The question ‘how long should I fix my mortgage for’ has much in common with questions like ‘what are interest rates going to do?’, ‘how much can I save in a year’ and ‘what should I name my first born’? The best answer depends on crystal ball gazing, personal circumstances and market analysis. While we can’t give you a definitive number, because it’ll be different for everyone, we can certainly step through the things you need to consider before choosing a fixed rate term.

Once you’re up to speed and ready for professional advice, we can connect you (for no charge) with one our mortgage advisers. They’re paid by the lender you eventually choose, so their service is free.

Reasons to choose a fixed rate mortgage

Fixed rates are popular because they are nearly always lower than the current floating rate. So the cost of financing your home is generally less with a fixed rate, unless interest rates fall and the floating rate becomes less than the fixed rate you selected. Another reason to love fixed rate loans is certainty. A fixed interest rate won’t change during its term. For example, when you put $200,000 of your home loan on one-year fixed at the rate offered at the time, that’s the interest rate you’ll be charged every month for the next year. Your repayments won’t go up; nor will they go down.

The main downside of a fixed rate is ERCs (early repayment charges). If you want to pay the loan off faster by injecting the occasional lump sum or extra payment, you’ll probably pay for the privilege. Always ask the bank to calculate the ERC before you go ahead with an extra payment. You might discover it’s better to put the extra money aside in a savings account until the loan comes off fixed. As mentioned above, the other downside of a fixed rate is the potential to be stuck on a rate that’s higher than the floating rate because rates have dropped while you were fixed.

Fixed and floating - the best of both worlds

When you’re setting up your home loan, the compromise position is to put some of your borrowing on floating and some on fixed. Herald financial columnist Mary Holm says “having at least part of your loan on floating means if you receive an inheritance, win a lottery or get redundancy pay, you can pay down your mortgage without penalty. And if you want to use an offset or revolving credit mortgage, these are only offered as floating mortgages”.

Here’s an example to help you understand why many people have a foot in both camps:

Moana and Matthew

First home buyers Moana and Matthew purchased a home back in November 2020. At the time, their lender’s floating rate was 4.5%, the 1-year fixed rate was 2.3%, the 2-year rate was 2.6% and the 3-year rate was 2.8%. They knew rates were at historical lows and had tested their mortgage affordability using much higher rates. Their plan was to repay their loan as fast as possible while they could. They decided to split their $500,000 loan into two portions – a fixed-rate portion of $425,000 and a floating portion of $75,000, which they offset against their emergency savings account. Part of the reason for doing this was because Moana was in the running for a major work promotion, which would enable them to bump up their mortgage repayments – something a floating mortgage allows you to do without penalty.

Because interest rates might stay low for at least a couple more years, Moana and Matthew chose a 1-year fixed rate and a 30-year term. Their ambition was to clear the $75,000 floating loan within a year. When the larger chunk of loan comes off 1-year fixed, they planned to move $50,000 of it to floating (so they could pay it off quickly if they had the means) and fix the rest at the new 1-year rate. This was a pattern they hoped to keep repeating for as long as possible. By fixing for just one year at a time, they believed they were in a better position to secure good fixed rates going forward. However, if interest rates rose steeply in a year they realised they might end up re-fixing at a less favourable rate than if they had fixed for two years. Rates did start to rise quickly, so they chose a longer fixed rate for more certainty and only kept a small amount on floating, as the higher rates meant they’d have less surplus for making extra repayments.

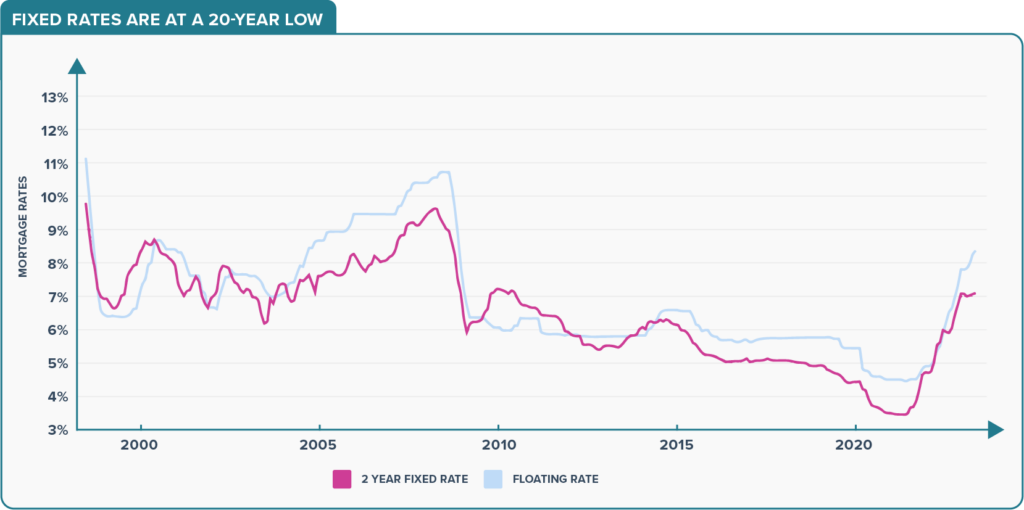

Fixed rates are at a 20-year low

Why are floating rates nearly always higher than fixed rates?

David Tripe, Professor of Banking at Massey University School of Economics, explains the difference between fixed and floating rates like this:

“In New Zealand, banks compete more vigorously for fixed-rate loans because they can rely on keeping the fixed-rate business until the end of the term. Floating rates can be repaid at any time, which increases the risks for the bank managing its funding.” 1

Why do fixed rates vary so much from one year to five?

When you check out our mortgage rates page, you’ll usually see that the 1-year fixed rate is lower than the 5-year fixed rate. The reason for this is simple: banks can’t see into the future (although they try very hard to), so there’s a risk their costs for maintaining a five-year home loan will rise during the term and affect their margin. They offset some of this risk by making interest higher for longer terms. Short term rates tend to be lower, because banks have a clearer view of the immediate future. However, if interest rates are particularly high to control inflation and are widely expected to ease in the future, you may find the five-year rates are slightly lower than one-year rates. The unknown, of course, is how low one-year rates will go over that five-year period.

How to choose the length of your term

This will depend on interest rate predictions and your plans. It usually pays to get independent financial advice as well as talking with your lender.

When choosing your term, consider these possibilities:

- If feeling secure is important to you, a longer-term fixed rate offers more certainty, even though you’ll probably be paying a little more interest, at least to begin with.

- If you think interest rates could go down in the immediate future, choose a shorter term loan.

- If you think interest rates could increase significantly in the future, choose a longer-term fixed rate.

- If there’s a possibility of extra money becoming available in the immediate future, a shorter term loan gives you the flexibility of paying off a lump sum when it comes off fixed, and then re-fixing if you want to.

- If you’re thinking of selling your home in the near future, a floating rate will give you maximum flexibility.

- If you have short-to-medium term plans to sell your home, choose a fixed term that supports your plans, i.e. you’ll come off a fixed rate at about the time you want to sell and avoid ERCs. However, it may be possible to transfer your home loan to your new property, so discuss your plans with your lender.

What happens when a fixed rate term finishes?

If you do nothing, the loan will automatically switch to the lender’s floating rate. When this happens you can either stay on floating or fix again when it suits you.

If you’re certain you want to fix again immediately, it’s best to organise the new fixed rate with your lender about a month before your current fixed rate term ends. This way you’ll totally avoid the higher interest of a floating rate. ‘Rolling fixes’ is a mortgage strategy that many Kiwis use – each fixed rate term is followed by another, which is chosen ahead of time.

Always do the math for the worst-case scenario

When lending rates are low, it can be easy to get over-confident about your ability to repay a loan. If you take the opportunity to get ahead on your repayments, you’ll have a smaller loan and more room to move when rates are high. Remember that just a decade ago the 2-year fixed rate was hovering between 8 and 9%. That could happen again, which suggests you should have a play with our mortgage repayments calculator to see what a higher interest rate would do to your repayments.

A $600,000 loan on 2-year fixed with a 30 year term at 4.0% interest has repayments of $2,865 per month. The same loan at 8.0% interest has repayments of $4,403 a month.

When in doubt, get good advice

If you’re confused about fixed rate strategies, talking to an unbiased expert can help. The FMA offers advice about finding a suitably-qualified adviser. Or alternatively choose an accredited adviser from our panel.