First home buyers return

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 61 responses.

- The main themes to come through from the statistical and anecdotal responses include these.

First home buyers are rapidly returning to the market. - Banks are becoming more willing to lend.

- Investors are less disinterested – but still largely on the side-lines.

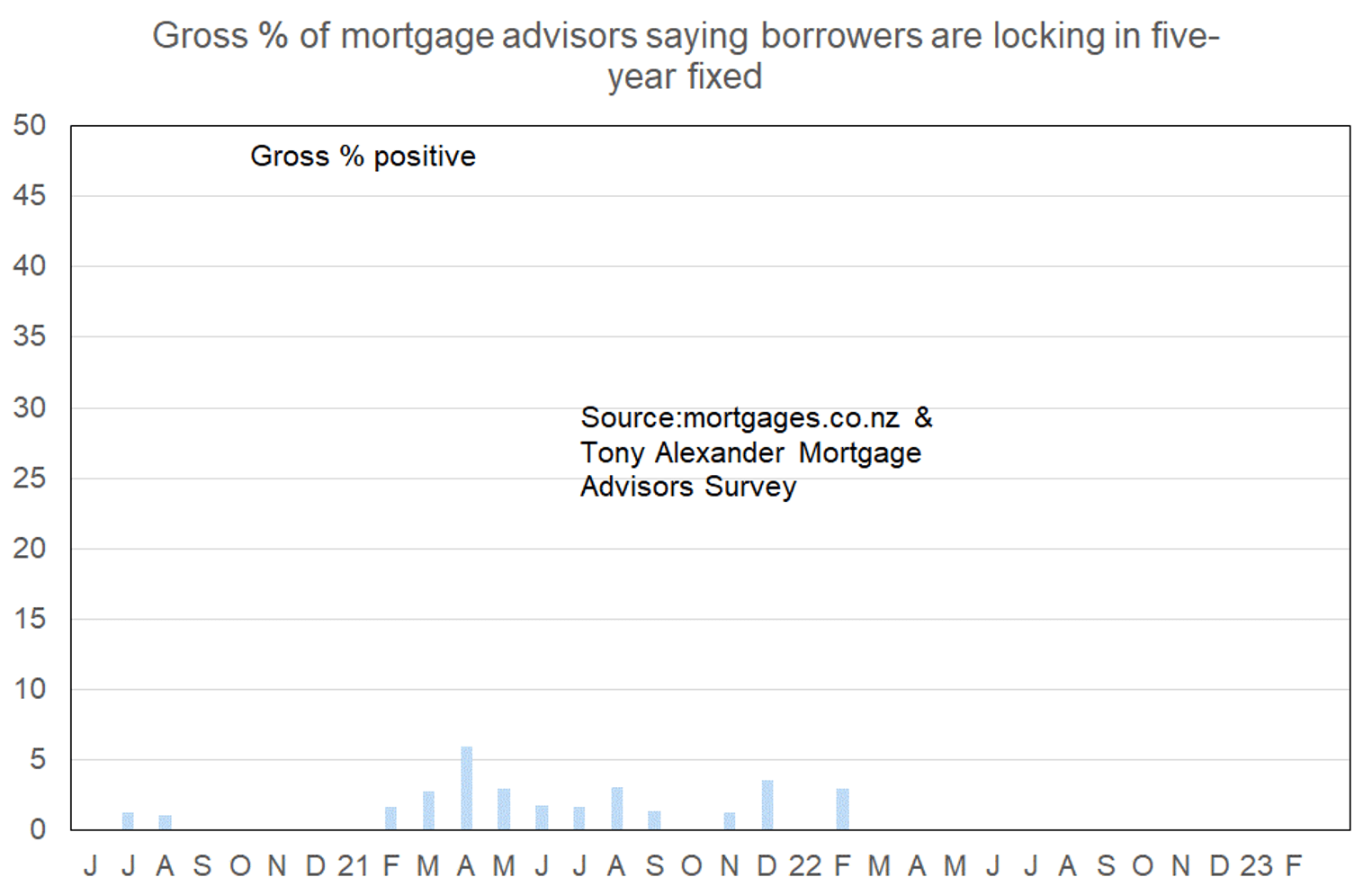

- Borrowers increasingly prefer fixing their mortgage rate for only one year.

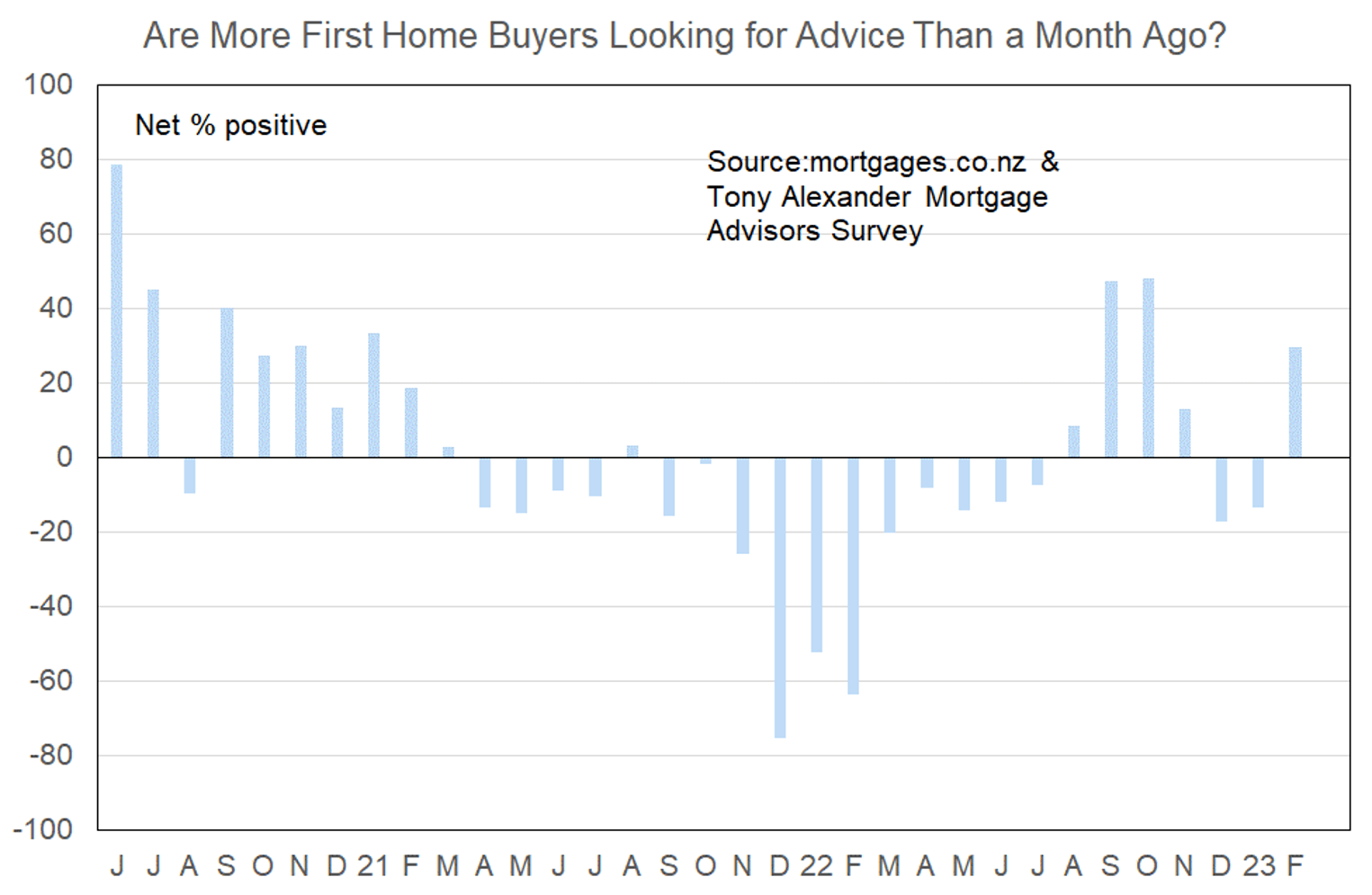

More or fewer first home buyers looking for mortgage advice

Just before the Reserve Bank raised the official cash rate a record 0.75% to 4.25% on November 23 a net 13% of mortgage advisers replying in our monthly survey said they were seeing more first home buyers in the market. That proportion fell immediately to -17% in early-December and as reported four weeks ago was still weak at -13% in January. But now the net percent has jumped to a well above average 30%.

This is not as strong as in September and October before we learnt about higher than expected 7.2% inflation. But it is a strong result which shows the improvements in similar gauges in my other surveys over the past three weeks are confirmed as strengthening. The young buyer’s strike is over.

Comments on bank lending to first home buyers submitted by advisers include the following.

- Approval is provided more quickly and efficiently – likely a symptom of reduced bank volumes.

- CCCFA slight easing.

- Largely unchanged. Kainga Ora still a significant pathway into the market. 20% borrowers are highly attractive to the banks and these approvals seem to be quite easy to obtain.

- It has definitely gotten easier – allowing more boarder income is a good start.

- Limited funding is available. All I’s and T’s need to be crossed and they are checking everything (as they have more time to check things now).

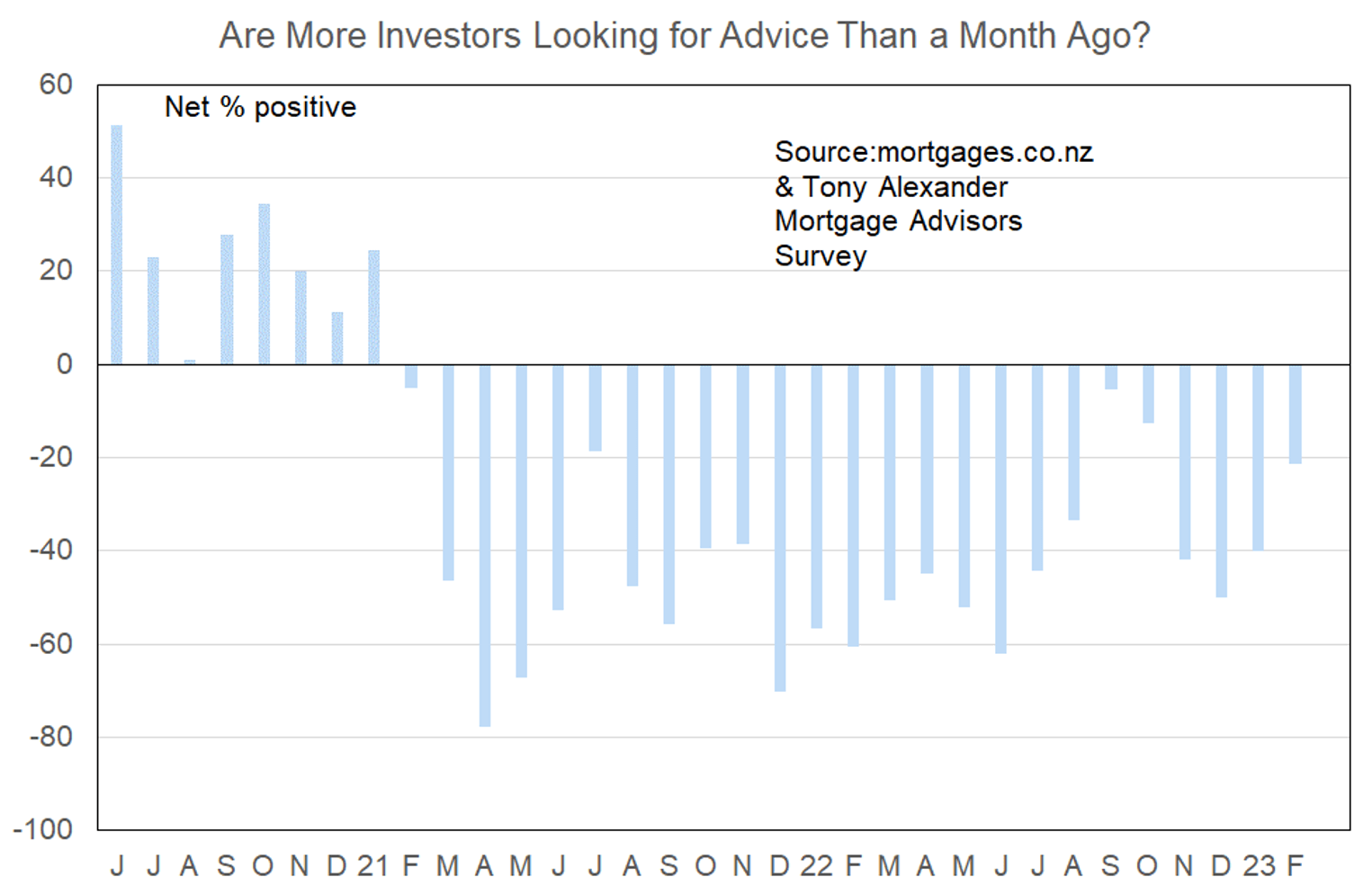

More or fewer investors looking for mortgage advice?

There has been an improvement in the net proportion of advisers seeing more investors in the market from -40% last month to -21% now. This is the least bad result since -13% just before the bad 7.2% inflation outcome of October 18. Investors are still largely absent from the market. It will be interesting to see if they pick up on the return of first home buyers and follow.

Comments made by advisers regarding bank lending to investors include the following.

- Very few investors in the market.

- Still difficult to meet servicing criteria with test rates and scaling of rent.

- Slowly, slowly softening of the scaling being applied to the rental income, but still very tough to make a rental property work from a servicing point of view.

- Still very driven by LVR rules. Investors buying the new builds are still being caught out on the LVR rules where they are able to borrow at 80% on a new build during the build or when it settles but as soon as they go back for more money the banks deem it existing and apply the 60% LVR rule which blows them out of the water again.

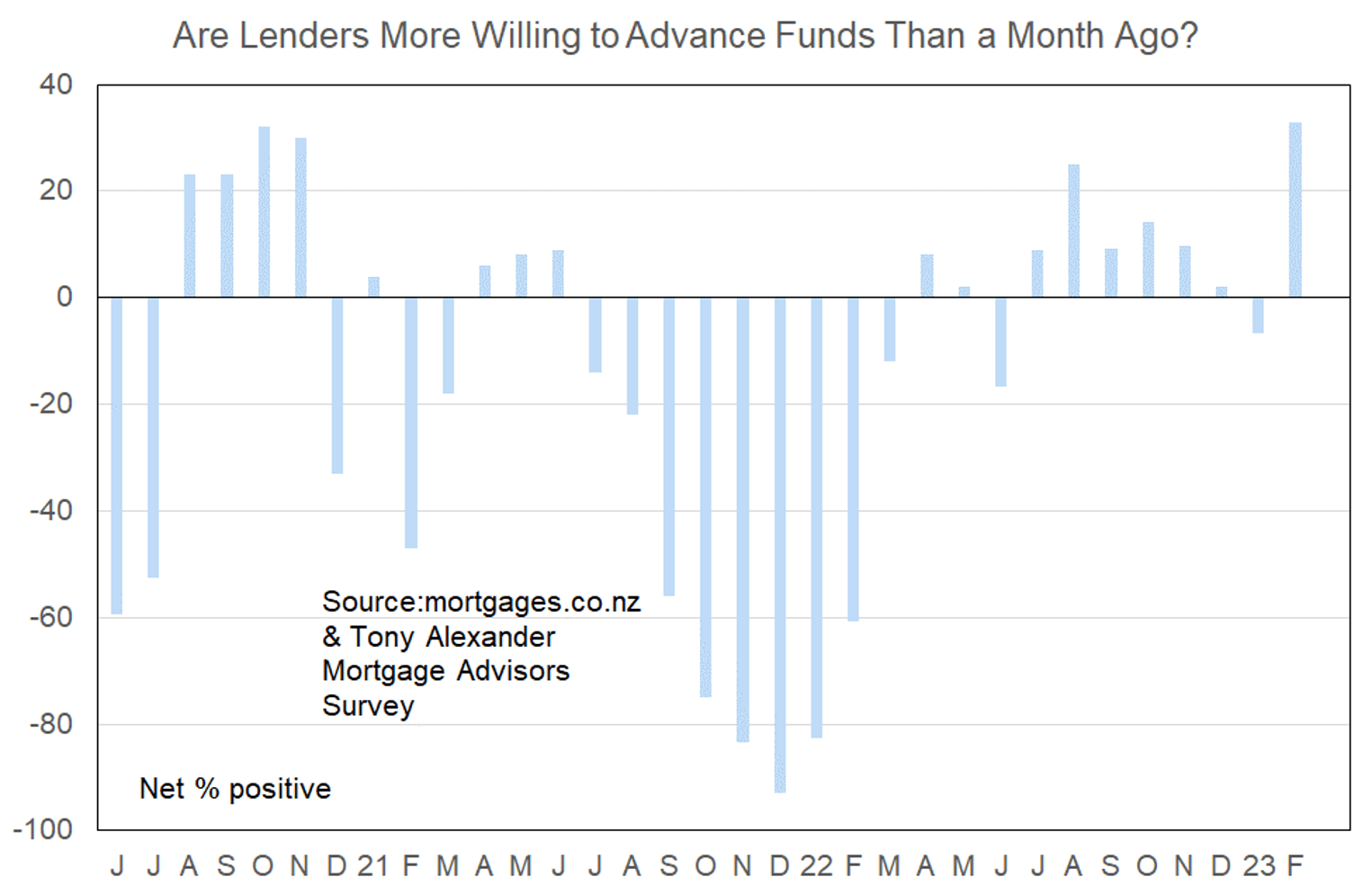

More or less lenders willing to advance funds?

A net 33% of advisers have said that banks are becoming more willing to lend funds. This is a sharp improvement from a net 7% in January saying that funding was getting harder to achieve and is the strongest result on record.

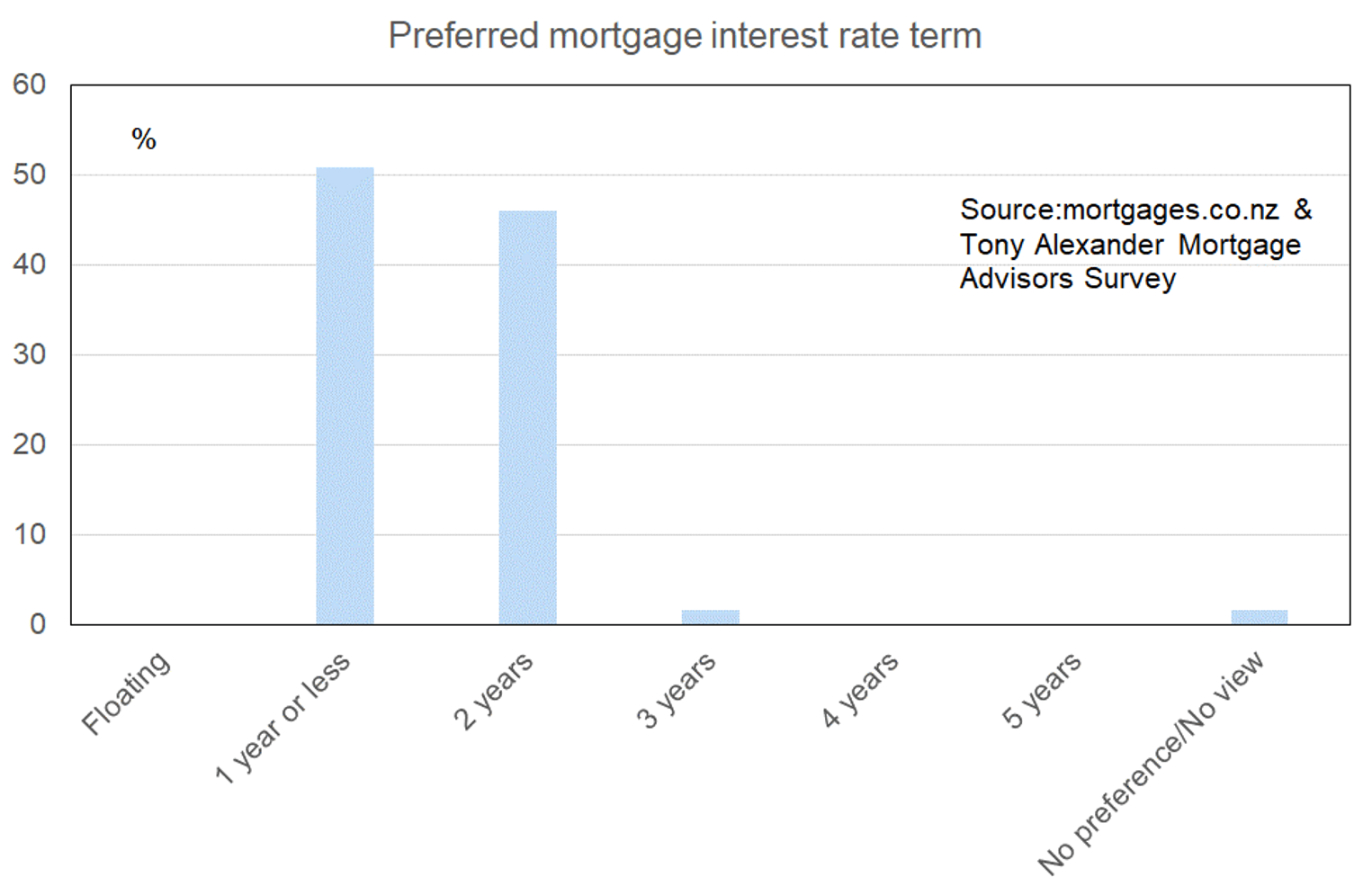

What time period are most people looking at fixing their interest rate?

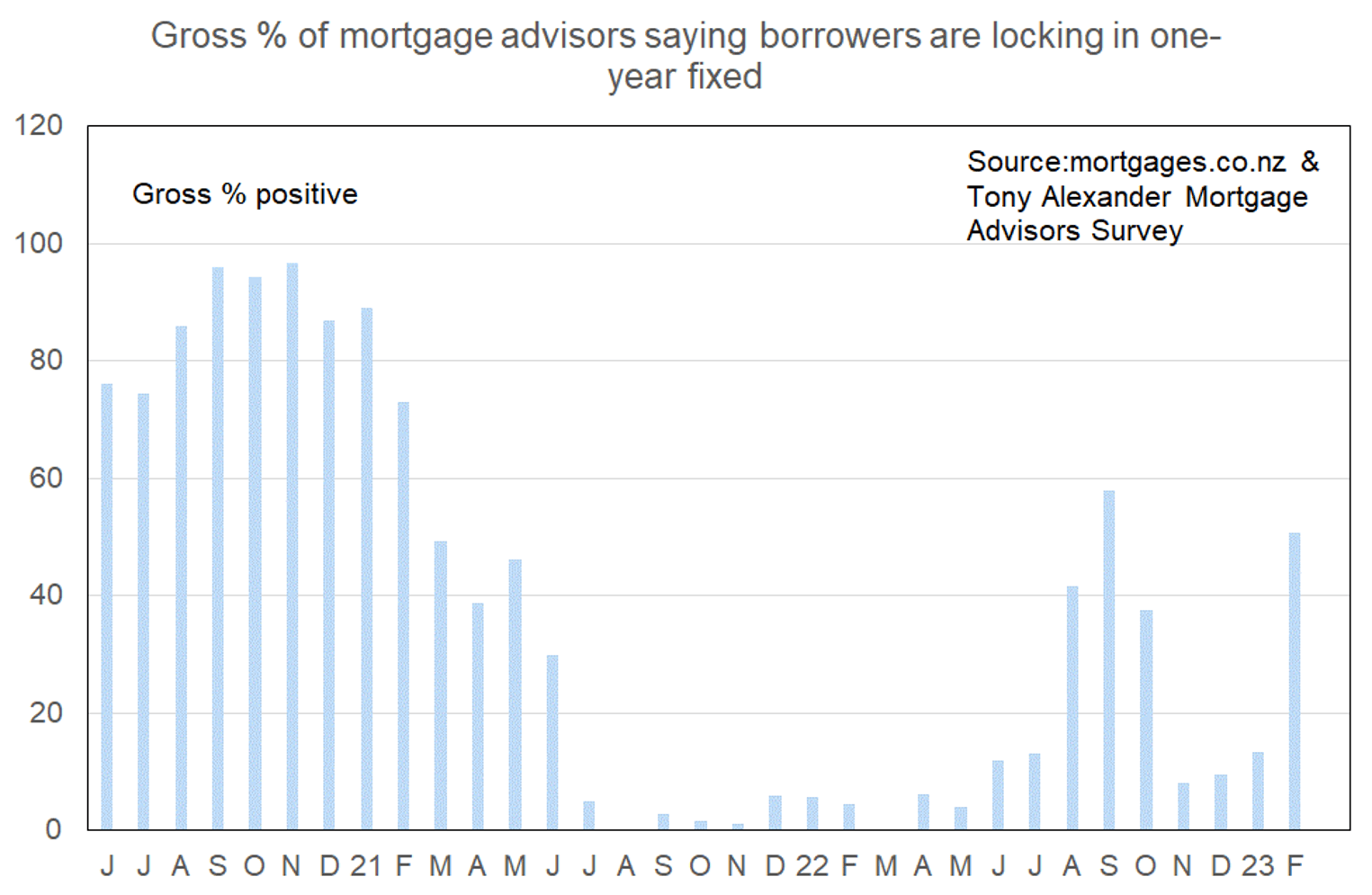

This month there has been a substantial shift of fixed rate term preference towards one year and away from two years. 51% of advisers say that their customers prefer fixing one year, up from only 13% saying this in January and 10% in December.

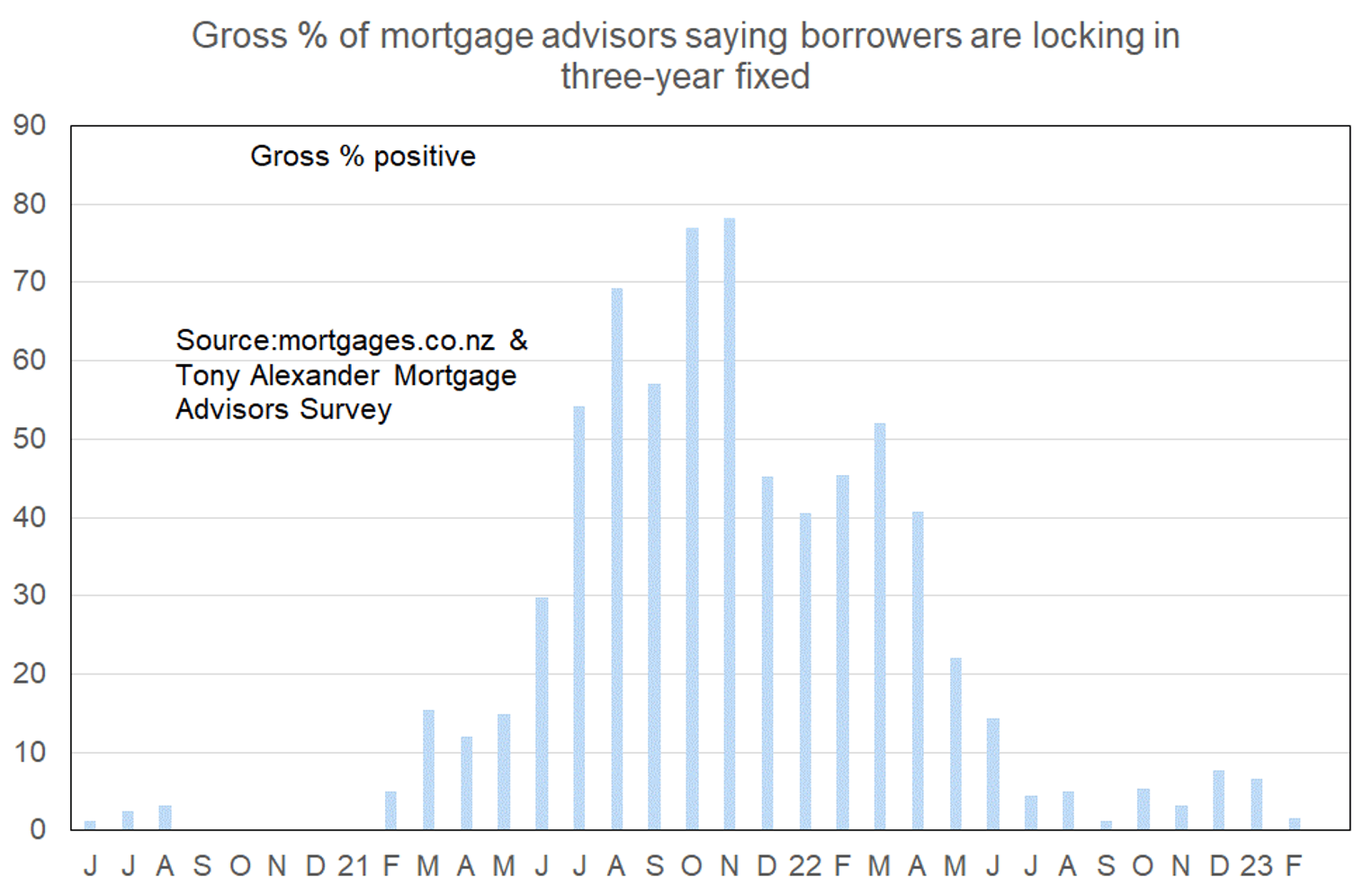

As has been the case since the middle of last year very few people are wanting to fix three years.