Investors Back Off - Slightly.

Apart from sports competitions at certain times of the year, there is perhaps more attention paid to developments in the residential real estate markets around New Zealand than any other subject. In discussions about the markets commentators and analysts have substantial bodies of data to choose from including from REINZ, Valocity, CoreLogic and Trademe in particular.

But these data sources all have one thing in common. They focus on recorded turnover in the real estate market but from a backwards looking perspective.

With this survey and others in the Tony’s View sphere we are attempting to gain some insight into what turnover and prices will be doing in the near future by asking market participants at the coalface what it is that they are seeing.

The unique aspect of the mortgages.co.nz & Tony Alexander Mortgage Advisors Survey is that we gain insight into bank lending willingness and practices which is not available from any other source. And we get to see things from the perspective of Mortgage Advisors and this can deliver some greater insight into the specific issues besetting buyers of property which don’t always come out in our other main real estate survey with REINZ.

This month we have received responses from 59 mortgage advisors around the country and they tell us the following.

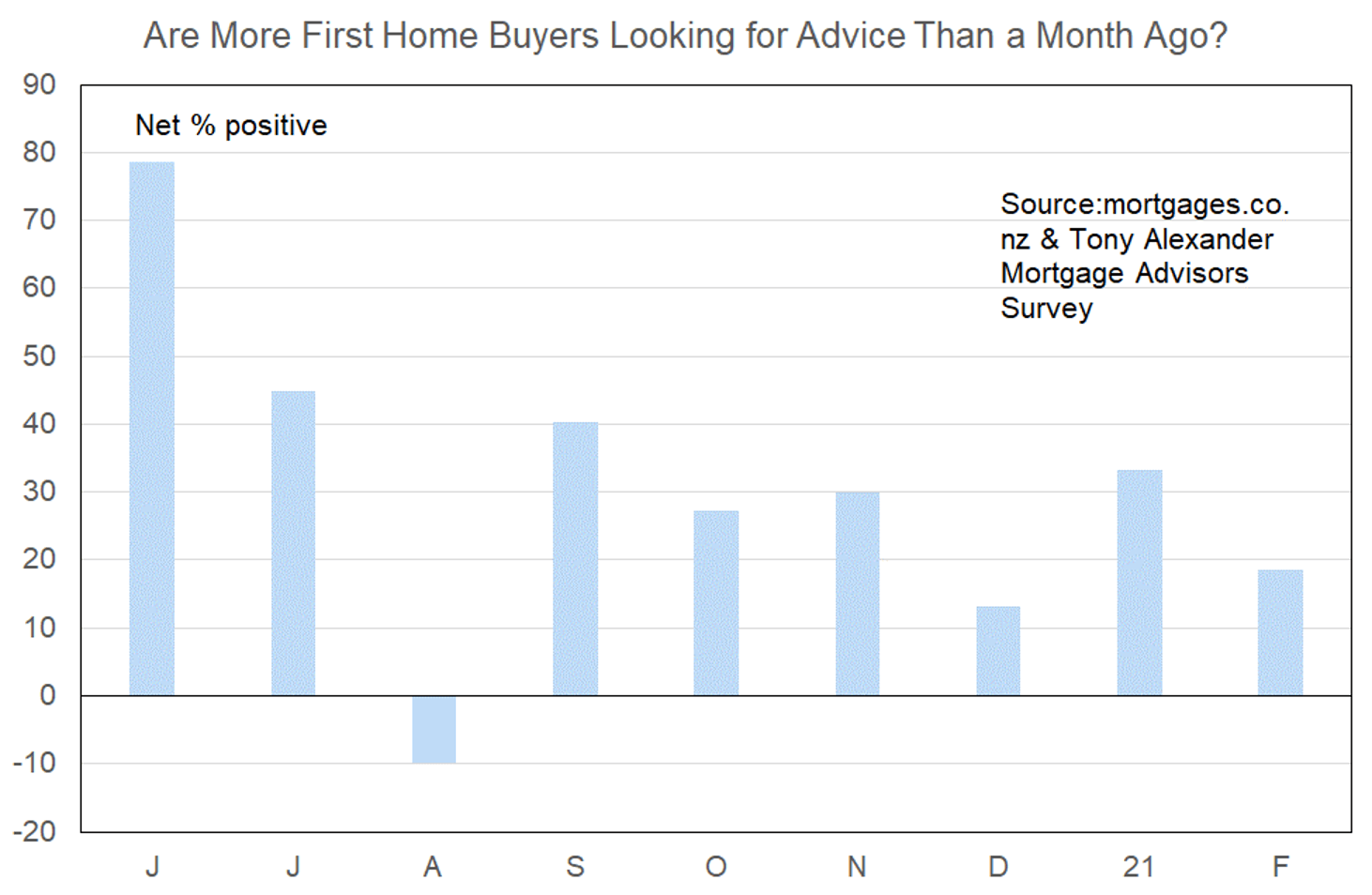

Are more first home buyers looking for advice than a month ago?

In February (last week) a net 19% of advisors reported that they are seeing more first home buyers in the market. This tells us that despite the high levels of prices around the country young people continue to step forward to make their first property purchase.

However, this reading of a net 19% is down from a net 33% who in January were seeing more first home buyers.

That earlier result for January, in hindsight, looks like a simple bounceback after many buyers took a breather heading into Christmas after many months of searching for properties, attending Open Homes and auctions.

The trend in this measure of activity is only slightly downward so it would be difficult to run any argument currently that first home buyers are backing away from the market.

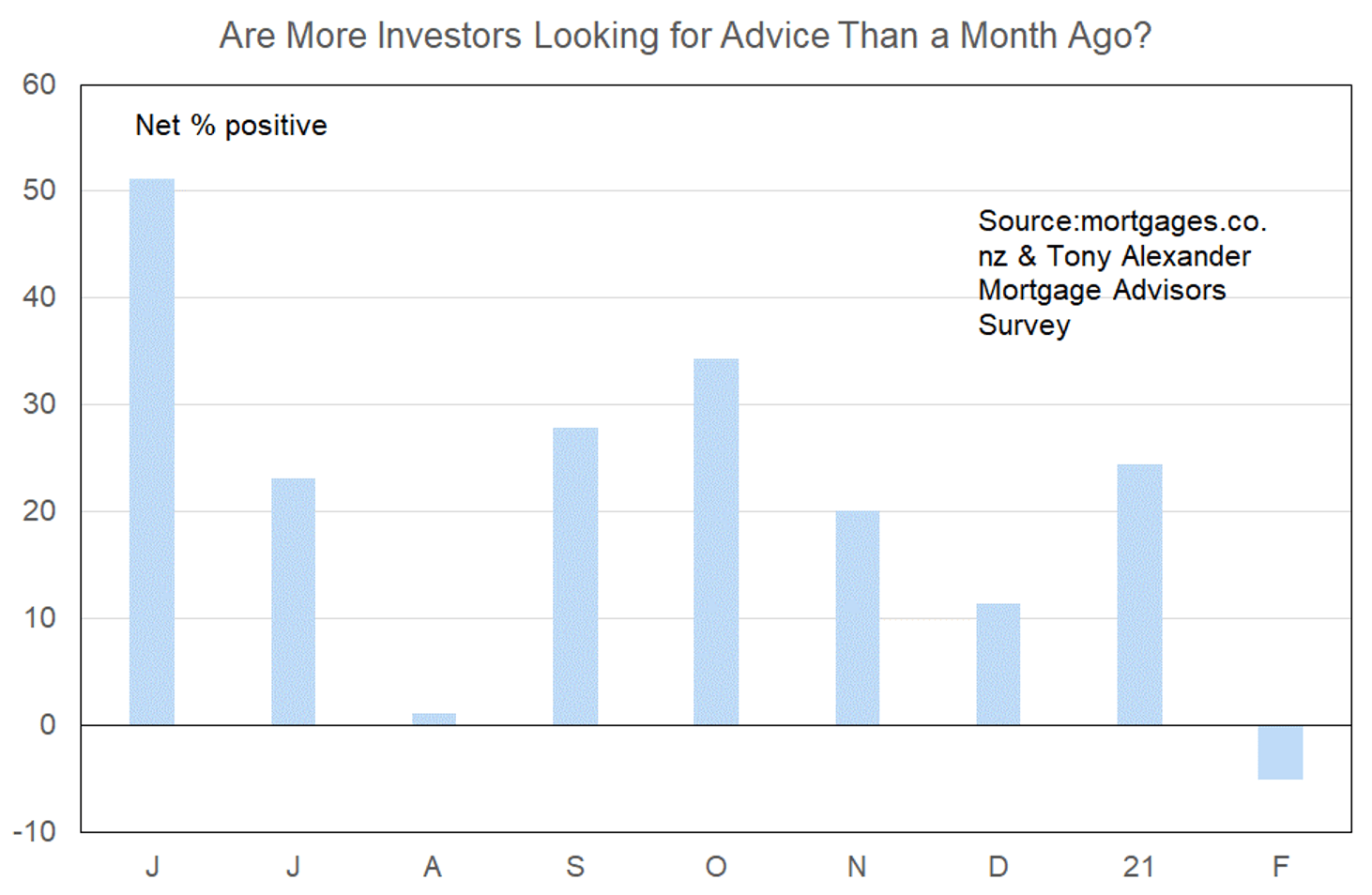

We cannot draw that same conclusion however for investors.

Our latest survey has drawn a response from mortgage advisors that a net 5% are seeing fewer investors in the market. That is, in net terms investors are starting to back away.

Are more investors looking for advice than a month ago?

In the absence of any rise in interest rates, prices continuing to go up and encourage expectations for capital gains, and rents rising, there is only one strong candidate to explain this change – and maybe one weak possibility.

The most likely explanation for investors starting to back away is the announcement from the Reserve Bank that effective from February 11 all loans to investors which had not already been approved will need to incorporate a 40% deposit. Plus, actual lending from March 1 will require 30% and actual lending from May 1 40%.

Given the high levels of house prices around the country these are not small amounts for the majority of investors who purchase property with a mortgage. Data from CoreLogic released this week for instance tell us that in January 30% of property transfers were to owners of multiple properties borrowing money, while another 11% was to multiple property owners paying with cash.

This development will please both the banks who in many instances had applied a 40% minimum deposit requirement some months or weeks back, and the Reserve Bank which has been reluctantly dragged by the banks into officially restoring the 40% minimum which was last applied in 2018.

This development reduces the chances that the Loan to Value Ratio for investors will need to be changed to a deposit of 50%. But these are early days and next month and the month after as people have had more time to digest the change, we will gain far better insights via this survey.

The potential small reason for the easing of investor demand is commencement of new Residential Tenancy Act rules. However, no advisor noted any relevance of these changes in their responses.

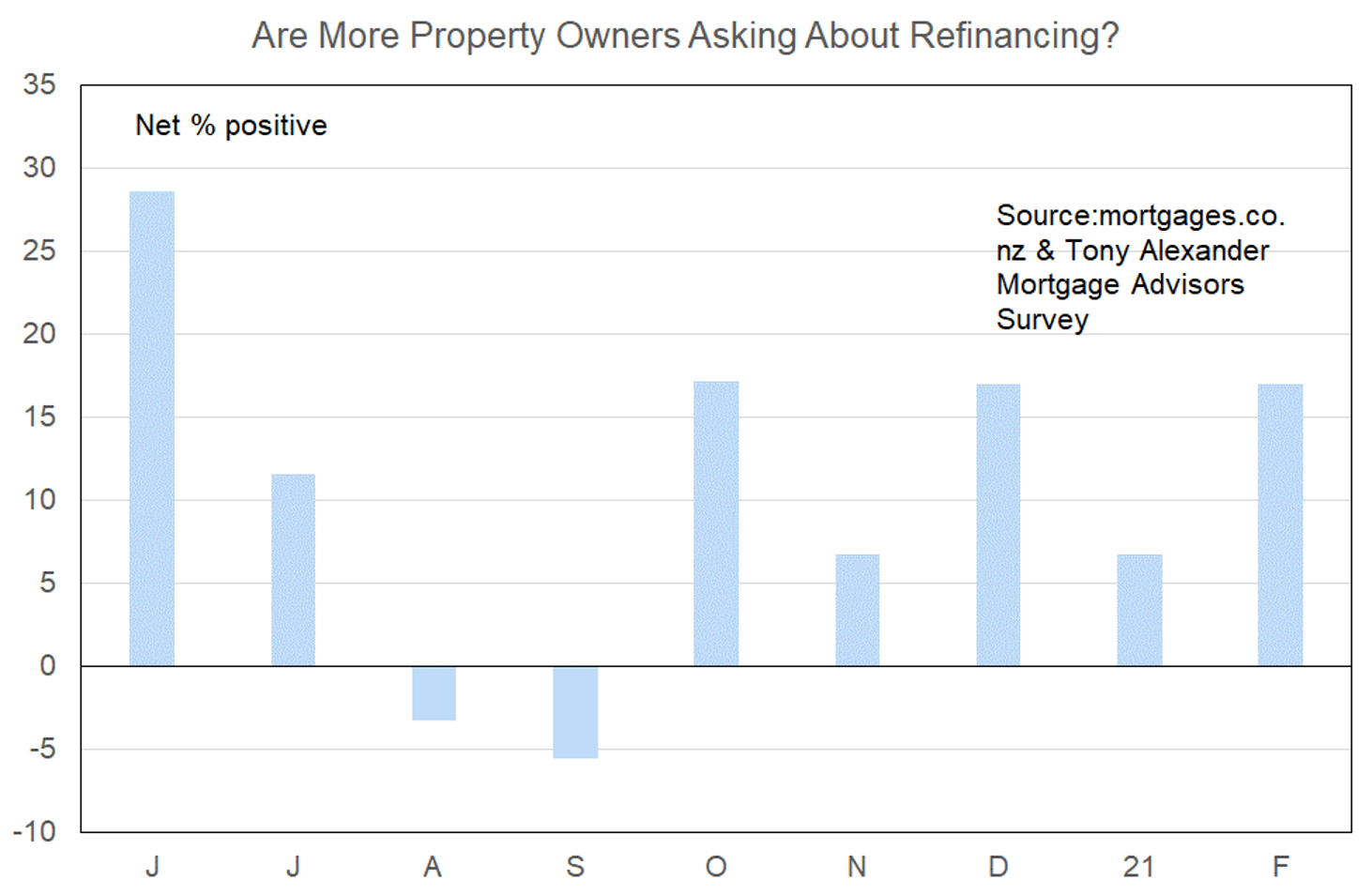

Are more property owners asking about refinancing?

Each month we also ask mortgage advisors if they are seeing more people seeking to refinance their existing mortgage. This may happen because people wish to use some of their equity (borrow more money) to fund a purchase. Or they may be seeking to alter the term at which their mortgage interest rate is set.

This month a net 17% of advisors have said that they are seeing more requests for refinancing information. This is equal to the result in December and suggests that the strong levels of retail spending which have been observed across numerous categories in recent months are likely to continue.

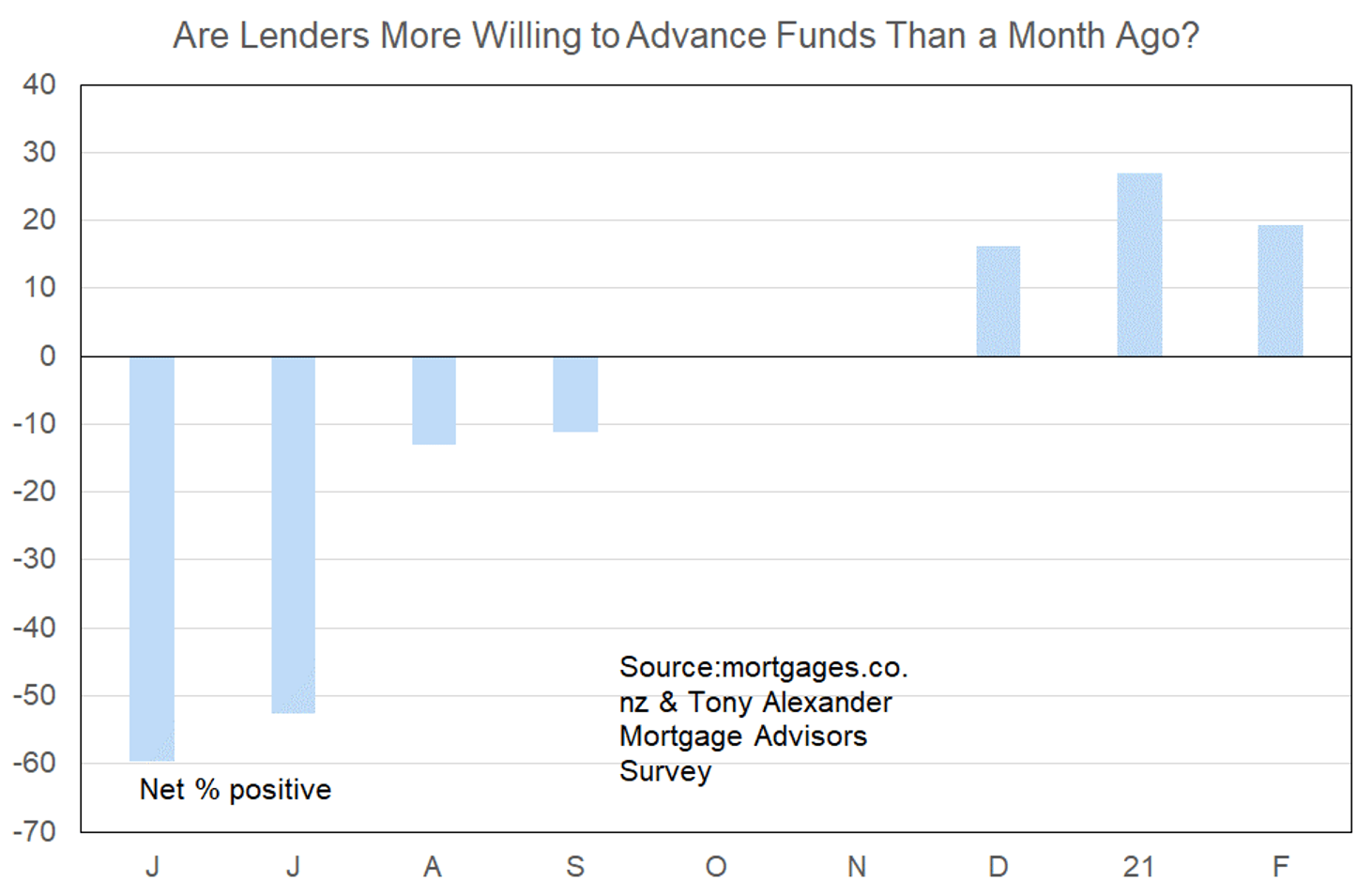

Are lenders more willing to advance funds than a month ago?

As noted earlier in this report, we can gain insight from mortgage advisors regarding bank willingness to lend which is not available from any other source. In that regard this month we have seen a slight dip in the net percentage of respondents saying that banks are becoming more willing to lend – to a net 19% from 27% in December.

However, though this may be a decrease, it still means that willingness to lend is improving and this situation stands in stark contrast to the early days post-lockdown when advisors reported that willingness to lend was worsening.

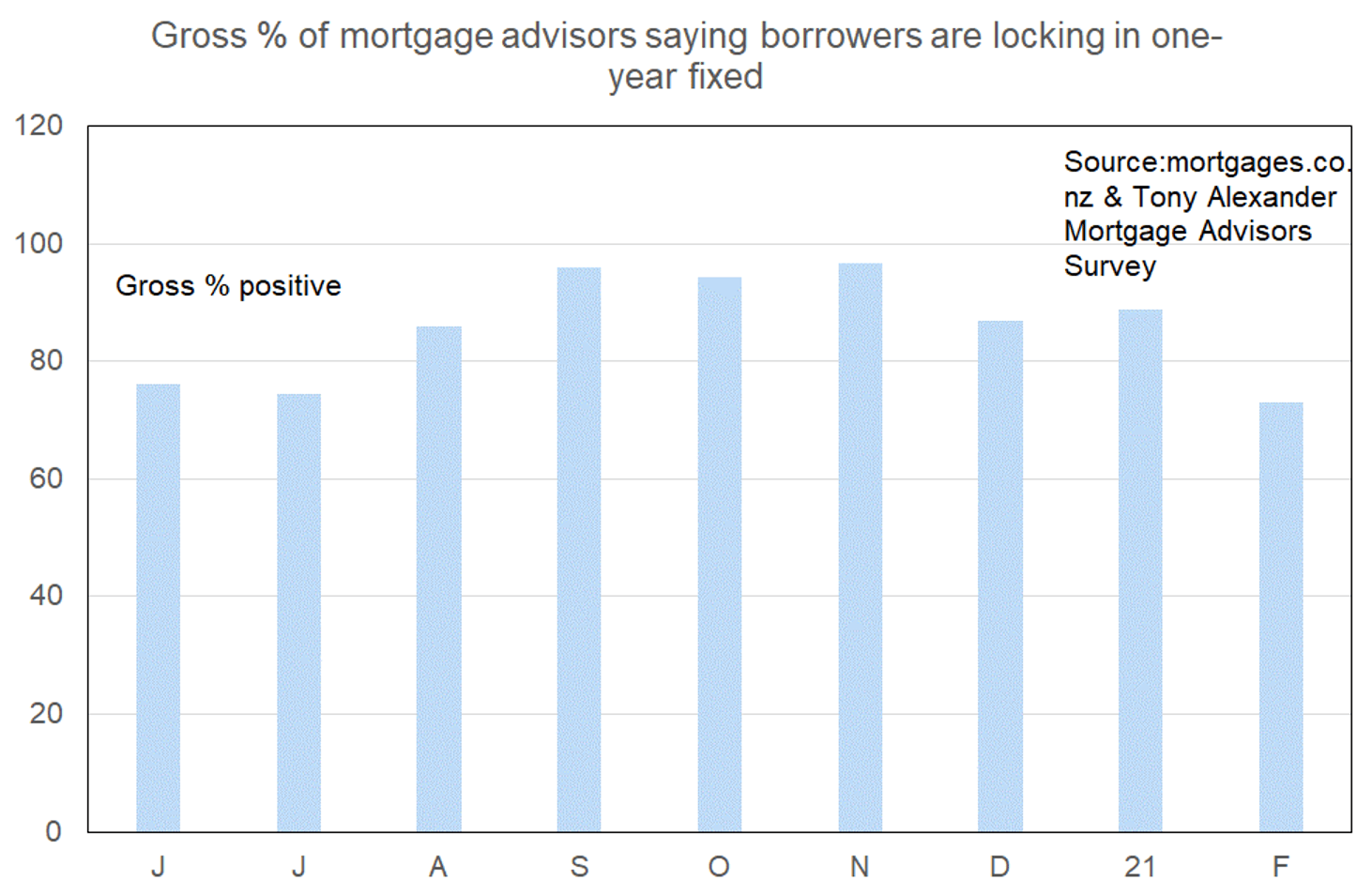

Gross % of mortgage advisors saying borrowers are locking in one year fixed

Finally, we ask mortgage advisors to indicate the term which their customers are tending to favour for fixing their mortgage interest rate. For the first time we have observed a decent change in this measure. There has been a decline in the proportion of advisors saying that clients prefer the one-year term down to 73% from 89% in January, 87% in December, and 97% in November.

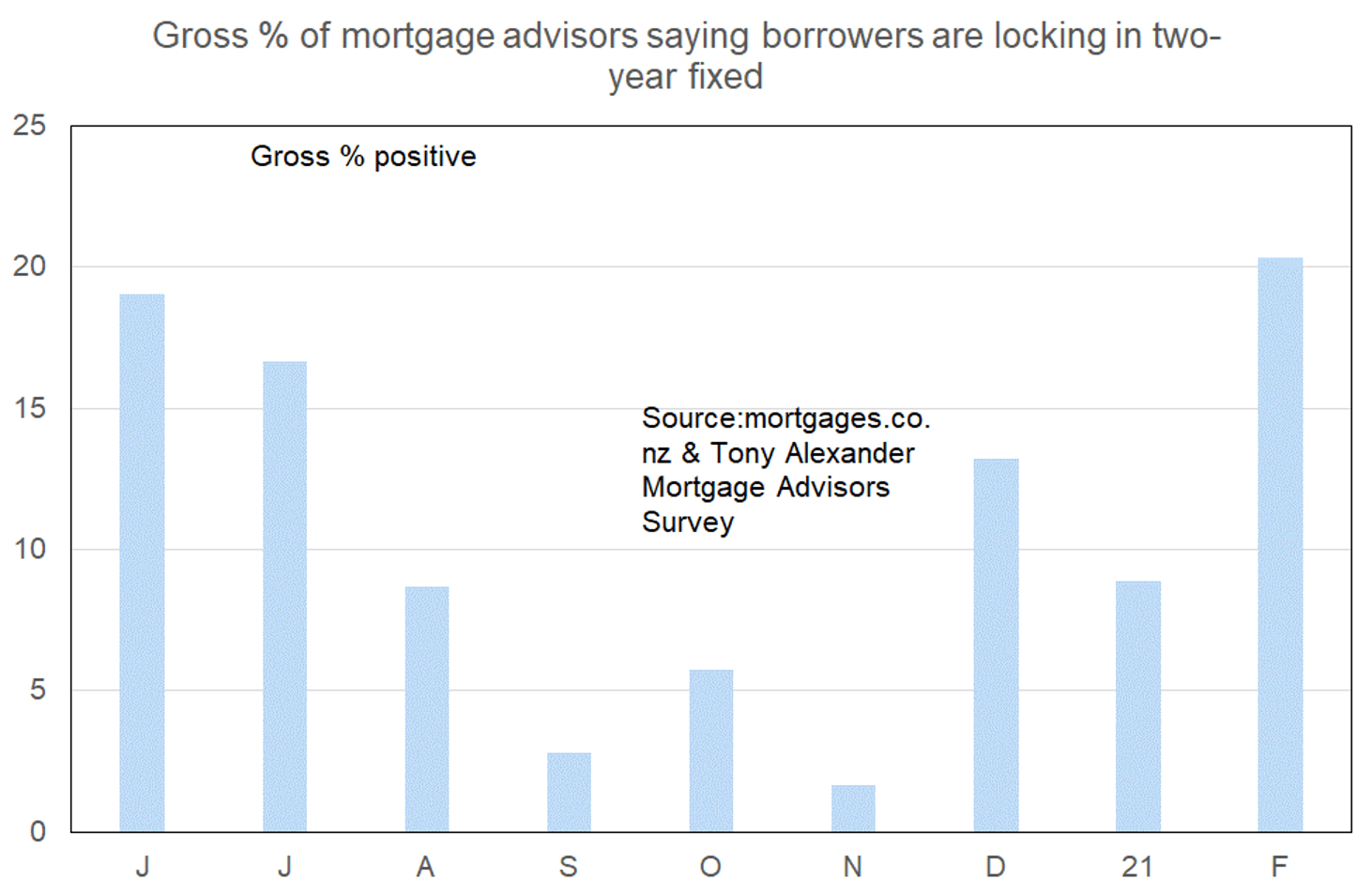

Gross % of mortgage advisors saying borrowers are locking in two year fixed

What term is it that people are shifting towards? Two years. A gross 20% of advisors now say that is the preferred term for their clients.

Are many people fixing even longer than that? Not many. Only 5% of advisors report people favouring three years, 0% four years, and just 2% for five years.