Slight easing of the crunch

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week and yielding 75 responses, shows that while investors continue to remain out of the market, the extent to which first home buyers are withdrawing has eased somewhat.

Lenders are perceived to be still becoming less willing to lend. But the extent to which they are easing off credit availability has eased a lot. The credit crunch may have past its peak, although some banks are tightening rules for assessing investors’ expenses, and some are going to wait until June before altering their rules related to the Credit Contracts and Consumer Finance Act.

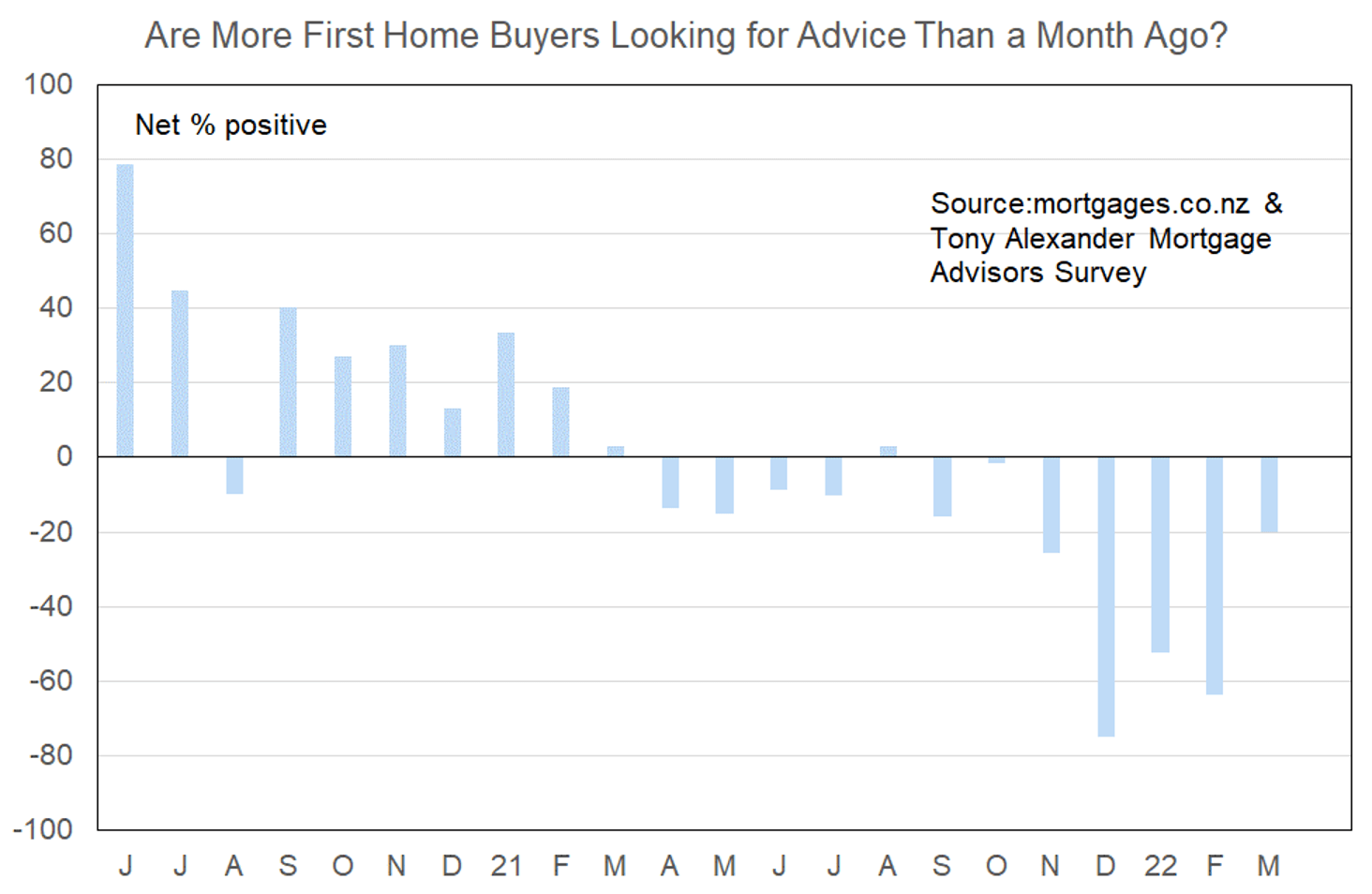

More or fewer first home buyers looking for mortgage advice

A net 20% of our 75 responding mortgage advisers this month have reported that they are seeing fewer first home buyers in the market. This is a sharp improvement from levels of the past three months and although still negative does bespeak of the stepping back in response to tight credit and rising interest rates perhaps having past its peak.

Young buyers are facing a barrage of factors to try and take into account as they contemplate attempting a purchase. How far will prices fall? How high will interest rates go? What will be the impact of the soaring cost of living? How many more listings will appear? Are banks really going to start lending again?

Comments submitted by advisers indicate that banks are very slowly opening up again to less than 20% deposit lending but are not uniformly altering their expense assessments in response to the anticipated change in CCCFA rules. Here are a selected few of those comments relevant to bank lending to first home buyers.

- Some banks have opened to over 80% LVR but needs to be a live deal with a signed and dated S&P and a very strong UMI. Unachievable for most.

- Interest rates for testing debt servicing are slowly increasing.

- Banks are slowly re-entering the sub-20% deposit market.

- 90% lending-most have started opening up again and interest is returning here. Still very focused on expenses whether 10% or 20% deposit some banks more rigid than others.

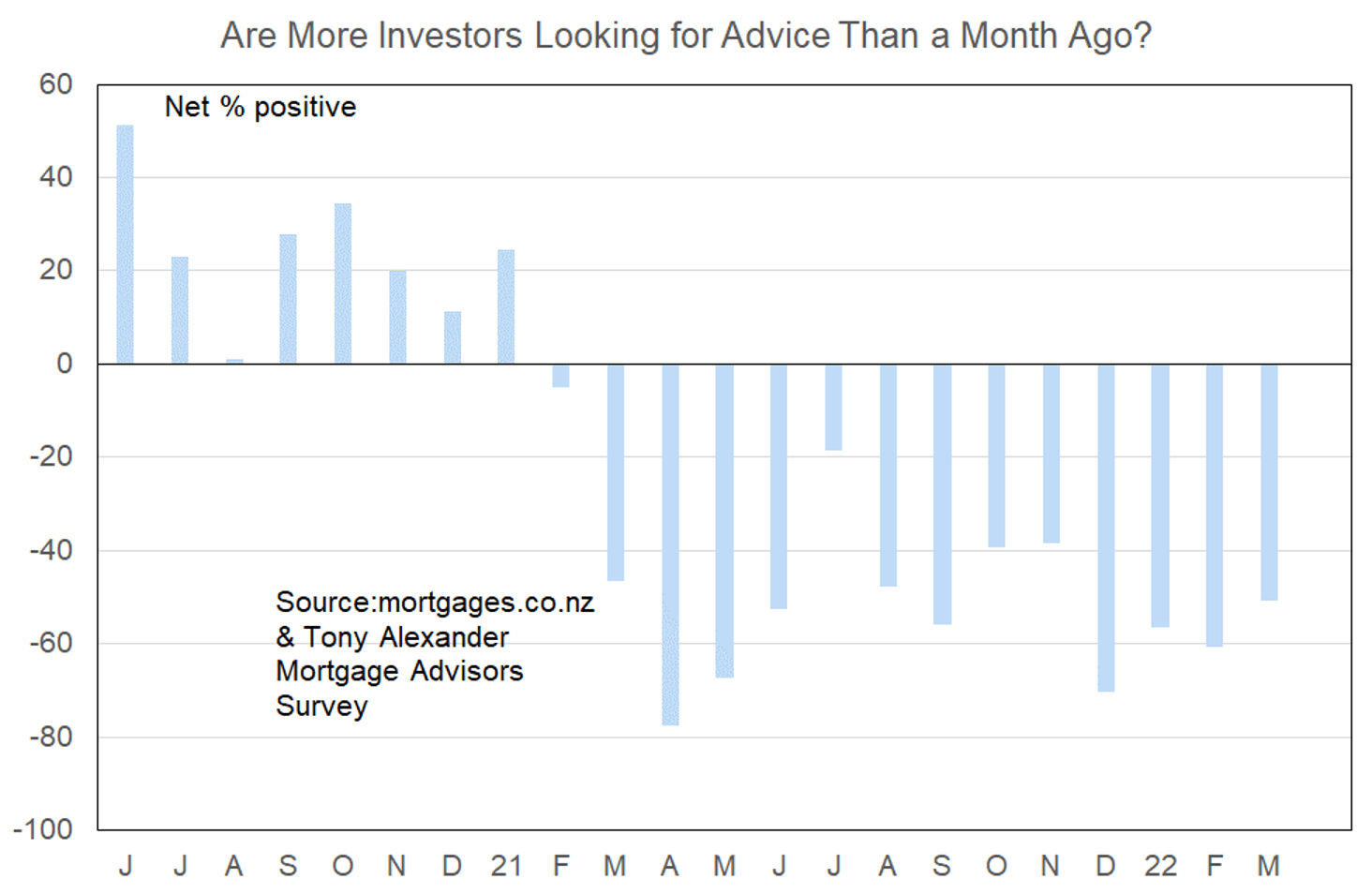

More or fewer investors looking for mortgage advice?

Comments made by advisers regarding bank lending to investors can be summarised as showing

- continuing tight credit availability,

- some extra scaling of predicted rental incomes,

- widespread inclusion of insurance and rates as specific expenses no longer covered by traditional rent scaling.

“LVR of 60% against existing properties and 80% for new builds. Prior to the CCCFA and DTI changes (DTI of 6 is being implemented by xxx and 7 by yyy), $100 per week in rental income would service approx. $45,000-50,000 in increased borrowing based on the banks’ debt servicing calculations. Now with the DTI’s and CCCFA changes, $100 per week in rental income will increase borrowing capacity by around $25,000. That is a nearly 50% reduction in borrowing capacity. Based on this, a property renting for $600 per week will only increase borrowing capacity by around $150,000 (previously up to $300,000) with the balance of the purchase price having to come from unused debt servicing capacity within the applicant’s personal income. A property costing say $900,000 will require the applicant to have upwards of a net $1,000 per month surplus ($5,000 per month rather than $4,000) – more than previously to meet servicing criteria.”

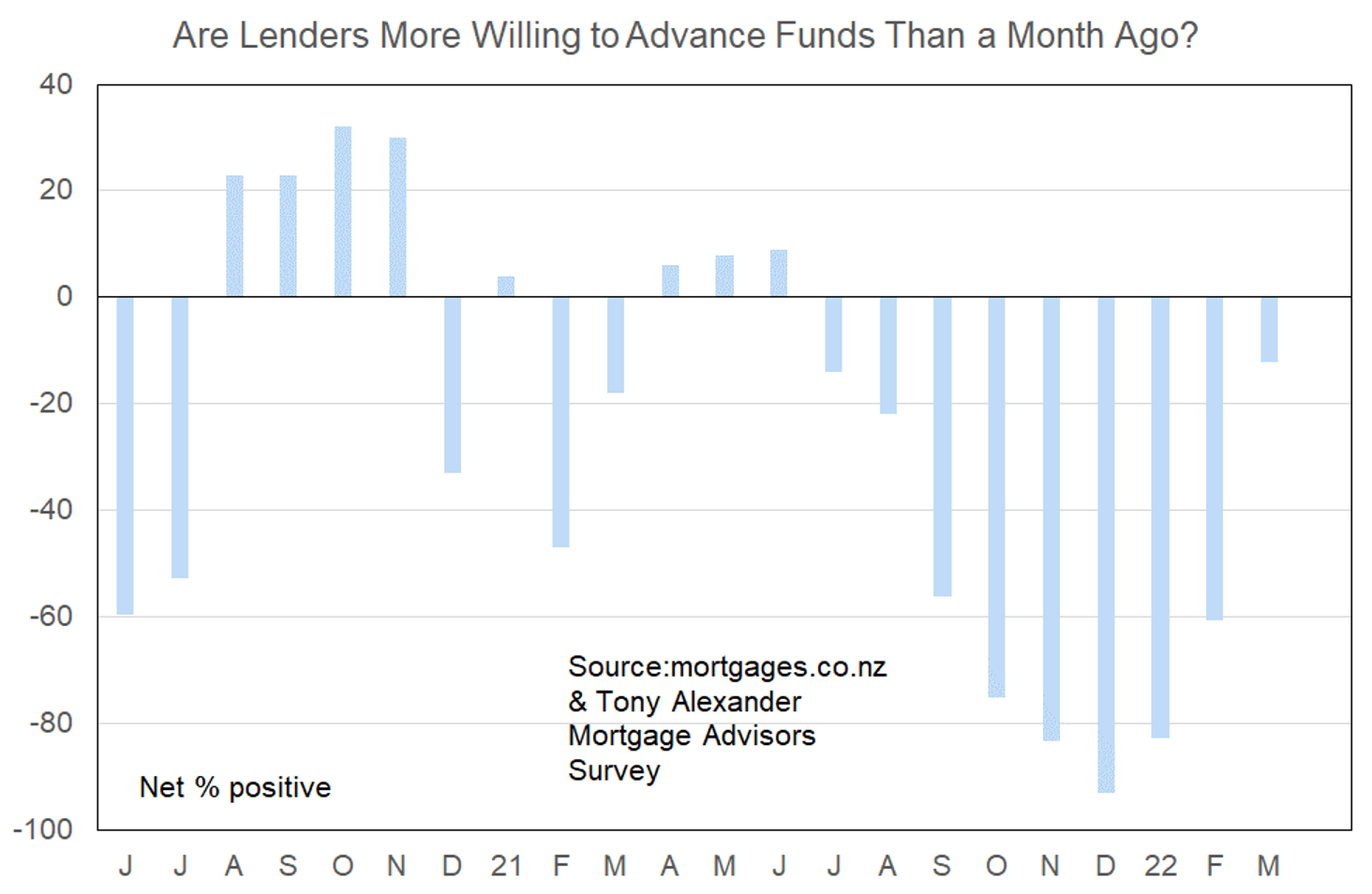

More or less lenders willing to advance funds?

There has been a sharp change in the net proportion of mortgage advisers feeling that banks are more willing to lend funds. At its worst back in December a net 93% of advisers said banks were less willing to lend. That eased to 83% in January, 61% last month, and just 12% this month. Credit availability remains tight, but allowing for statistical variations there is only a small extra amount of worsening occurring in lending willingness.

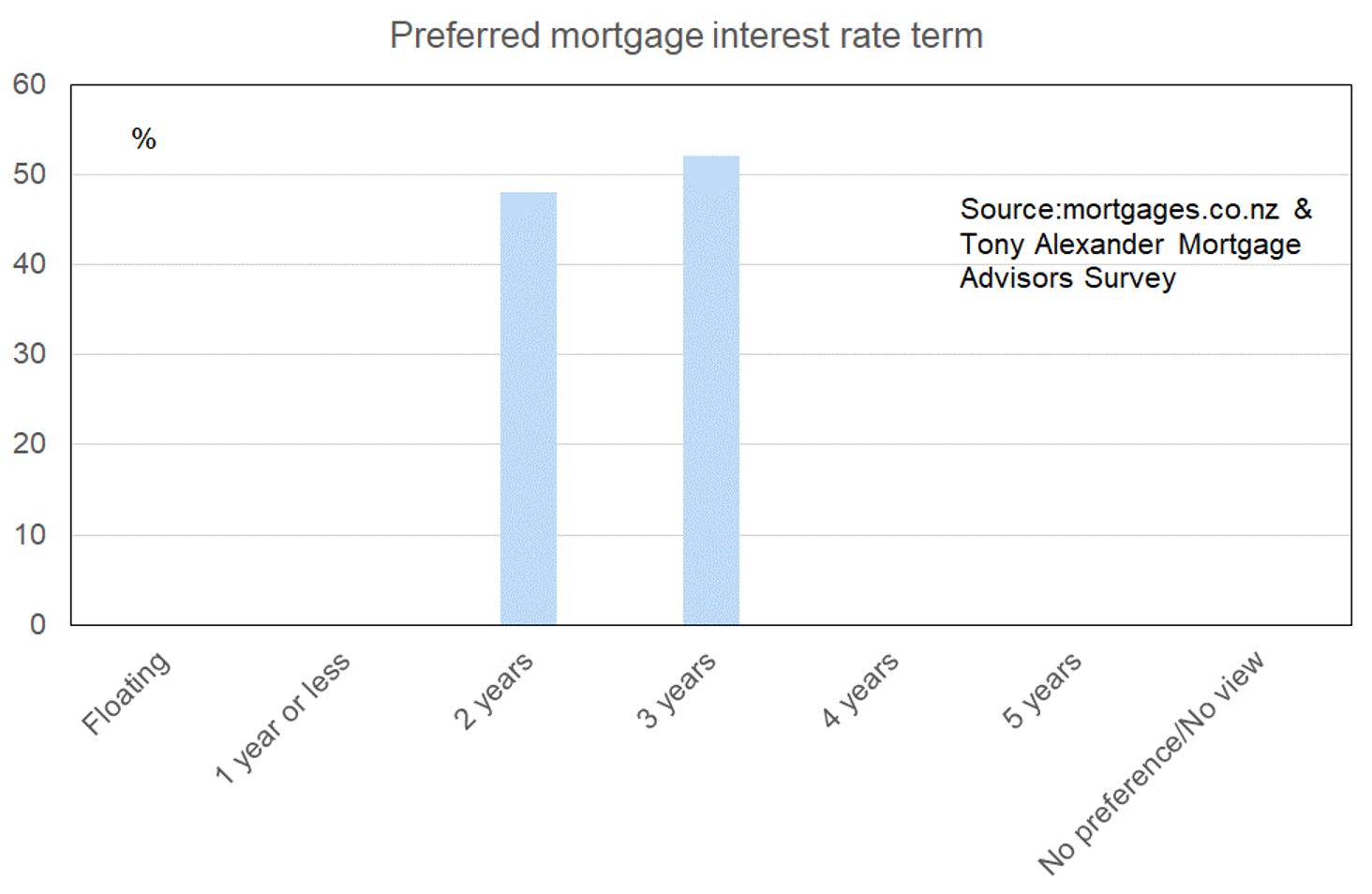

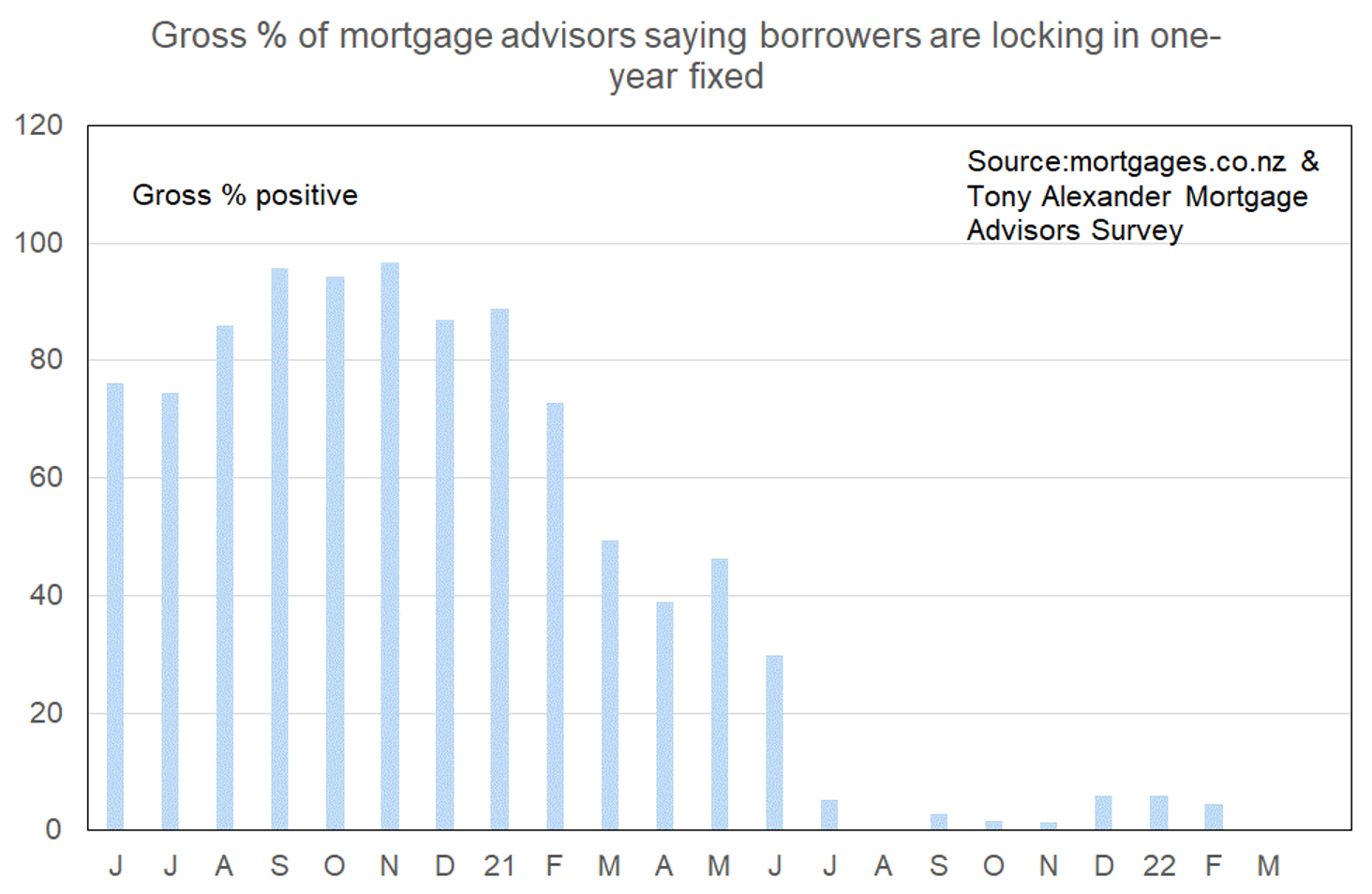

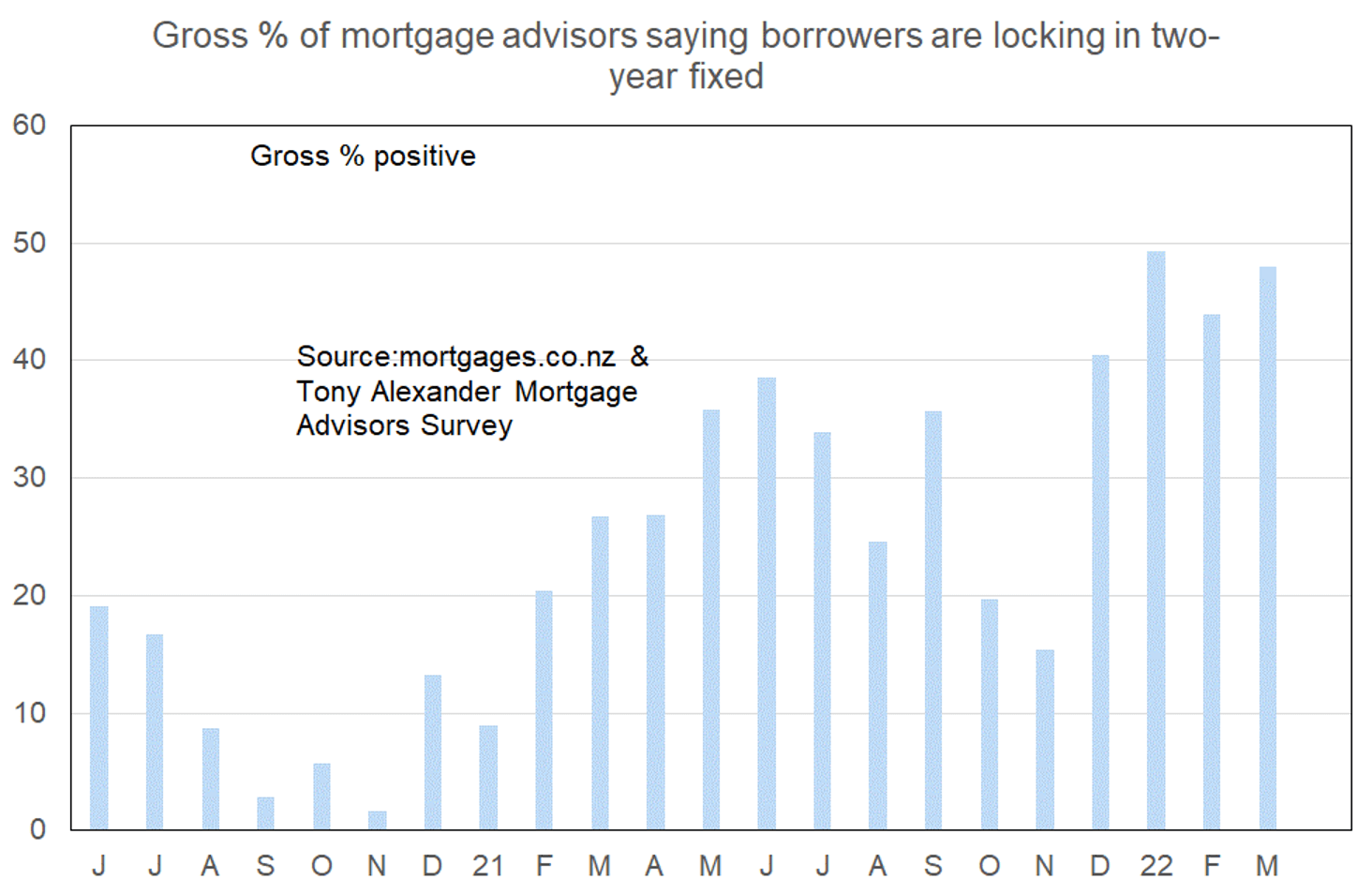

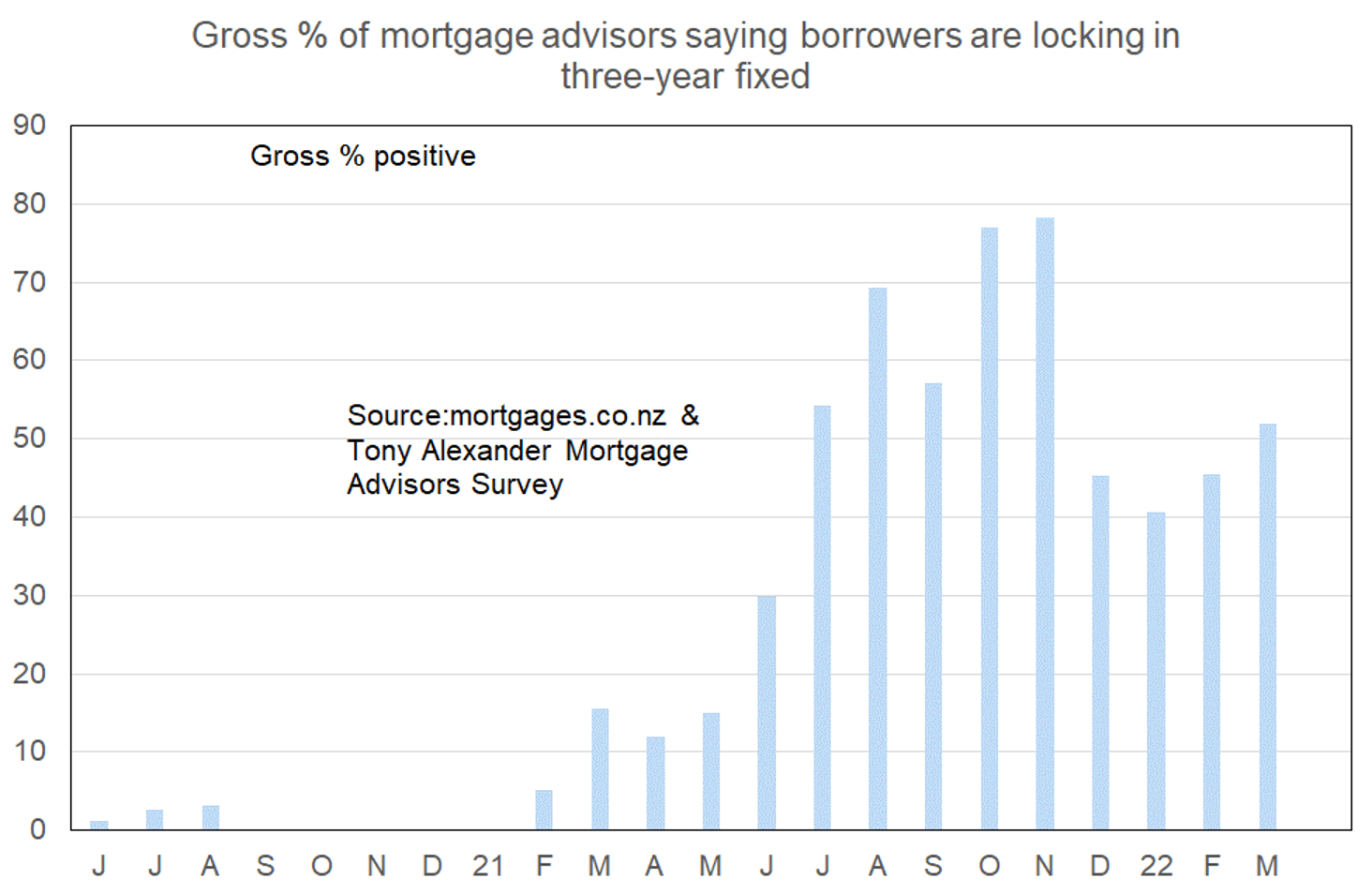

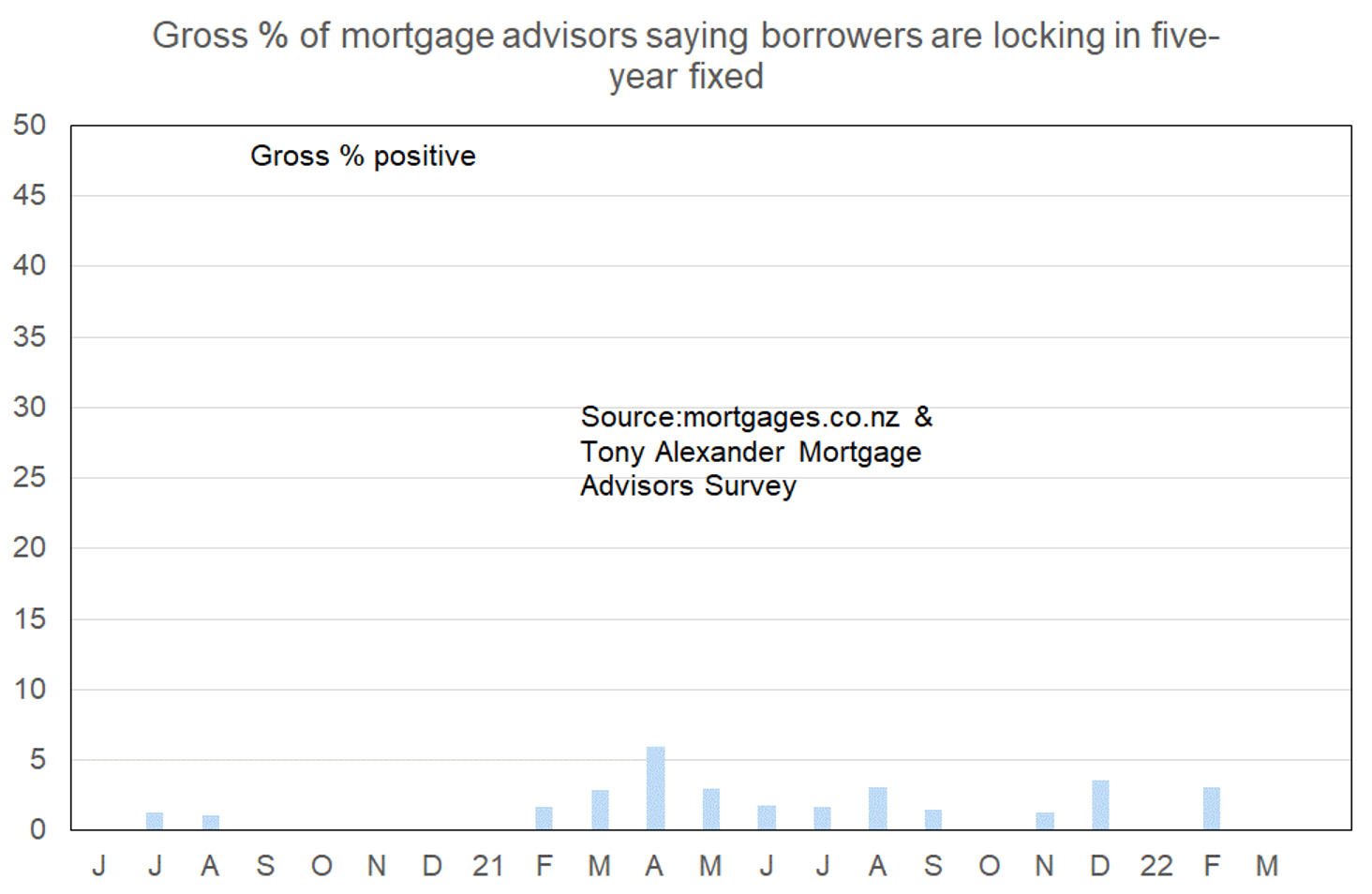

What time period are most people looking at fixing their interest rate?

Advisers report that people remain strongly in favour of the two and three year fixed terms. No-one reported any interest in terms of one year, four, or five years.