Investors step back.

Each month since June last year we have surveyed mortgage advisors throughout New Zealand asking them what they are seeing. The insights which these advisors can provide give us early insight into changes that are happening in buyer behaviour in particular, well before such changes show up in any of the official datasets.

We also gain unique insight into changes in bank lending practices which are not available from any other outlet.

This month we can see a strong continuation of reaction to the government’s March 23 housing policy announcement seen in the late-March survey.

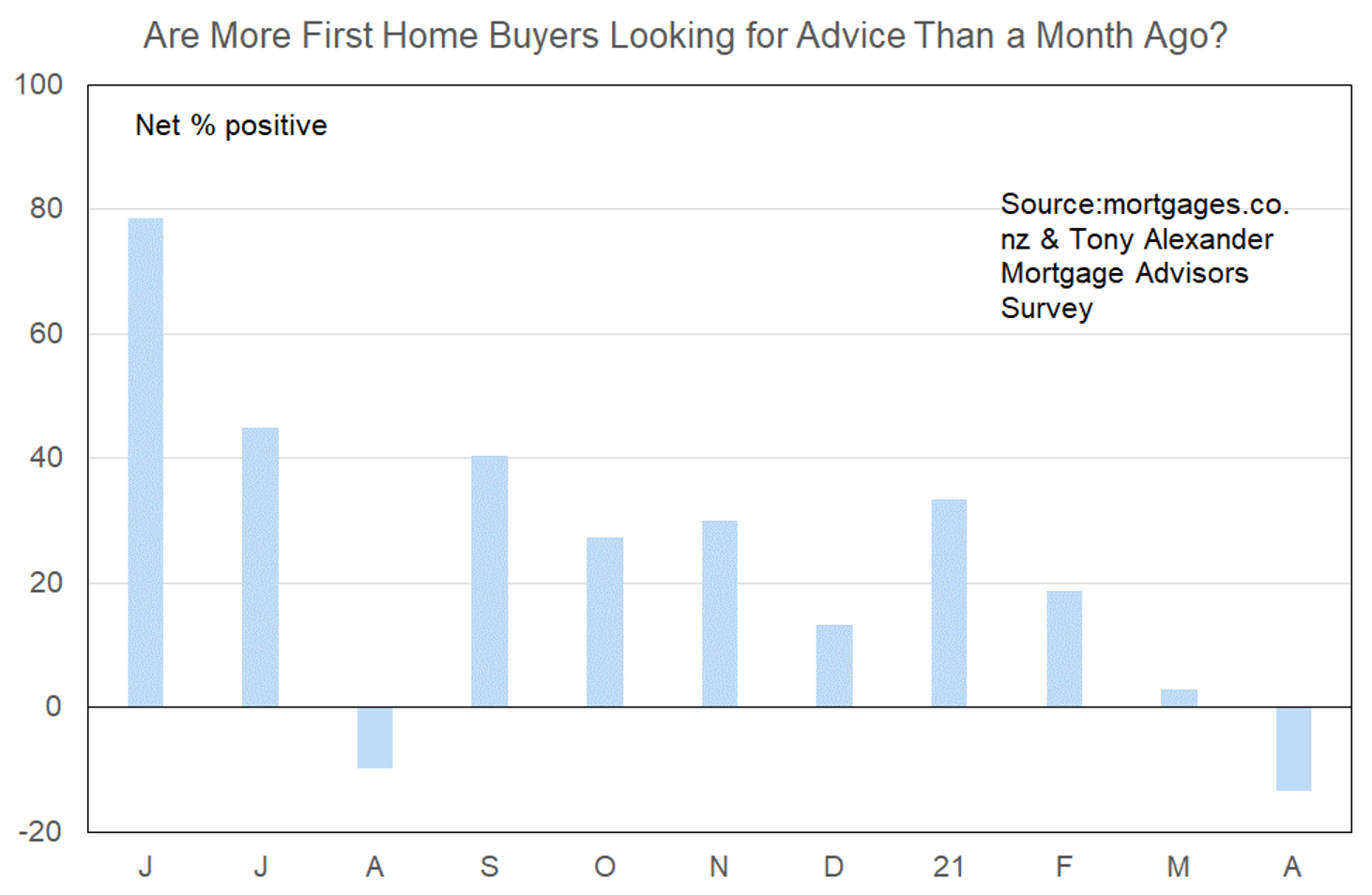

More or less first home buyers looking for mortgage advice

The negative result suggests that we can start to answer the question of whether first home buyers are responding to the increasing crackdown on investors by moving in to take advantage of the situation. Not really as yet, especially as a trend over recent years has been for first home buyers to “rentvest” – purchase an investment property to rent out in anticipation of a capital gain which will deliver a good deposit for an eventual home to live in themselves.

These young buyers have had this path all but denied to them now by the rule changes, and in fact they may be more negatively affected by extension of the brightline test to ten years than any other grouping of investors.

One thing we have learnt over the years is that when there is a generalised cooling in the NZ housing market and access to property becomes easier for those still looking to buy, first home buyers tend not to retain the same or greater presence.

They become concerned about the risk of falling prices, and, for those with small deposits, the risk of negative equity.

Our latest survey result is consistent with this past behaviour. But these are still very early days in market response to the March 23 announcements and a recovery in first home buyer demand could easily occur given the strong labour market, good levels of consumer confidence, and backlog of frustrated buyers.

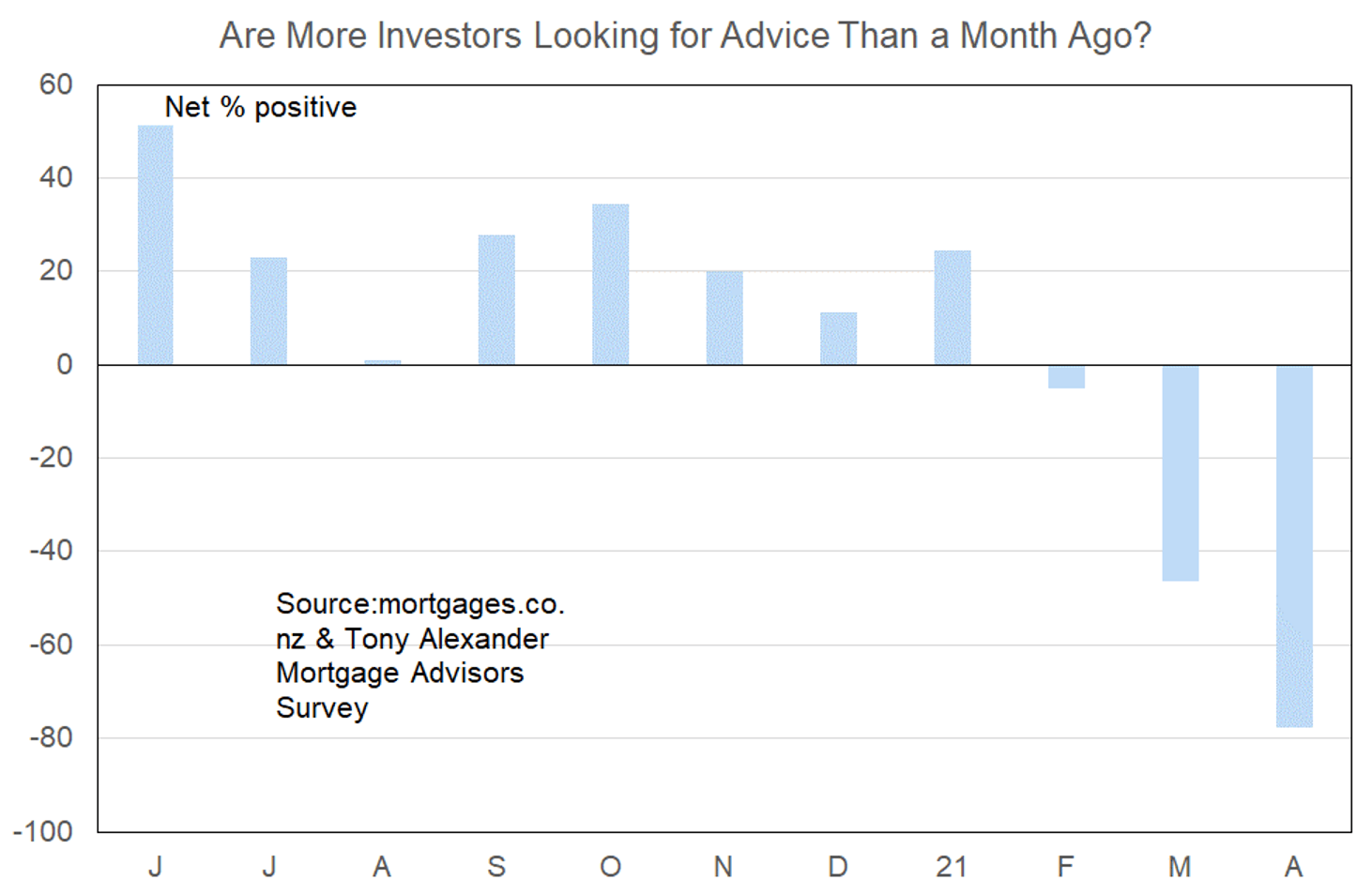

More or less investors looking for mortgage advice?

For the third month in a row our survey has revealed a net negative proportion of mortgage advisors reporting that they are seeing fewer investors. In February the outcome was -5%, March -46%, and this month -78%.

Only one of our 68 respondents this month reported seeing more investors, 54 said fewer, 12 said nothing had changed, and one had no view.

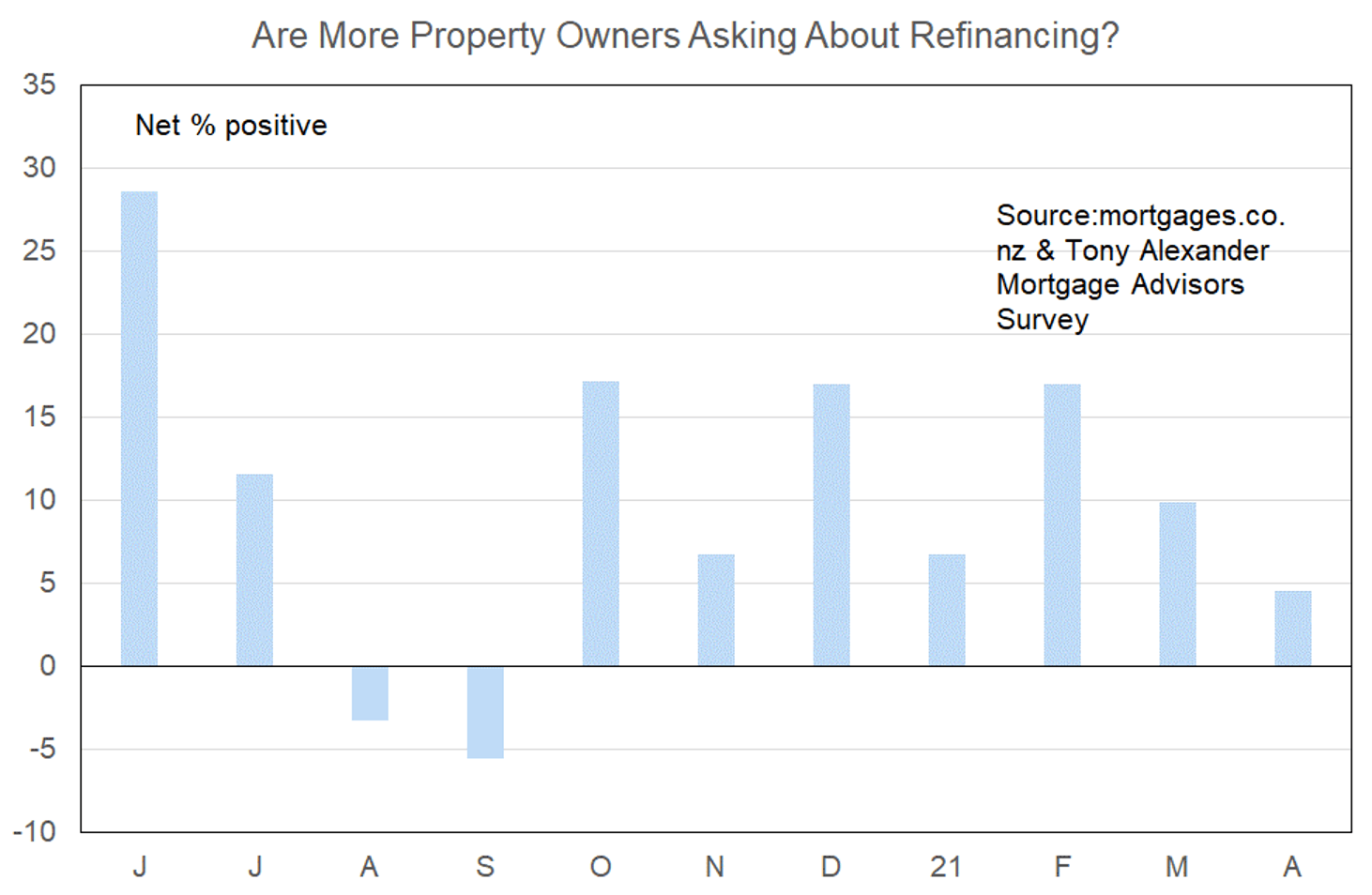

More or less property owners looking for refinancing?

Enquiries about refinancing can be driven by a desire to lock in long-term fixed interest rates before they rise, break fixed rates because of market rate falls, or sometimes draw down equity on one’s property to finance purchases of consumer goods and services, or another property.

In that regard there are two pressures moving in opposite direction to each other at the moment. Some people will be looking to lock in a longer-term fixed rate – as discussed below. Others will be shelving plans to raise debt to invest in another property.

We would expect in the current climate of rising concerns about interest rate increases, that more people would be asking about refinancing. But this month there has been a fall in the net proportion of mortgage advisors seeing such enquiries to a net 4% positive from 10% in March and 17% in February.

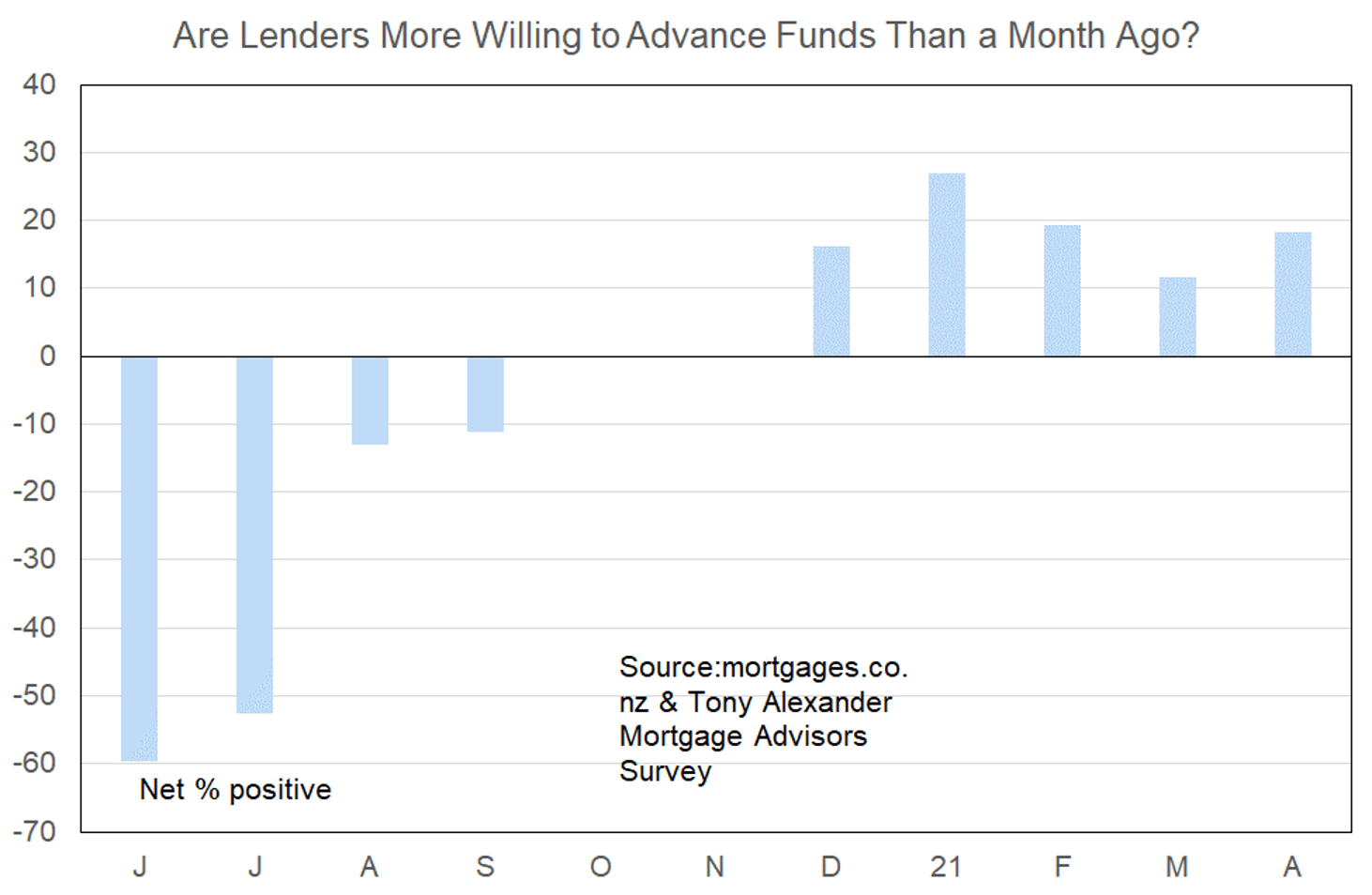

More or less lenders willing to advance funds?

What time period are most people looking at fixing their interest rate?

In recent surveys and other commentary, we have been noting growing optimism about recovery in the world economy, and growing expectations of rising inflation and tightening monetary policies. As yet, central banks by and large are continuing with their mantra that they do not intend raising their official interest rates until 2024. But the Bank of Canada broke ranks last week with an indication that they anticipate tightening monetary policy from late-2022. The financial markets in New Zealand are also pricing in at least one 0.25% increase in the official cash rate here before the end of 2022.

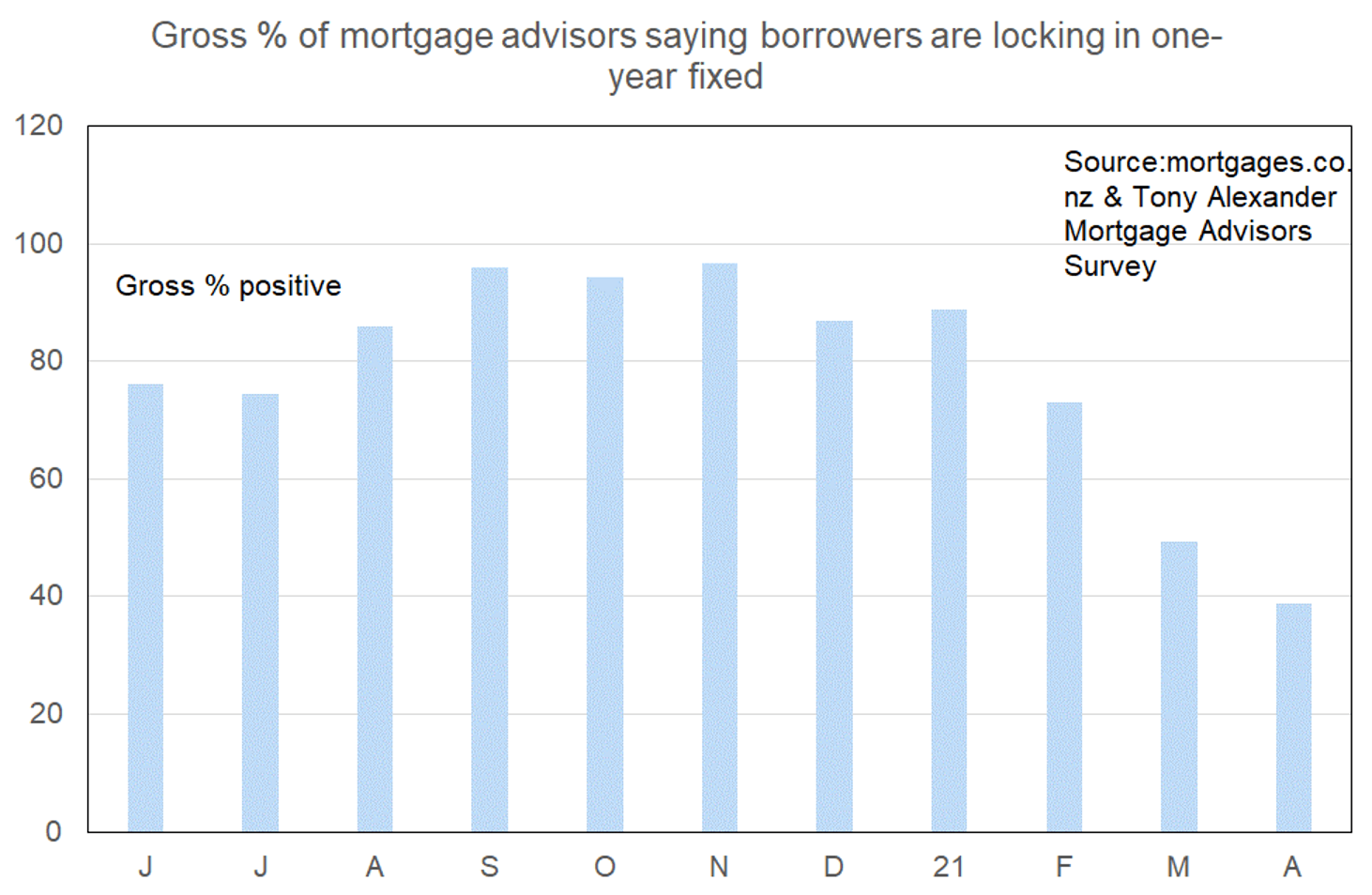

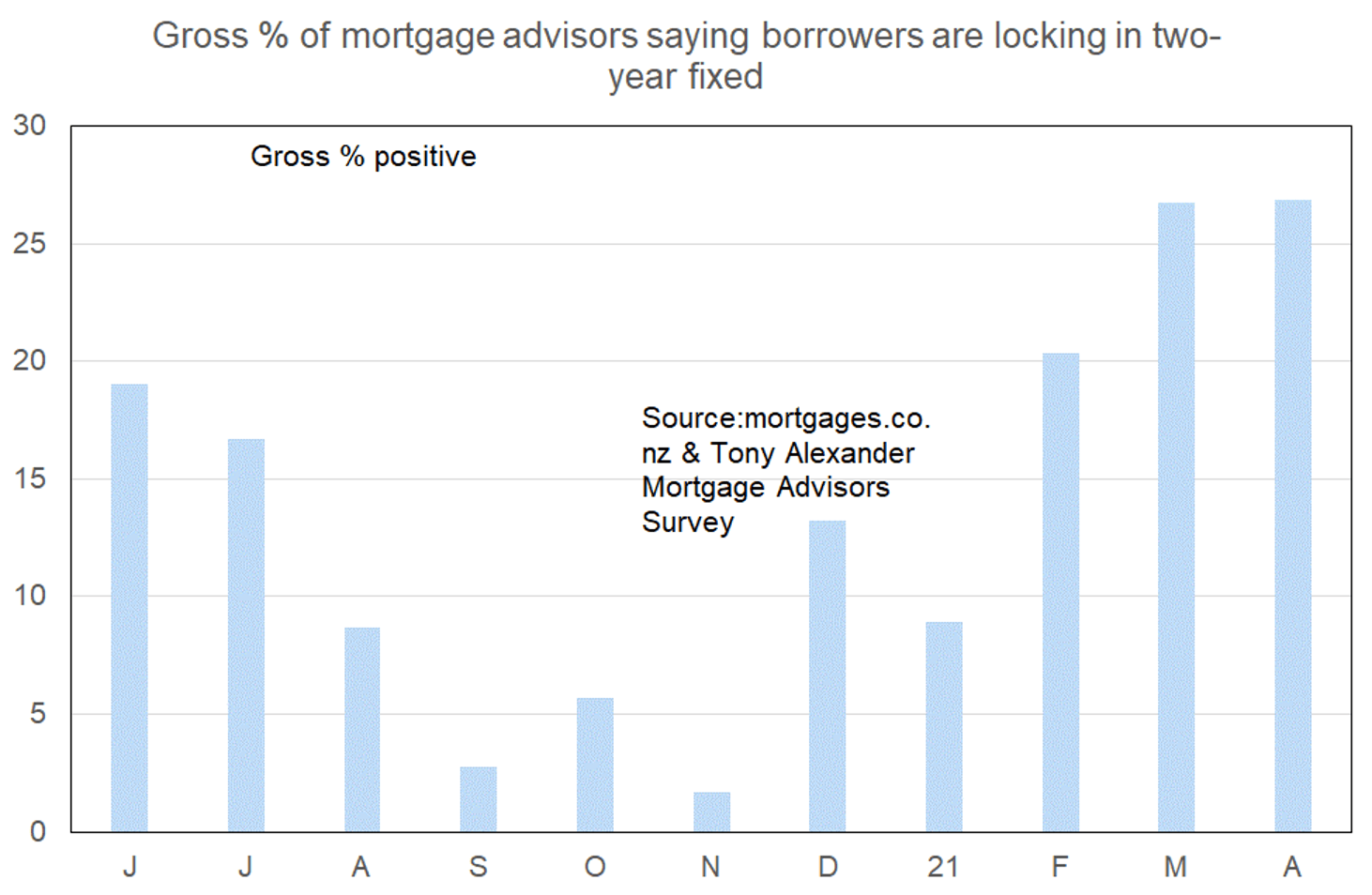

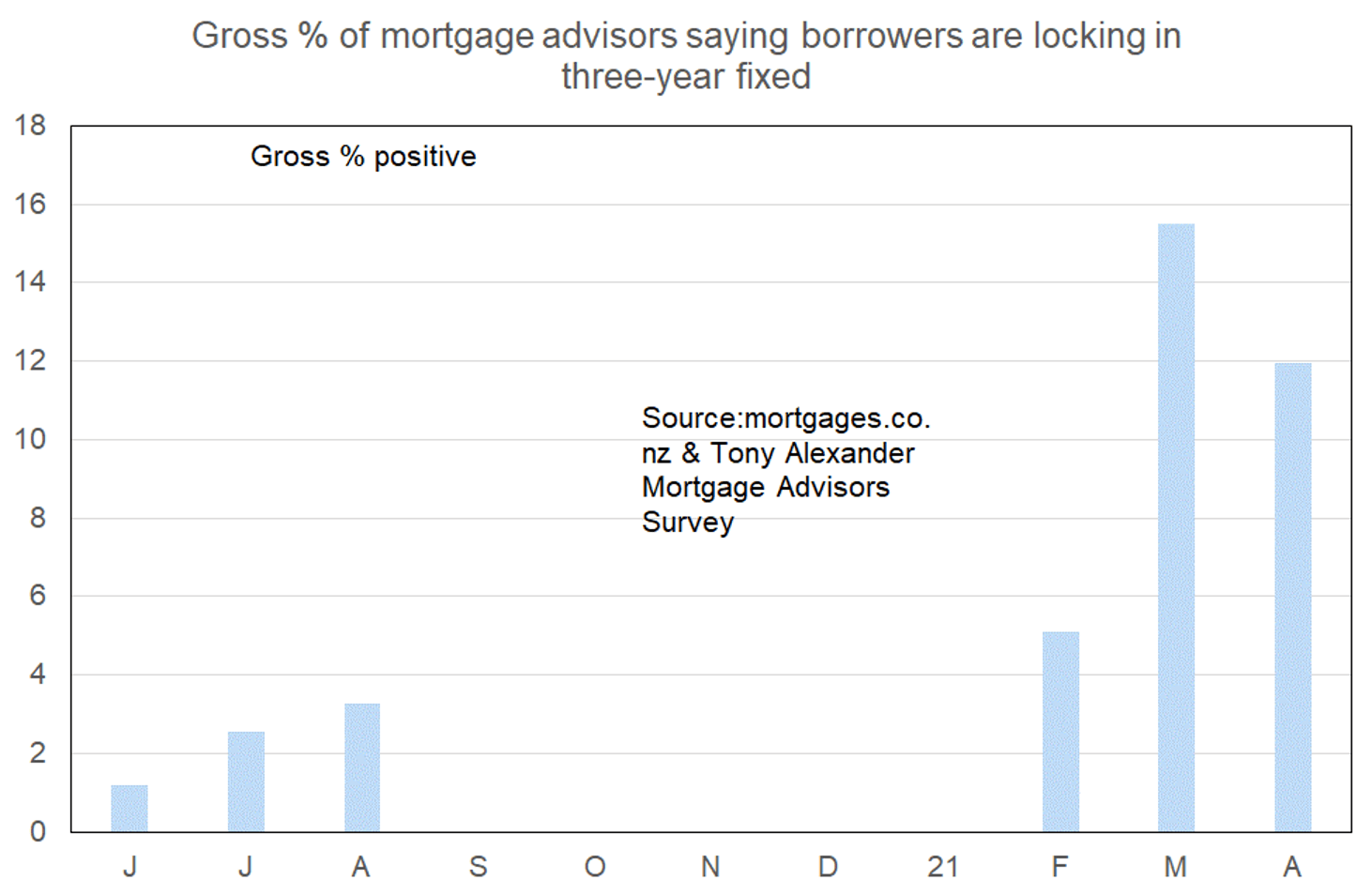

As retail borrowers have picked up on these changes in commentary and market pricing, they have started to shift their previous strong preference for the one-year fixed rate term towards slightly longer terms.

In this month’s survey a gross 39% of mortgage advisors say that the term most preferred by their clients is one-year. This is the lowest proportion since our survey started in June and down from 49% last month and 73% in February.

A gross 27% of advisors report that borrowers now prefer the two-year term. This is unchanged from the result in March.

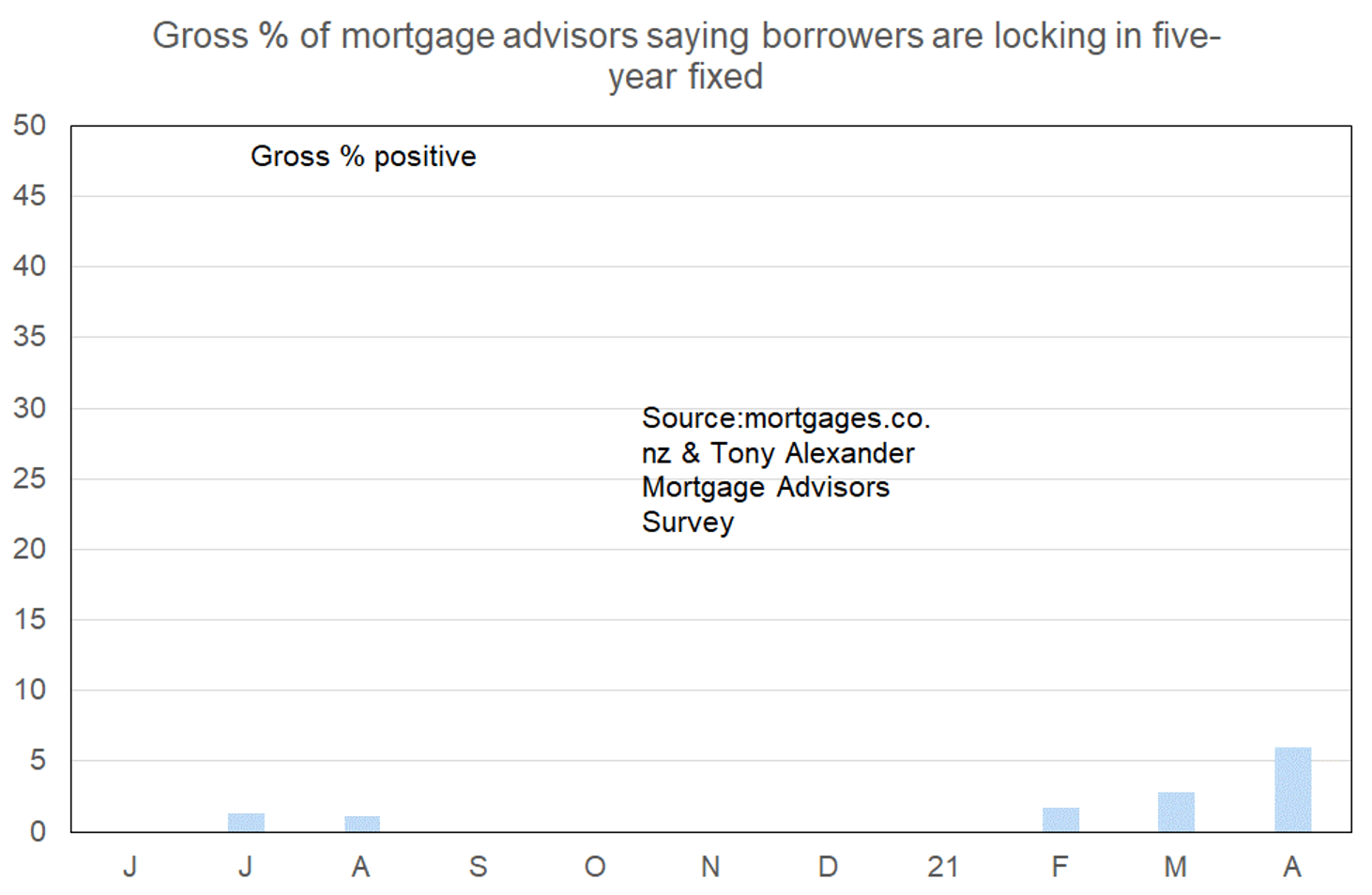

Only 4% report the perennially lowly-favoured four-year term as preferred. But a gross 6% now say that the five-year term is most preferred. The graph below is scaled with the vertical axis ending at 50 simply to keep the extent of the switch to the five-year term in perspective with the one-year term in particular.

After results came in for this month’s survey two bank increased rates for their home mortgage loans at fixed rates for three years and beyond. Given the publicity surrounding this change it is likely that in our next survey a far greater proportion of advisors will report a shift in borrower preference further out along the yield curve beyond the candy-like one-year rate.