Investors wait and see

Each month since June last year we have surveyed mortgage advisors throughout New Zealand asking them what they are seeing. The responses which these advisors can provide give us early insight into changes that are happening in buyer behaviour in particular, well before such changes show up in any of the official datasets.

We also gain unique insight into changes in bank lending practices which are not available from any other outlet.

This month we can see that while investors are still stepping back from the market as they await policy details, fewer are seen as doing so than last month. However, more first home buyers are exercising caution than last month.

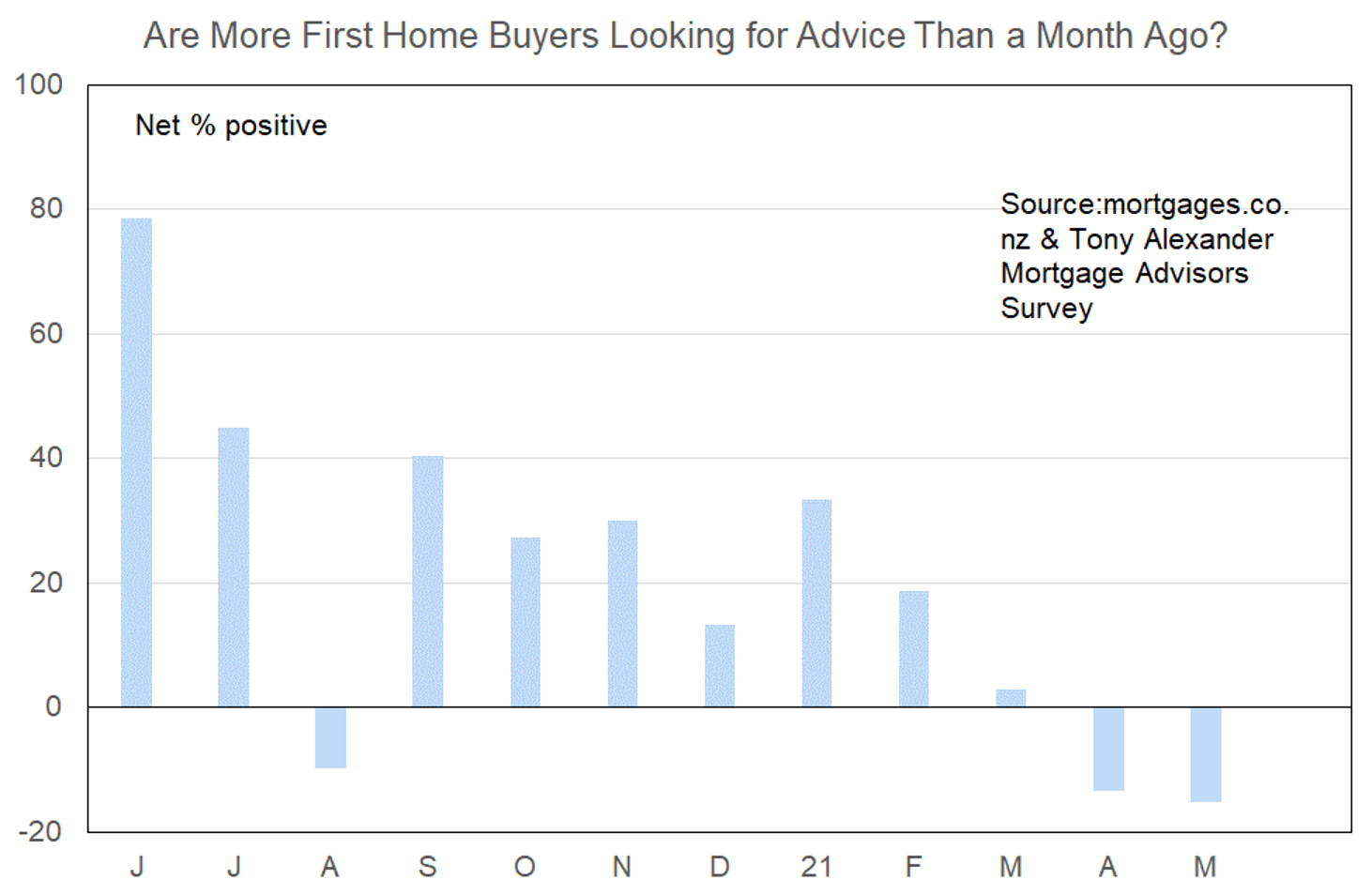

More or less first home buyers looking for mortgage advice

While the government’s intention on March 23 was to dissuade investors from buying existing houses and therefore provide reduced competition for first home buyers, young buyers have also been scared away for now.

A net 15% of mortgage advisors have reported that they are seeing fewer first home buyers. This is a slight increase from April’s result of a net 13% seeing fewer such buyers.

What’s interesting is that although we can probably attribute the decrease in first buyer interest to uncertainties created by the March 23 policy changes, along with restoration of loan to value ratio rules from March 1, a downward trend in their market participation has been in place since July last year.

As noted previously in our report, first home buyers were the first group to move forcefully into the real estate market once the nationwide lockdown ended in May last year. They had grown their deposits during the seven-week period, LVRs had been removed, mortgage rates had been cut to record lows, and there were hopes of increased listings and decreased competition.

But as our graph above shows, the early rush of buyers eased off fairly quickly, then growth in new property seekers ceased in March.

Given that the May 20 Budget contained no new measures which might boost home purchase ability for young people, improvement in their presence may not happen until at least the new rules are fully clarified.

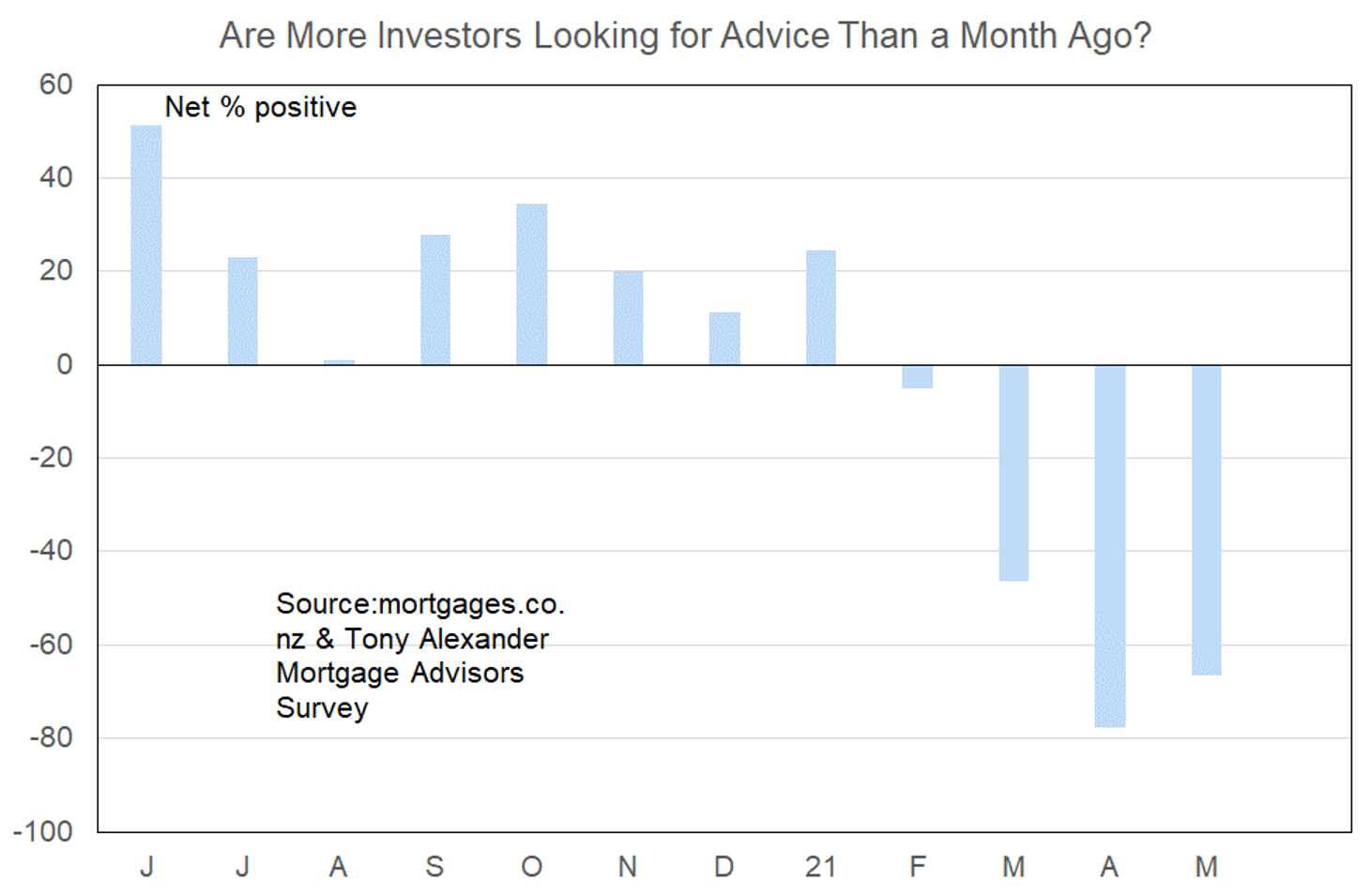

More or less investors looking for mortgage advice?

The government is achieving some success in its desire to discourage Kiwis from investing in residential property. A net 67% of our 66 respondents this month have reported that they are seeing a decrease in the number of investors looking for advice.

This is an improvement from a net 78% seeing fewer investors in our last survey in April. This by no means suggests that investors are returning to the market. But the speed with which they are pulling back has diminished to a small degree.

This does not allow one to conclude that the market is strengthening and that fresh price pressures are set to return. But it does hint that when rules are fully clarified surrounding new builds in particular, withdrawal of investors may peter out. We shall have to wait and see – and the comments submitted by mortgage advisors suggest waiting and seeing is exactly what many investors are doing for now.

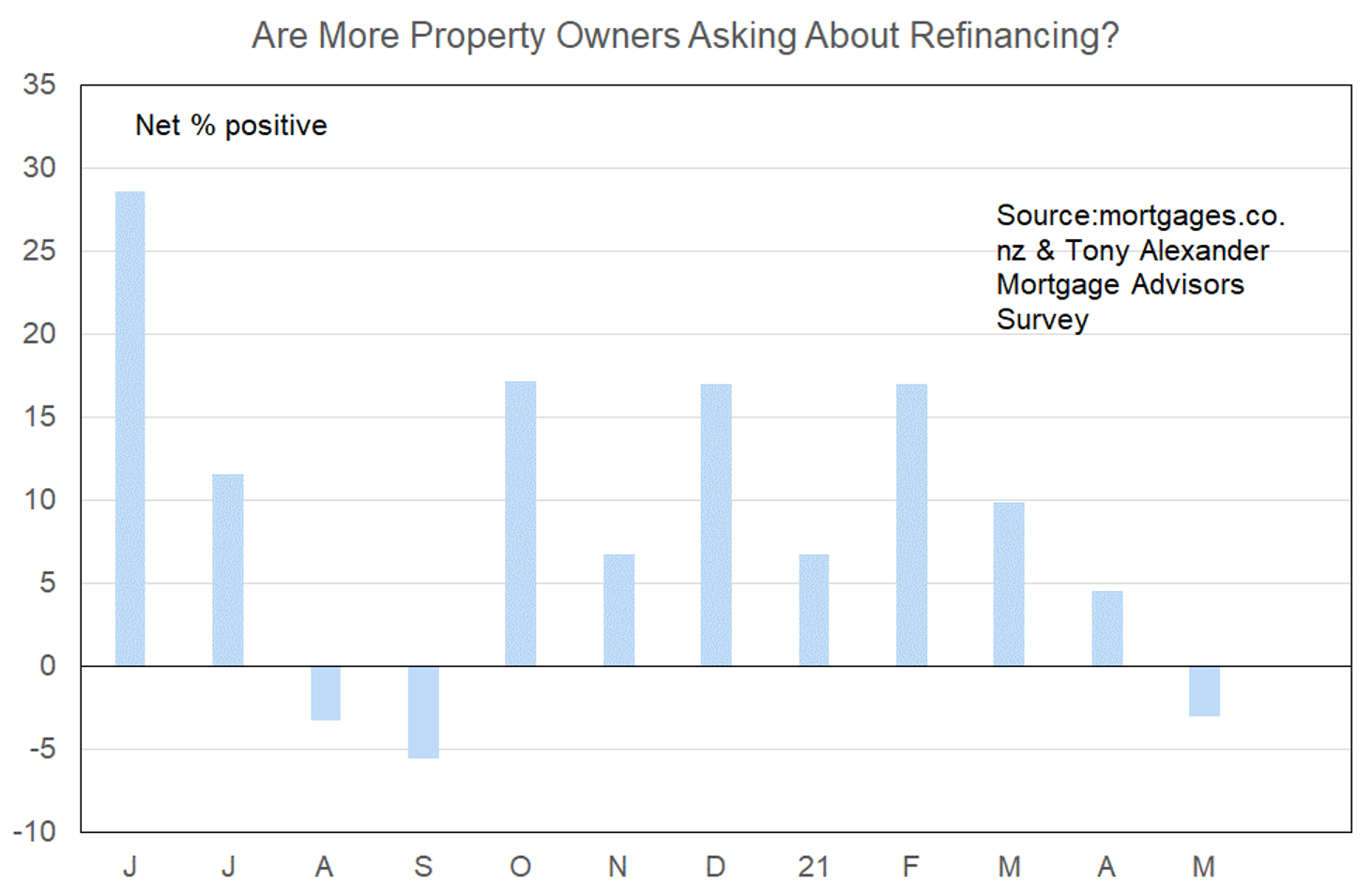

More or less property owners looking for refinancing?

A net 3% of mortgage advisors this month have reported that they are seeing fewer homeowners looking for advice on refinancing their debt.

The negative result for this measure is not unprecedented. However, the last time it happened – over the August to September period last year – Auckland had just experienced a fresh lockdown which dented confidence generally including for the housing market.

As a general rule we would associate a high level of refinancing enquiry with a strong residential real estate market. The decrease in enquiry now would suggest some reduction in the willingness of people to consider using home equity to finance general spending.

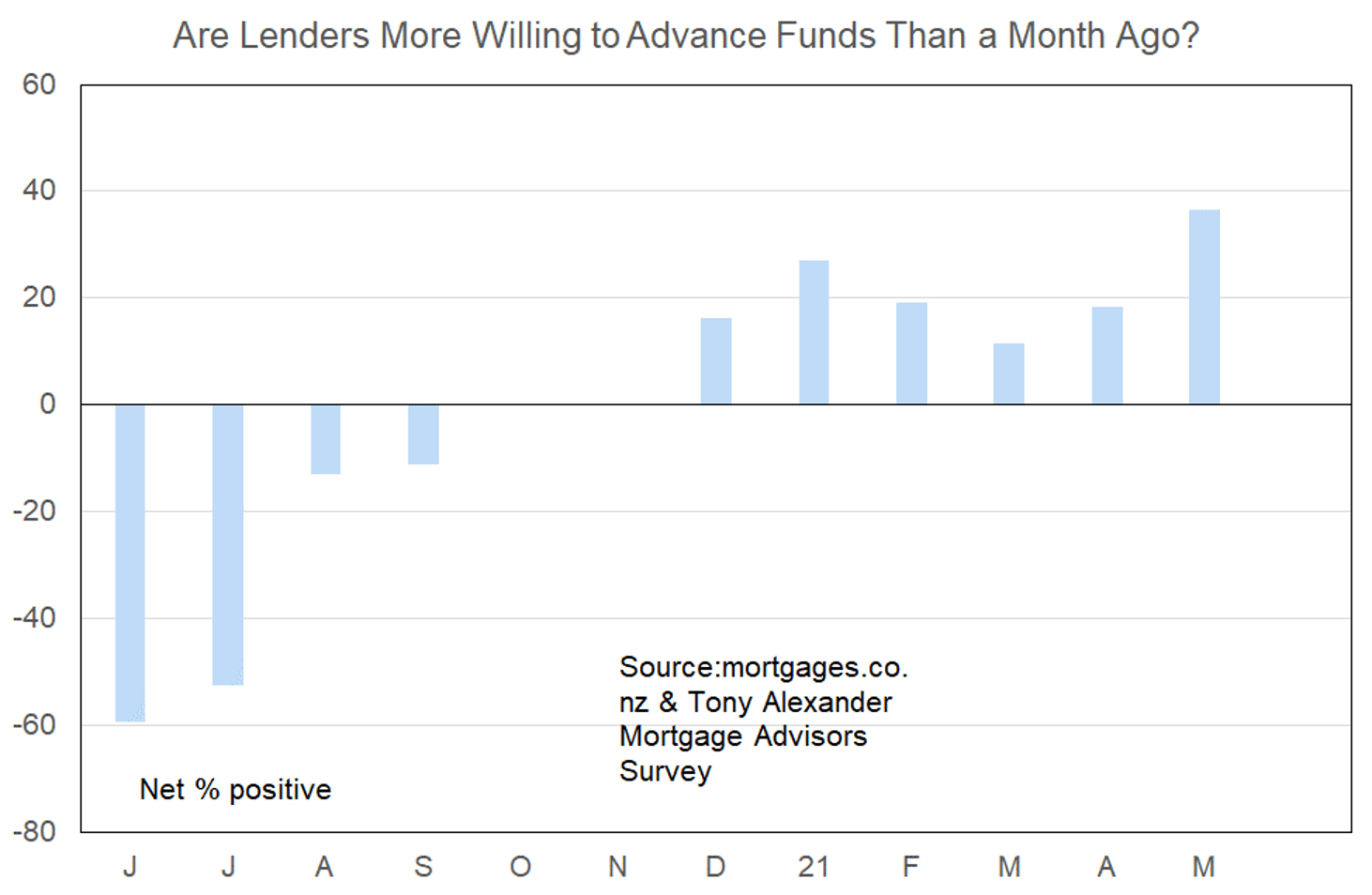

More or less lenders willing to advance funds?

There is anecdotal feedback both of banks tightening their lending criteria and loosening at the same time. One large lender for instance has decreased the proportion of an investor’s rental income which they will allow to be used for debt-servicing calculations.

Our survey shows that overall, mortgage advisors feel banks are becoming slowly more willing to advance funds for home purchase purposes. This may be an indication that much as various surveys are suggesting investors will sell properties, lenders are not of the opinion that a wave of price-depressing selling is imminent against which some bulwark in the form of tighter lending rules is required.

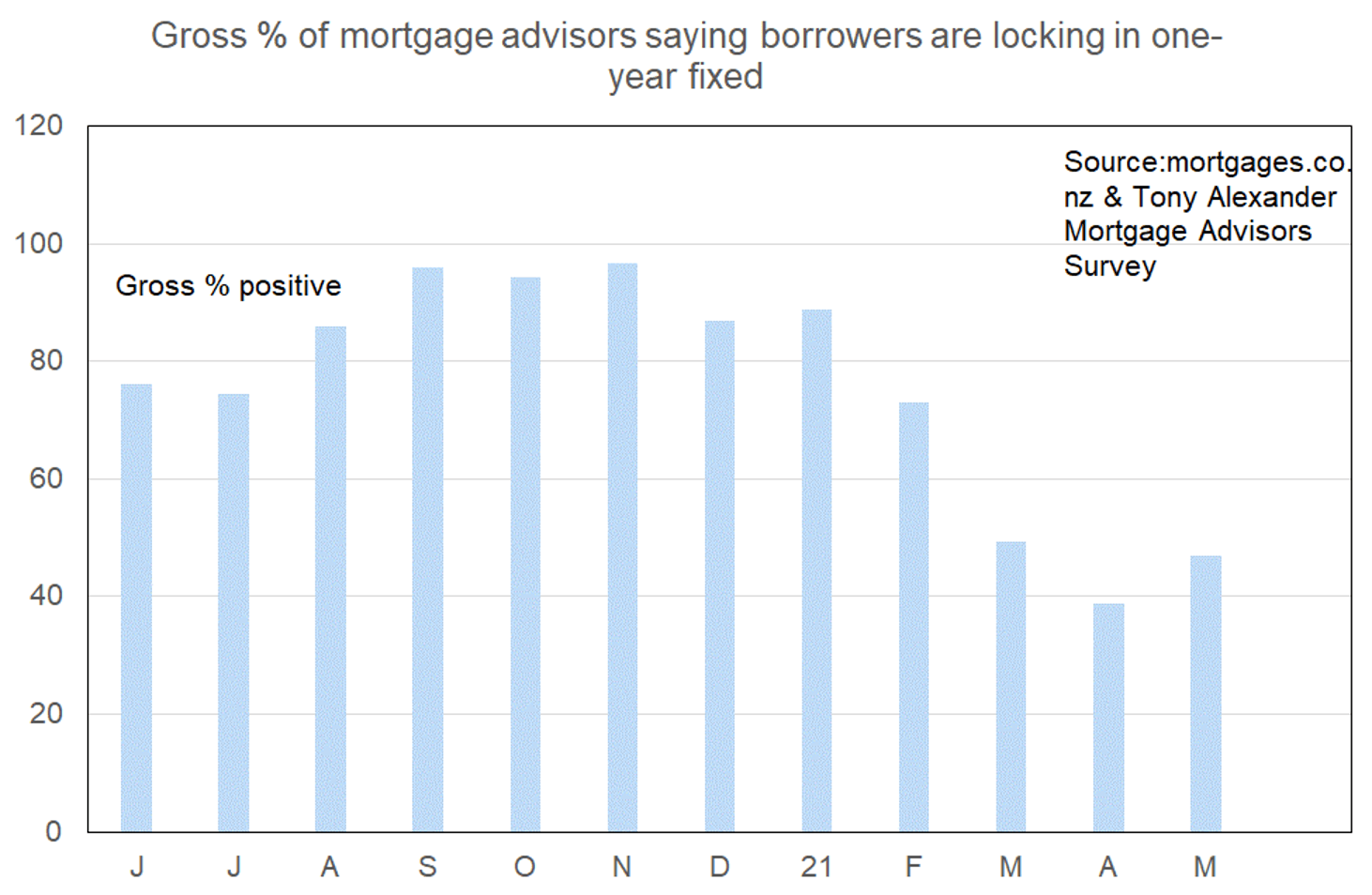

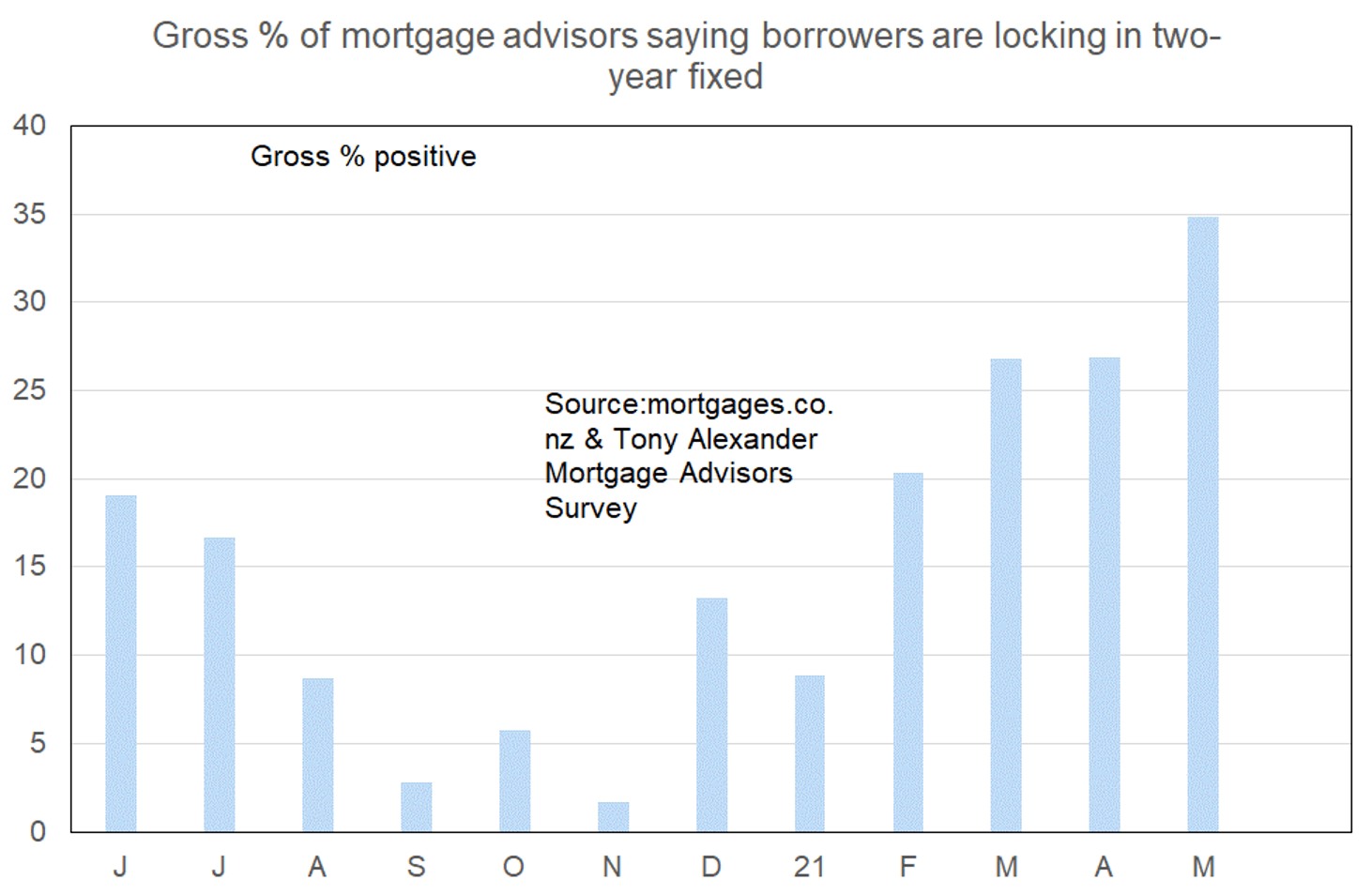

What time period are most people looking at fixing their interest rate?

Around the world the most intensely debated topic in financial markets currently is the extent to which rising inflation is temporary and whether central banks might be thinking about pulling back from their promises to keep interest rates at current levels through into 2024.

Both the United States Federal Reserve and Reserve Bank of Australia have recently stated their plans remain for low rates out to that time. The Bank of Canada has suggested late next year may present the conditions to warrant higher interest rates. But they are essentially on their own so far with that view.

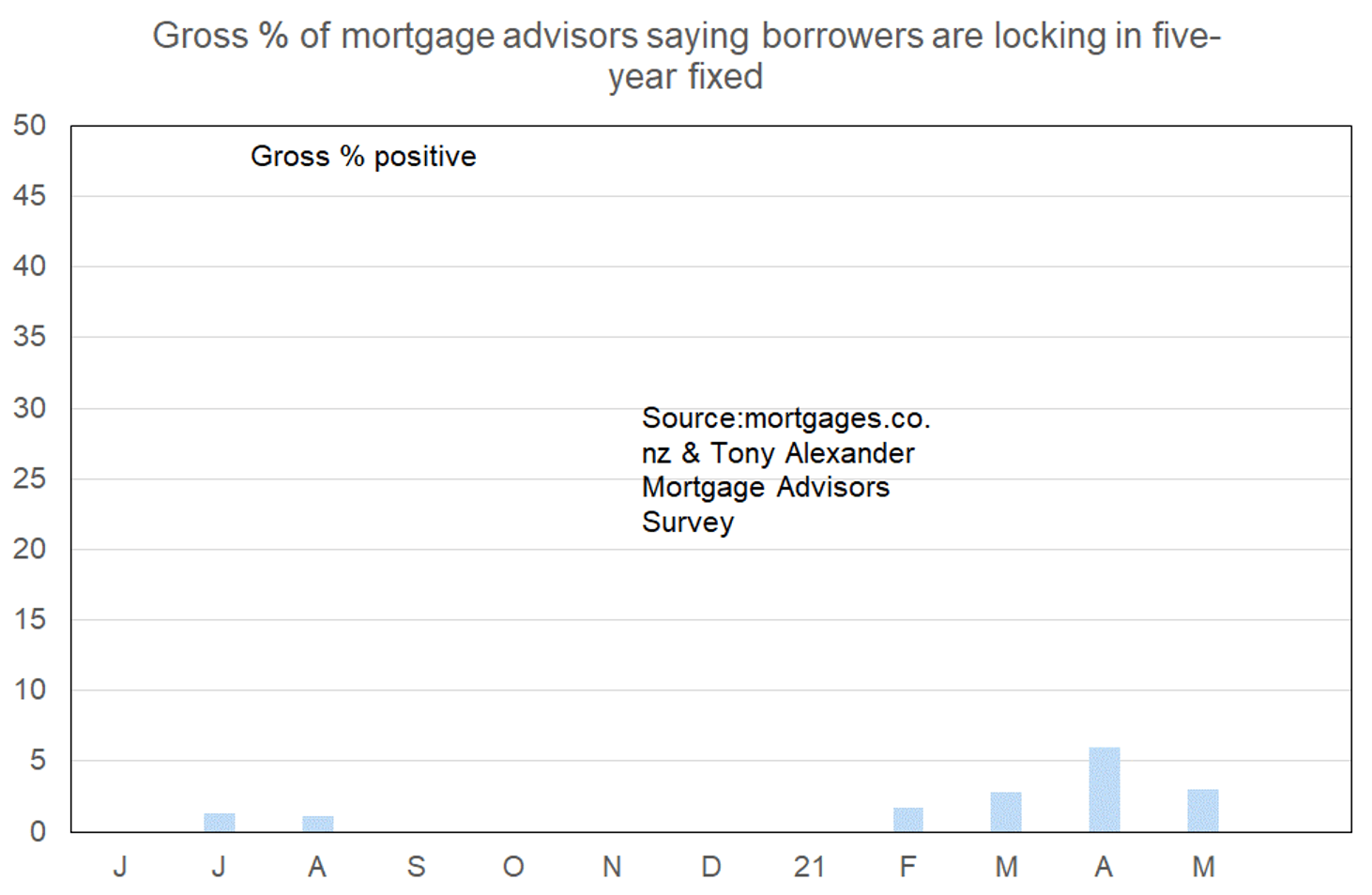

In the absence of any solid monetary policy predictions or moves upon which to base their commentaries, writers for now are struggling to paint a scary interest rates scenario here or offshore. That means the impetus felt by borrowers to shift away from short-term fixed rates to longer terms is still mild.

Nonetheless, our monthly survey of mortgage advisors has revealed that over the past few months there has been a rise in the proportion of borrowers showing a preference for the two-year term. That gross proportion now stands at 35% from 27% in April and March and just 9% at the start of the year.

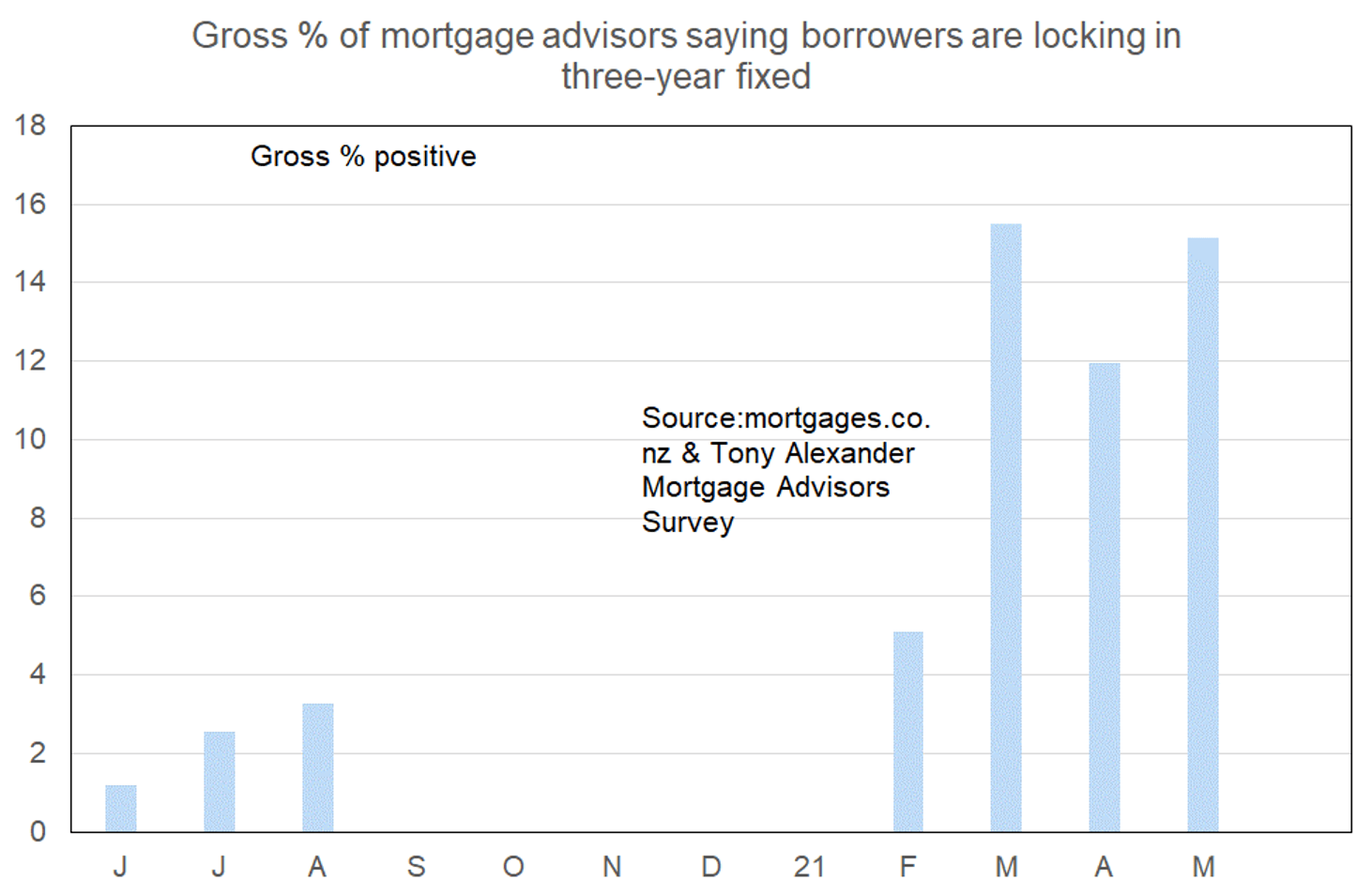

There has also been a slight rise in preference for the three-year term.