First home buyers back

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken this week, attracted 56 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- Banks are slightly easing lending criteria for first home buyers.

- Anticipation of more buyers coming forward is encouraging some people to try and make their purchase now rather than waiting.

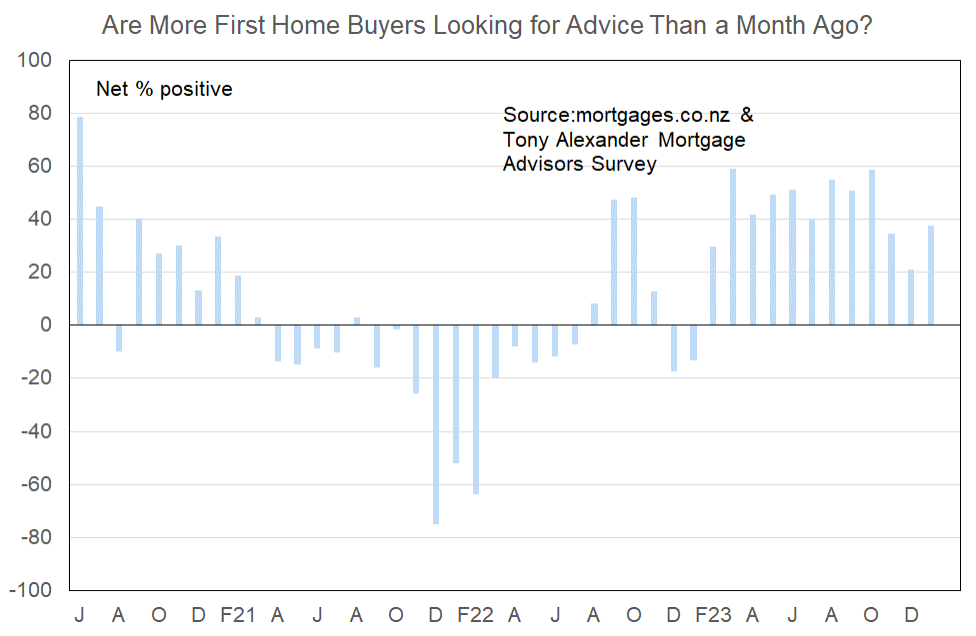

More or fewer first home buyers looking for mortgage advice

In our first survey for the year a net 38% of advisors have reported that they are seeing more first home buyers looking for advice. This is up from a net 21% in December and 35% in November, suggesting that the December dip was simply a pre-Christmas stepping back.

Now, with people returning from holidays and evidence of markets rising and interest rates slowly falling with more declines expected, young buyers are showing renewed interest in making a property purchase.

Comments on bank lending to first home buyers submitted by advisers include the following.

- No Change. Still limited low deposit funds available. No pre-approvals.

- Banks seem more willing to workshop deals and have them work, I think they are keen to get business done and locked in before rates start to come down.

- Some are open to negotiate the surplus income required per month – if it’s a strong deal otherwise it’s worth submitting. Xxx bank in particular is lenient with boarders and will allow 2 for over 80% LVR which is really helpful to FHB reliant on boarder income that don’t meet Homes & Communities FHL criteria.

- Inclusion of boarder income in high LVR loans has been helpful, especially for individual purchasers.

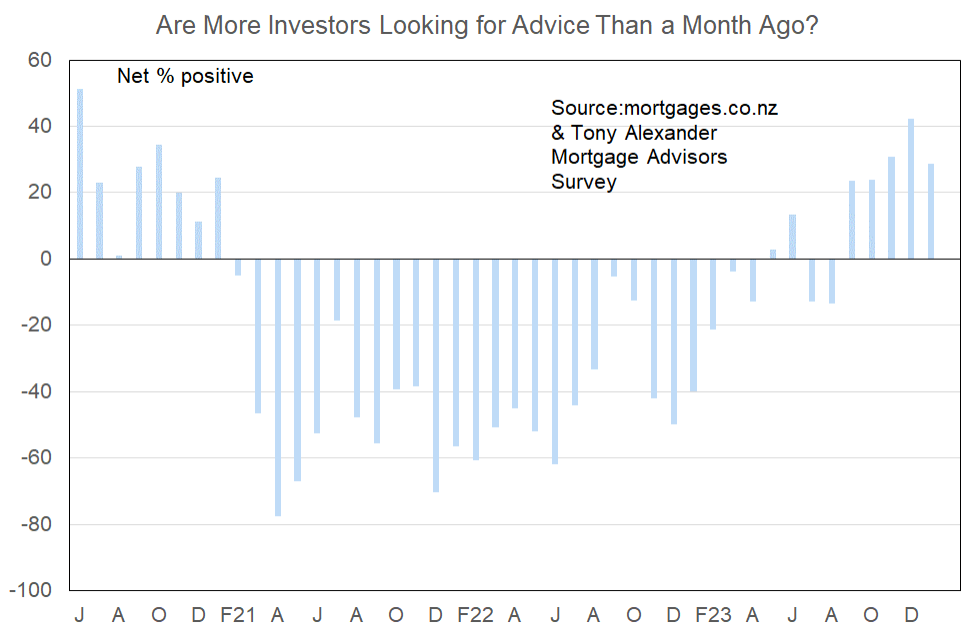

More or fewer investors looking for mortgage advice?

Whereas our surveyed revealed a dip in first home buying interest pre-Xmas and now a recovery, for investors the pattern is the opposite.

A net 29% of our survey respondents have said that they are seeing more investors coming in for advice. This is down from a net 42% in the December survey but about the same as November’s 31%.

Investors are still struggling to make the numbers work with high cost increases and high interest rates, and banks are showing little new enthusiasm for lending to investors as yet. But tax rule changes are being greeted positively and this may bring more interest forward as the year progresses. There is no evidence of a wave of new investors appearing as such.

Comments made by advisers regarding bank lending to investors include the following.

- Previously banks shaded the rental income by 20% to allow for Rates, insurances, prop management fees and the possible tax liability on the non-tax deductibility and vacancy. with the introductions of deductibility and the banks now requiring the actual rates and insurance cost to be included in the expenses, The banks have reduced the shading, however, it seems the banks are overly conservative for investment proposals.

- Still very difficult to get the numbers to stack up, but the banks are easing their criteria slowly but surely.

- Not much change yet, but expect some as the year progresses. Interest rates are still prohibitive for a lot of existing investors.

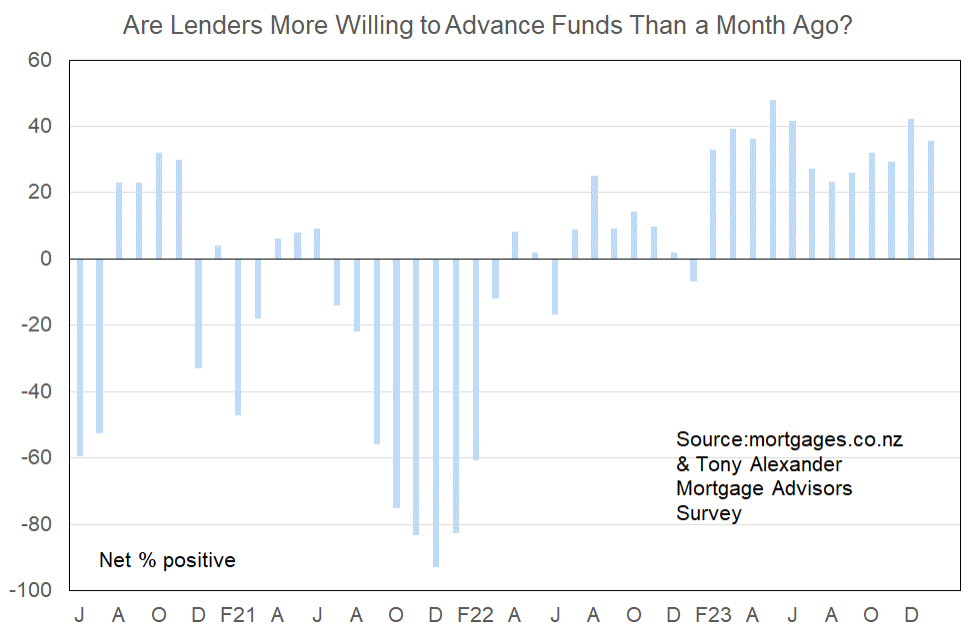

More or less lenders willing to advance funds?

A net 36% of respondents this month have reported that lenders are becoming more willing to advance finance. This outcome is broadly consistent with others since March last year and evident in the comments which brokers have submitted regarding changes in bank lending criteria.

No broker however has indicated that banks are falling over themselves to advance funds. Caution continues to prevail, but the direction of change is positive – if slow.

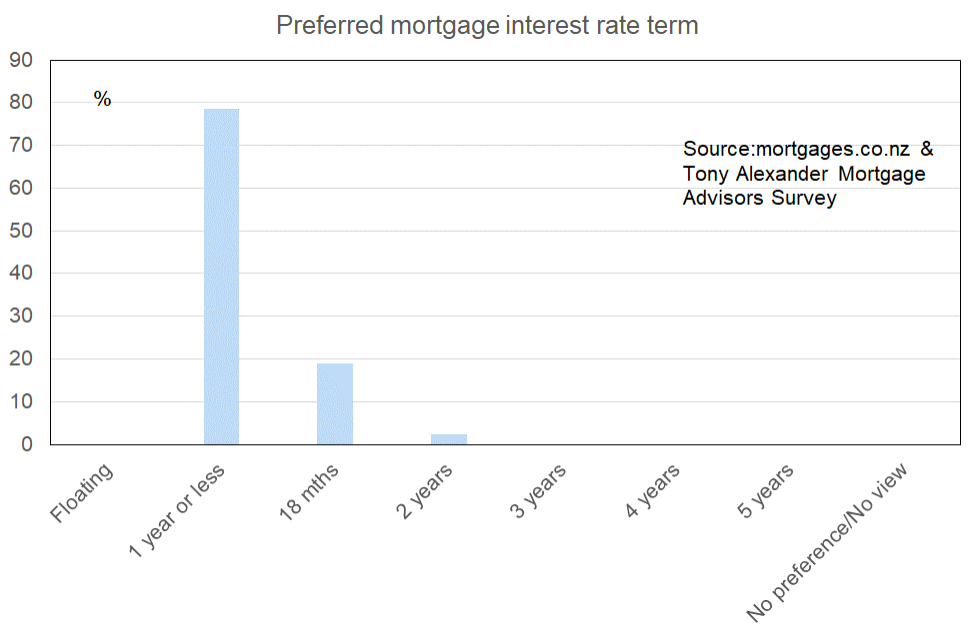

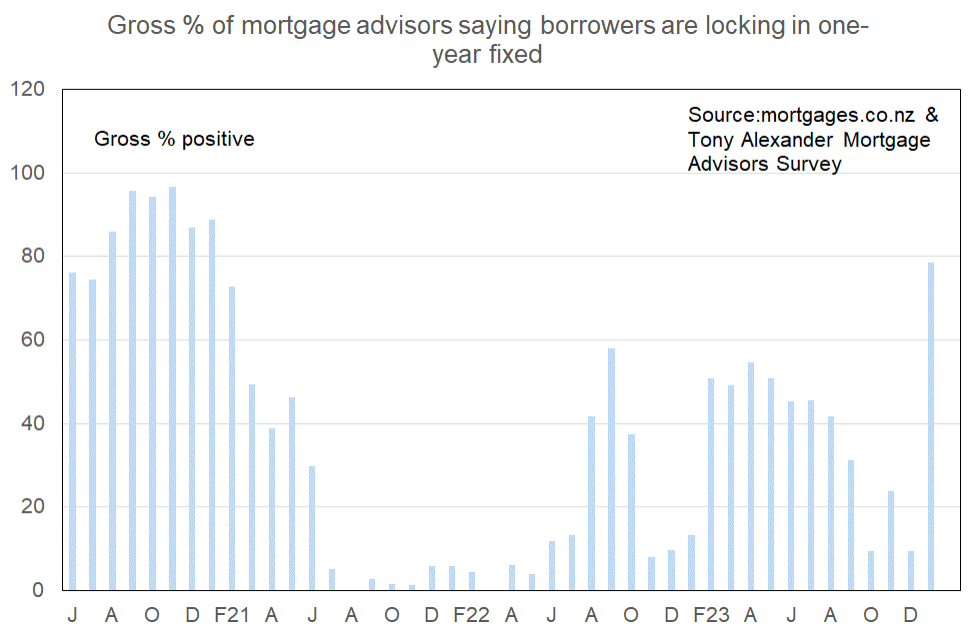

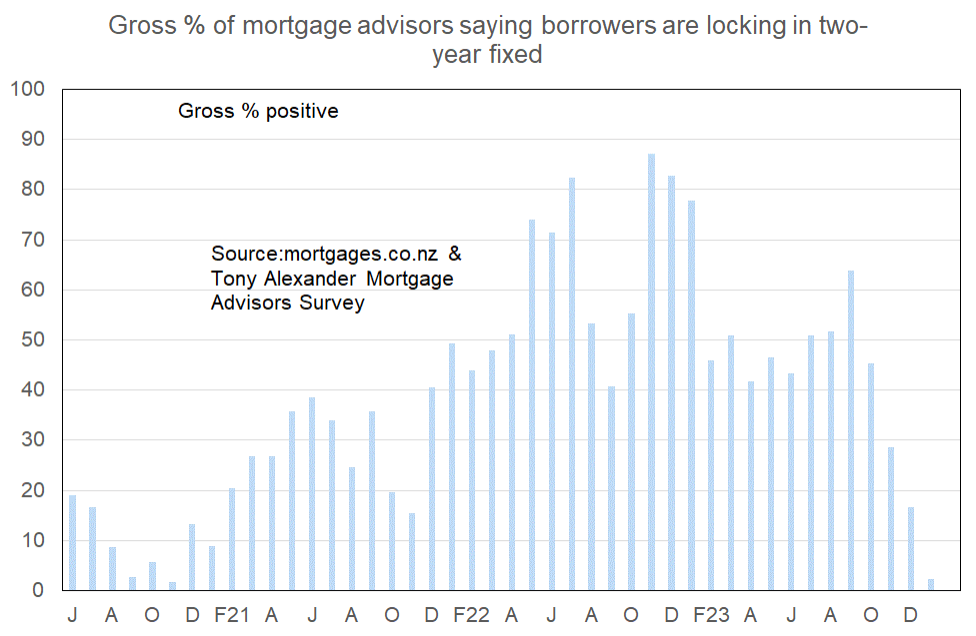

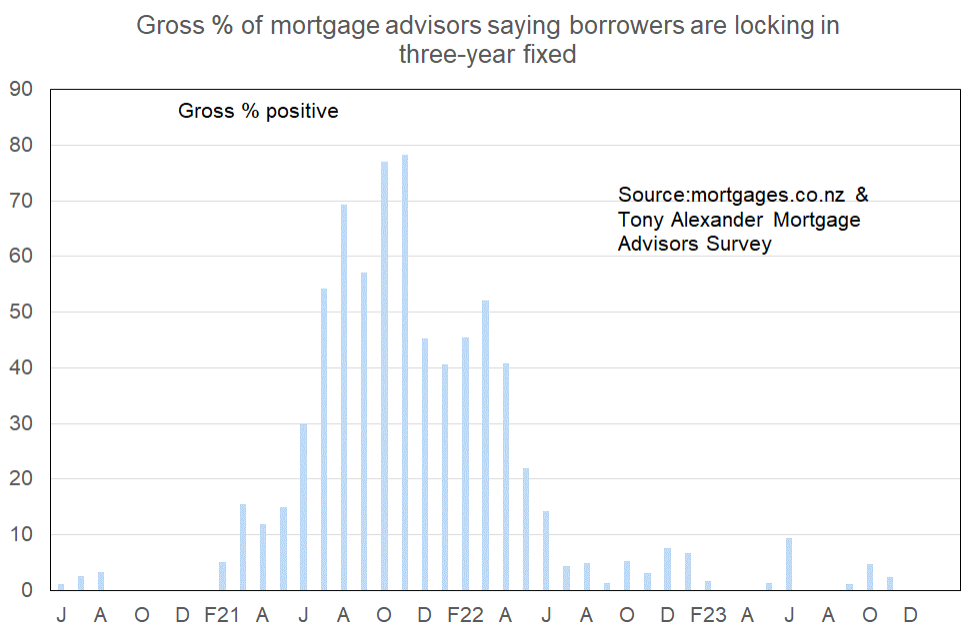

What time period are most people looking at fixing their interest rate?

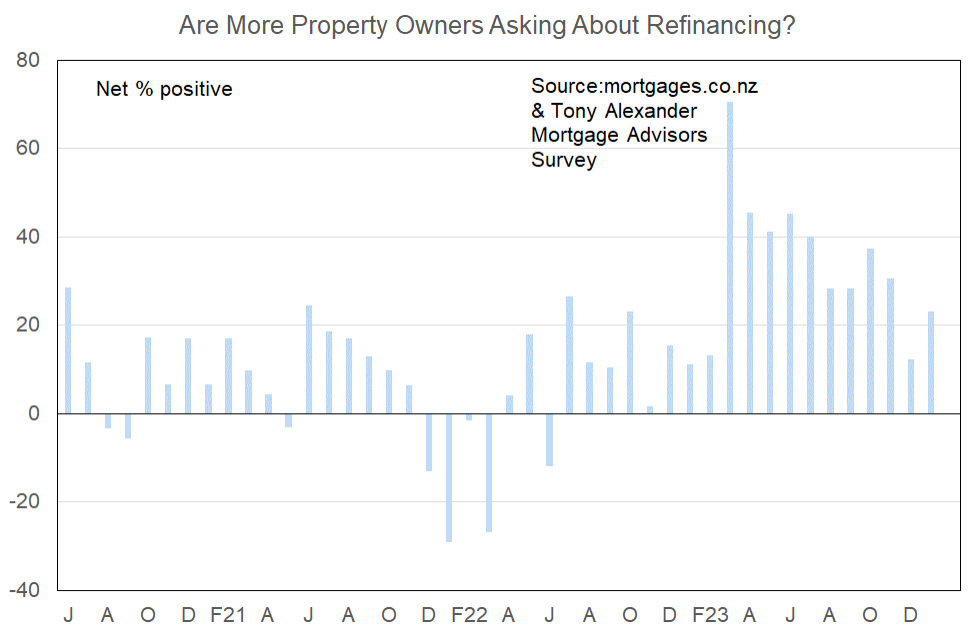

Are more property owners asking about refinancing?