Strength remains

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 55 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- First home buyers remain active in the mortgage market, but most investors are on the sidelines waiting for the election outcome.

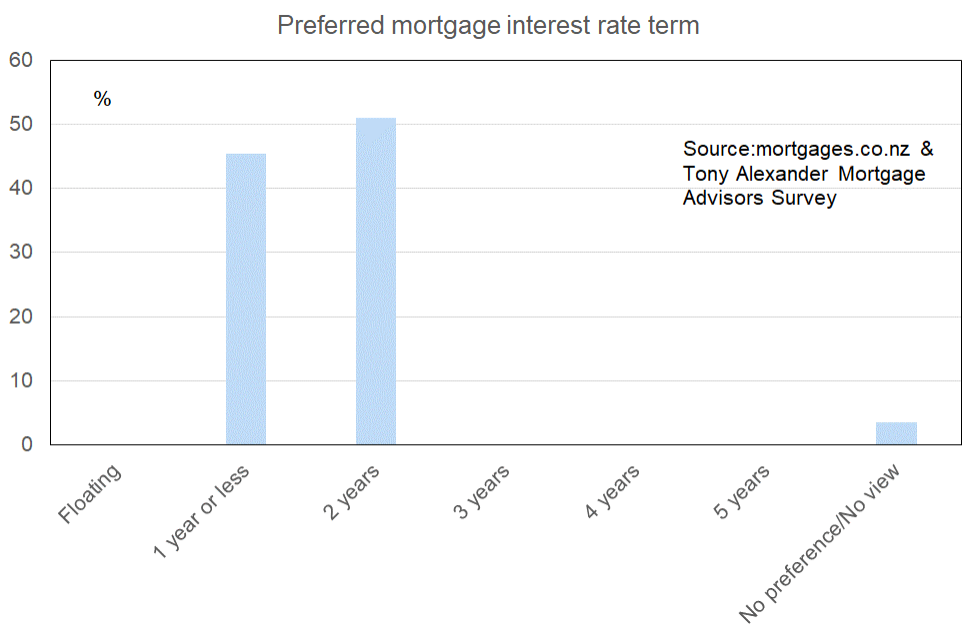

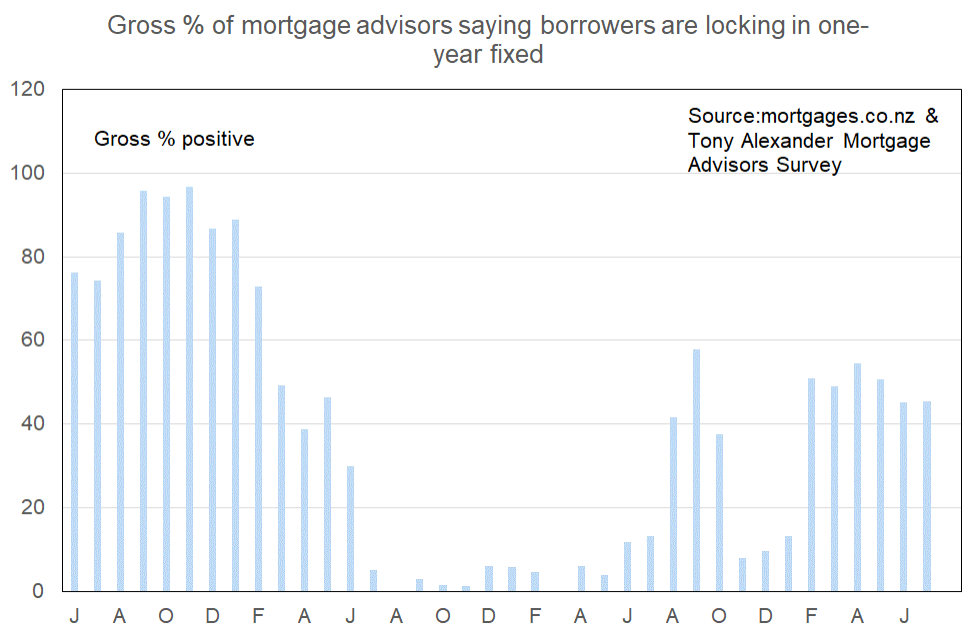

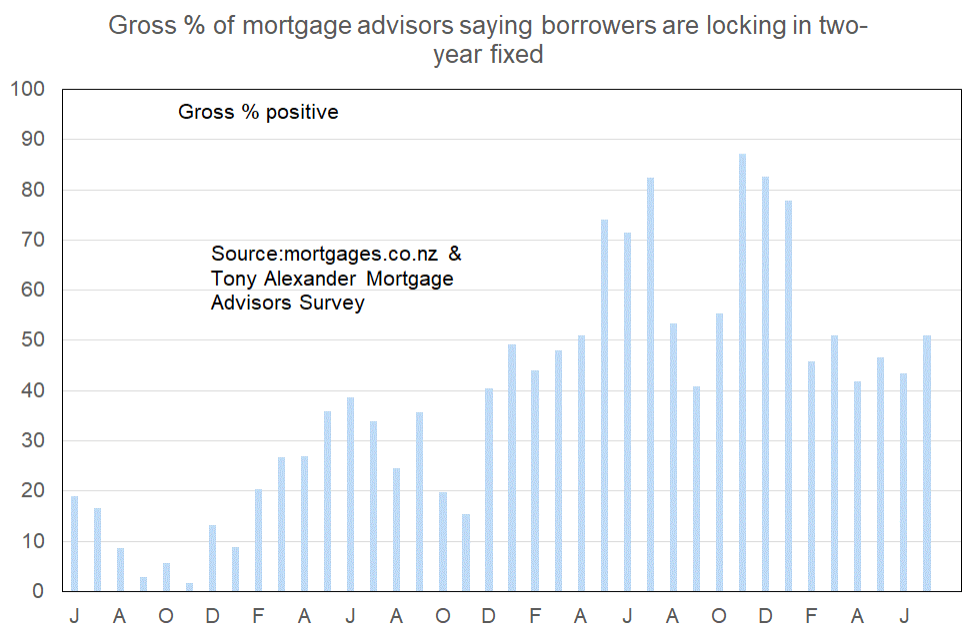

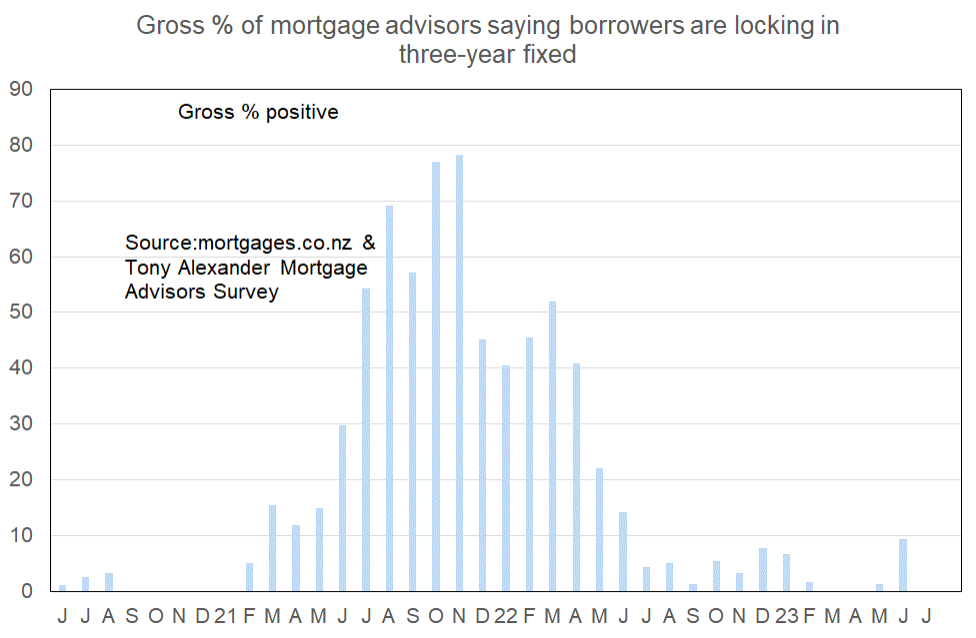

- There has been a lift in borrower preference for fixing two years.

- High stress test mortgage rates are keeping a lot of buyers on the sidelines, frustrated perhaps as they see signs of the market turning but are unable to make a purchase until interest rates fall.

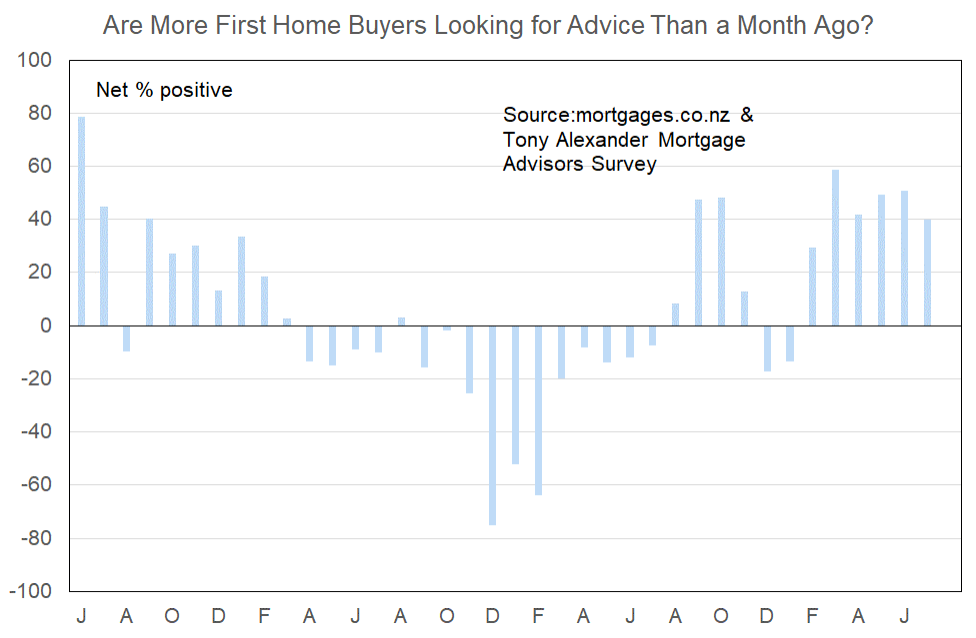

More or fewer first home buyers looking for mortgage advice

July represents the sixth month during which a strong net positive proportion of mortgage advisers responding in our monthly survey have said that they are seeing more first home buyers in the market. A net 40% have said so compared with 51% in June and 49% in May.

The decline is unlikely to be the start of an easing trend but instead may reflect a slight stepping back by some buyers. This could be in response to the recent round of bank mortgage rate rises which have been undertaken despite no tightening of monetary policy by the Reserve Bank.

Comments on bank lending to first home buyers submitted by advisers include the following.

- More lenient now with clients’ expenses which is good, discretionary expenses not needed to be included now in applications.

- Less restrictions on expenses, however, seem to be seeing more clients with credit impairments.

- Higher stress test rates are eliminating a number of potential hopeful buyers. Slight loosening of high LVR lending with banks now entertaining ‘new’ clients if deals are live

- LVR restrictions lifted last month have been positive.

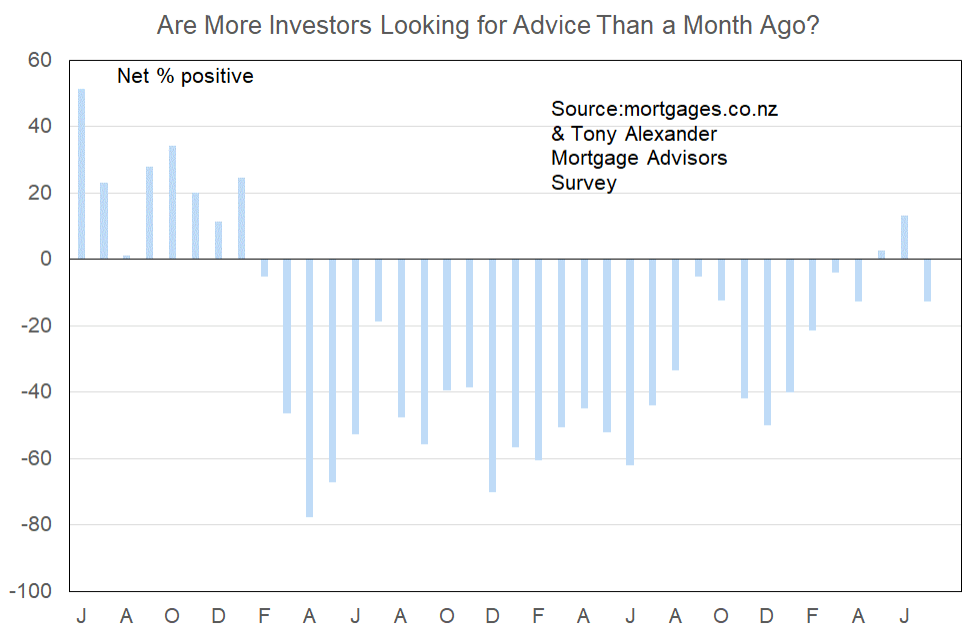

More or fewer investors looking for mortgage advice?

Comments made by advisers regarding bank lending to investors include the following.

- Investors still sitting on the sidelines until they know what’s happening with the election & interest deductibility.

- Brutal. Basically a waste of time unless clients have very strong income and low debt.

- Investors have gone very quiet, not getting any enquire from them in regard to buying another property.

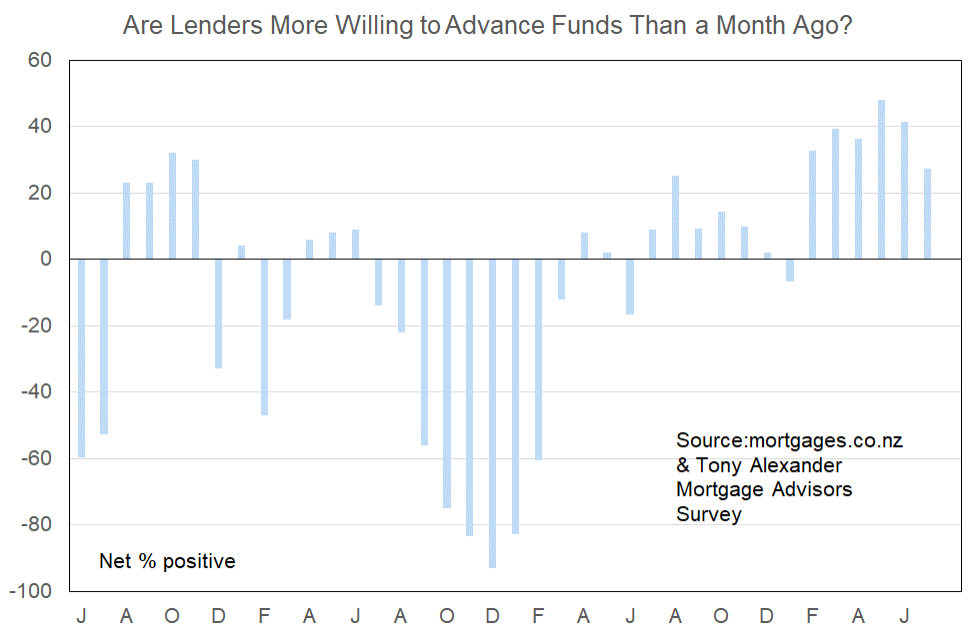

More or less lenders willing to advance funds?

In an environment of low sales and with the Reserve Bank perhaps still sensitive to any signs that mortgage rates are being discounted, banks are relying on easier lending rules in order to at least protect market share.

The easing of lending toughness has been assisted by the June 1 change in Loan to Value Ratio rules allowing banks to undertake extra lending at less than 20% deposit, and cutting the minimum investor deposit from 40% to 35% of property valuation.

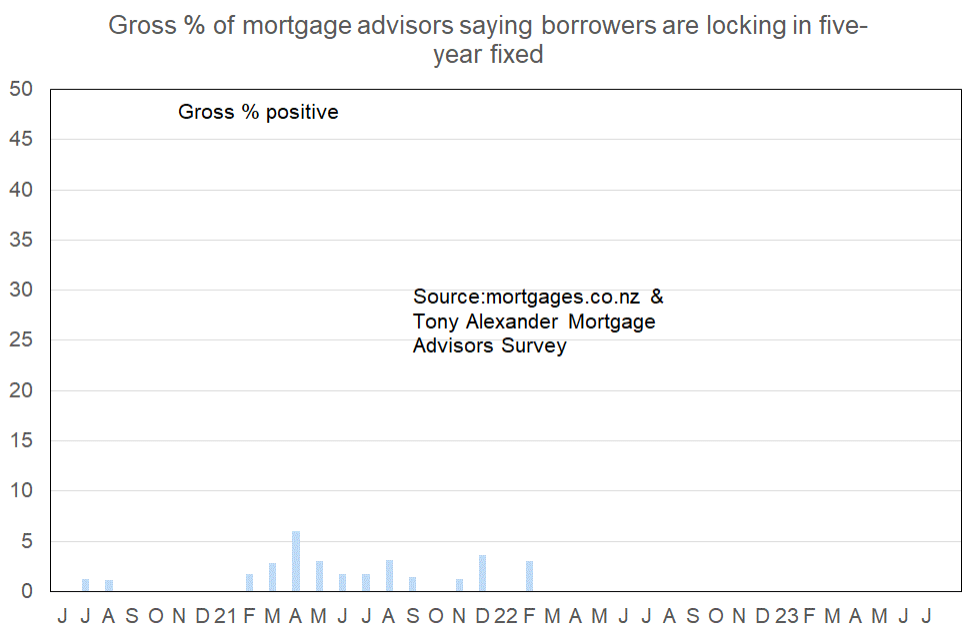

What time period are most people looking at fixing their interest rate?