Conditions still tough

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 68 responses.

The main themes to come through from the statistical and anecdotal responses include these.

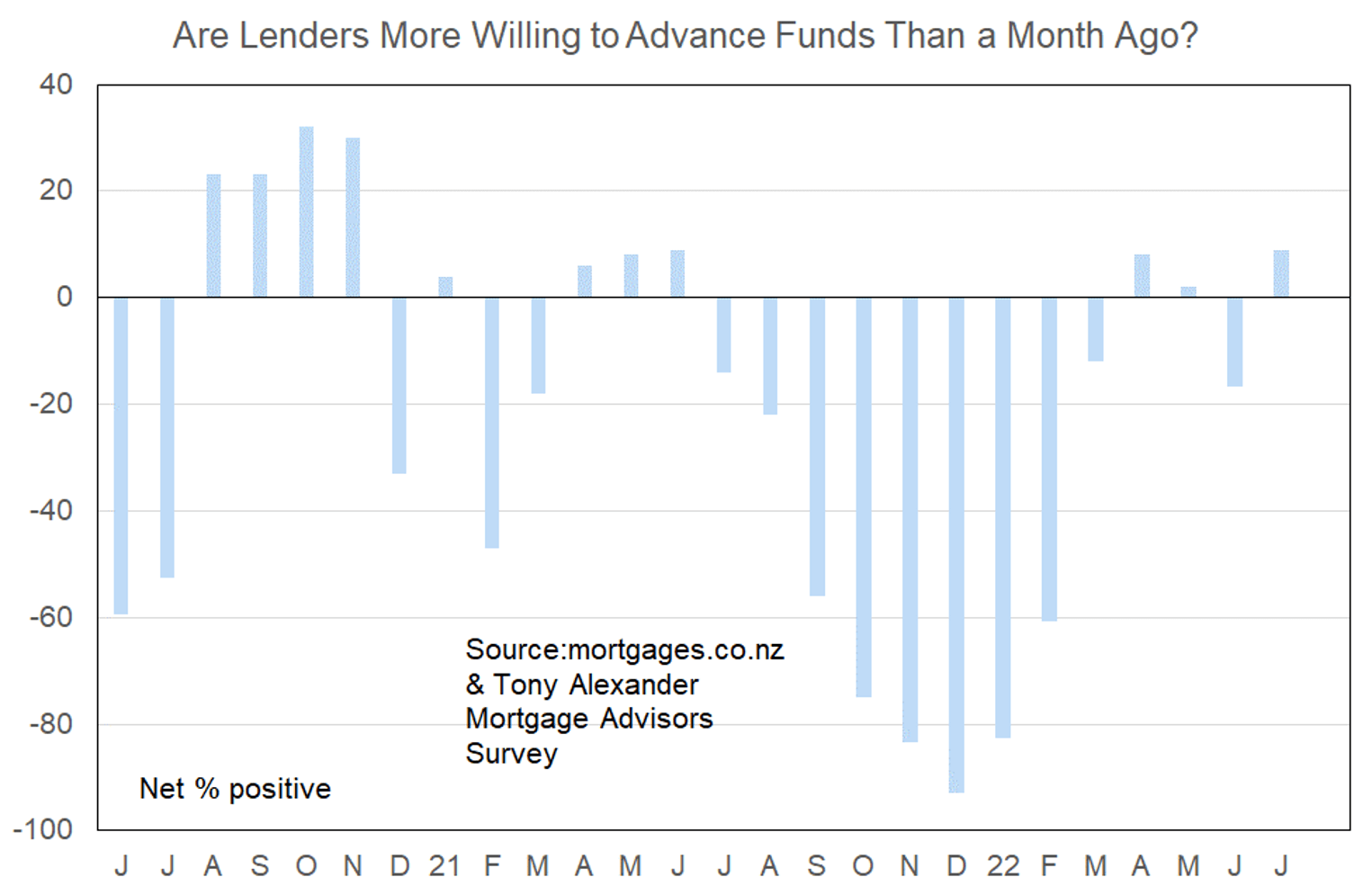

- We passed the peak credit crunch period early this year but as yet availability of finance cannot be considered generous.

- Investors continue to be largely absent as buyers, but the stepping back of first home buyers could be near an end – depending on their ability to get finance.

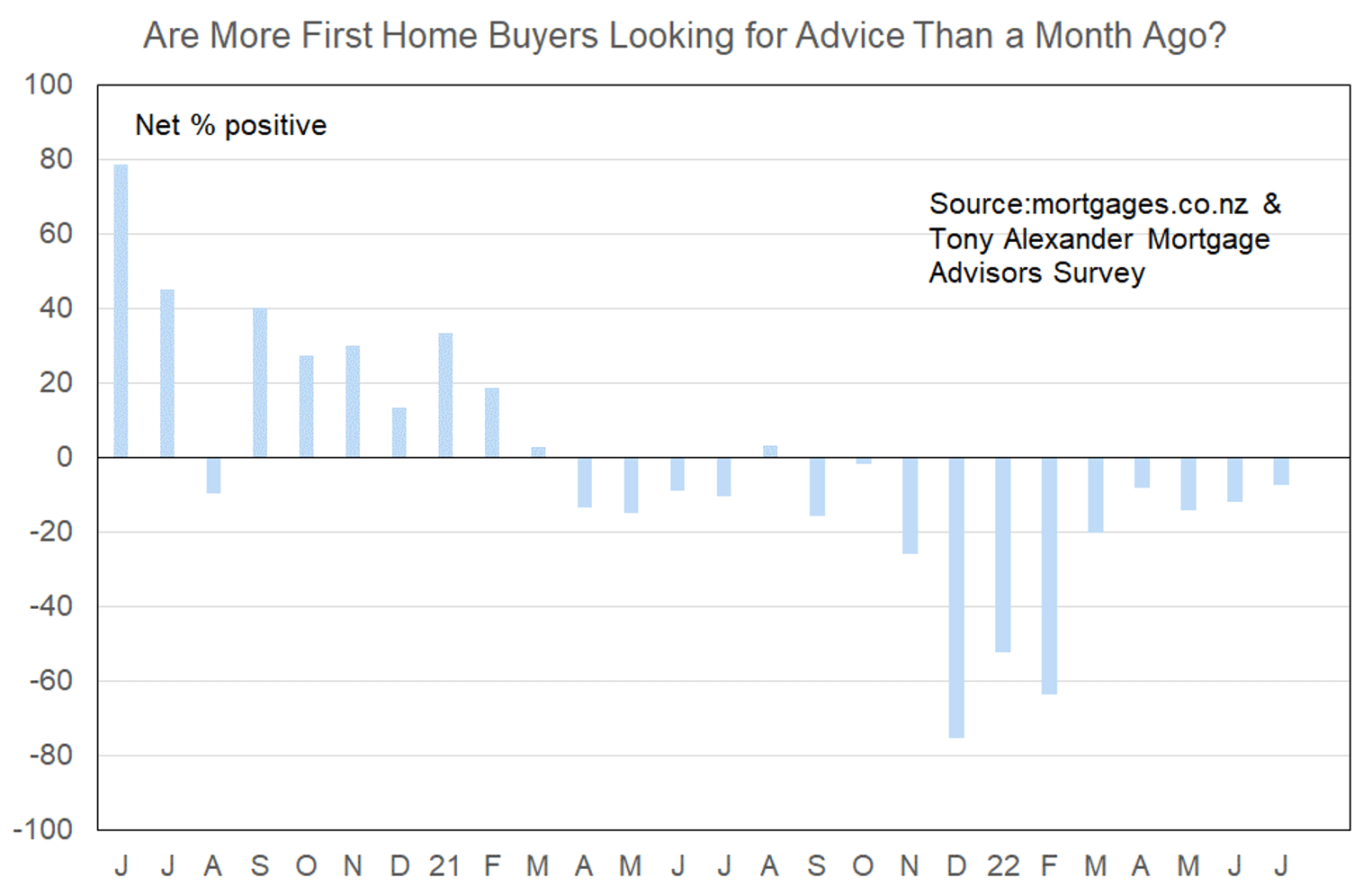

More or fewer first home buyers looking for mortgage advice

In November 2021 first home buyers were hit badly by the tightening of LVR rules, and then hit again from December when the CCCFA changes came into effect. The result was a net 75% of mortgage advisers in December reporting fewer first home buyers looking for assistance.

In that regard the latest result of -7% means we are well past the worst of the credit crunch. However, as yet there are few solid signs that first home buyers are stepping forward in greater numbers.

Comments on lending to first home buyers submitted by advisers include the following.

- There are limited low deposit options outside new builds and Kainga Ora. High test interest rates are reducing the amount FHB’s can borrow.

- The majority of first home buyers I am dealing with lately are with Kainga Ora First Home loans, due to them not having a 20% deposit.

- Most lenders have backed off from low equity loans and are again prioritising existing customers over new to bank customers.

- CCCFA ‘improvements’ are immaterial and make no difference.

- Due to high servicing test rate, approvals are a wee bit challenge at this stage however banks are open to lend and anyone that fits is getting approved with decent cash backs.

- There has been some loosing up of the detailed analysis of bank statements. Lenders are now accepting that what happened in the past is not a reflection of what spending habits will be in the future once new lending is in place. Biggest issue now is not the value of a new home, but the cost of the repayments given the rising interest rates.

- Less emphasis on spending habits.

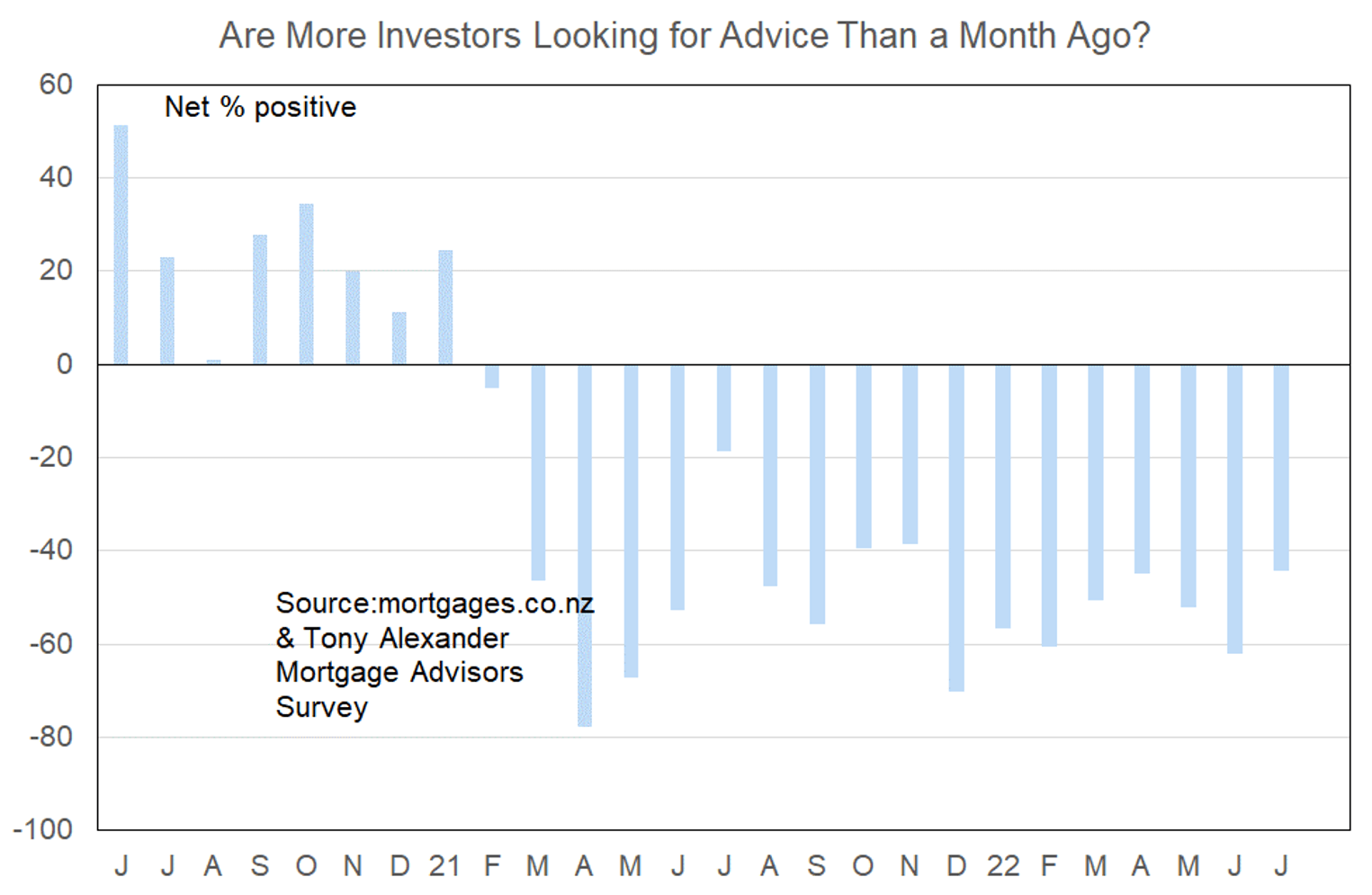

More or fewer investors looking for mortgage advice?

A net 44% of advisers have reported that they are seeing fewer investors coming forward for assistance with arranging finance. The graph here tells us that there is no obvious improving trend in this measure and investors by and large have stepped back from buying ever since the tax changes were announced last year.

Comments made by advisers regarding bank lending to investors include the following.

- Rent being scaled heavily and accounting for rates and insurance separately. Pretty penalising for investors at the moment under regular bank criteria and difficult to find solutions.

- There is still quite a difference in rental income calculations between different banks

- Interest Only is becoming harder to get for more than 2 years. Could previously get up to 5 years with no issue. Conversations are now around when they plan to re-enter the market so they can time the run for the 2024 Tax Year (assuming National wins next Sept) so they can have the interest deductibility back.

- Difficult for investors. Not a lot of activity, however, investors starting to enquire again.

- Investors have fallen off a cliff. I’ve not done an investment loan since May.

More or less lenders willing to advance funds?

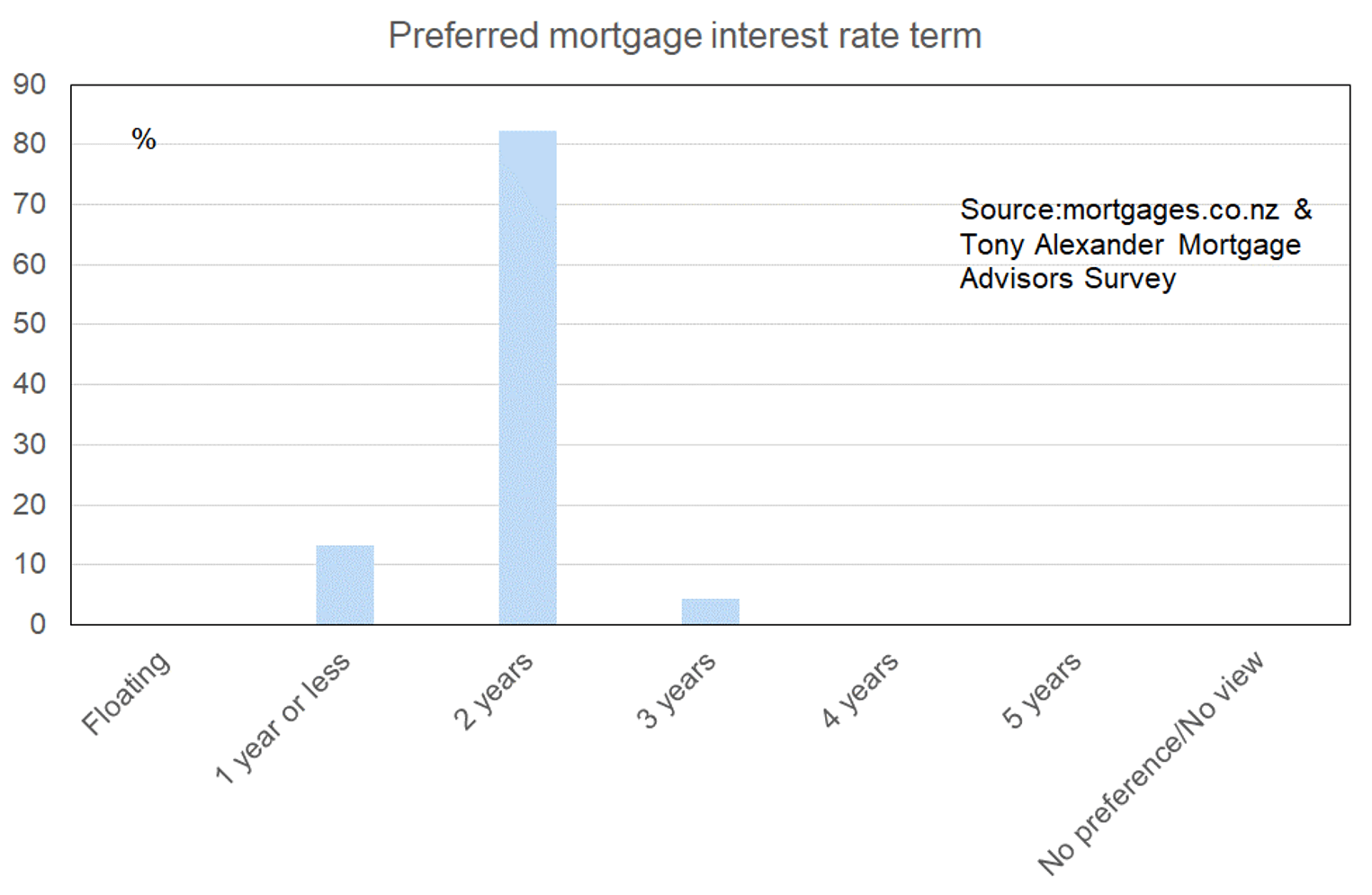

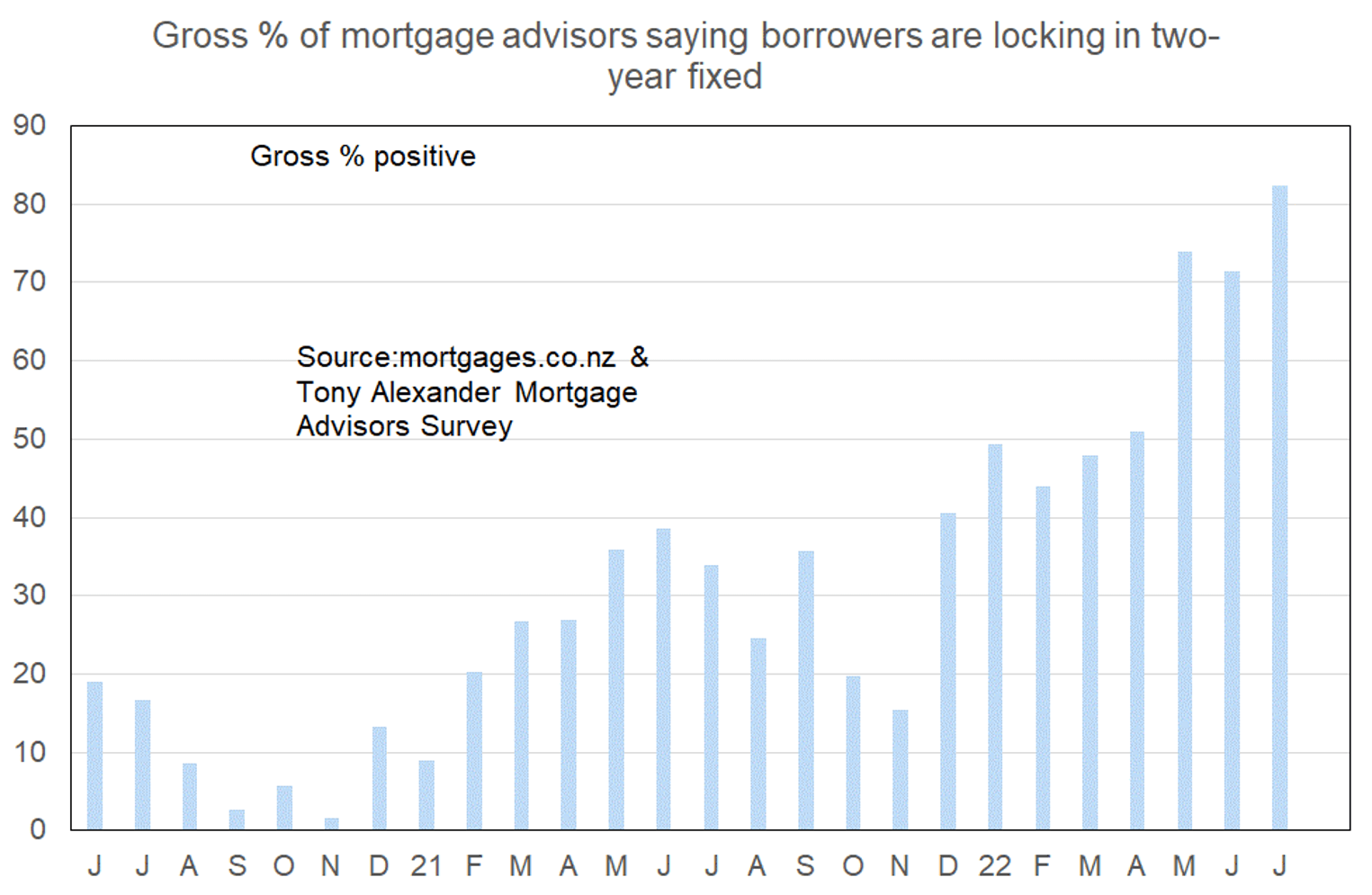

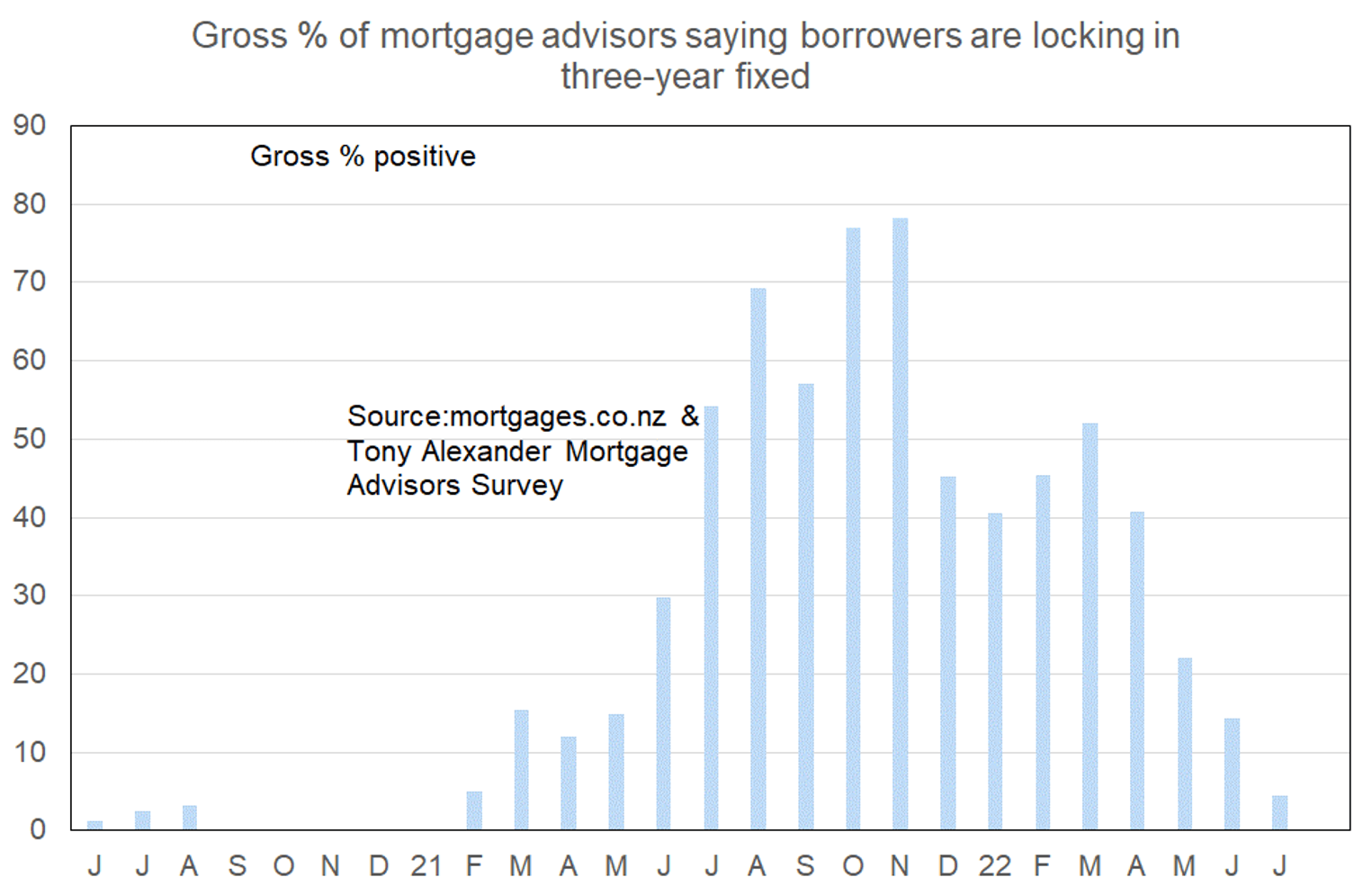

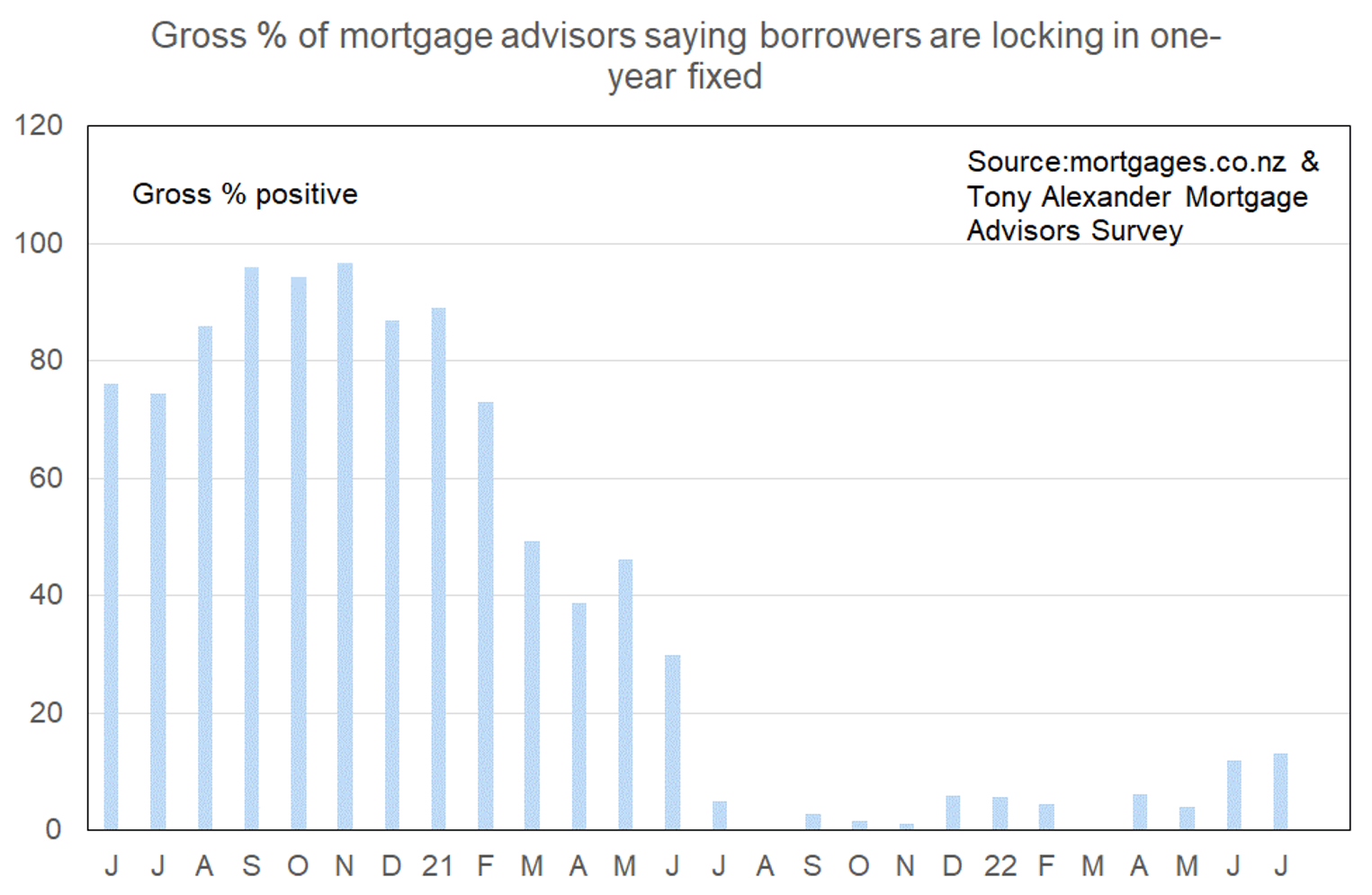

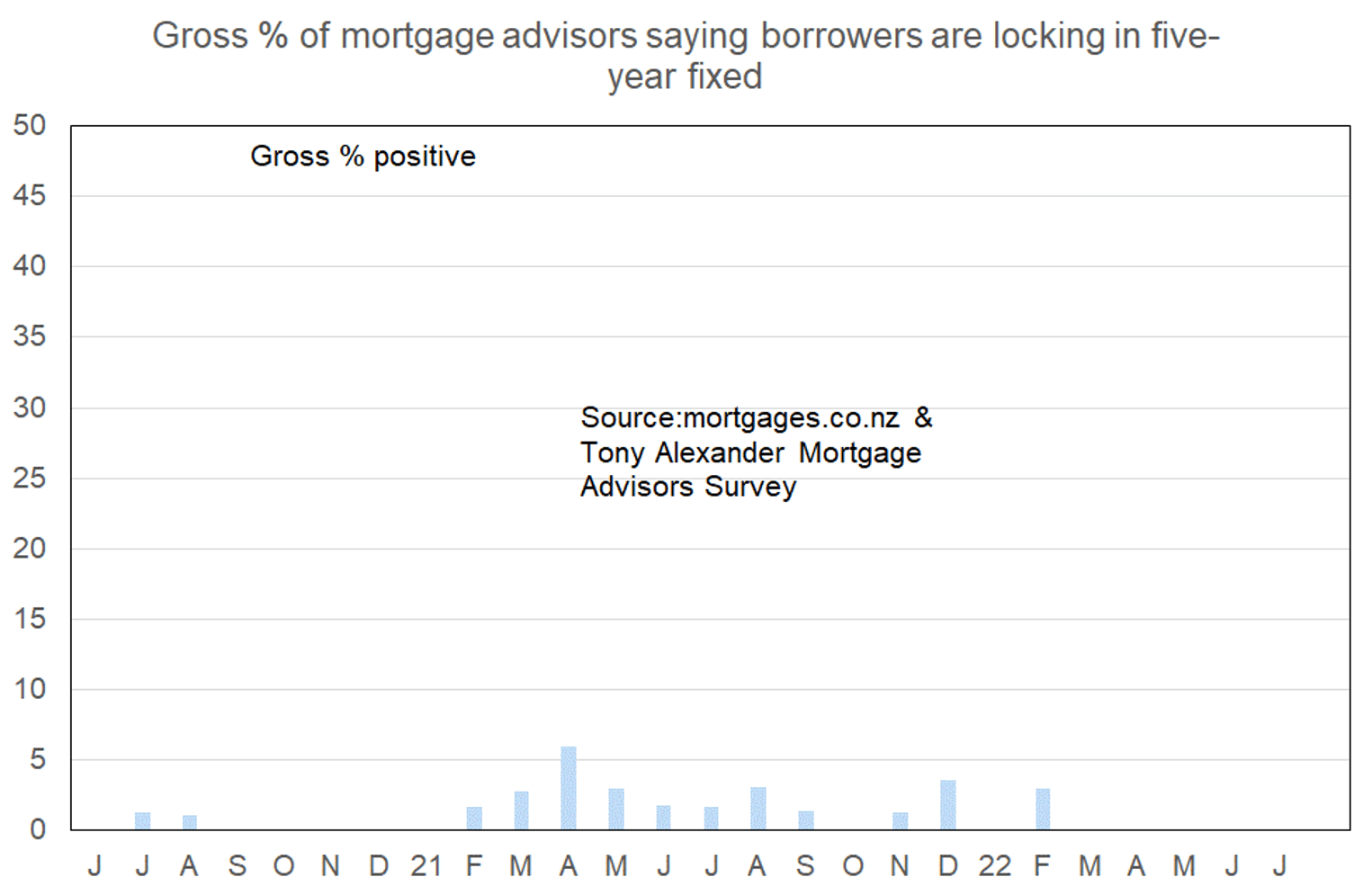

What time period are most people looking at fixing their interest rate?