Buyer drought for summer persists

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 45 responses. This is lower than normal but understandable given the time of year.

The main themes to come through from the statistical and anecdotal responses include these.

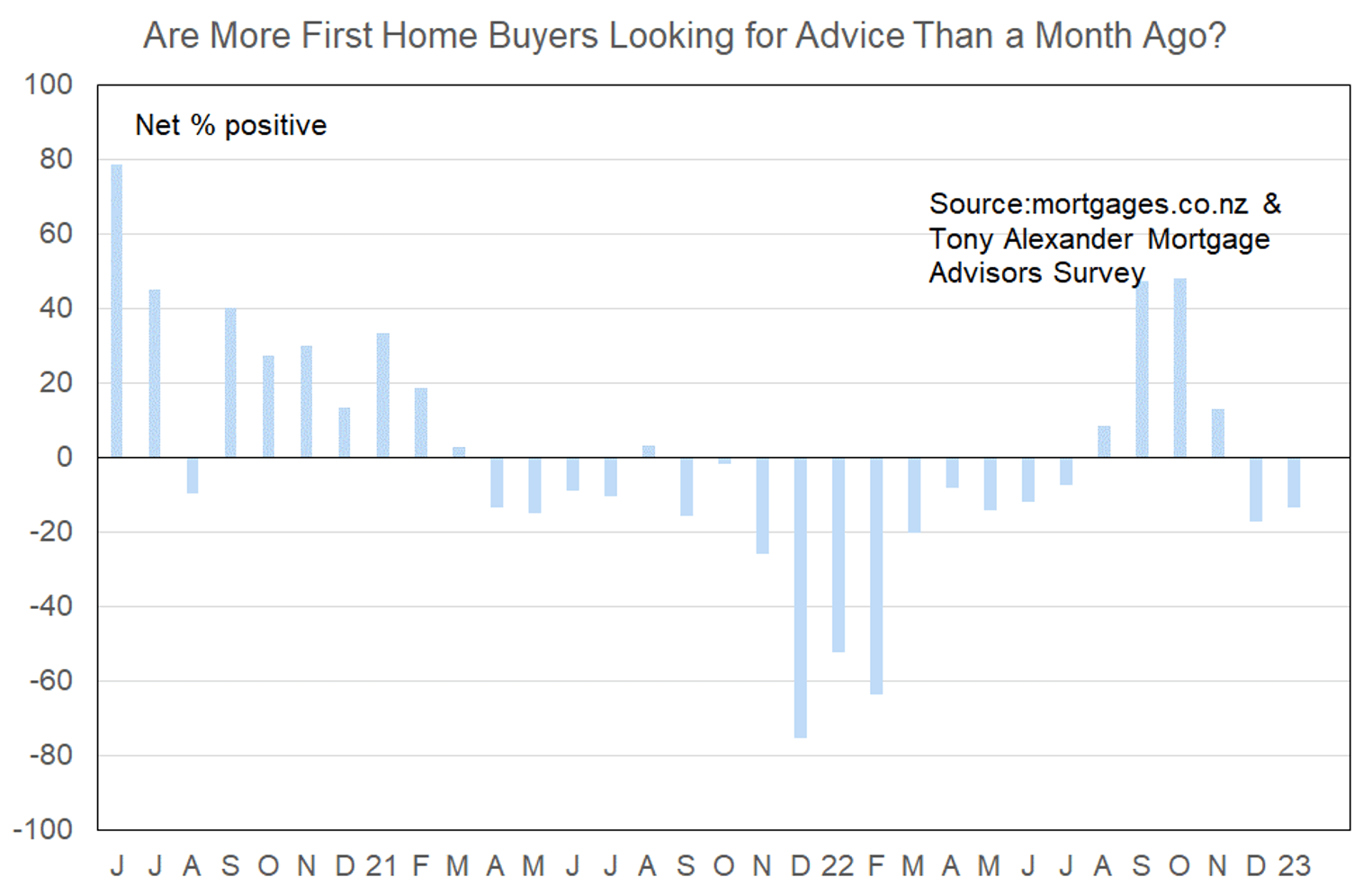

- Buyers remain in the shadows be they first home buyers or investors.

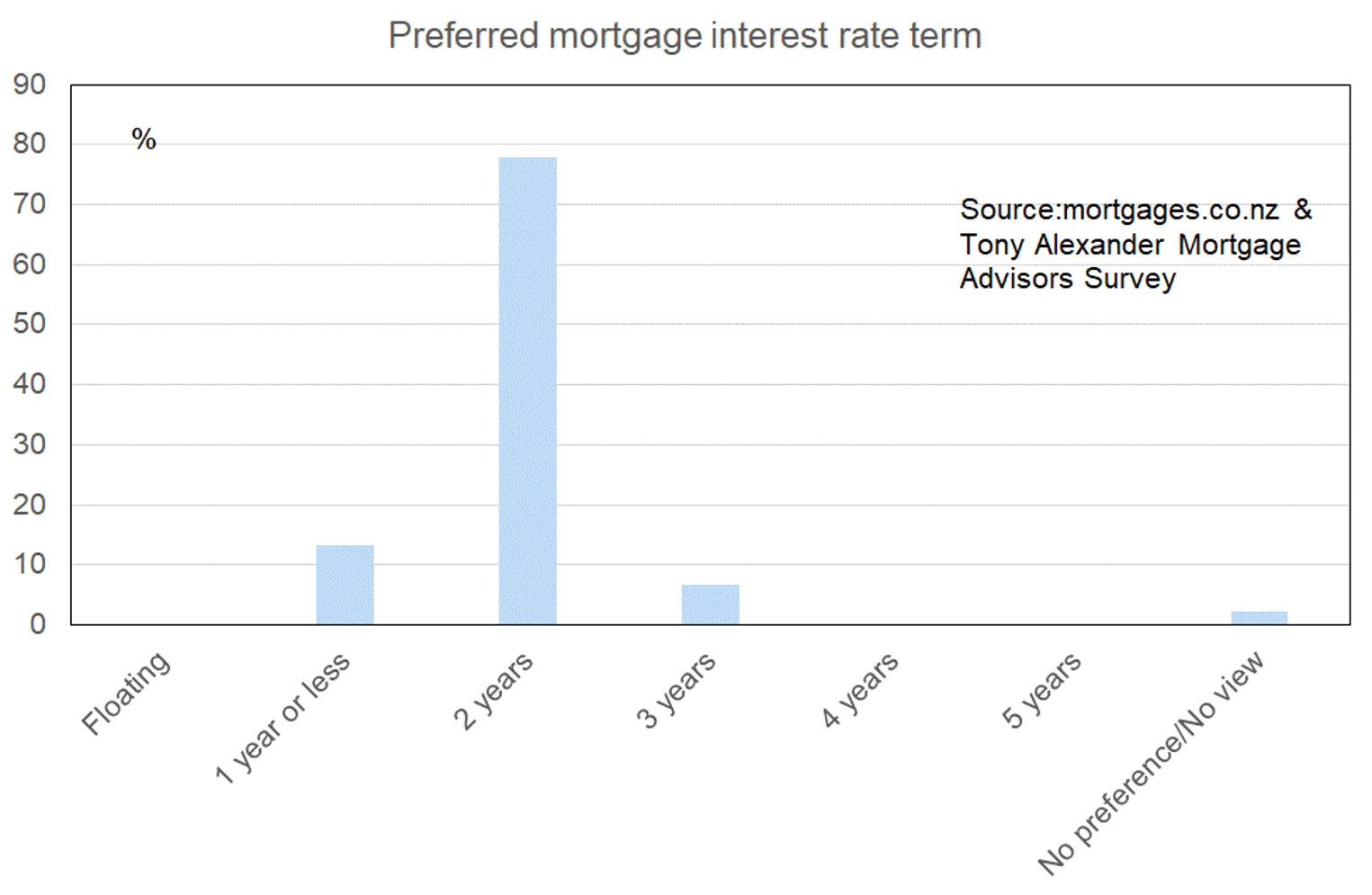

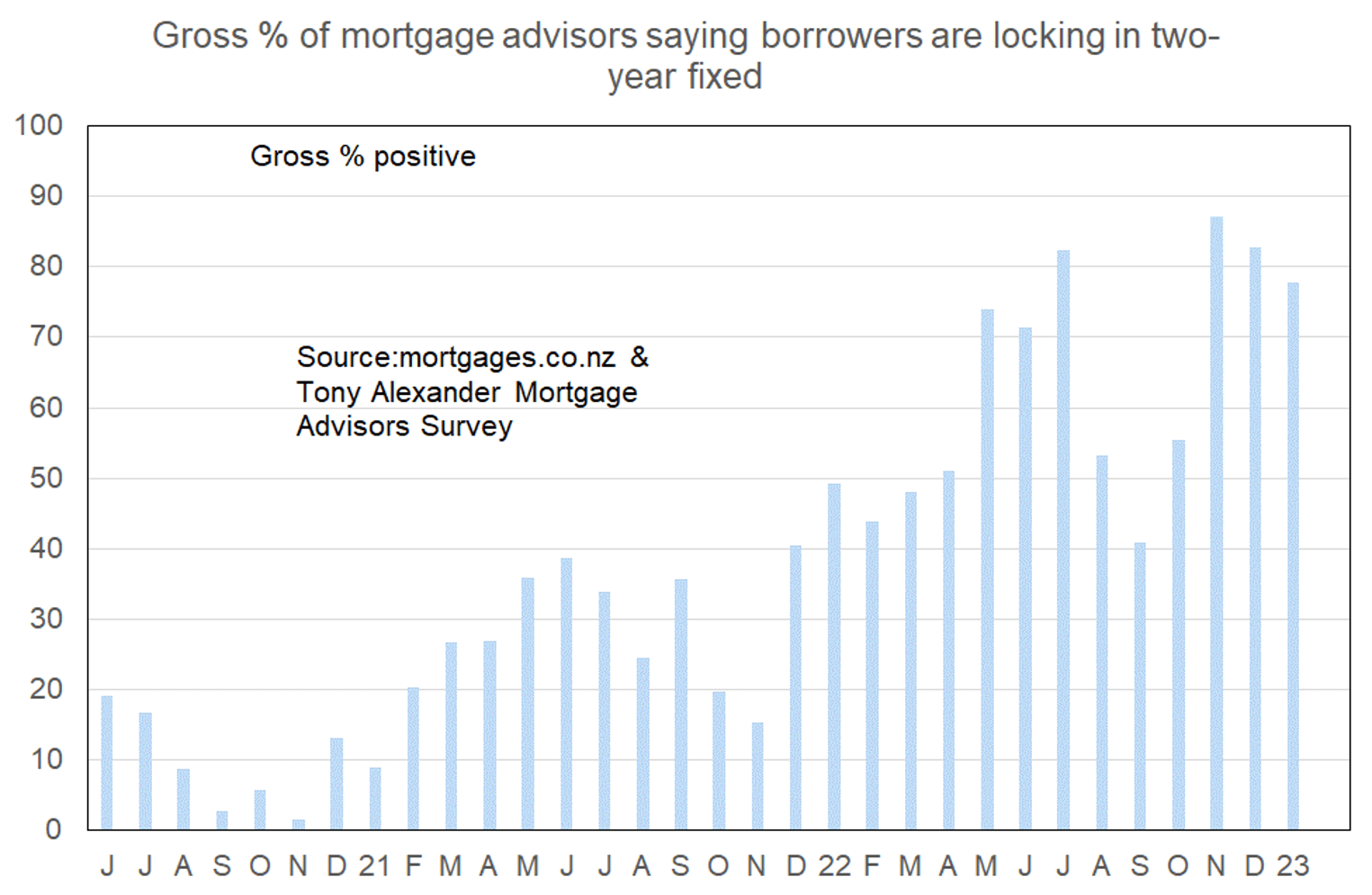

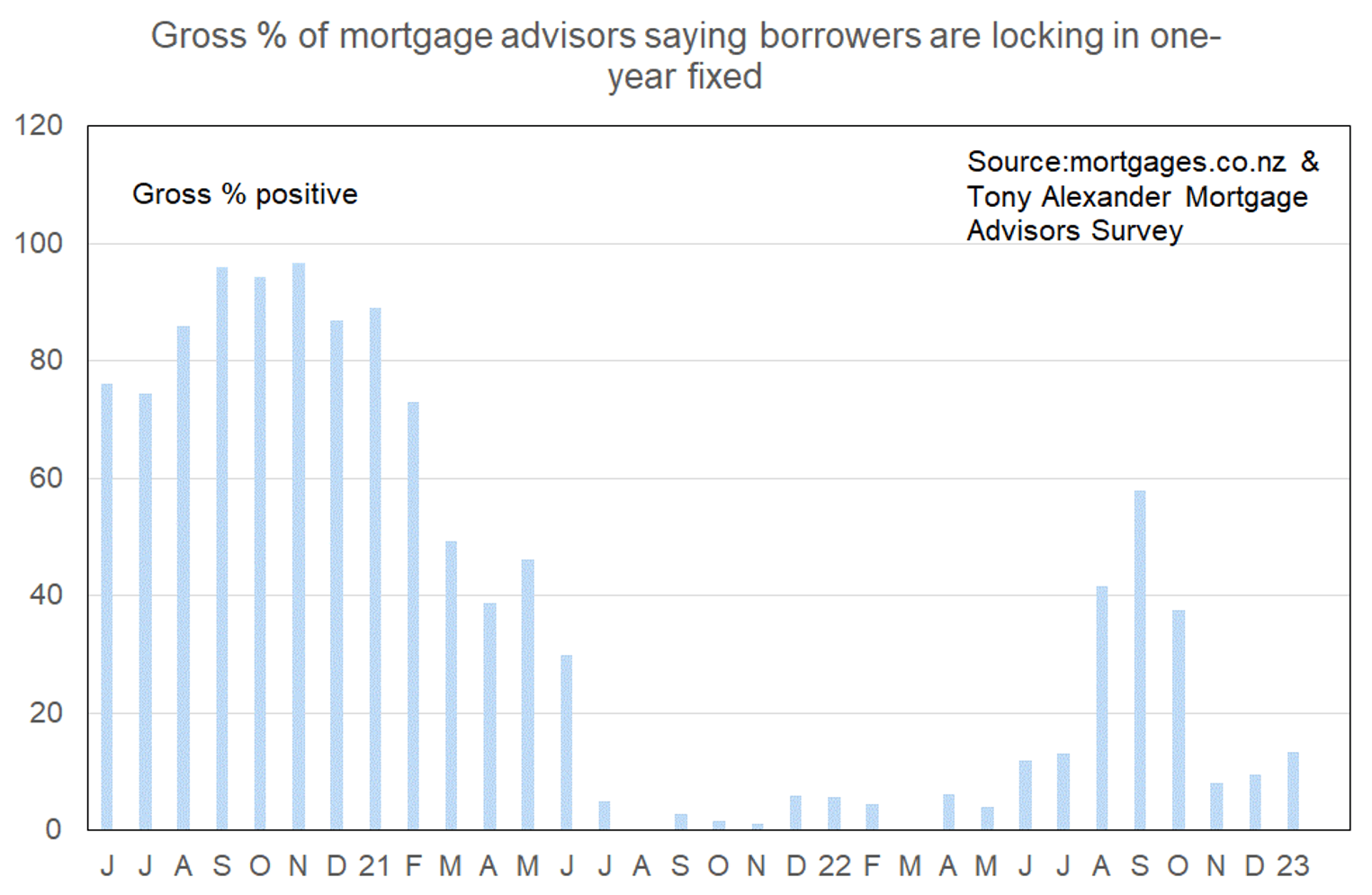

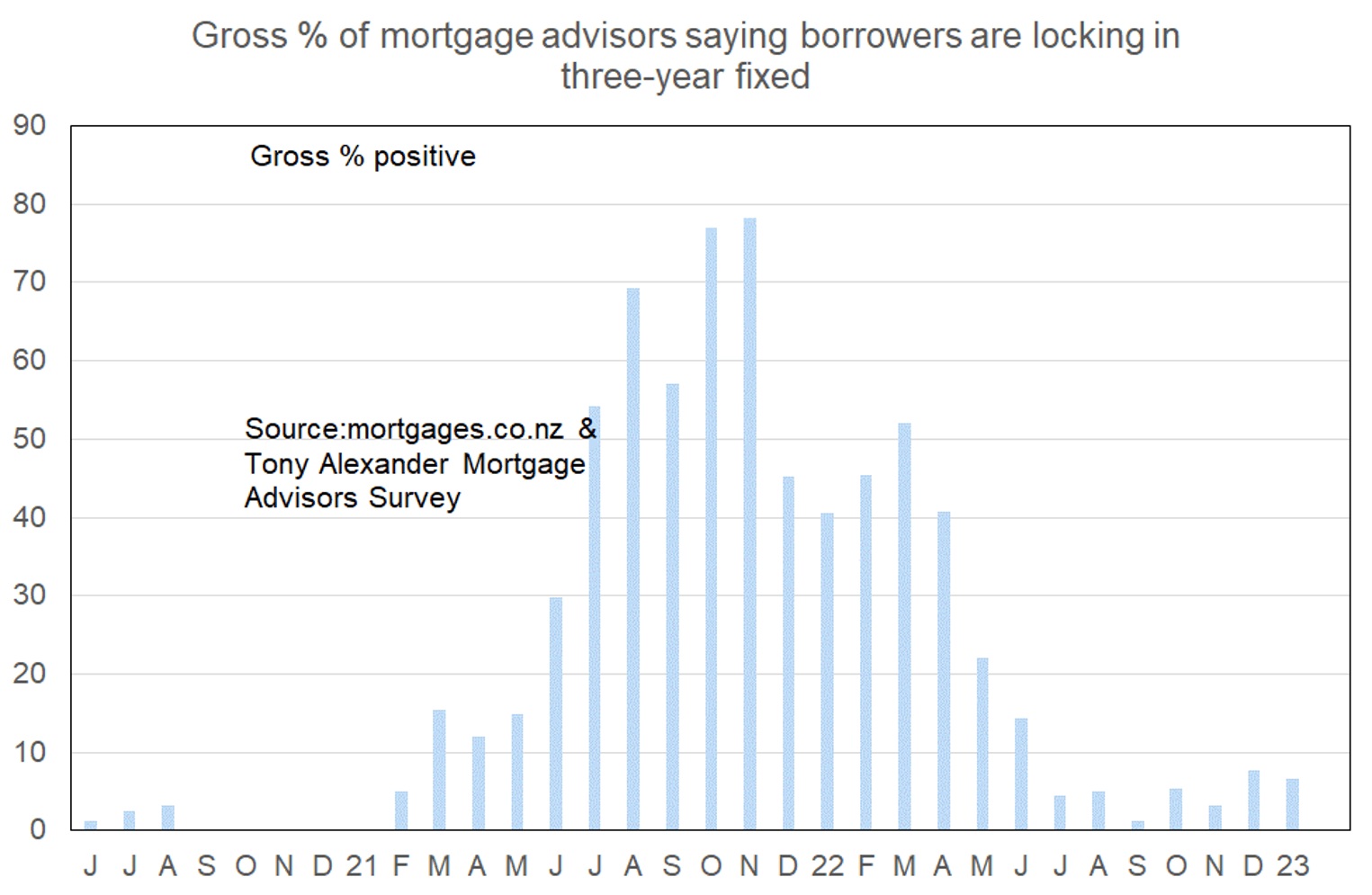

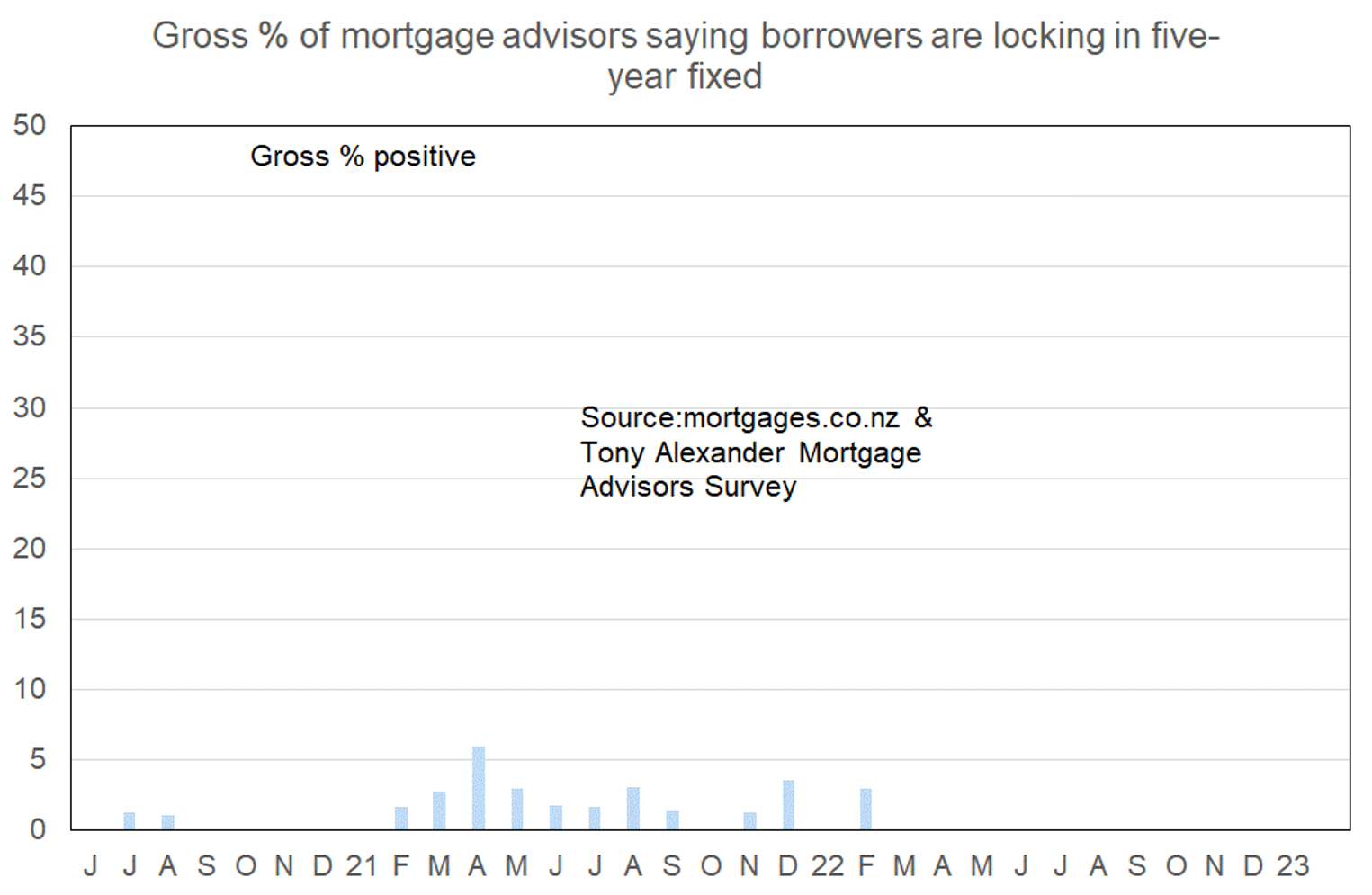

- The strong preference remains for fixing two years.

- Banks are perceived to have tightened their lending rules slightly.

More or fewer first home buyers looking for mortgage advice

Comments on lending to first home buyers submitted by advisers include the following.

- Test rate is quite high and that is affecting the borrowing, there are a lot of people who are willing to purchase but do not want to buy something old and cheap and are happy to wait. Banks are very willing to lend if you can meet the servicing requirement and with Kainga Ora you can borrow up to 95% of the property price if you meet the criteria.

- Still a lack of funding if you have got less than 20% deposit.

- Too early in the year to say just yet.

- No change. Limited funding for FHB on existing properties is creating a hole in the market for sellers of “first home” properties. Investors won’t buy and RBNZ limitations mean FHBs are being pointed to new build purchases.

- One bank backing out of new builds not completed.

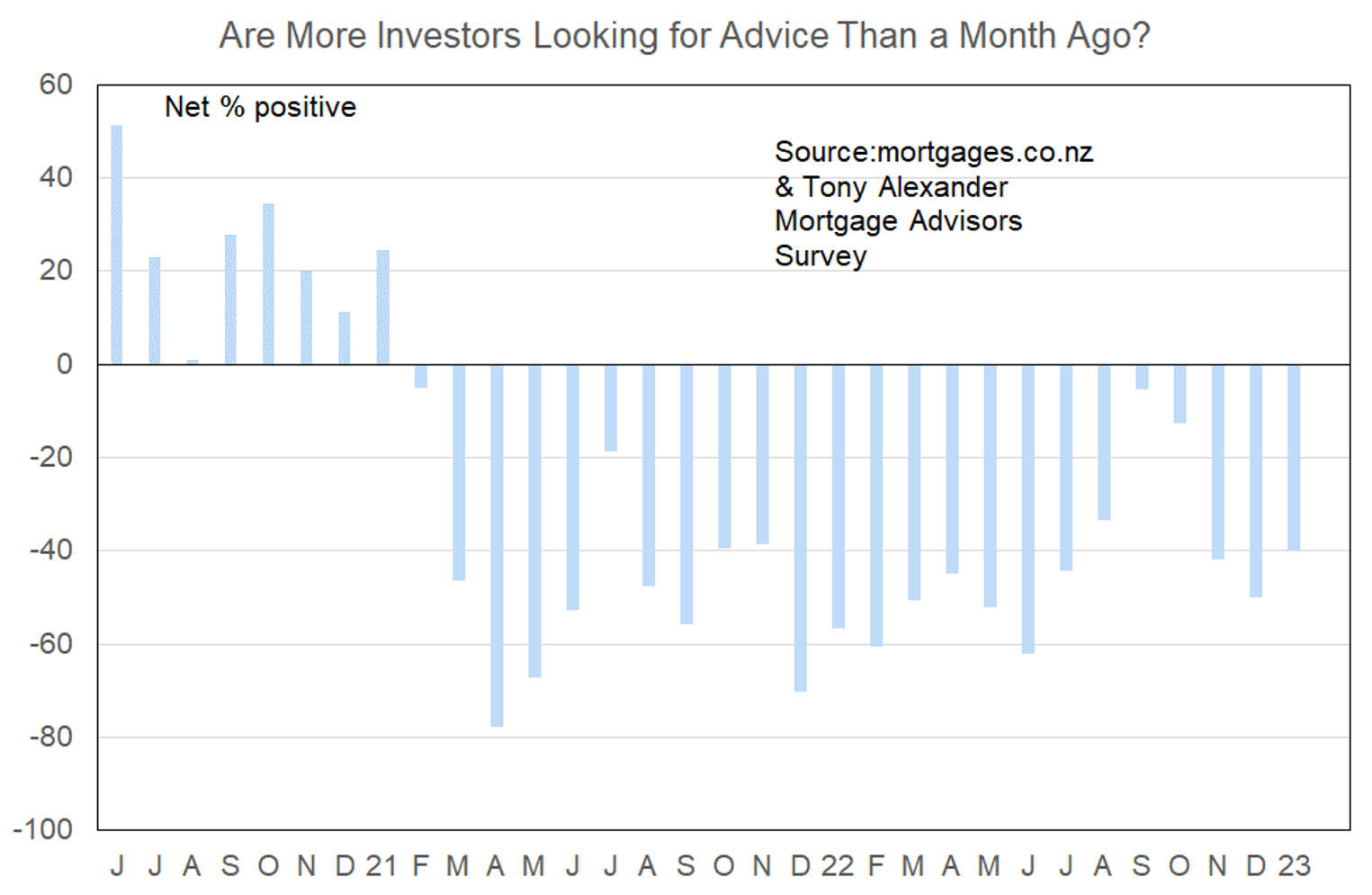

More or fewer investors looking for mortgage advice?

A net 40% of our survey respondents have reported that fewer investors are coming forward for assistance with their financing requirements. Technically this is an improvement from the net 50% of the last survey. But realistically it still means that interest from investors in residential property buying remains as bad as it has been since early-2021 when the tax rules changed.

Comments made by advisers regarding bank lending to investors include the following.

- No recent changes: there are basically no investors in the market, people who are buying investments are very cashed up or buying for a family member etc. There is no activity in that space at all.

- Tightening up on current property values when looking at LVR.

- None that I notice – other than 1% cash contribution offered to OO and IP.

- Still limiting LVR to 60% on investment deals, plus banks are doubling up on proposed expenses by shading rental income to 70% and then adding rates and insurances for an investment property on top of this.

- Banks slowly easing up the lending criteria after the CCCFA changes but very slow.

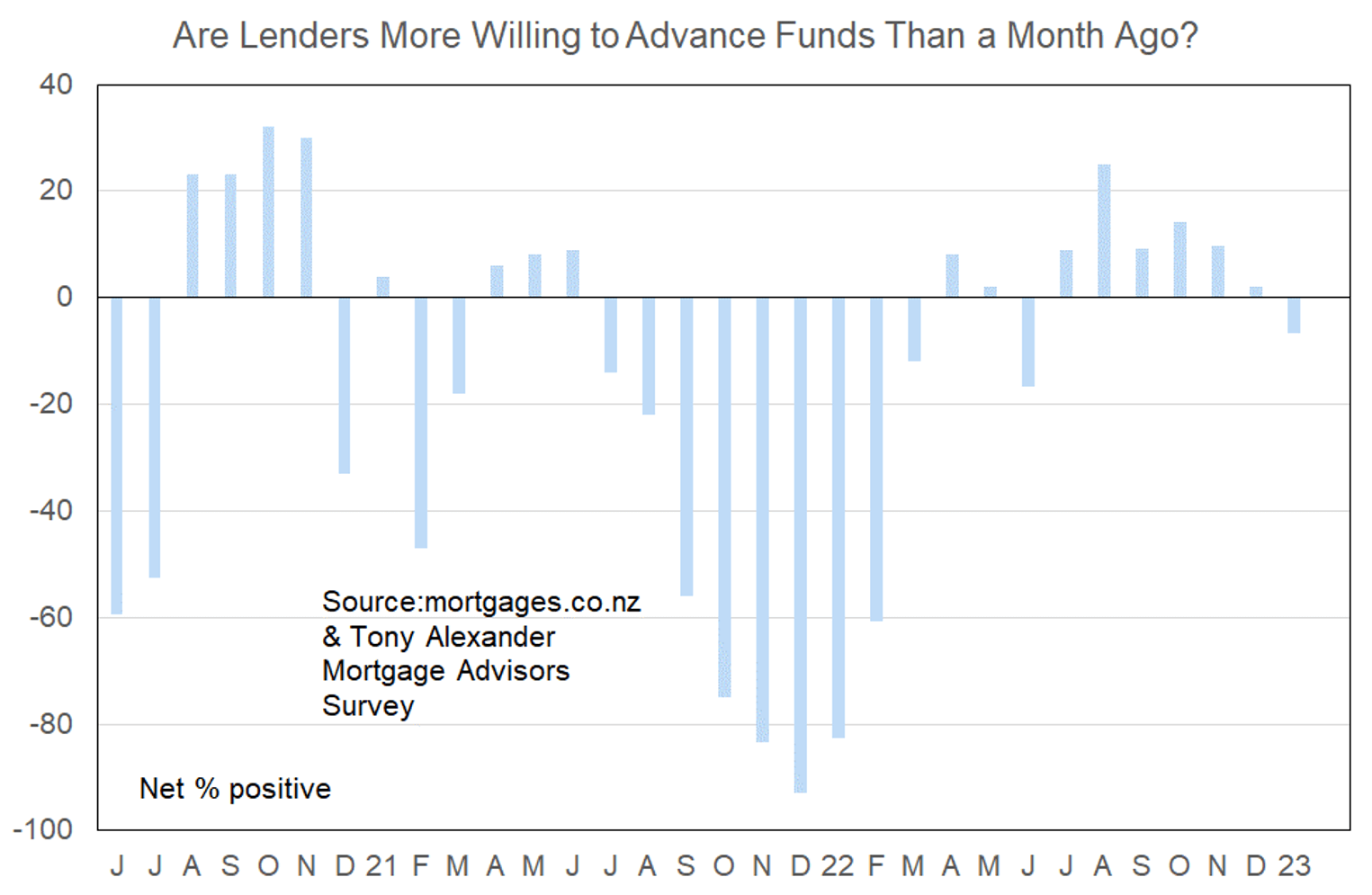

More or less lenders willing to advance funds?

A net 7% of survey respondents this month have reported that banks have become less willing to advance mortgage money. This is a deterioration from net positive changes in the previous six months and may be driven by some bank concern about falling house prices going by one or two comments.

Overall, the comments submitted by mortgage advisers don’t support the case that there is a particularly large tightening in lending criteria underway, and some have reported an improvement. The best interpretation is probably that not much is changing at the moment and sector participants are largely waiting for people to get back to work, stop thinking about holidays, and turn their attention once again to buying or selling a property.

What time period are most people looking at fixing their interest rate?