Investors increasingly present

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken this week, attracted 57 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- The extent to which advisers are seeing more first home buyers has eased, but investors are increasingly present.

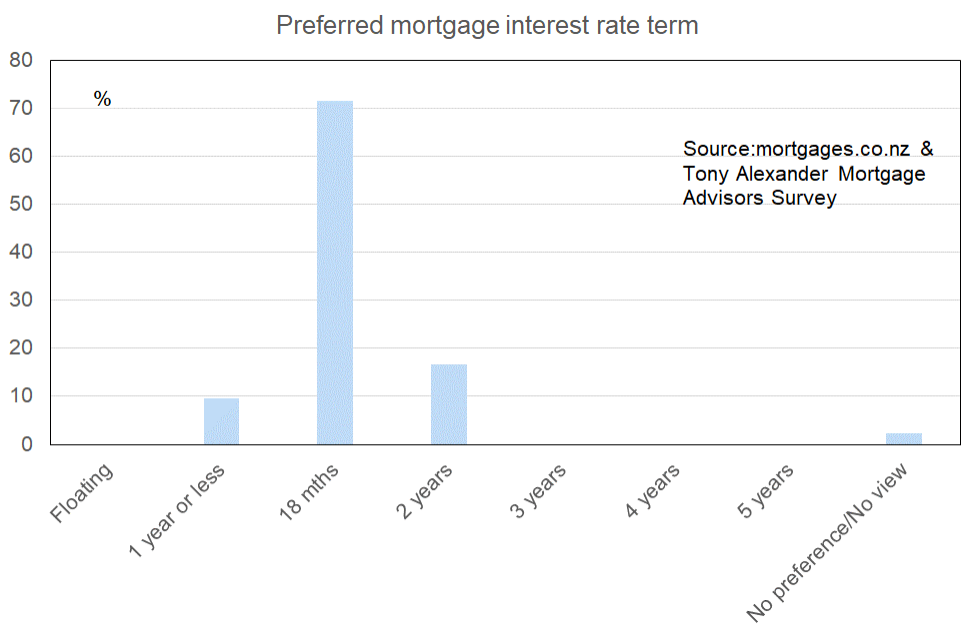

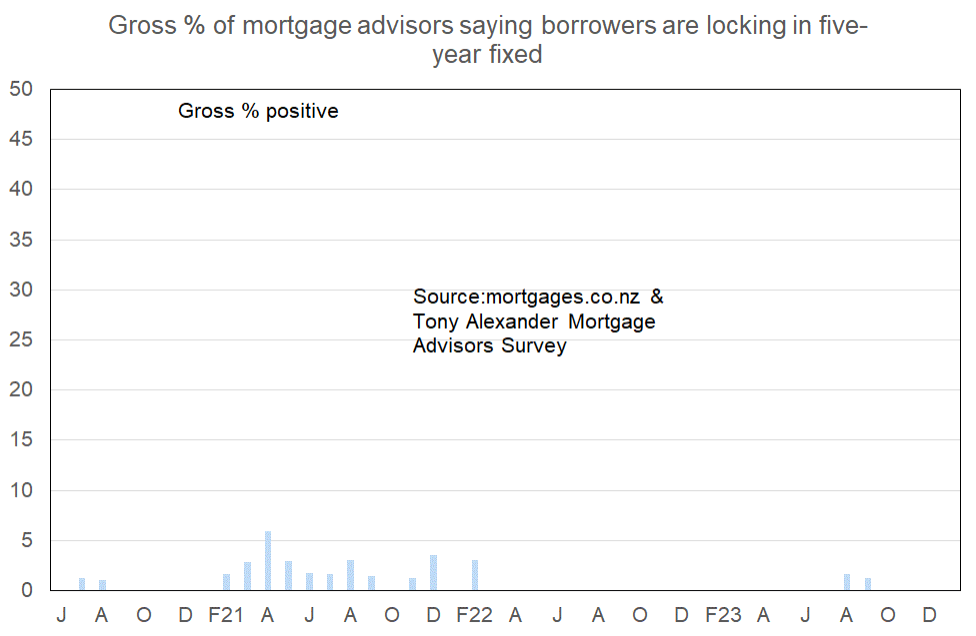

- Borrowers overwhelmingly favour fixing 18 months over all other terms.

- There is some slight easing underway in bank lending criteria and test interest rates.

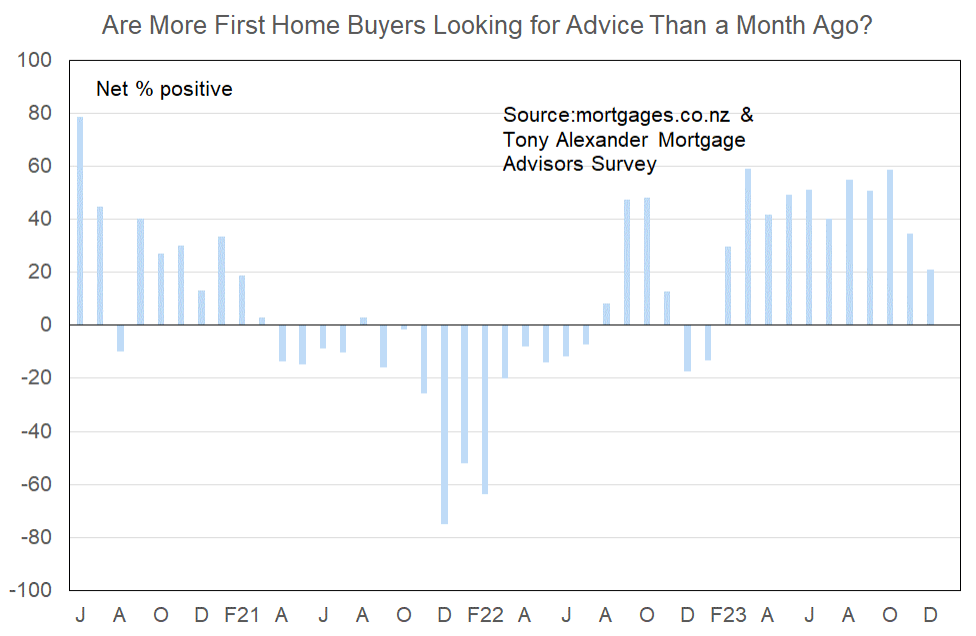

More or fewer first home buyers looking for mortgage advice

A net 21% of our 57 respondents this month have said that they are seeing more first home buyers in the market. This tells us that young buyers are increasingly looking to make a purchase. However, the speed with which they have been moving into the market has slowed down recently.

Last month a net 35% of advisers said they were seeing more first home buyers and in our October survey the result was a net 59%.

Comments on bank lending to first home buyers submitted by advisers include the following.

- Banks are lowering their UMI for over 80% lending.

- Lenders seem to be applying a slightly lower test servicing rate (xxx bank have just dropped theirs today), however still requiring live deals for lending over 80%.

- Debt serving ability is still key with high testing rates and cost of living this is the main restriction on borrowers. No change.

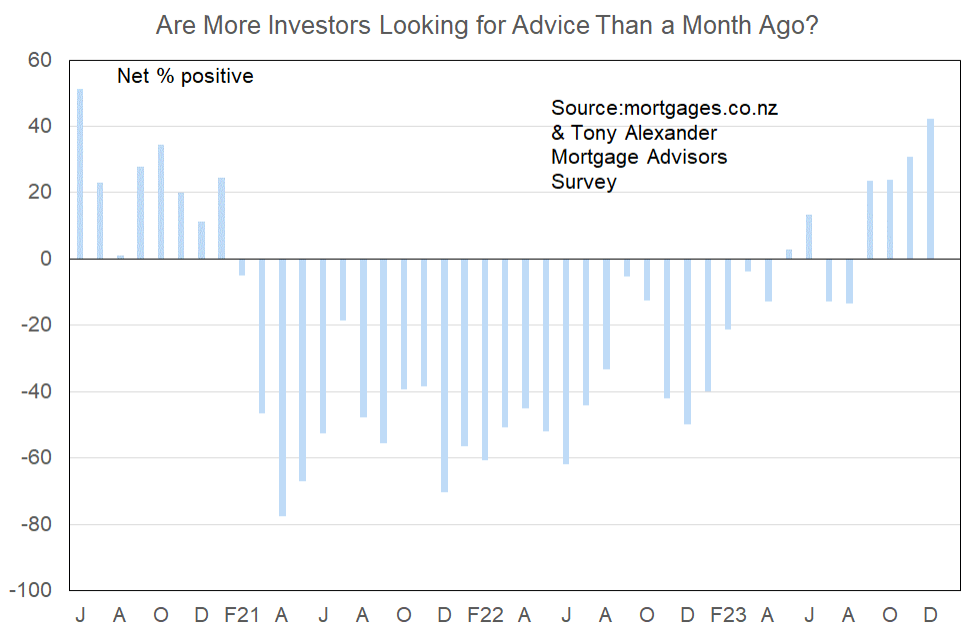

More or fewer investors looking for mortgage advice?

While the speed of market entry by first home buyers is slowing, for investors it is accelerating. This month a net 42% of mortgage advisers have reported that they are seeing more investors looking for advice. This is up from a net 31% last month and 24% in October, and is the strongest result since June 2020.

Some respondents have noted that the change in government has had an impact. But many also noted that investors are still wary and concerned by high interest rates and rapidly rising costs for the likes of insurance and council rates.

Comments made by advisers regarding bank lending to investors include the following.

- I have had a massive increase in investor enquiries since the change of government. At this stage it feels more like enquiry, but they are defiantly waiting in the wings and ready to punch next year.

- A little more scrutiny in relation to the Rates and Insurance expenses. Requiring verification of these upfront as they no longer accept these as a given in the declared expenses.

- Lenders are beginning to soften the investment expenses calculations for investment properties due to Government tax deductibility changes.

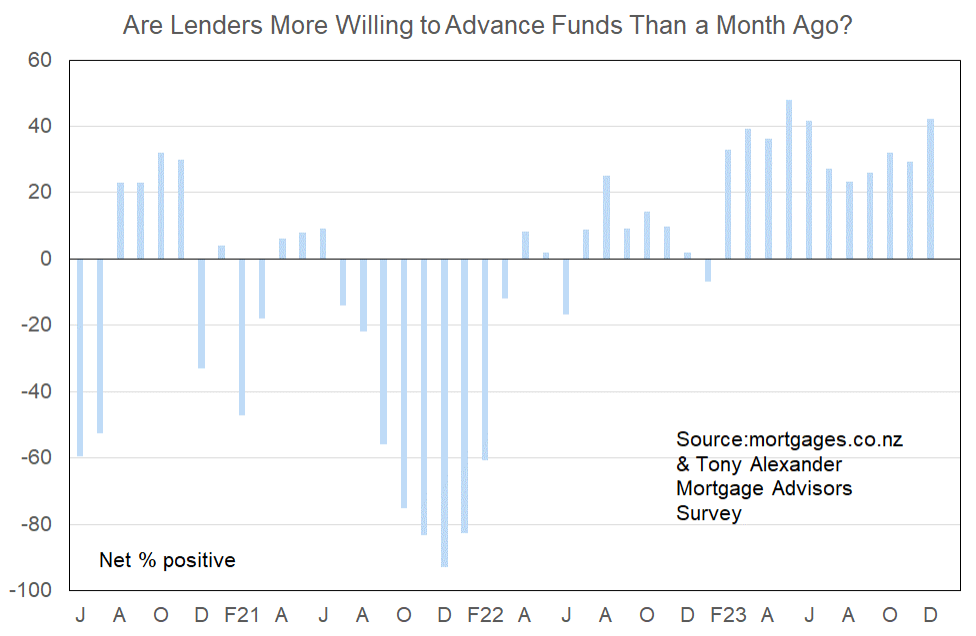

More or less lenders willing to advance funds?

What time period are most people looking at fixing their interest rate?

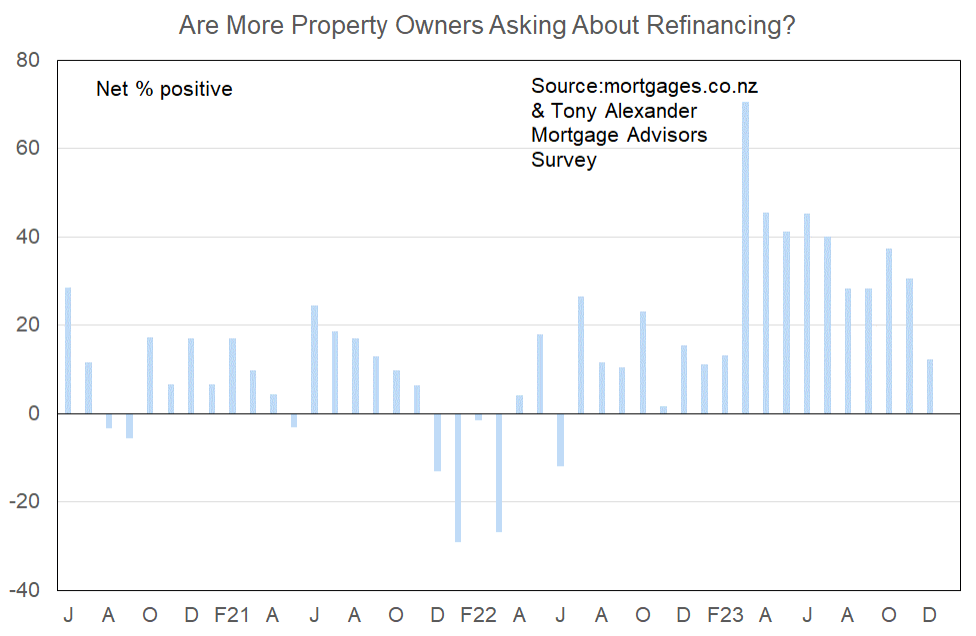

Are more property owners asking about refinancing?

There has been a further decrease this month in the net percent of mortgage advisers saying that they are seeing more people looking to refinance their mortgage. This decline might reflect anticipation of easing mortgage rate pain not too far down the track.