Loan Check is free to use and lets you quickly check your chances of getting pre-approval for a mortgage. It also lets you adjust your figures and immediately see the effect on your mortgage potential.

If your Loan Check results look positive, we match you with a selection of trusted mortgage brokers from our hand-picked panel. Choose a preferred adviser, find out more about them and book your meeting, at a time that suits you. Loan Check is a great way to find out where you stand right now. Here’s how it works.

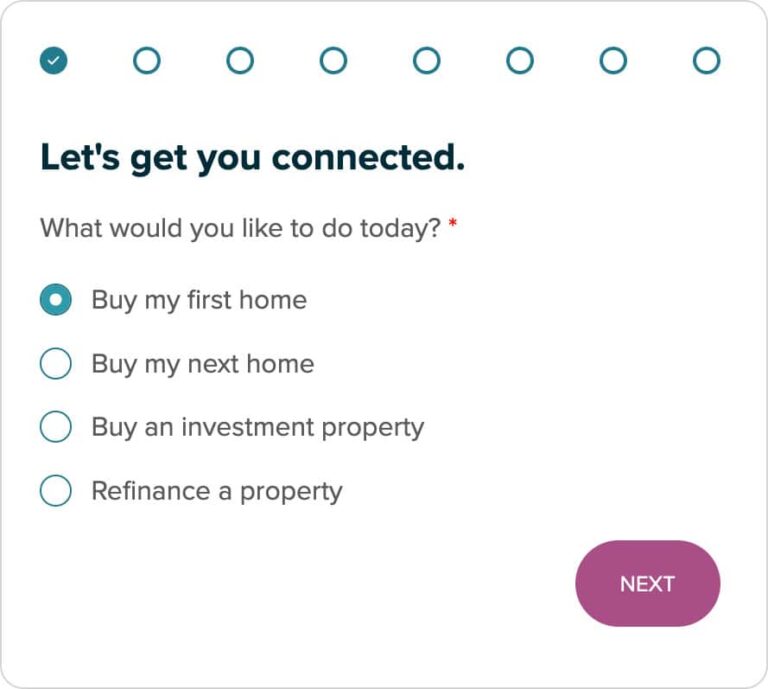

Enter information and set up access

Start by answering a series of quick questions about your buying situation and the property you’re considering. Then enter your details and choose a password.

Completing this set-up process ensures you can sign in securely. It also means you can pause anytime, then come back and pick up from where you left off. Your data is safe with us, Loan Check uses best-practice encryption to protect your information.

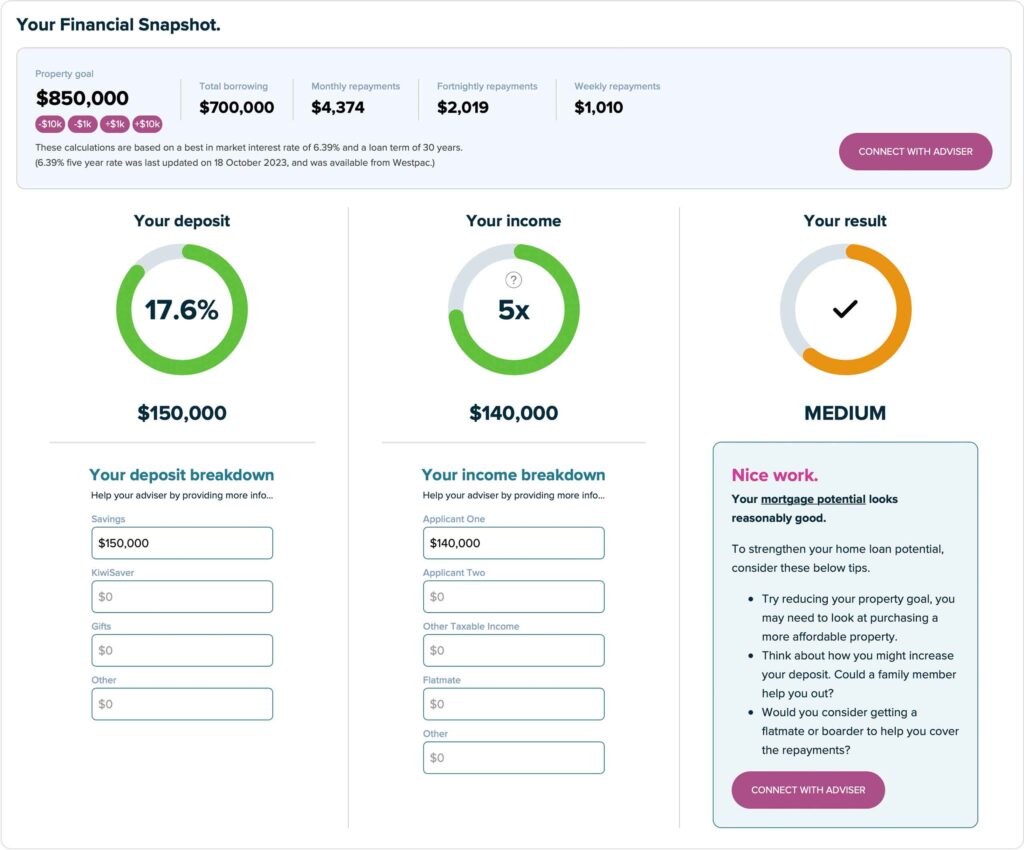

The Loan Check dashboard for property buyers

Once you’ve completed set-up, you’ll see your Loan Check dashboard. If you’re planning to buy a property, you will be presented with your financial snapshot. Alternatively, if you’re refinancing a property, you will see a range of refinance options. Jump to refinancing dashboard.

Your financial snapshot summary

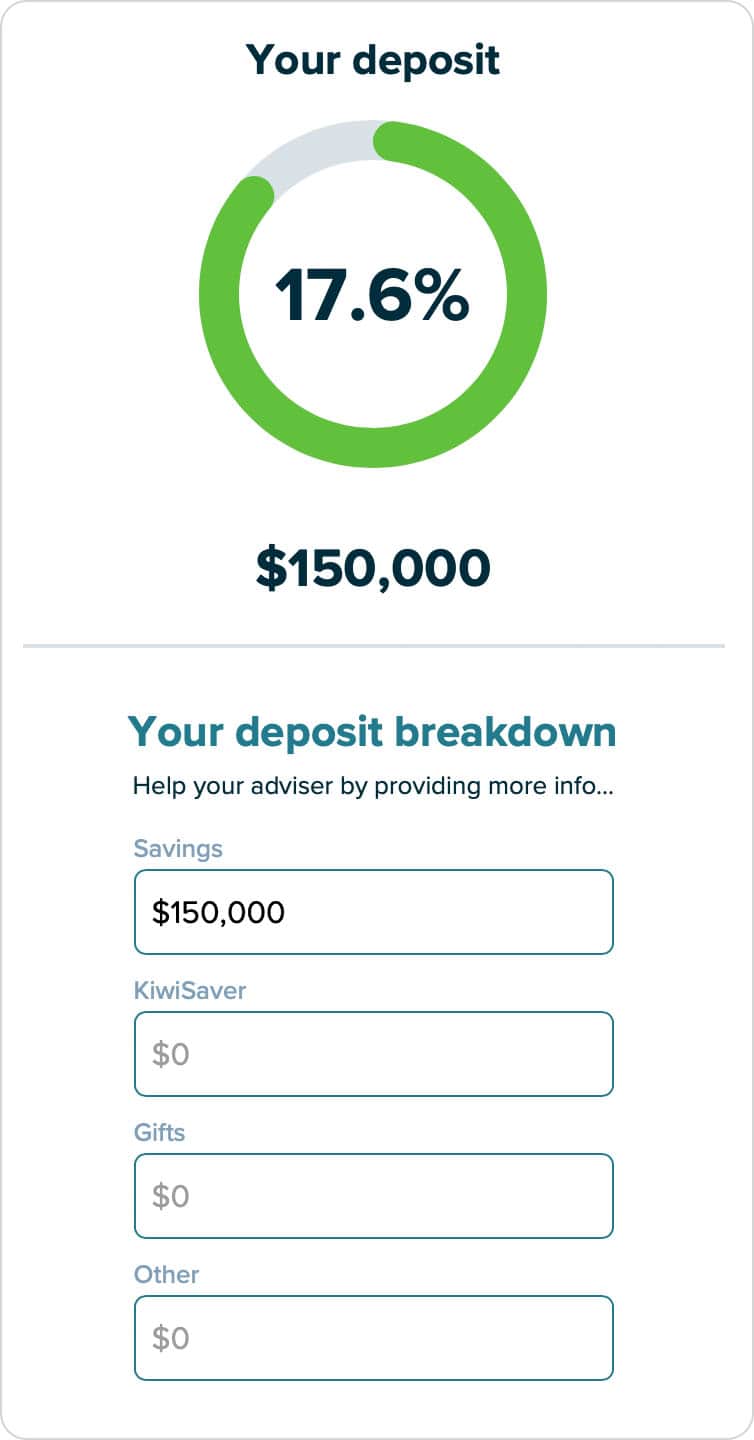

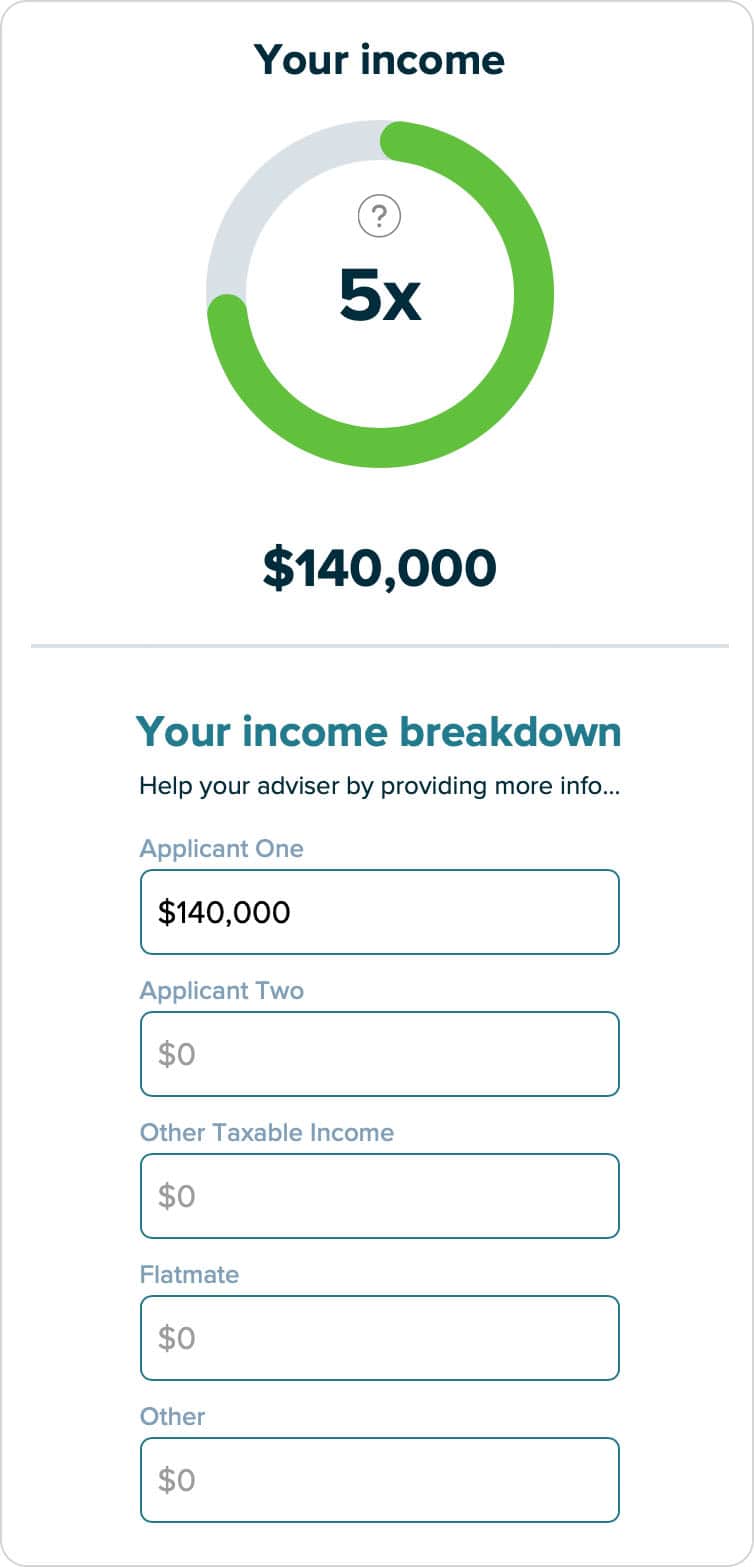

Your deposit & income

See how much your deposit is as a percentage of your property goal.

Strengthen your position by providing additional information as part of your deposit breakdown. This little bit extra will ultimately help your adviser and speed up your home loan application.

Be sure to provide more information in your income breakdown.

Add your partner’s income or any additional income you may have to strengthen your home loan potential.

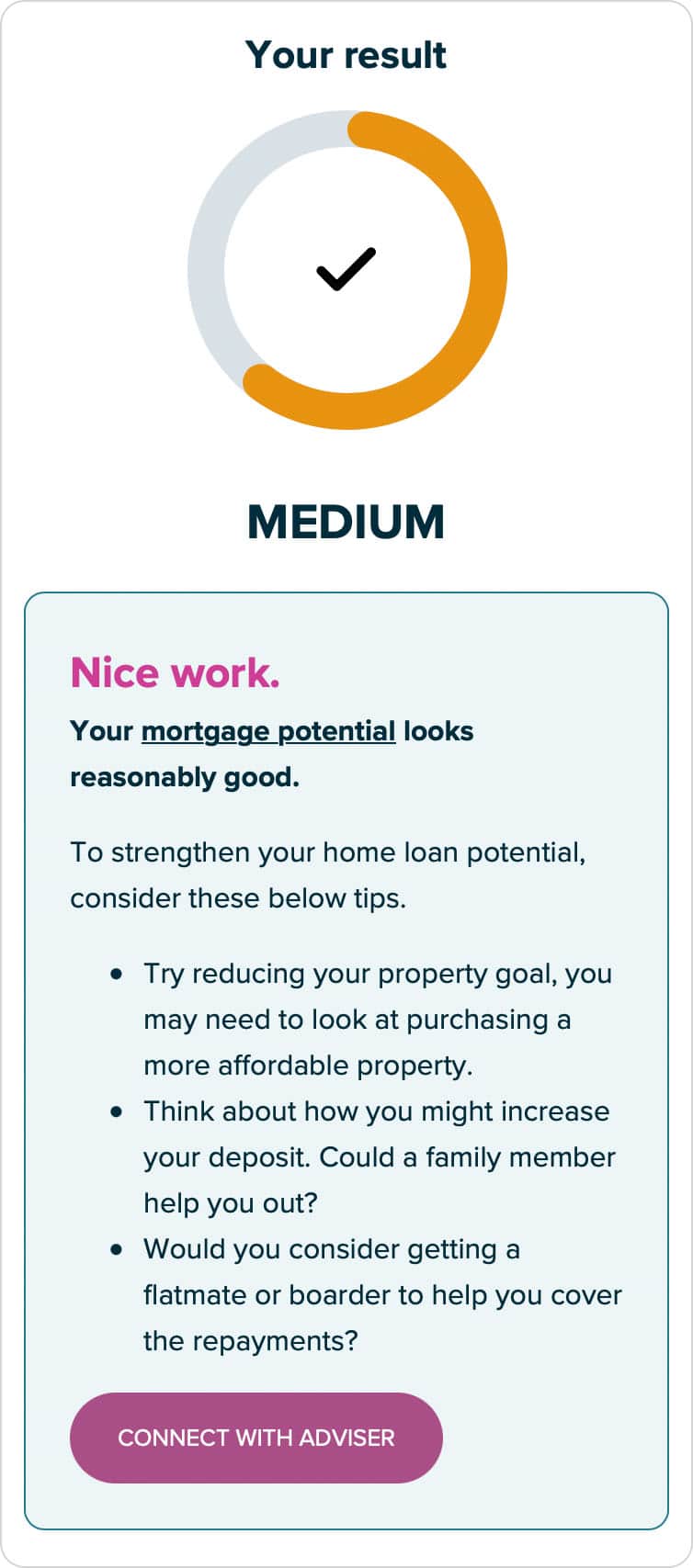

Your results

If your result is ‘strong’ or ‘medium’, you will be invited to connect to a mortgage adviser.

If your result is ‘not quite ready’, you can make adjustments. Possibilities include decreasing the value of your property goal, increasing your deposit with a cash gift or equity from another property, and increasing your income by adding rent from a flatmate/boarder/tenants or buying with a partner.

If you aren’t able to change your result to medium or strong, don’t worry – we’ll look after you with our free nurture programme. You’ll receive online resources and tips that will help you to move forward

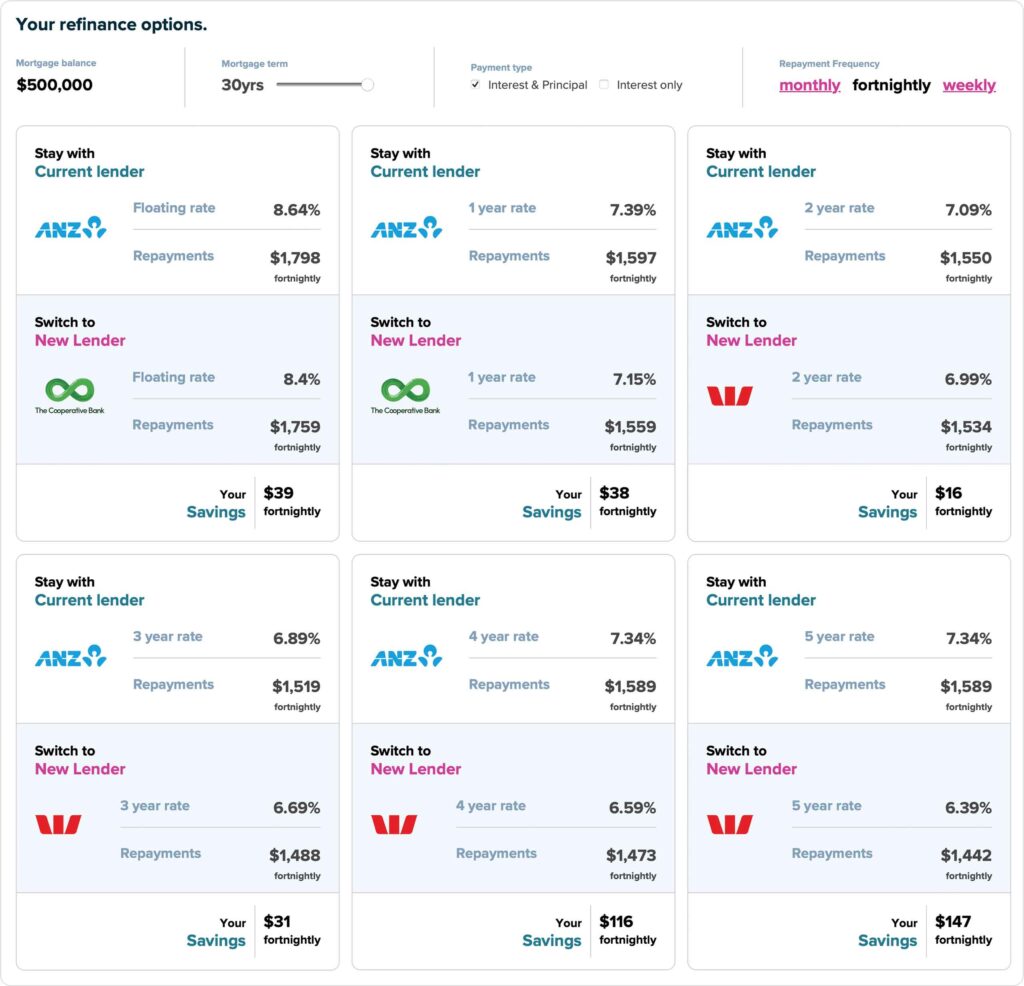

The Loan Check dashboard for refinancing

The refinancers dashboard presents a ‘stay vs switch’ assessment to help you decide which lender and rate/term is best for you.

Make adjustments to your term, payment type and repayment frequency to see how much you could save.

Compare between your current lender’s rates and the market’s best rates. Once you’ve done your research, get connected with an adviser.

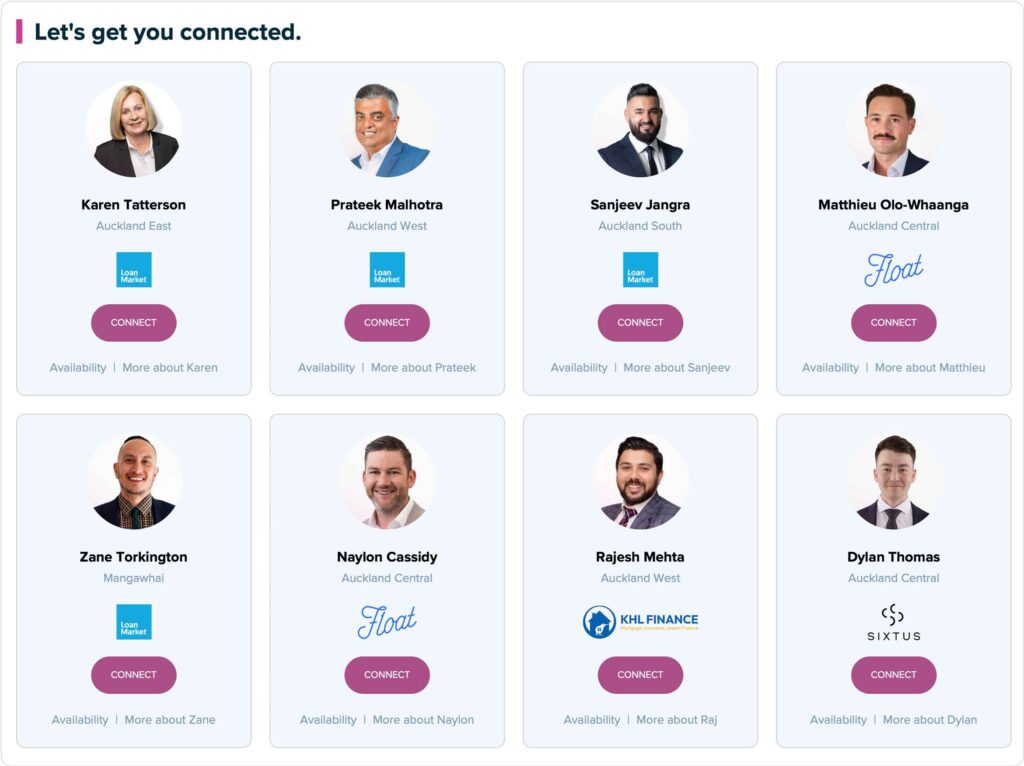

Chose an adviser from our panel

We’ll match you to a selection of our hand-picked advisers. Find out more about them, check their availability and choose the person who feels right for you.

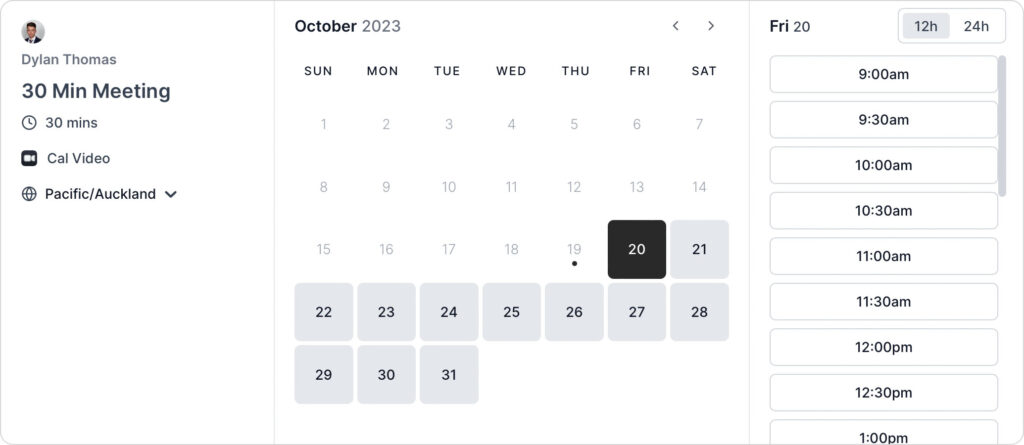

Book in your adviser at a time that suits you

Using the calendar, you can book a 30-minute video call with your preferred adviser. Choose a date and time that suits you.

FAQs...?

Loan Check uses an algorithm to assess your chances of getting a loan, based on current loan criteria for major home lenders. It’s the only tool of its kind in New Zealand and it costs nothing to use. Loan Check can also take you to the next step with your plans, by offering you a choice of mortgage advisers who are matched to your location and needs.

If you get the ‘not quite ready’ result from Loan Check, which suggests you won’t currently be approved for the loan you need, you can explore your inputs to find a solution. For example, you could adjust to a cheaper property, a bigger deposit or a higher income. If you aren’t able to change your result to Medium or Strong, don’t worry we’ll look after you with our free nurture programme. You’ll receive online resources and tips that will help you to move forward.

A positive Loan Check result doesn’t guarantee lender approval. Our tool is designed only to provide a quick indication for you and your mortgage adviser. These calculations have been formulated through market research and in consultation with our adviser panel, based on data from recent home loan pre-approvals.

The Loan Check formula is constantly monitored. We make changes to adjust for OCR announcements, bank serviceability increases and differing market conditions, via the latest adviser feedback.

Yes! When you’re getting into the New Zealand property market for the first time, using Loan Check to understand your chances of getting a home loan can give you confidence to move forward. And if the result isn’t as good as you hoped, you’ll know what action you can take to improve your position.

Try out Loan Check today.

Check your chances of a home loan and get matched with a top adviser. Use Loan Check to quickly determine if you are mortgage ready. It helps you understand your likelihood of pre-approval and puts you on the pathway to home ownership.