Credit availability improves

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week and yielding 49 responses, (lower than usual because of Easter) shows

- bank willingness to lend has solidly improved over the past two months,

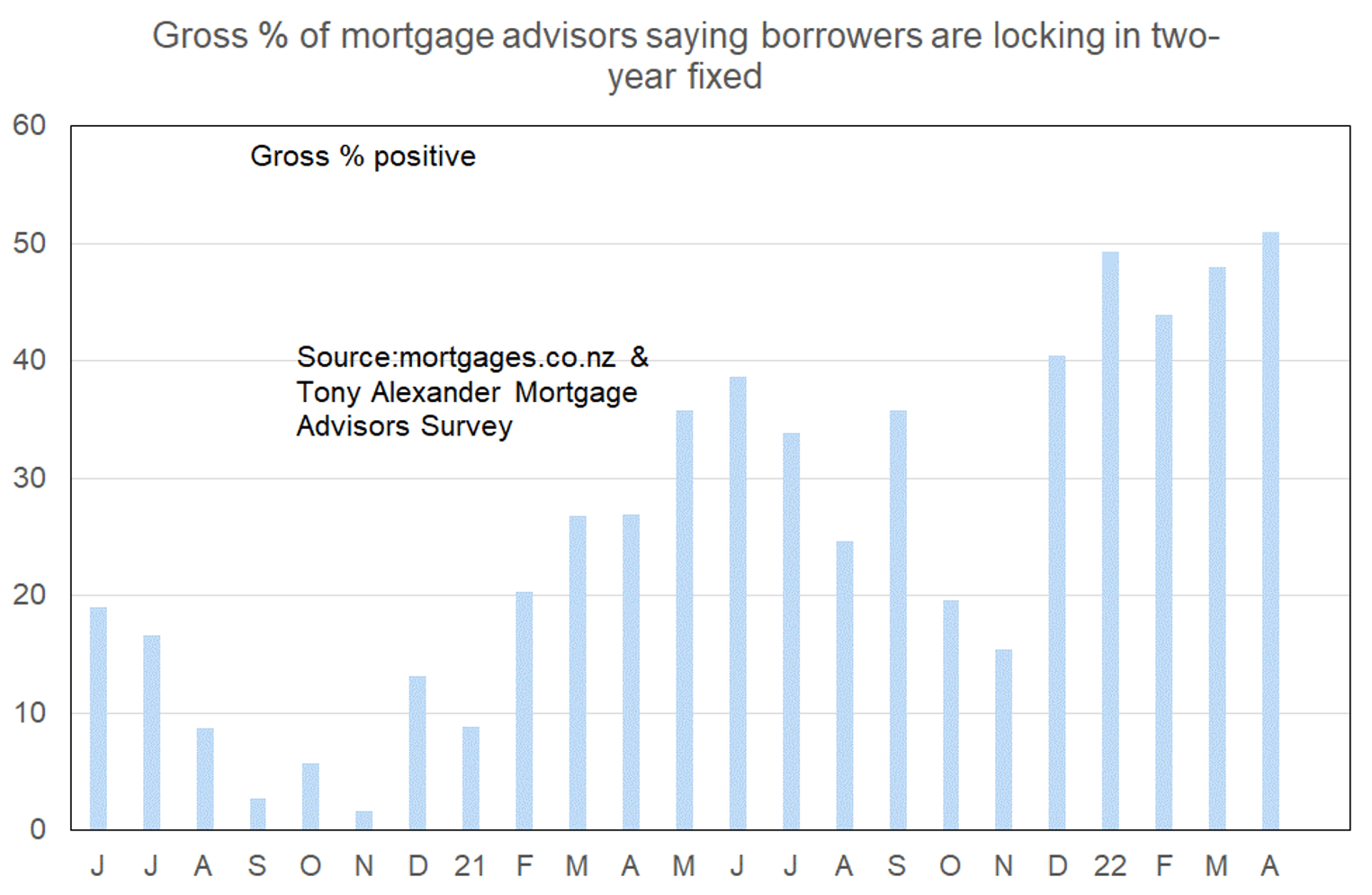

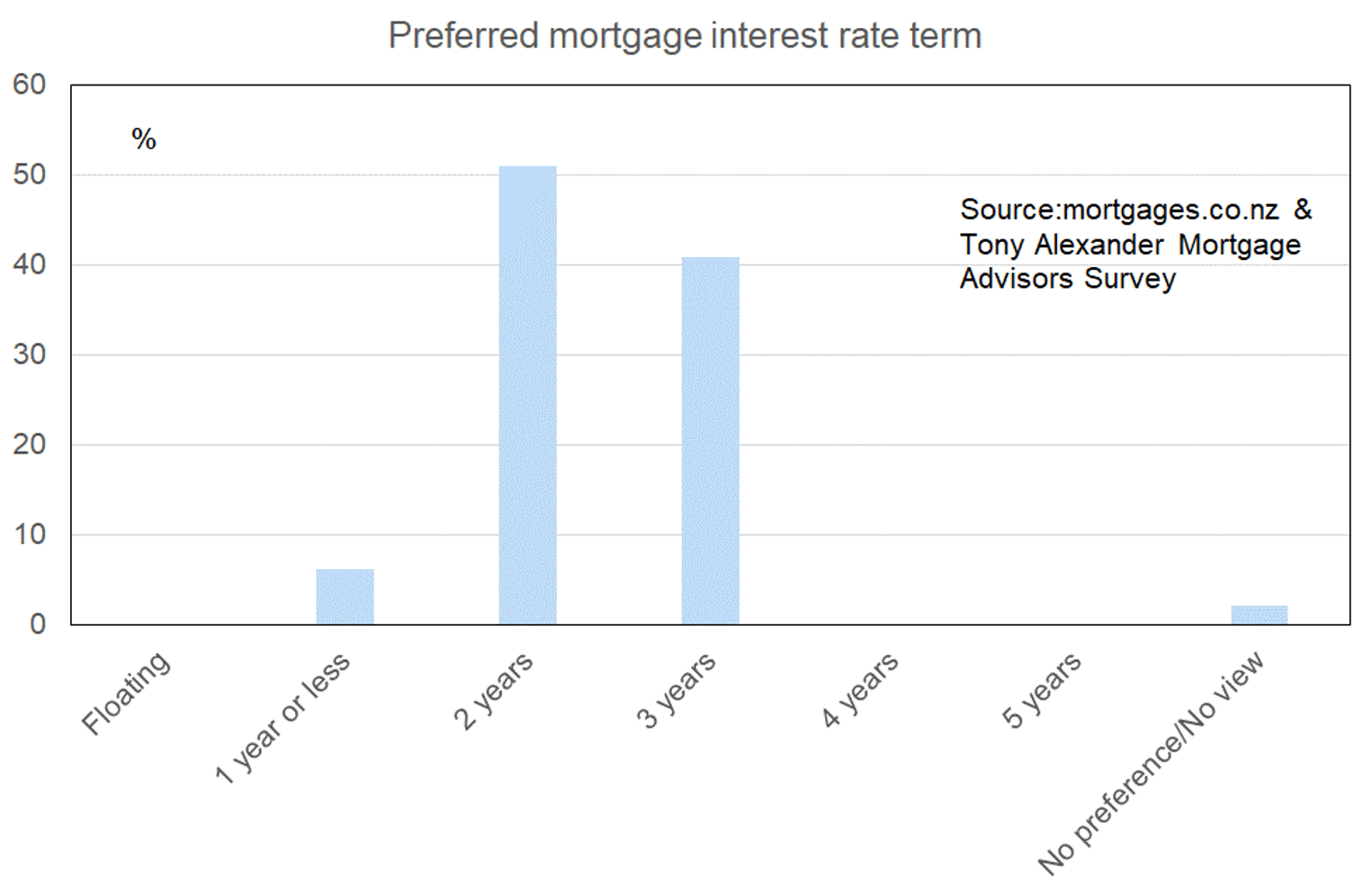

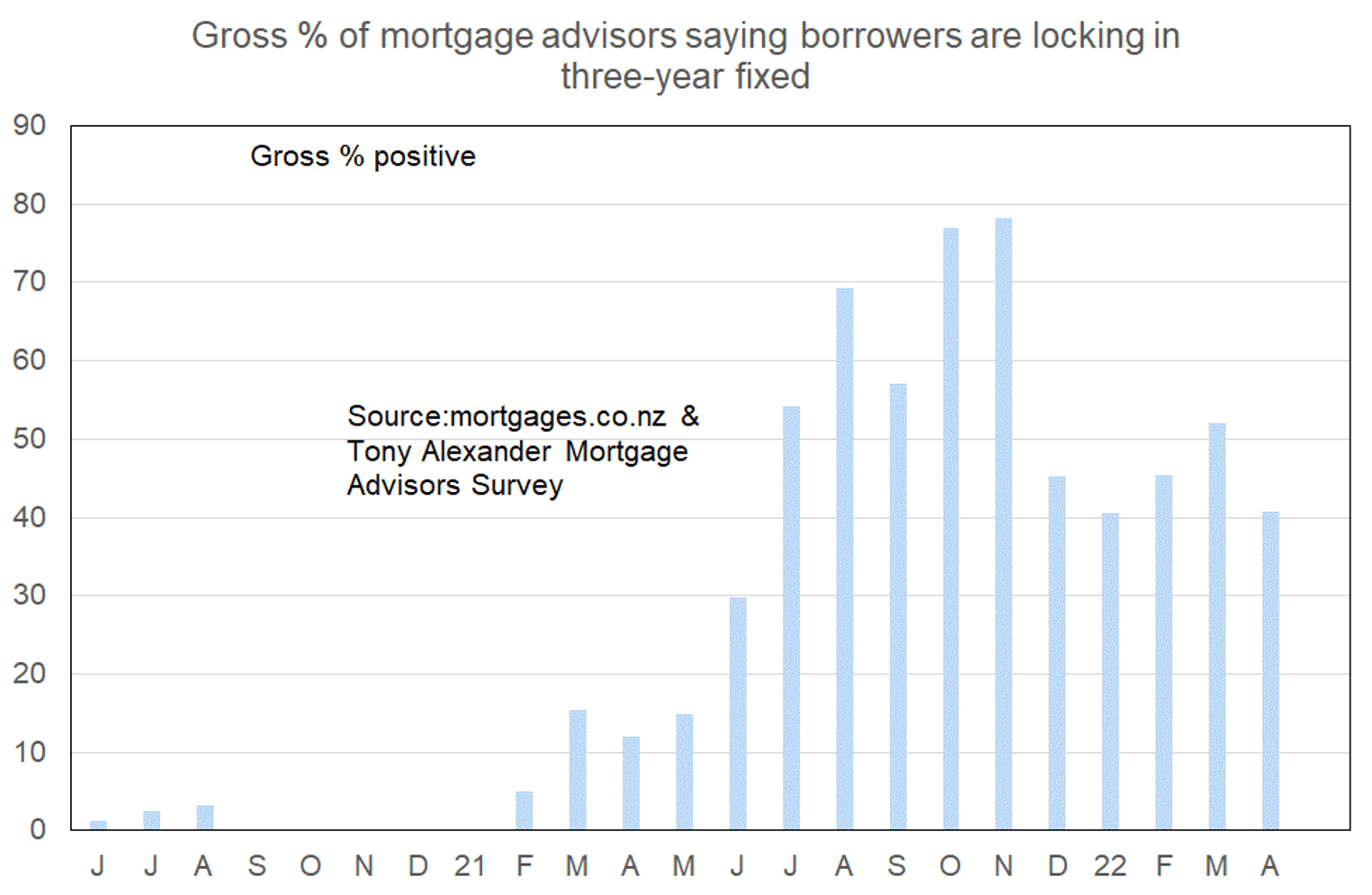

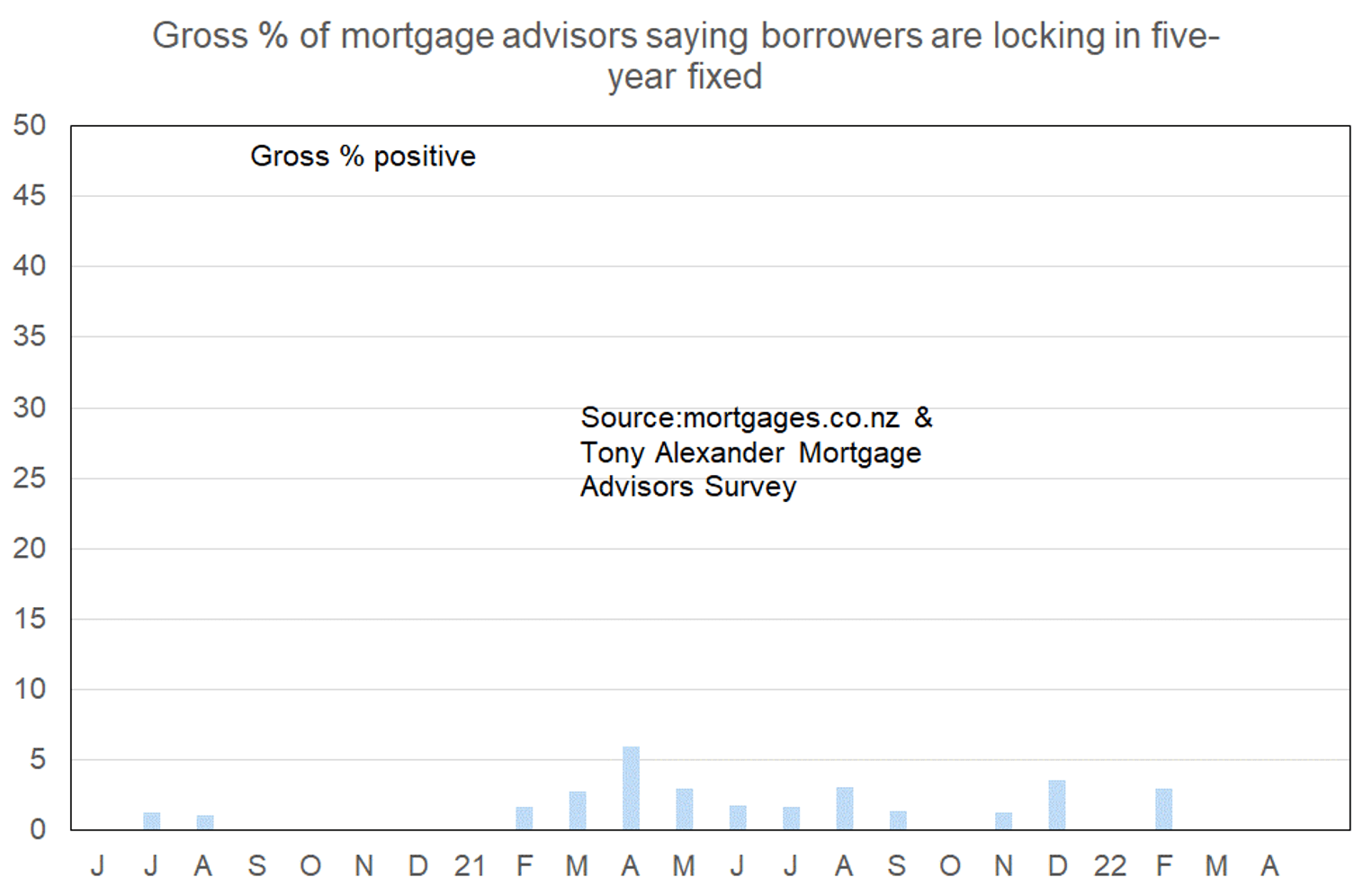

- the two year term is increasingly favoured by borrowers, and

- first home buyers are becoming less inclined to desert the market,

- but bank implementation of tightened lending rules remains highly variable.

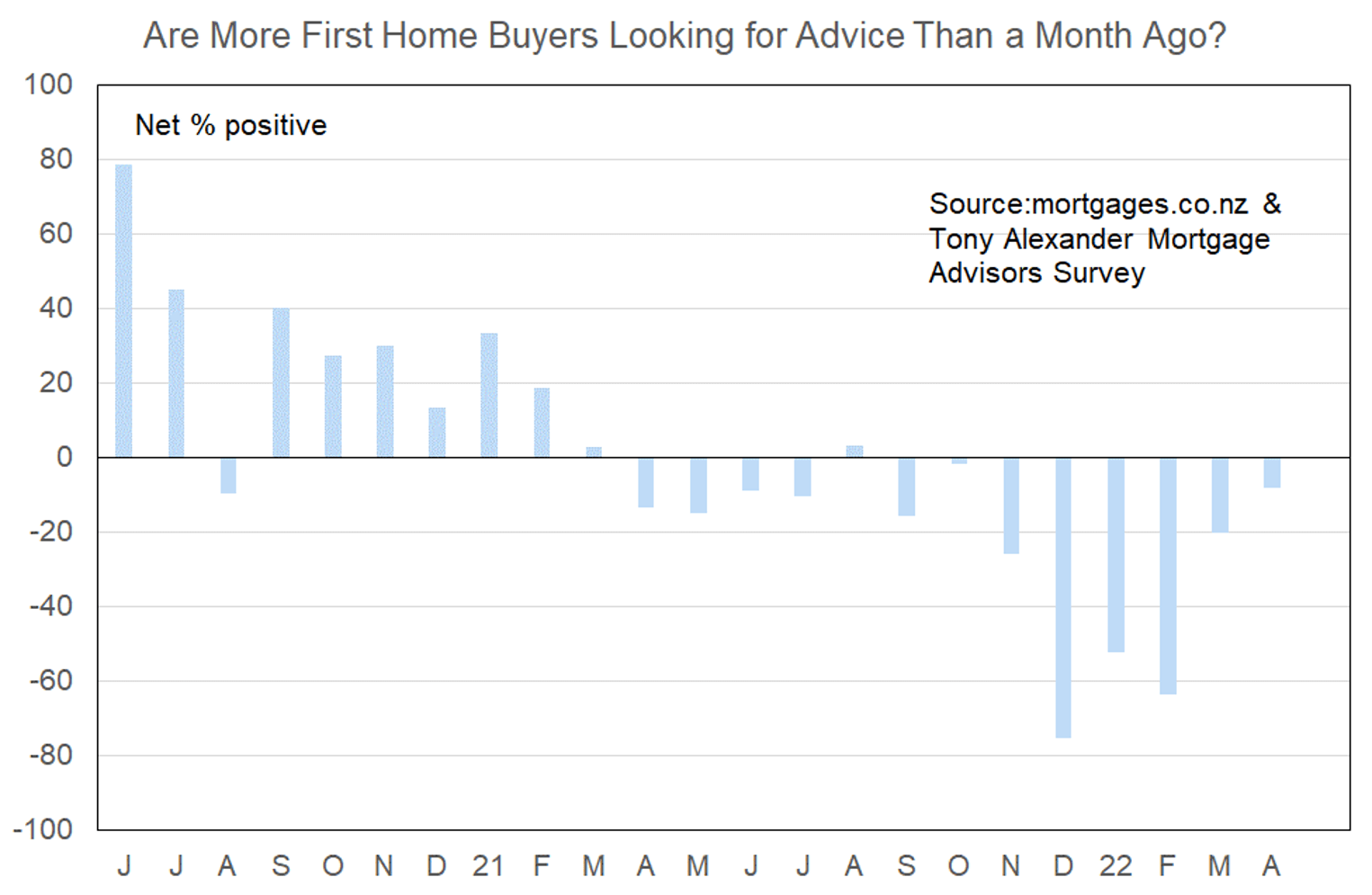

More or fewer first home buyers looking for mortgage advice

Things have come a long way since the initial days of the pandemic when many people tried all at once to purchase property. First home buyers initially led the rush towards the end of the first nationwide lockdown in 2020, but investors quickly took over as they saw prices were not falling as had been expected.

The sharp jump in prices then return of LVRs from February 2021 meant many first home buyers were taken out of the market before this time last year. The next change was investor buyers stepping back substantially after tax rules were changed at the end of March 2021.

Some measures show first home buyers then filling up the gap left by those investors. But our survey shows that this was not due to a new rush of first home buyers returning to the market after March 2021. Instead, they naturally accounted for a higher percentage of sales simply because there were fewer investor buyers.

The next change affecting first home buyers was the newly tightened LVR rules from November 2021 then implementation of Credit Contracts and Consumer Finance Act changes from December. The credit crunch created by these changes prevented many first home buyers from making a purchase and as word spread of new financing difficulties these buyers stopped making enquiries.

Now, there is an easing in the credit crunch underway and the new situation is this. Credit access is becoming less of a barrier to first home buyers making a purchase. But will they still stay away from auctions etc. because of falling prices and talk of people shifting to Australia? We shall see.

Comments submitted by advisers indicate that implementation of CCCFA rules remains inconsistent between the banks and credit availability overall to first home buyers is tight. However, some easing is evident including greater availability of low deposit lending.

- “There still seems to be confusion between mainstream banks on how to interpret the CCCFA rules, all mainstream banks have applied the rules in drastically different ways.

- Changes weekly depending on funding position, impossible for advisers/clients to operate.

- The banks seem more reasonable when looking at expenses over the past 3 months.

- LVR over 80% is back on the table.”

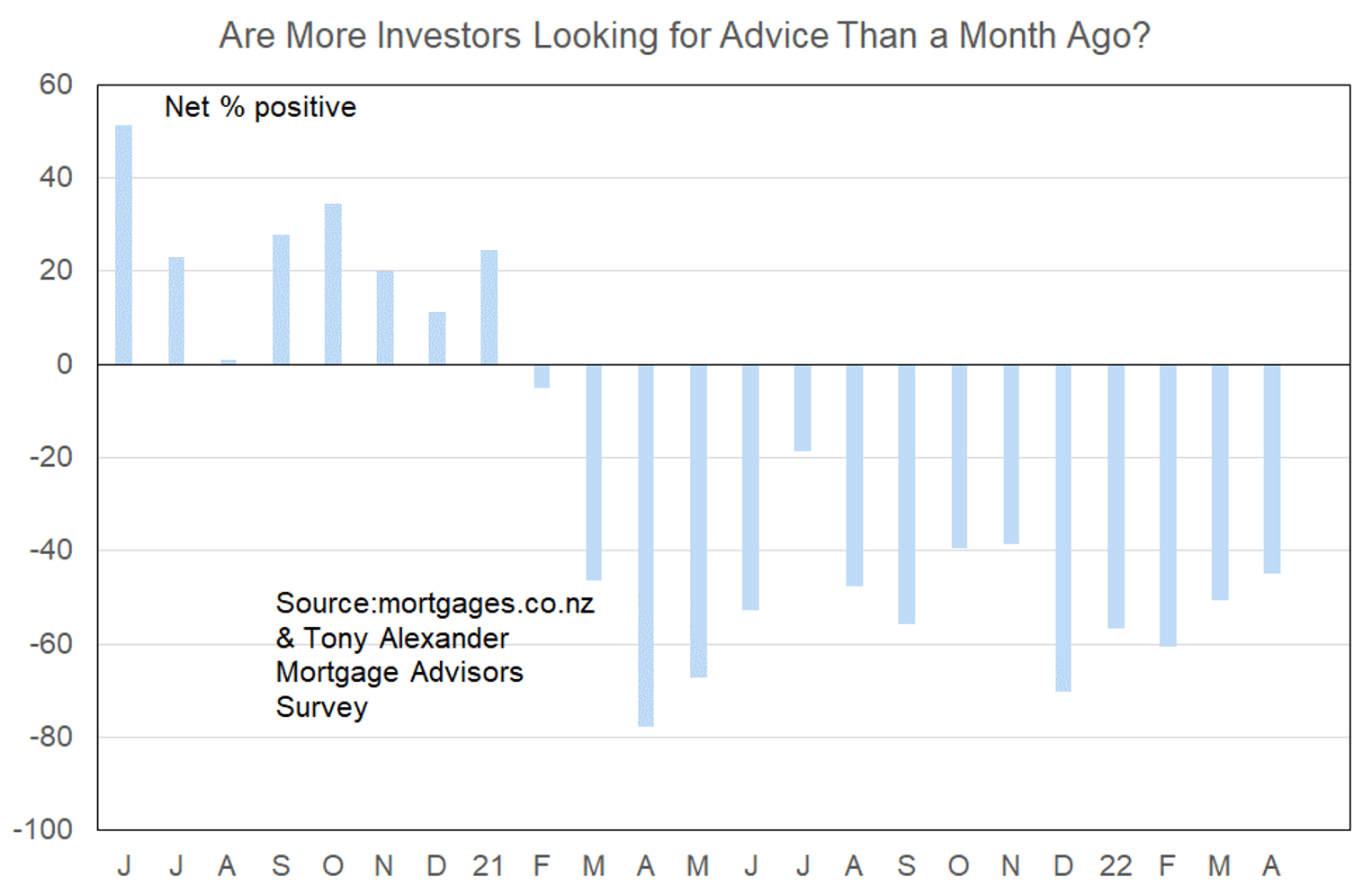

More or fewer investors looking for mortgage advice?

As is the case with first home buyers, mortgage advisers note that the pullback of investors is becoming less intense. But the negativity remains with a net 45% of advisers saying that they are seeing fewer investors.

Essentially, there is no change in the underlying level of investor interest in making a new purchase – low – ever since the March 23 2021 announcement of tax changes.

Comments made by advisers regarding bank lending to investors can be summarised as showing

- “Getting tougher in terms of scaling rental income. Essentially clients have to be more able to service the lending on their own bat.

- Age of investment property is needing to be provided i.e., before 27 March 2020 or after 27 March 2020.

- One lender has relaxed some of their criteria slightly but not enough to make a significant difference. The lender is not scaling rent as much as they were and no longer require evidence of rates & insurance costs for investment properties (although they still take into account the declared costs in the debt servicing calculation.”

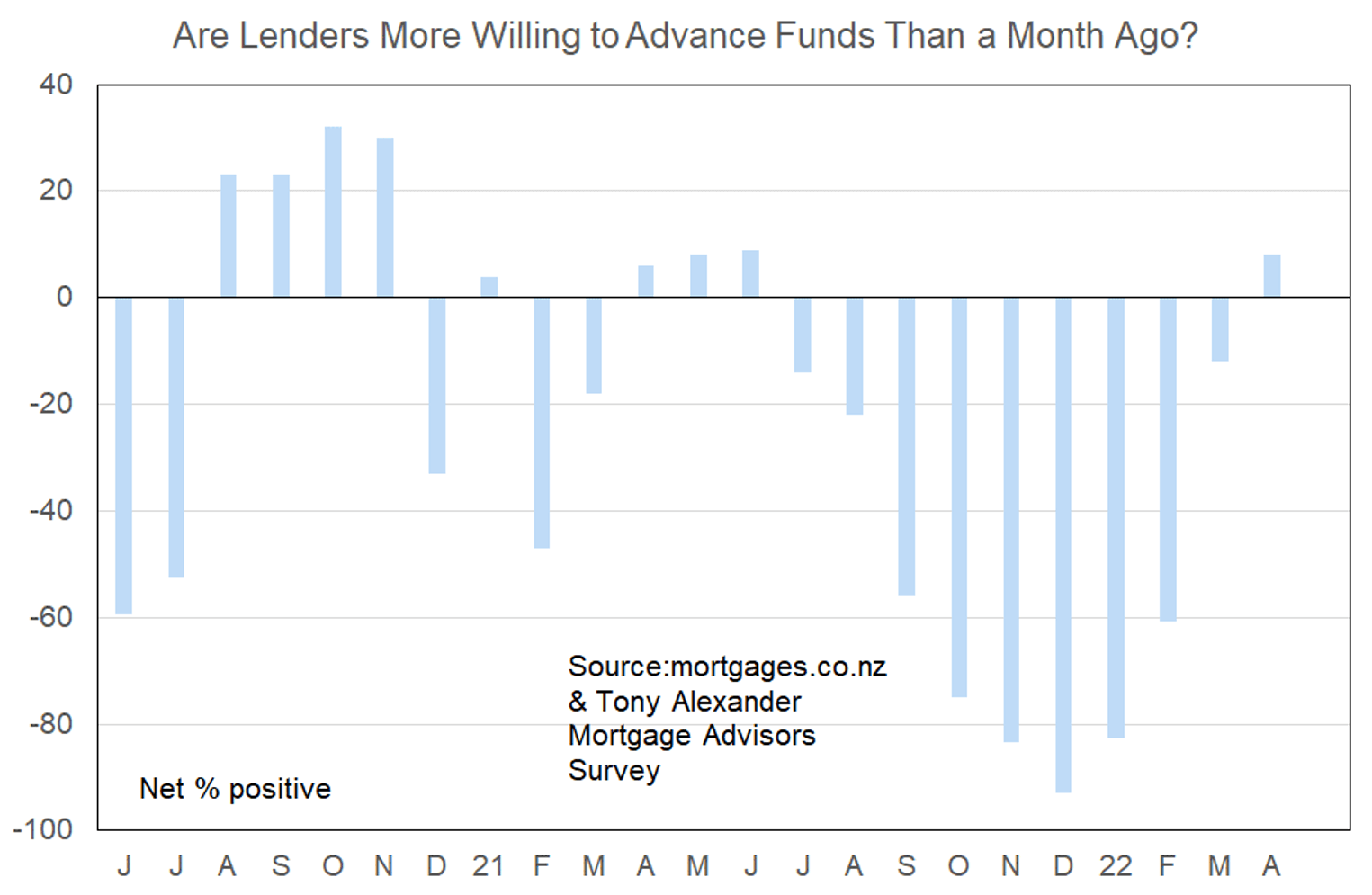

More or less lenders willing to advance funds?

For the first time since June last year there are more mortgage advisers reporting that banks have eased their lending criteria than those reporting a tightening.

This likely reflects the passage of time away from introduction of tougher LVR and CCCFA rules and banks coming to grips on how to more reasonably apply such rules.

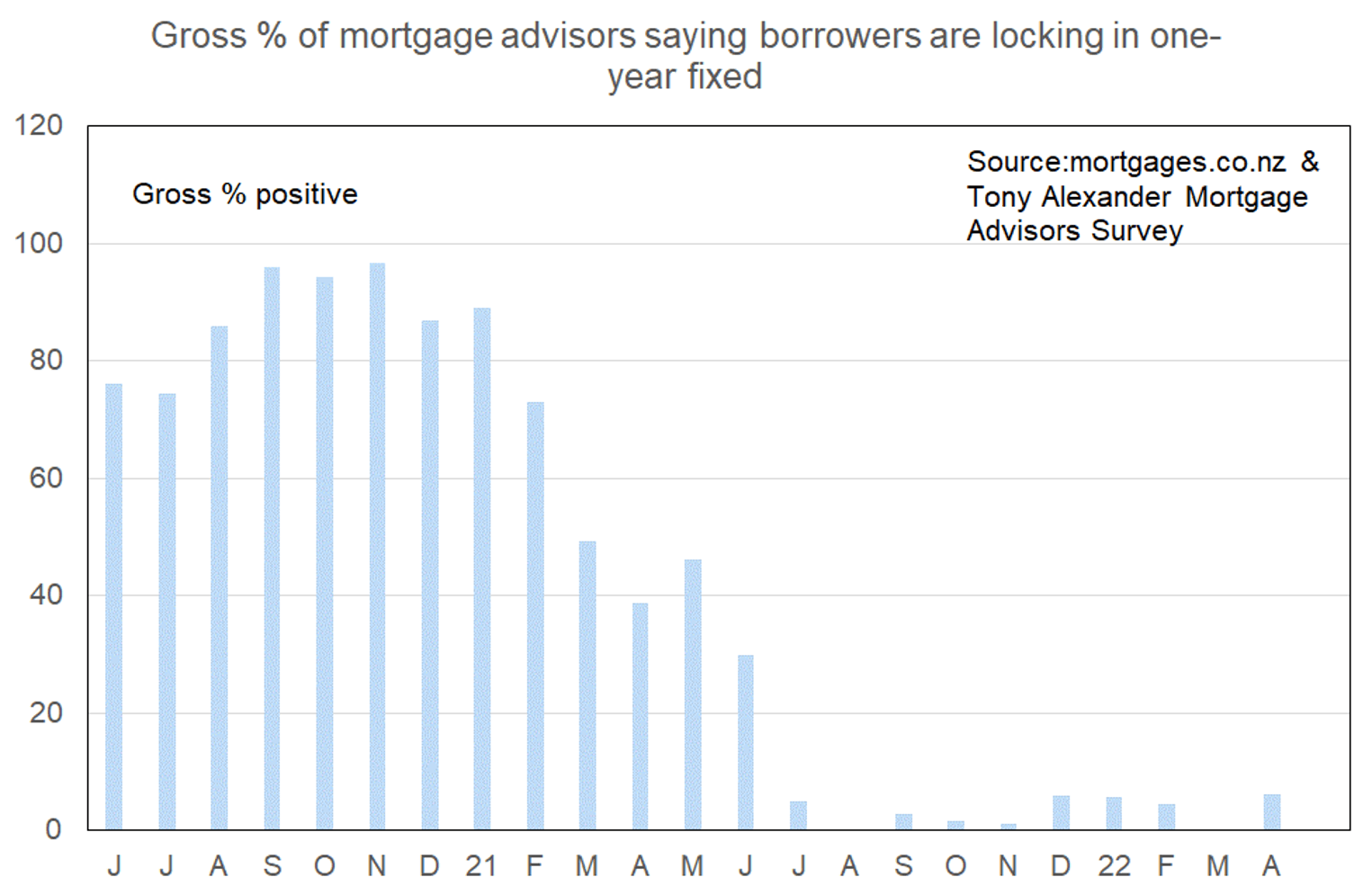

What time period are most people looking at fixing their interest rate?

Mortgage advisers report that the preference for fixing shown by borrowers is shifting more and more to the two year term.