Buyers more cautious

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken this week, attracted 54 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- First home buyers are backing away from the housing market.

- Investors are showing some new yet still mild interest in buying while the market is weak.

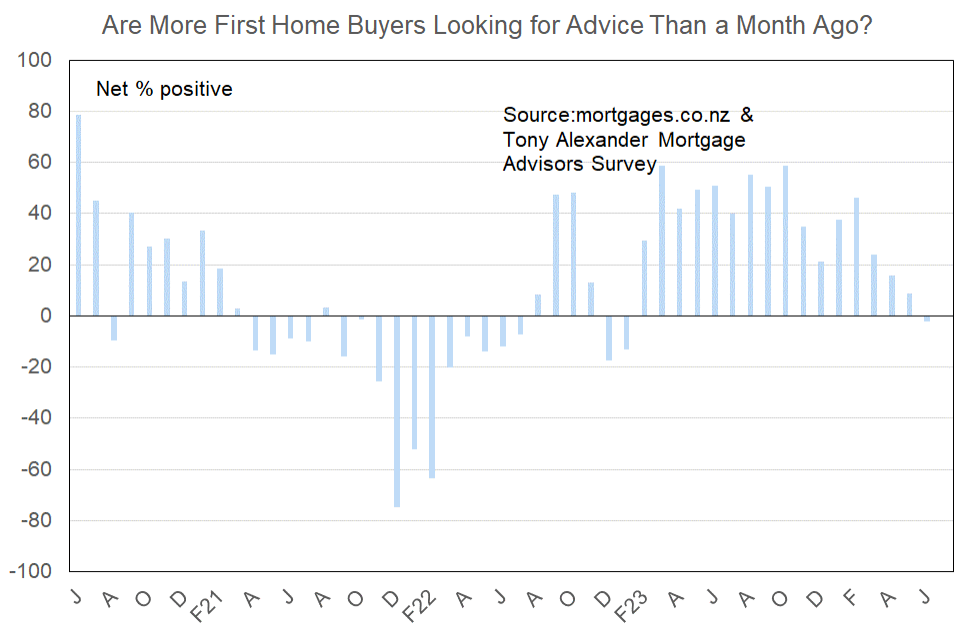

More or fewer first home buyers looking for mortgage advice

A net 2% of the respondents in this month’s survey have said that they are seeing fewer first home buyers in the market looking for advice. This is the first negative result since January 2023 and is well down from the net 46% in February who said they were seeing more young buyers in the market.

Economic conditions in New Zealand have noticeably deteriorated since the earliest months of this year. In particular, worries about employment security have jumped higher and for many potential young house buyers this will be the first time they have seen a weakening of the labour market without any official moves to provide economic stimulus.

Comments on bank lending to first home buyers submitted by advisers include the following.

- Slight improvements in allowing boarder income to assist servicing.

- Main change in last few months is confirmation of full House Insurance – no exclusions.

- Offering more cash contributions if client is an FHB (0.9% v 0.8%), allowing a boarder for high LVR lending.

- Banks want to lend to first home buyers, but it’s the buyers that are now uncomfortable with buying as they are really scared of the banks’ interest rates along with the chance of them losing their jobs. Lots of uncertainties in this arena.

- No changes, other than not having the First Home Grant.

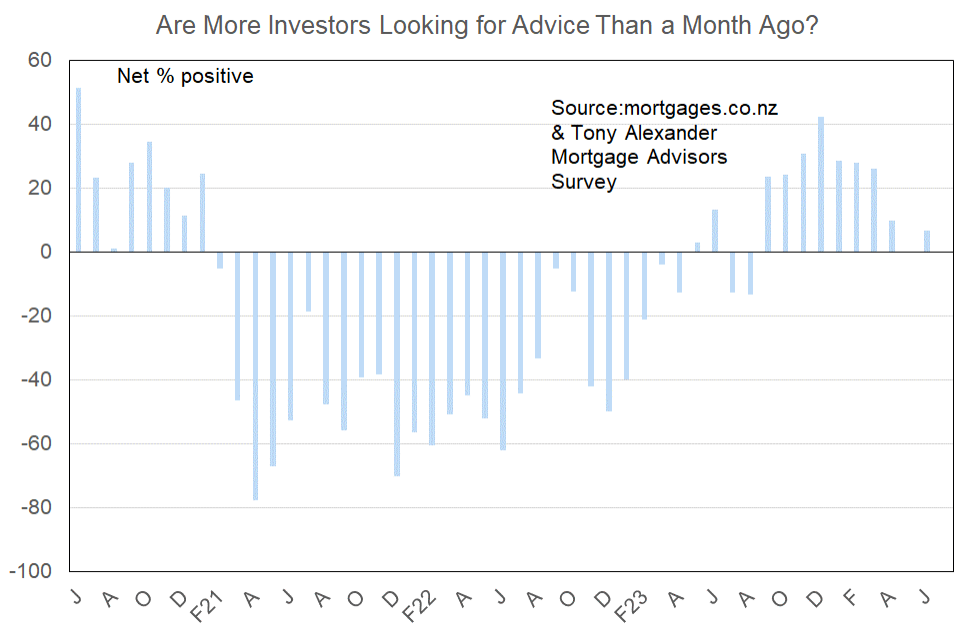

More or fewer investors looking for mortgage advice?

A net 7% of mortgage brokers have noted that they are seeing more investors in the market looking for advice. It is not common for this measure to be stronger than that for first home buyers and a number of advisors noted that investors are showing increasing interest in purchasing now that the tax rules have changed.

But as our graph here shows, the rise in investor buying interest in the latter part of last year did not last long and it may be safest to say that since April there has been little net change in investor presence in the market as buyers.

Comments made by advisers regarding bank lending to investors include the following.

- Starting to see changes with the rental haircuts with the reintroduction of interest deductibility, but banks are very slow to open the door much wider.

- They have altered their calculators to allow for tax deductibility of interest cost (in a round about way) and are less punitive when allowing for rates & insurance costs associated

- Due to the upcoming easing of interest deductibility, the banks have reverted back to not differentiating when a house was purchased when shading/ haircut, rental income assessment. Now rental income is treated the same regardless of when purchased.

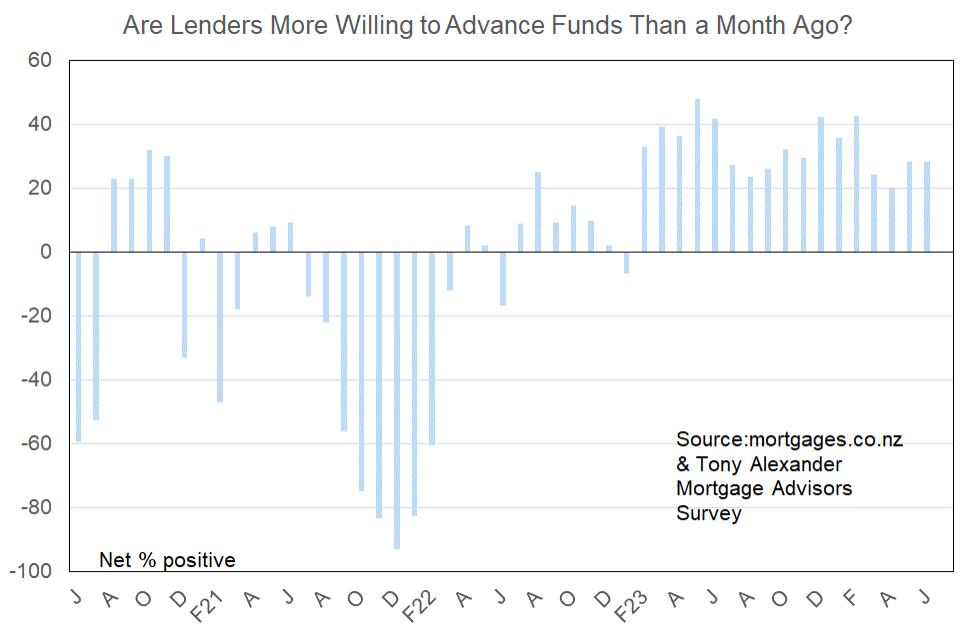

More or less lenders willing to advance funds?

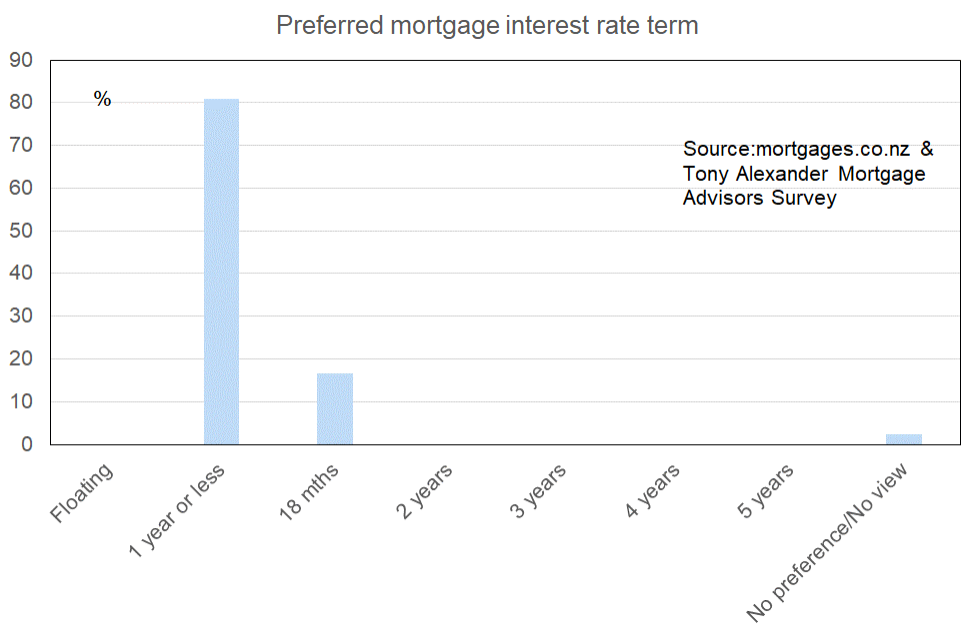

What time period are most people looking at fixing their interest rate?

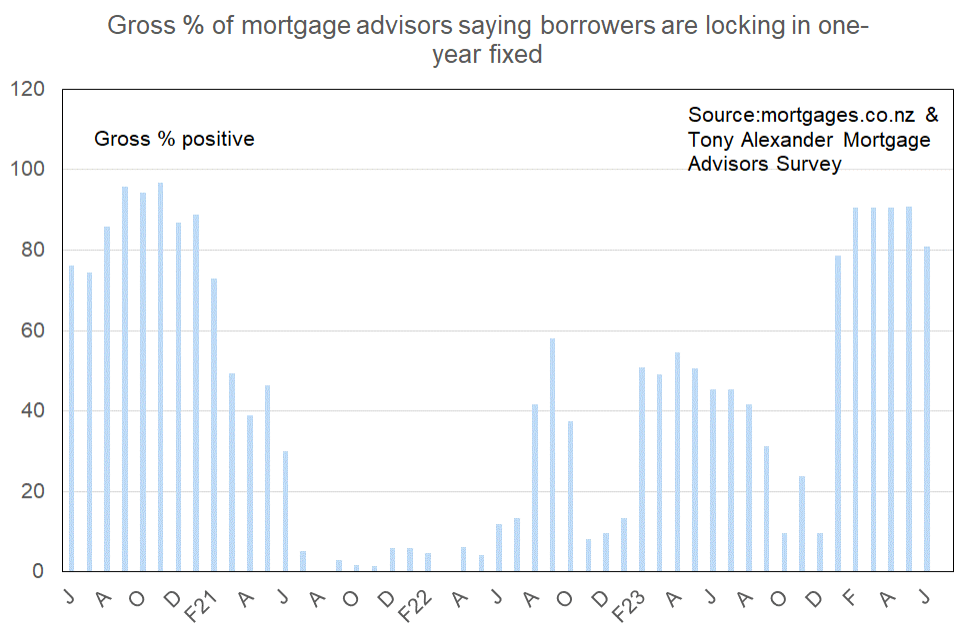

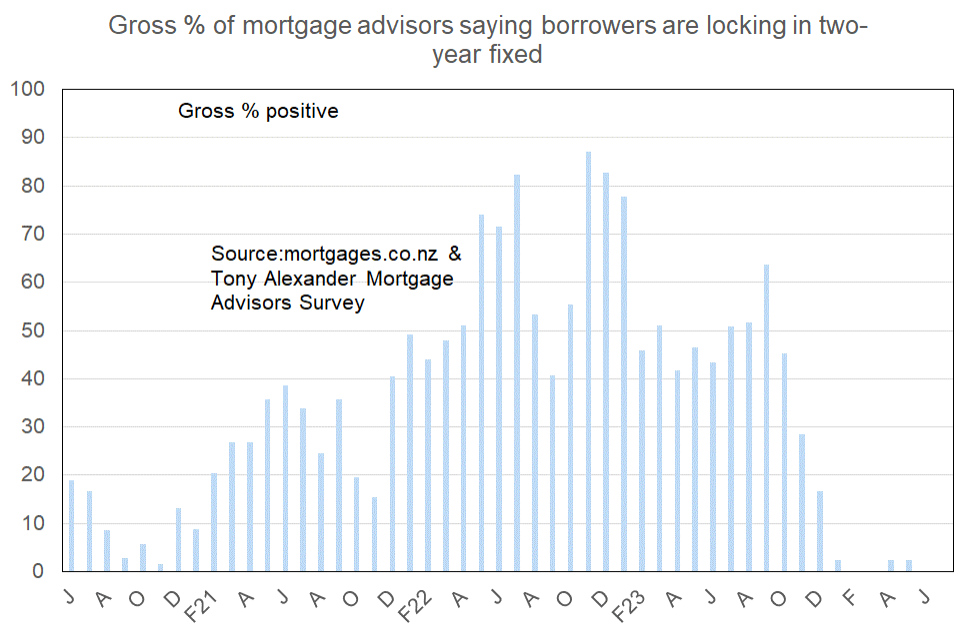

There is a widespread view amongst economists and the general public that the next change in monetary policy will be an easing. Most expect this easing to come early next year and that is why borrowers are showing high preference for fixing their mortgage interest rate for just a 12 month period.

People wish to eventually take advantage of lower rates and feel that locking themselves into a long term now would deny them that chance.

81% of brokers say that buyers favour fixing for one year or less while 17% say they favour fixing from just over one year to two years.

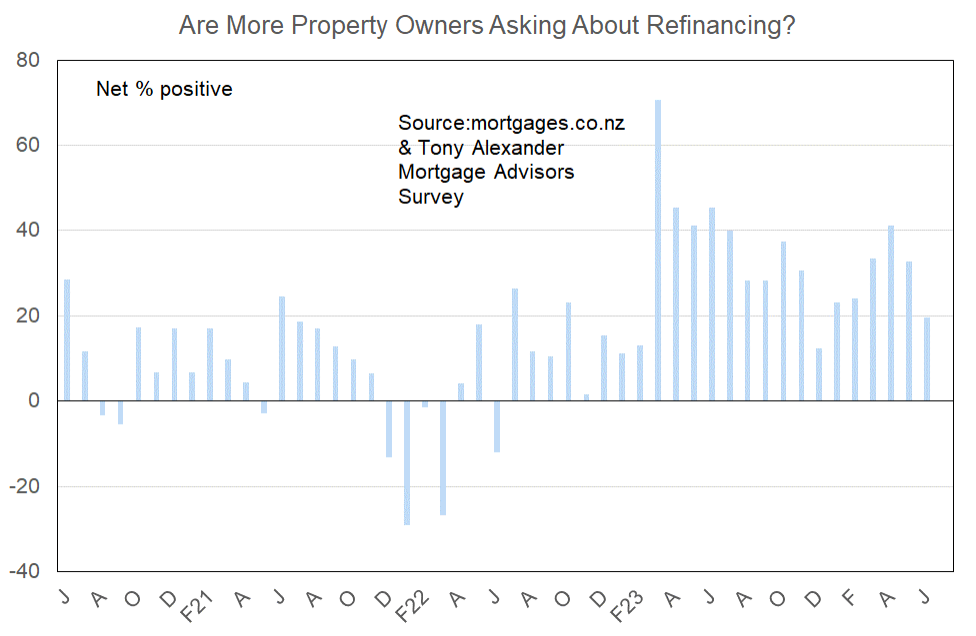

Are more property owners asking about refinancing?

There is an easing underway in the net proportion of brokers saying that more people are stepping forward and enquiring about refinancing their existing mortgage.

As previously noted, it is difficult to figure out what this means for the general supply of properties coming to the market. But the rise in this measure earlier this year does correlate with a rise in fresh property listings at the same time.

This suggests fresh listings may now be easing off and that is a result we can also see in my monthly survey of real estate agents.