Rate rise impact evident

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 62 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- The recent round of fixed mortgage rate increases has made investors step much further back from the market.

- First home buyers are showing in increasing numbers but at less of a pace than before the rate rises.

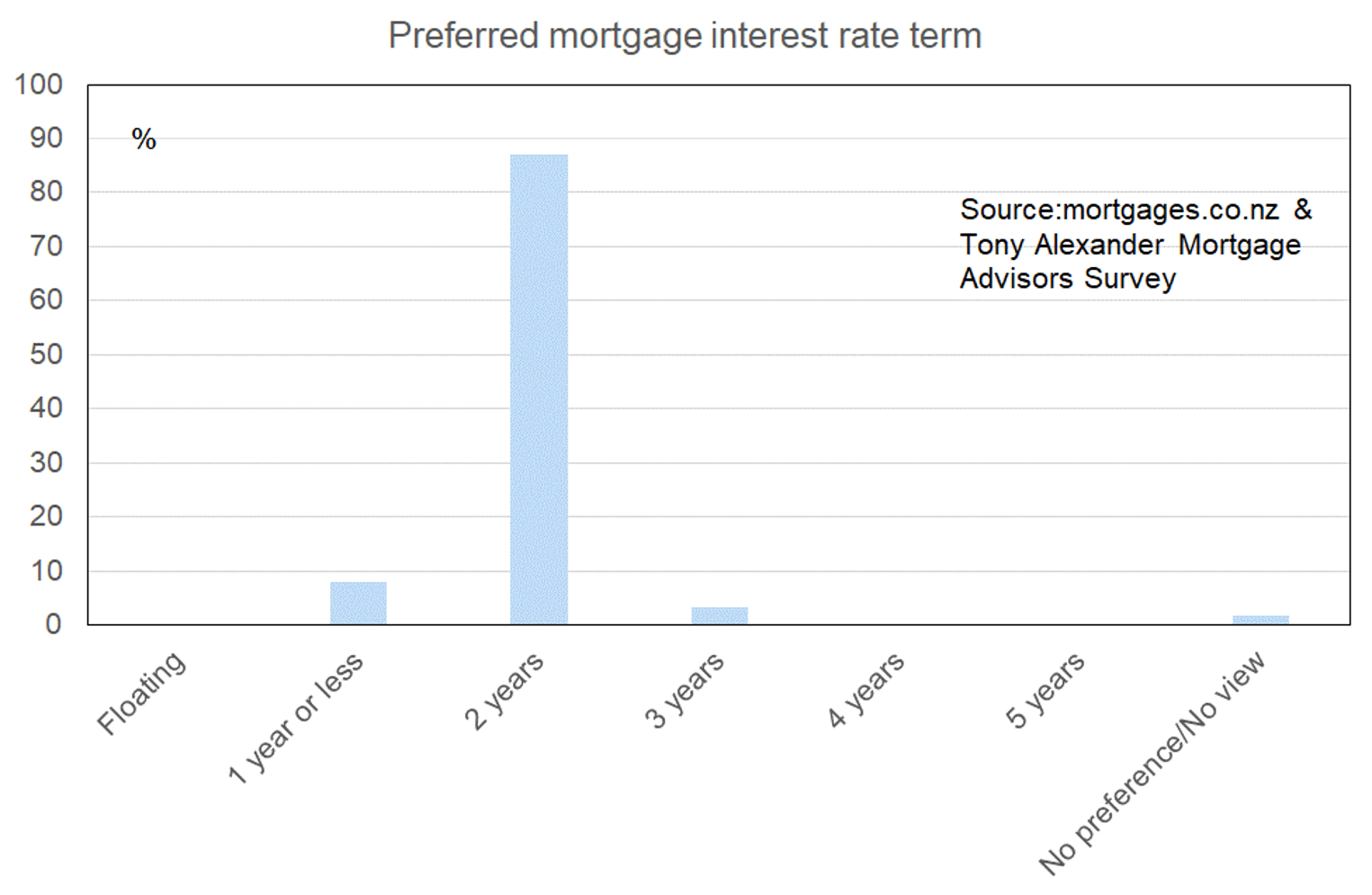

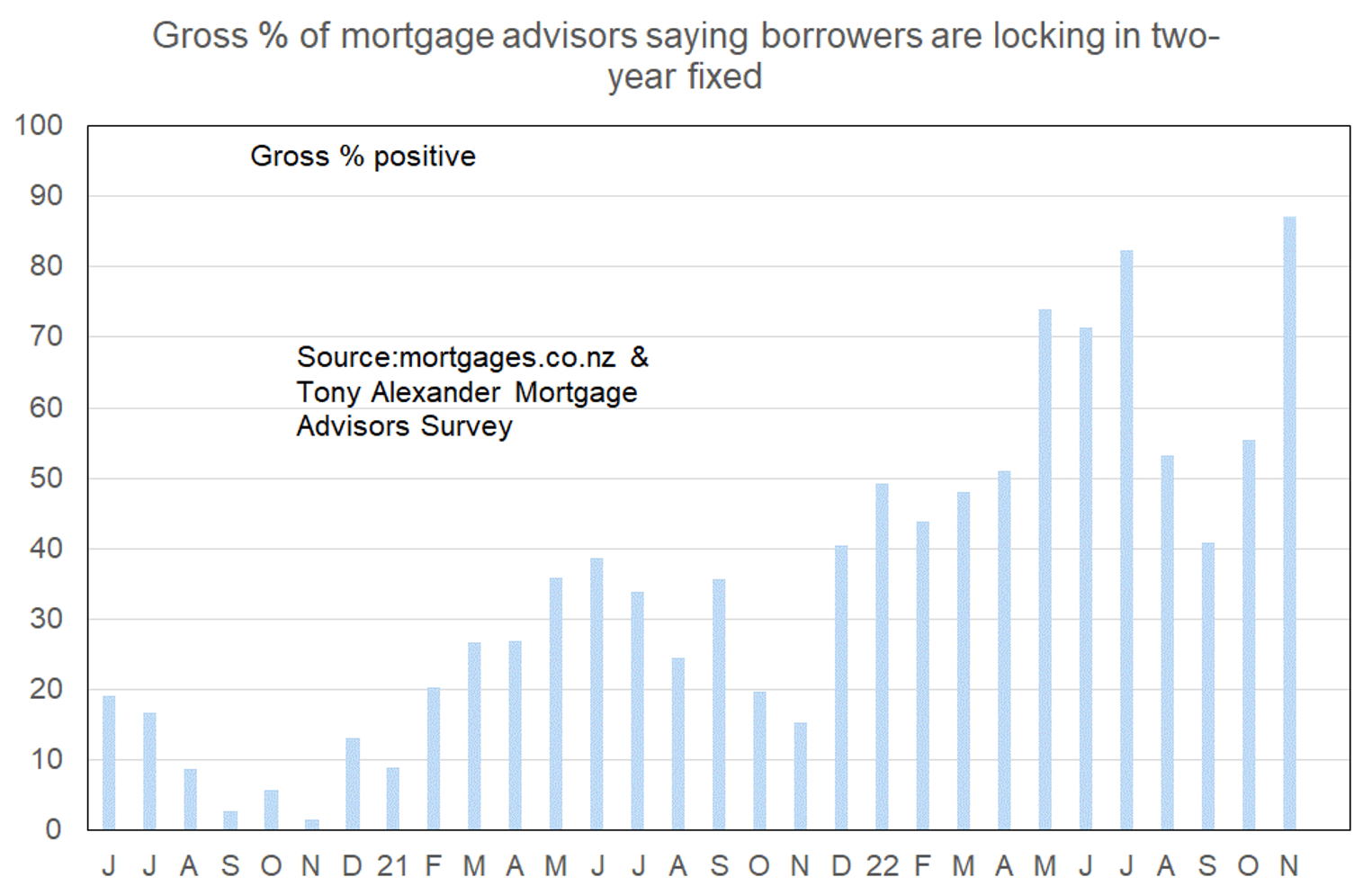

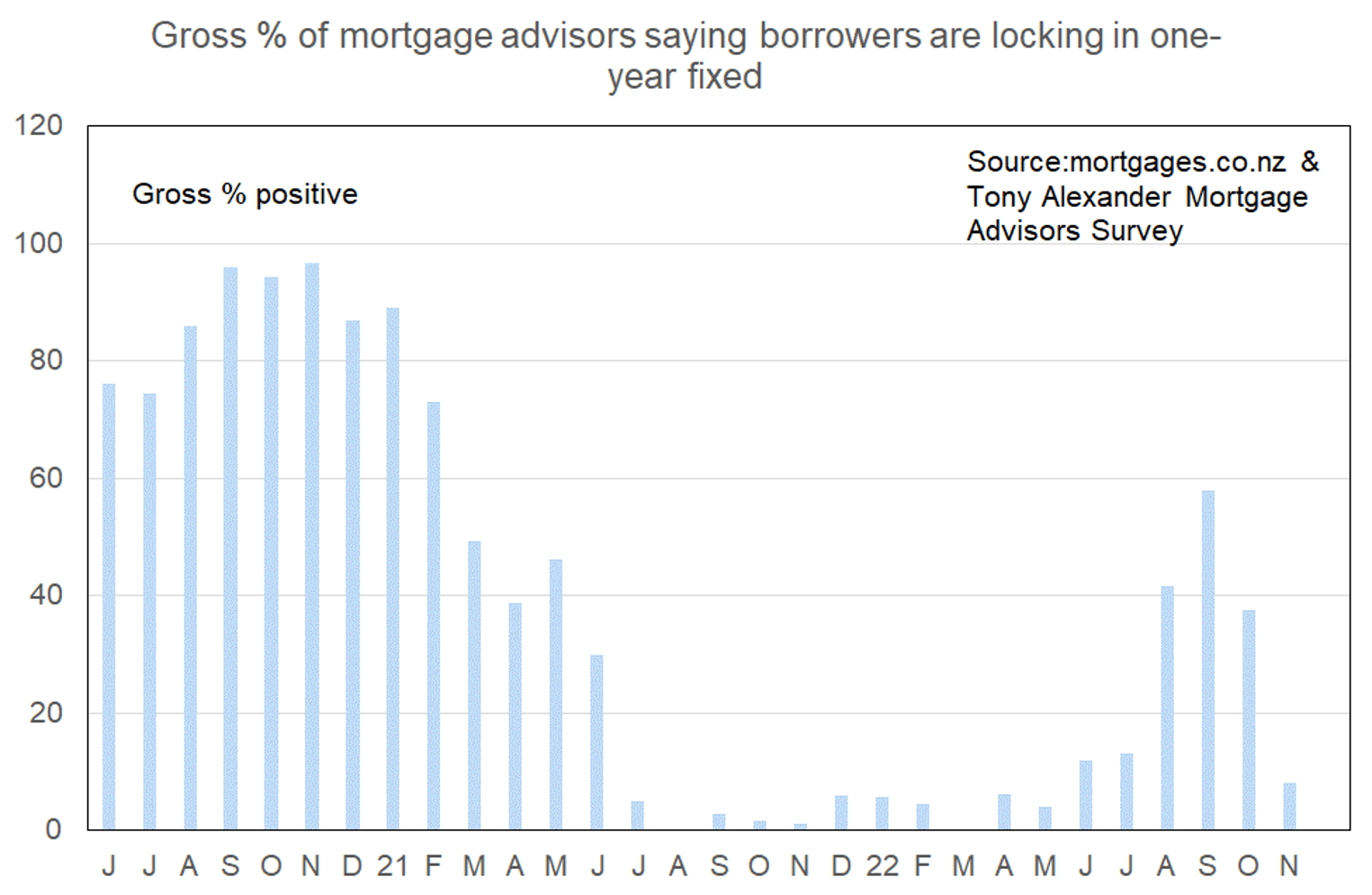

- The term preferred by borrowers for fixing their interest rate has shifted strongly to two years.

- Bank willingness to lend is very slowly improving. But meeting debt servicing requirements is very hard for many borrowers.

- Many buyers are holding back, waiting until they are confident interest rates will decline and that house prices have stopped falling.

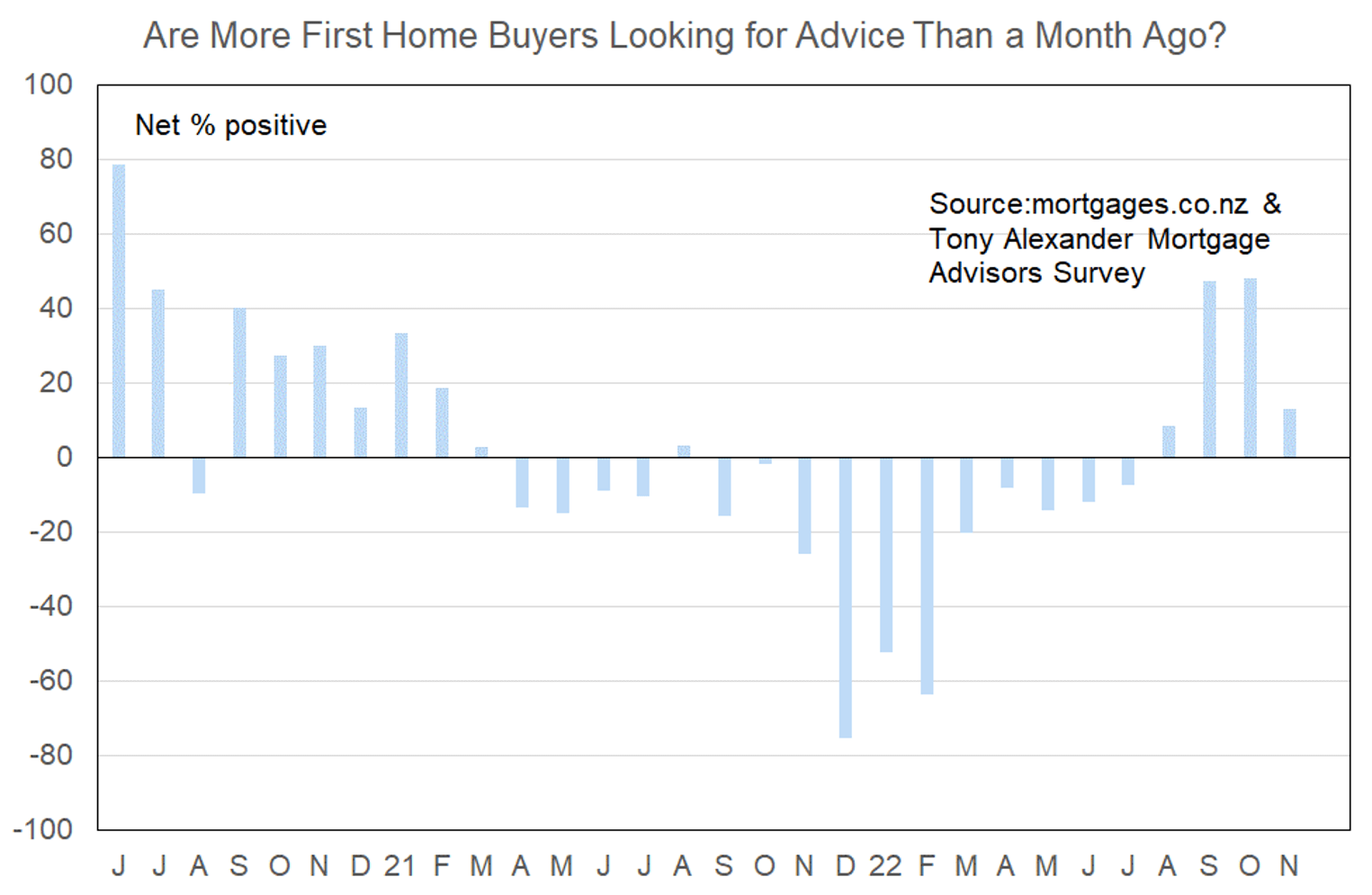

More or fewer first home buyers looking for mortgage advice

There has been a decline in the net proportion of mortgage advisers saying they are seeing more first home buyers in the market to 13% from 48% in both October and September. The flow is back to slightly better than it was in August and remains positive.

First home buyers appear to be aware of the opportunity being presented by the current market where prices have fallen while incomes have risen, competition from investors and owner occupiers is weak, and listings are plentiful.

Comments on lending to first home buyers submitted by advisers include the following.

- Some of the big banks are slowly reducing their UMI (uncommitted monthly income).

- Thresholds for lower deposit lending, still very high and quite restrictive.

- Similar appetite but limited high-LVR options available aside from Kainga Ora.

- Banks more willing to get deals over the line – will make suggestions in how to adapt your application to make the deal work. Offering 1% cash for new loans over certain amount.

- Banks are lending.

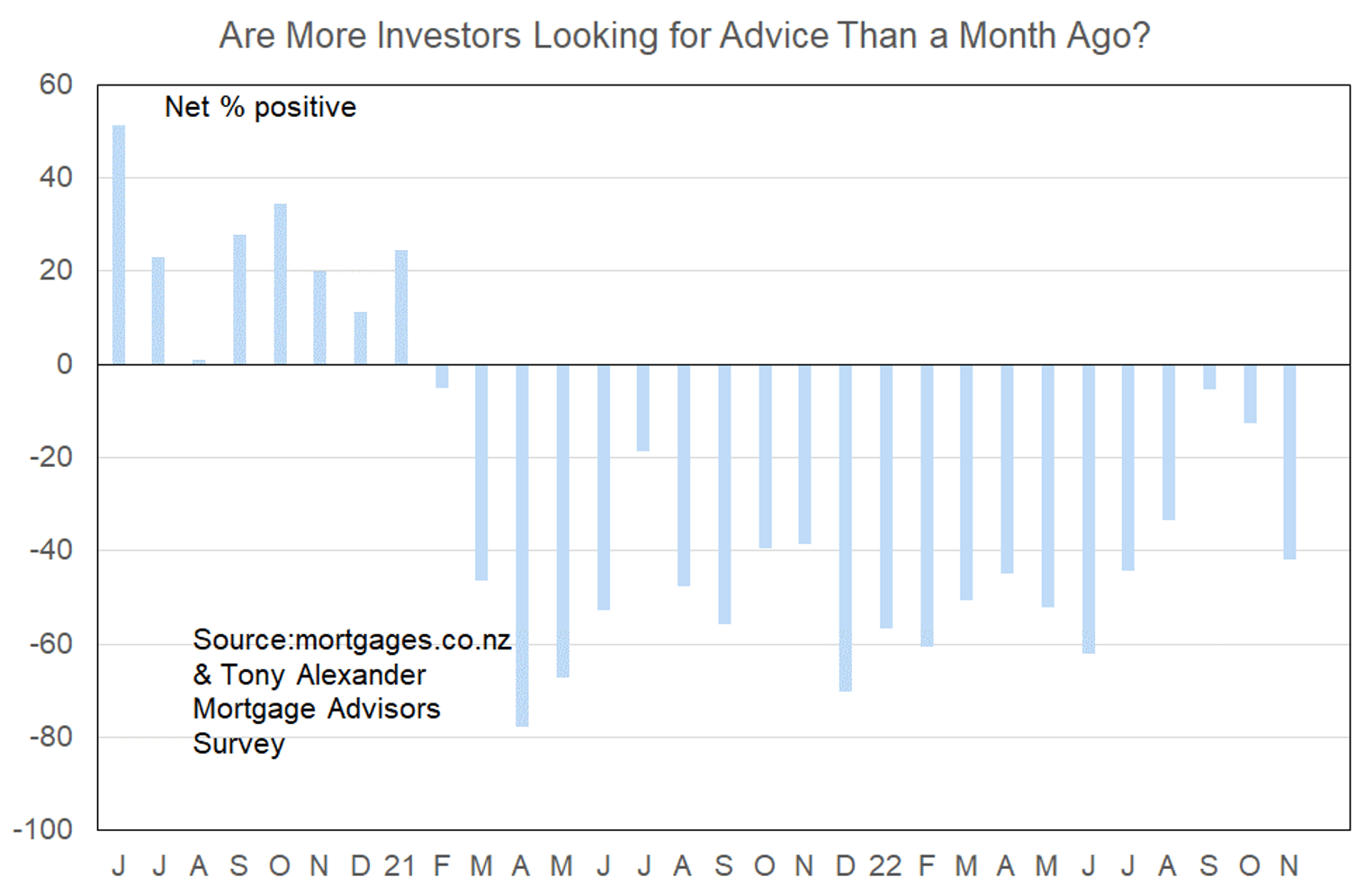

More or fewer investors looking for mortgage advice?

As first home buyers have returned to the market in recent months investors have been showing a decreasing tendency to desert any thoughts about making a purchase. However, since the latest round of interest rate rises following the higher than expected inflation outcome, investors have again run for the hills.

A net 42% of mortgage advisers have reported seeing fewer investors, down from a net 13% in October. As the graph shows, the role of investors in the residential real estate market has gone back largely to where it was between the period from February last year up until August this year. This result is consistent with that seen in my recent survey of real estate agents. First home buyers still there, but investors absent once again.

Comments made by advisers regarding bank lending to investors include the following.

- High shading of income. Some banks include rates and insurance as ad expense in addition to the rental shading – others don’t.

- Xxx bank has relaxed criteria, lowered UMI from $1k to $200pm for an investment purchase, and no need to include rates / insurance costs as per other lenders

- A slight loosening of rental income scaling for existing dwelling investment properties.

- Haven’t had an investor enquiry since March 2021.

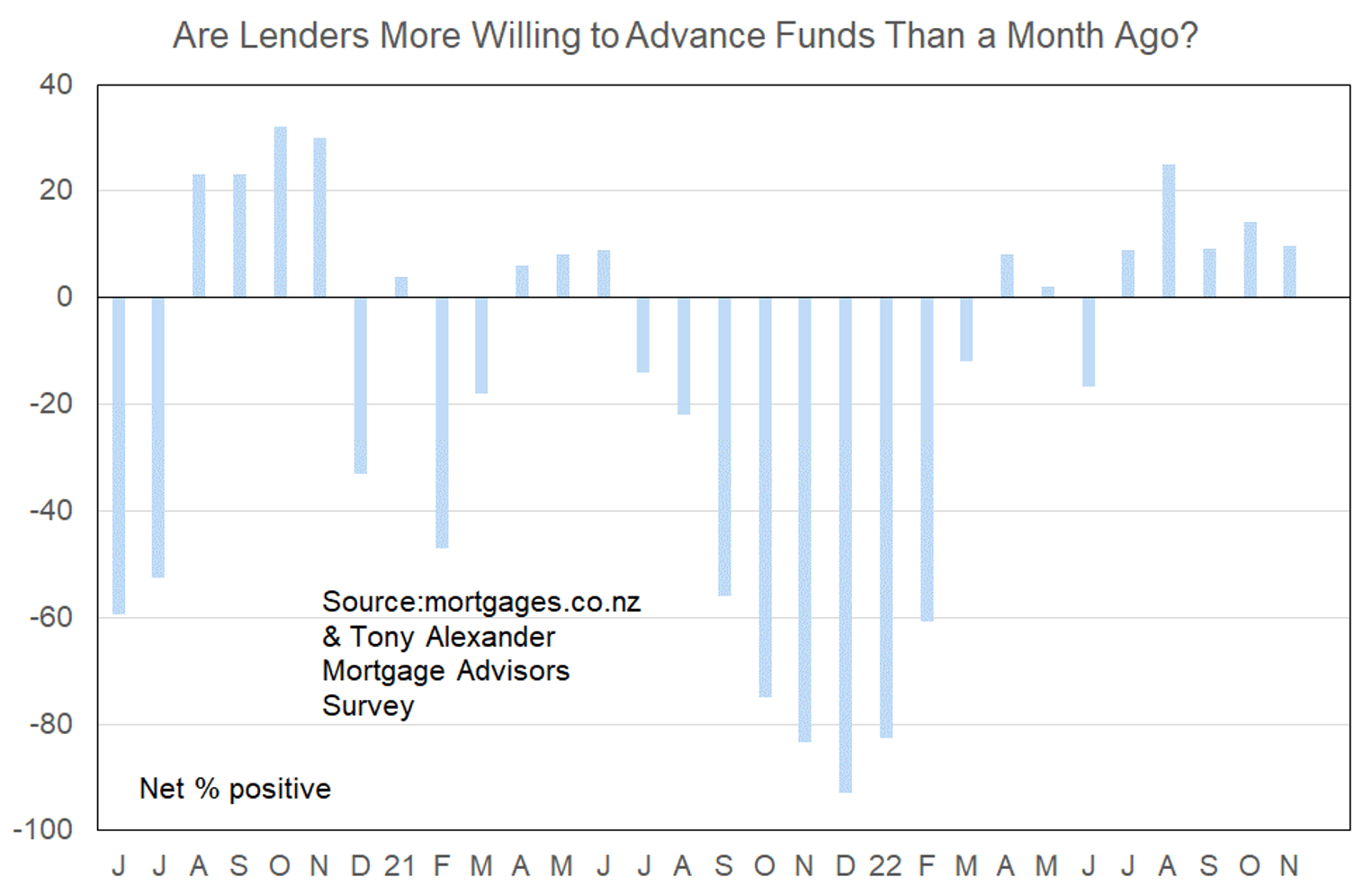

More or less lenders willing to advance funds?

The intense credit crunch over the second half or 2021 into very early this year has eased considerably as the year has progressed. Since July our survey has consistently shown more mortgage advisers feeling that banks are becoming more willing to lend. There has been no meaningful change in this measure over the past month, although the comments provided by advisers indicate more easing of criteria at the margin than has been the case for a year and a half.

What time period are most people looking at fixing their interest rate?

Given that two year interest rates are higher than one year rates this strong shift indicates a desire to protect against feared future rate rises – something not apparent for all but the most forward-looking borrowers in 2021 when five year mortgage rates were at 2.99% versus one year rates at and below 2.5%.

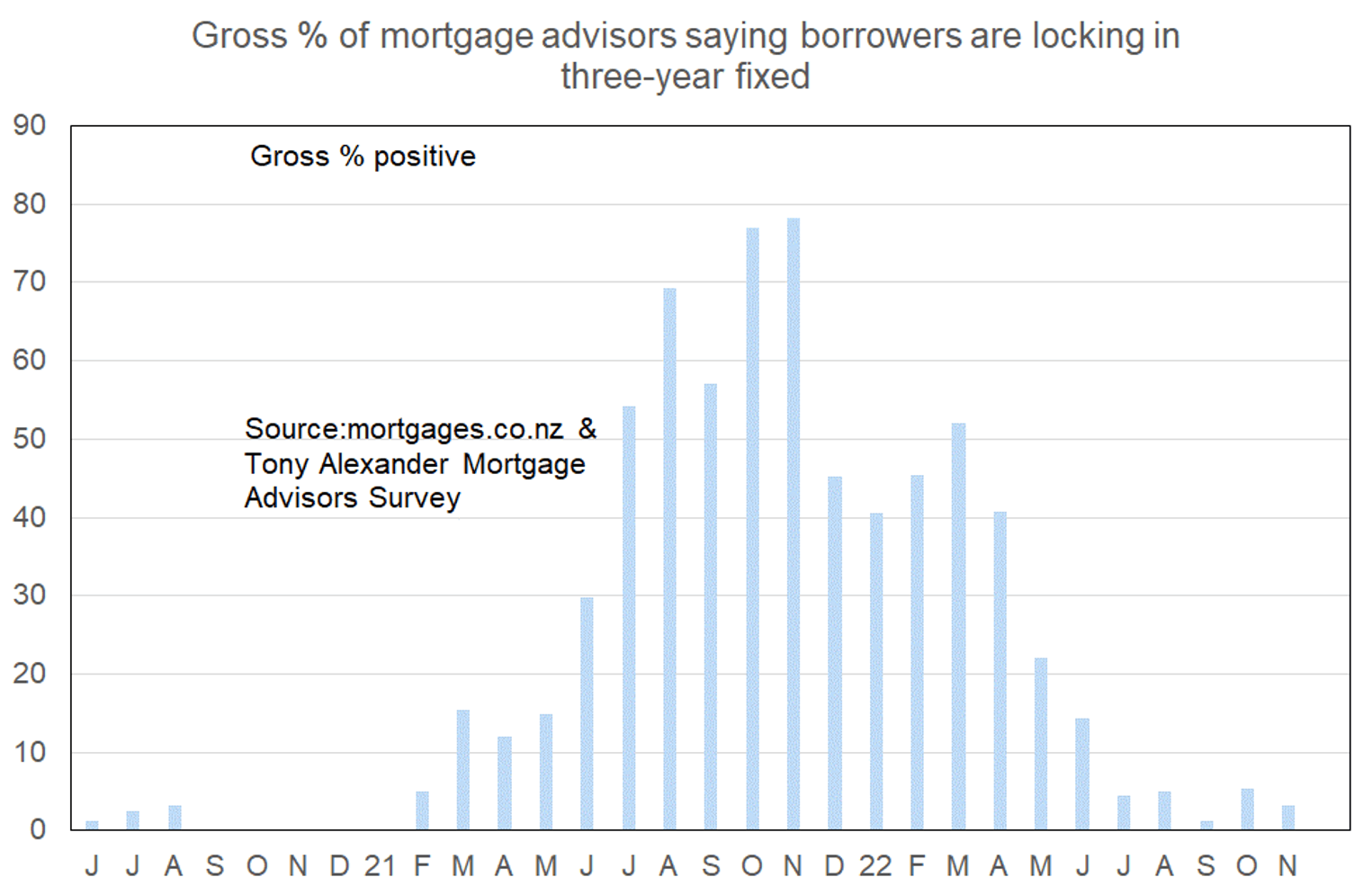

Current interest rate concerns are not great enough to push many people out to considering the three year term for fixing their interest rate.

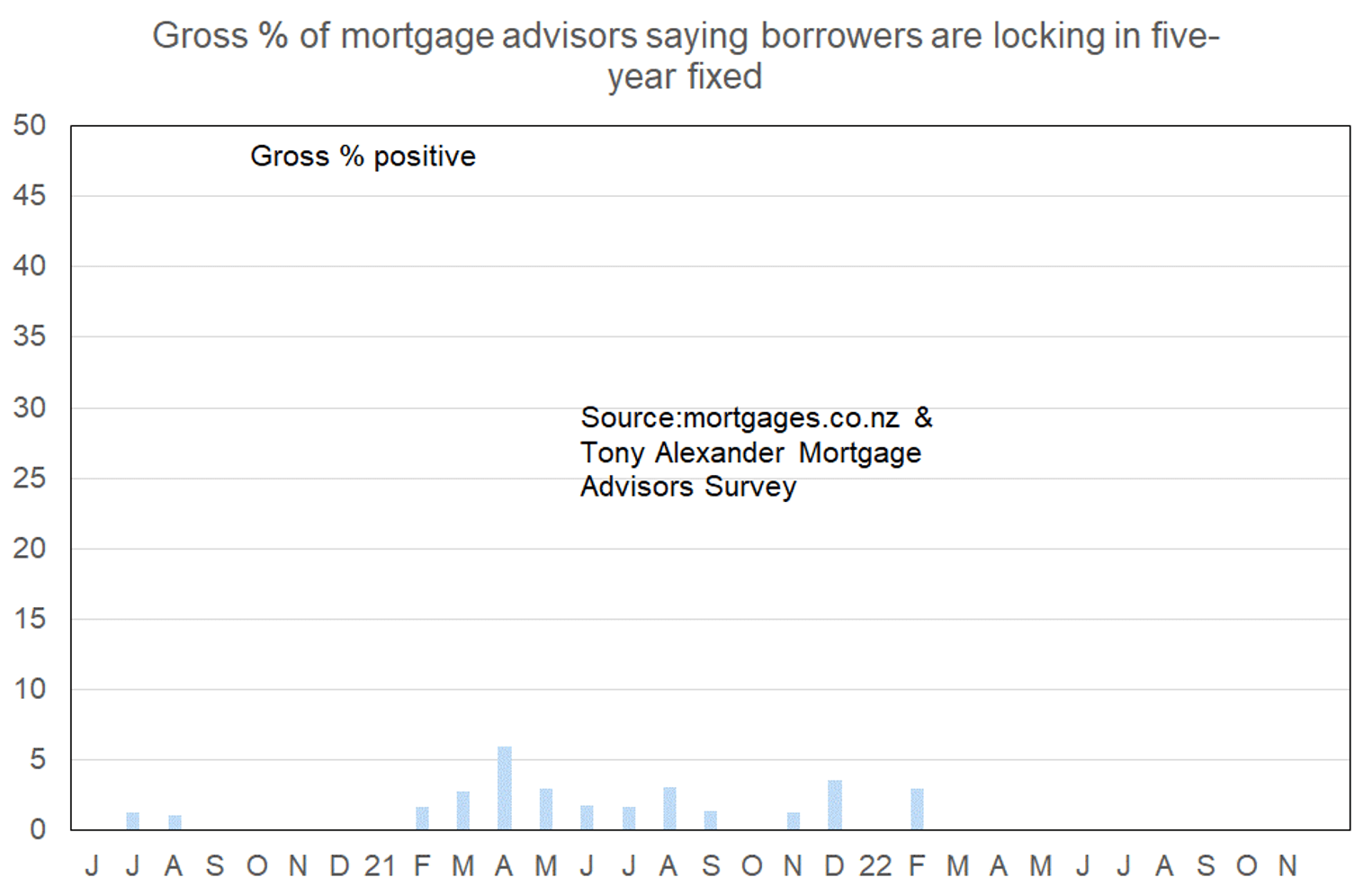

And as usual, no-one is noting demand for fixing five years.