Caution continues

Each month since June last year we have surveyed mortgage advisors throughout New Zealand asking them what they are seeing. The responses which these advisors can provide give us early insight into changes that are happening in buyer behaviour in particular, well before such changes show up in any of the official datasets.

We also gain unique insight into changes in bank lending practices which are not available from any other outlet.

This month advisors have again noted that they are seeing fewer first home buyers and property investors. But the intensity of the easing off in demand has reduced slightly for both groups, whilst the increasing discussion about interest rate changes may account for a lift in enquiries about refinancing.

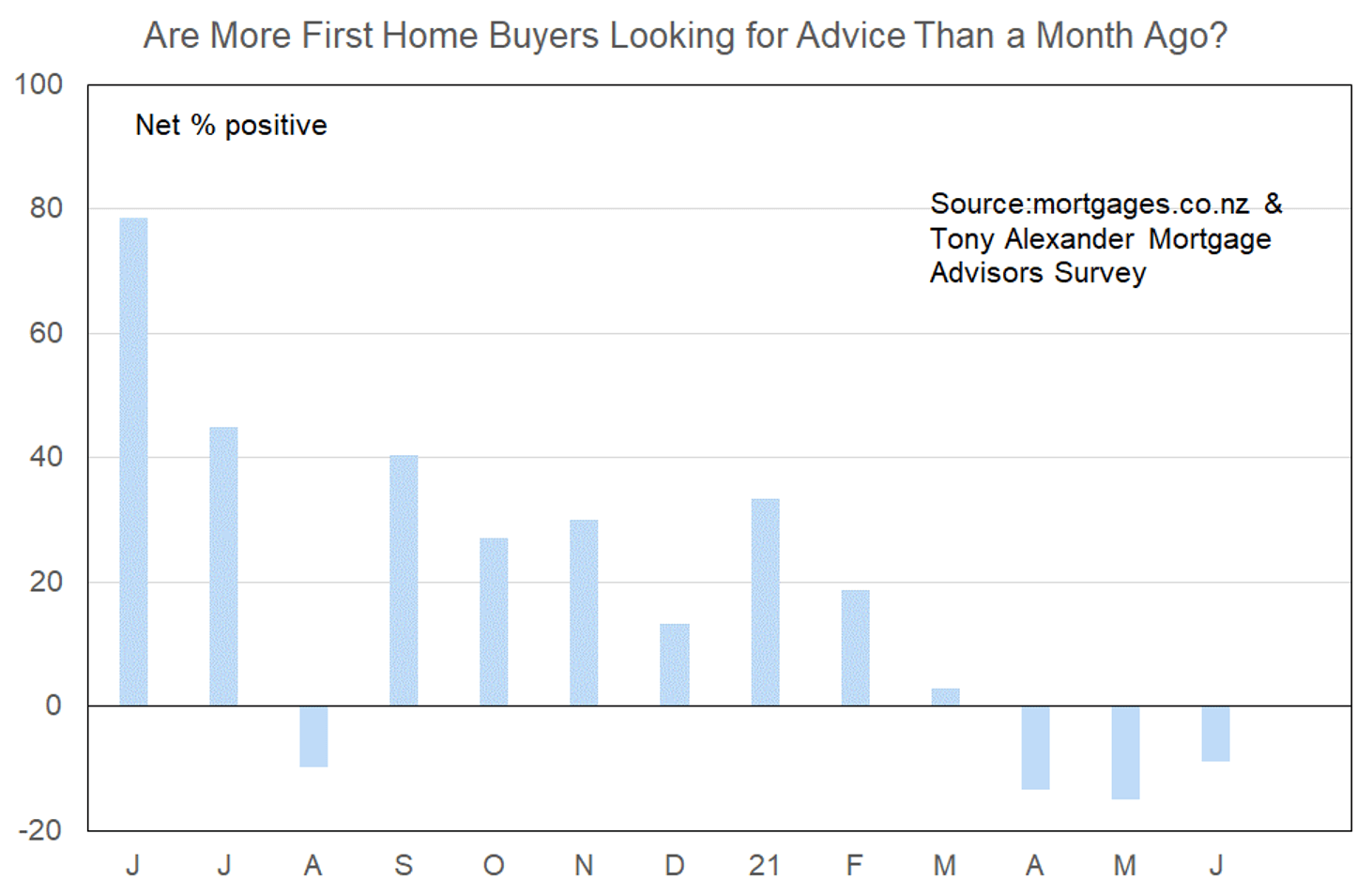

More or less first home buyers looking for mortgage advice

For the third month in a row, and following the March 23 tax policy announcement, our survey has revealed a decrease in the number of first home buyers being seen by mortgage advisors.

A net 9% of our 57 respondents have said that they are receiving fewer requests for information from people buying a property for the first time. This is an improvement from a net 15% last month and 13% in April. But as the following graph shows, conditions remain weaker than at any time during 2020 except August.

Taken in conjunction with the results for investors and feedback in other surveys, it is clear that people contemplating the biggest financial decision so far in their lives are feeling uneasy. However, data from CoreLogic tell us that in April there was a rise in the proportion of property sales going to first home buyers to 23% from 21% in March and 22% in February.

This change, in spite of first home buyer caution, arises because of the greater pullback in market presence of investors, discussed below.

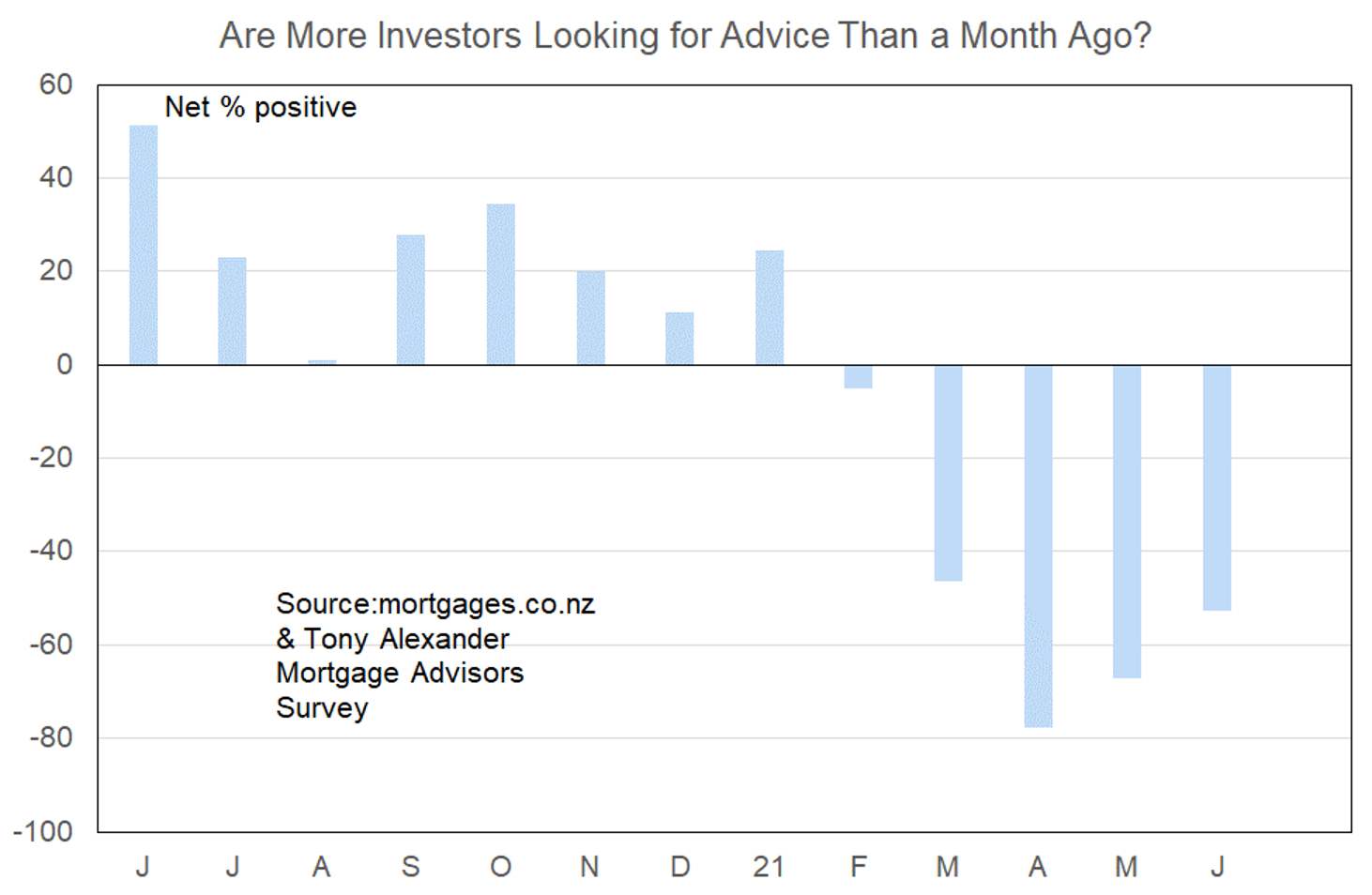

More or less investors looking for mortgage advice?

A net 53% of our respondents in this month’s survey have reported a decrease in the number of investors coming forward for mortgage advice. This represents the second month in a row when this measure has improved. But at -53% it clearly signals substantial wariness on the part of investors, and the change from a peak period of weakness in April of a net 78% pulling back is not all that large.

The government has clarified the rules regarding new builds and things are in line with the broad outline announced on March 23 regarding loss of ability to deduct interest expenses and extension of the brightline test – both for investments in existing houses. Better understanding of the tax changes may see some further easing off in the intensity of investor withdrawal from the market. But discussion about rising interest rates is growing and the Reserve Bank is to be given the ability to use debt to income (DTI) lending restrictions in future years. This implies a structural easing off of investor demand.

Experience tells us that when changes are made to markets of a long-term nature, such as the tax changes, the initial reaction of affected parties can easily exceed the long-term impact. That is probably the case for residential property investors currently, and feedback from various sources indicates that some of the easing off in their property demand is mainly because many are for the moment concentrating on selling some less desired properties to reduce debt.

Eventually a new equilibrium will be reached and we should be able to track its development using this particular measure.

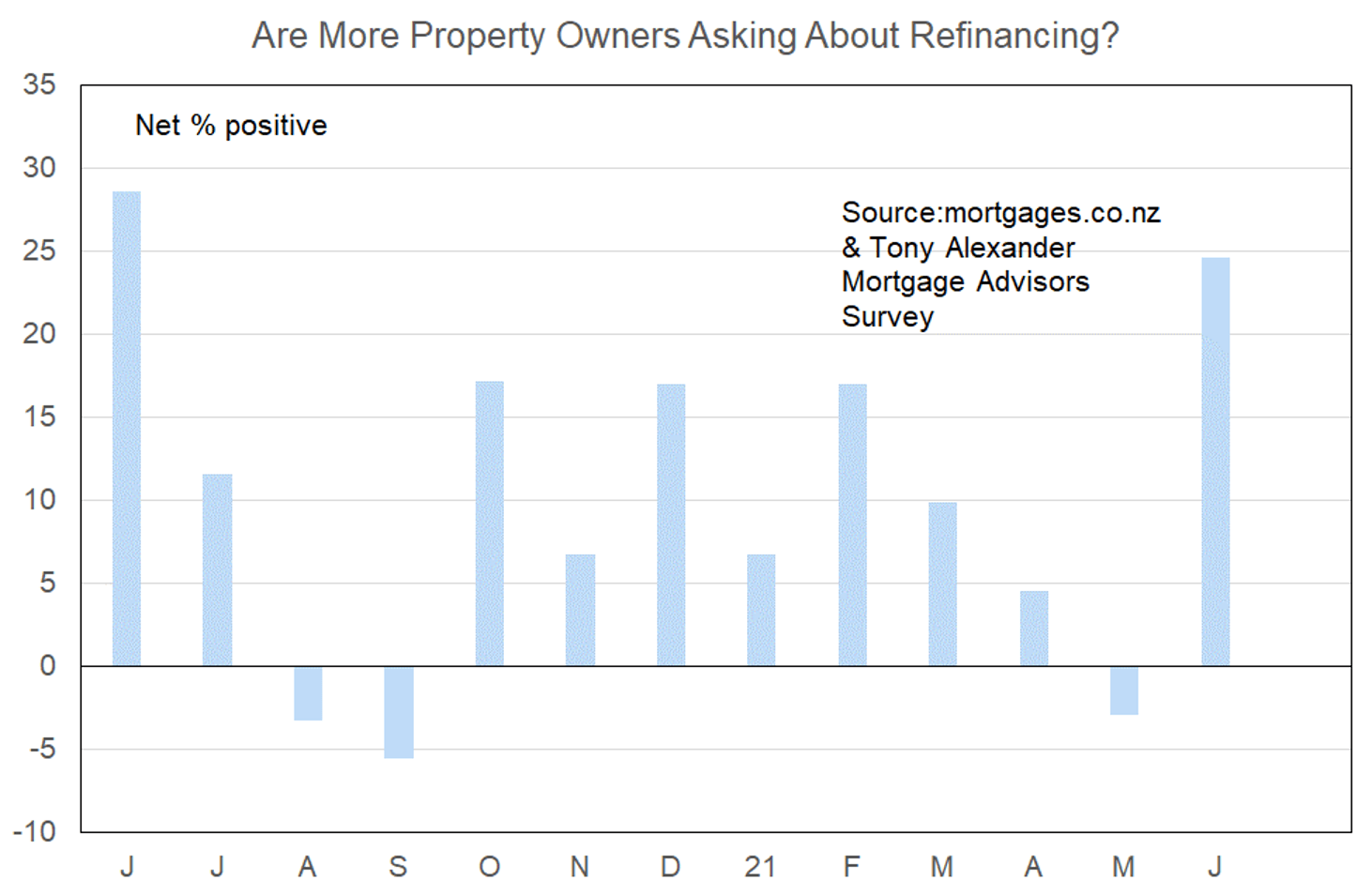

More or less property owners looking for refinancing?

There has been a sizeable jump this month in the net proportion of mortgage advisors reporting that they are receiving more enquiries about refinancing – to a net 25% from -3% last month.

There are likely to be three factors behind this surge in such enquiry. First, there has been a sharp rise in general discussion about accelerating inflation and rising interest and mortgage rates and it is natural to expect debtors to seek information on how to protect themselves against potential rate increases.

Second, as a result of the housing tax changes many investors are indicating they plan slimming down their portfolios to reduce debt. Some are shifting debt onto other assets where deductibility of interest expenses will continue.

Third, the economy is performing very strongly and the accompanying rise in consumer confidence seen in various surveys is likely to be encouraging people to think about using some of their accrued housing (paper) wealth to finance extra spending.

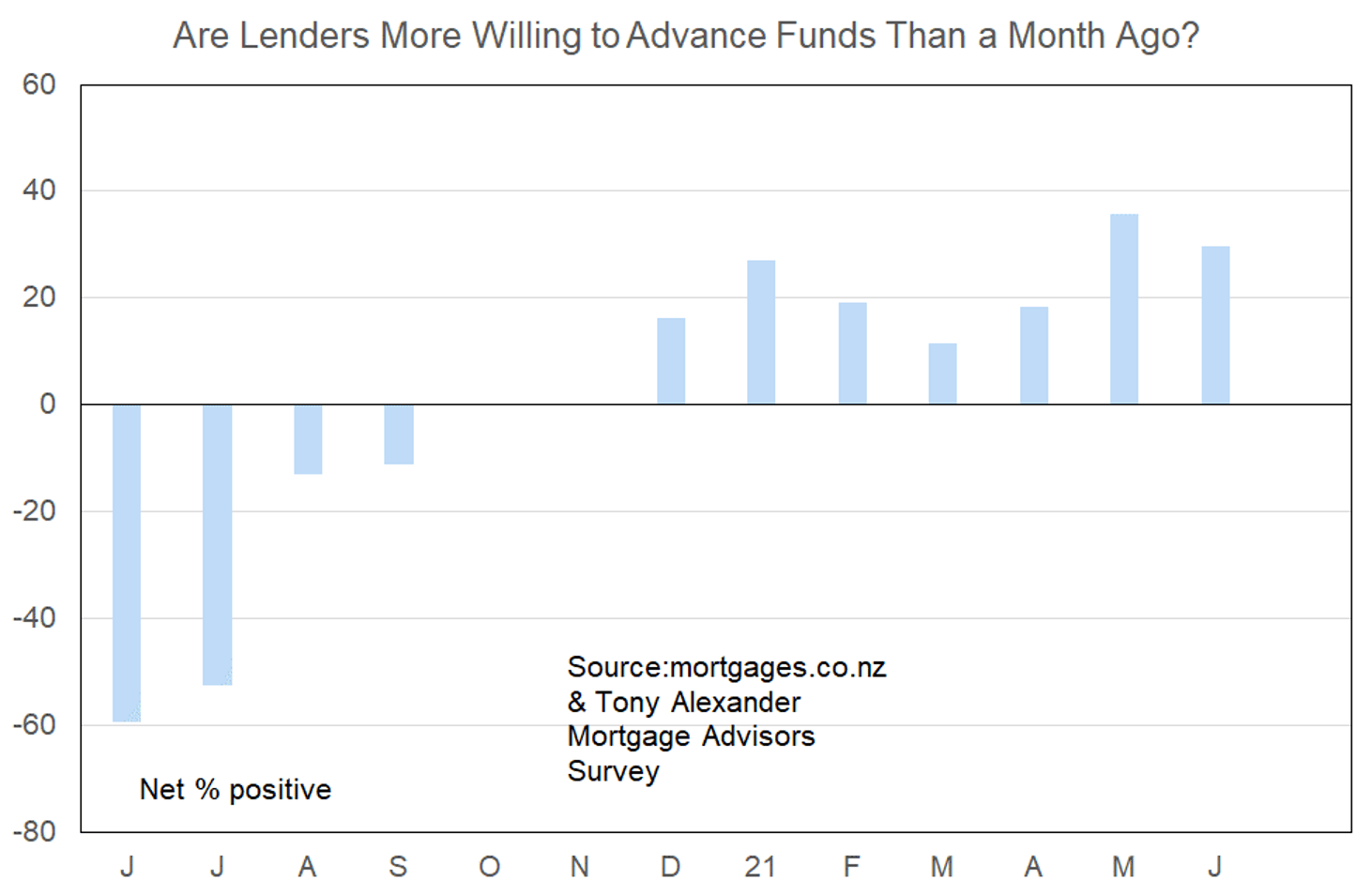

More or less lenders willing to advance funds?

As house prices rise bankers can naturally feel reduced concerns about net losses should borrowers default. But at the same time, if rises have been exceptionally strong as they have been for the past year, concerns about the ability of prices to hold up can arise.

On the face of it that latter effect should probably be dominant at the moment and generating increased lender caution. But it looks like it is being outweighed by the strong resurgence of growth in the New Zealand economy and such growth generally causes a cyclical rise in the willingness of financiers to lend money.

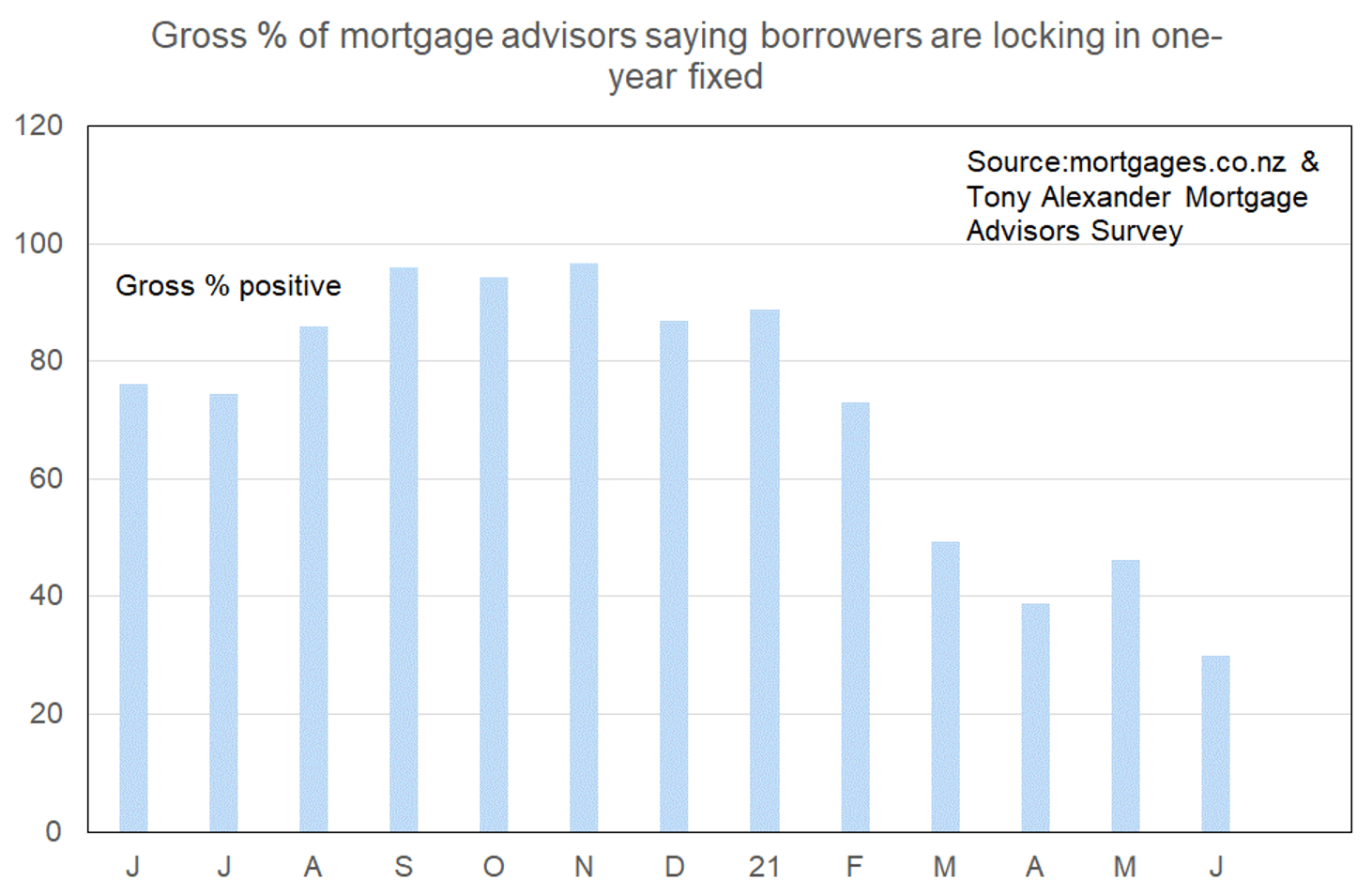

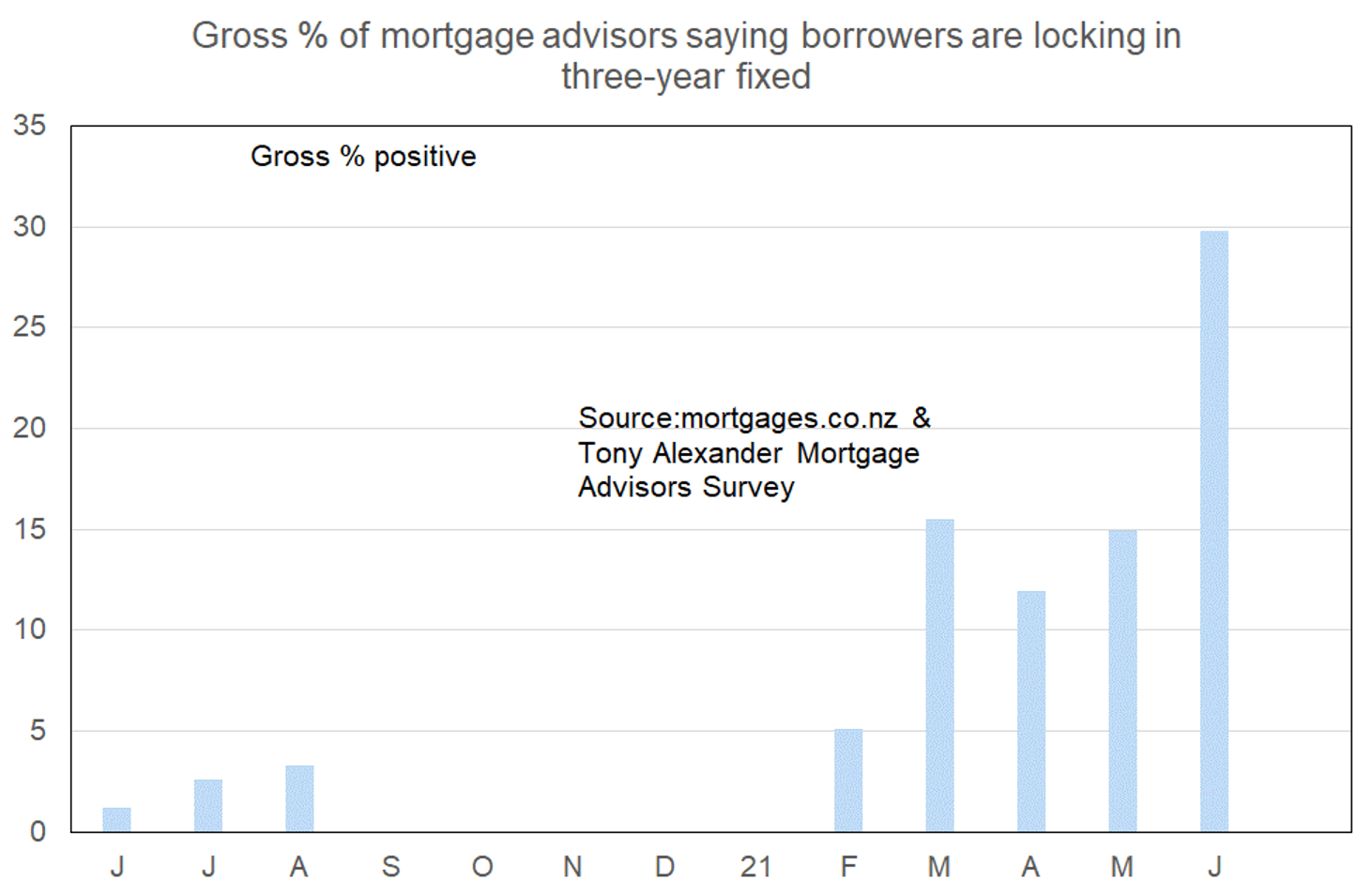

What time period are most people looking at fixing their interest rate?

Back in January, a gross 89% of mortgage advisors reported that the fixed rate term most favoured by their clients was one-year. That proportion eased to 79% in February as discussion started to appear regarding interest rates going up. Come April the proportion was 39% but it rose to 49% in May perhaps as some rate worries eased off amidst signs of slowing real estate market activity.

But in the past month general media discussion about strong economic growth, rising inflation, and the growing need for higher interest rates, has bloomed. Just a few days ago the Federal Reserve in the United States indicated they would start raising interest rates in 2023 rather than their previously very firmly stated 2024 time period.

Our own central bank on May 26 published a set of interest rate predictions for the first time since February 2020 and revealed an expectation of their official cash rate rising 1.5% from the September quarter of next year.

A few days ago, NZ’s economy was revealed to have grown by 1.6% during the March quarter, rather than rising 0.5% as analysts had predicted, or shrinking 0.6% as the Reserve Bank had estimated four weeks ago.

Now, our survey reveals that just a gross 30% of advisors say that the one-year term is the favourite of borrowers – and that despite banks slightly reducing that rate.

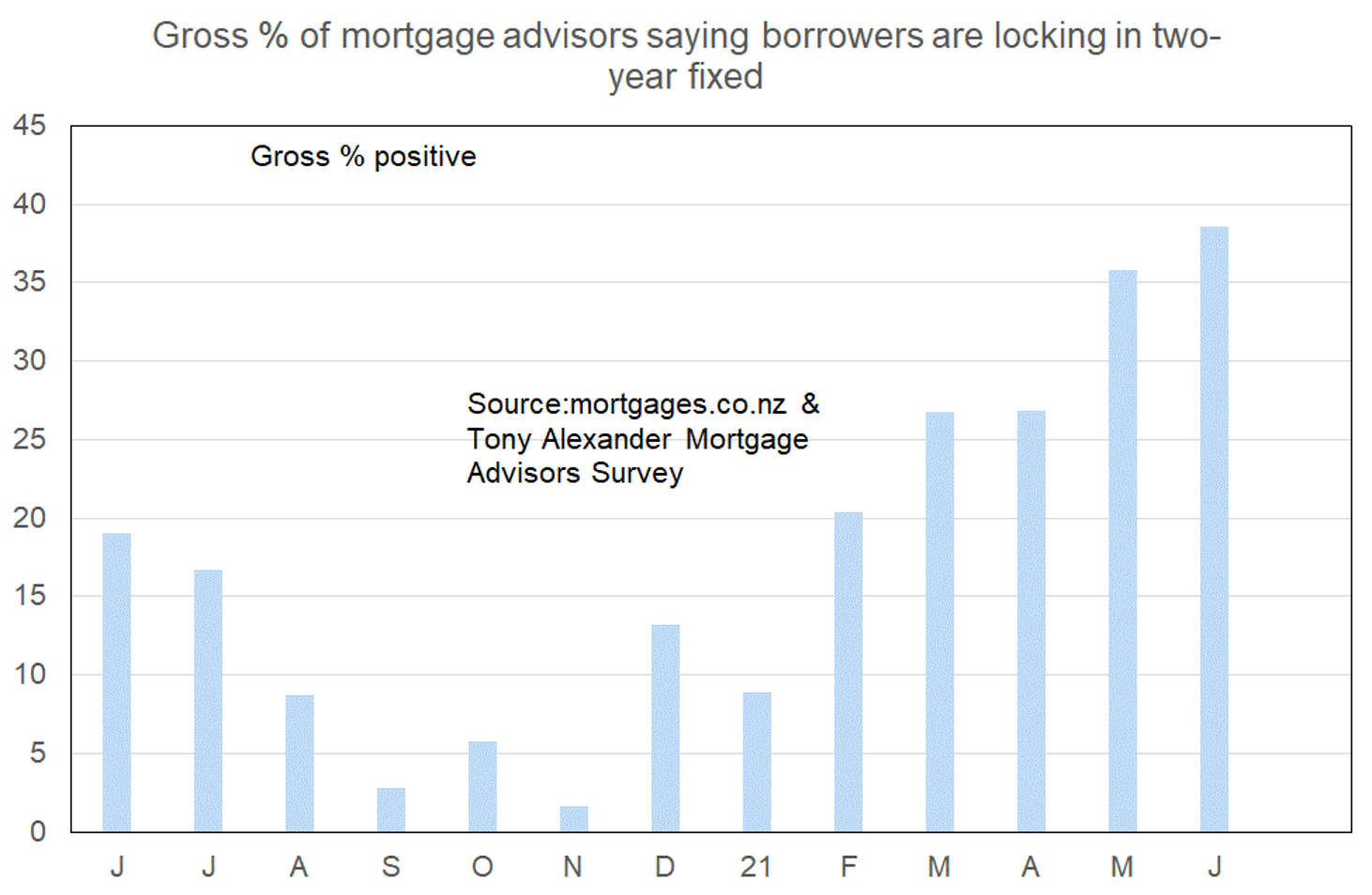

Why have banks been cutting their one-year rates when there has been no easing of monetary policy? Probably because borrowers have started shifting to longer term rates and the margins for those time periods of two years and beyond have been well below average. Hence, banks have been raising their medium to long-term mortgage rates.

Two months ago, one could easily borrow at a fixed rate of 2.99% for five years from a number of lenders. Now the typical rate is 3.69%.

Our survey shows that the two-year term is now more popular than the one-year term.

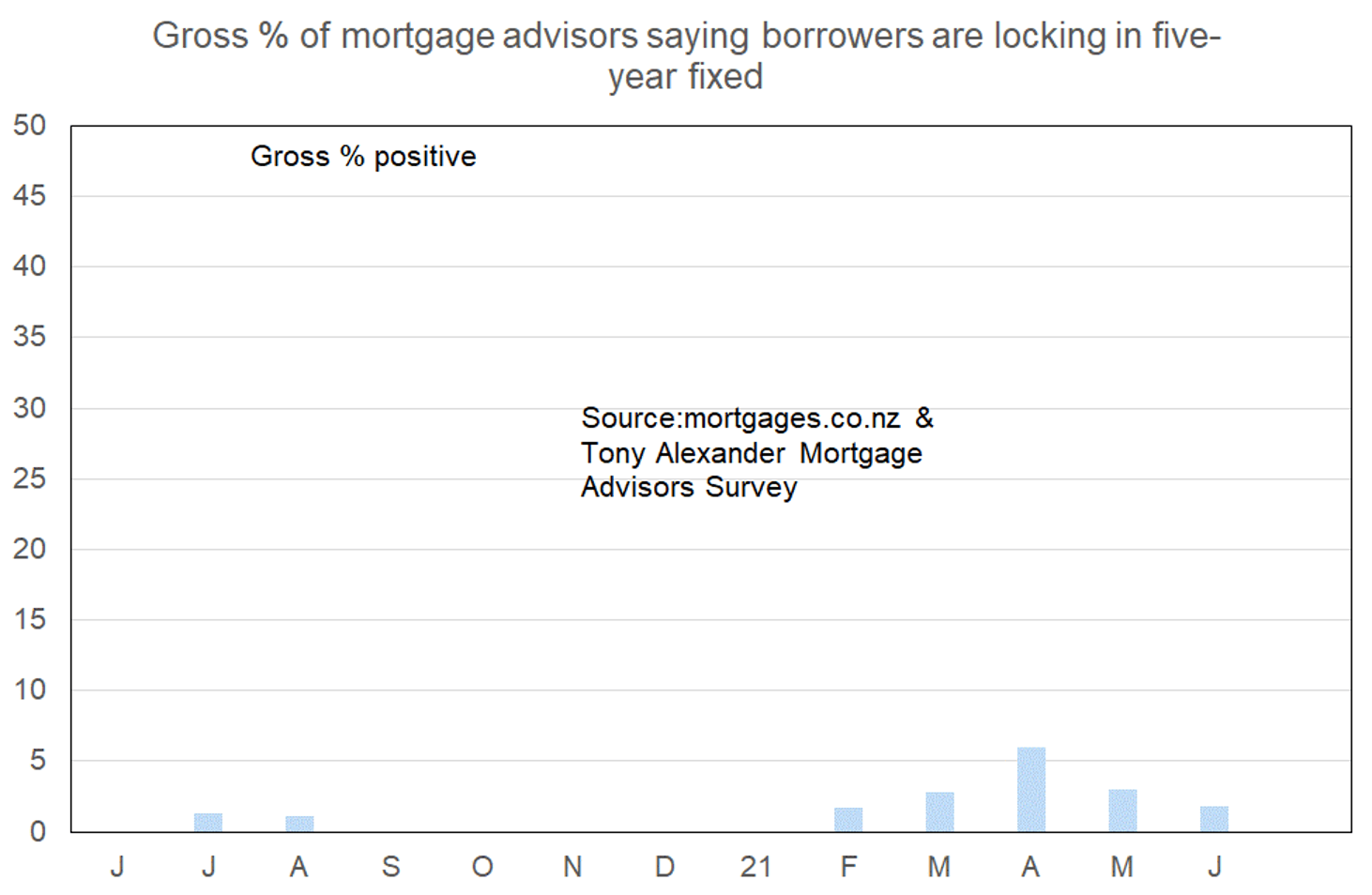

The five-year term still remains favoured by very few, and now that the rate for this time period is so far above that for the one-year term, such lack of preference is likely to continue.