Buyers still cautious

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken this week, attracted 46 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- Amidst deepening concerns about job security fewer advisors are reporting that more buyers are entering the market.

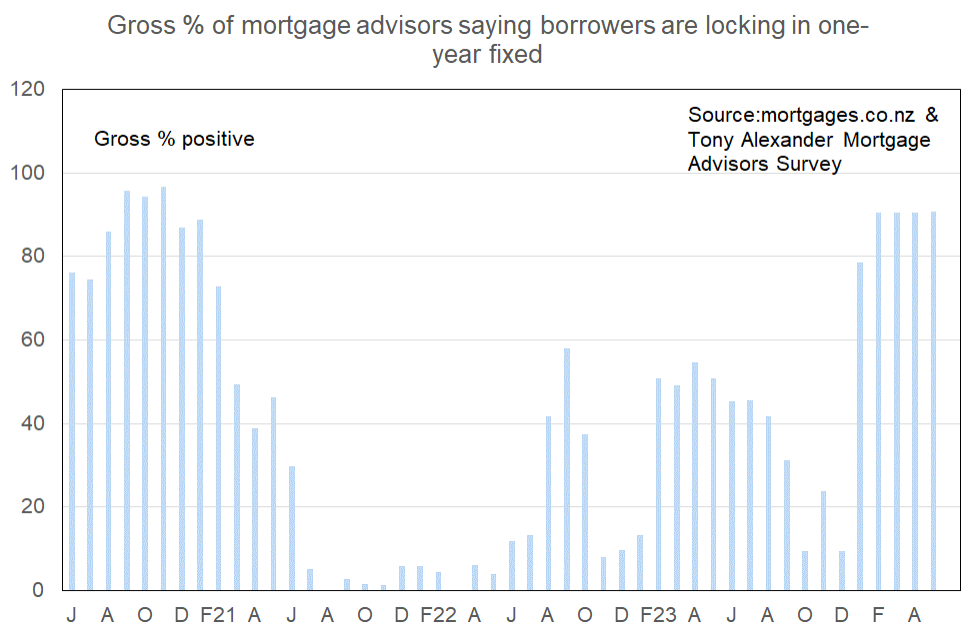

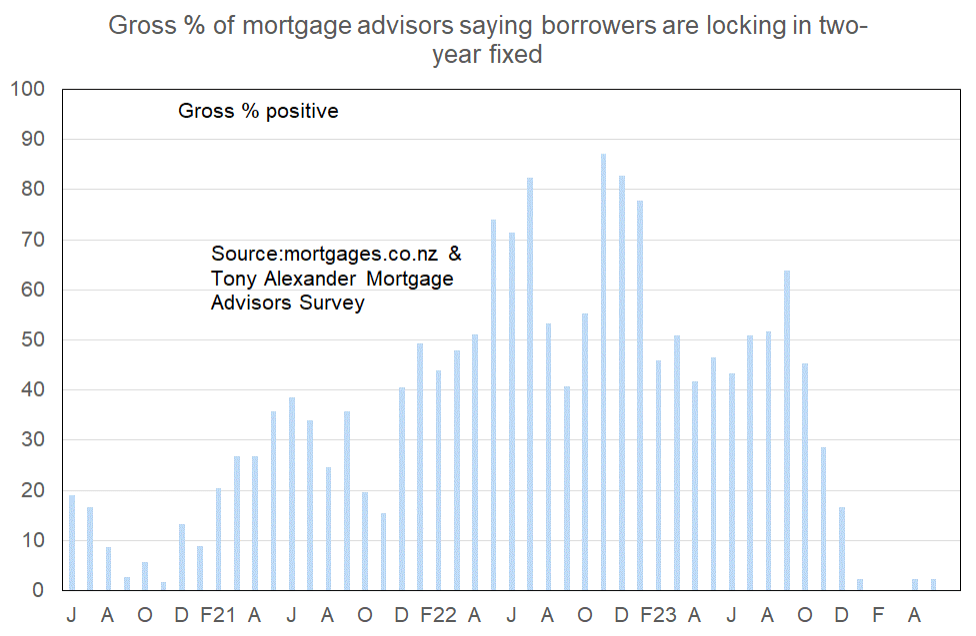

- Buyers and existing property owners continue to overwhelmingly favour fixing their mortgage rate for one year or less.

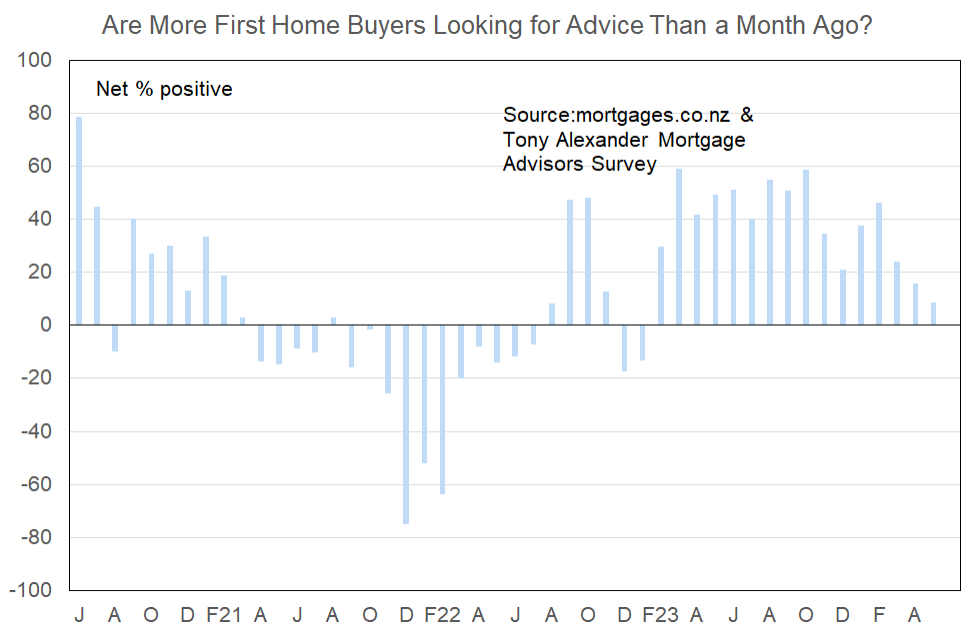

More or fewer first home buyers looking for mortgage advice

Only a net 9% of advisors this month have reported that they are seeing more first home buyers in the market looking for financing advice. This is down from a net 16% in April and 46% in February.

The latest result is the weakest since January 2023 and gels with many other measures showing that although young buyers are solidly in the market there is a weakening in their enthusiasm – often due to new employment uncertainty.

Comments on bank lending to first home buyers submitted by advisers include the following.

- Provided they are meeting the lenders test rate and show proven affordability for the mortgage, I’m having no trouble gaining approvals. Less concerned about discretionary spending.

- Banks have started keeping an eye on DTI but not implemented yet.

- Banks are open for newbuild properties but regularly change their position on whether they want to lend to high LVR customers to purchase an existing property

- Boarder & Flatmate Declaration being allowed for higher LVRs.

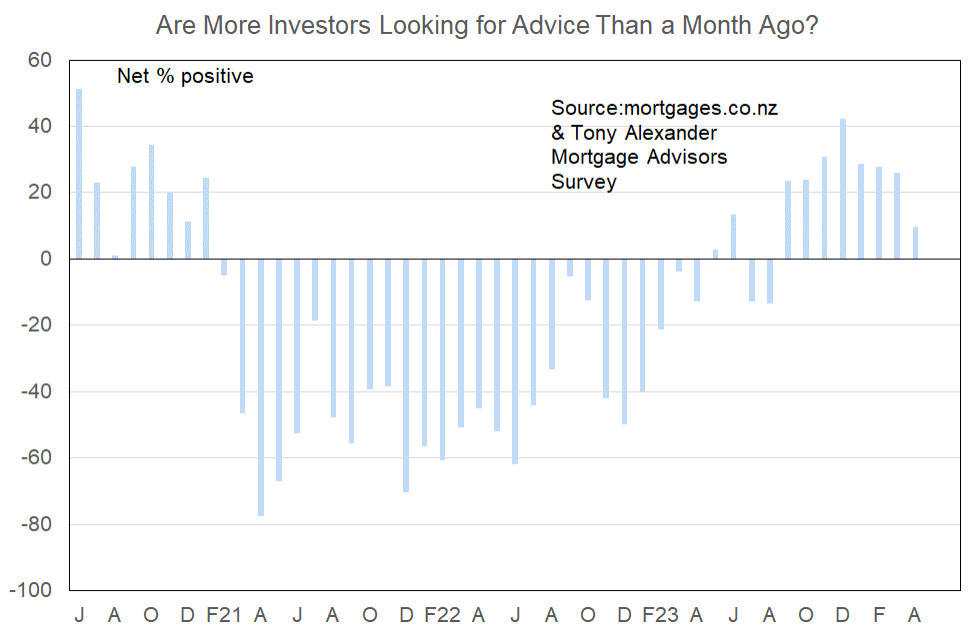

More or fewer investors looking for mortgage advice?

A net 0% of advisors in this month’s survey have replied that they are seeing more investors in the market. This is down from a net 10% seeing more investors in April and a net 42% seeing more in December.

The surge in investor interest late last year which followed the earlier strong lift in home purchases by first home buyers has not been sustained in the face of rapidly rising costs and loss of expectations of immediate additional price rises.

Comments made by advisers regarding bank lending to investors include the following.

- No investors in the market right now as they are waiting for the Brightline test changes 01/07/24. This is also when there will be a further influx of properties as cash strapped investors offload their investment properties.

- Been slow to react, but one bank now altered their rent calculations (after the taxation change) on their servicing calculator. Including DTIs within applications, but they’re not using them yet. Interest only extension looks to be approved, but very time consuming and application intensive process.

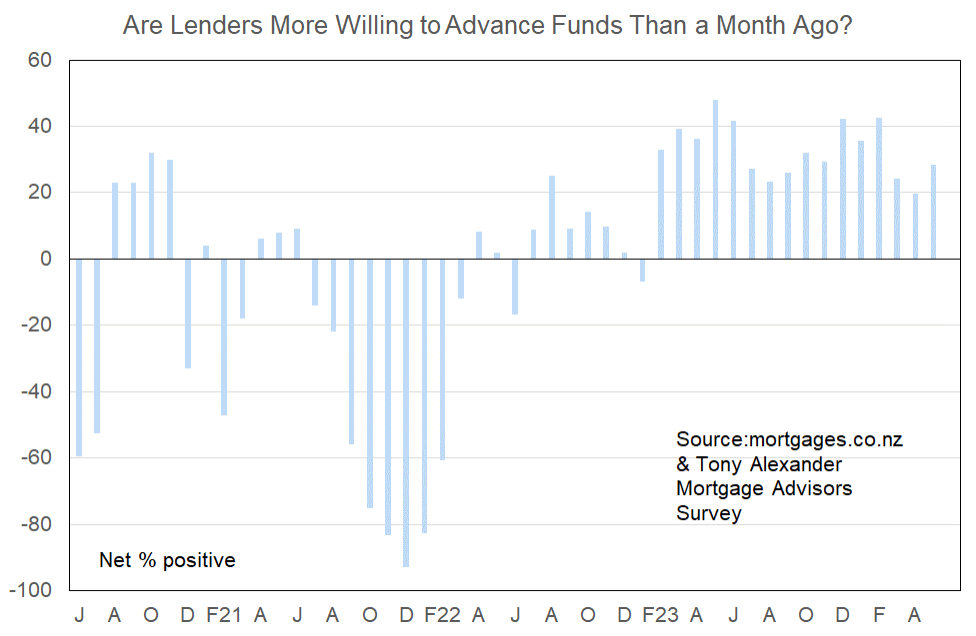

More or less lenders willing to advance funds?

There has been a rise in the net proportion of mortgage brokers feeling that banks are becoming more willing to lend to 28% from 20% last month. This is only one month of recovery so it would seem too soon to conclude that the banks are becoming more willing to compete for market share.

However, written comments submitted by mortgage advisors suggest that lenders are slowly easing their lending criteria though not universally so.

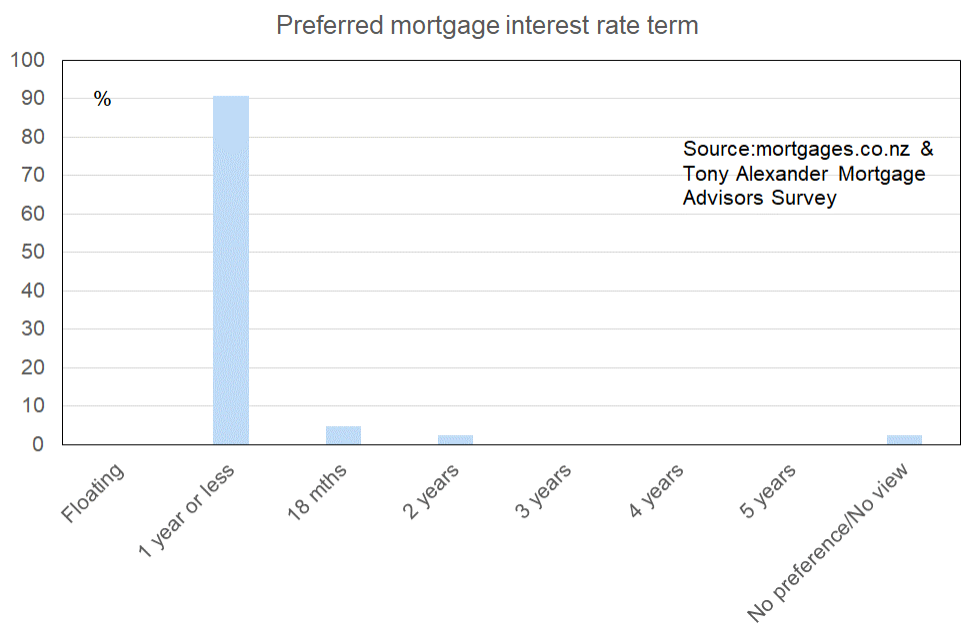

What time period are most people looking at fixing their interest rate?

For the fourth month in a row 90% of advisors have reported that buyers mainly favour fixing for a period of one year or less. There is a general belief that interest rates will fall within the next 12 months and beyond and potential property buyers and those looking at renewing a maturing fixed interest rate want to take advantage of that falling rate regime.

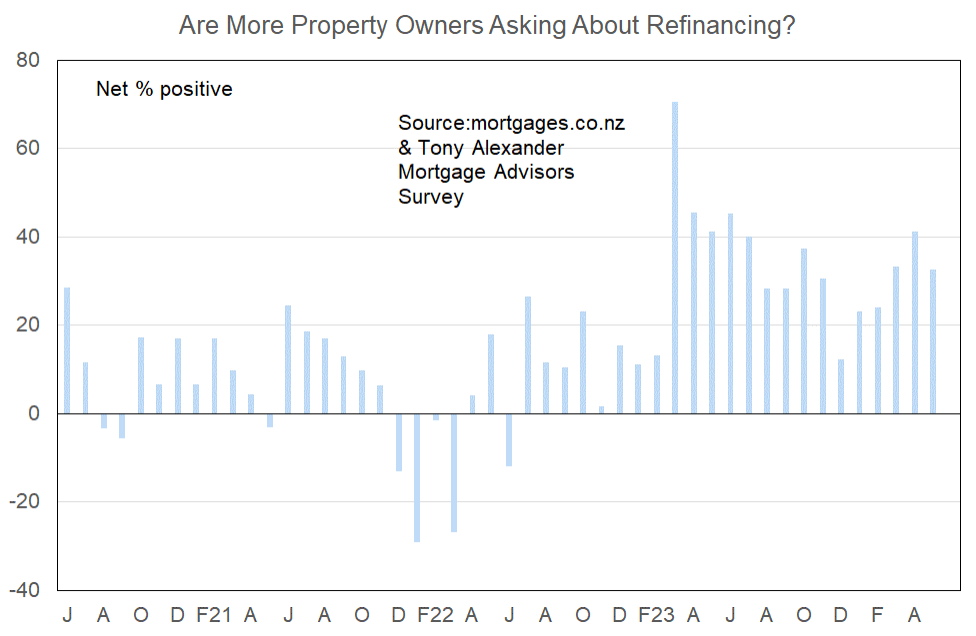

Are more property owners asking about refinancing?

There was a noticeable lift in the proportion of brokers seeing more people asking about refinancing early in 2023. As the graph here shows this level of refinancing interest remains high with a net 33% of brokers this month seeing more refinancing enquiries. Interest in managing through this period of still high mortgage interest rates remains robust.