More buyers withdraw

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 52 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- For the second month in a row increases in mortgage interest rates have made buyers step back from the market. Many no longer qualify for a loan.

- A theme in adviser comments about bank willingness to lend is that outside of test rates rising, banks are loosening credit criteria and more actively welcoming business.

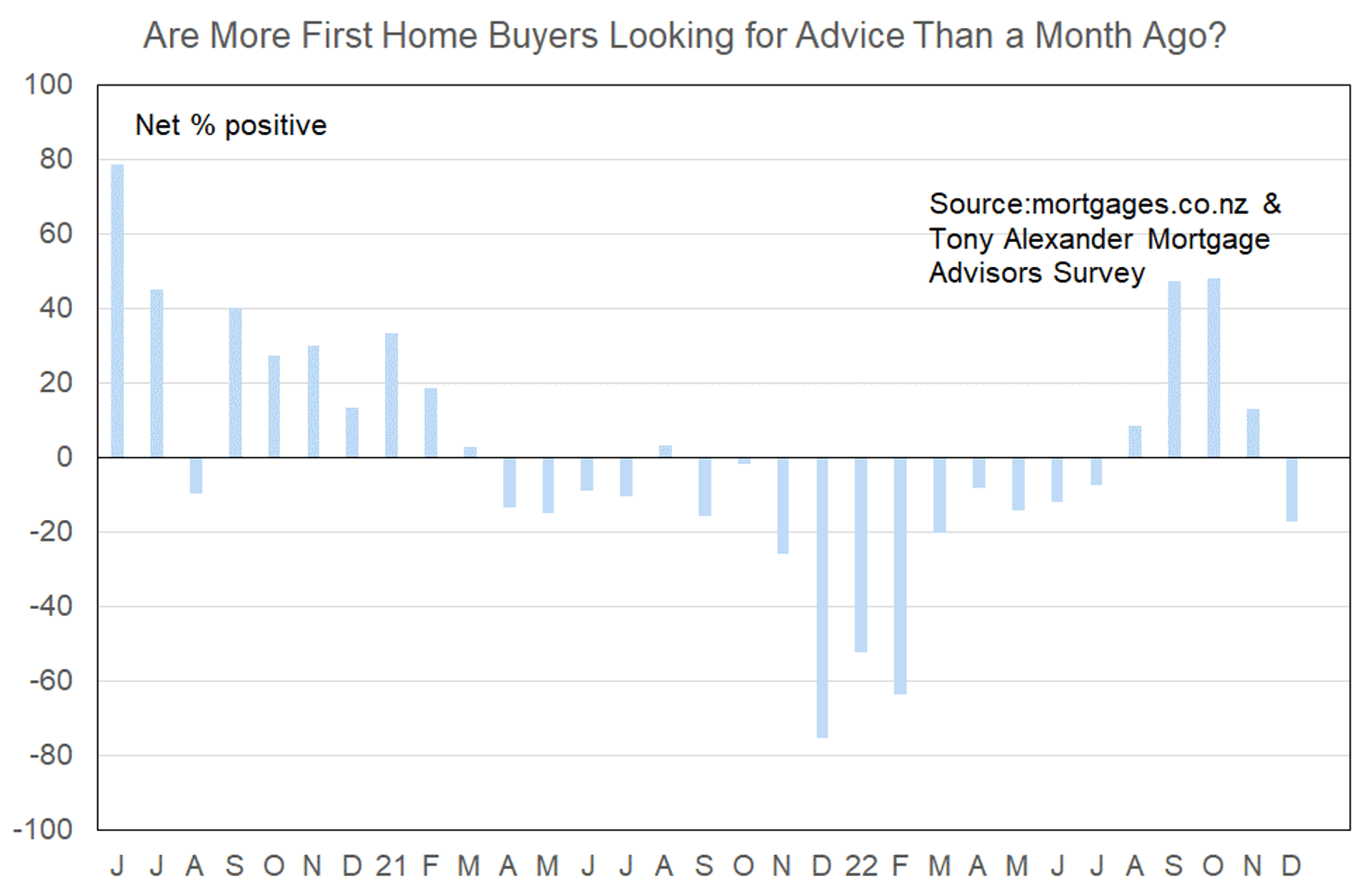

More or fewer first home buyers looking for mortgage advice

Comments on lending to first home buyers submitted by advisers include the following.

- Test rates have increased to 8.60%.

- LVR restrictions is still the killer. If clients do not meet First Home Loan criteria its very difficult to get funding. There are willing participants but the limitations on low deposit funding as well as aggressive affordability tests are hamstringing many potential borrowers

- Slight loosening underway. Flatmate income increased x 2 lenders.

- If they don’t have 20% deposit or a family supporting property don’t bother applying.

- No change, but I notice everyone seems happier and therefore more willing to take the time to try and work out ways of reducing the obstacles to the approval and getting declines overturned.

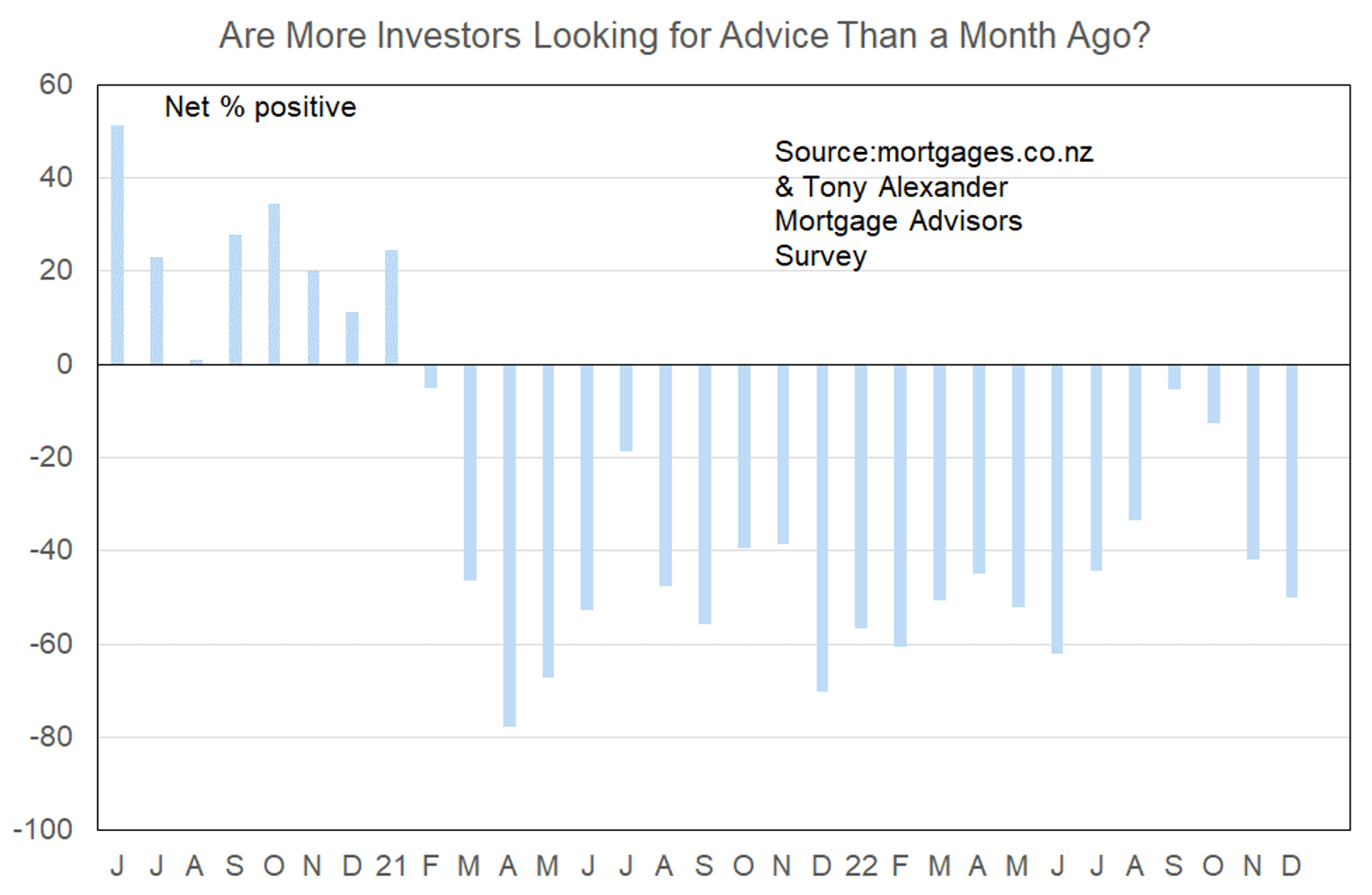

More or fewer investors looking for mortgage advice?

Comments made by advisers regarding bank lending to investors include the following.

- The removal of tax deducibility has significantly removed huge amounts of servicing capacity, as a result it pushes a lot of investors to use 2nd tier/nonbanking lending.

- Slight loosening underway. Better rental shading starting to be implemented by one lender.

- No investment loans completed last 6 weeks.

- Nonbank lenders look to be providing alternative options here. As the interest rates go up the nonbank lender products seem more suitable for investors.

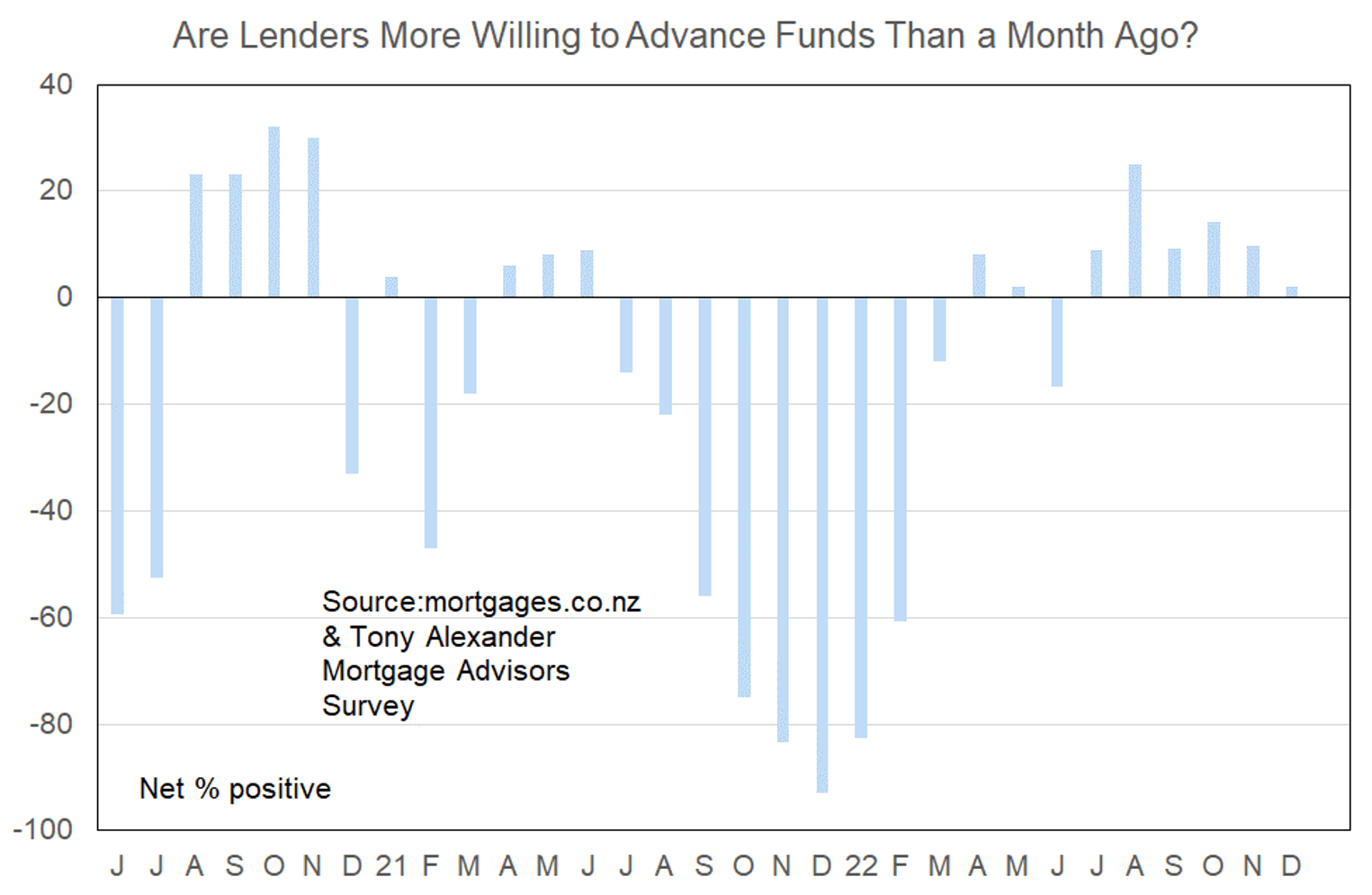

More or less lenders willing to advance funds?

This question gives us insight into something no other survey does – bank willingness to lend. At a time when all other indicators have deteriorated in this survey, that of real estate agents plus my Spending Plans survey, we see a still positive result here. A net 2% of advisers have reported that bank willingness to lend is improving. This is down from a net 10% last month, but the fact that the reading is still positive when so much other woe is out there tells us something important.

Banks are becoming used to working with the tougher Credit Contracts and Consumer Finance Act, and their desire to make loans to meet sales targets and make profits means they are pulling back bit by bit on criteria such as the proportion of rent they will count in income calculations, and allowance of boarder income being included.

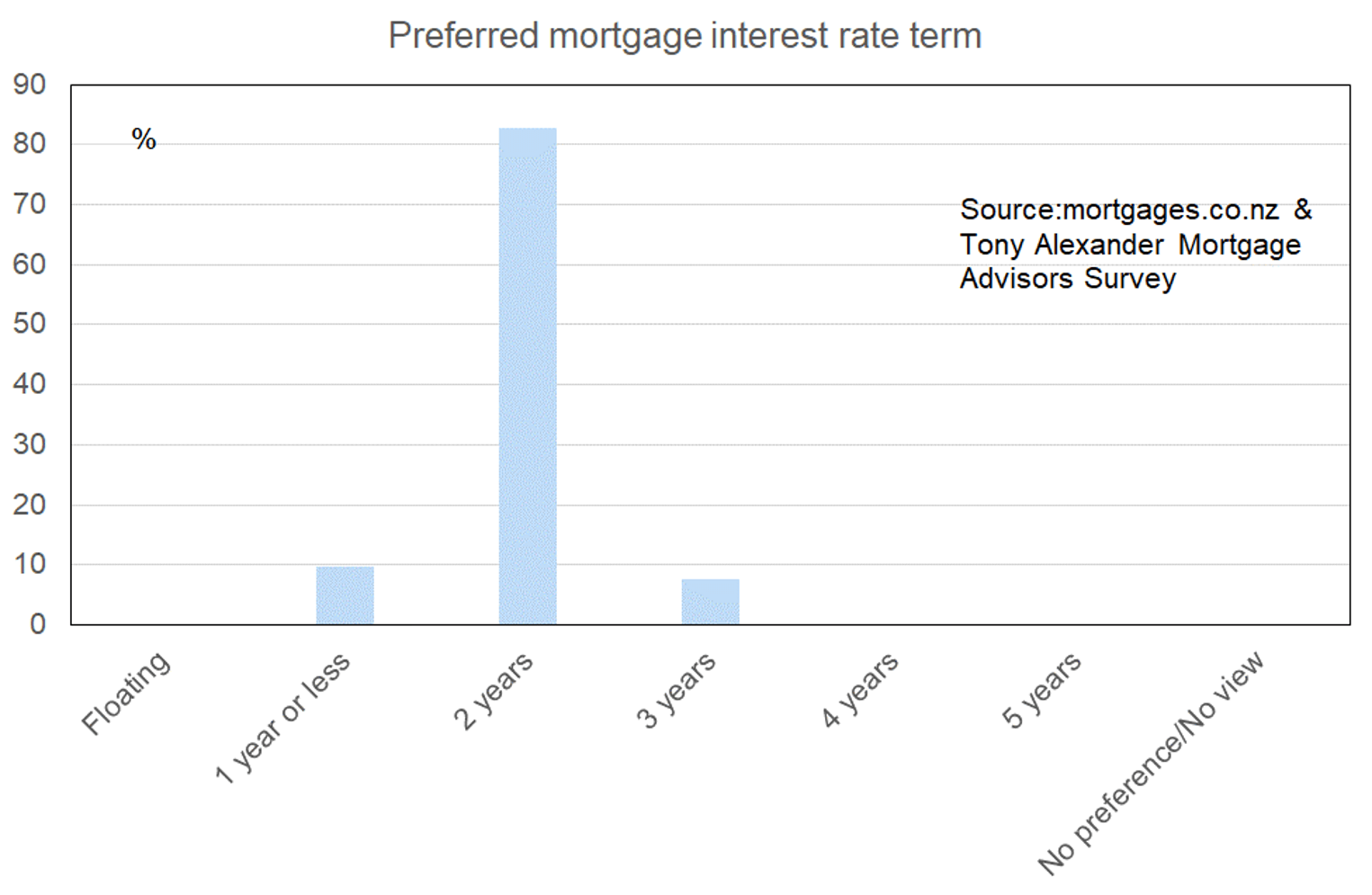

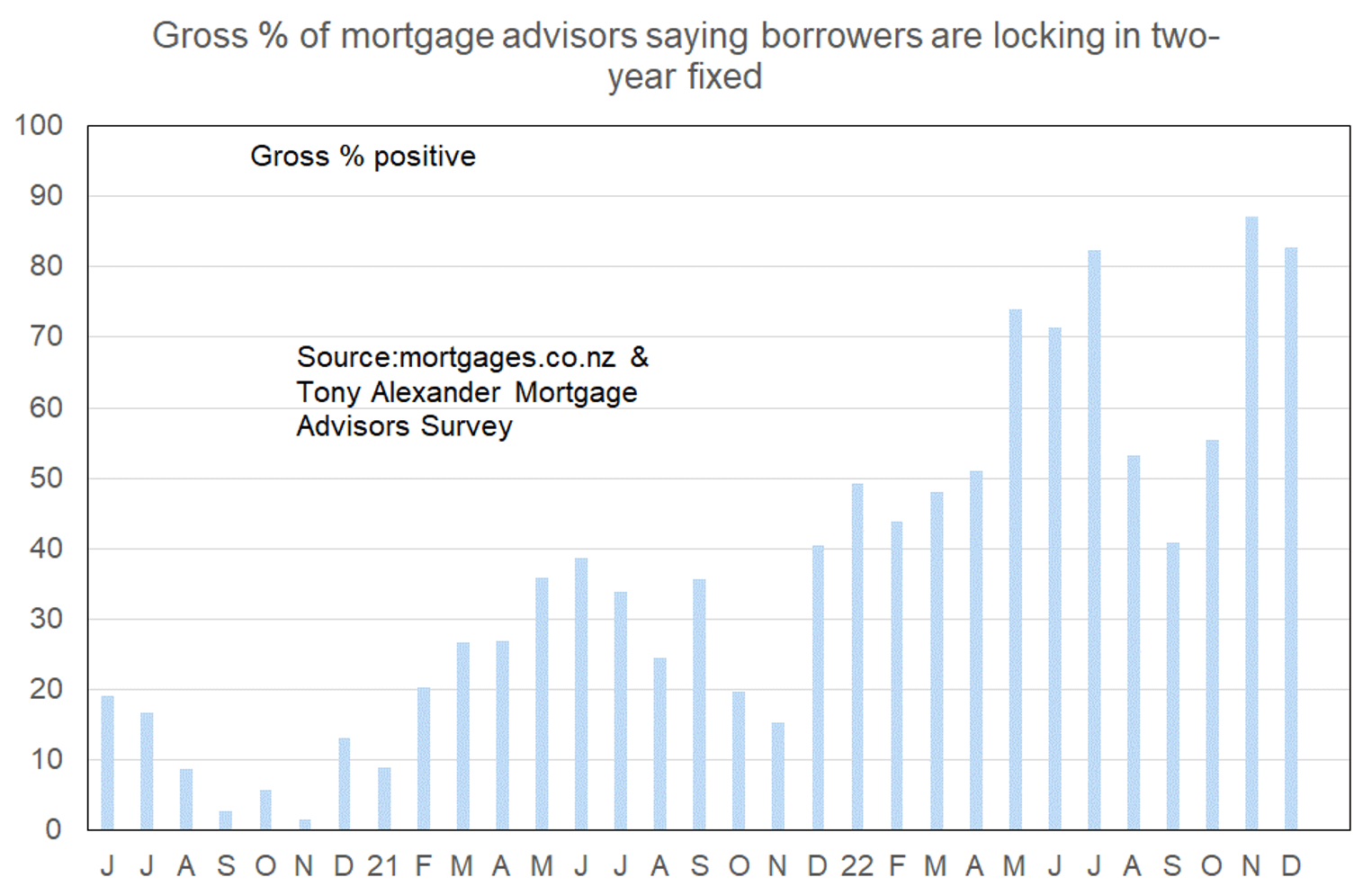

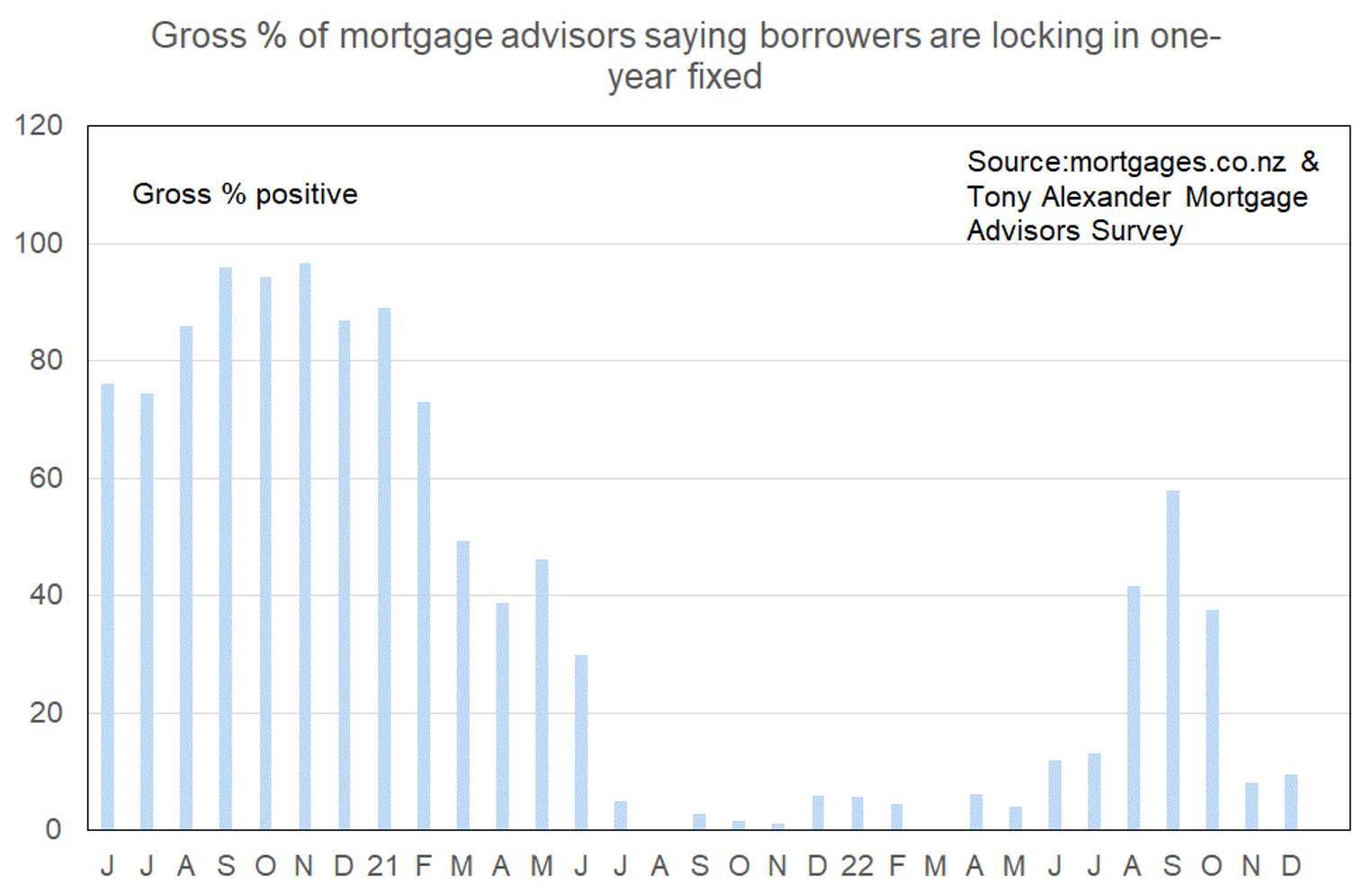

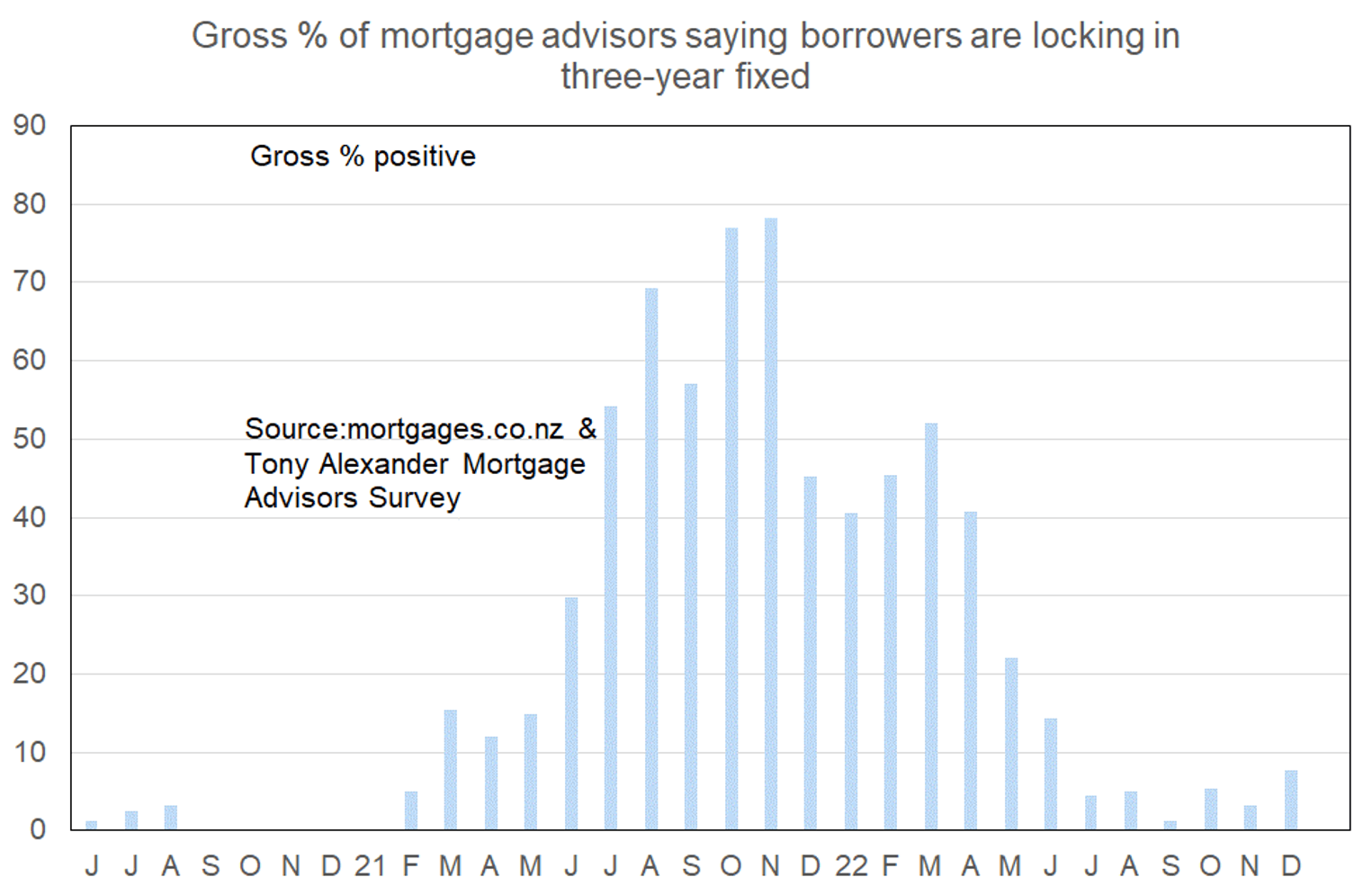

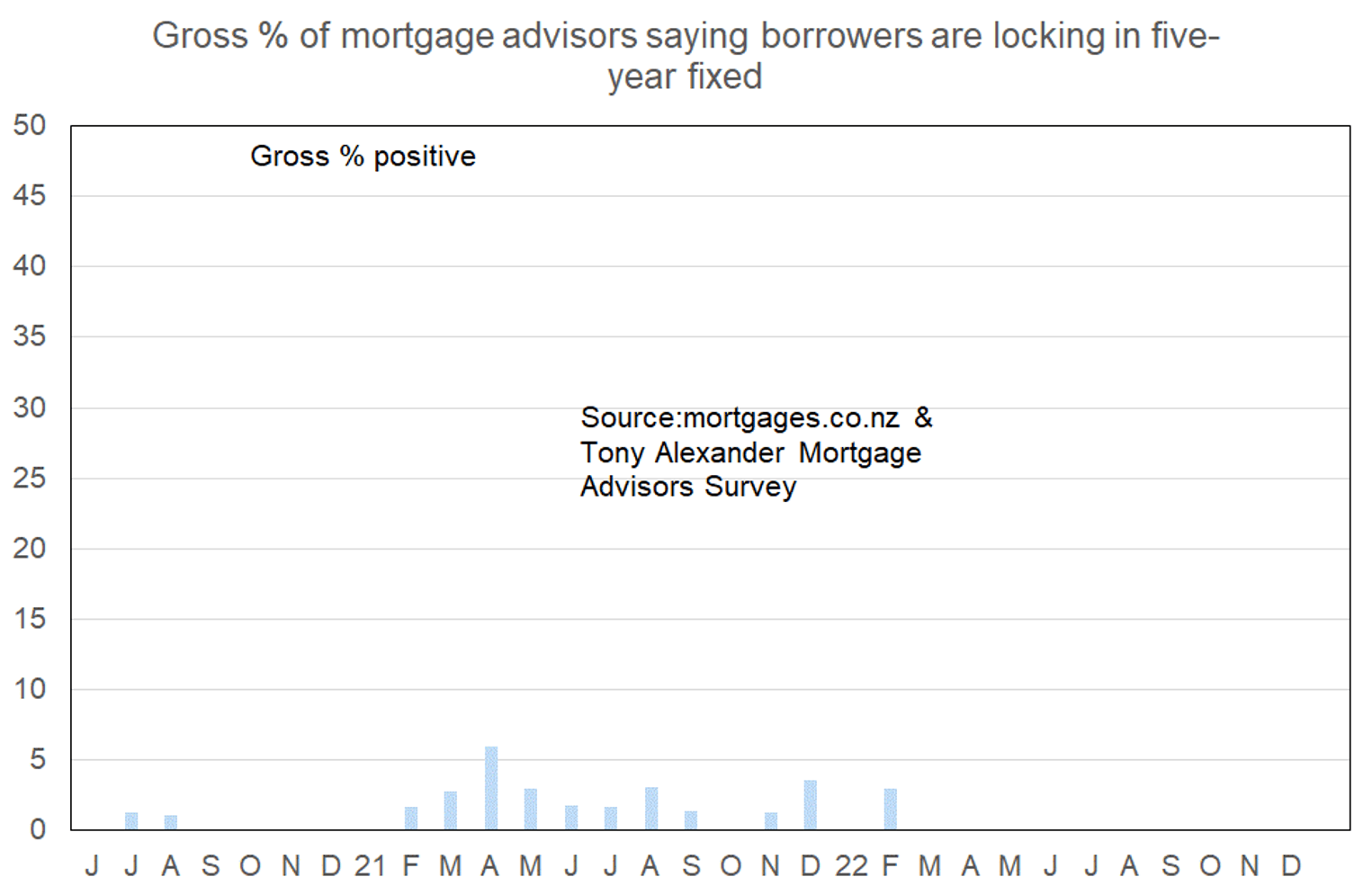

What time period are most people looking at fixing their interest rate?