Credit crunch slowly easing

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week and yielding 50 responses shows

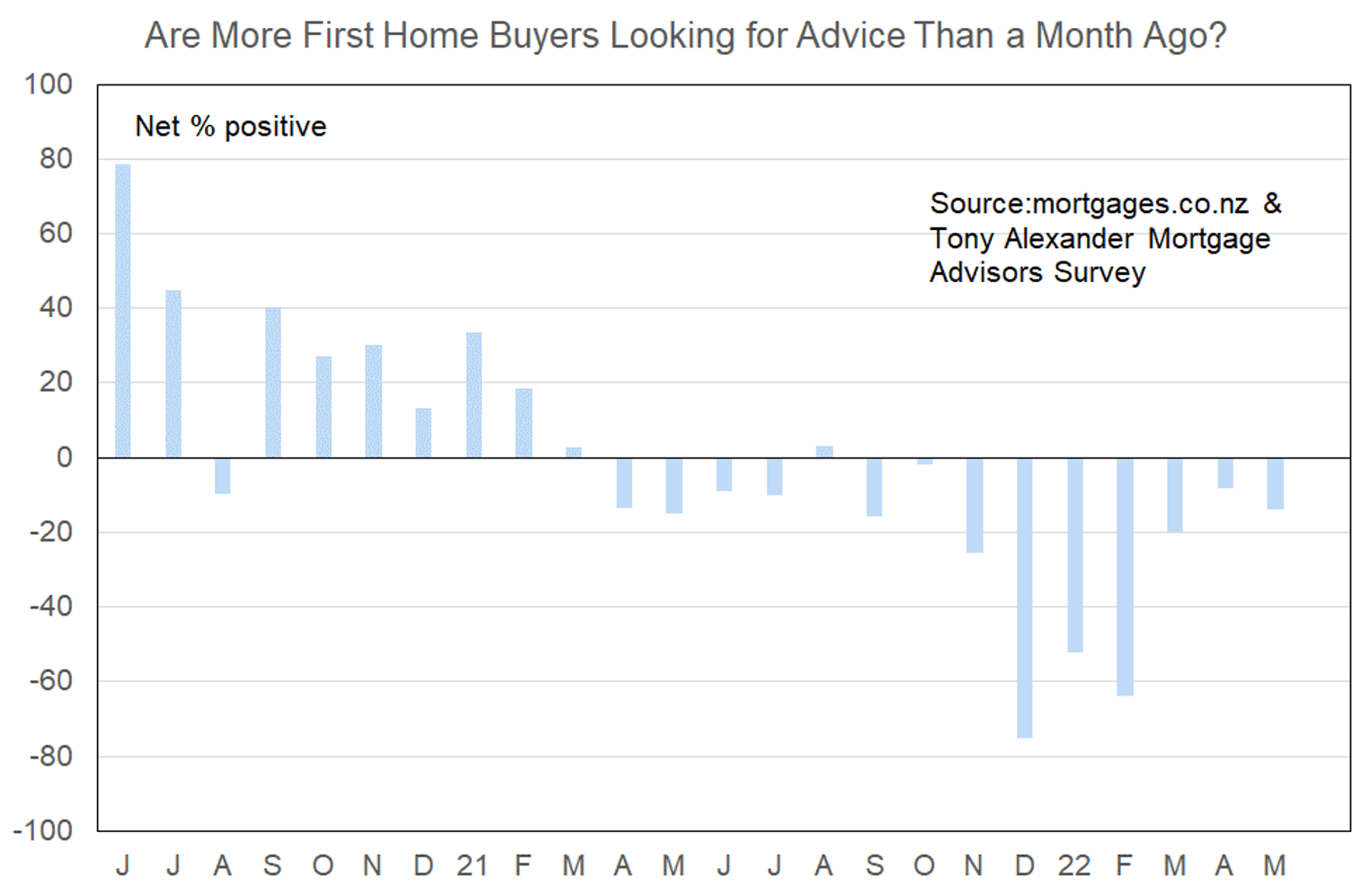

- first home buyers are still wary but becoming slightly less so,

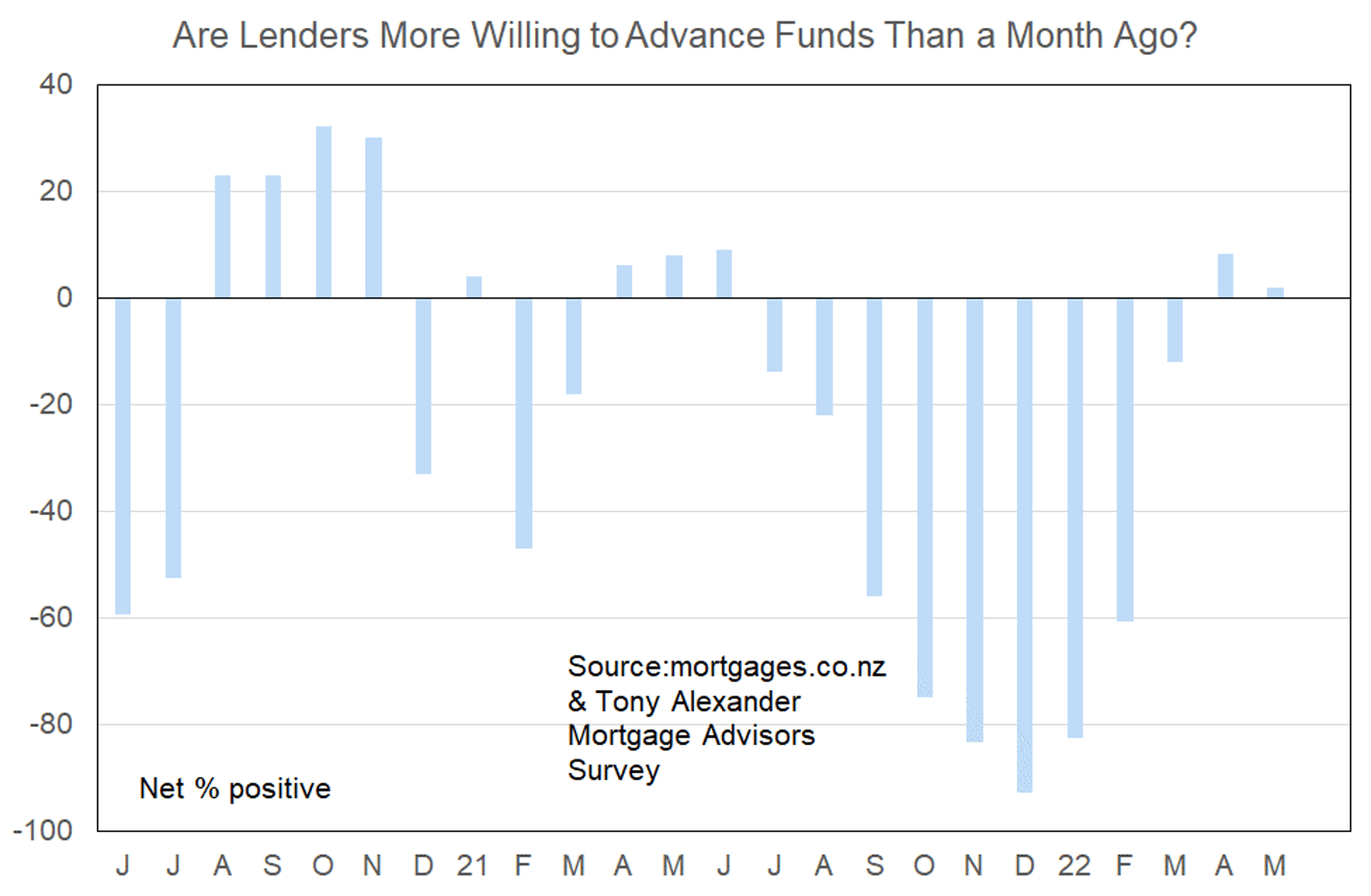

- lenders are becoming slowly more willing to advance funds, and

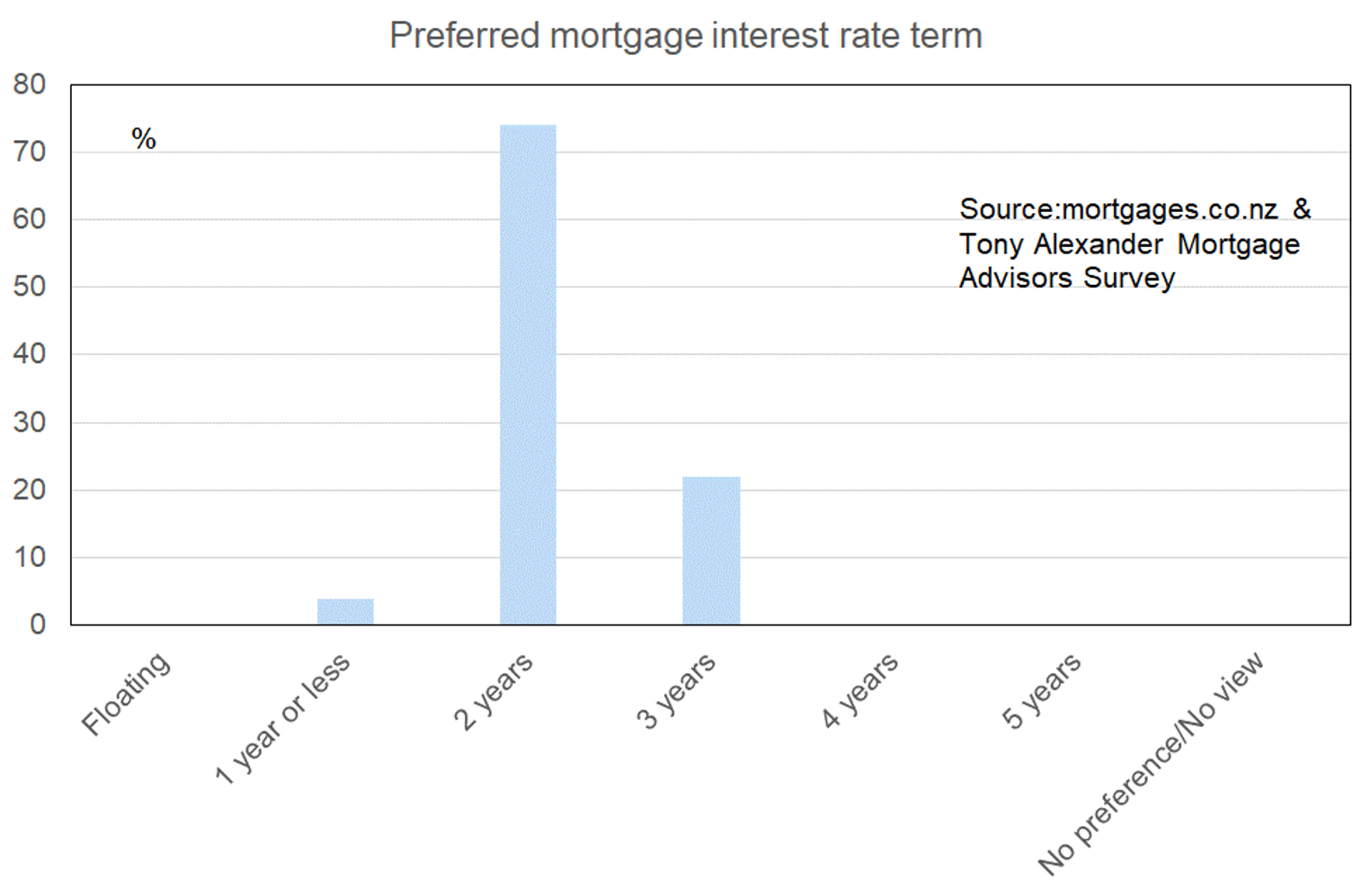

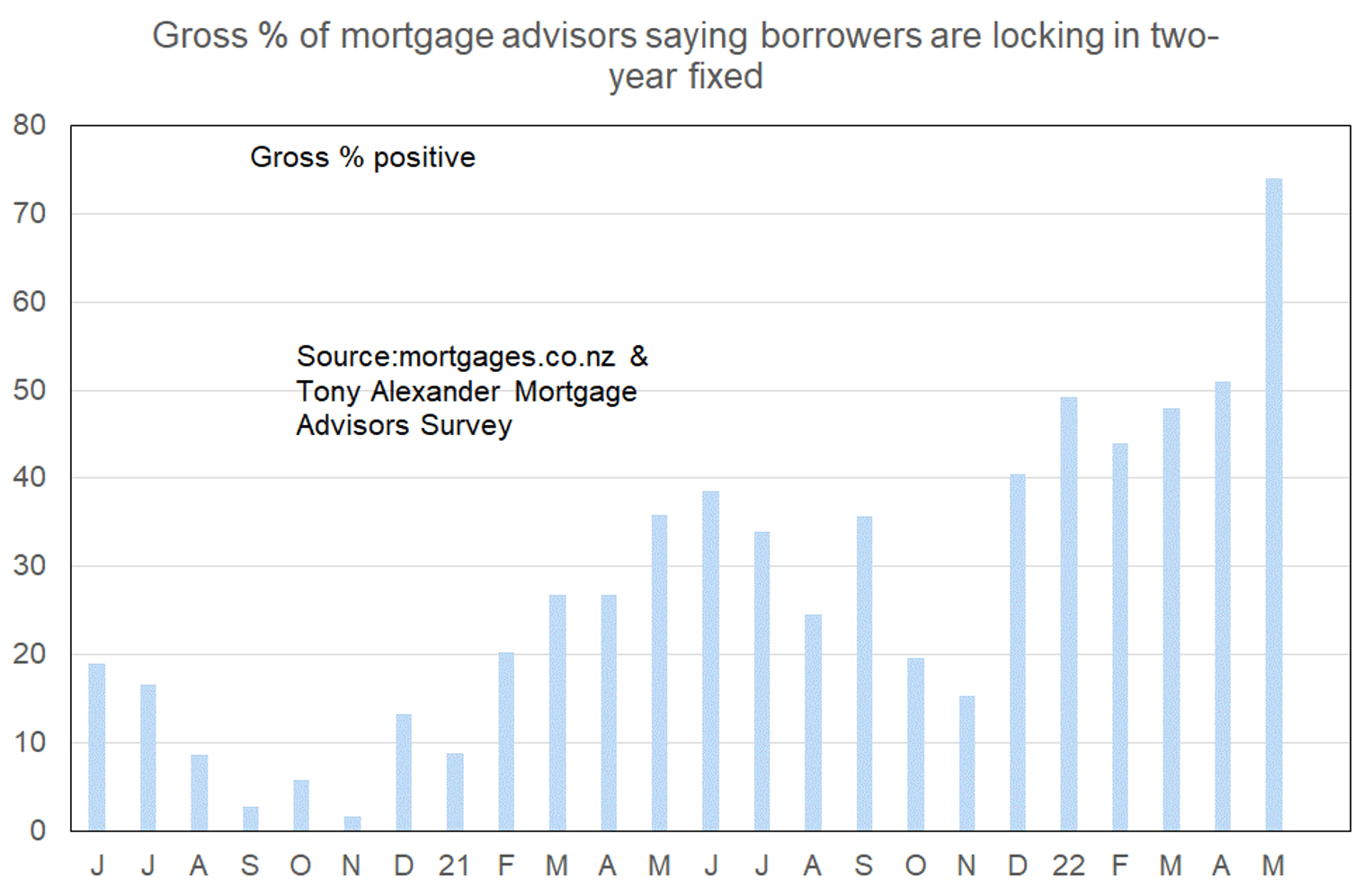

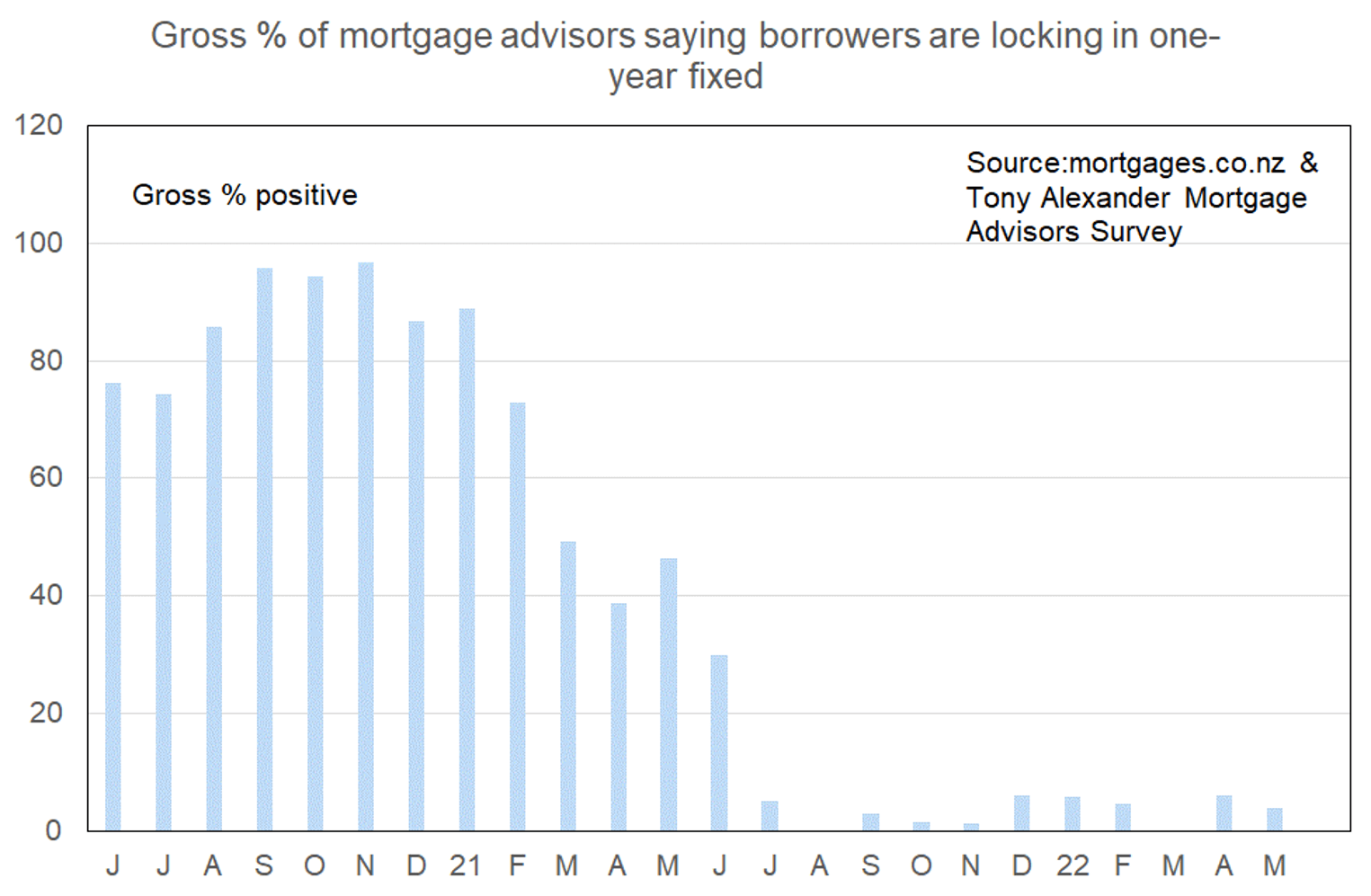

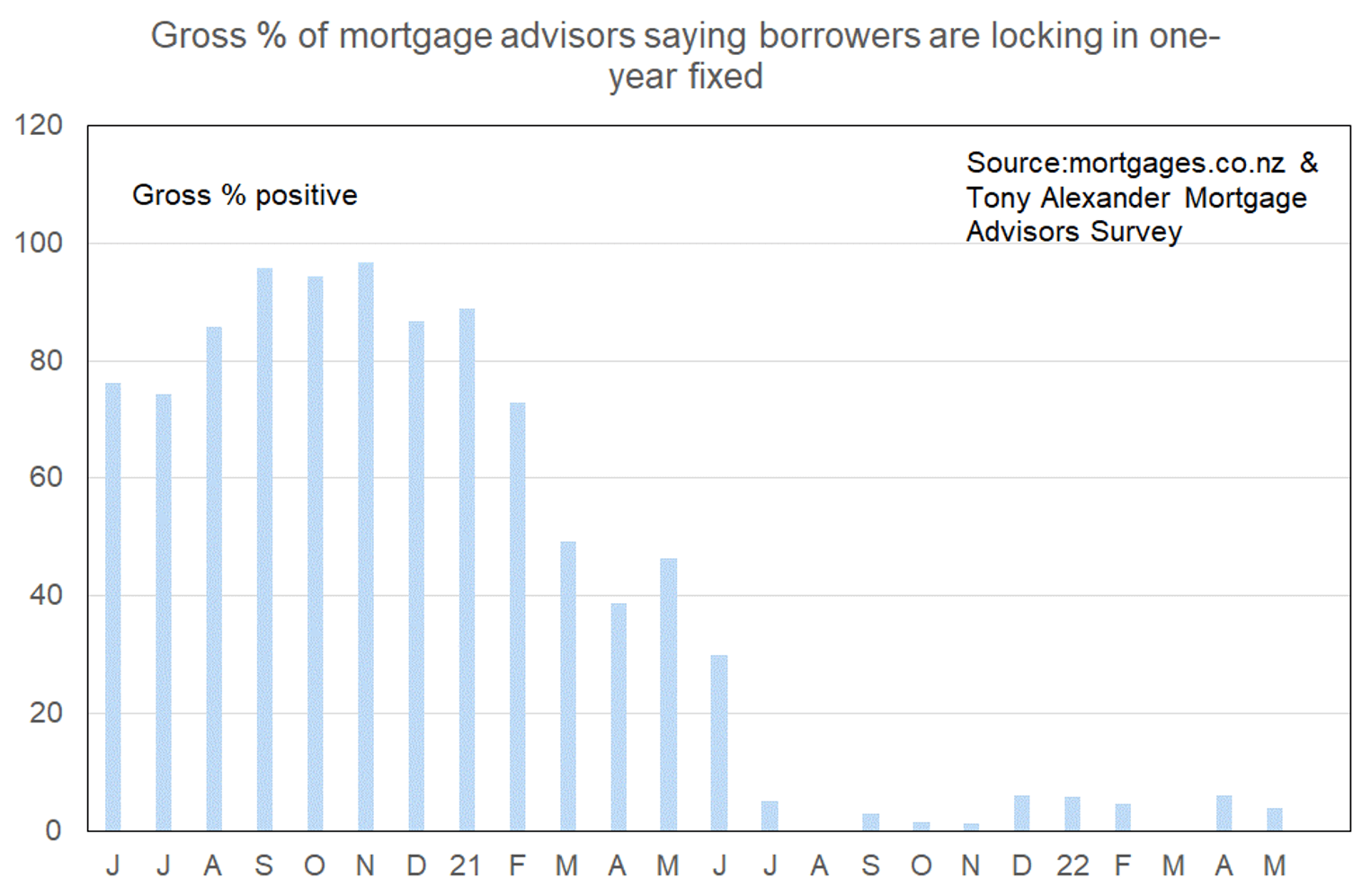

- two years is the overwhelming favourite for fixing one’s mortgage rate now.

More or fewer first home buyers looking for mortgage advice

But the data still tell us that young buyers continue to step back from the market at the same time as banks have become slightly more willing to advance funds (see below).

The main period of first home buyer withdrawal occurred when first the tightened loan to value ratio rules came into force from November, and then the Credit Contracts and Consumer Finance Act changes became effective from December 1. Planned changes in that legislation may have assuaged some concerns of the lenders, but first home buyers remain unconvinced.

They will also however be standing back in response to still rising mortgage interest rates, reduced ability to save because of the soaring cost of living, and perhaps cementing in of plans to shift to Australia.

Comments on lending to first home buyers submitted by advisers include the following.

- Some lenders have loosened up on the interrogation of bank statement spending. Still very tough from an affordability perspective and limited largely to existing bank if less than 20% deposit.

- First home buyers would typically have to be a main bank customer to be able to apply, which generally restricts their options. This is due to the RBNZ LVR restrictions.

- Increases in the test rates are seeing purchases not being able to borrow as much. One lender has also changed criteria for building a new home with additional deposit requirements and increasing contingencies due to escalating building costs.

- LVR speed limits having a major impact. xxx is the latest to advise its stopped lending temporarily over 80% LVR

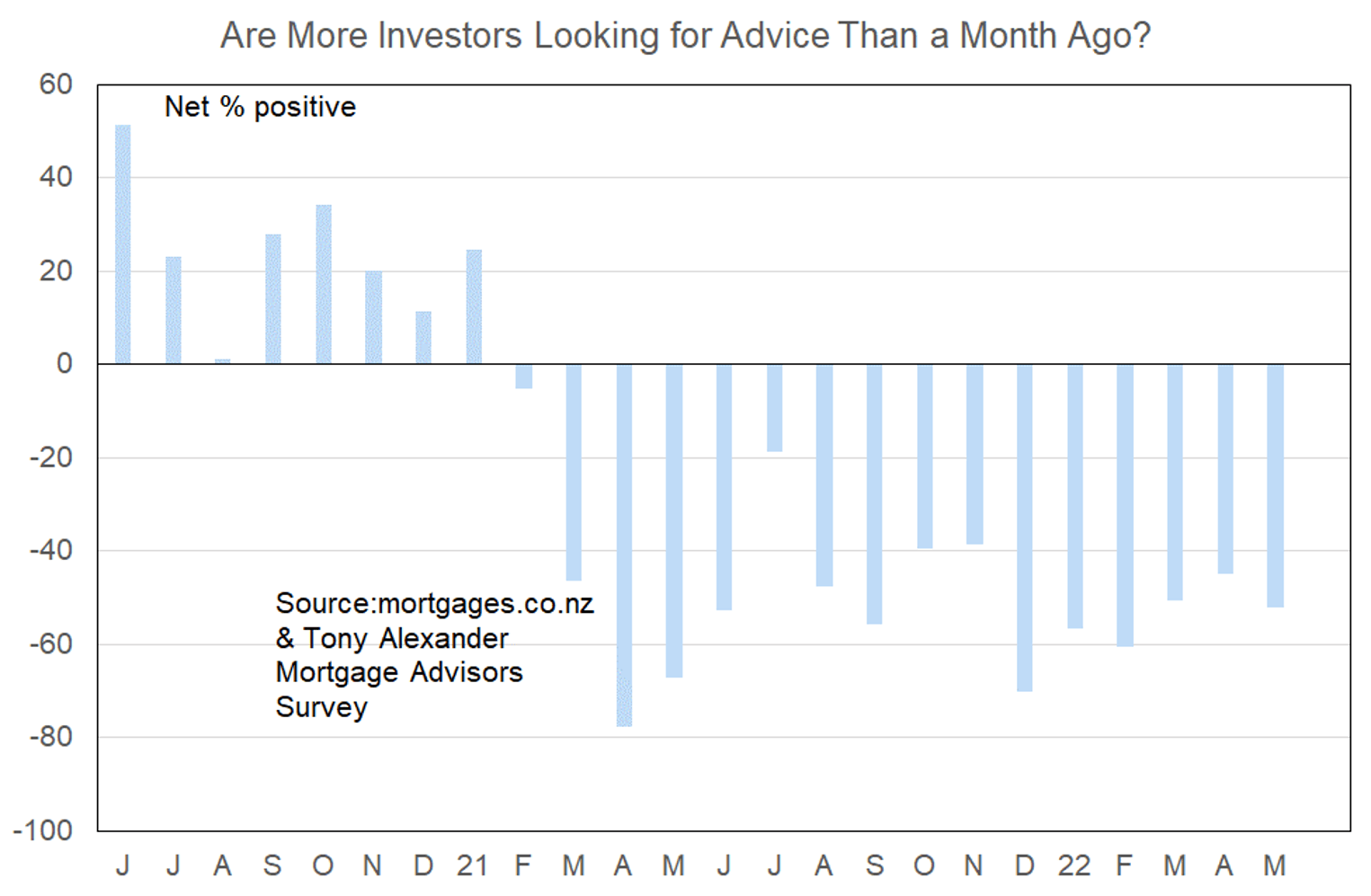

More or fewer investors looking for mortgage advice?

A key characteristic of the changing housing market remains the backing away of people investing in the supply of additional rental properties. But this stepping back is not being matched by investors stepping forward to sell – something captured in my other surveys but not this particular one.

Comments made by advisers regarding bank lending to investors include the following.

- A lot of new investors are buying brand new as land prices have come down, example in Rolleston, it is down $50k already.

- Not seeing many investor applications.

- More and more expenses are being included in affordability calculations and rental incomes being scaled more than before. Making it very difficult for those with existing portfolios.

- Investors need really strong incomes. Rental income and expenses calculations so harsh that you need to basically need to be able to service all new debt on your own income.

- Non-bank lenders are now better in this space – longer committed interest-only periods. More realistic surplus income expectations.

More or less lenders willing to advance funds?

But high Loan to Value Ratio (LVR) lending has become slightly less available than before, and test rates used for calculating debt servicing ability have been increased. There has also been a tightening of eligibility for financing of new construction.

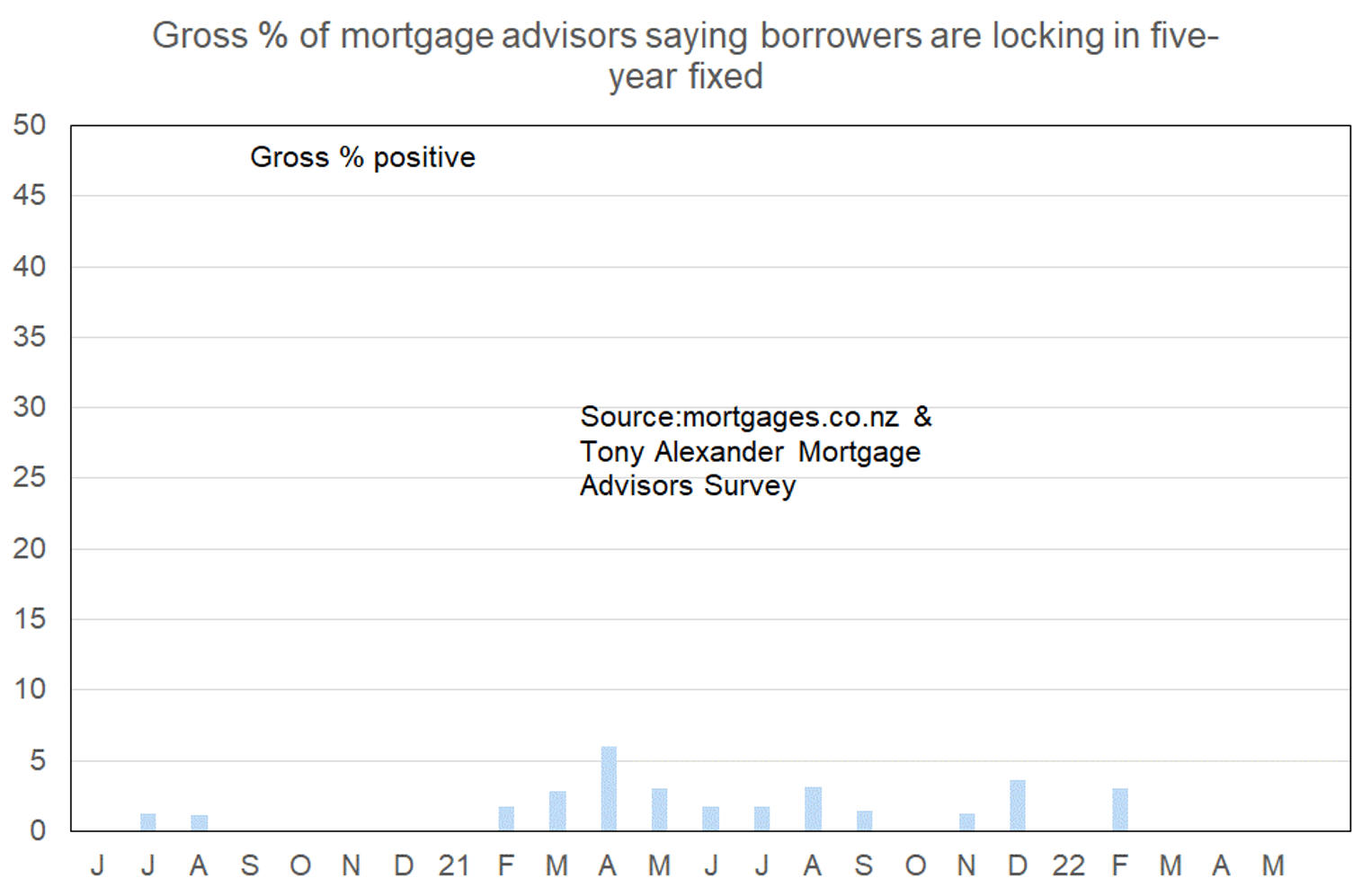

What time period are most people looking at fixing their interest rate?

When and if it does happen, it might be associated with a lift in people locking in fixed for five years. But that will only be if the yield curve representing fixed mortgage rates goes firmly inverse. This refers to the situation where short-term interest rates are above long-term rates.

When this happens, some people will take the pain of short-term fixing or even floating in anticipation of rates falling away. Others will either blindly opt for the cheapest rate, or they will feel they have no choice if that long-term rate is the only one which will mean they can meet lender debt servicing rules.

Having said that, if banks apply test interest rates which are not dependent upon the term and the actual rate relevant to it, then this locking in long-term at the wrong point in the interest rates cycle could be absent this time around. It was last present when the curve went inverse in 1998 and 2008.