Buyers return

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken this week, attracted 65 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- Buyers are returning to the residential real estate market with both investors and first home purchasers increasingly evident.

- Banks are firmly perceived as being more willing to lend funds, but processing times have blown out.

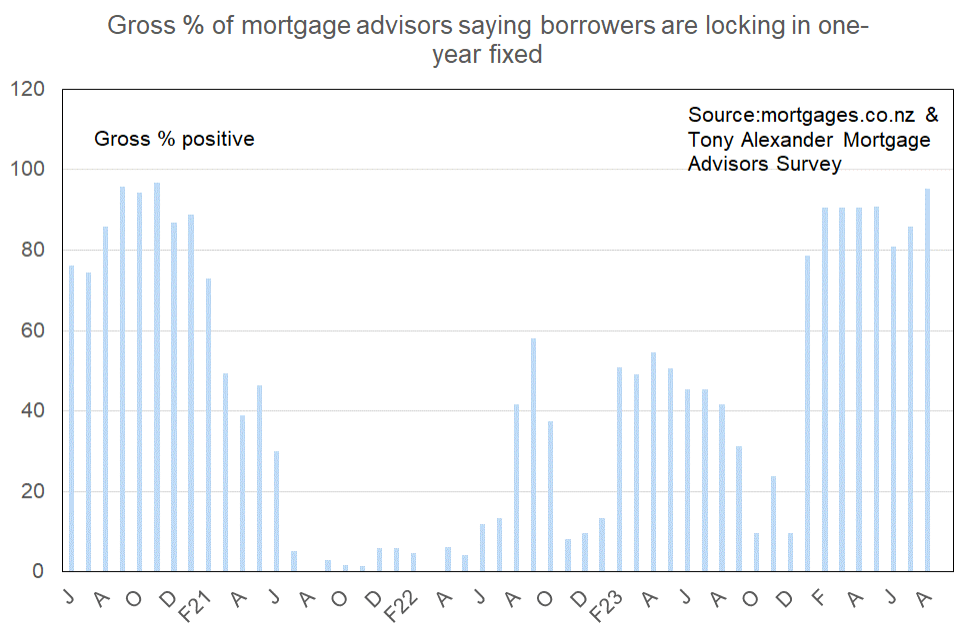

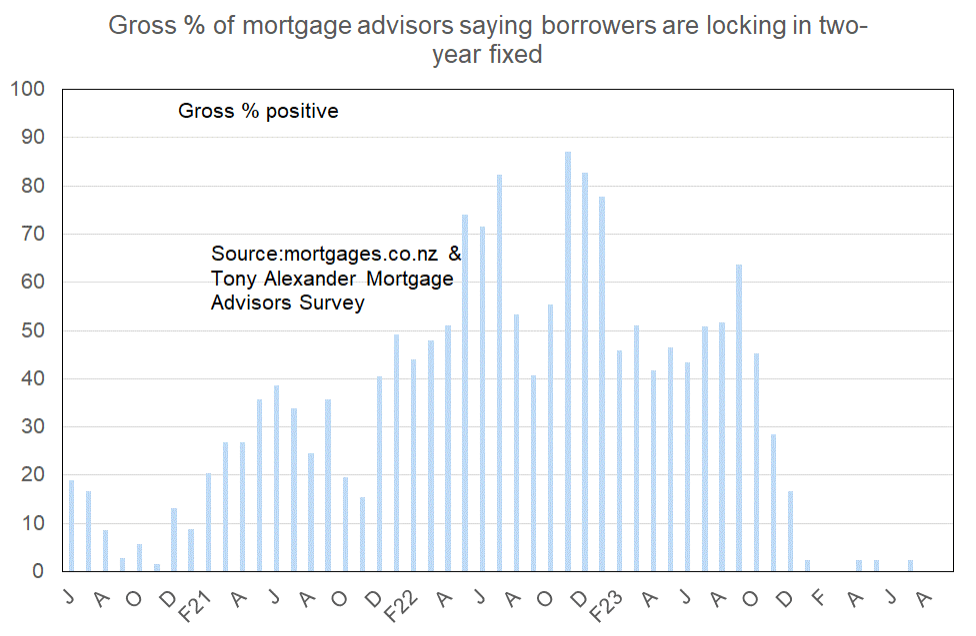

- The widespread community anticipation of lower mortgage rates has driven borrowers almost exclusively to fixing one year or less – mainly six months.

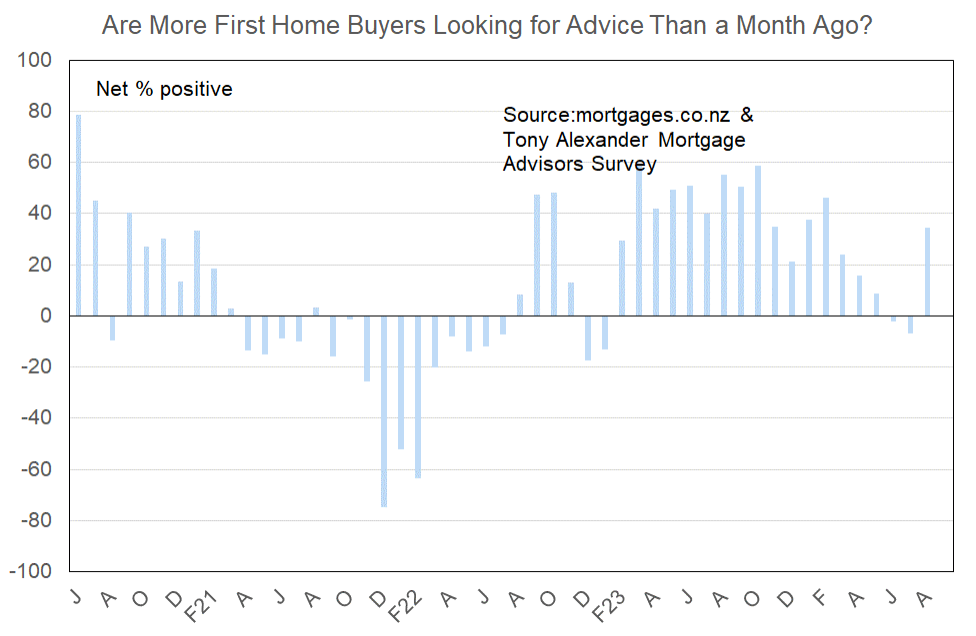

More or fewer first home buyers looking for mortgage advice

A net 35% of mortgage brokers this month have reported that they are seeing more first home buyers in the market. This is a strong turnaround from the net 7% who early in July said that they were seeing fewer first time purchasers.

The change in sentiment about interest rates appears to be the driving factor behind this turnaround.

Comments on bank lending to first home buyers submitted by advisers include the following.

- Seem to have sprung to life with a view prices are at low point, a number of Pre-approved clients now signing S&P agreements.

- Lowered UMI minimums across several banks which is assisting first home buyers lend a little more.

- No real impact with DTIs yet.

- Pretty tough on poor account conduct, the cost of living increasing has meant a few aren’t managing things as well or had their hours reduced earlier this year

- Just as long as the FHB’s have a 20% deposit and can afford the lending under the new DTI rule, then all of the Banks are lending quire easily.

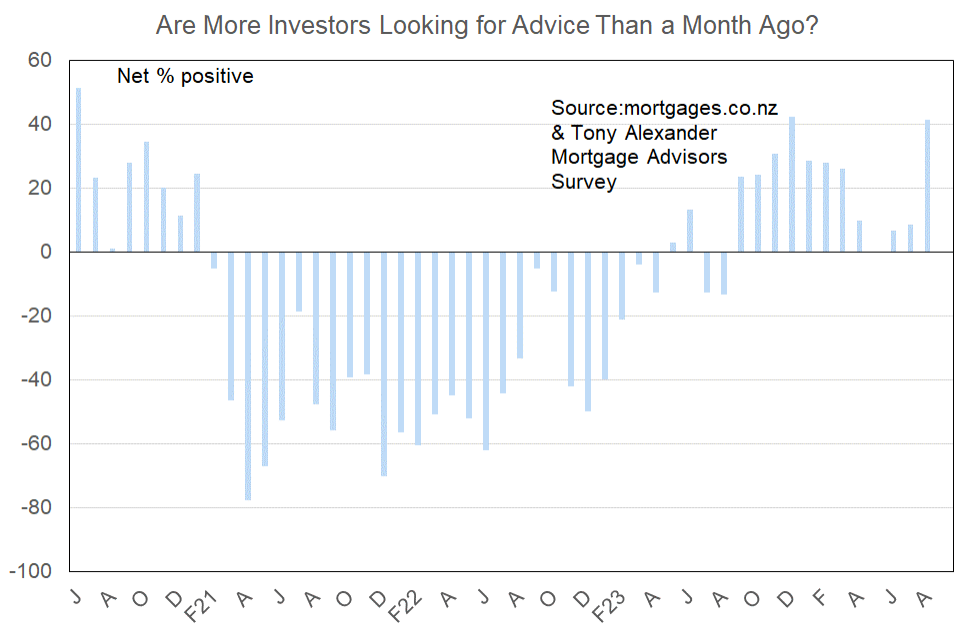

More or fewer investors looking for mortgage advice?

A net 38% of brokers this month have said that they are seeing more investors in the market. This is a gain from just a net 9% last month seeing more investors and the strongest result since December last year.

Factors contributing to the change appear to be the interest expense tax deductibility and brightline test changes, along with hopes for lower mortgage rates. However, brokers still note that for many investors are few and far between and numbers still don’t stack up in favour of a purchase in many instances.

Comments made by advisers regarding bank lending to investors include the following.

- Most still double counting rates/insurance as well as discounting rental income making affordability tough to meet.

- Slow changes on CCCFA

- DTI influencing this space with some not able to get approvals due to this restriction. Actually makes our lives somewhat easier as we can have initial assessments based on this and either rule in or out progressing an application

- Removal of rates and home insurance for most lenders now, which has vastly improved affordability. Still a couple including these, that will hopefully change over the coming weeks as they are now out of market for property investors.

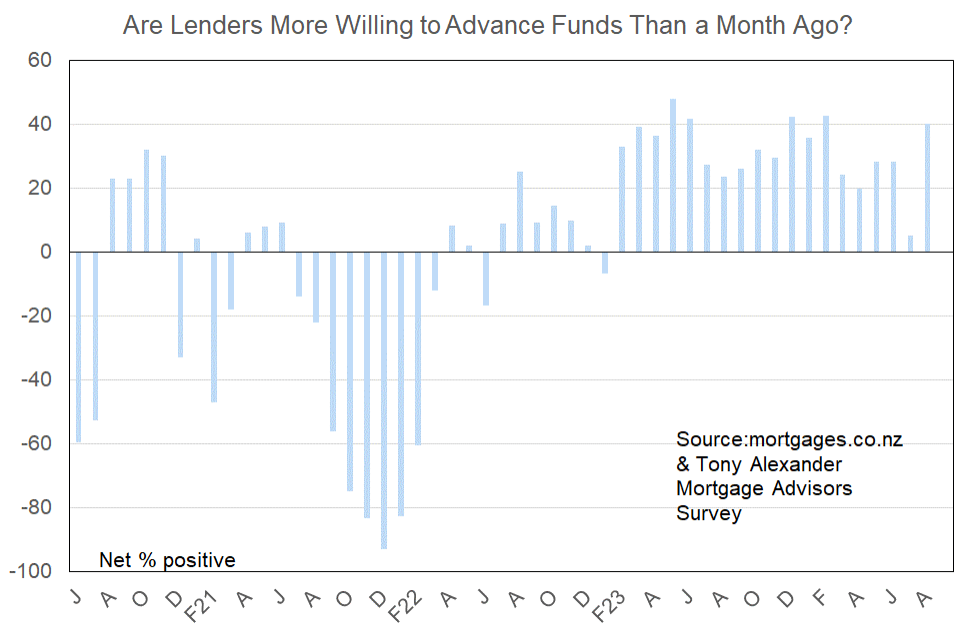

More or less lenders willing to advance funds?

A net 40% of brokers this month have reported that in their opinion banks have become more willing to lend funds. This is a change from the unusually low net 5% feeling this way in July.

As was the case last month, a number of brokers stressed that processing times for applications have blown out.

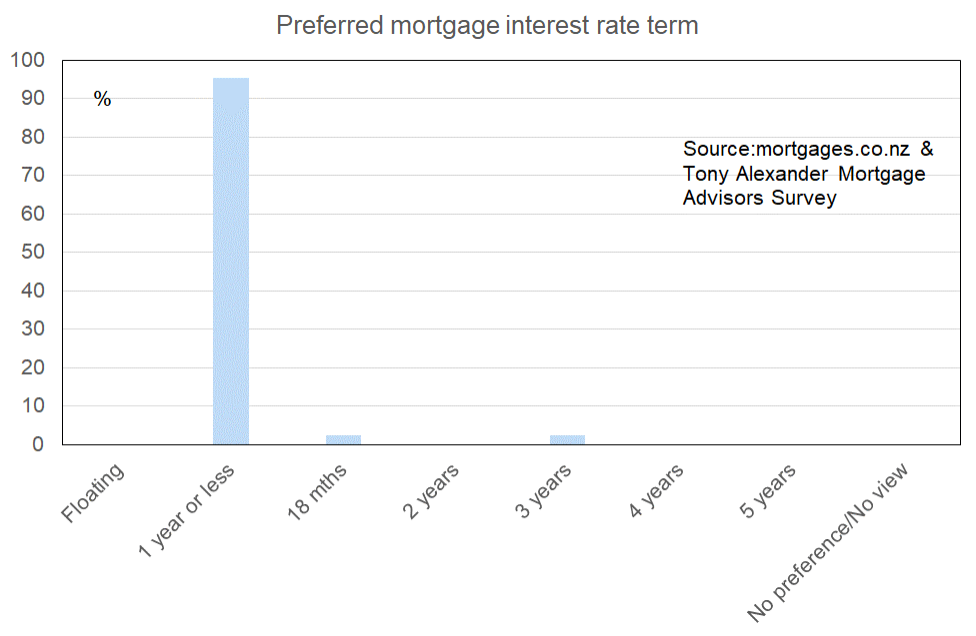

What time period are most people looking at fixing their interest rate?

A gross 95% of mortgage advisors have reported that customers want to fix for one year or less.

This is the highest such level since November 2020 when 97% of brokers said people wanted to only fix short. But back then the motivating factor was the level of the one year fixed rate near 2.29%. This time it is not the common 6.85% one year fixed rate which is attracting people but the very strong expectation that interest rates will fall firmly over the coming year.

In other words, people only look forward to where rates are likely to go when they are high and set to fall, not low and set to rise.

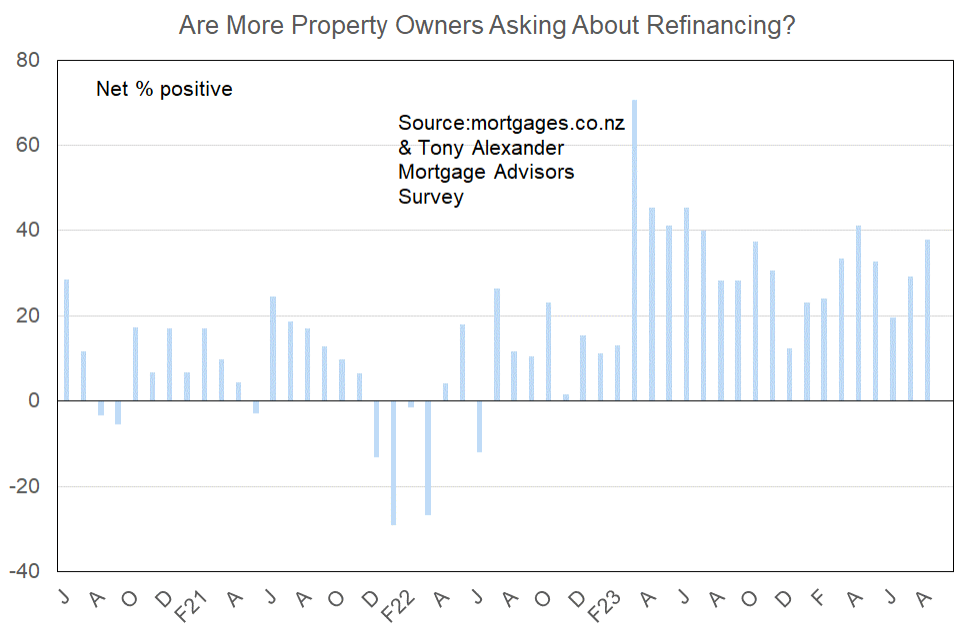

Are more property owners asking about refinancing?

A net 38% of mortgage advisors in this month’s survey have said that they are observing more property owners making refinancing enquiries. Given the widespread expectation that interest rates will fall this jump from a net 29% last month is more likely to reflect plans to sell rather than a search for a cheap rate in high rate times.