Buyers more cautious

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken this week, attracted 51 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- Buyer interest in residential property remains but it has eased slightly recently.

- Bit by bit banks are slowly easing their lending criteria.

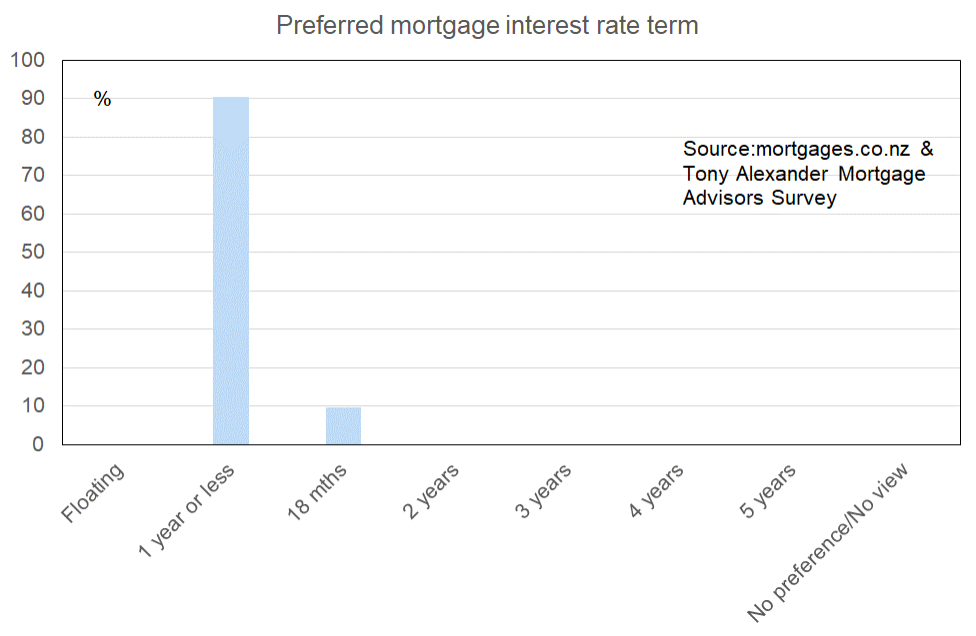

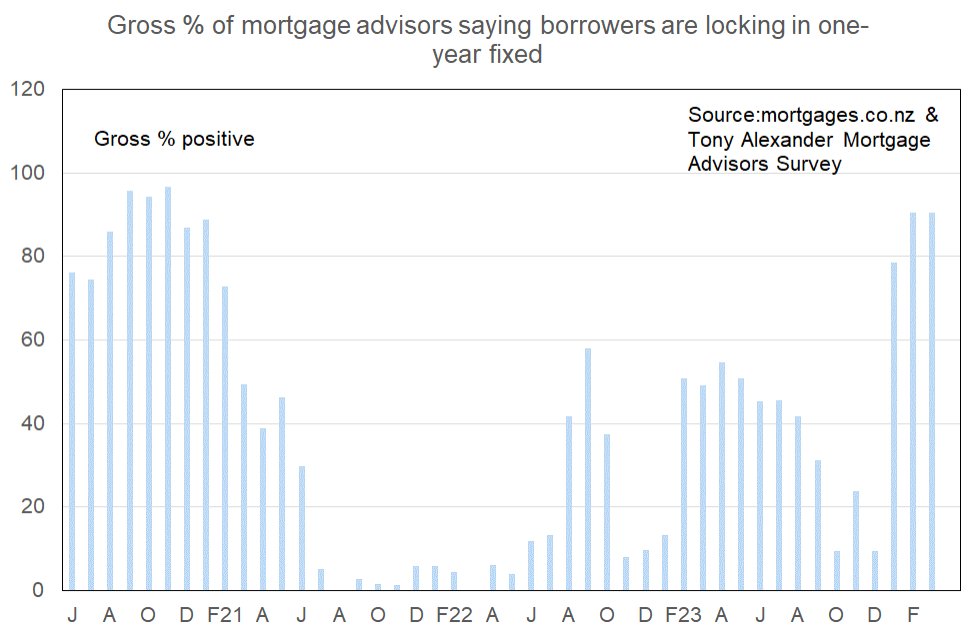

- Borrowers overwhelmingly only want to fix their interest rate for a period of one year or less.

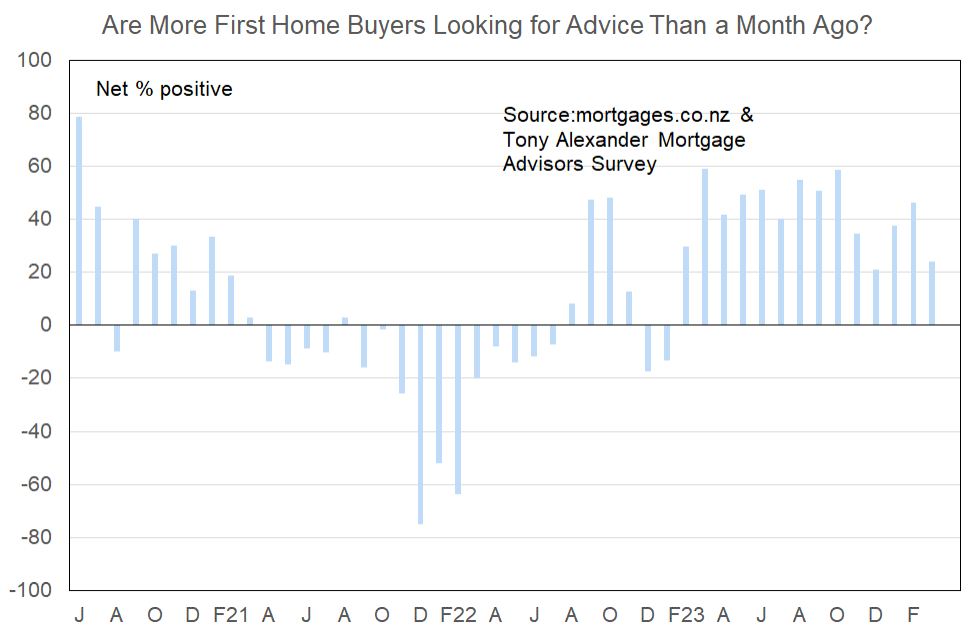

More or fewer first home buyers looking for mortgage advice

A net 16% of the 51 mortgage brokers replying in this month’s survey have said that they are seeing more first home buyers in the market. This is down from 24% last month and the weakest result since -13% of January 2023.

The result gels with measures in my other surveys showing that people are responding to their worsening expectations for the economy and new fears about income and employment by pulling back from earlier plans to purchase a property.

Comments on bank lending to first home buyers submitted by advisers include the following.

- Two banks are now offering 60-day preapprovals for main-bank first home buyers. Also reducing the amount of surplus income per month based on deposit (15% or more is more lenient with surplus income, as an example). Xxx bank have now introduced boarder income for low-deposit lending and First Home Loan products. This has been long awaited!

- No real changes but banks appear to have slightly more availability of funding in the low equity space.

- Some indications of nervousness by lenders around contractors & length of contracts.

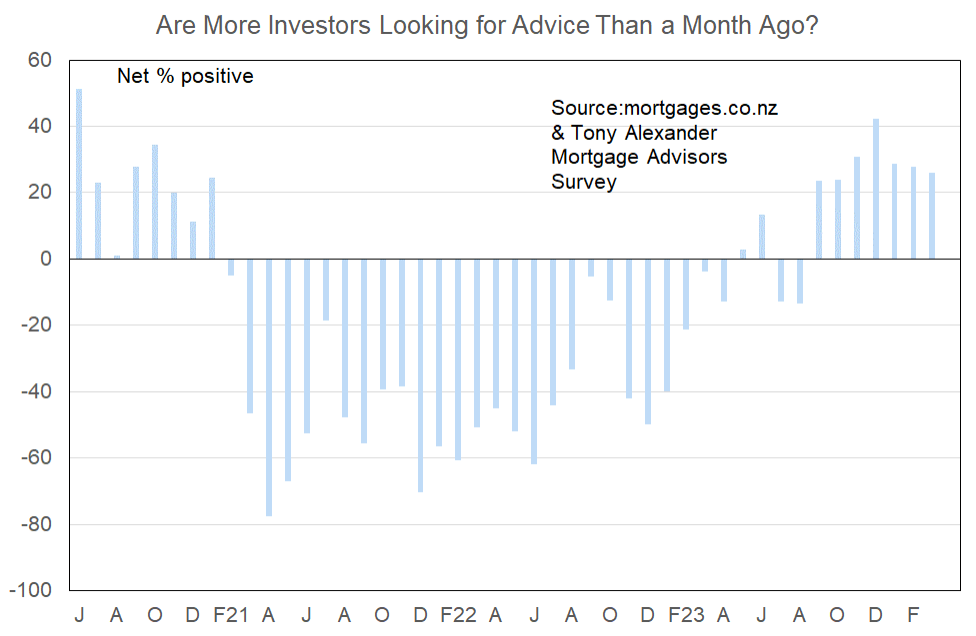

More or fewer investors looking for mortgage advice?

A net 10% of mortgage advisors have said that they are seeing more investors looking for assistance. This is down from 26% in March and the peak of 42% in December and is the weakest result since -13% in August last year.

The investors are still in the market looking to purchase and many brokers have noted this in their written comments. But an air of caution prevails amidst rising costs of running a rental business.

Comments made by advisers regarding bank lending to investors include the following.

- Some banks are no longer requiring we factor in insurance/rates costs.

- DTI calculations are being added to UI calculators, however not really flowing through to significant changes at this point.

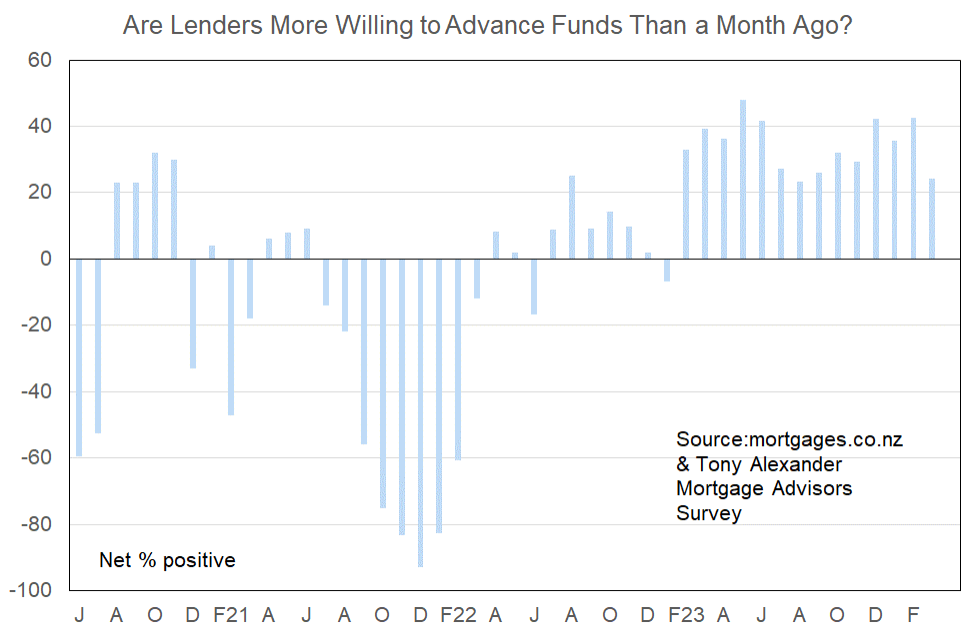

More or less lenders willing to advance funds?

Many of the written comments supplied by brokers indicating easing lending criteria being applied by banks. This is reflected in the net 20% of brokers saying that banks are becoming more willing to advance funds.

This however is down from a peak of 43% in February indicating that as we head into Winter the pace with which banks are becoming more willing to advance funds has eased off to some degree. At least the direction of change is positive still for those looking to make a home purchase.

What time period are most people looking at fixing their interest rate?

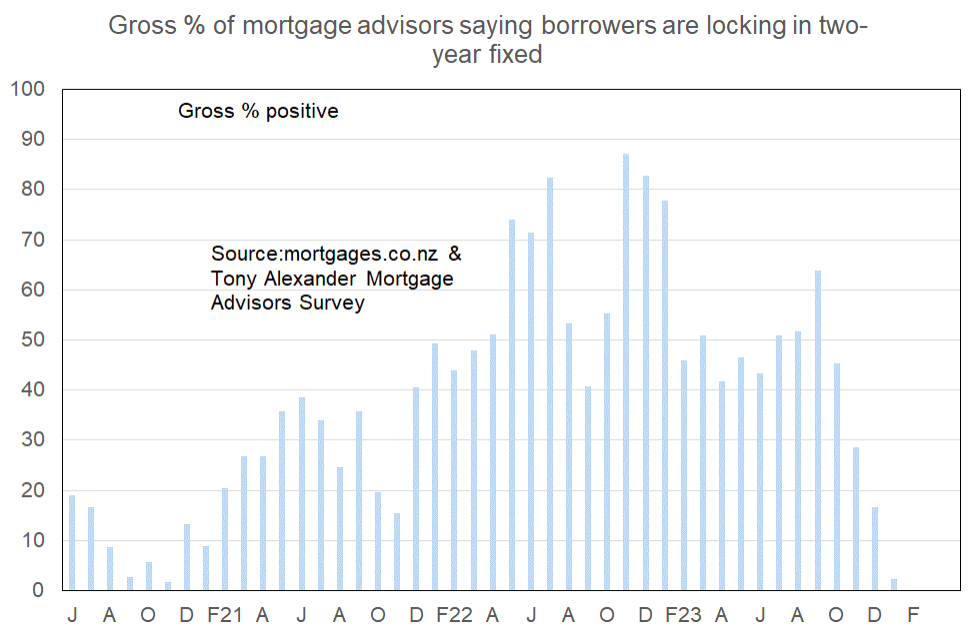

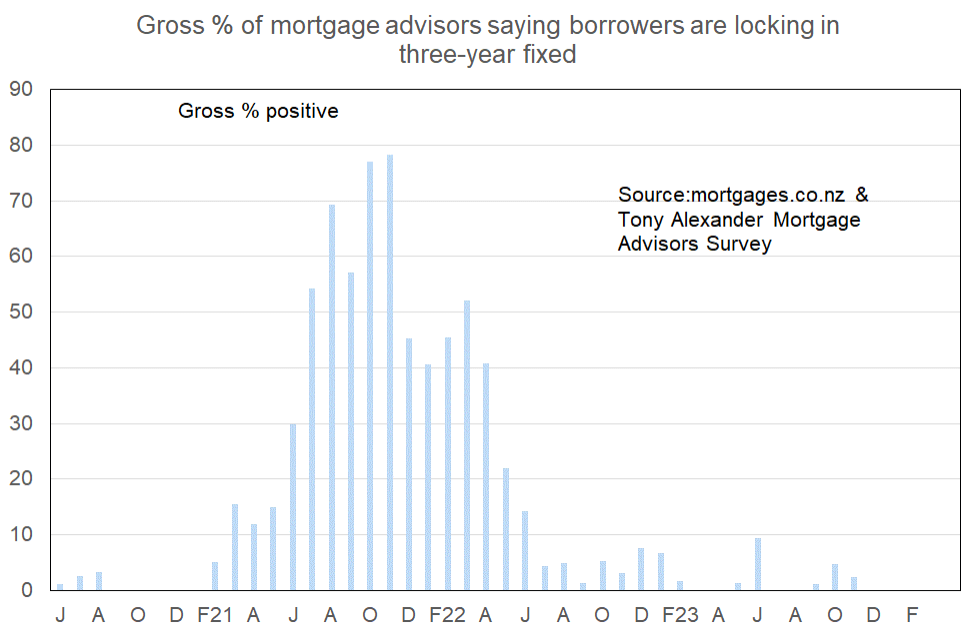

It remains the case that almost all borrowers favour fixing their interest rate for a period shorter than two years. Most overwhelmingly favour fixing six months or one year only in expectation of monetary policy easing from late this year.

The desire to fix 6-12 months has been exceptionally strong since the start of this year.

Almost no borrowers wish to fix two years.

Fixing for three years is of interest to no-one.

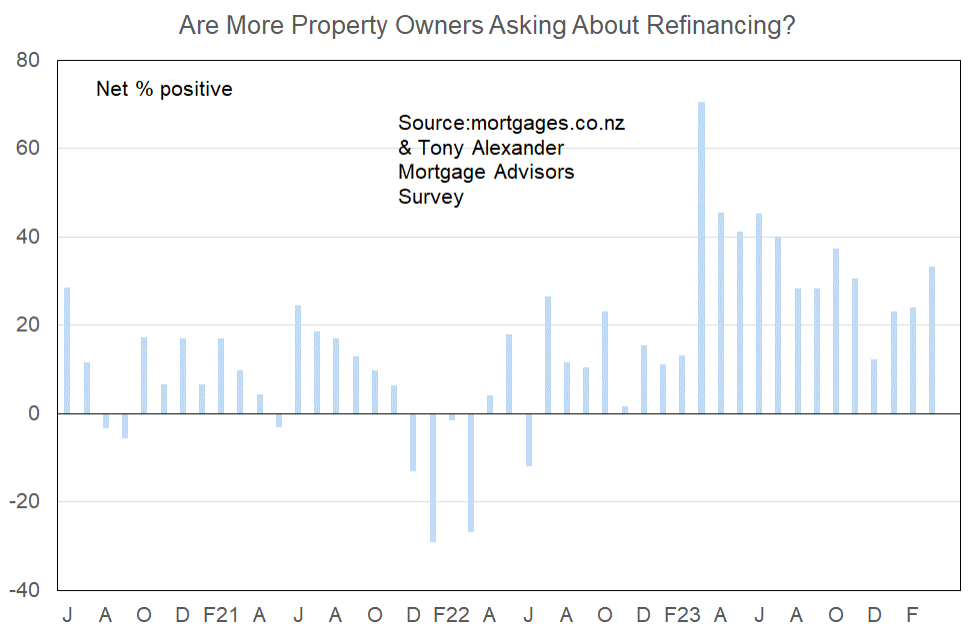

Are more property owners asking about refinancing?

For the fourth month in a row brokers have reported that they are seeing more people enquiring about refinancing their mortgage. The cost of living has increased sharply for those with mortgages over the past 2-3 years and cash flow considerations at a time of rising job loss worries are naturally leading people to seek cheaper funding. Whether they find it is another story, however.