Buyers backing off.

Each month since June last year we have surveyed a number of mortgage advisors throughout New Zealand asking them what they are seeing. The insights which these advisors can provide give us early insight into changes that are happening in buyer behaviour in particular, well before such changes show up in any of the official datasets.

We also gain unique insight into changes in bank lending practices which are not available from any other outlet.

This month we can see in the results which 71 mortgage advisors have provided, that both investors and first home buyers have become more cautious in their approach to the housing market around the country.

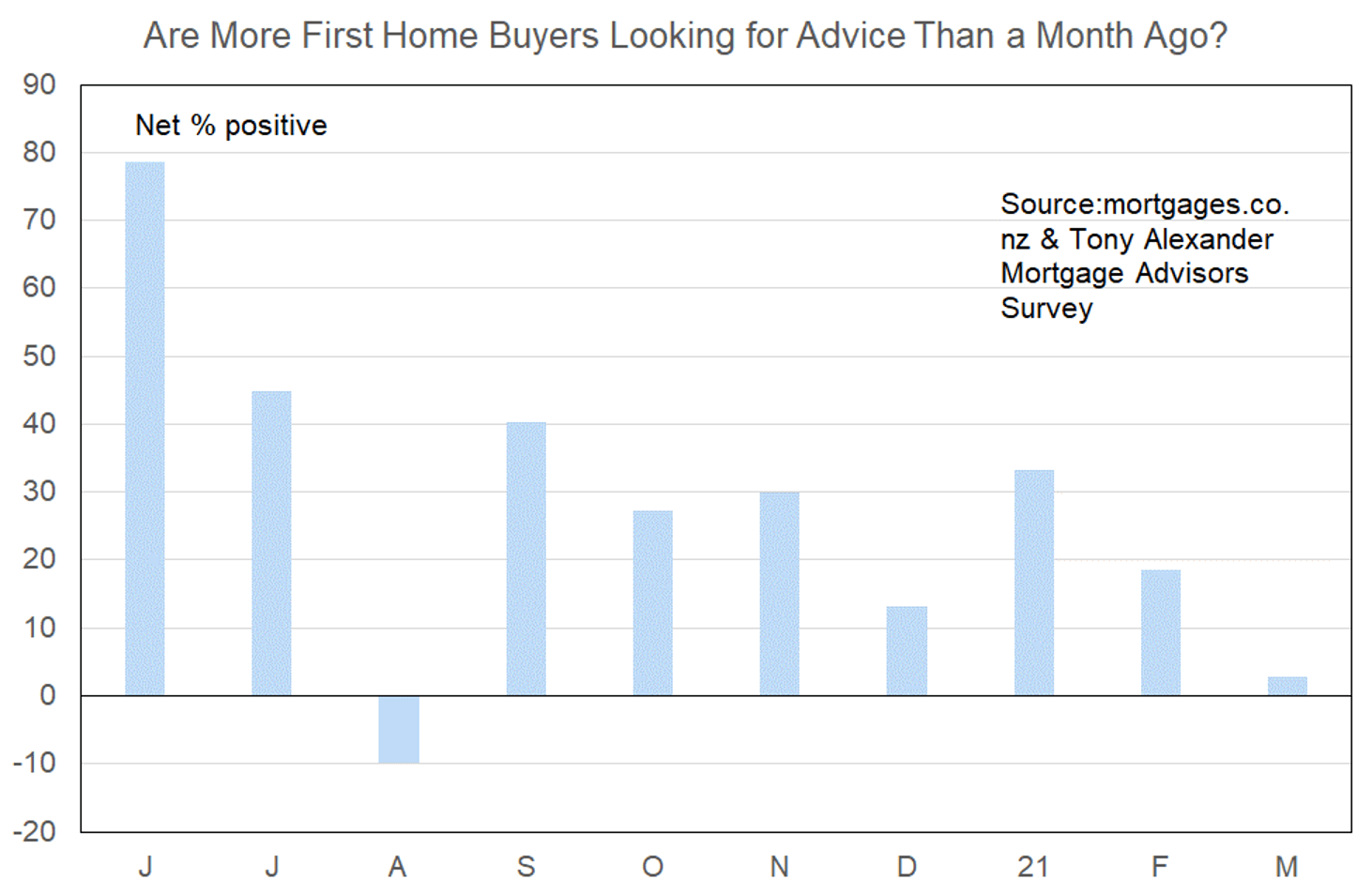

First home buyers less present

Back in January a net 33% of advisors said that they were seeing more first home buyers looking for advice. This fell to a net 19% in February. In March, with all results coming in after Tuesday’s housing announcements, a net 3% of advisors said they are seeing more first home buyers.

This is the lowest result since June barring the -10% in August when Auckland went into its first solo lockdown.

While a month ago we concluded from the data that it did not definitely allow a conclusion that first home buyers were backing off slightly, based on this latest result we can say that.

However, comments submitted by advisors indicate that a high degree of FOMO and angst still exists amongst young buyers as they seek to use finance pre-approvals to purchase something whilst watching prices move away from them.

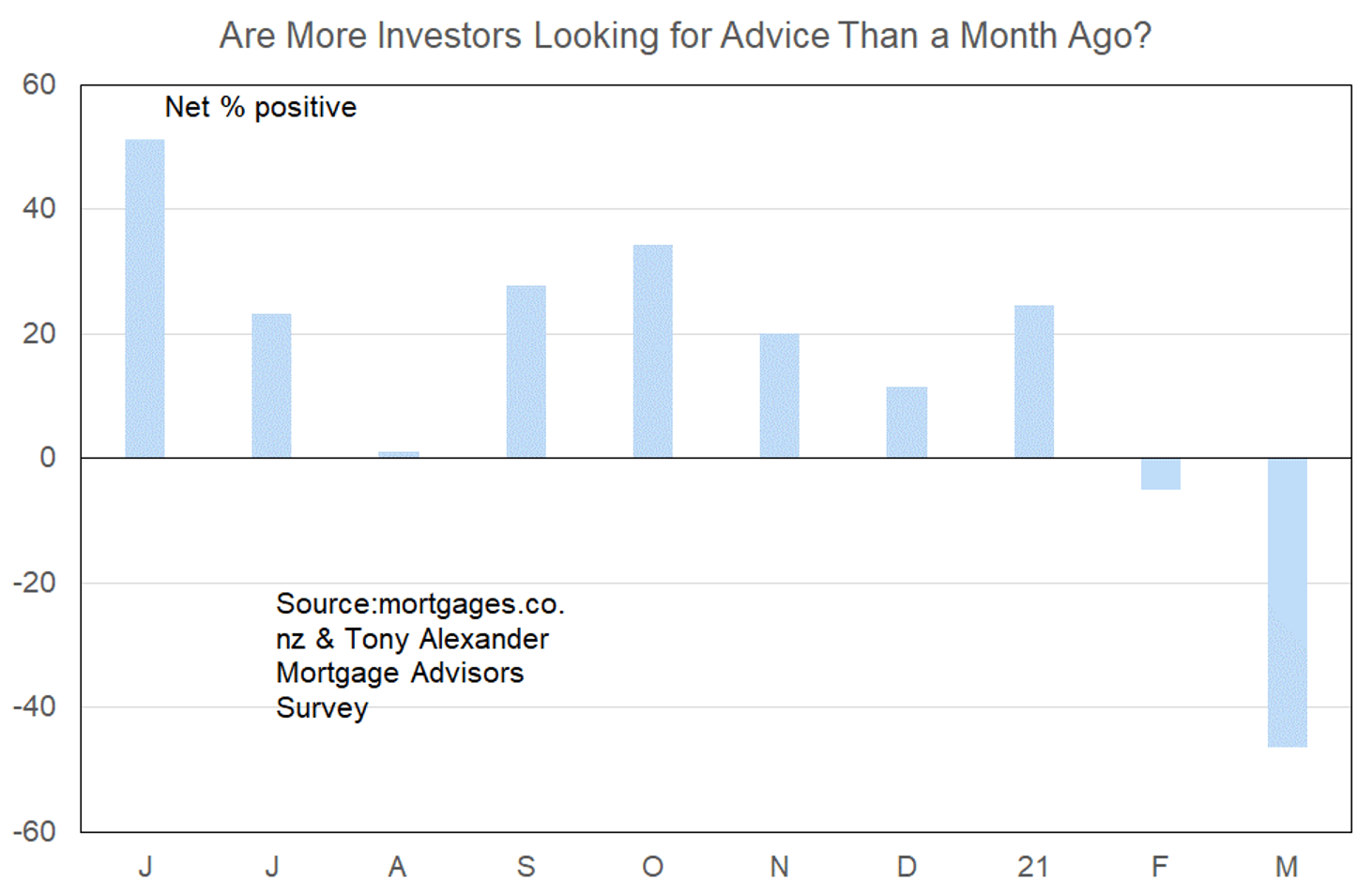

Investors start calling time out

Whereas mortgage advisors at a pinch continue to report a small rise in the number of first home buyers looking for advice, this is not the case for investors.

A net 46% have reported that they are fielding fewer enquiries from property investors. This is the second month in a row of shrinkage following February’s net 5% saying they are seeing fewer investors.

Had the Finance Minister had this result and a few others like it in hand perhaps from our other surveys, he may have been less inclined to take last week’s step of removing tax deductions from rental property revenue. Then again, maybe not given the strong desire to enact a shift in the market towards owner occupiers and away from investors.

All of the results in this month’s survey were received after the announcement of Tuesday 23. But the strong number of responses on that day when advisors would have had only limited interaction with clients suggests that were we to run the survey again from this week, the outcome for investors would likely be more negative than shown.

Why would investors have been easing off in their demand ahead of the policy news? Some of their withdrawal would reflect a simple response to prices being at a high level. But a substantial factor is likely to have been the February 11 announcement regarding 40% minimum deposits for investors. Some of those who did not already have finance arranged are likely to have pulled out of the market for want of the necessary dollar amount as a deposit.

Those with pre-arranged finance would in many cases have been scrambling to secure a property to buy and settle on ahead of the May 1 deposit requirement coming into play for all investors. It is not entirely clear at this stage whether the group of investors who have scrambled to buy and potentially paid top dollar to secure a property will lose their tax deducibility straight away or be classified as existing owners from March 29.

There is a risk of non-settlement of some purchases.

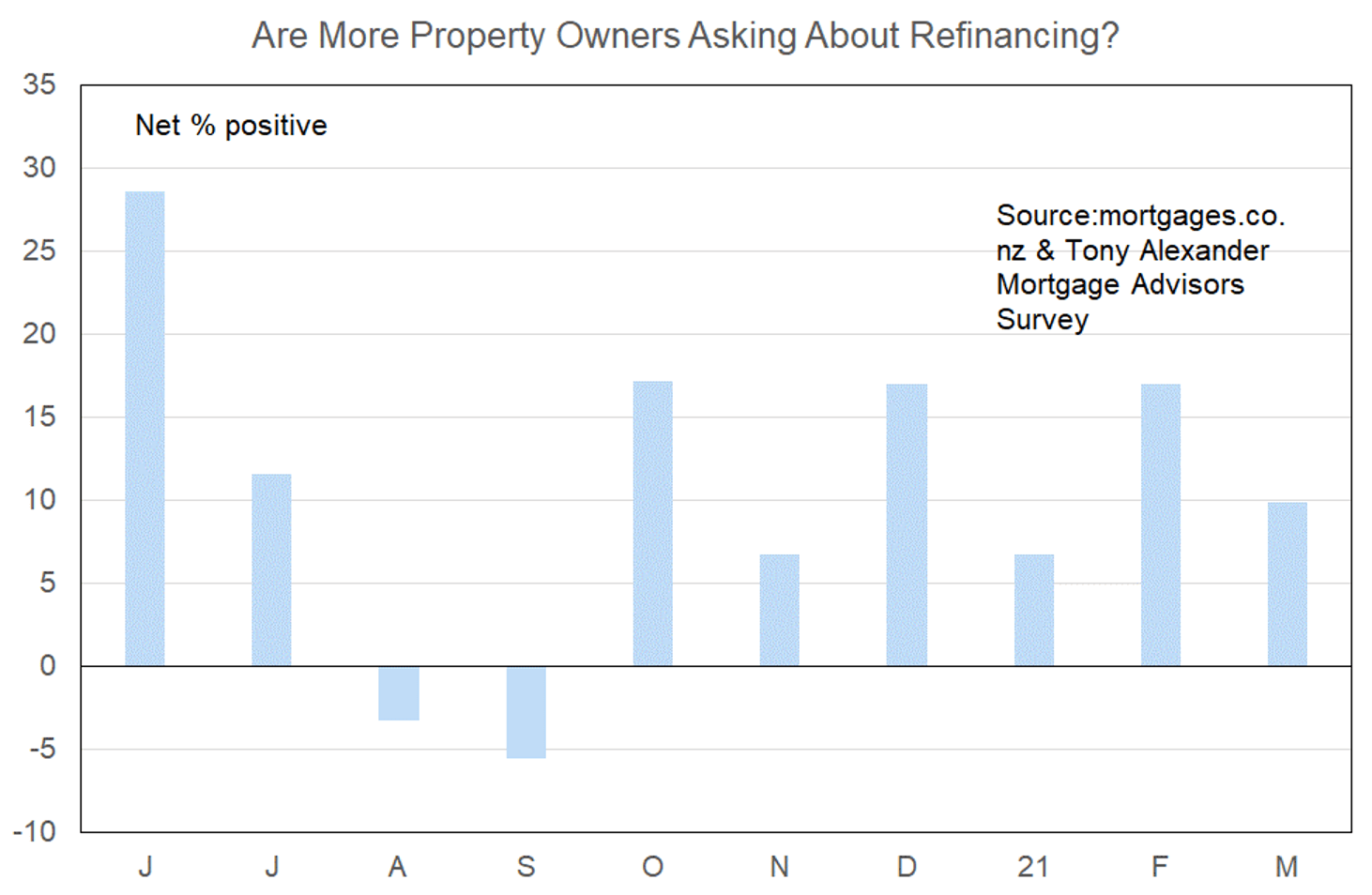

Refinancing trendless

Each month we also ask mortgage advisors if they are seeing more people seeking to refinance their existing mortgage. This may happen because people wish to use some of their equity (borrow more money) to fund a purchase. Or they may be seeking to alter the term at which their mortgage interest rate is set.

This month a net 10% of advisors have said that they are seeing more requests for refinancing information. This is down from a net 17% seeing more such refinancing requests in February.

But as has been the case since our survey started, there is no trend as yet apparent in this measure.

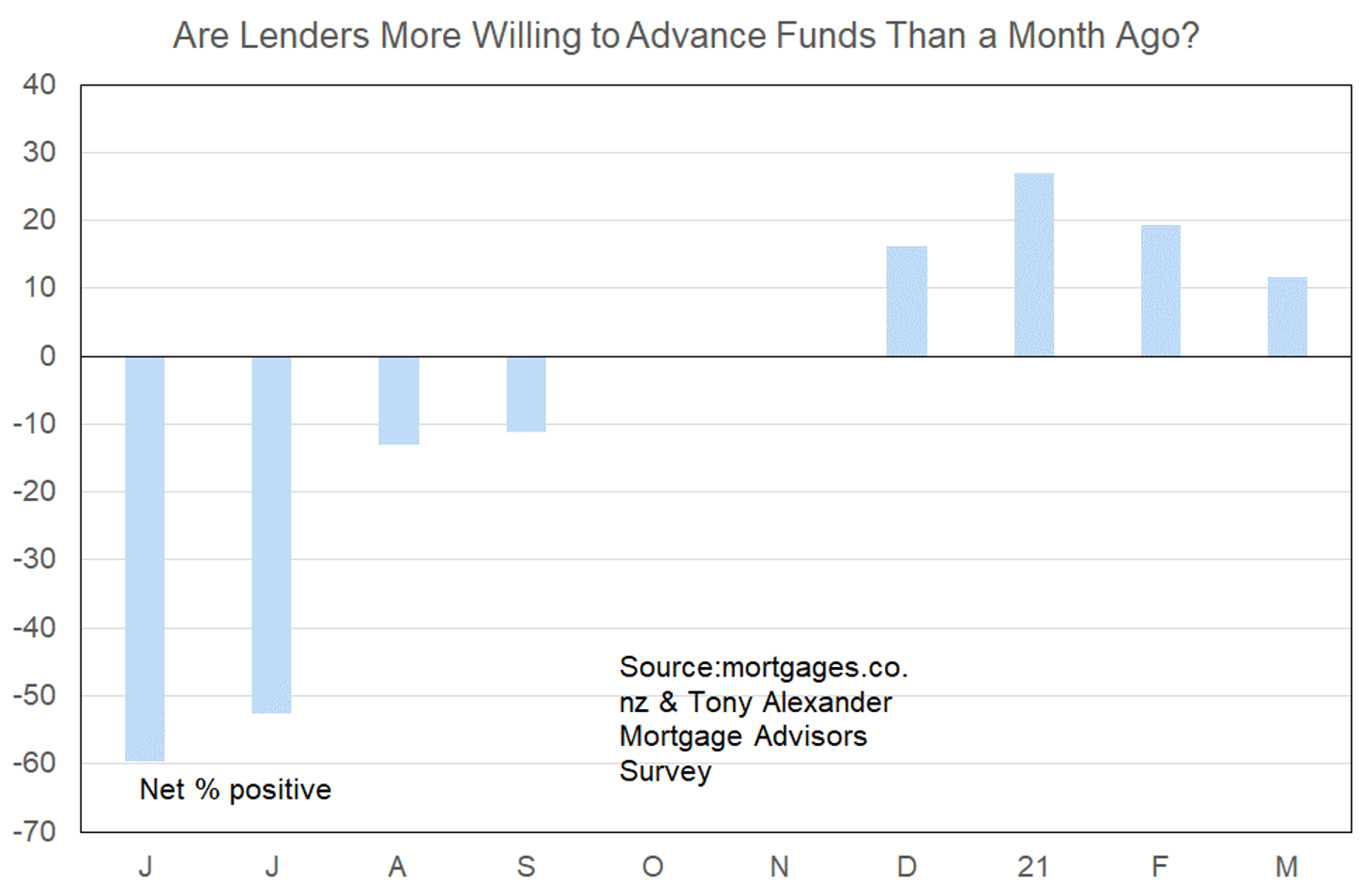

Banks more willing to lend

Given that investing in residential property has now been revealed as a riskier path than previously thought (heightened risk of unpredictable changes in regulations), it is likely that banks will tighten up their lending criteria for investors in coming months.

Our survey’s timing has probably precluded the capture of such changes as yet, but it will be interesting to see the results for this question next month.

Borrowers fixing longer

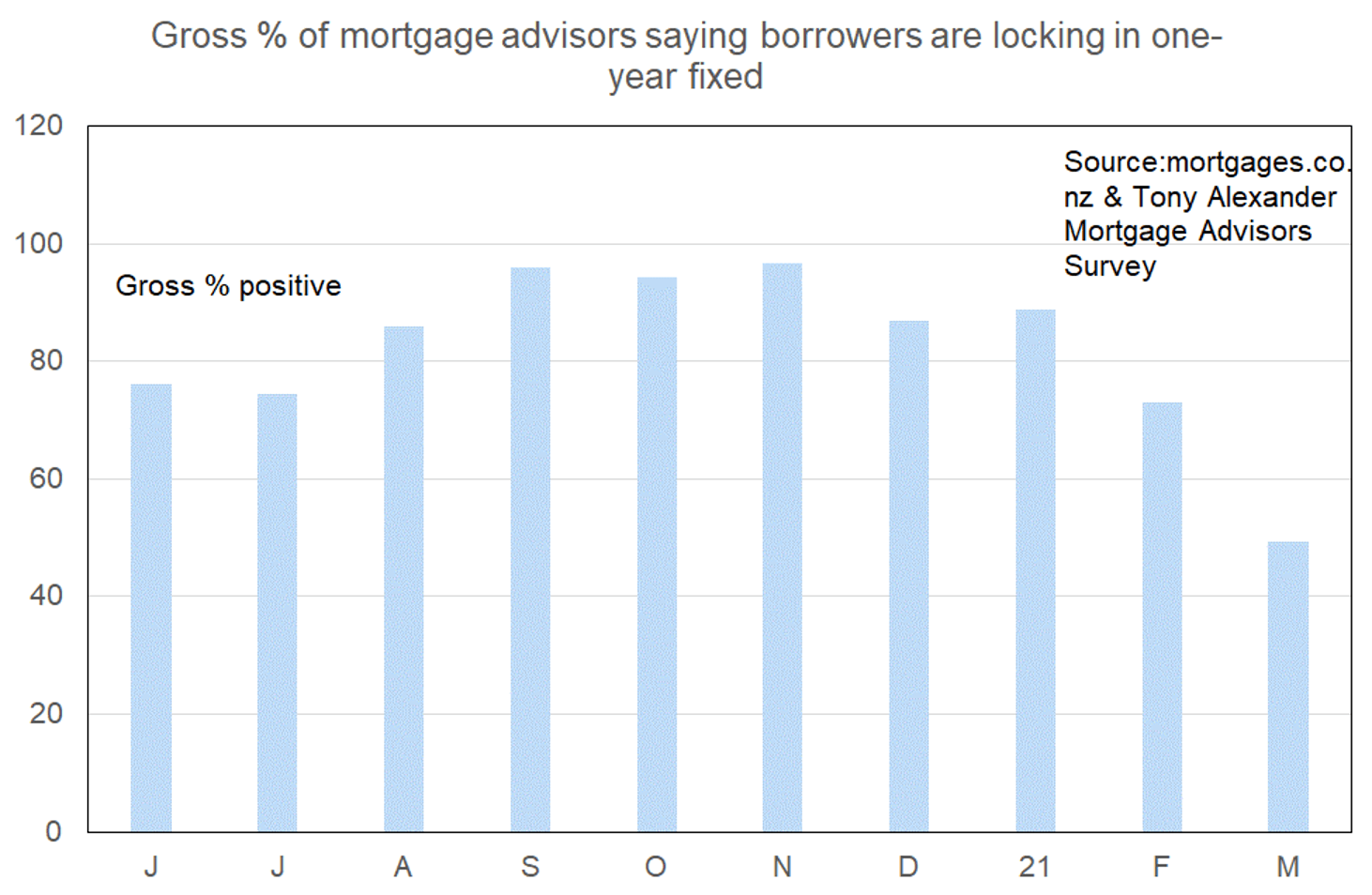

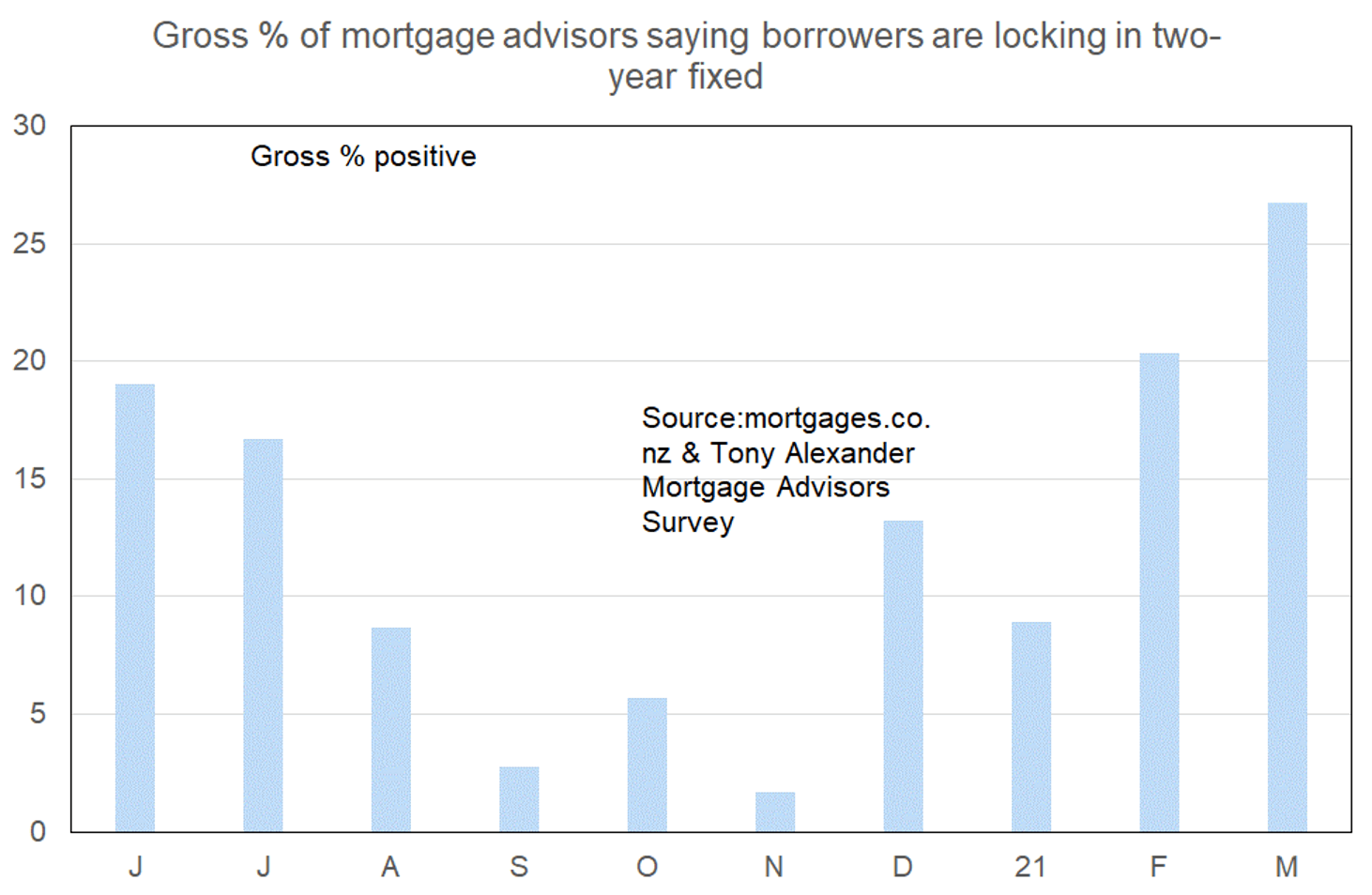

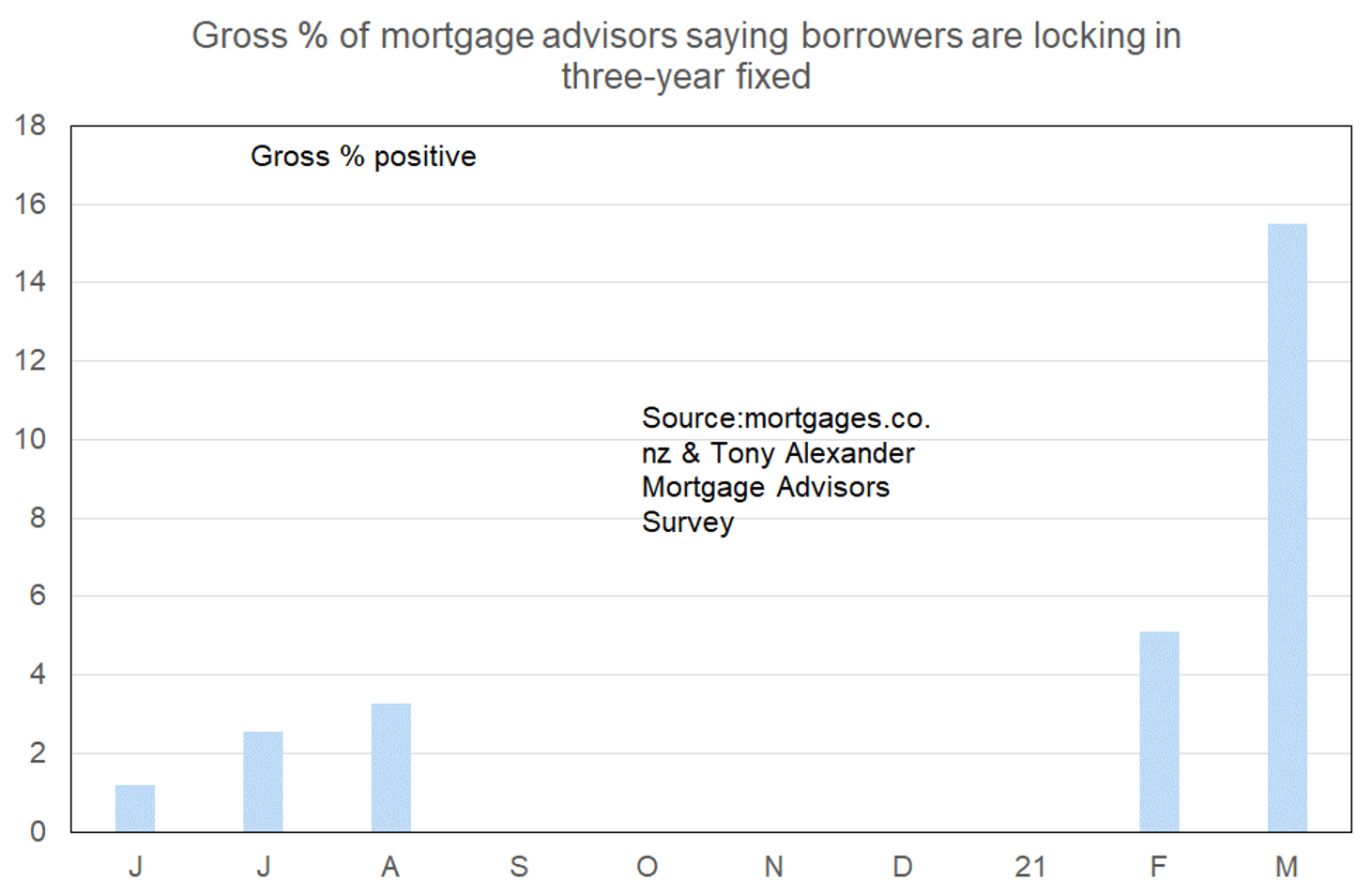

We also ask mortgage advisors the time period over which borrowers are preferring to fix their loans. Last month there was a small movement away from the one-year term which has been very popular since our survey started. This month there has been a far more substantial shift.

The gross percent of advisors reporting that their clients prefer the one-year term has fallen to 49% from 73% in February and 89% in January.

Only 3% say their clients are preferring the five-year term.

Why have these term preferences shifted? Most likely because of

- the increasing discussion regarding rising global inflation,

- increases in bank medium to long-term funding costs bringing expectations of higher fixed mortgage rates, and

- rising concerns that the Reserve Bank might tighten monetary policy earlier than previously thought.

Ironically, at exactly the same time as these expectations have developed and term preferences have shifted, wholesale bank funding costs have in fact fallen slightly. This easing of their costs reflects expectations that house prices will not rise as previously expected because of the changes announced on March 23.

Reduced house price inflation can mean less consumer spending from paper wealth. However, given that the bulk of house price gains have only occurred since September, it is not likely that many people have in fact splurged on the basis of their perceived higher property valuation.

In addition, house prices are not measured in the Consumer Price Index, but rents are along with building materials.

To the extent that higher house construction is incentivised by the tax and brightline changes, it is likely that the pace of increase in building materials costs may accelerate (especially following this week’s revelation of some timber shortages).

Therefore, while the coming month may bring an easing of the recent shift towards longer terms for fixing one’s mortgage, the change could be temporary, especially in light of the increasing discussion offshore regarding global inflation.