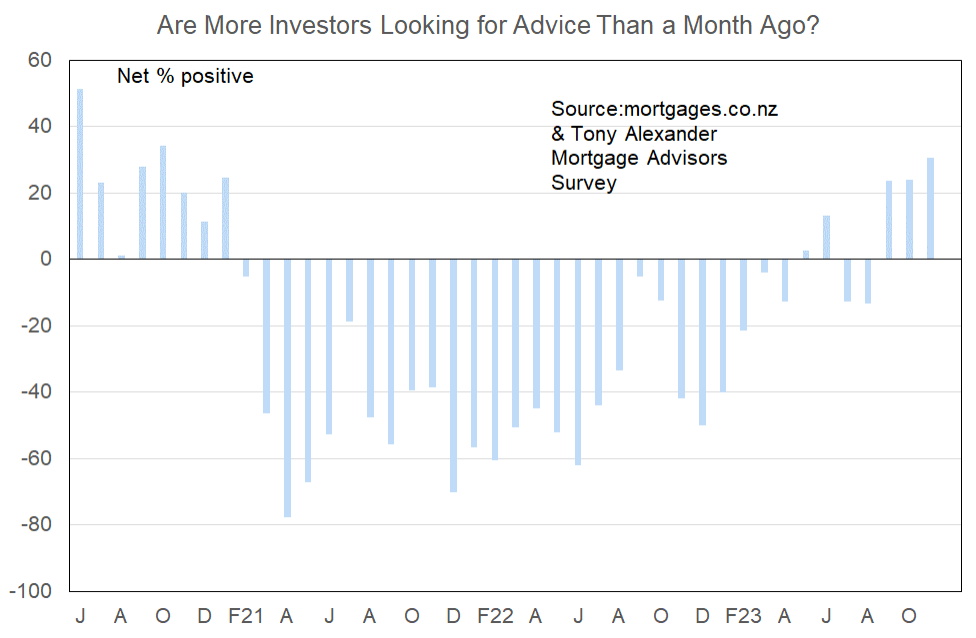

More or fewer investors looking for mortgage advice?

For the third month in a row the net proportion of brokers reporting that they are seeing more investors seeking advice has increased. The outcome this month is a net 31% from 24% last month. Three months ago a net 13% were still saying there were fewer investors in the market.

As the graph clearly shows, there has been a firm turnaround in investor interest in recent months.

Comments made by advisers regarding bank lending to investors include the following.

- Reduced hair cuts on rentals at one large bank.

- Rental calculations vary across banks, with some banks trimming the rental income very hard. Some count rates and insurance as an expense, some don’t.

- A few are easing up but its still pretty tough.

- Waiting on confirmation of changes to interest deductibility laws.

- Loan servicing assessed at 9.15% is a tough hurdle to jump.

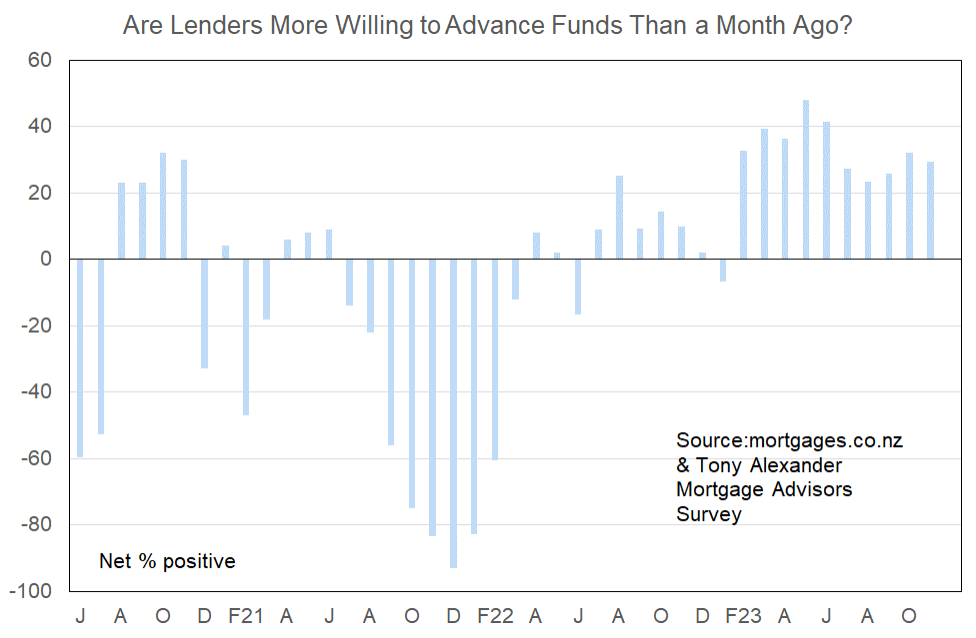

More or less lenders willing to advance funds?

A net 29% of mortgage advisers have reported that banks are becoming more willing to advance funds. This outcome is consistent with others since February and the comments supplied by respondents show that lenders are slightly and slowly improving lending rules as each month goes by. But they remain hesitant to make any large changes.

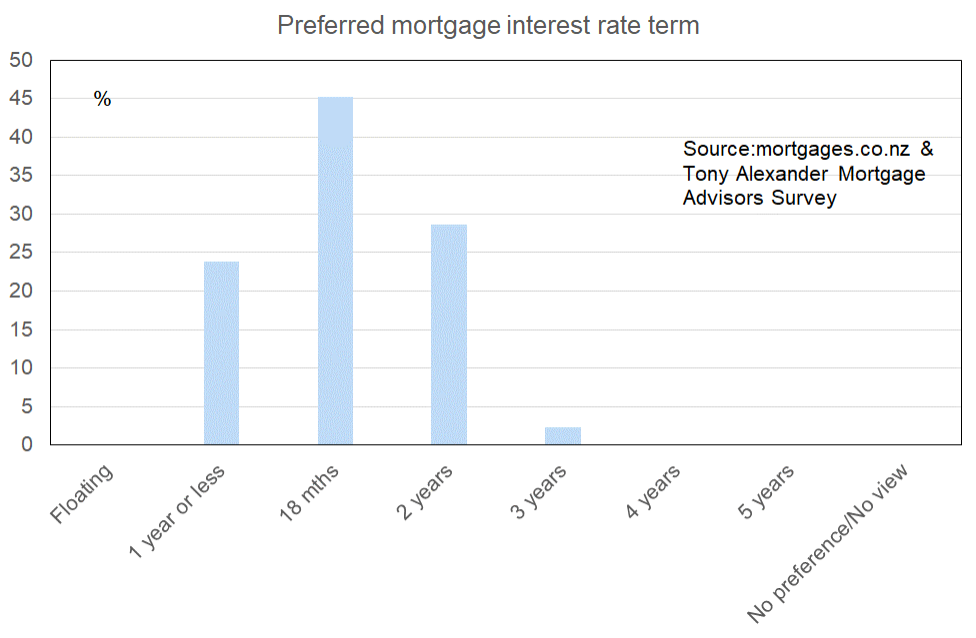

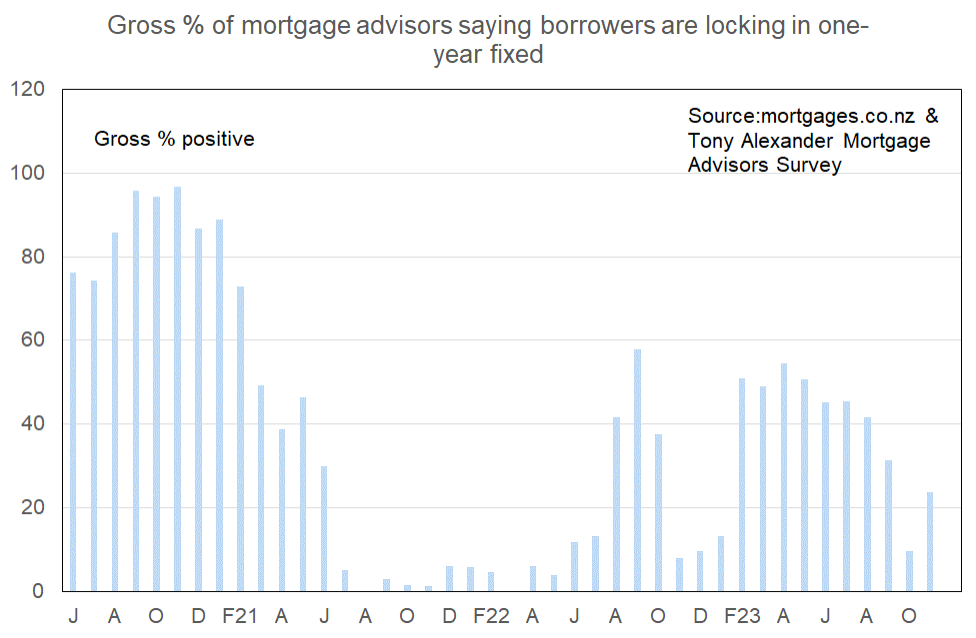

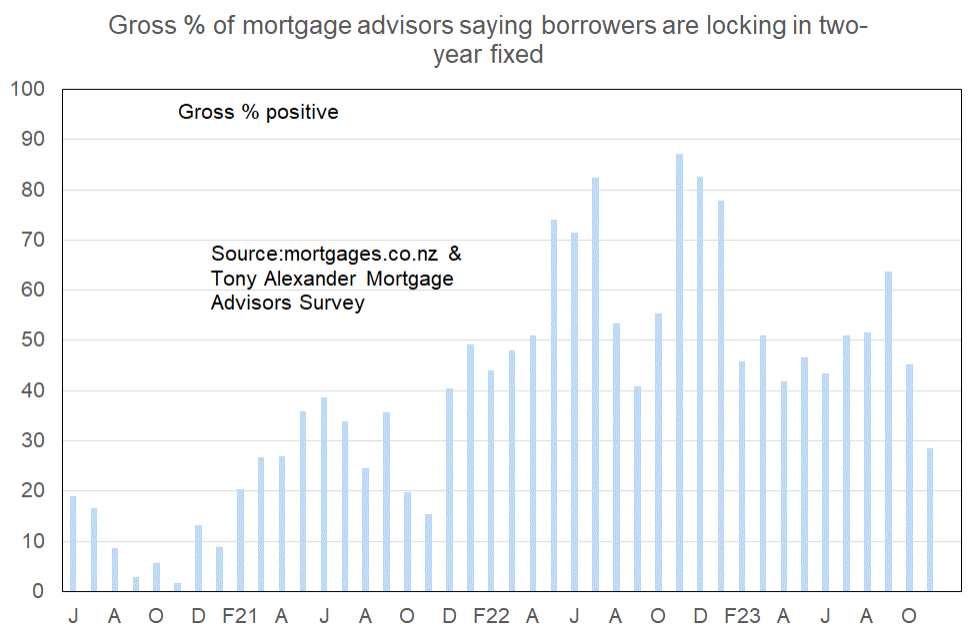

What time period are most people looking at fixing their interest rate?

We might be able to interpret these shifts as meaning people are becoming slightly more confident of rate falls a year or so from now.

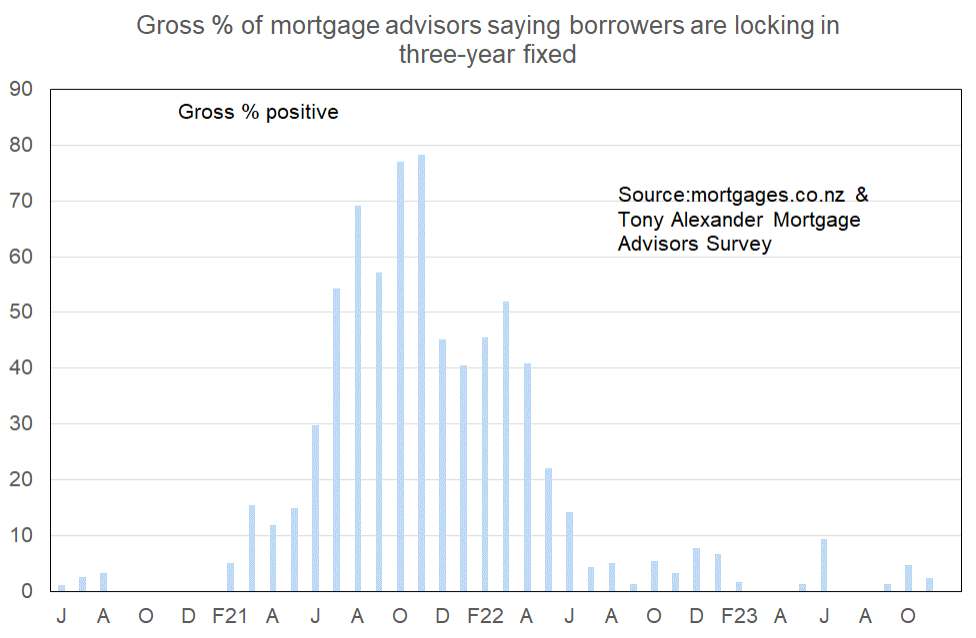

For the record, here is the graph of brokers saying the three year term is most preferred.

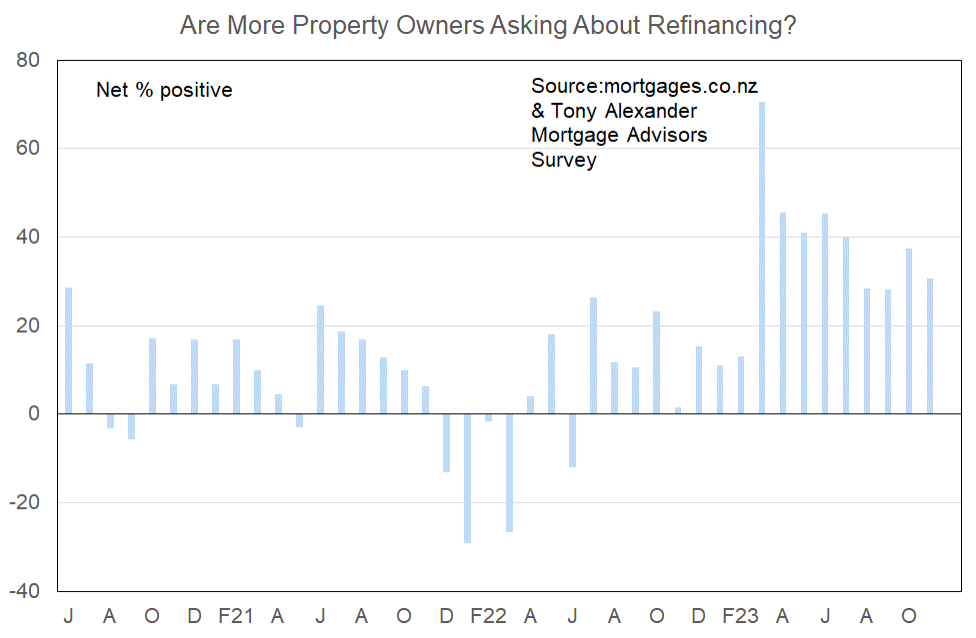

Are more property owners asking about refinancing?