Many home owners are getting ready for a substantial rise in their mortgage payments, as their one and two-year fixed interest rate deals conclude. While every household’s circumstances differ, it’s safe to assume that the extra interest expense will pose a challenge for the majority of borrowers.

If you’re concerned about how to handle this situation, we recommend you seek advice from a financial adviser or mortgage broker. Having an experienced professional on your side can be invaluable. In the interim, here are some useful strategies to consider.

How to get professional mortgage advice

If your interest rate rises from 4.0% to 6.5%, you’re definitely going to take a hit. But how do you determine the exact amount? One approach is to use a home loan repayment calculator, such as the one available here.

To estimate your new minimum repayments, follow these steps:

- Enter the amount you still owe for the loan amount

- Enter the remaining years of your original loan term for the loan term

- Manually input the new interest rate

- Choose your usual repayment frequency (monthly, fortnightly, or weekly)

You can then compare the outcome to your current repayment to see the difference.

For instance, if an $800,000 home loan balance with 25 years remaining on its term changes from 4.0% to 6.5%, the fortnightly repayment will rise by $544.

Top tip

If you’ve been making payments higher than the minimum required (to pay off your loan faster while interest rates were low) you may not see a significant increase in the new minimum repayments.

However, if you stick to the new minimum your loan won’t be fully paid off until the original end date, which means you’ll pay interest for a longer period. If you want to factor in your shortened loan term, you can enter the remaining time until your current end date (which will be sooner than the original) in step two above.

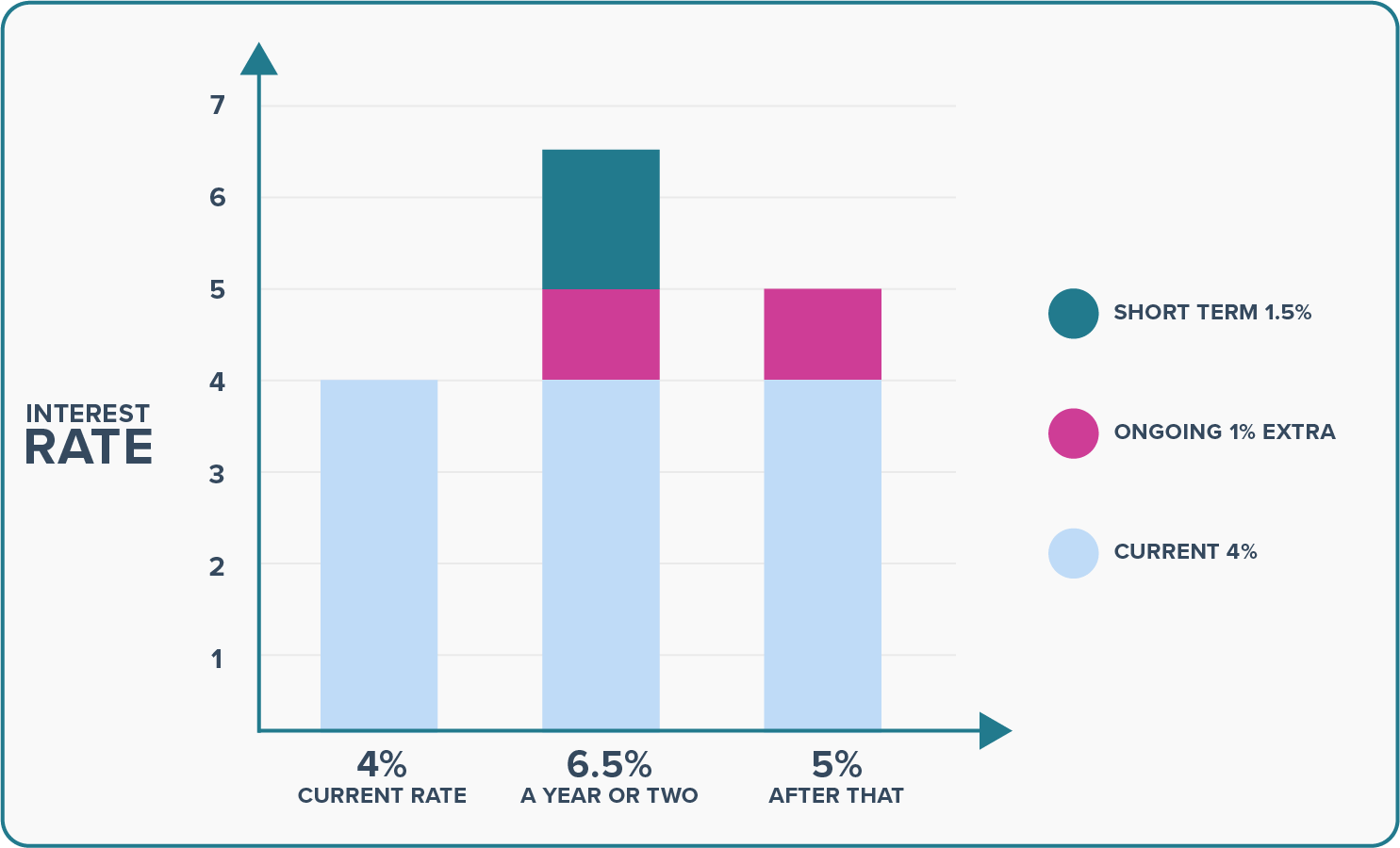

The initial surge is likely to settle down

If this forecast is accurate, it suggests you may only have to plan for a long-term interest rate of 5%, resulting in an additional $210 per fortnight (as demonstrated in the example already discussed). Nonetheless, during the first year or two, you’ll need to factor in both the ongoing 1% increase plus an extra 1.5% annually, to account for the full initial increase from 4% to 6.5%.

Utilising the previously mentioned calculation for a $800,000 loan with a remaining term of 25 years, the difference in payments between an interest rate of 5% and 6.5% amounts to $334 per fortnight or $8,684 annually.

This perspective suggests a dual strategy:

- Firstly, you can modify your household budget to permanently accommodate the enduring rise in home loan payments – such as a hike from 4% to 5% or an extra $210 per fortnight as mentioned above.

- Secondly, you can find a way to fund the temporary interest surge for a year or two – i.e. the jump between 5% and 6.5% – an additional $334 per fortnight, amounting to $8,684 in a year.

Getting a cashback by switching your home loan provider

Currently, major banks are providing significant one-time cash rewards to new home loan clients who have a minimum of 20% equity in their homes. These exclusive offers are usually about 1% of the loan amount. For instance, on an $800,000 home loan balance, the cashback would be $8,000. This could help cover the additional short-term 1.5% required until interest rates stabilise at approximately 5%.

Before you decide to grab a cashback offer, you need to consider these potential downsides:

- Cashback offers often come with a condition that requires you to remain with the new provider for a period of up to four years. This may restrict your flexibility to switch to a better deal during that time.

- If you received a cashback incentive when you took out your current home loan, switching to another lender may require repaying some or all of the cashback amount, depending on how long ago you received it.

- Switching to a new lender involves certain expenses, such as lawyer fees (typically around $1,000) and possibly a new registered valuation for your property. On a positive note, some lenders may offer to contribute towards these costs.

Check out our guide about refinancing your mortgage.

Get a lower interest rate by changing your home loan provider

Another strategy is to shop around for a lower interest rate with a new home loan provider. This is best done as your fixed interest rate approaches its end, so that you can switch without incurring any early repayment penalties. However, there may be costs associated with switching lenders (lawyer fees and a registered valuation).

Researching the best deal for you is easier with the assistance of a professional mortgage broker who represents most major home loan providers. These brokers know the best rates available and may have access to exclusive deals that aren’t advertised. Typically, the lender you choose to go with pays the mortgage adviser, so the advice and service you get doesn’t incur a fee. Check out our free find a mortgage broker service.

Get a better loan set up by restructuring with your existing lender

You have a couple of options when it comes to reducing your regular home loan repayments without changing your lender.

- One way is to extend your loan term to achieve lower monthly repayments. Keep in mind that this will mean a longer road to becoming mortgage free and more interest payments over the life of the loan. However, it could be a good temporary solution until your finances improve and you’re able to shorten the loan term again.

- Another option is try an offsetting home loan, where your borrowings (or some of them) are neutralised by a linked bank account. Although offset loans have a floating interest rate, which is usually higher than fixed rates, the positive balance of the linked account offsets the negative loan balance, so you pay less interest. To make the most of this option, you can pay your wages or salary into the linked account. You can then use a credit card for your everyday purchases, which maximises the offsetting effect until you repay your credit card in full and receive your next salary payment.

Become a one car household for a while

Sell some stuff

Reducing the amount of unnecessary stuff you have declutters your life, generates extra money and improves your carbon footprint.

Trade Me and other online marketplaces are great platforms for selling un-needed items that are still in good condition. As well as earning extra cash, you’re giving others the opportunity to purchase items at a lower cost, rather than buying brand new.

Setting a planet-friendly goal – like not buying any new clothes for a year – is also a great way to save money and make your life more sustainable. Fast fashion is a major contributor to environmental problems, so reducing your clothing spend is good for the planet. Recycle boutiques and second-hand stores are great alternatives to buying brand new.

Get a flatmate

Do you have an extra room that’s currently being used for storage? Consider clearing it out and installing a flatmate. Take a look at the ‘flatmates wanted’ section of Trade Me to see what similar rooms in your area are going for.

Remember that any rent collected will be considered taxable income. However, if you include some expenses – such as a portion of utilities – these may be tax deductible. Additionally, it’s important to reach out to your insurance company to determine whether your home and contents policy will be impacted.

If you decide to move forward with renting out your spare room, it’s wise to create a written agreement outlining terms and conditions (things like rent payment deadlines, expectations for shared expenses and chores).

Get a side-gig going

If you have untapped skills and experience – or lots of spare time – you have the potential to earn additional income. Nowadays, many types of paid work can be accomplished from home on a casual basis. Additionally, numerous employers are looking for people who can work a few hours a week to help out during busy periods. Alternatively, get creative and start making things that can be sold at a weekend market. From building bird feeders to sewing sarongs, there’s massive scope for handcrafted products.

You can choose to end your side gig once peak interest rates have backed off or keep it going to speed up your journey towards financial freedom.

Dealing with the long-term increase in your home loan repayments

As we mentioned earlier, financial commentators are saying it’s unlikely that home loan interest rates will return to the low levels of recent years. They’re predicting that interest rates will eventually settle down to around 5%. Preparing for this ‘new normal’ means adjusting your household budget for the long term. Our budget planner can help you to create a spending plan.

If sticking to your budget becomes difficult, there are free budgeting services available. You can also consult a mortgage adviser about restructuring or refinancing options.

If it ever looks like you’ll miss a home loan repayment, it’s crucial to communicate with the lender as soon as possible to explore short-term solutions. They might offer you a repayment holiday or interest-only period while you find a longer term solution.

For financial tips and help with budgeting, visit the free government-funded website sorted.org.nz.