First home buyers dominant

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 60 responses.

The main themes to come through from the statistical and anecdotal responses include these.

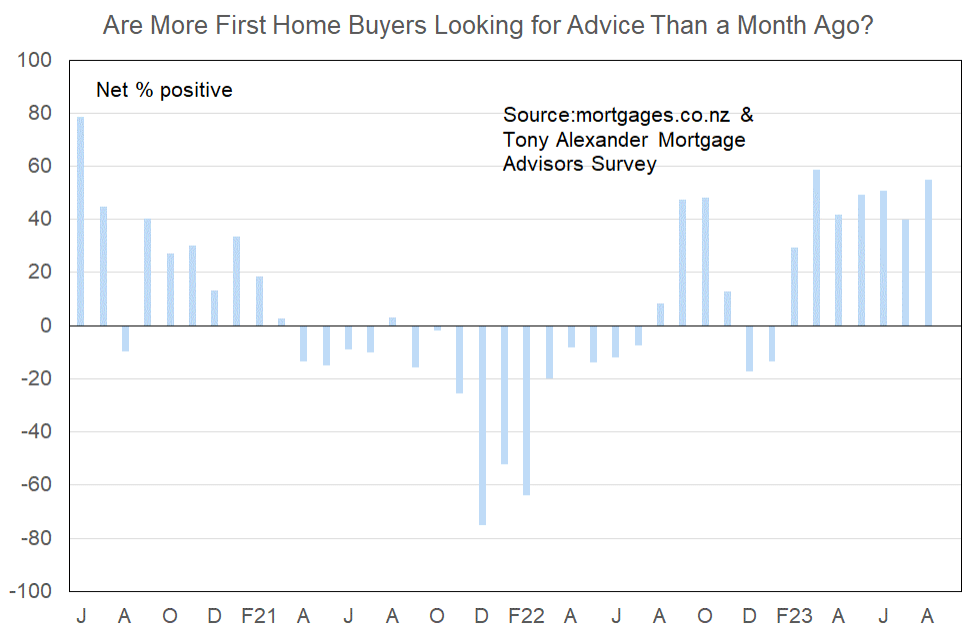

- First home buyers remain the main driving force behind improving activity levels.

- High test mortgage rates are preventing many potential buyers from being able to make a debt-funded purchase.

- The market overall is improving, but the upturn is only mild.

More or fewer first home buyers looking for mortgage advice

Comments on bank lending to first home buyers submitted by advisers include the following.

- Assessors being more reasonable with expenses

- Big one is that now most banks have a stress test rate now at 9% or over.

- Strong employment history is still top priority and minimal short term debt

- Very strict on First home buyers unless they meet the First Home loan criteria, making it hard to get those across the line due to high servicing and low equity margins.

- Higher test rates have meant loan amount is somewhat subdued.

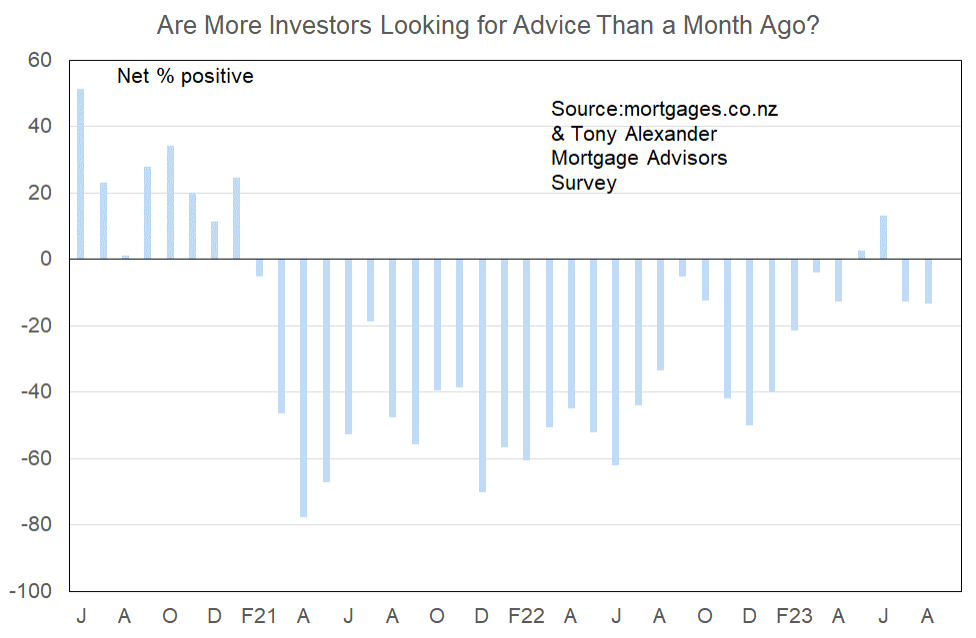

More or fewer investors looking for mortgage advice?

There is still no sustained indication from our monthly survey of mortgage advisers that investors are returning to the market to follow the first home buyers.

A net 13% of brokers have said that they are seeing fewer investors looking for financing advice. This is unchanged from July’s result.

Comments made by advisers regarding bank lending to investors include the following.

- Some minor loosening of policy from (a bank) this week. Very marginal but not shading rental income by as much as previous.

- Affordability is still a struggle for investors. The banks are willing to lend and the increase to 65% is good, if only they could afford to.

- Not really done much investor funding – 65% LVR has created a little enquiry, but same issue is the cash to service is not there.

- It’s so long since I had an investor enquiry, I have no idea how the banks are approaching them.

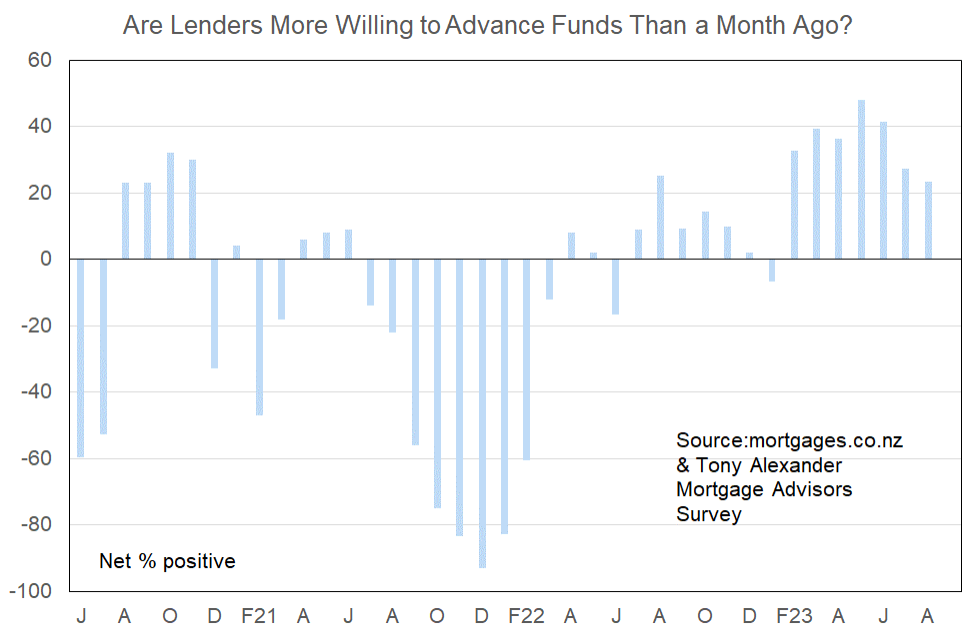

More or less lenders willing to advance funds?

In this month’s survey a net 23% of respondents have reported that banks have become more willing to advance funds. This continues a seven month run of indications that bank financing is becoming more readily available. This easing in lending criteria may reflect banks pulling back from trying to attract business through discounted interest rates.

But feedback from mortgage advisers shows that credit conditions cannot be considered to be easy – just slightly less tight. Many borrowers cannot meet debt servicing requirements with test interest rates near 9% and assessment of expenses and spare income requirements remain relatively tight – though easing bit by bit each month.

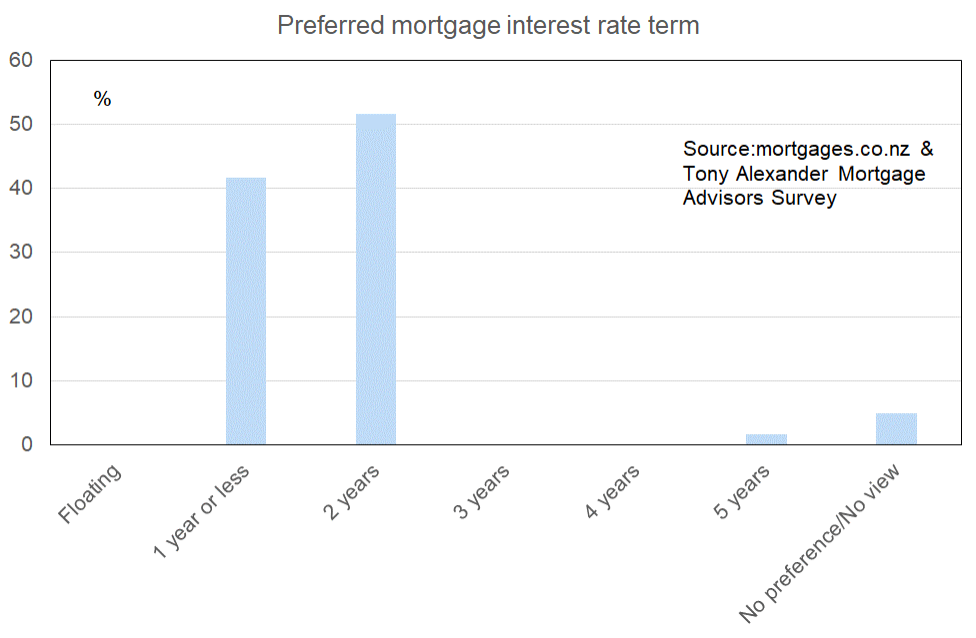

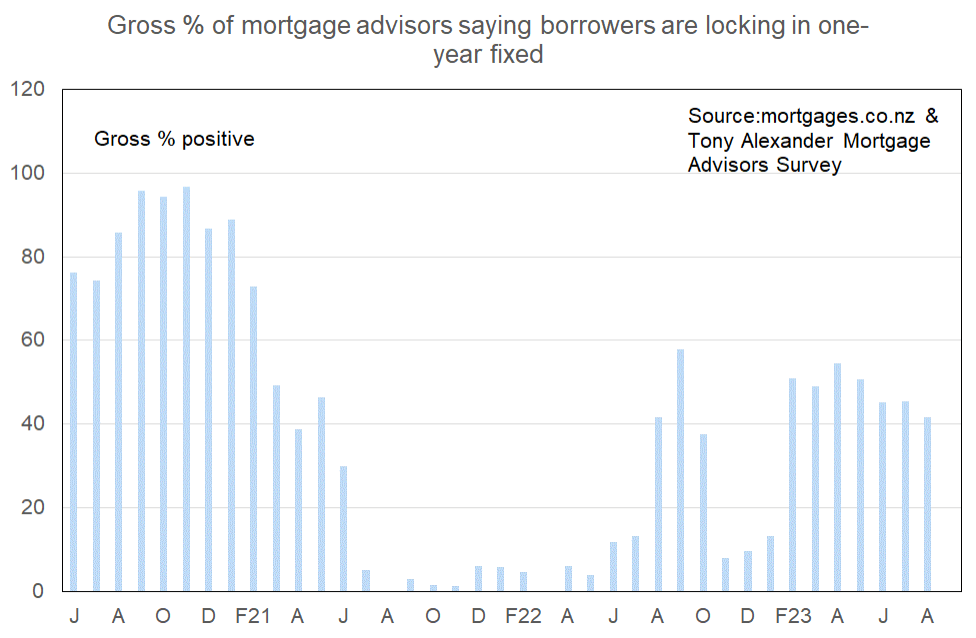

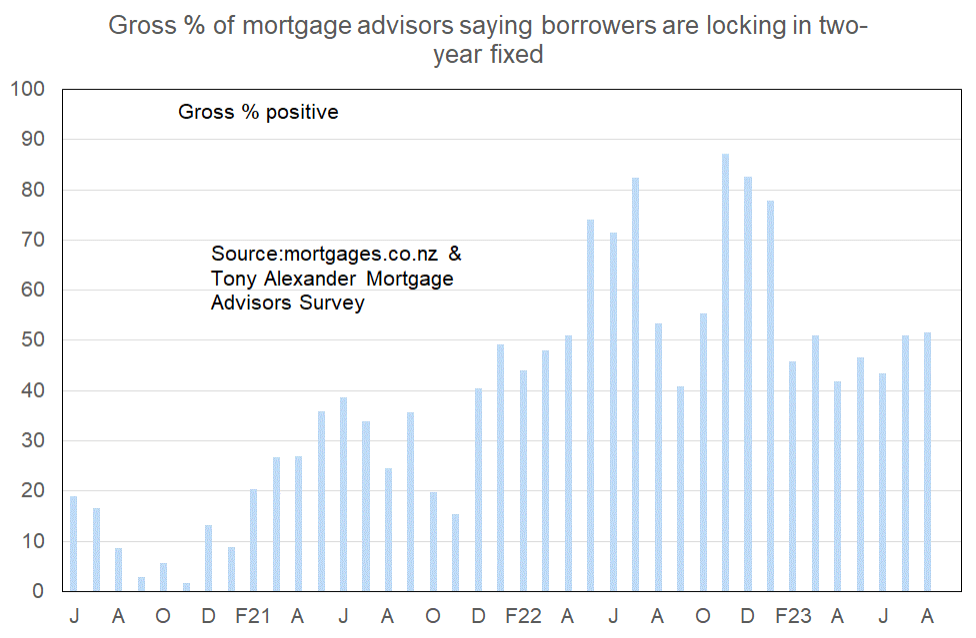

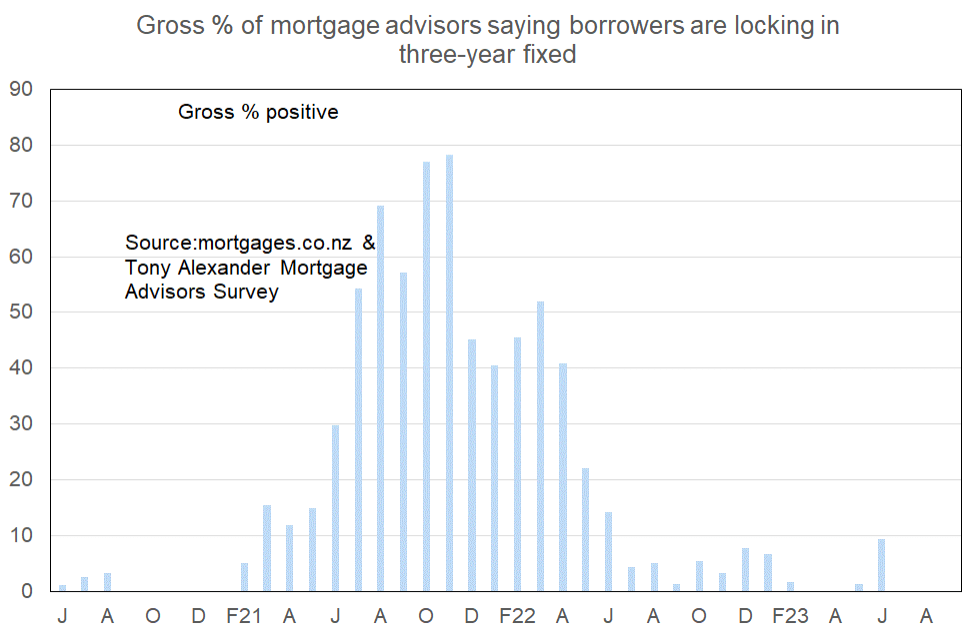

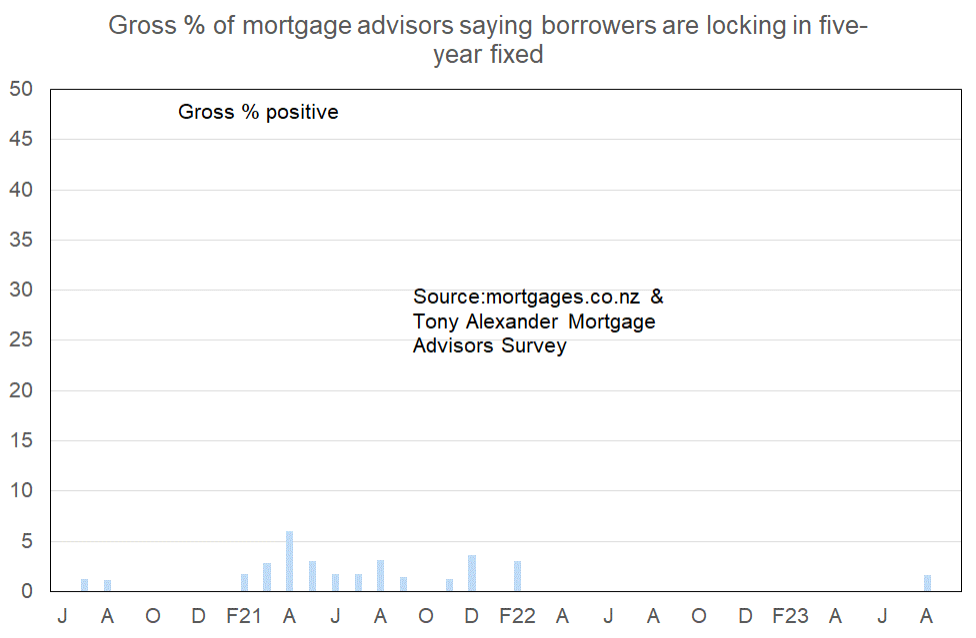

What time period are most people looking at fixing their interest rate?