Buyers still cautious

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken this week, attracted 58 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- A few more investor buyers are starting to appear, but activity levels are still low. Introduction of DTIs has had no noticeable impact but easing of LVRs has provided a small boost.

- Application processing times with banks have blown out and this may account for a sharp deterioration in perceptions of bank willingness to lend.

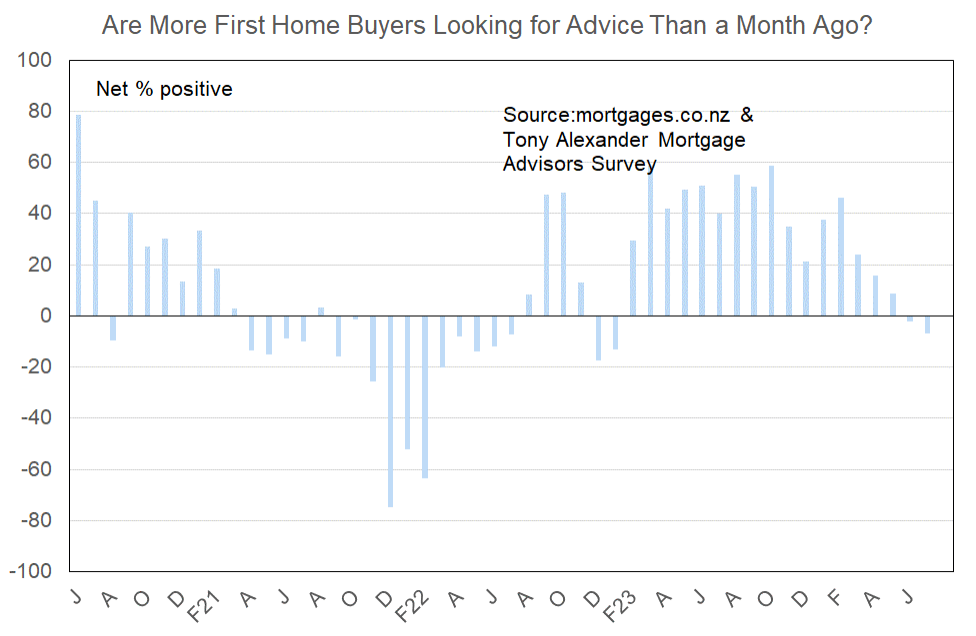

- A net 7% of advisers say that first home buyers are now backing away from the market.

More or fewer first home buyers looking for mortgage advice

A net 7% of mortgage brokers have said that they are seeing fewer first home buyers making enquiries. This is a deterioration from a net 2% negative last month and the weakest result since January last year. The measure is now well away from the net 46% positive result in February and reveals one of the starker deteriorations in Kiwi economic engagement from early this year.

Comments on bank lending to first home buyers submitted by advisers include the following.

- Some banks are really scrutinising build reports nail for nail and also demonstration of affordability popping up with 2x KO banks.

- Some affordability calculator changes reflect now higher minimum expenses making loan approvals harder.

- Focus continues to be on affordability. Not seeing any focus on DTI’s yet other than measuring them.

- One bank has changed UMI threshold from $1250.00 to $750 for over 80% deal for new customers.

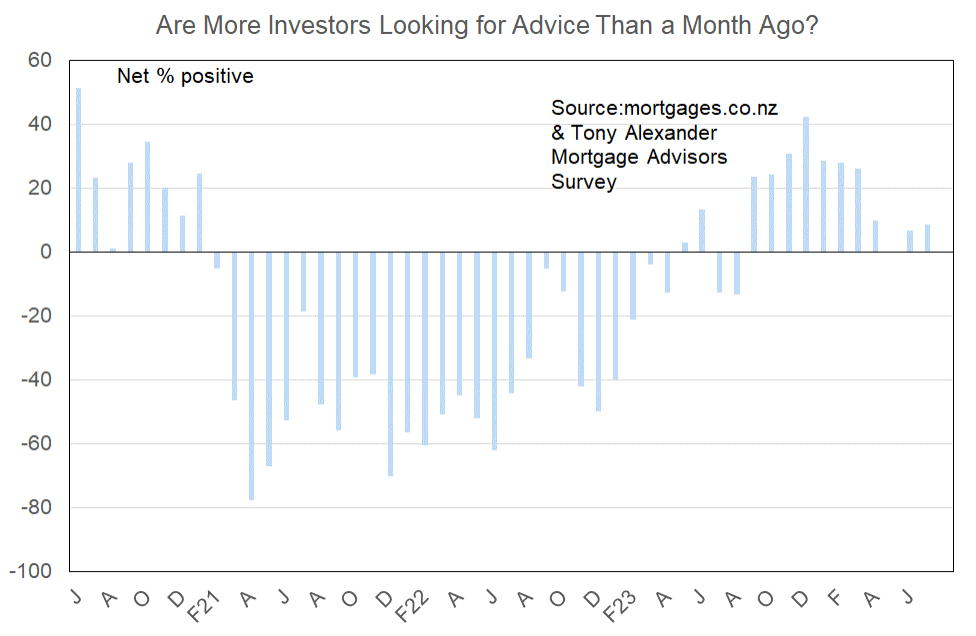

More or fewer investors looking for mortgage advice?

A net 9% of advisers have reported seeing more investors looking for advice. This is a small improvement from a net 7% last month but is still well down from the recent peak at 42% in December last year.

Why might this investor reading be stronger than that for first home buyers? Probably because of the surge in job insecurity revealed in my monthly survey of real estate agents depressing young buyer demand particularly, but hopes of canny counter-cyclical purchasing bringing some investors into the market. The easing of minimum investor deposit requirements from 35% to 30% of purchase price may also have slightly helped.

Comments made by advisers regarding bank lending to investors include the following.

- No real change other than the change in LVR’s to 70% for existing properties. DTI calculations with all lenders are different which is interesting Not all calculators provided to advisers are picking up the right information. Also seems there is confusion over whether new properties are exempt.

- Being especially pedantic around the exact insurance cost and council rates of an investment property when still only applying for pre-approval. Not being willing to condition for an amount that could be confirmed later.

- LVR’s eased to 70% as DTI’s introduced (7x)

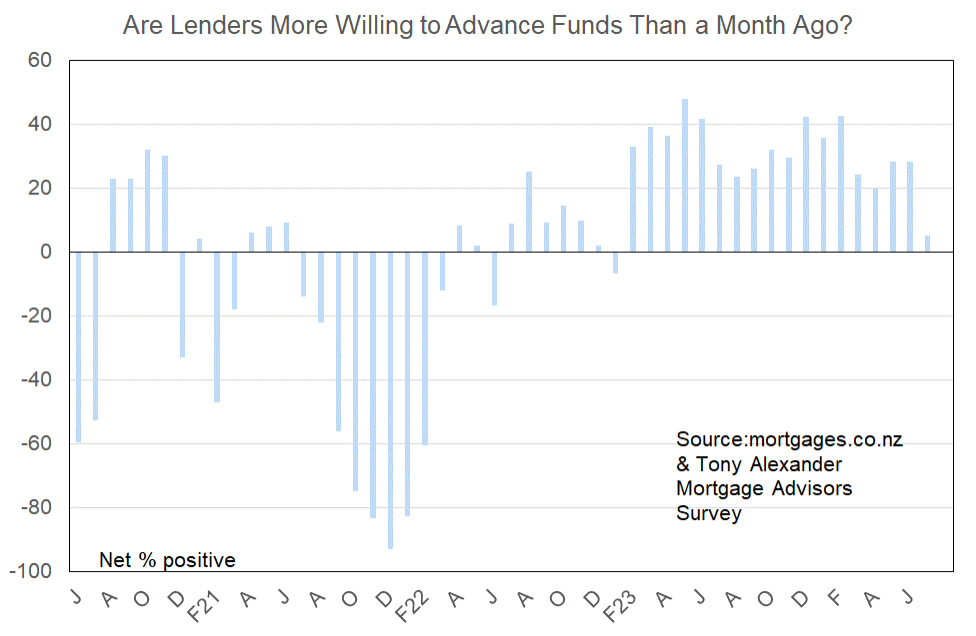

More or less lenders willing to advance funds?

This question has yielded the biggest change in our measures this month. Only a net 5% of mortgage advisers are saying now that lenders are becoming more willing to advance funds. The outcome is positive but well down from a net 28% in June and 43% in February.

A number of brokers stressed that processing times for applications have blown out and this may explain the result here.

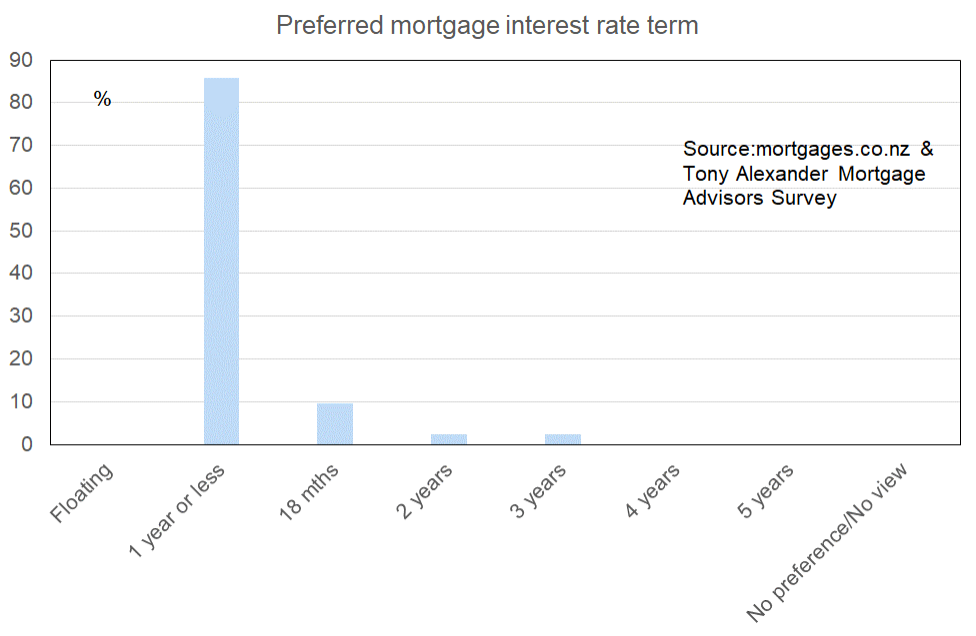

What time period are most people looking at fixing their interest rate?

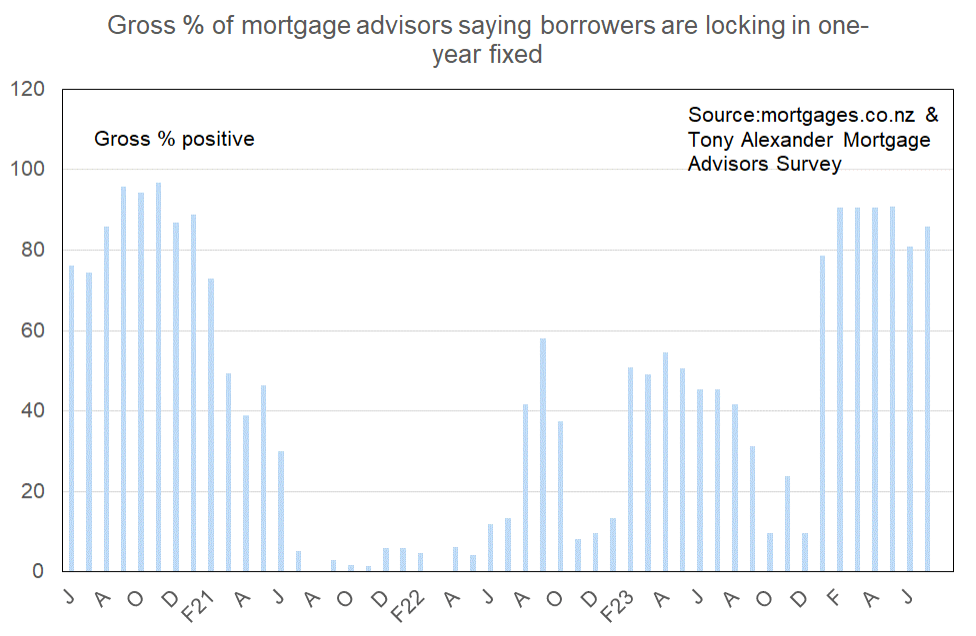

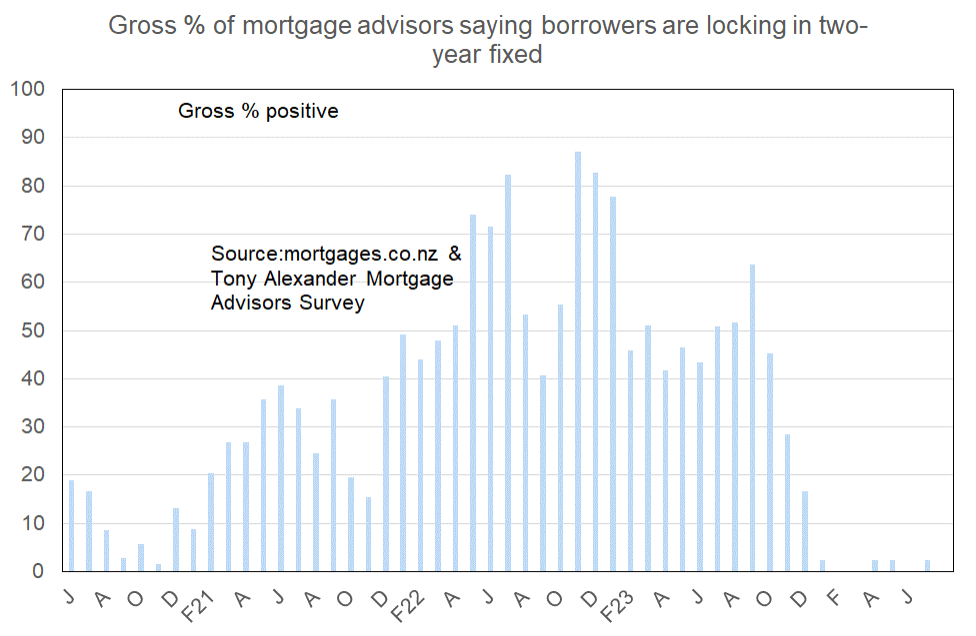

The widespread expectation that the next change in monetary policy will be an easing and that it will come much sooner than the Reserve Bank’s previously indicated September quarter of 2025 is encouraging people to only fix short.

86% of brokers say that borrowers are opting for a one-year term or less (six months is popular) and only 10% say fixing two years is preferred.

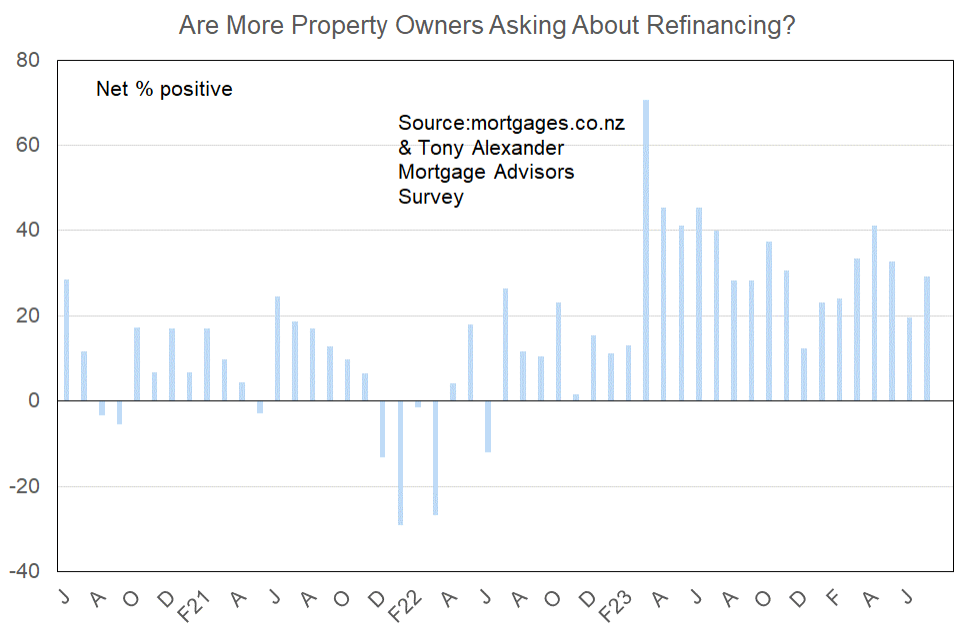

Are more property owners asking about refinancing?

A net 29% of mortgage advisers this month have reported that borrowers are increasing enquiries about refinancing. There are still some people rolling off rates near 3% onto new rates above 6.5%. Also, cashflow strains for owners from higher council rates and insurance premiums may be driving a greater focus on attempts to save an extra 0.1% off one’s new interest rate.

The problem for many people is that they could lower their rate by fixing long, but expectations of monetary policy easing are discouraging people from doing so. While this situation exists the cashflow pressures on people will likely add extra downward pressure to other areas of household spending such as hospitality and retail.